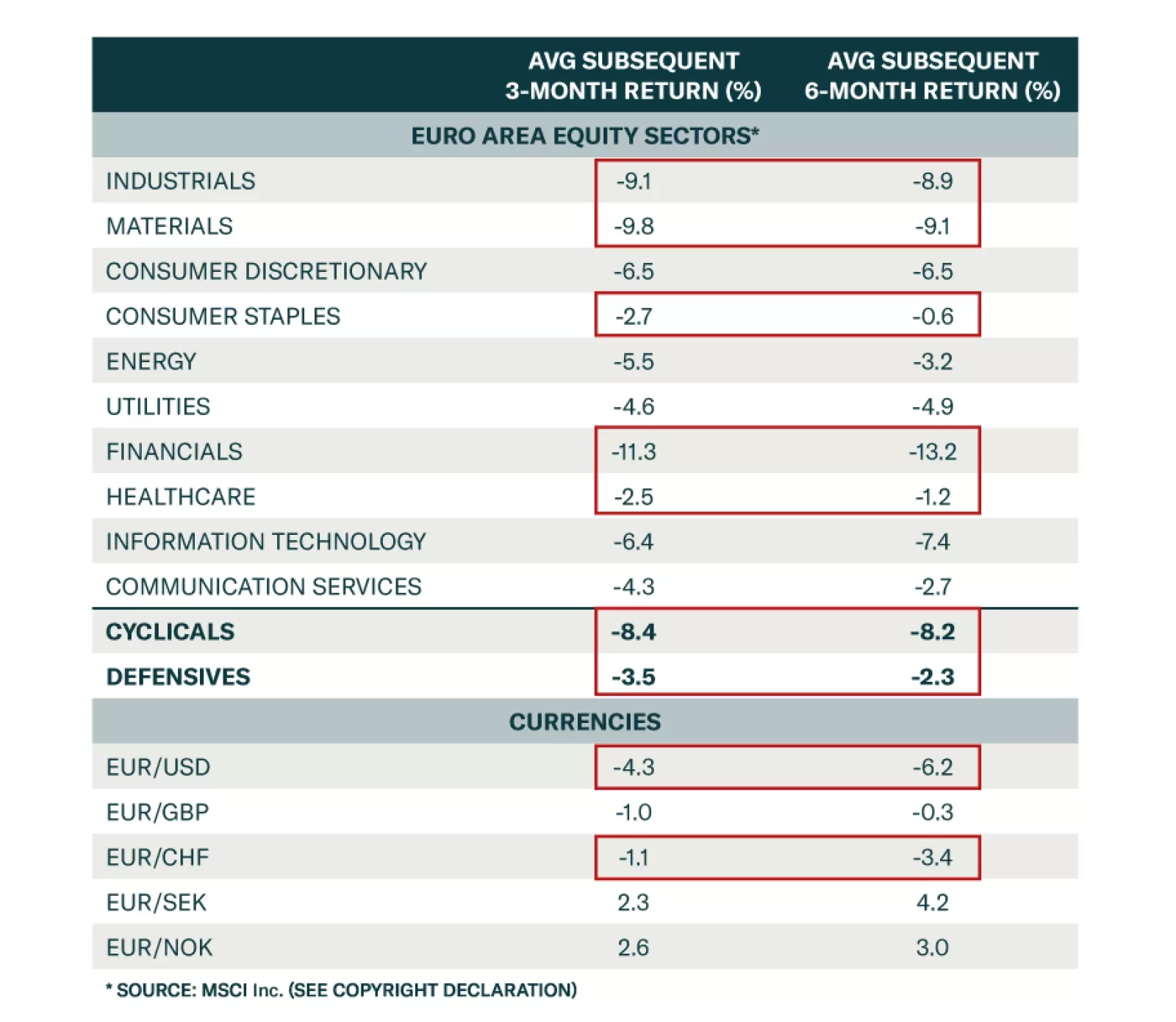

BCA Research’s European Investment strategists looked at previous episodes of carry-trade blowups and assessed the performance of the Eurozone’s key sectors, national markets, and currencies three and six months…

