While we are sympathetic to the view that the Fed could temporarily achieve a soft landing, we are skeptical that it could stick that landing for very long. Stocks could strengthen into year-end, with small caps potentially leading…

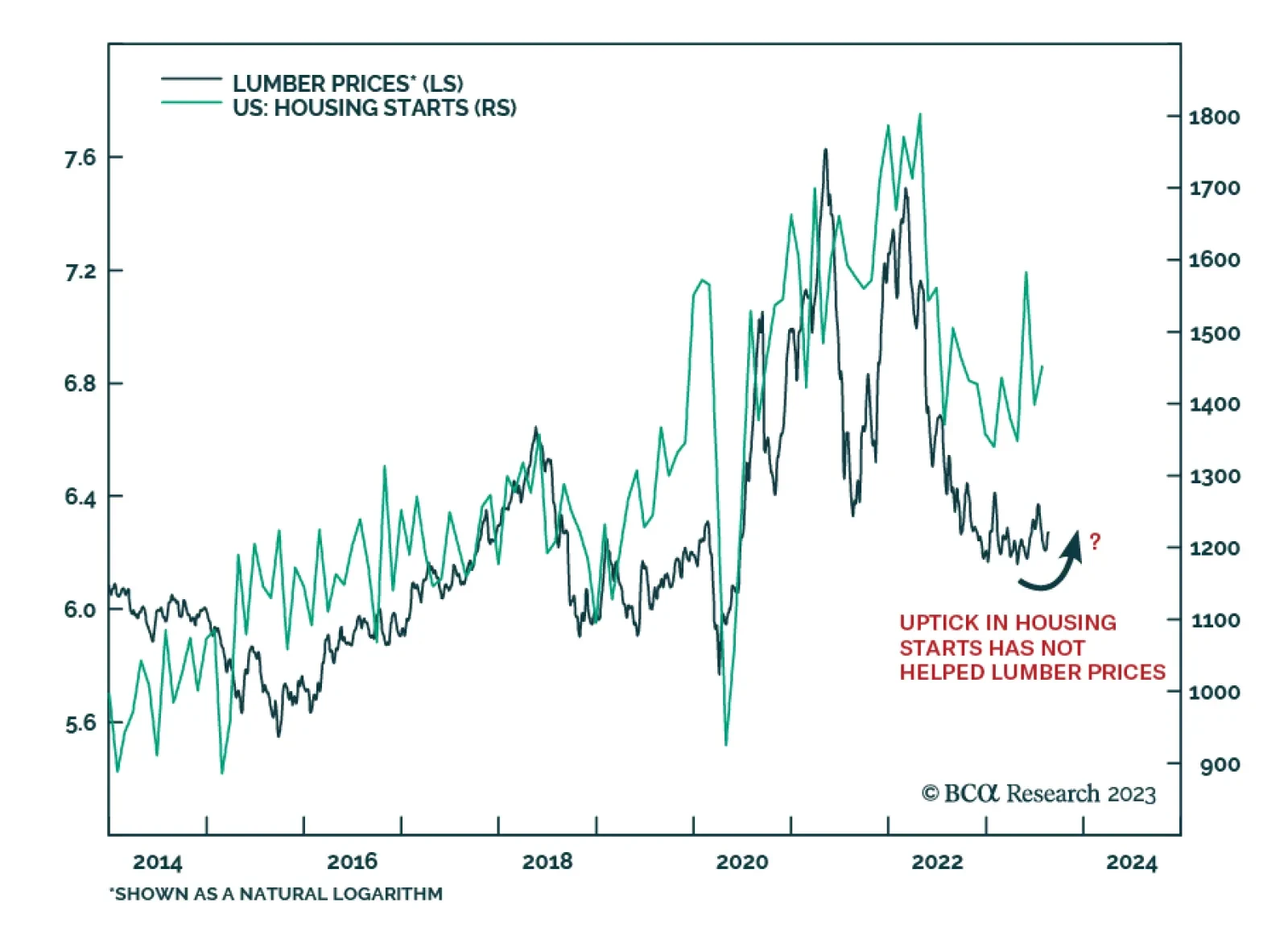

In a June insight, we discussed the possibility of a sustained lumber rally due in part to resilient housing market activity in the US and supply constraints in Canada, a major exporter of lumber. Since then, prices have remained…

