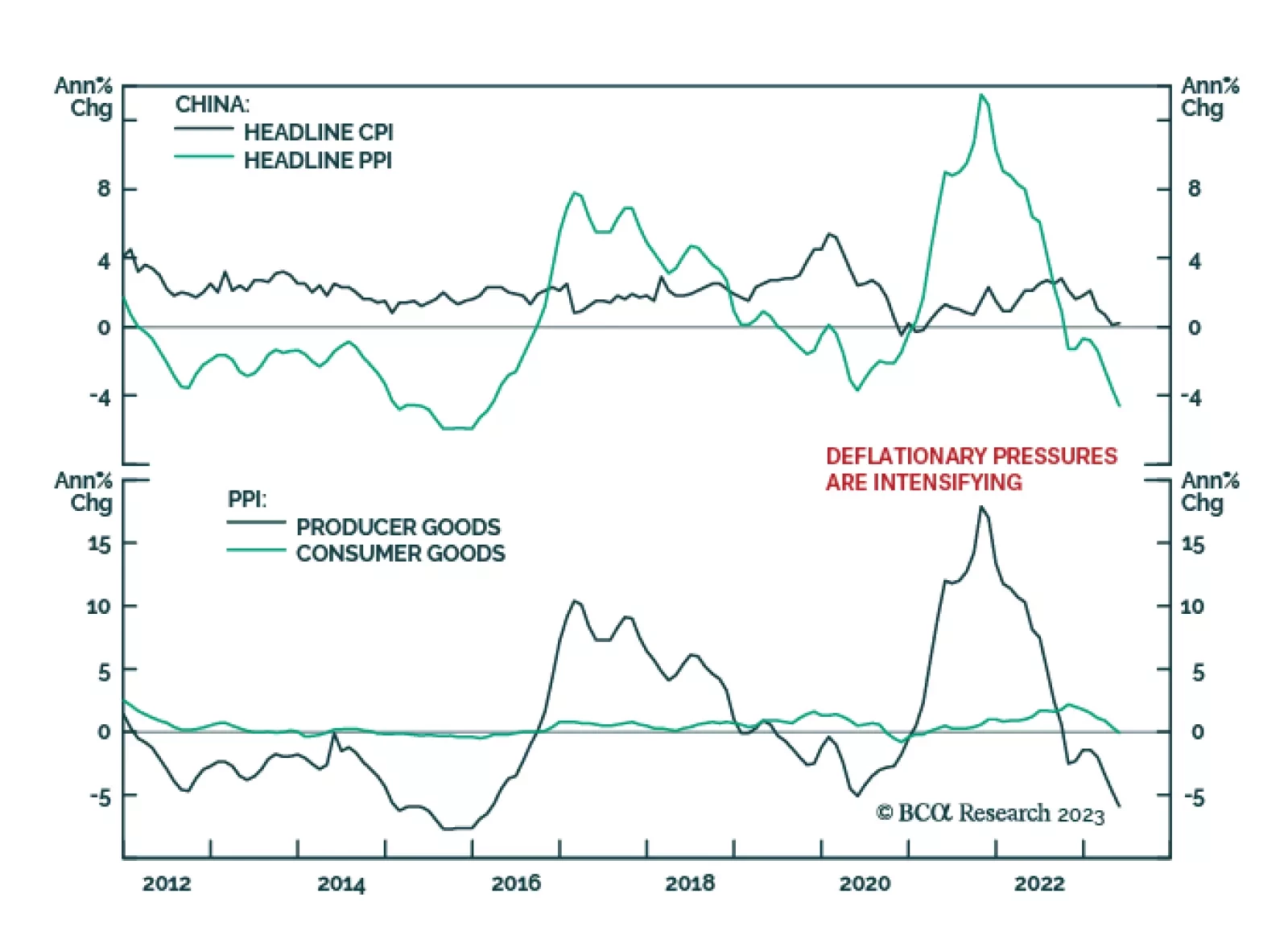

Chinese producer prices sent a disappointing signal about the domestic economy on Friday. The pace of decline in producer prices accelerated from -3.6% in April to -4.6% in May – worse than expectations of a -4.3% drop. The…