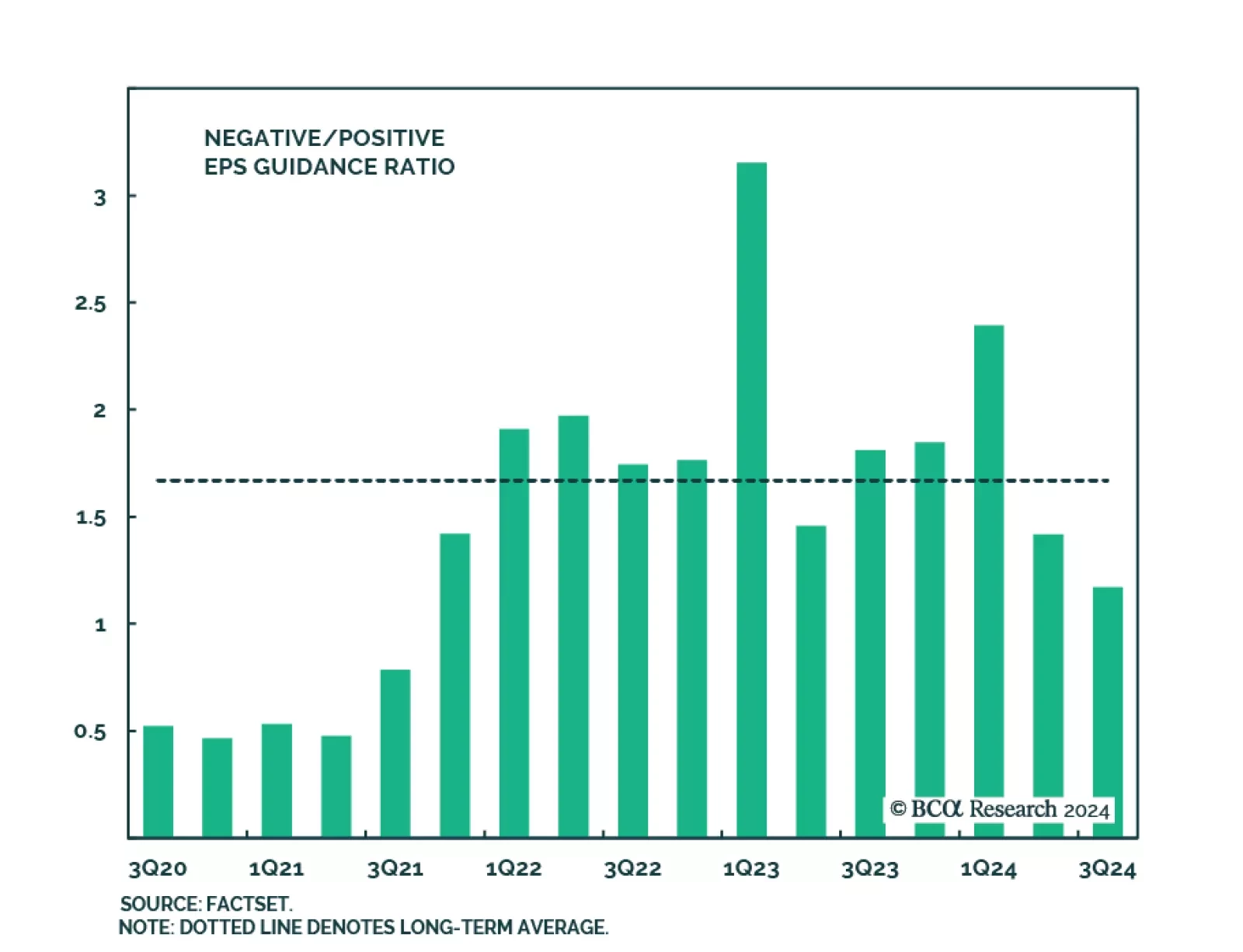

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

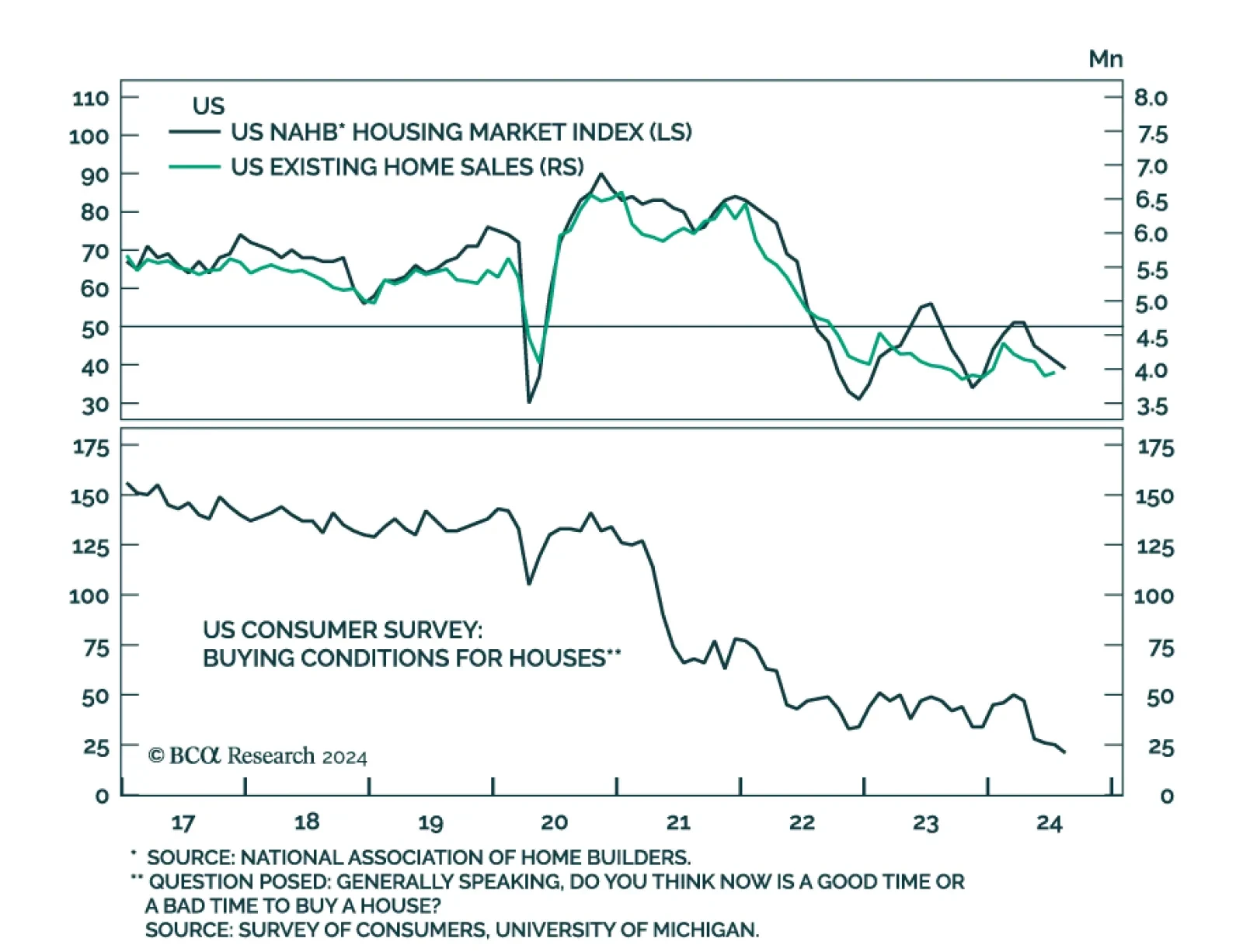

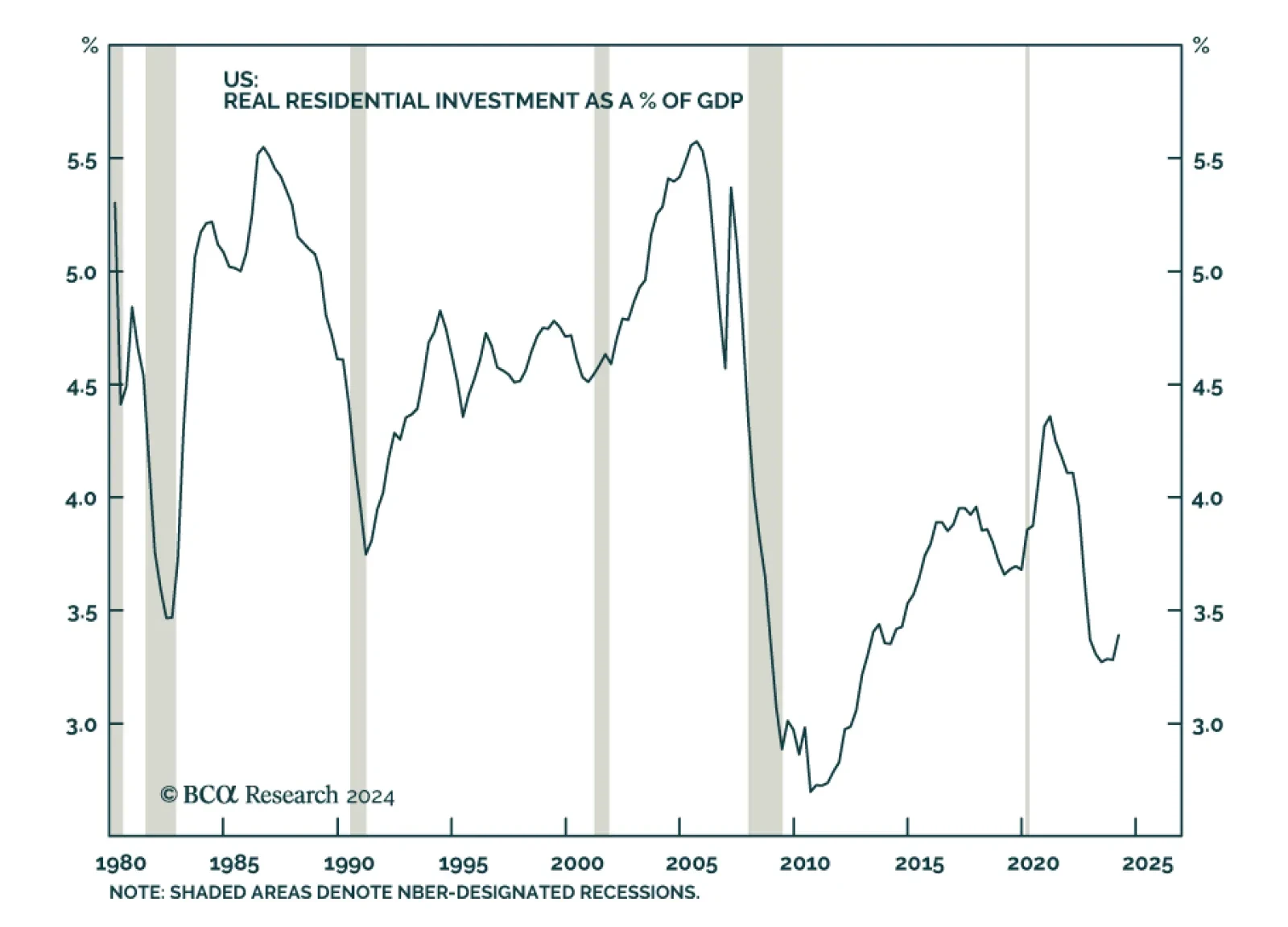

US housing market data have been mixed. In June, the FHFA House Price index unexpectedly declined 0.1% m/m and the NAHB housing market index unexpectedly eased to 39 from a 41 reading. In July, starts and permits both…

