The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

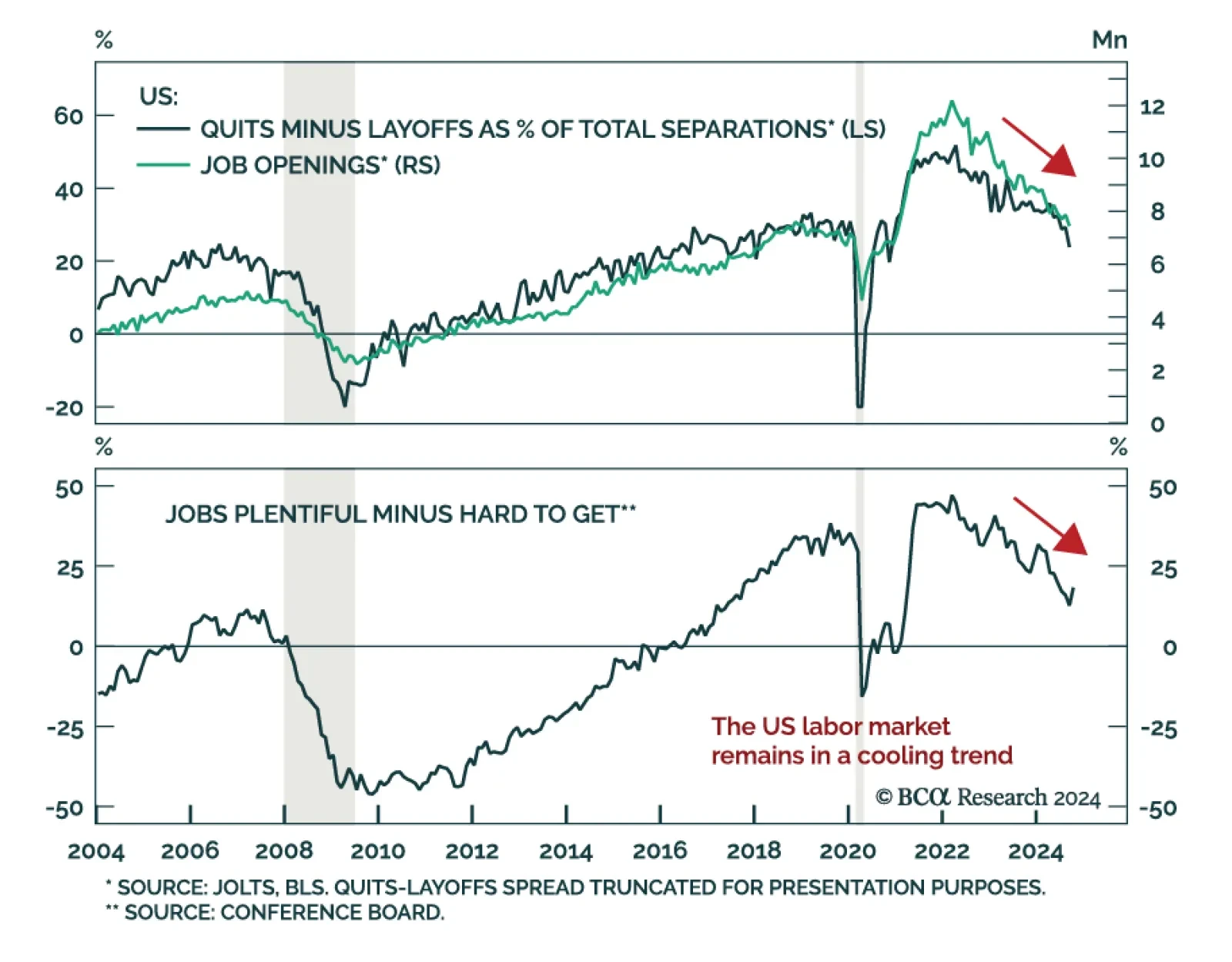

Job openings missed expectations at 7.44 million in September, a mild slowdown from August. The details of the JOLTS report were also negative, except for hirings which continue their June rebound. Meanwhile, consumer confidence…

