Recession-Hard/Soft Landing

The force of the post-election momentum leads us to believe we could be stopped out of our defensive positioning before the week is out, but we still believe in our recession call. If we are eventually stopped out, we will seek a more opportune entry point to bet against risk assets once the election fever runs its course.

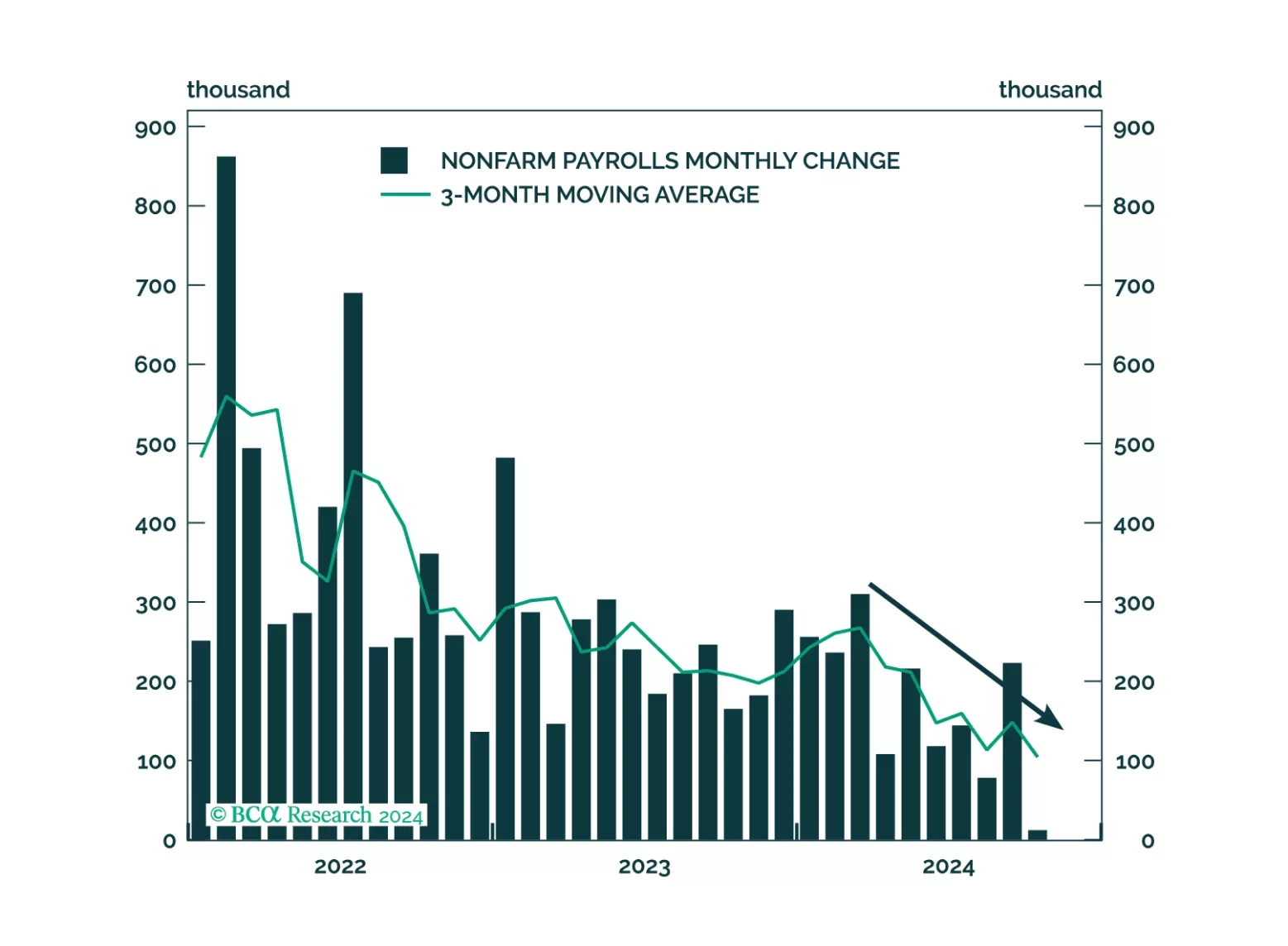