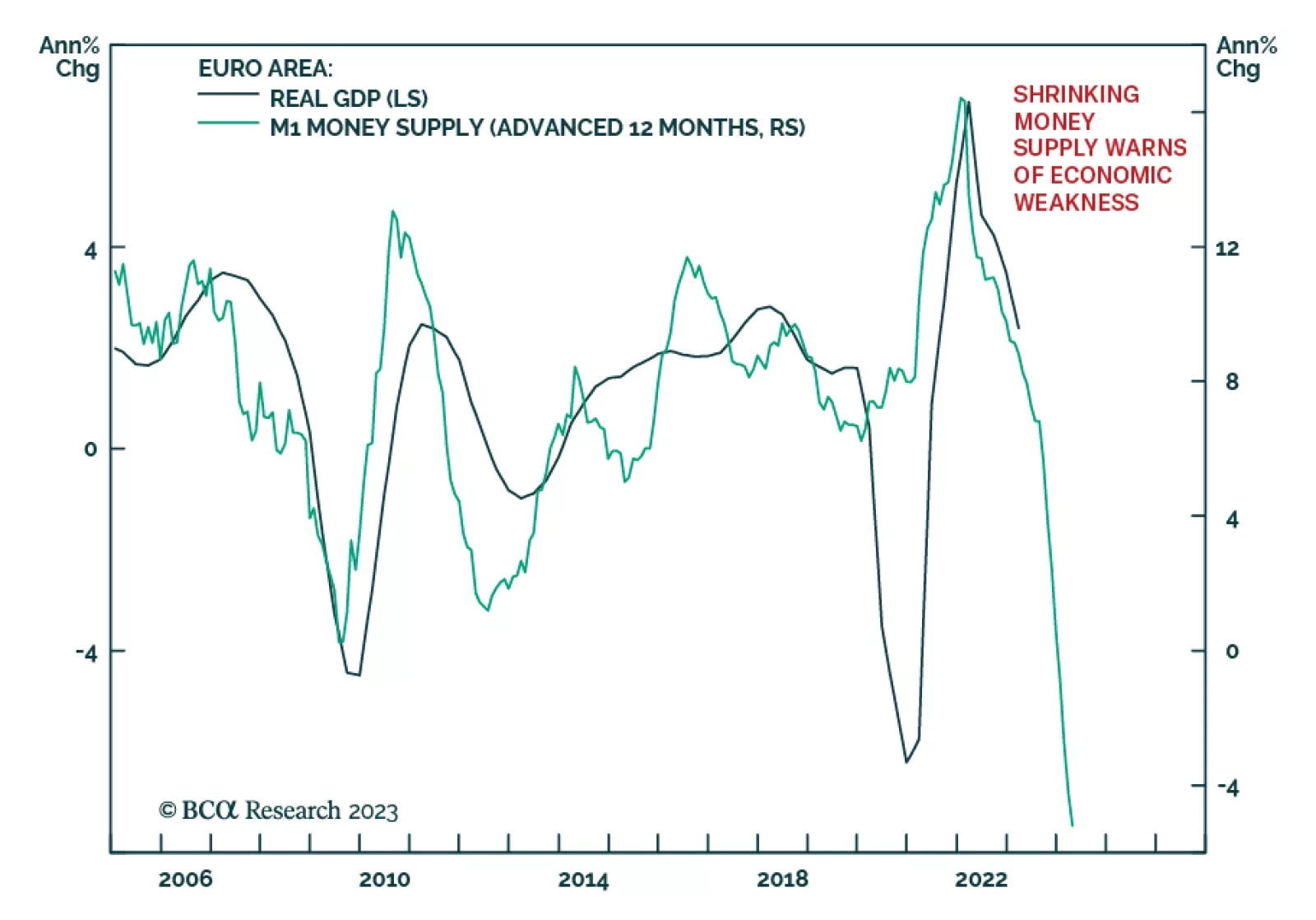

The final Q1 GDP release shows the Euro Area economy contracted by 0.1% q/q last quarter, a downwards revision from estimates of a 0.1% expansion. To the extent that this follows a 0.1% q/q decline in Q4 2022, the revised numbers…

A benign disinflation will support equities over the next few quarters. Stocks will fall next year as a recession begins when investors least expect it.