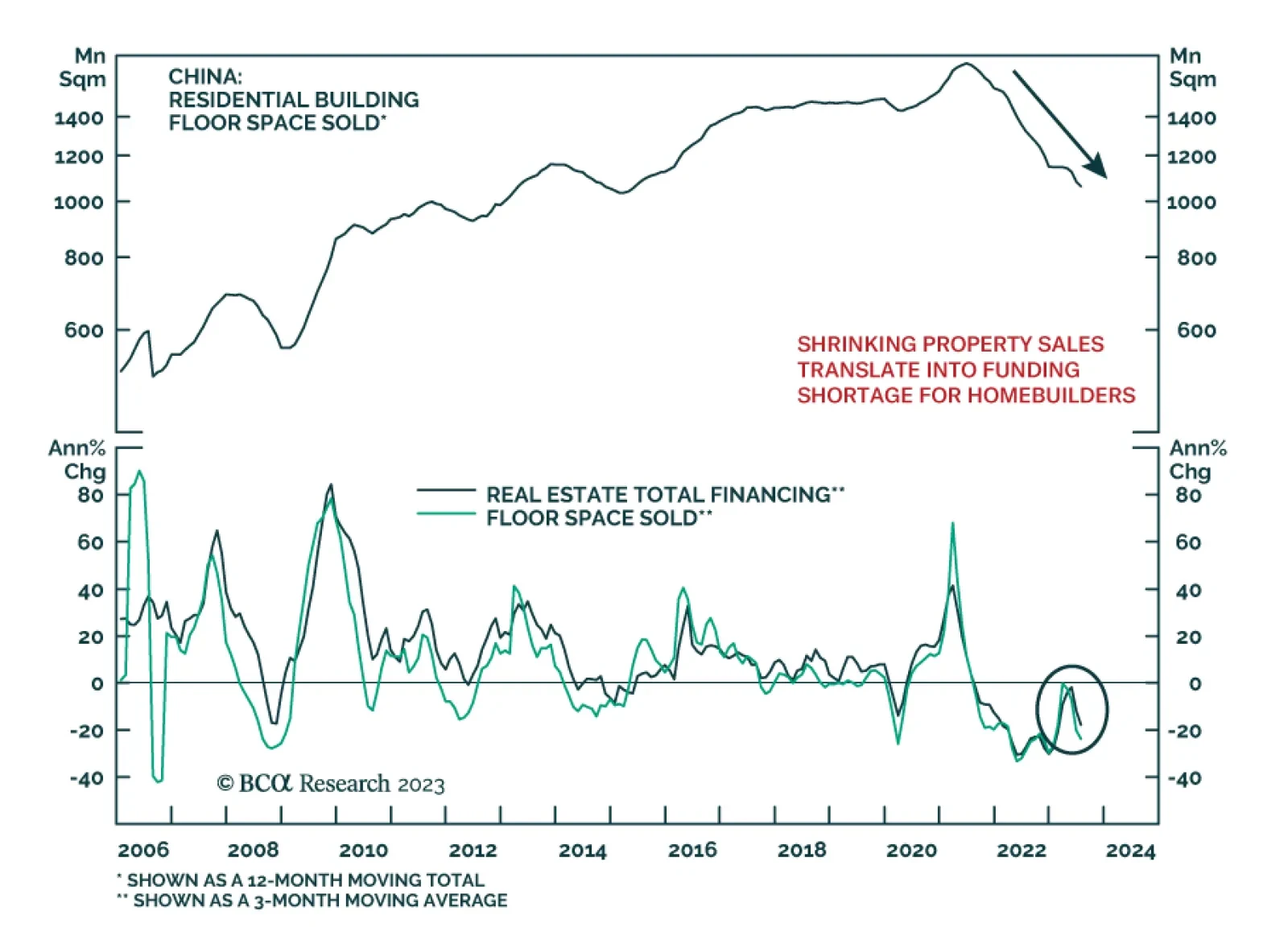

According to BCA Research’s China Investment Strategy service, although property-sector stocks in China’s onshore and offshore markets have been beaten down, they have not yet reached their bottom. The property…