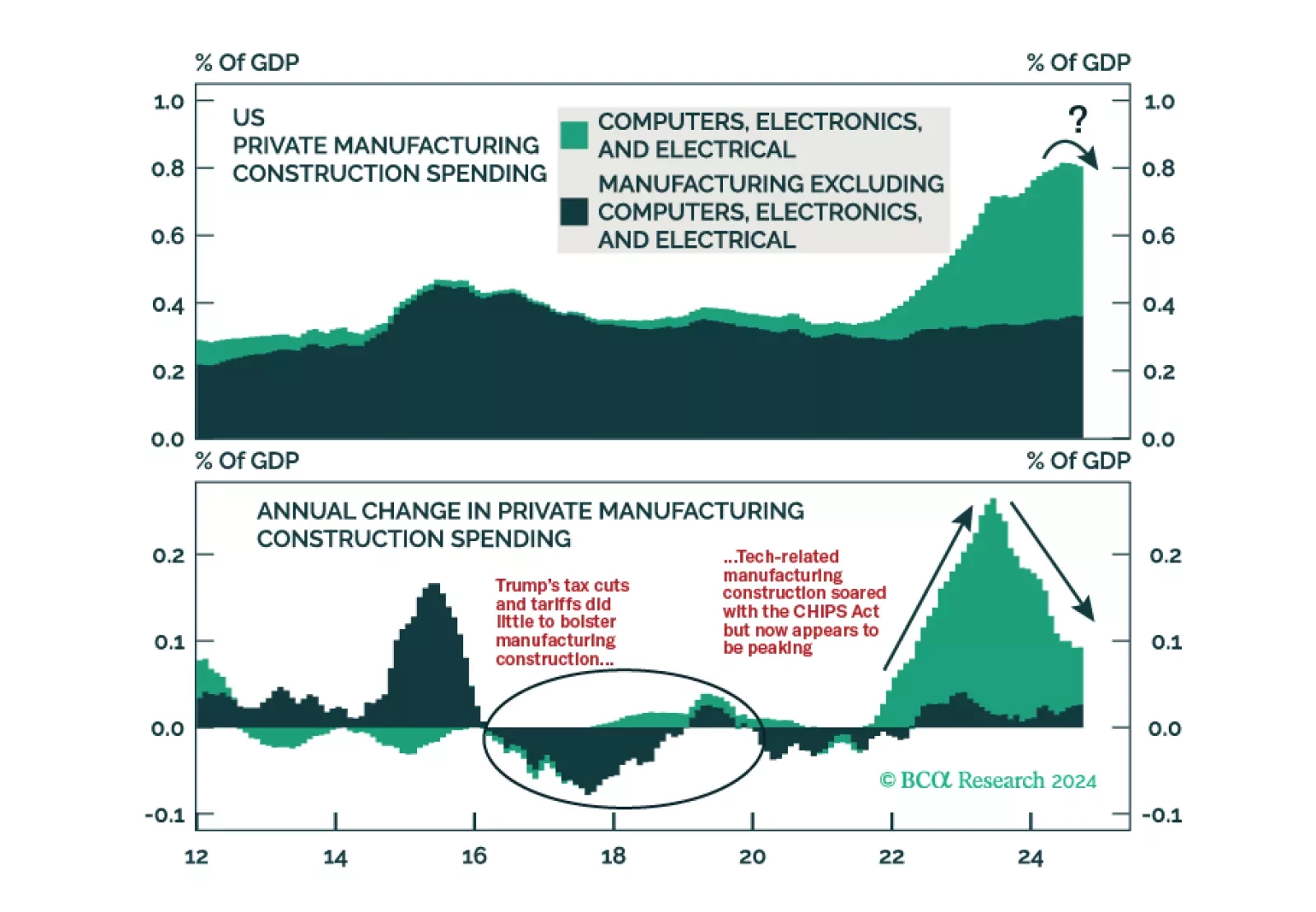

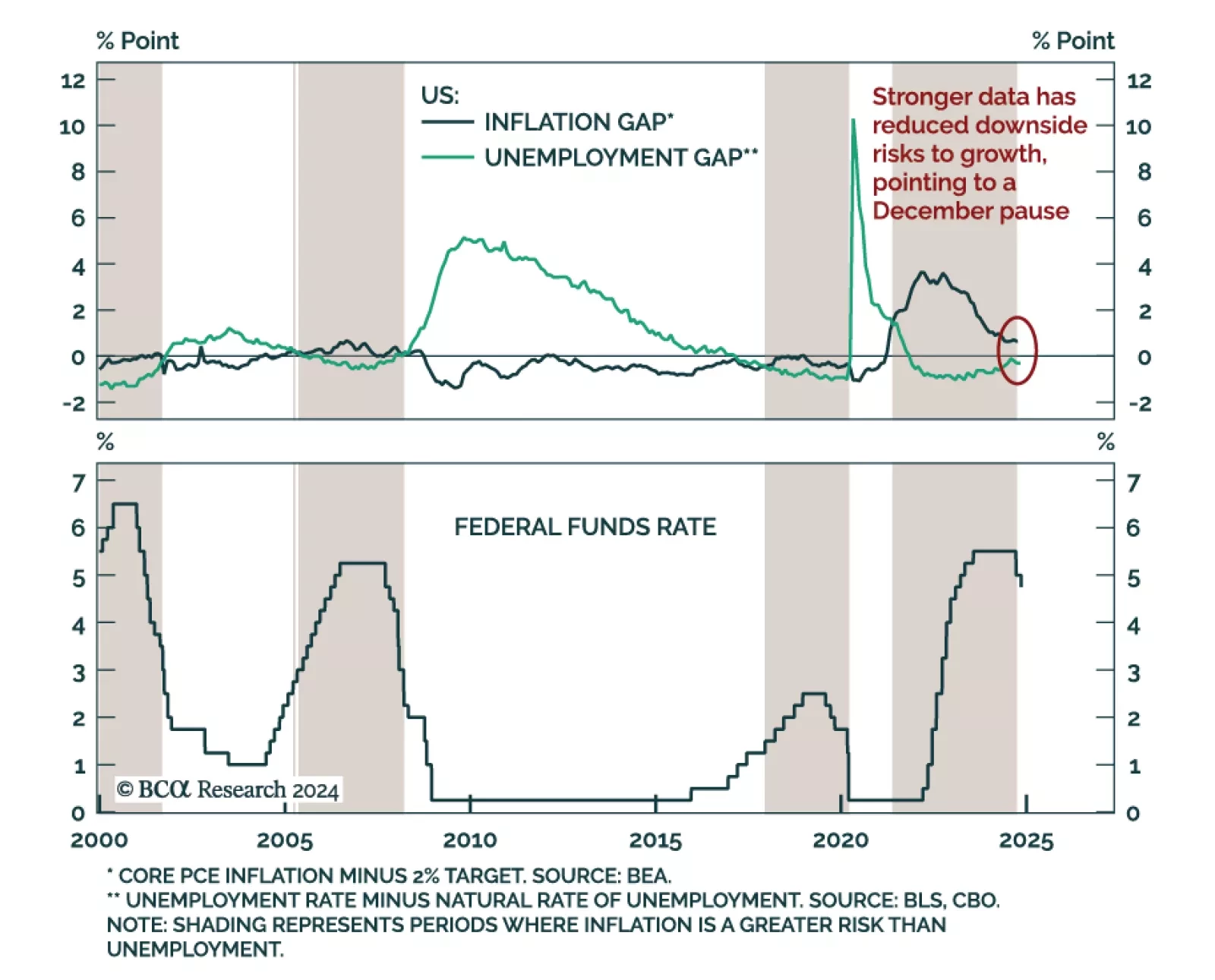

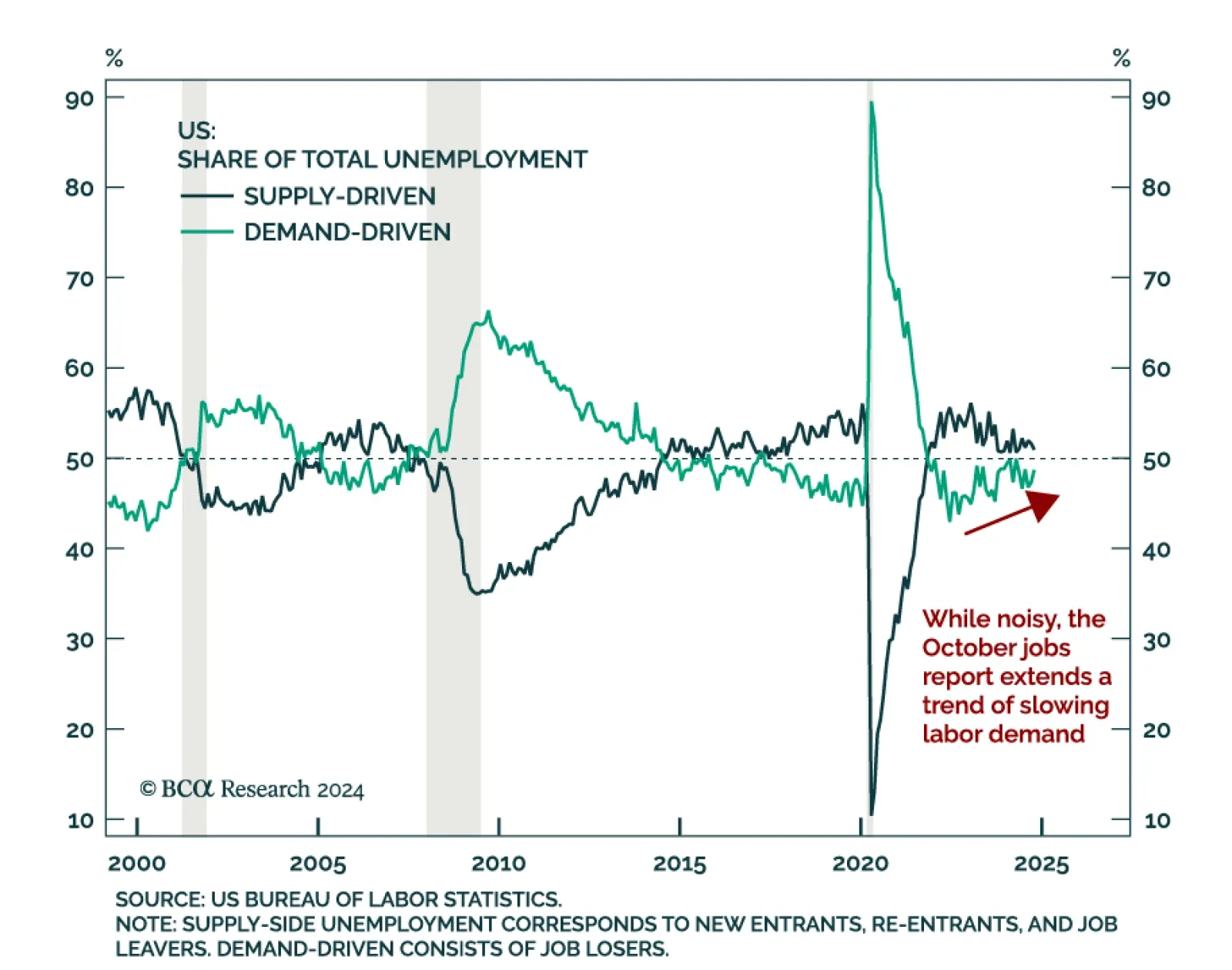

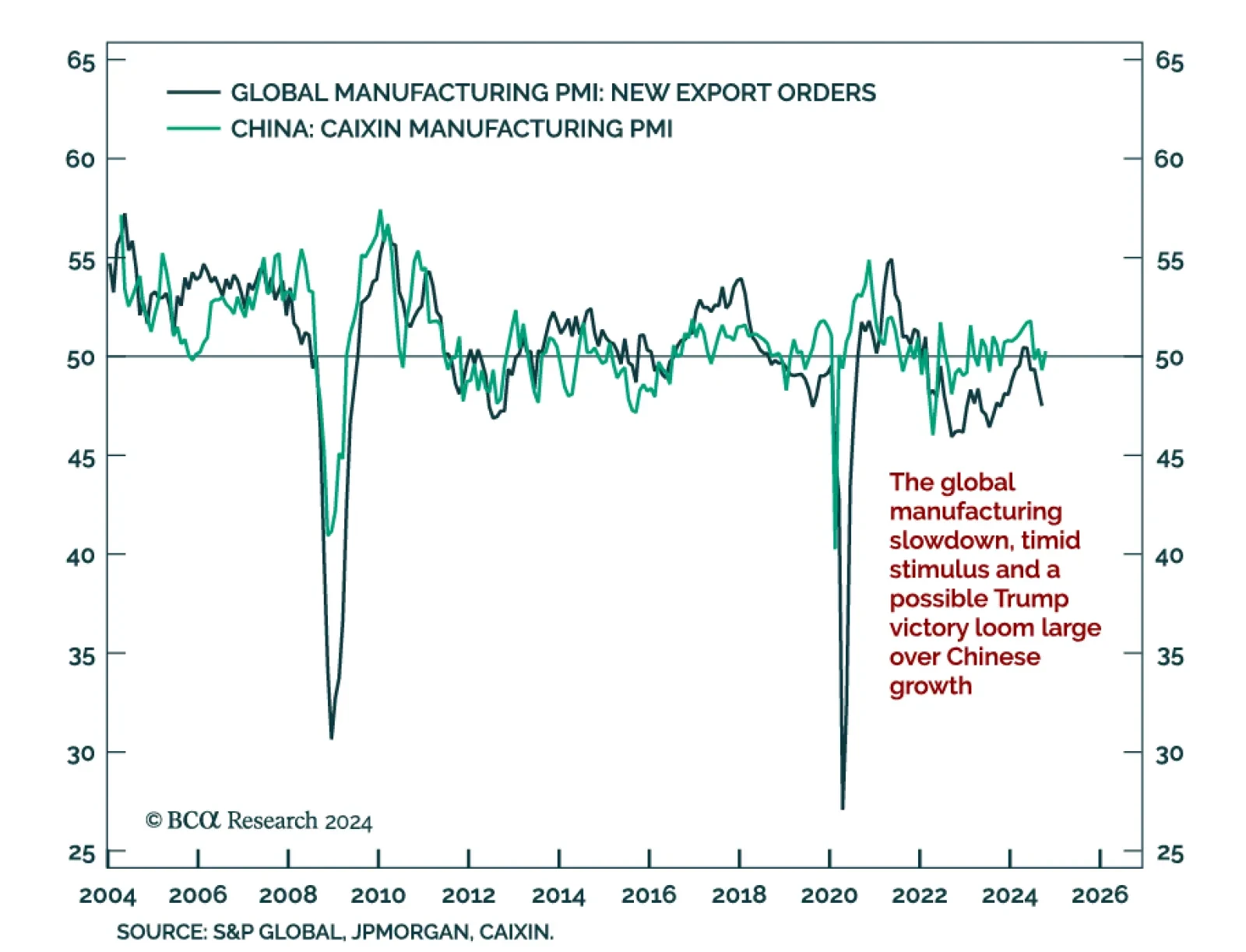

The prospect of a new trade war more than offsets the other pro-business parts of Trump’s agenda. With the labor market already weakening going into the election, we are raising our 12-month US recession probability from 65% to 75%.