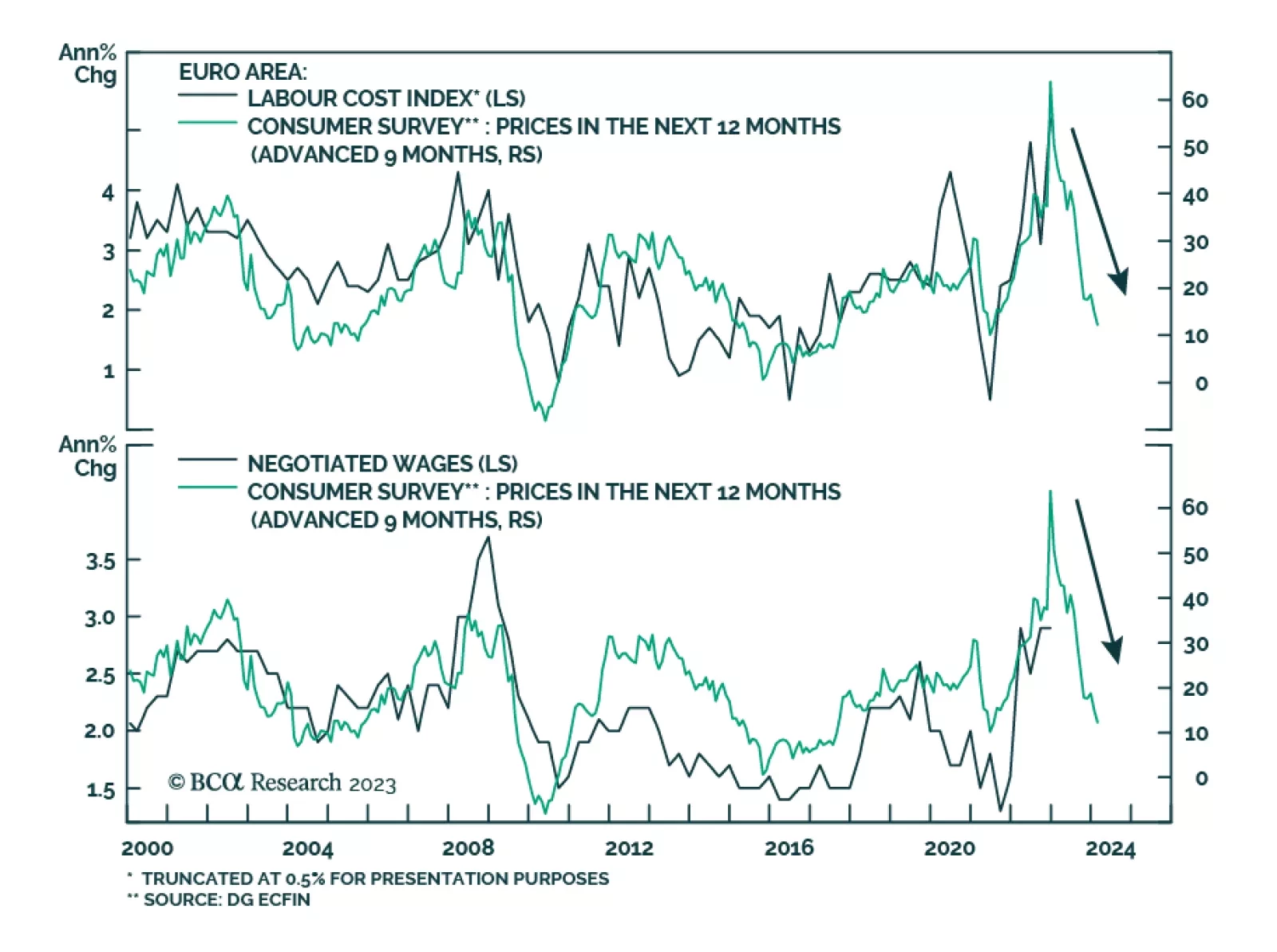

Eurozone households are becoming less concerned about the near-term outlook for inflation. The results of the latest ECB Consumer Expectations survey show a significant drop in median 12-month inflation expectations from 5.0% in…