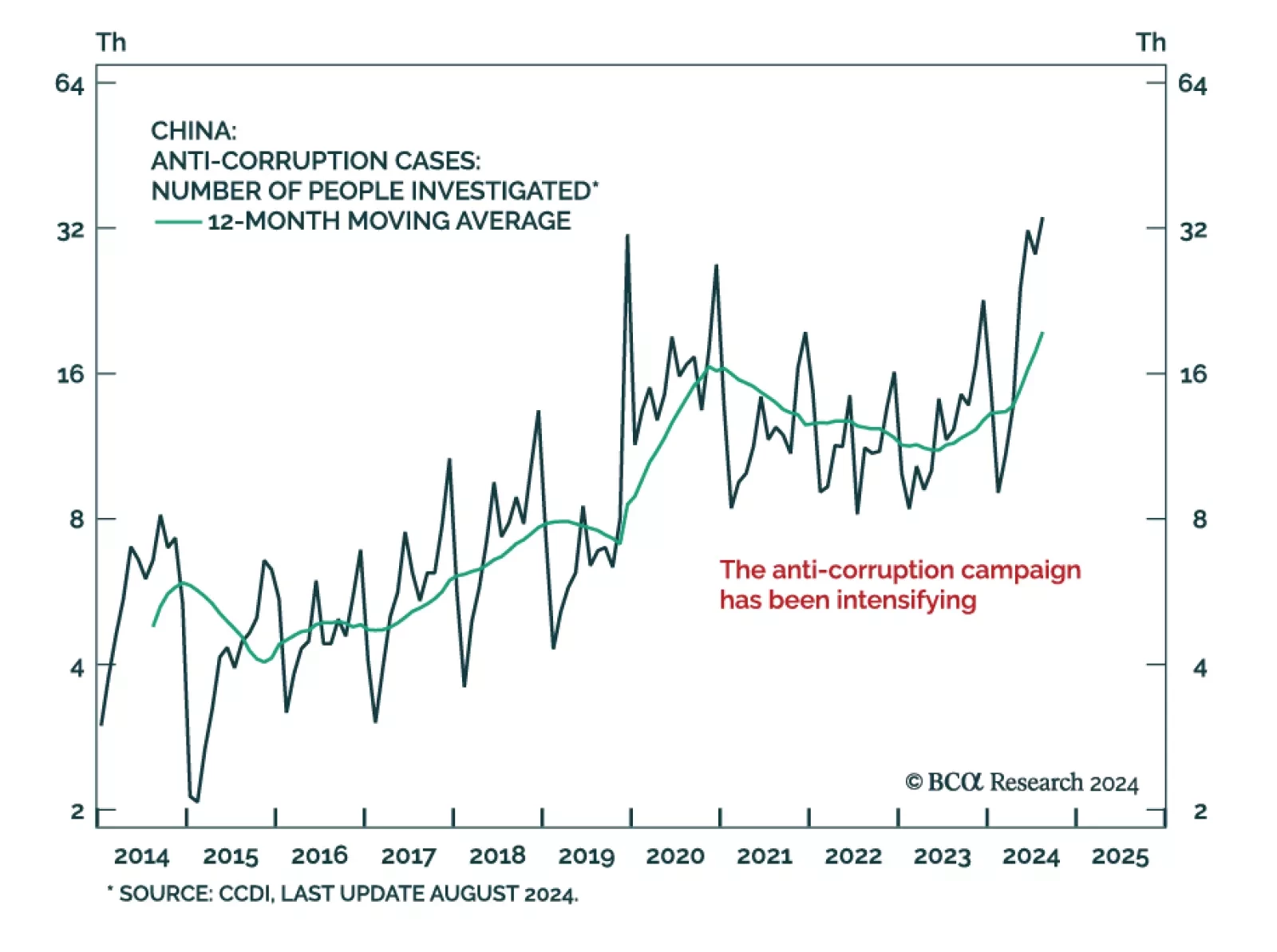

While moving in the right direction, China’s latest stimulus measures are falling short of the mark to reflate the economy. The latest rumors extend this trend. News agencies reported discussions of a CNY 10 trillion…