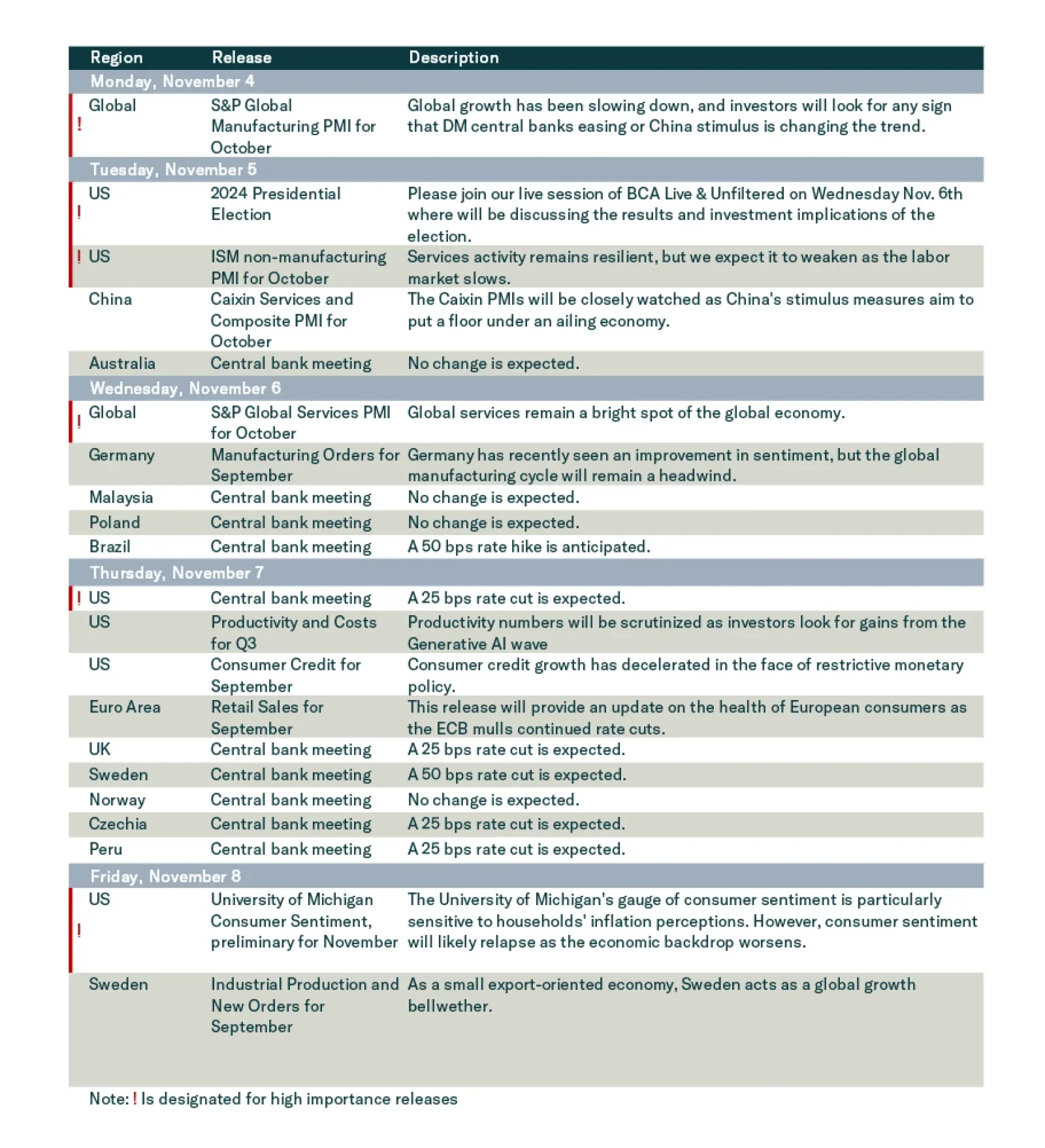

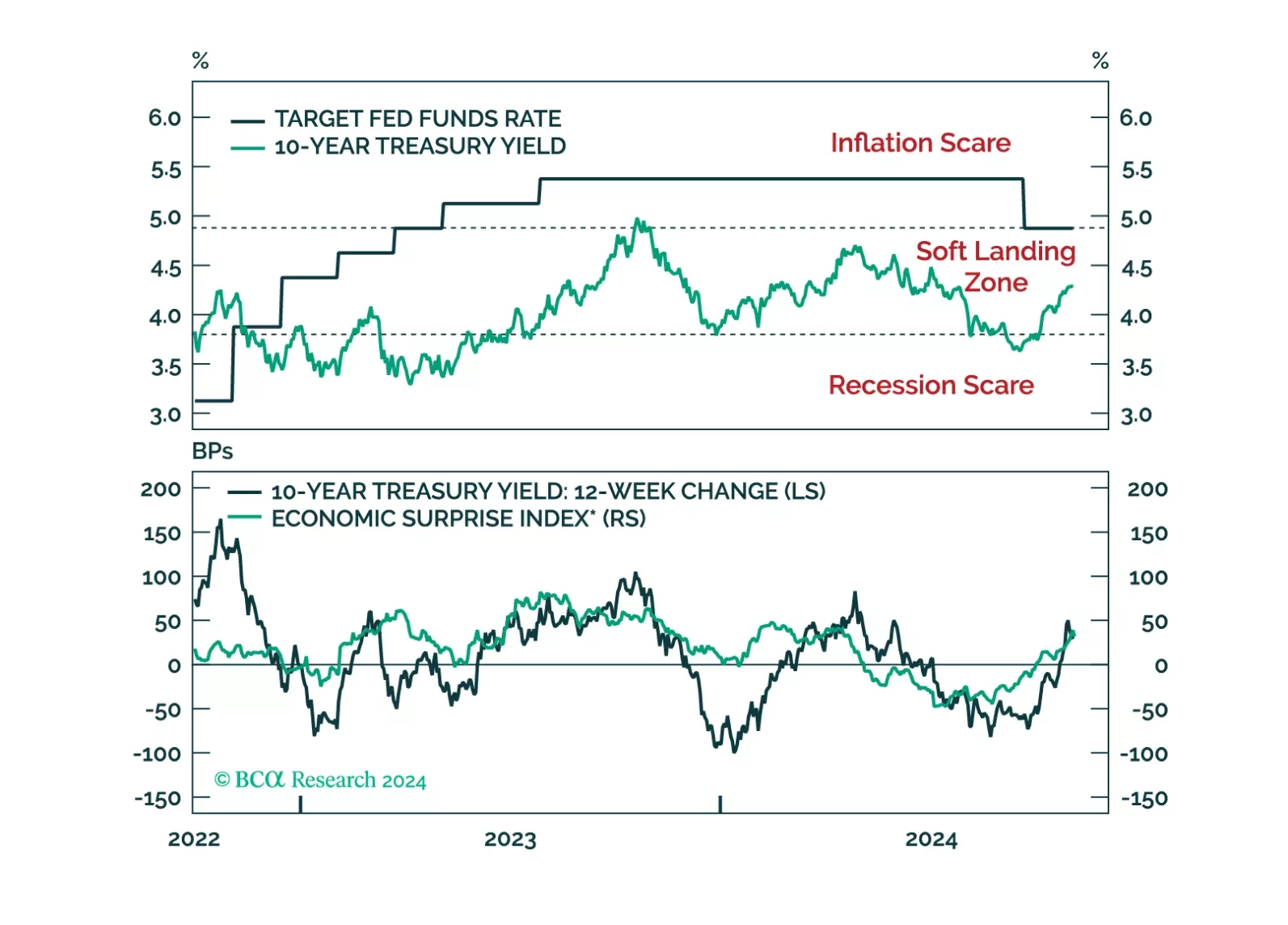

A reaction to this morning’s employment report and a preview of the potential bond market implications of next week’s