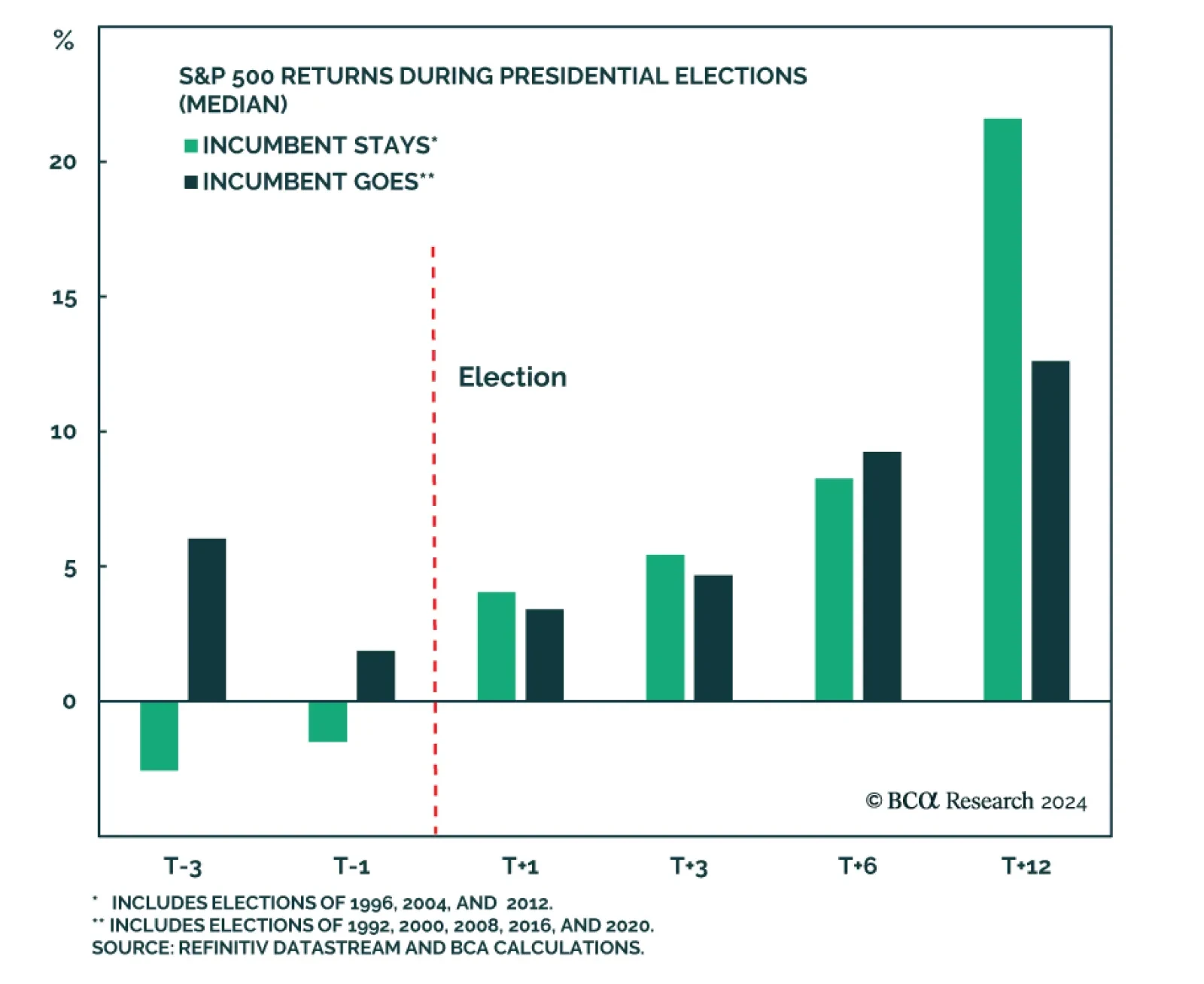

According to BCA Research’s US Political Strategy service, in the final months of an election cycle, equities underperform relative to non-election years. This extends further into Q1 of the following year due to…