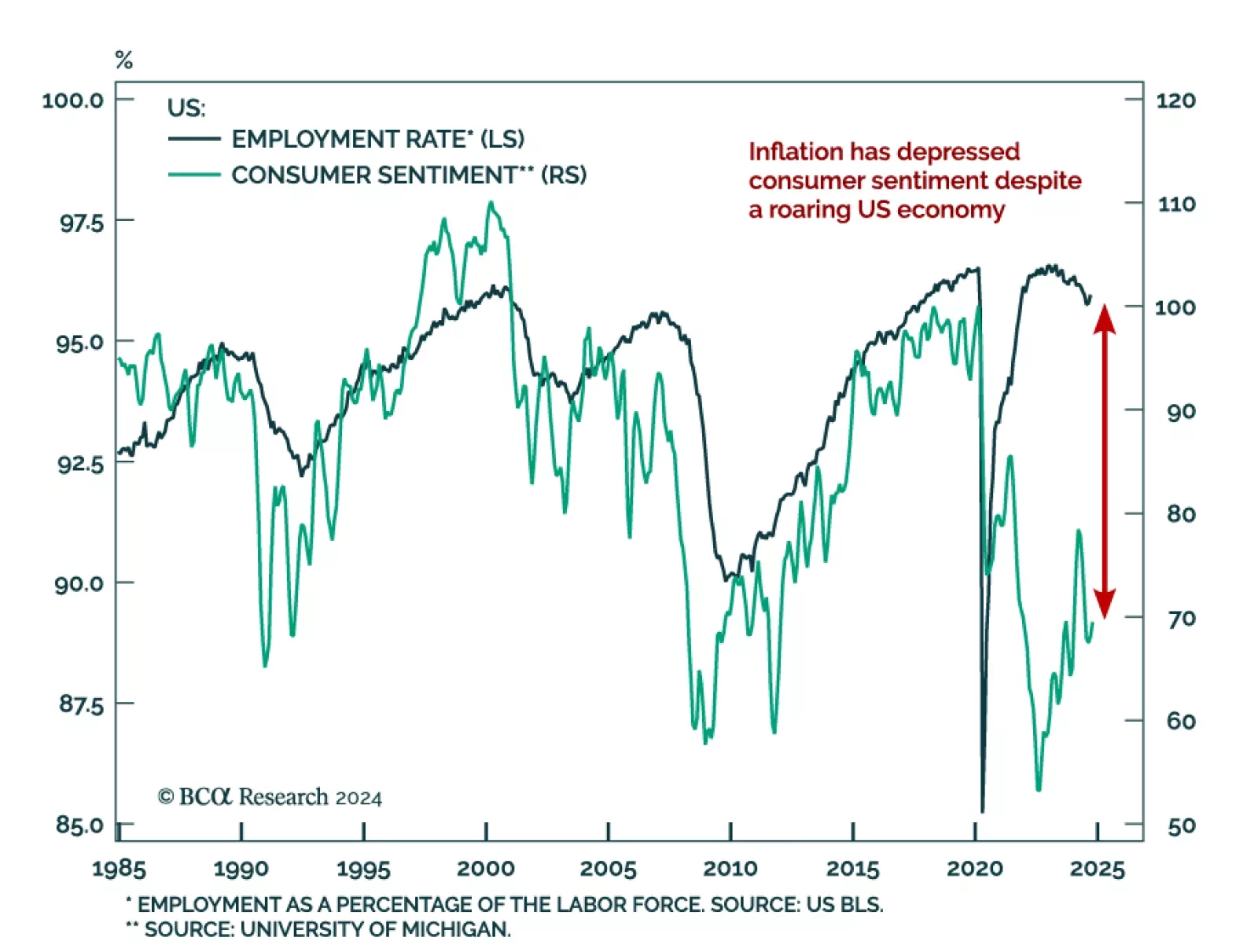

The main driver of global consumer sentiment in the past few years has been high inflation. Nowhere has this been the case more than in the US, where measures of animal spirits were depressed despite a roaring economy. Today,…

