Clients are increasingly more positive about the US economy, but there are no signs of exuberance. The rally could continue as the majority is not fully invested. Financial conditions have already eased, and the Fed is unlikely to…

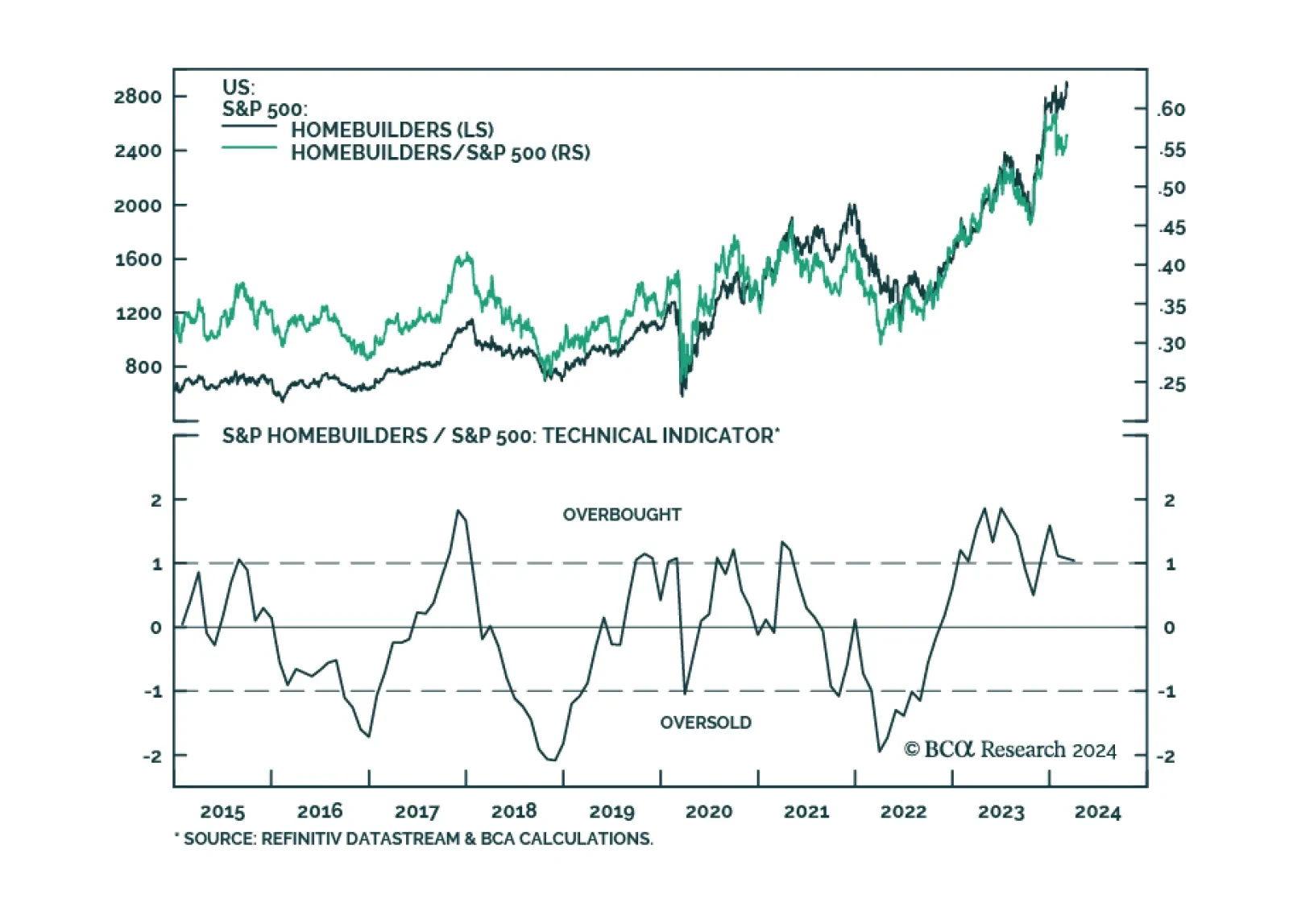