What’s going on? The market-weighted stock market is up. But the equally-weighted stock market is not up. Neither is credit. Neither are industrial metal prices. Neither is the oil price, despite two waves of OPEC output cuts. We…

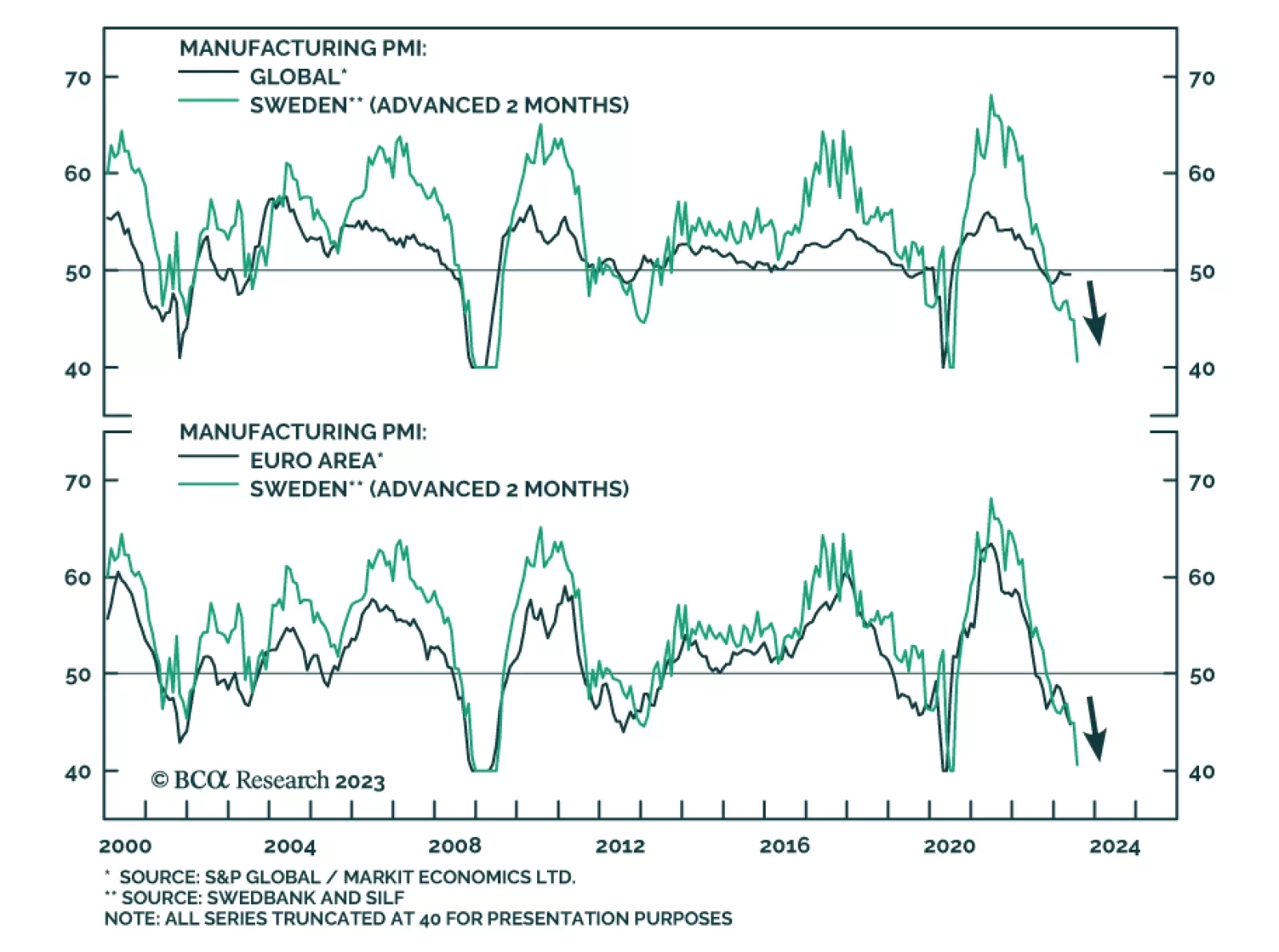

The Swedish manufacturing PMI declined to 40.6 in May, the lowest level since June 2020. This deterioration in Sweden’s manufacturing activity not only reflects the domestic economy, but it also highlights weaknesses in the…