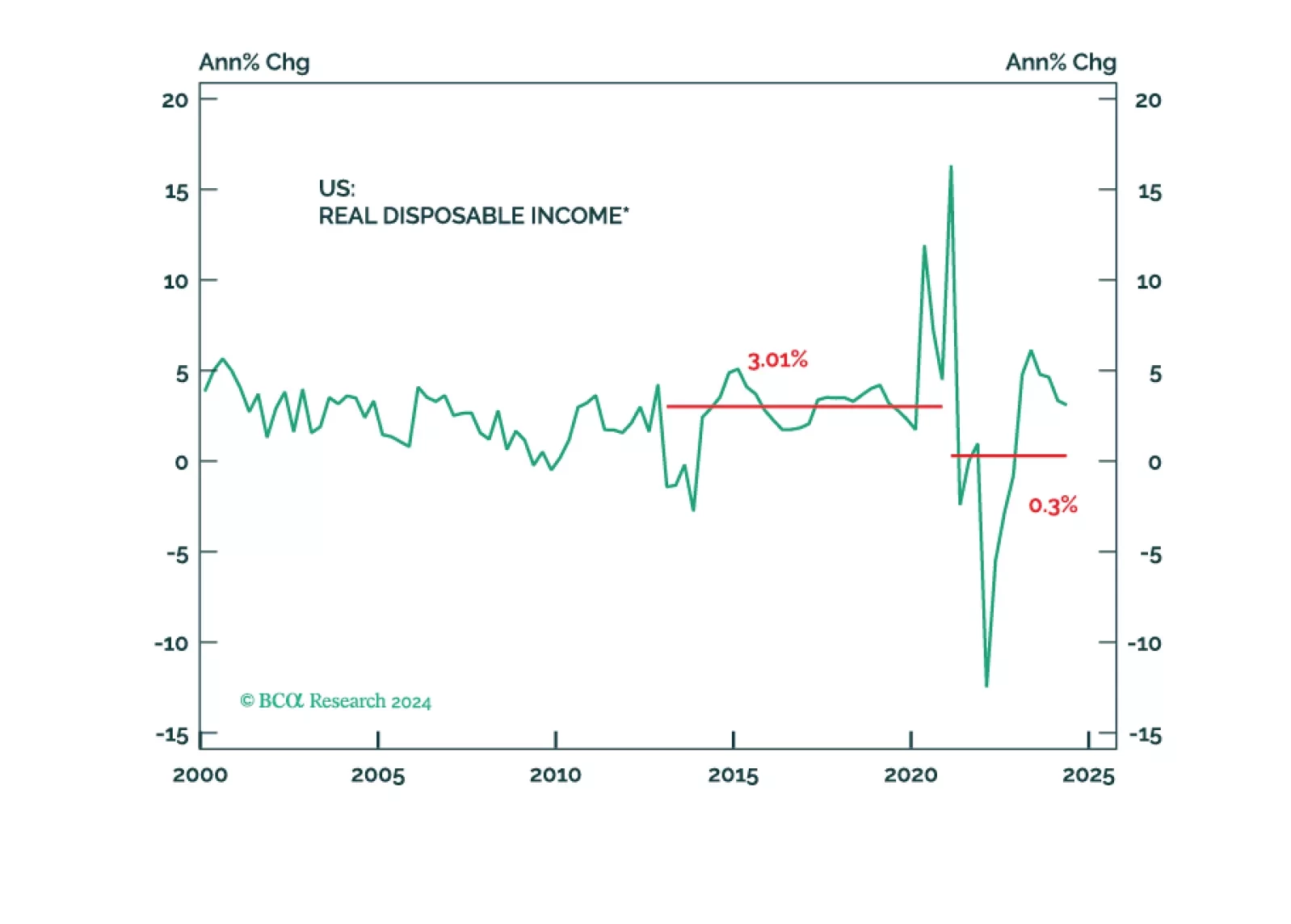

Middle-aged households have lagged youngish and older households since the pandemic and the 40-to-54 cohort is worse off than it was at the end of 2019. The fragmenting of the seemingly monolithic US consumer widens the path to a…