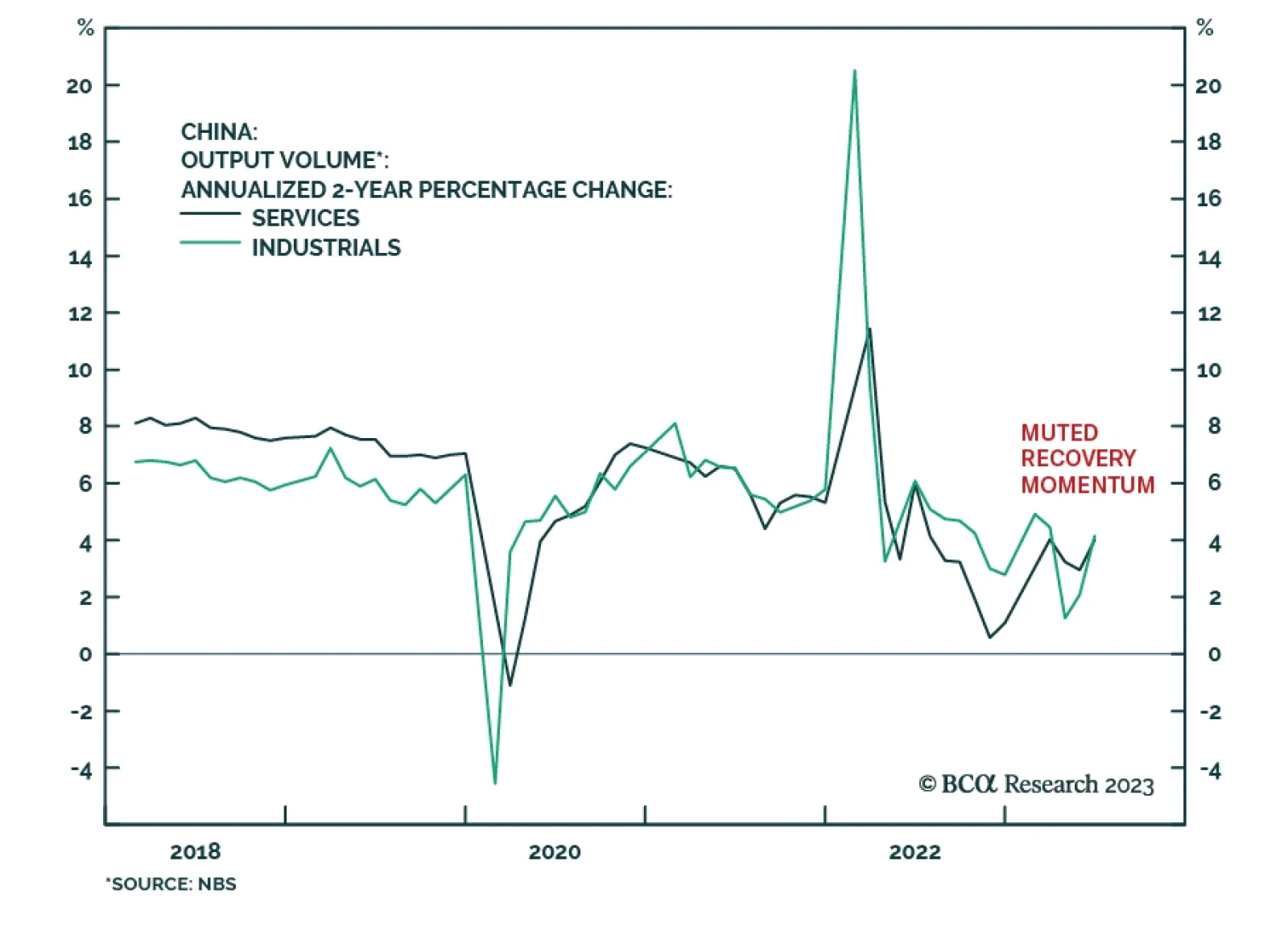

China’s extremely high savings rate is the real culprit behind its current economic woes. The authorities have been slow to stimulate the economy, and the risks of “Japanification” have increased. For now, the fact that China is…

The US is not out of the woods when it comes to inflation, which means that it is too early to conclude that the Fed can stop raising rates. Any further increase in inflation risk would prompt us to turn more cautious on stocks.

Although not our base case, there is a path for the US economy to avoid a recession over the next few years. We see the risks to stocks as tilted to the upside in the near term but to the downside over a 12-month horizon.