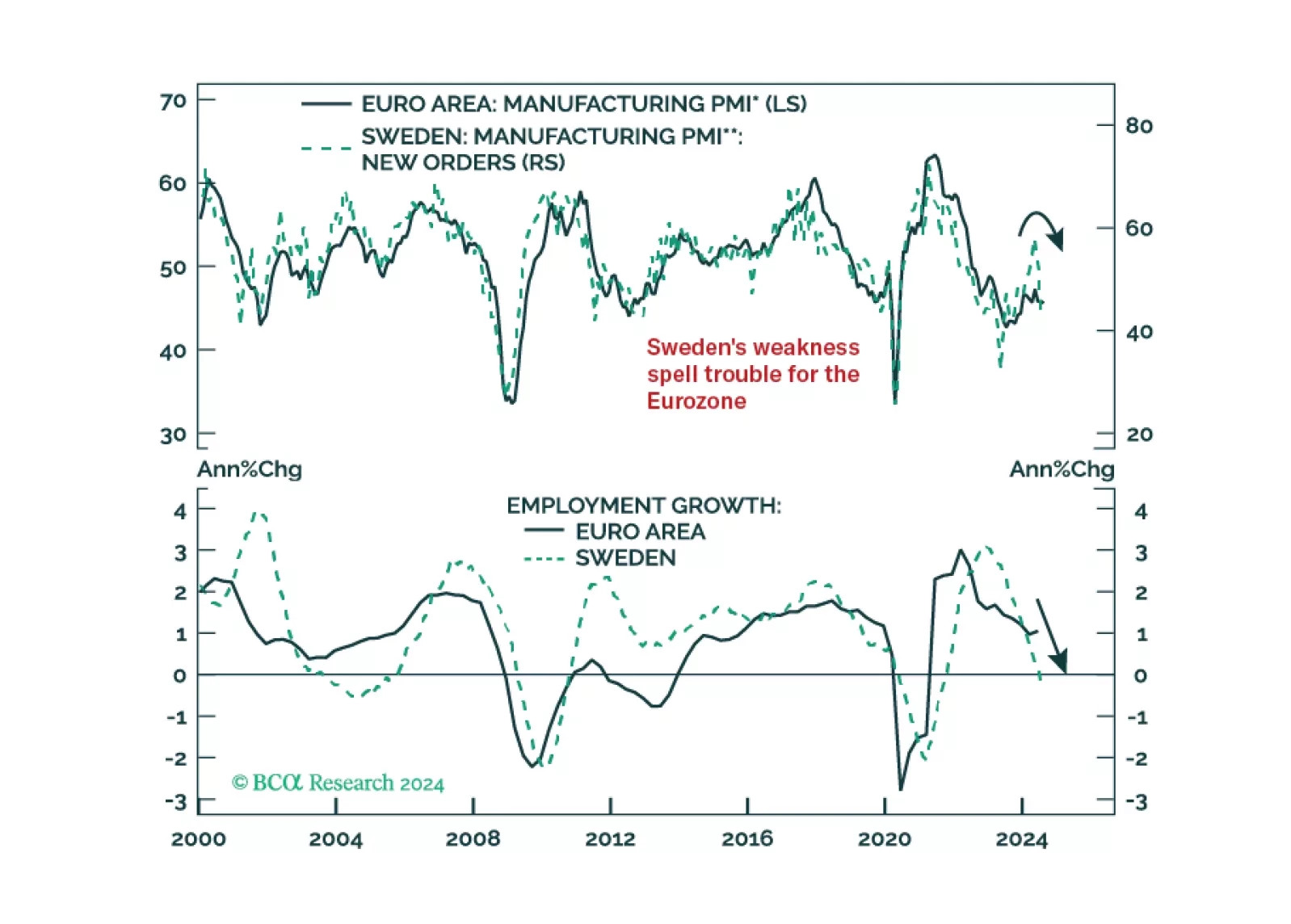

Our negative stance on European growth and assets is not devoid of risks. To gauge whether these risks warrant upgrading our growth outlook, we monitor Sweden closely. So, what is the current message from this Nordic economy?