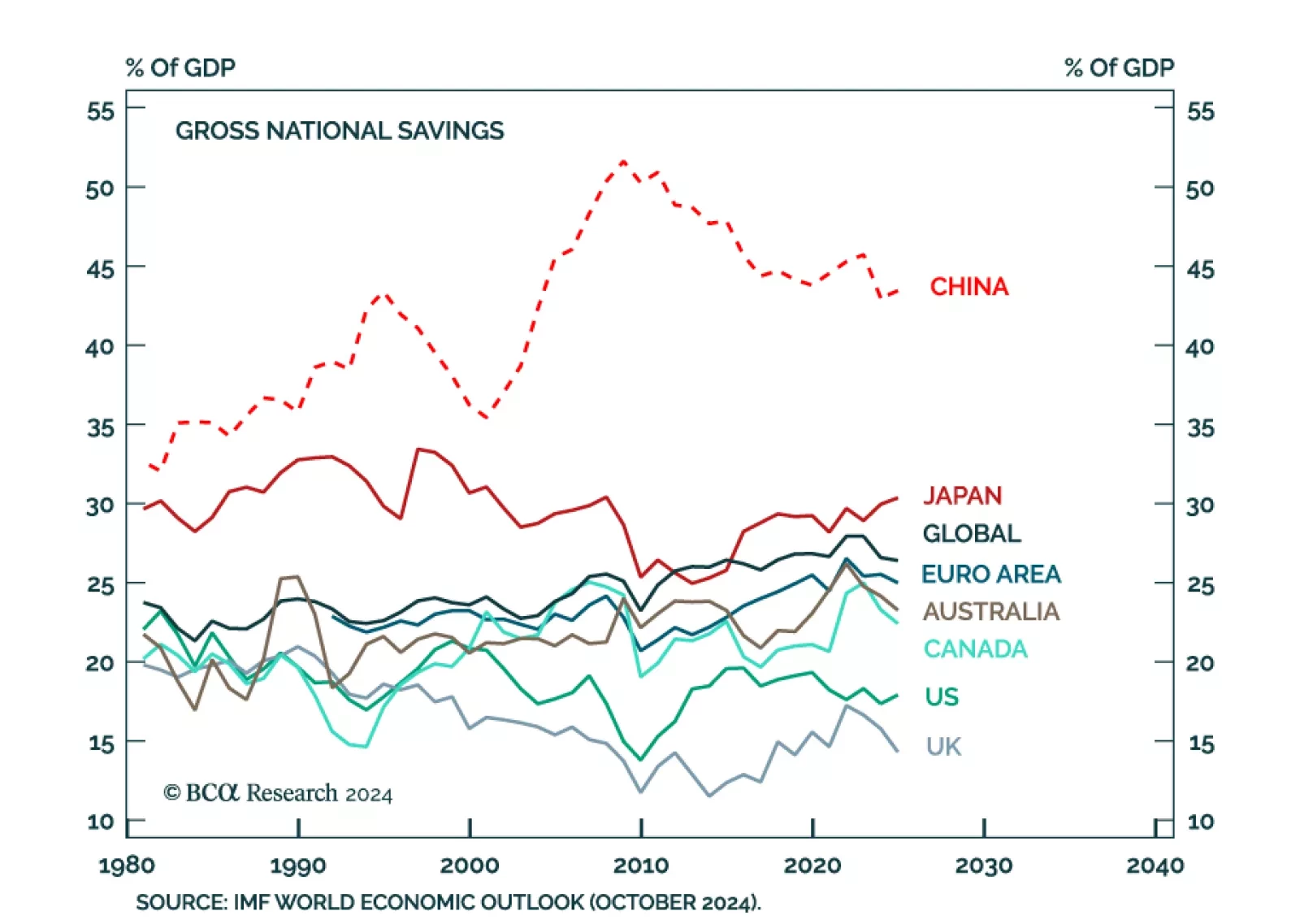

Savings must either flow into domestic investment, or abroad. Saving too much, with nowhere to funnel it, is breaking China’s economic model according to our Global Investment Strategy colleagues. As China's share of…