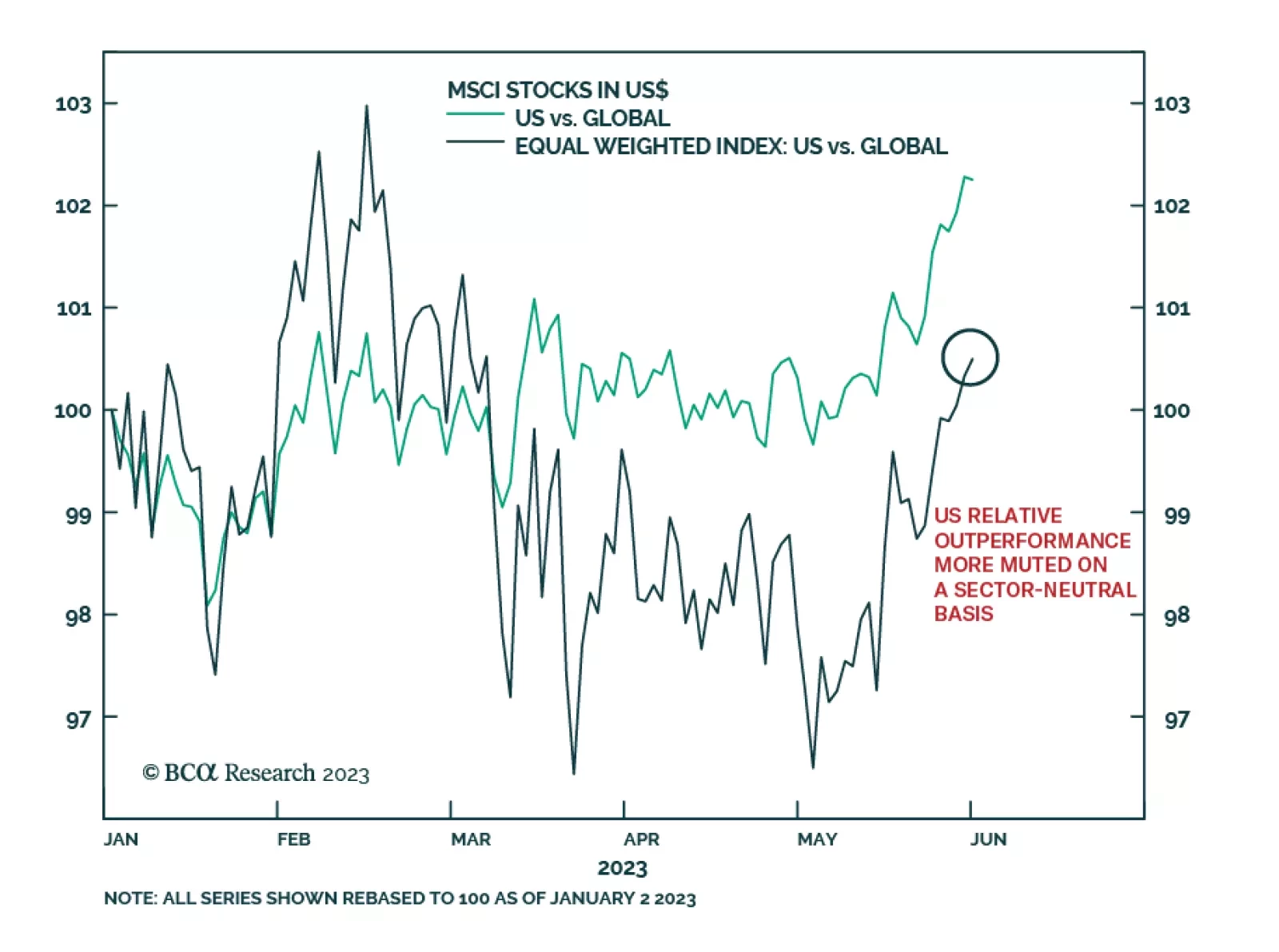

US stocks have outperformed their global peers on a year-to-date basis. The MSCI US index’s 7.5% gain since January 18 eclipses the ACW index’s 3.1% increase. This trend has recently become even more pronounced: while…