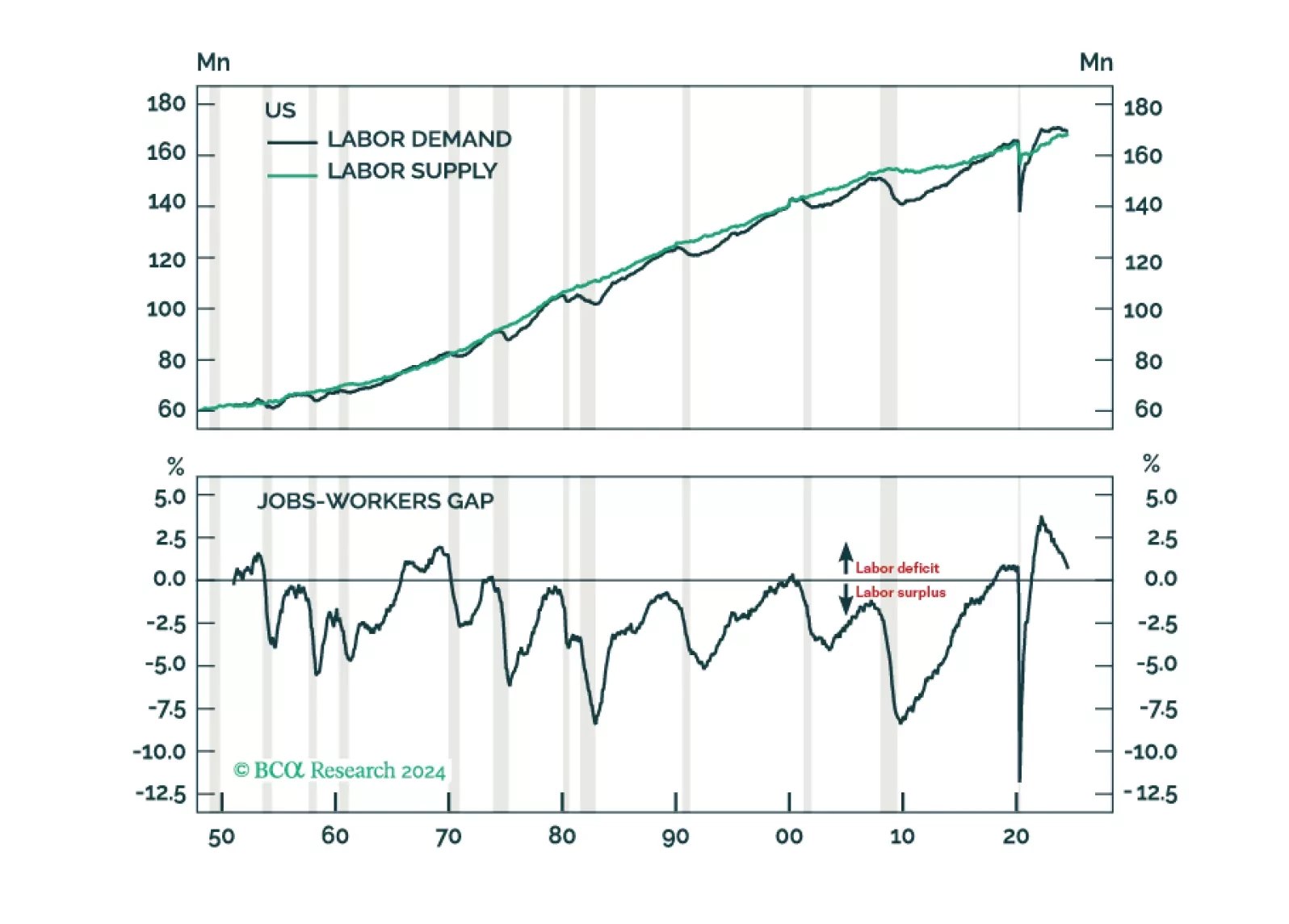

The great US labor market shortage is over. Labor demand will likely fall short of supply by the end of this year, causing unemployment to soar. Neither fiscal nor monetary policy will be able to prevent the coming recession.…