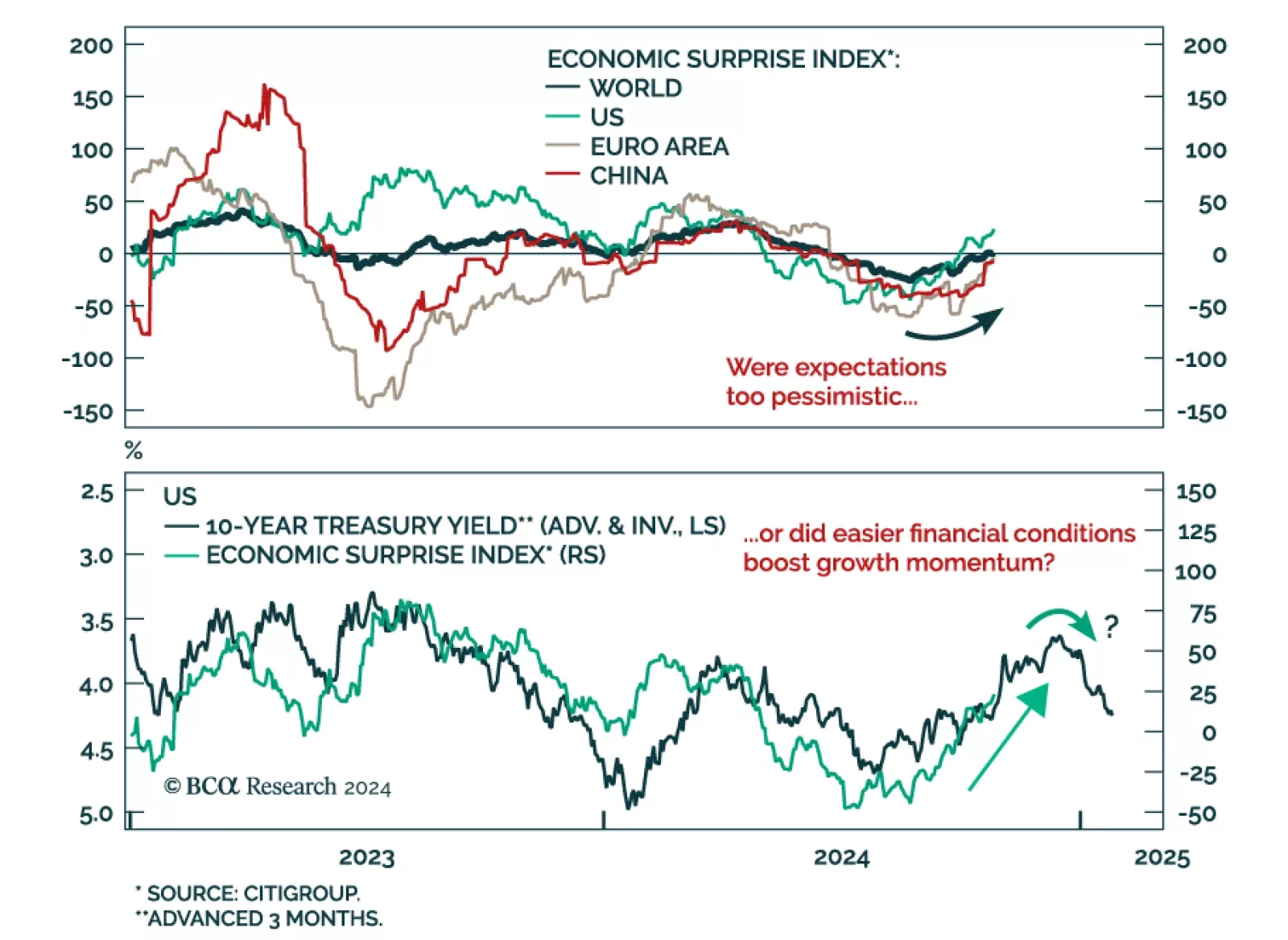

Global economic surprises have improved. Currently positive and improving in the US, they are rising from a low level in the Eurozone and China. Two explanations could explain this momentum. First, the recent easing in…