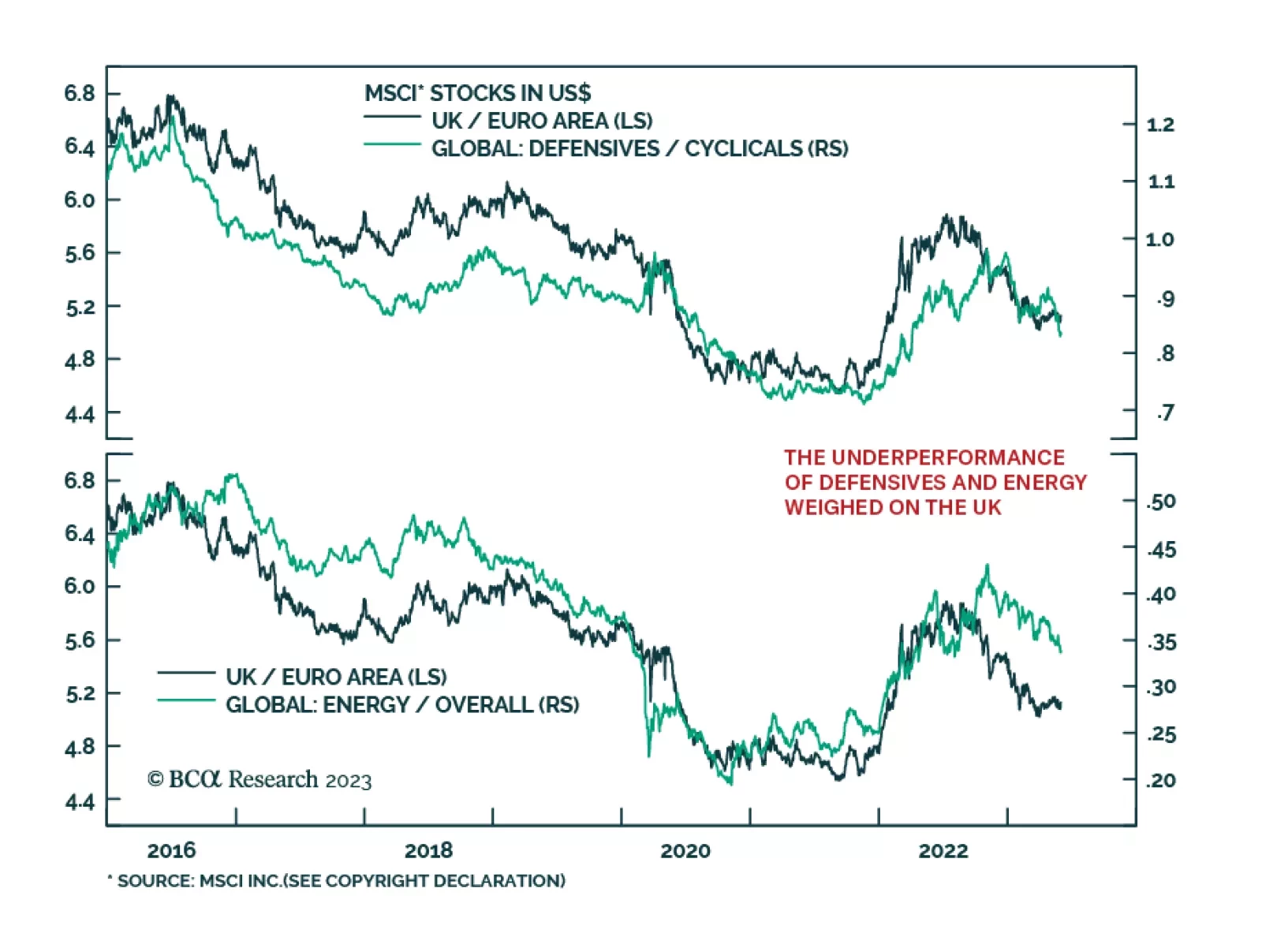

In our May In Review Insight, we showed that last month, UK stocks posted the lowest z-score among all major global equity markets, underperforming their Eurozone peers. What explains this relative weakness? The chart above…