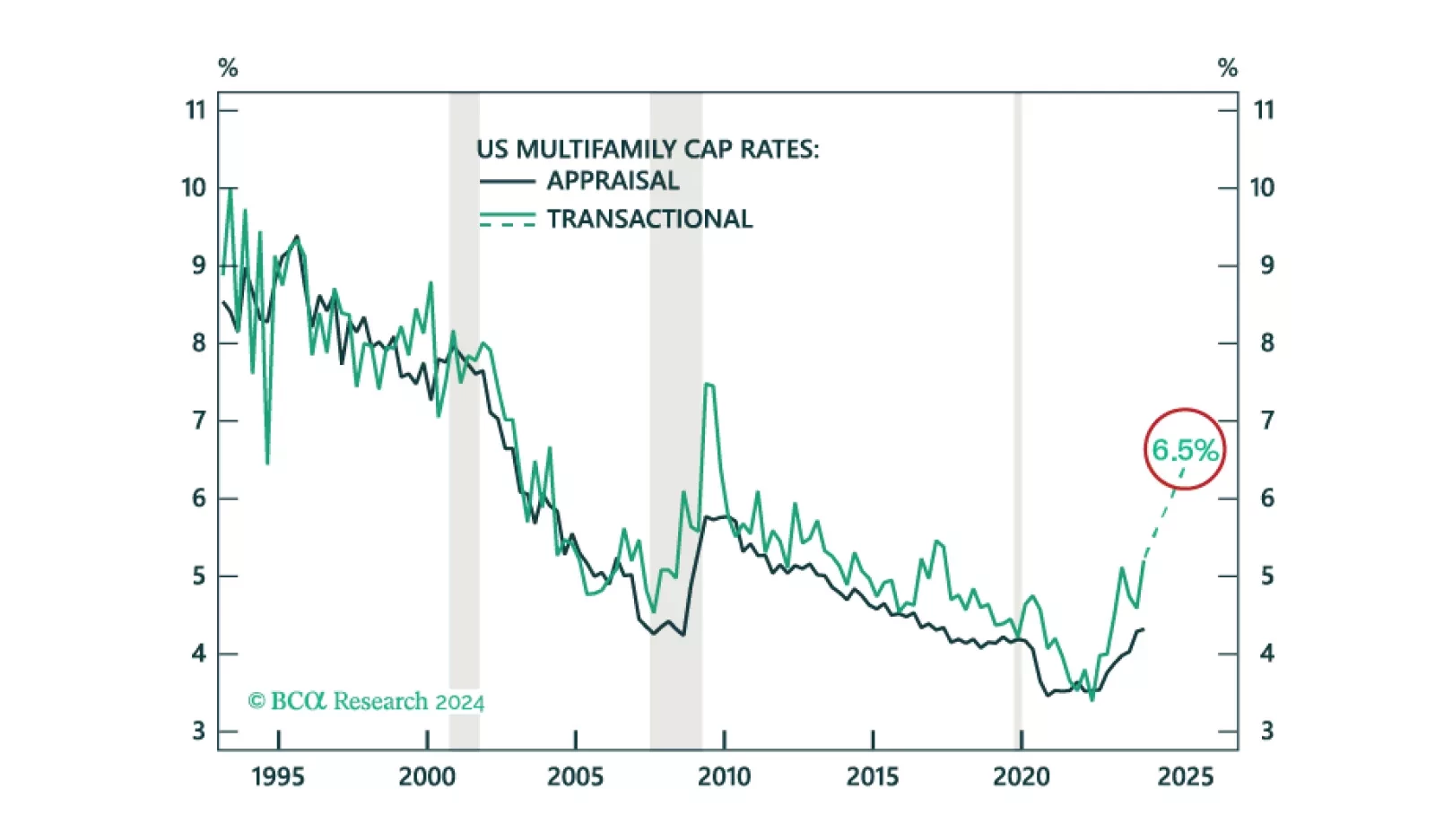

We project US Multifamily cap rates to increase from 5.2% to 6.5%. While we find an unfavorable risk-adjusted return on the asset, especially relative to other opportunities in CRE, cap rates are moving closer to peak.

