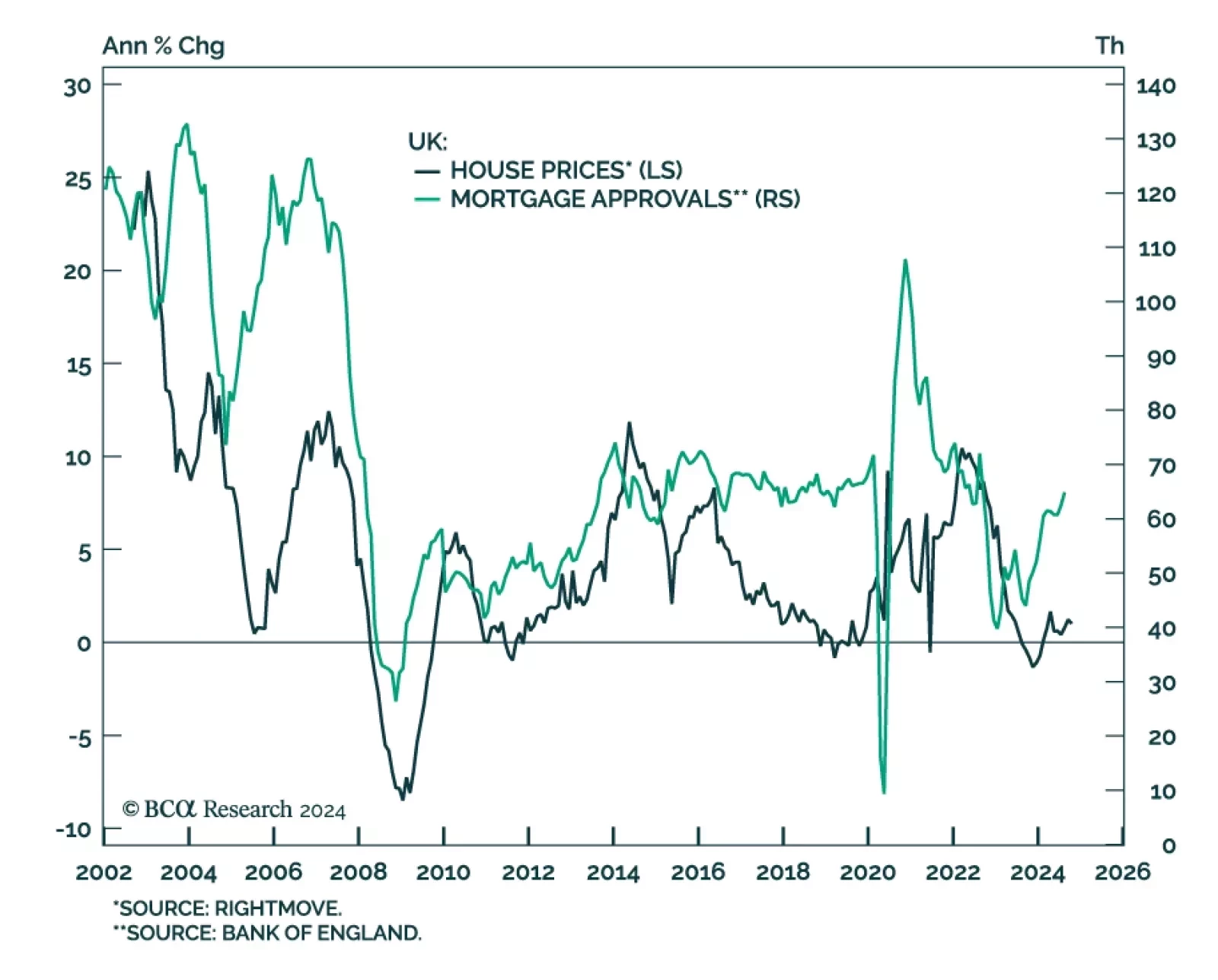

Despite elevated mortgage rates, UK home prices remain resilient. Average new seller asking prices were roughly flat in October, even as evidence of selling pressures are emerging. According to Rightmove, total home…