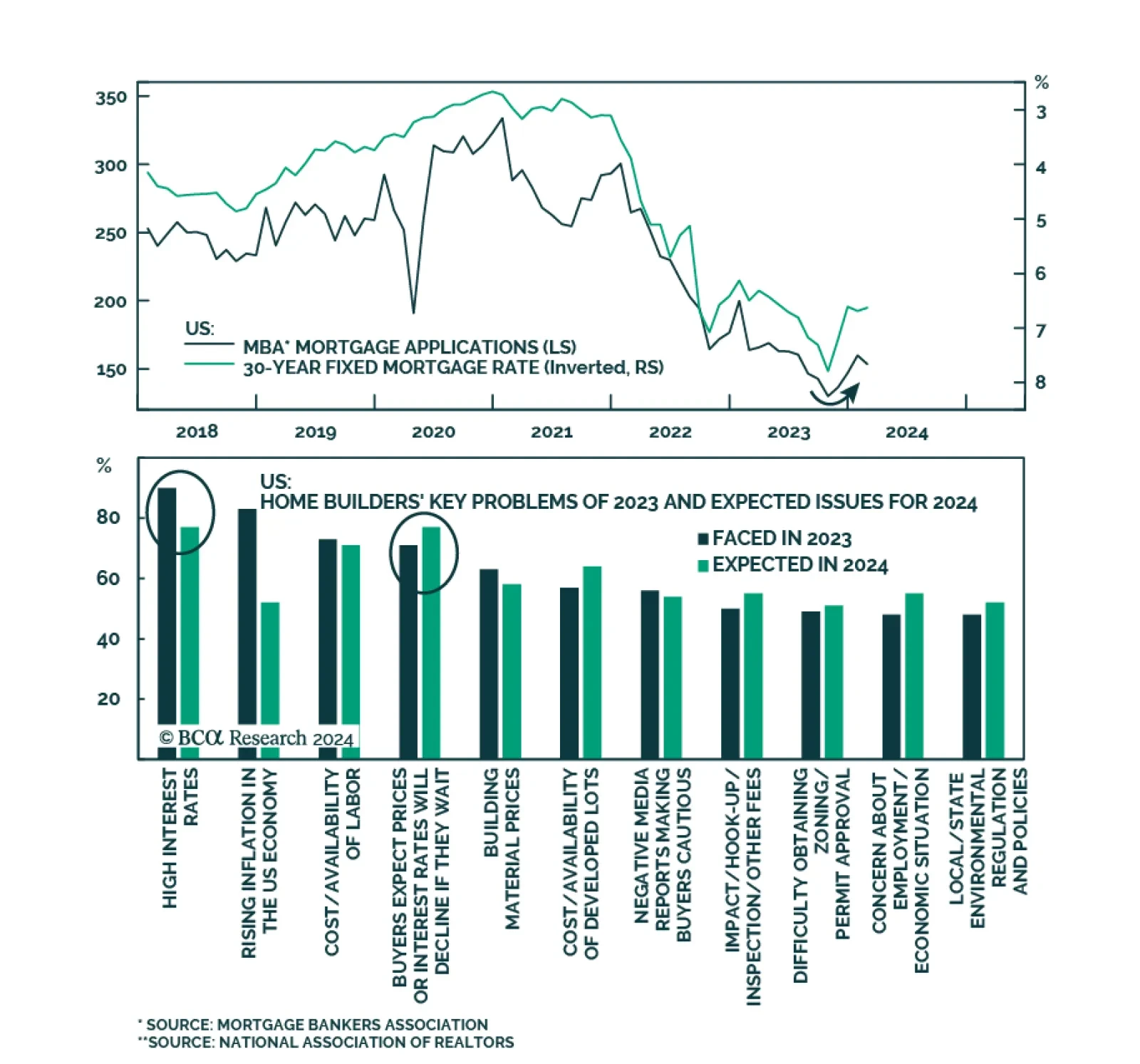

The S&P 500 Homebuilders index has returned a whopping 50% since October and outperformed the overall market by 24% over this period. Tight US housing supply is placing a floor under construction activity and constitutes a…