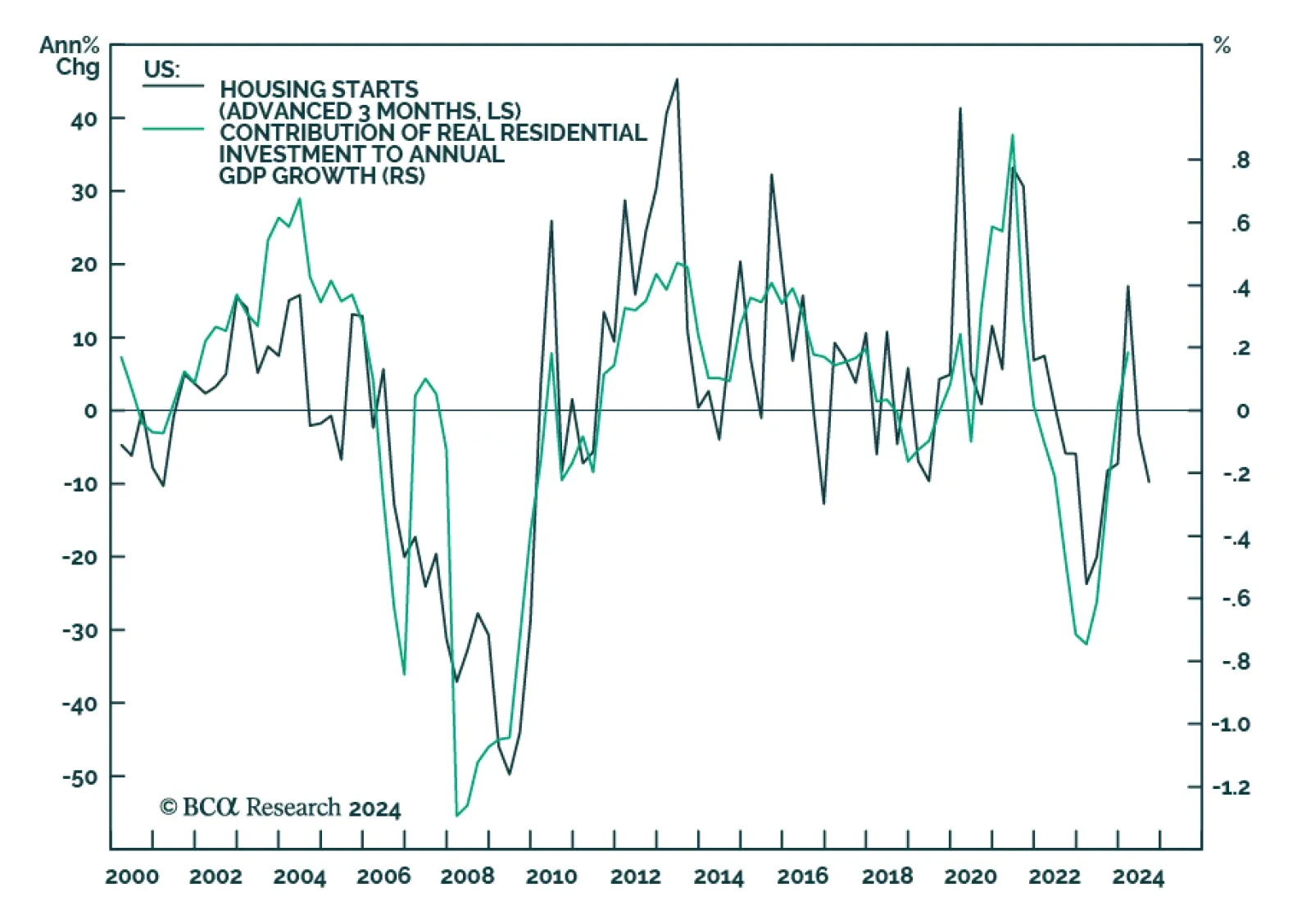

Right after the pandemic, many US homeowners locked in mortgages at extremely low rates. When interest rates rose, these homeowners refused to sell, as moving to a new home would result in an interest rate reset. In turn this…

Housing is the most interest-rate-sensitive sector of the economy. Yet, the very aggressive monetary tightening cycle has only had a muted effect on home prices. While recent housing market data have been mixed, prices have not…