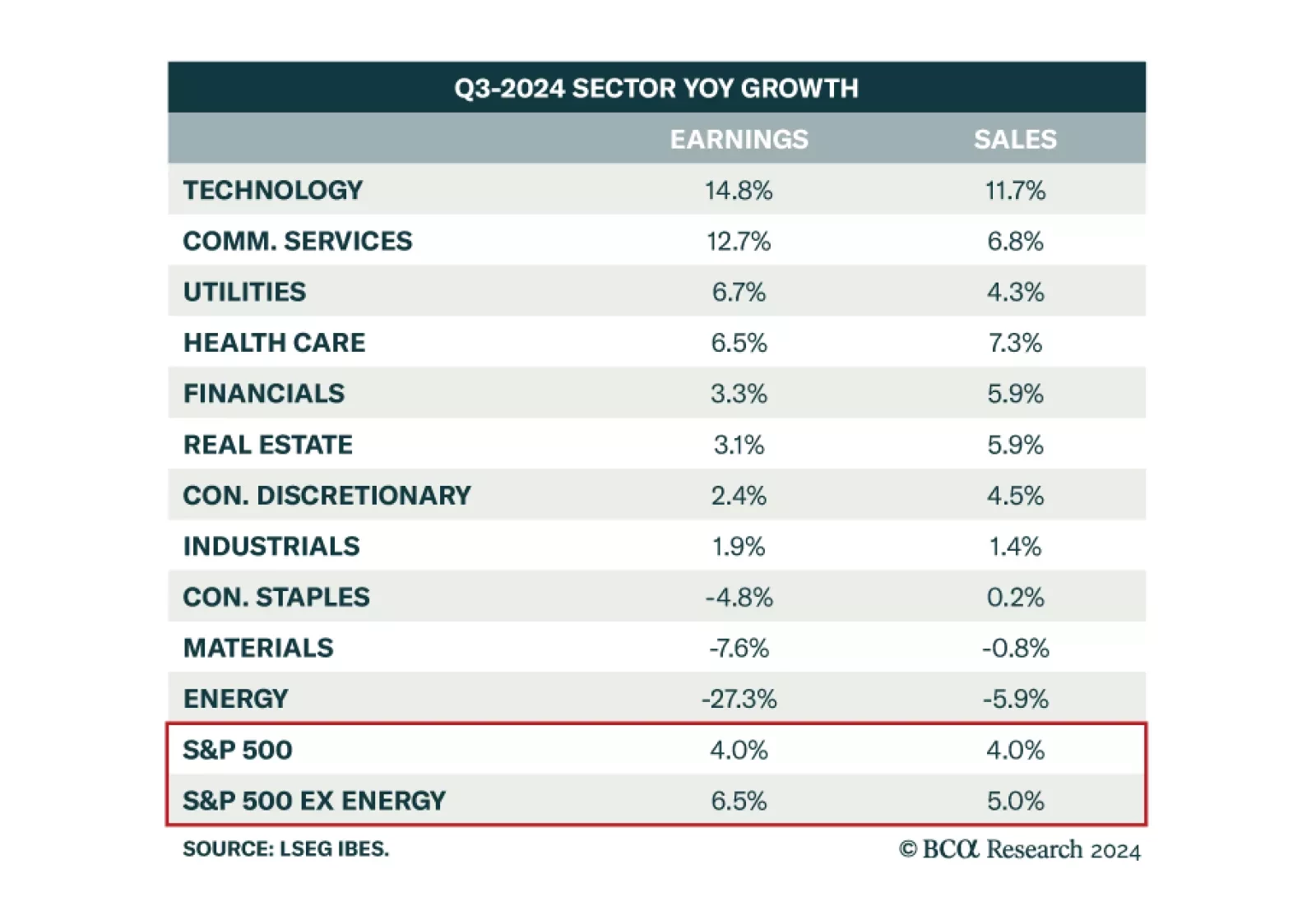

Our US Equity Strategy colleagues expect Q3 earnings to be strong enough to fuel the soft-landing narrative. Analysts expect S&P 500 earnings growth to be 4.0% year-over-year, with sales growth of 4.0% too. Yet, with…

US housing starts and building permits eased below expectations in September. Permits, a proxy for future construction, dropped 2.9% after rising 4.6% in August. New construction fell 0.5% after rising 7.8% a month prior. These…