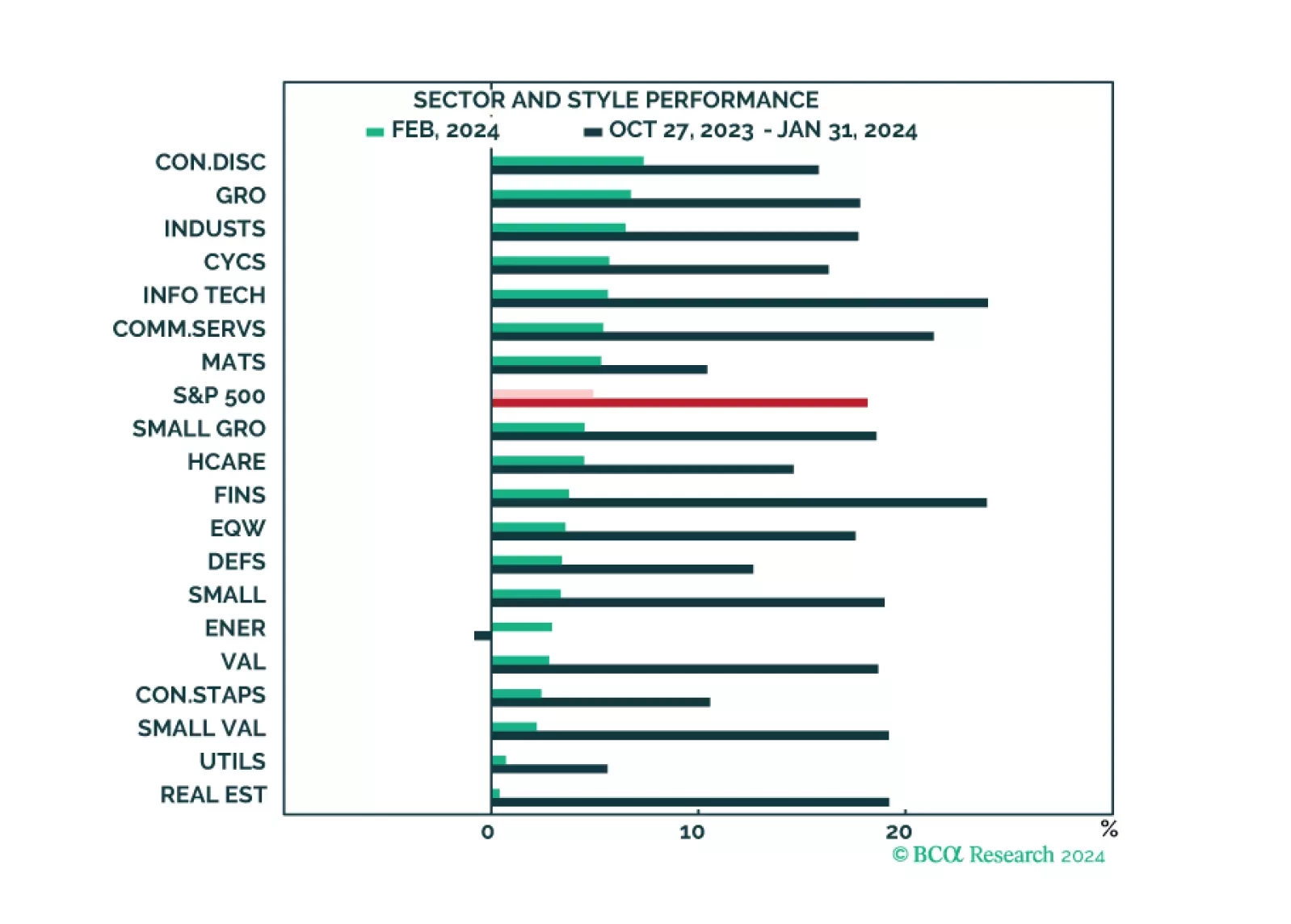

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…

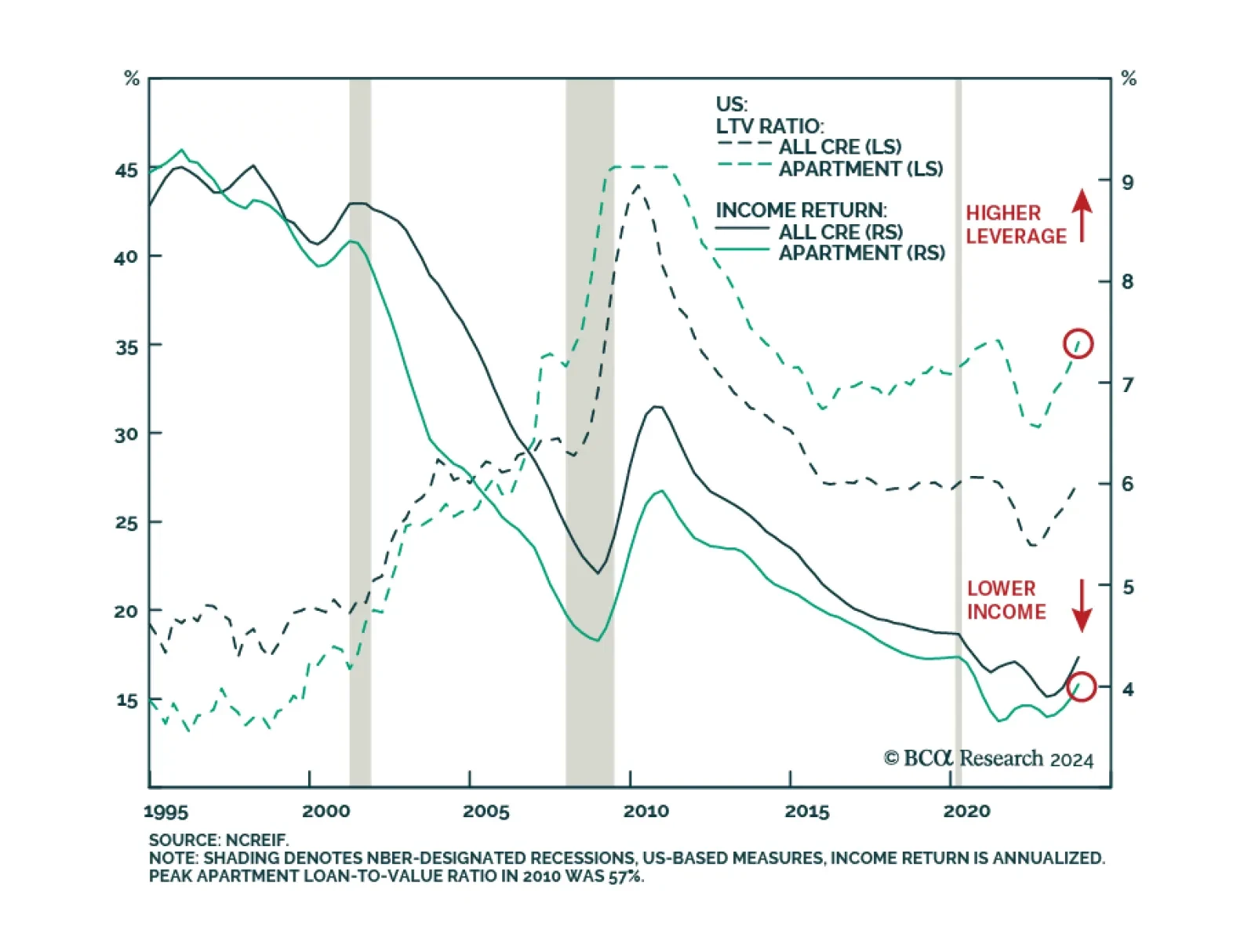

According to BCA Research’s Private Markets & Alternatives service, fundamentals show US Multifamily assets to be akin to picking up pennies in front of a steamroller. Multifamily, and Office, have long served as…