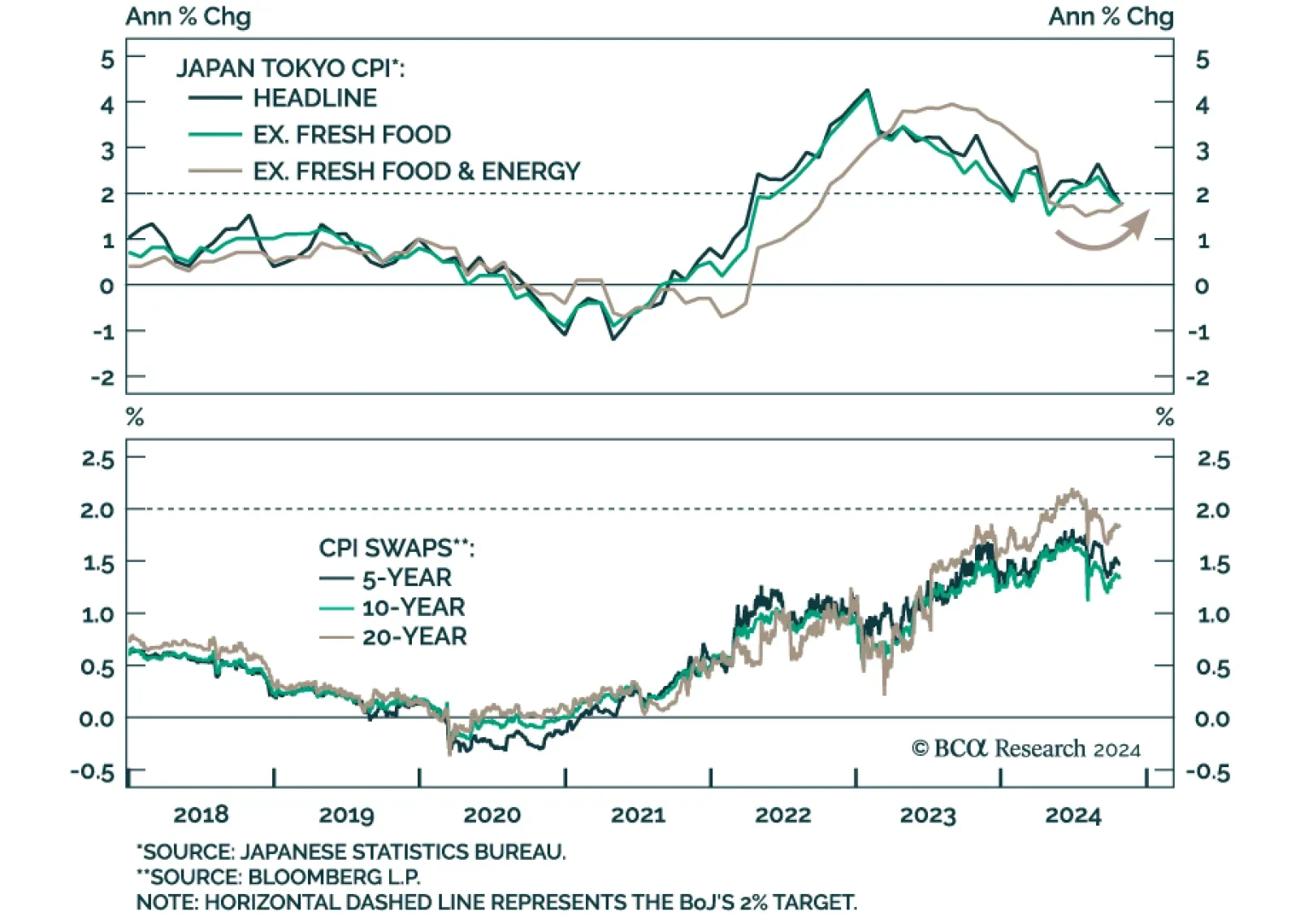

The “core core” (ex. fresh food & energy) segment of the Tokyo CPI basket beat expectations in October, printing at 1.8% year-over-year and accelerating from 1.6% in September after troughing at 1.5% in July. The…