On the surface, the latest batch of Chinese economic data released on Monday shows a deterioration in consumer spending with retail sales growth slowing sharply from 12.7% y/y to 3.1% y/y in June – slightly below consensus…

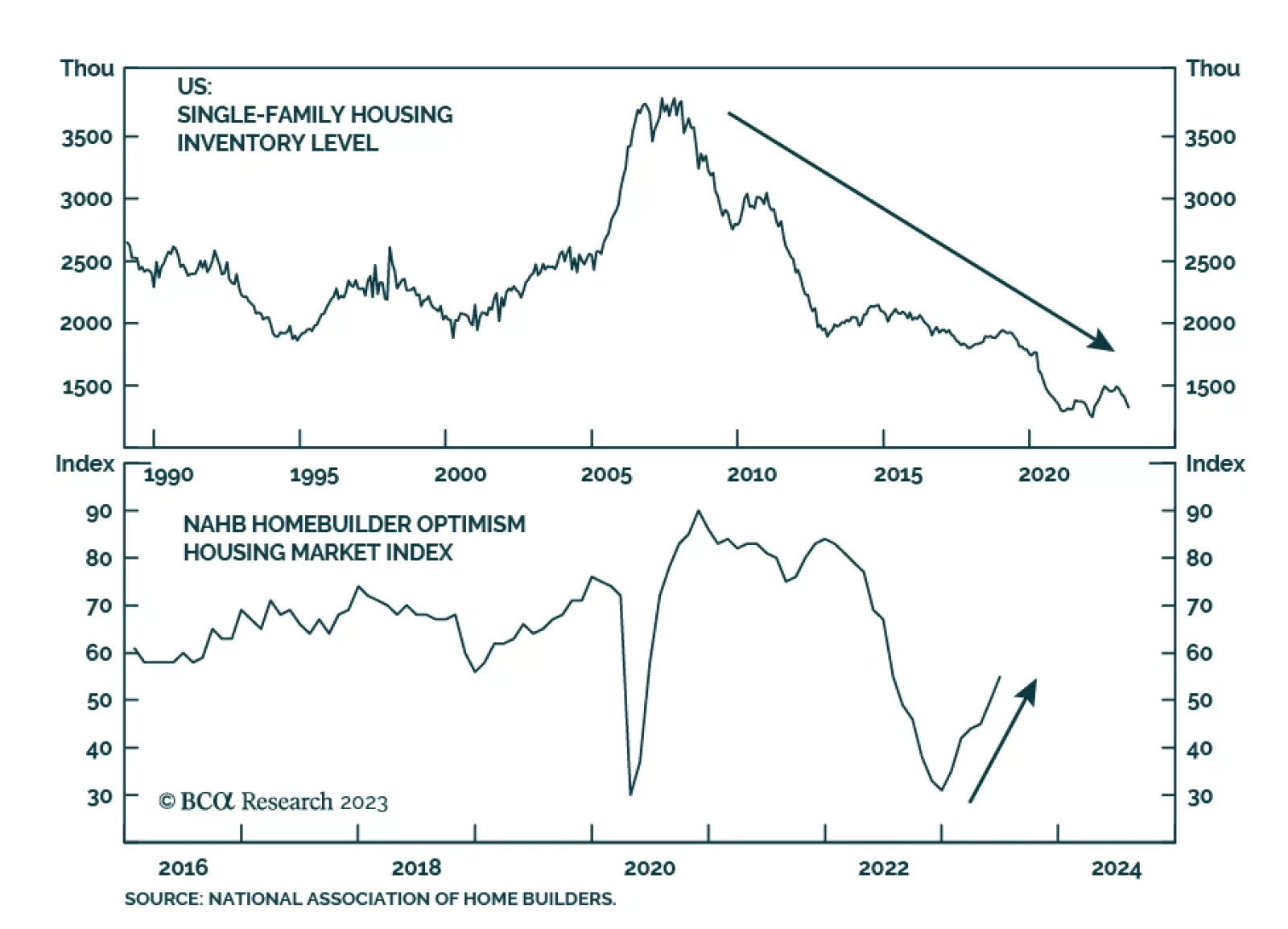

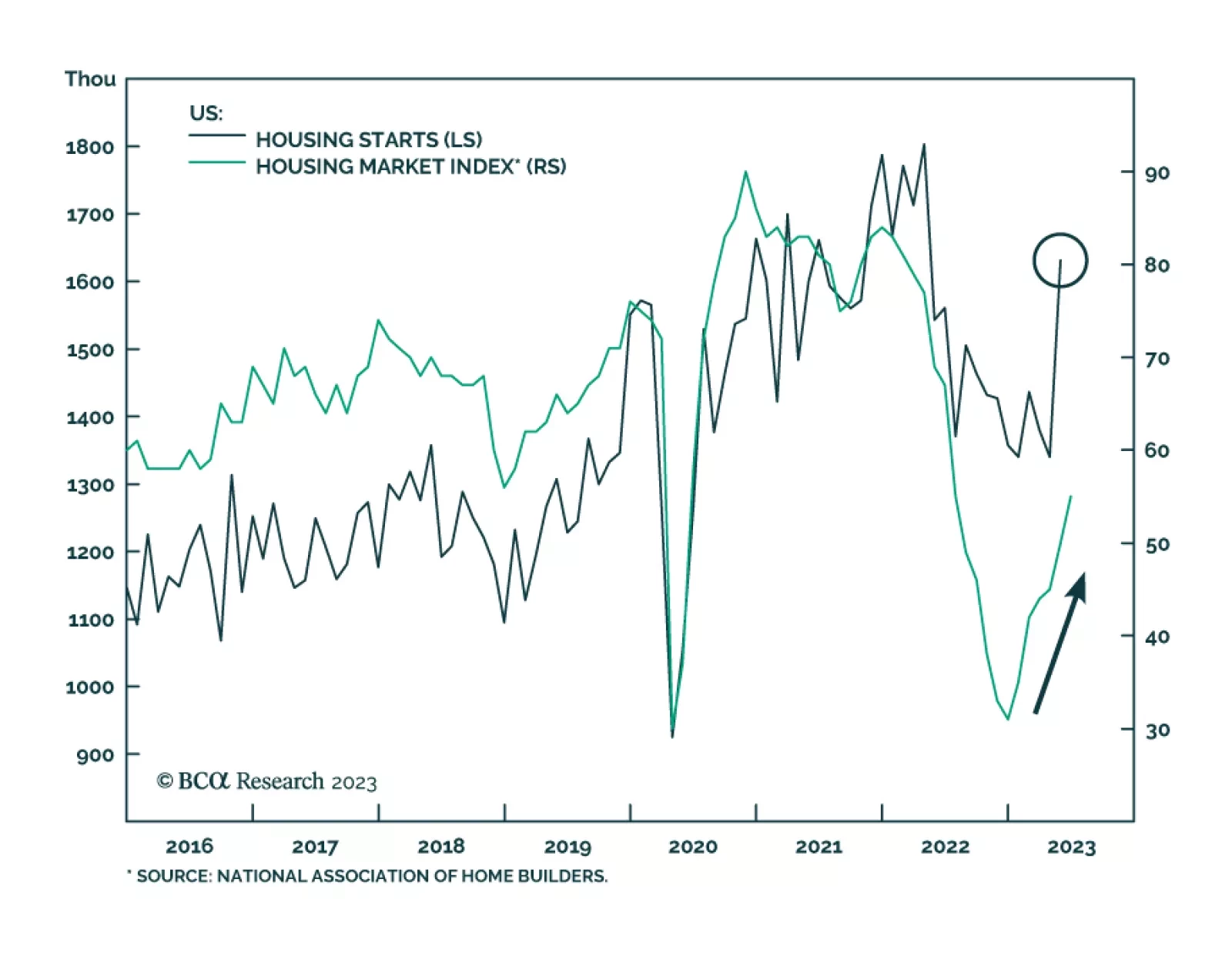

According to BCA Research’s US Equity Strategy service, residential REITs, homebuilders, and durable goods manufacturers are the beneficiaries of the negative supply shock in residential housing. Shortage of inventories…

In June, the rally gained momentum and broadened due to positive economic data, particularly in the housing market. We expect cheaper cyclical sectors and styles to mark a change in leadership as the rally broadens, helped on by…

In their just-published update of US housing market conditions, our colleagues at the BCA Bank Credit Analyst focus on whether May’s strong showing in new home starts and sales in May – up 21% and 12%,…