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

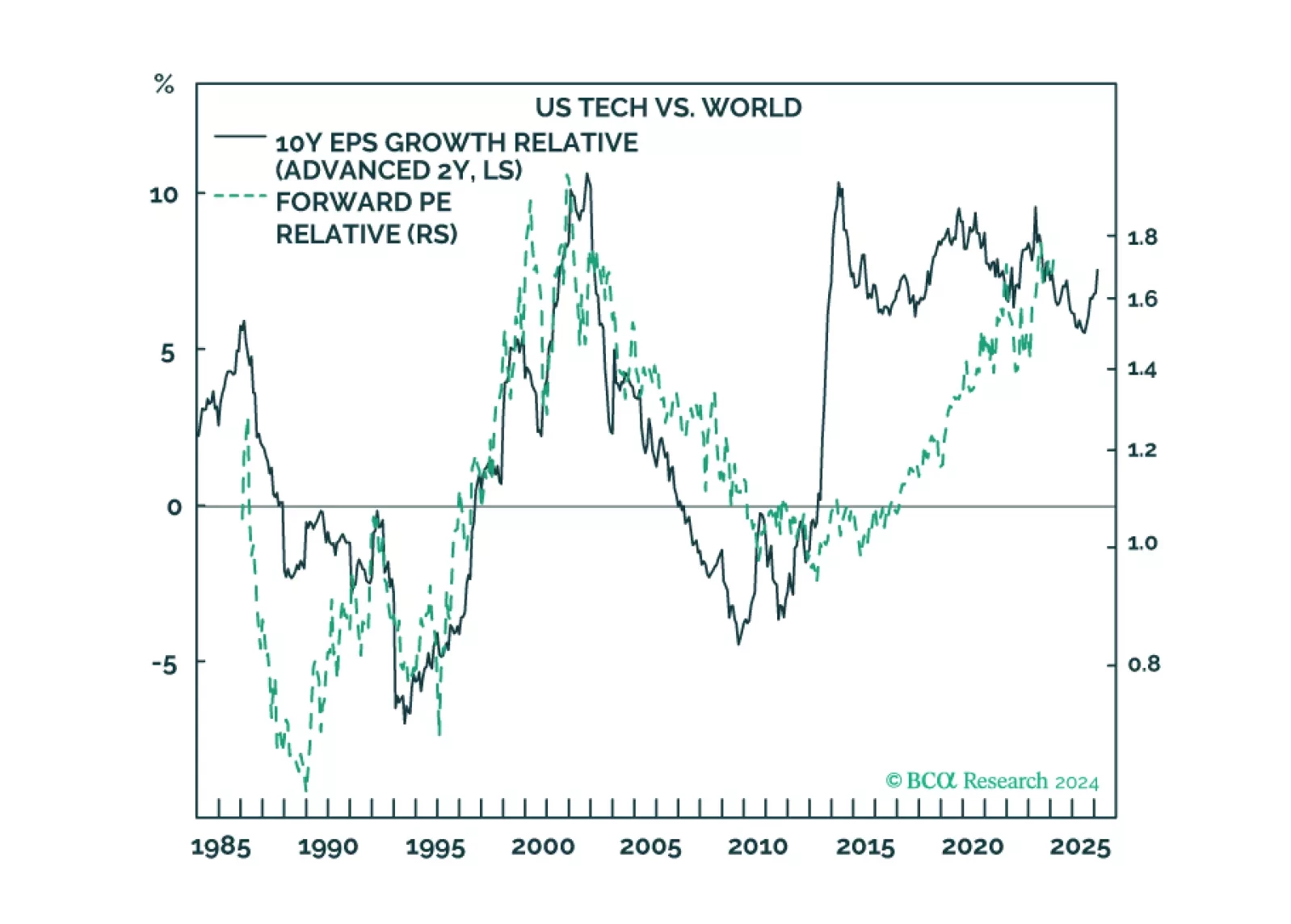

Our Valentine’s Day report is about two love stories: the infatuation with US tech and China’s infatuation with housing. We describe how these love stories will end, and why Europe could be the winner.