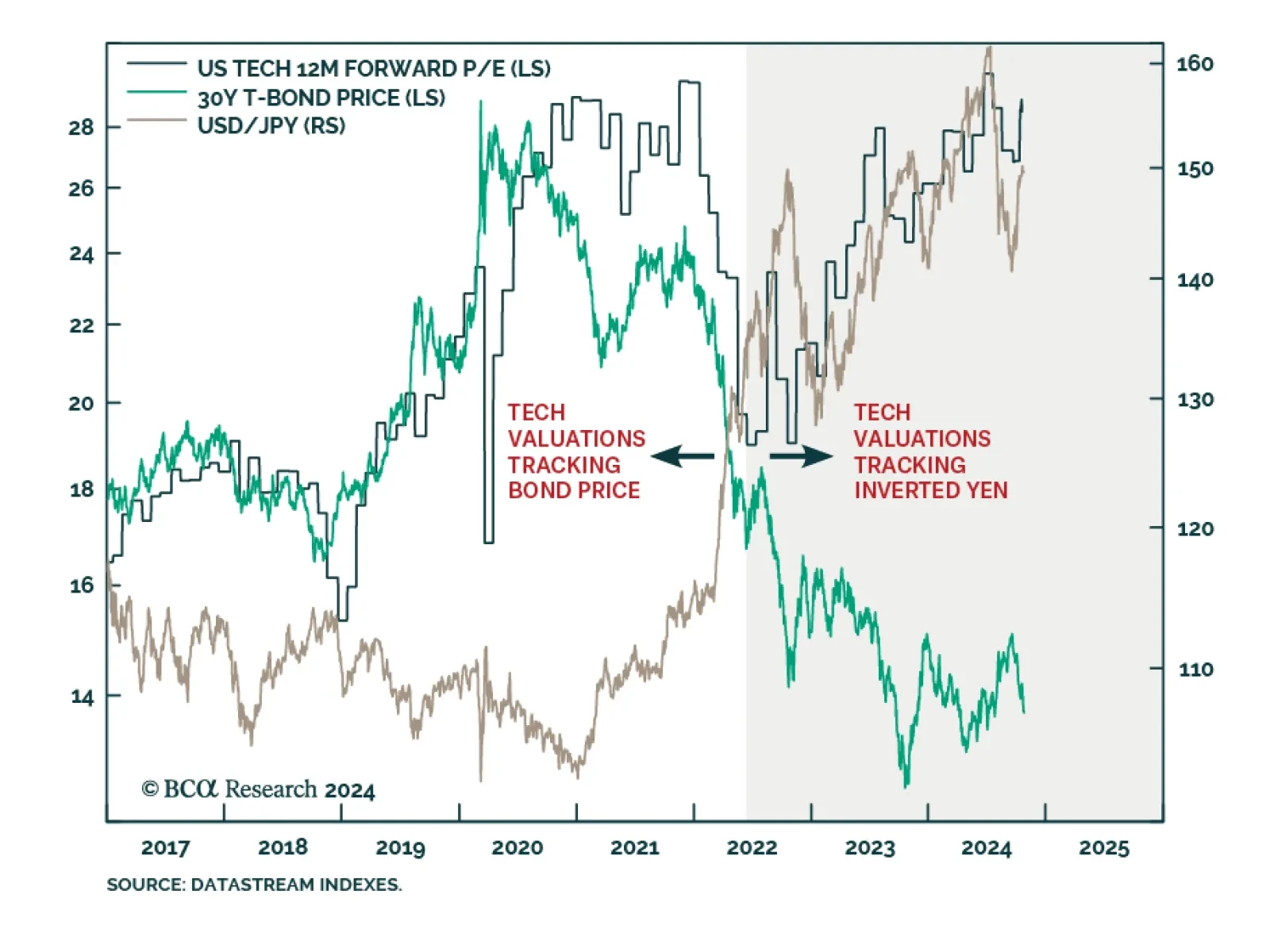

Our Counterpoint Strategy team believes the equity bull market’s biggest risk is the reversal of the divergence between Japanese and US real yields. Japan’s real policy interest rate differential versus the US…