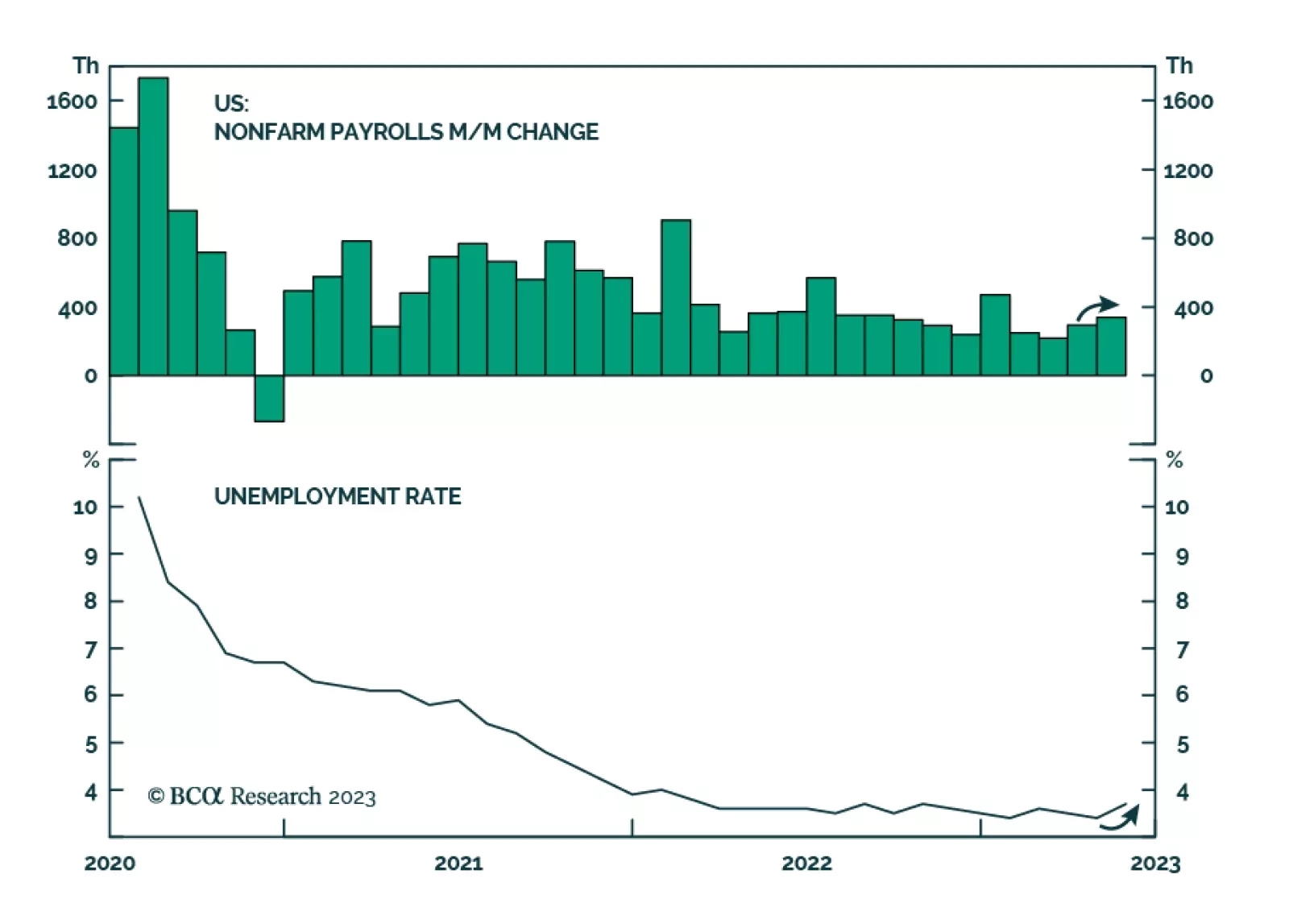

On the surface, Friday’s nonfarm payrolls report delivered a strong positive surprise. Establishment survey results reveal that employment increased by 339 thousand in May – above both the upwardly revised 294…