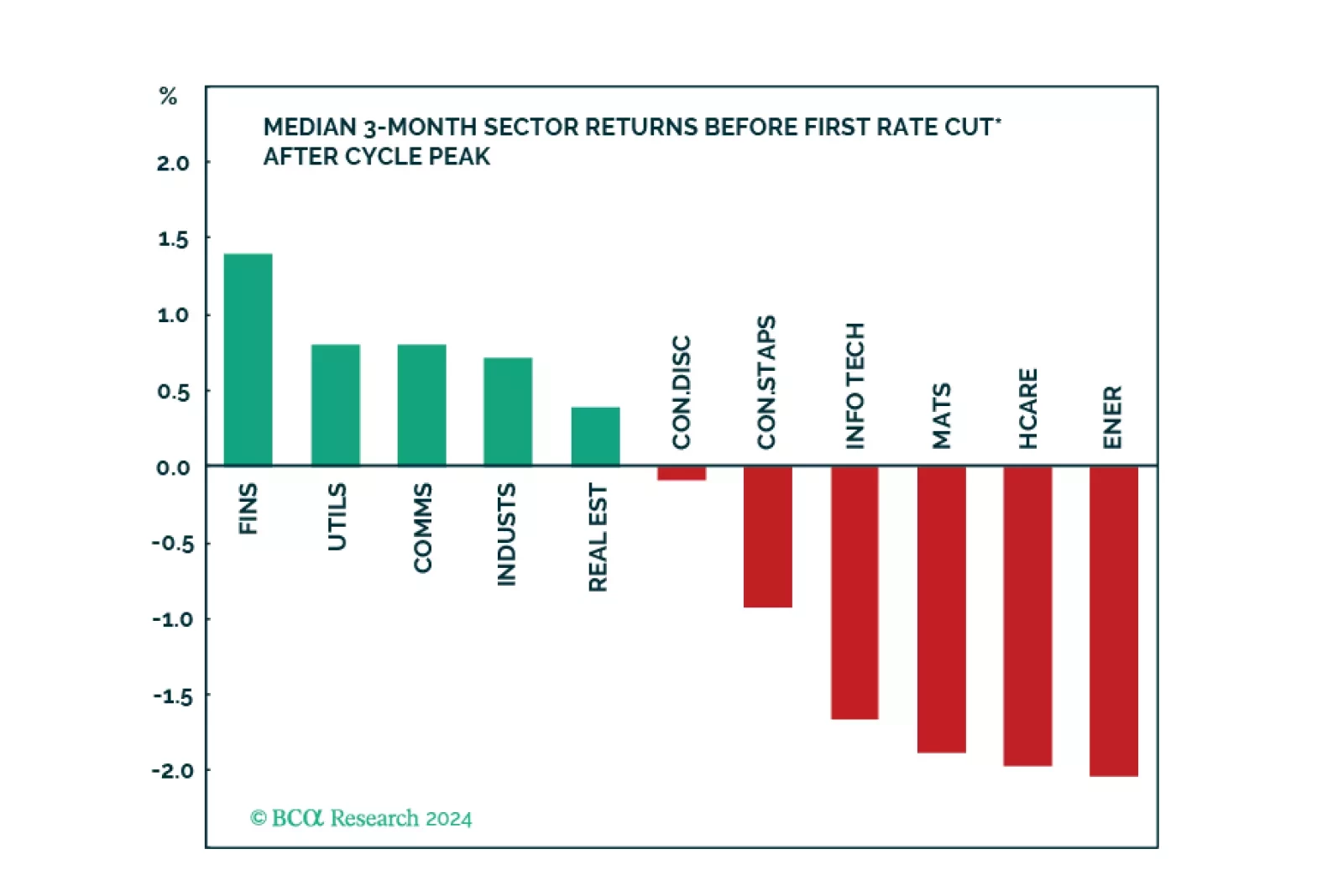

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

According to the latest MBA weekly survey, mortgage applications increased 3.7% in the week ending February 2. The contents of the report were mixed. A 12.3% jump in the refinance index drove the increase while mortgage…