US election and FOMC meeting.

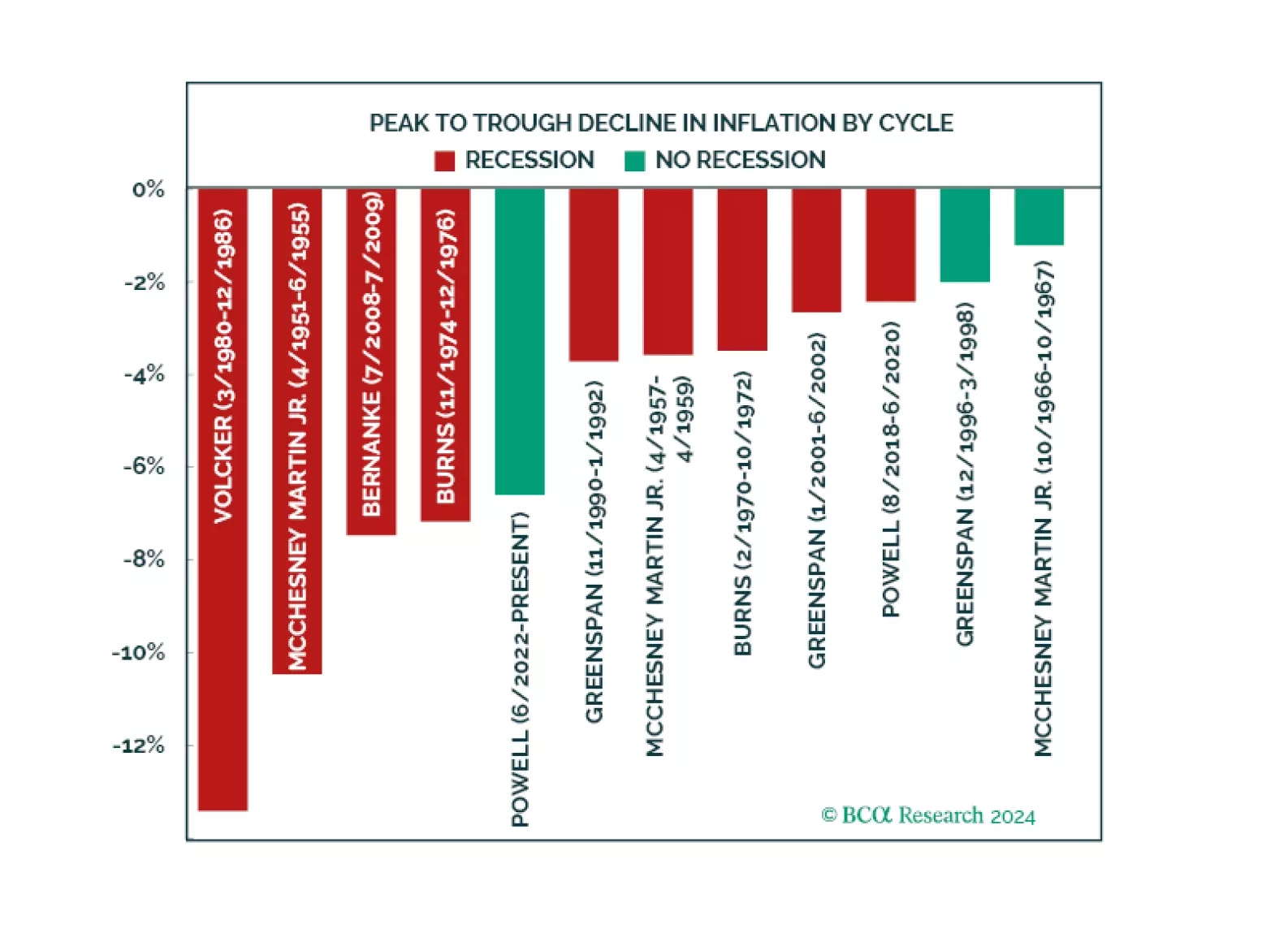

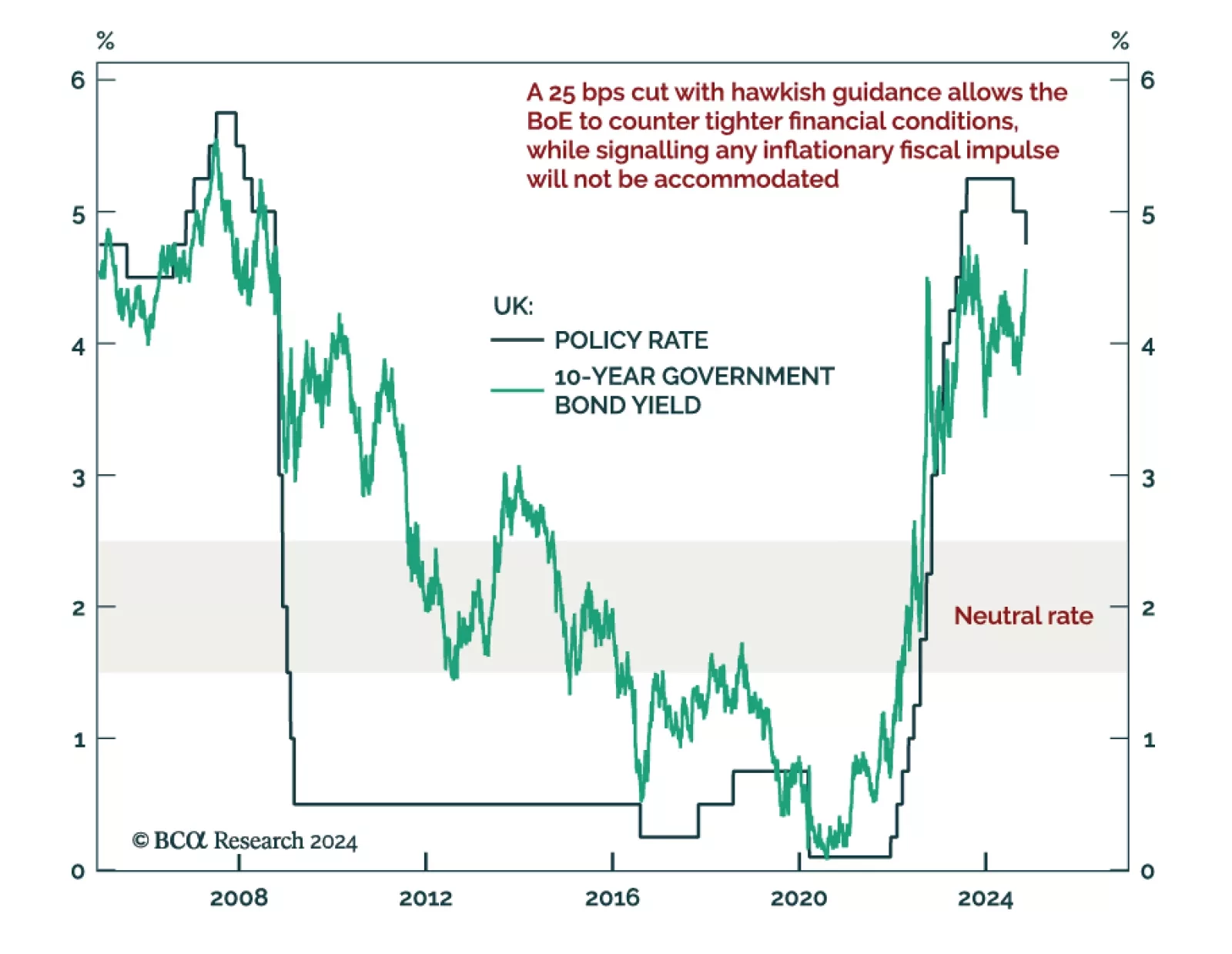

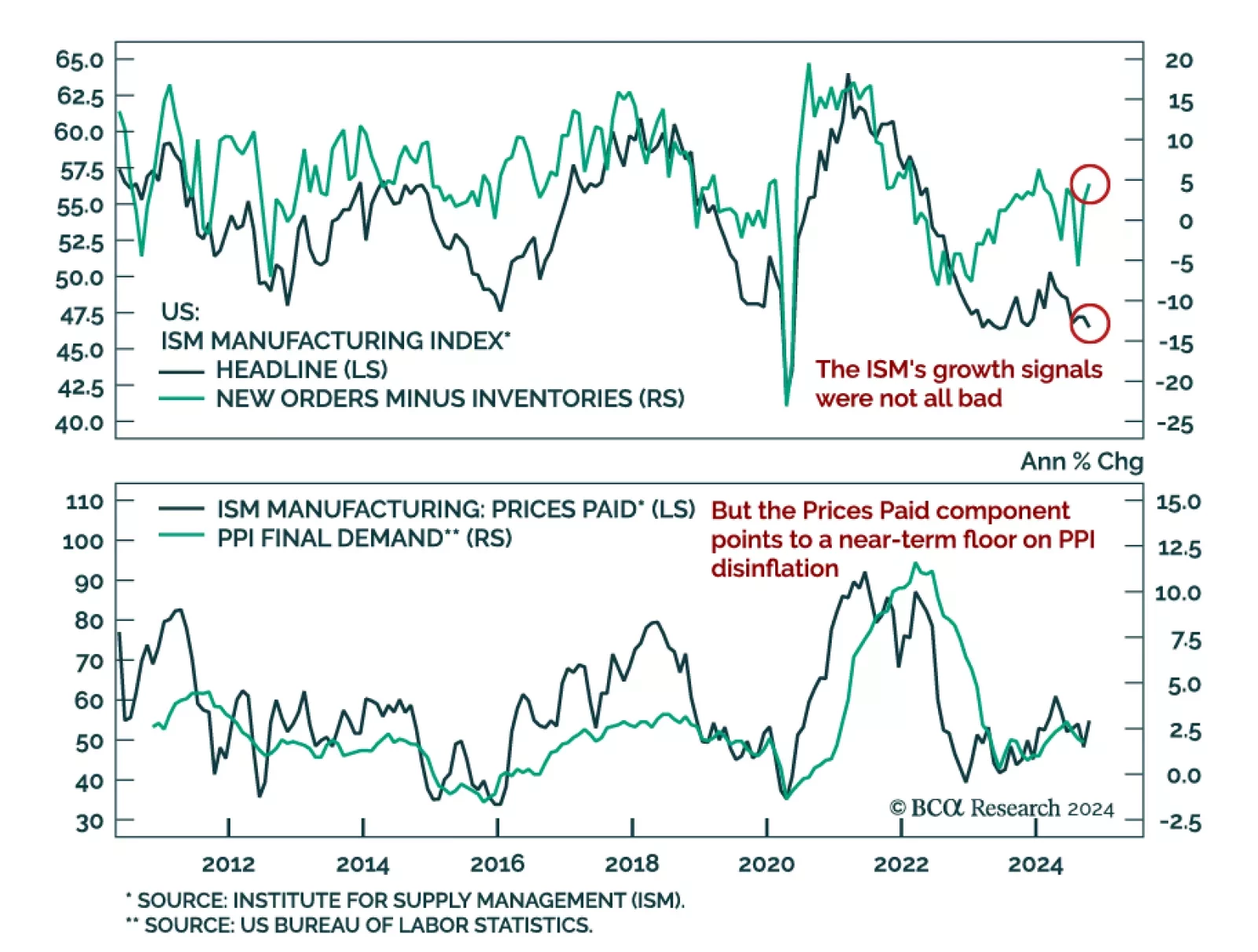

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other half have run out of juice. While this might be enough to keep the economy going, we maintain our defensive positioning. Equities have priced a very benign outcome. Meanwhile, rising rates in anticipation of a Trump win are pushing the economy away from the soft-landing path. We hedge the possibility of further upside in yields in case Trump gets elected by downgrading duration to neutral.