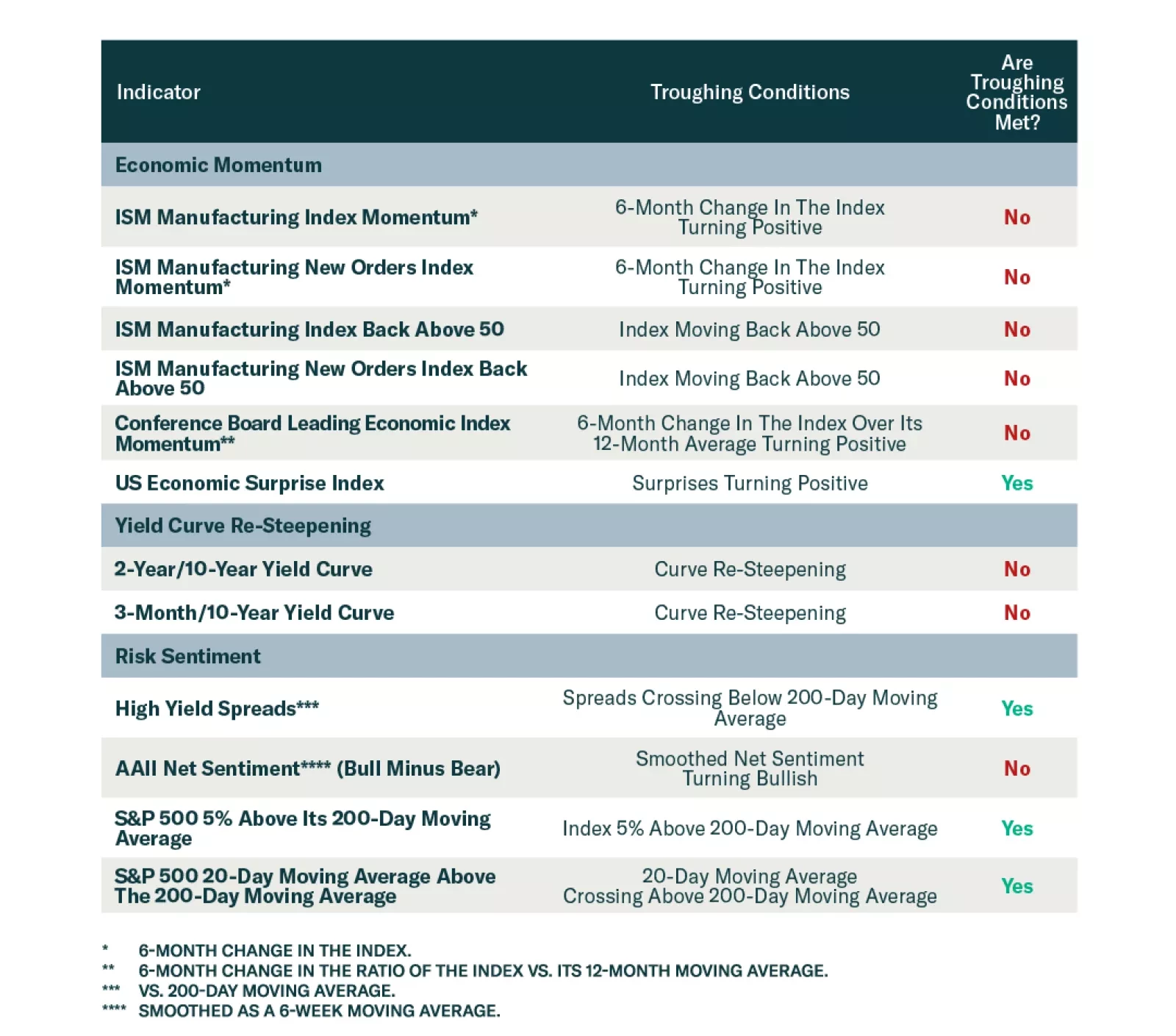

BCA Research’s Global Asset Allocation service continues to recommend an overweight on government bonds, neutral on cash, and underweight on equities and credit. Market technicals do not suggest this is a robust…