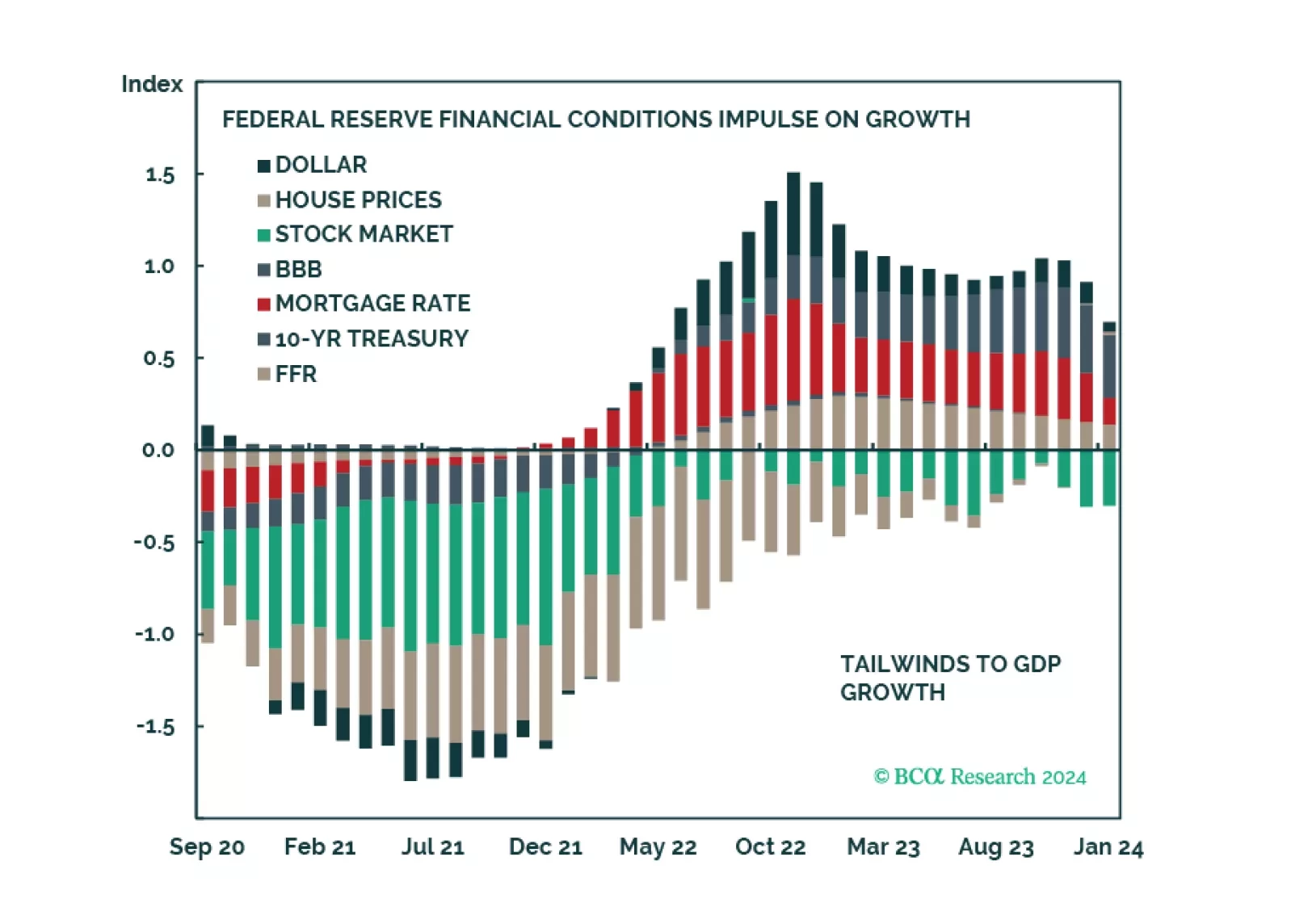

A recent slew of macroeconomic data has reassured us that the runway to a recession is longer than many thought. However, that positive realization comes with two caveats. First, the Fed pivot is not imminent, and the magnitude of…

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…