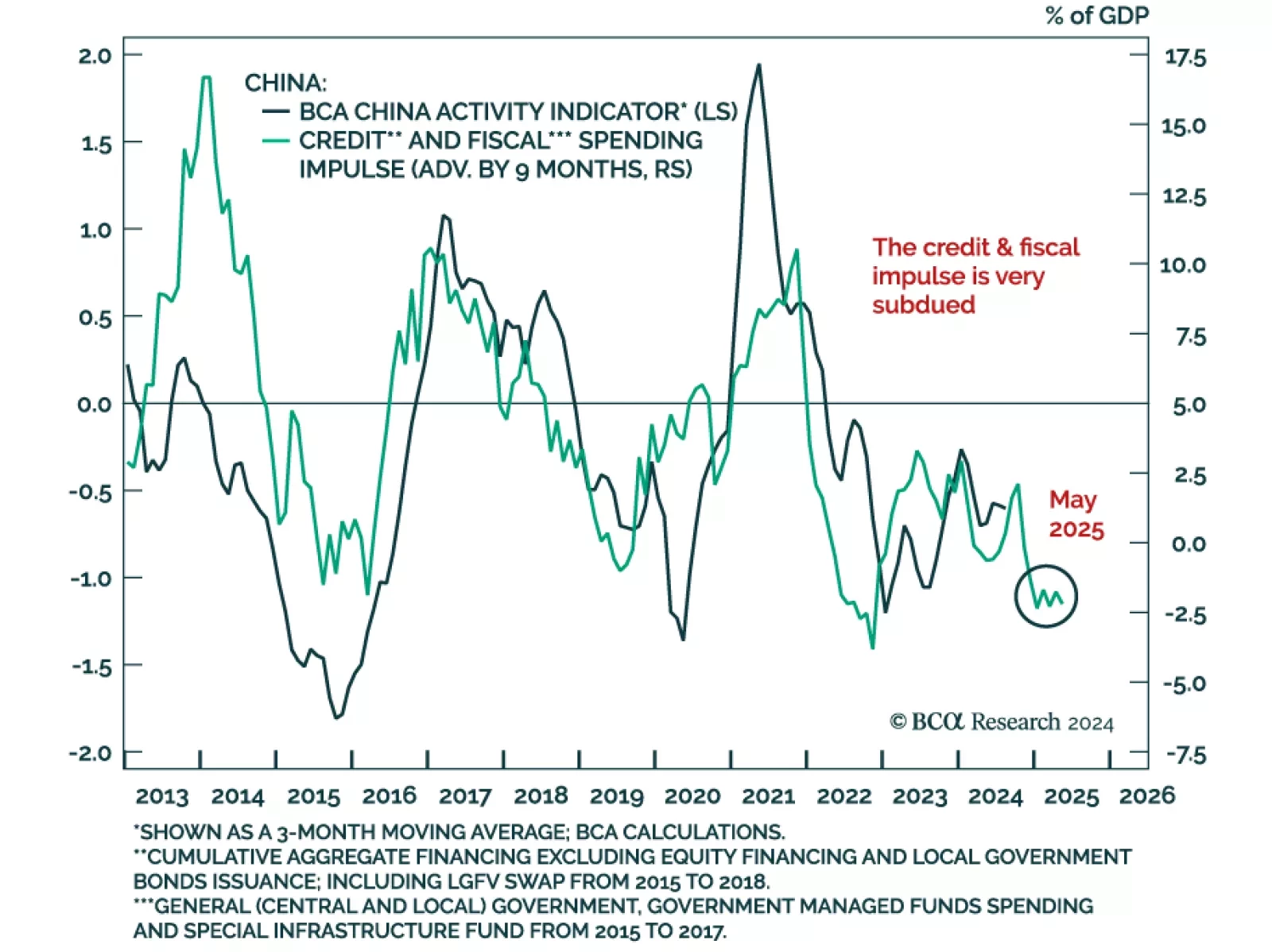

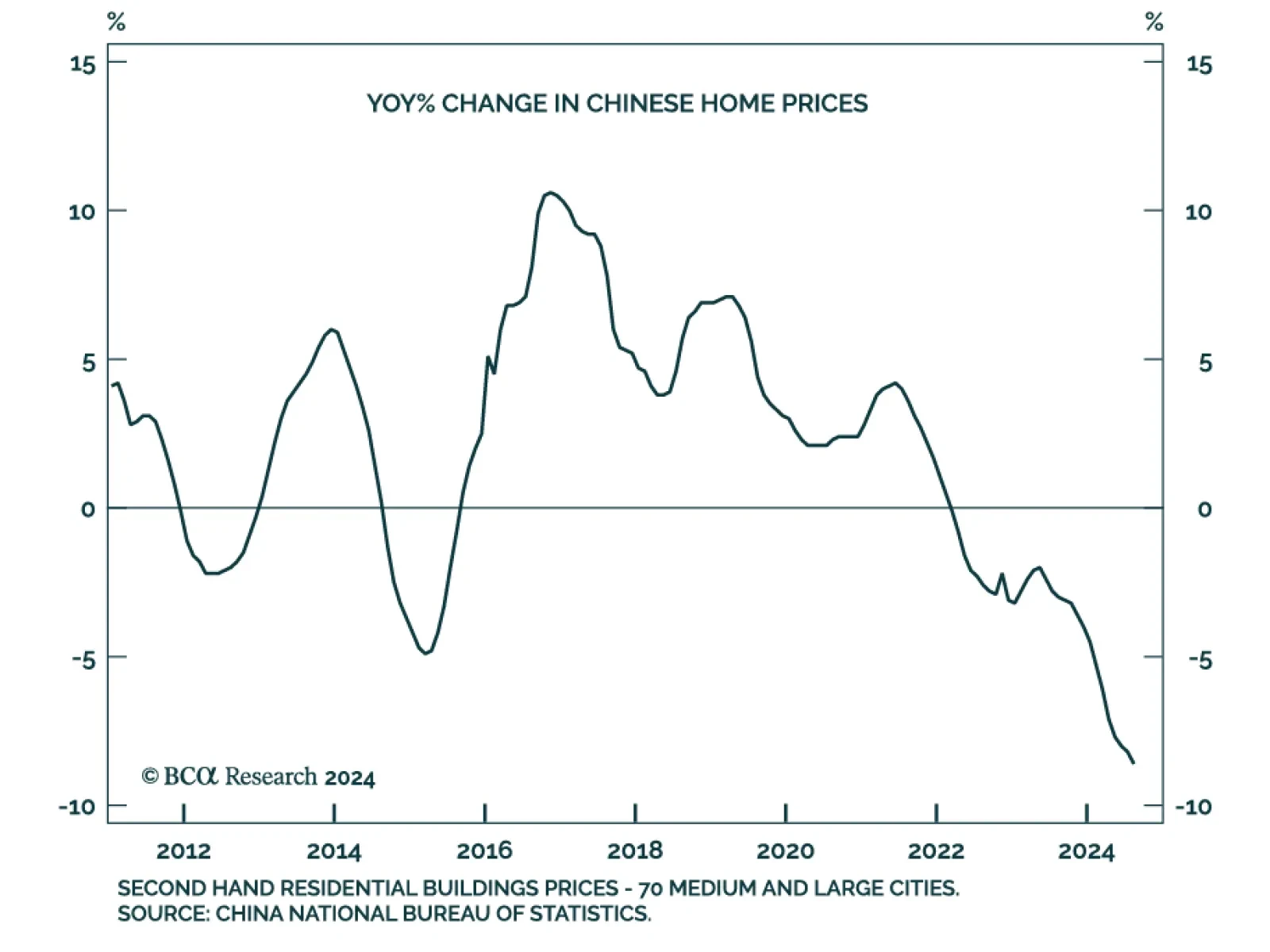

Chinese activity data met expectations, with Q3 GDP printing at 4.6% year-on-year, decelerating from 4.7% in Q2 but below the 5% 2024 growth target. Other metrics such as industrial production and retail sales beat expectations…

According to BCA Research’s Counterpoint service, absent the multi-decade housing and construction boom, China will be unable to generate the monster credit impulses that it did through 2000-20. While the credit…

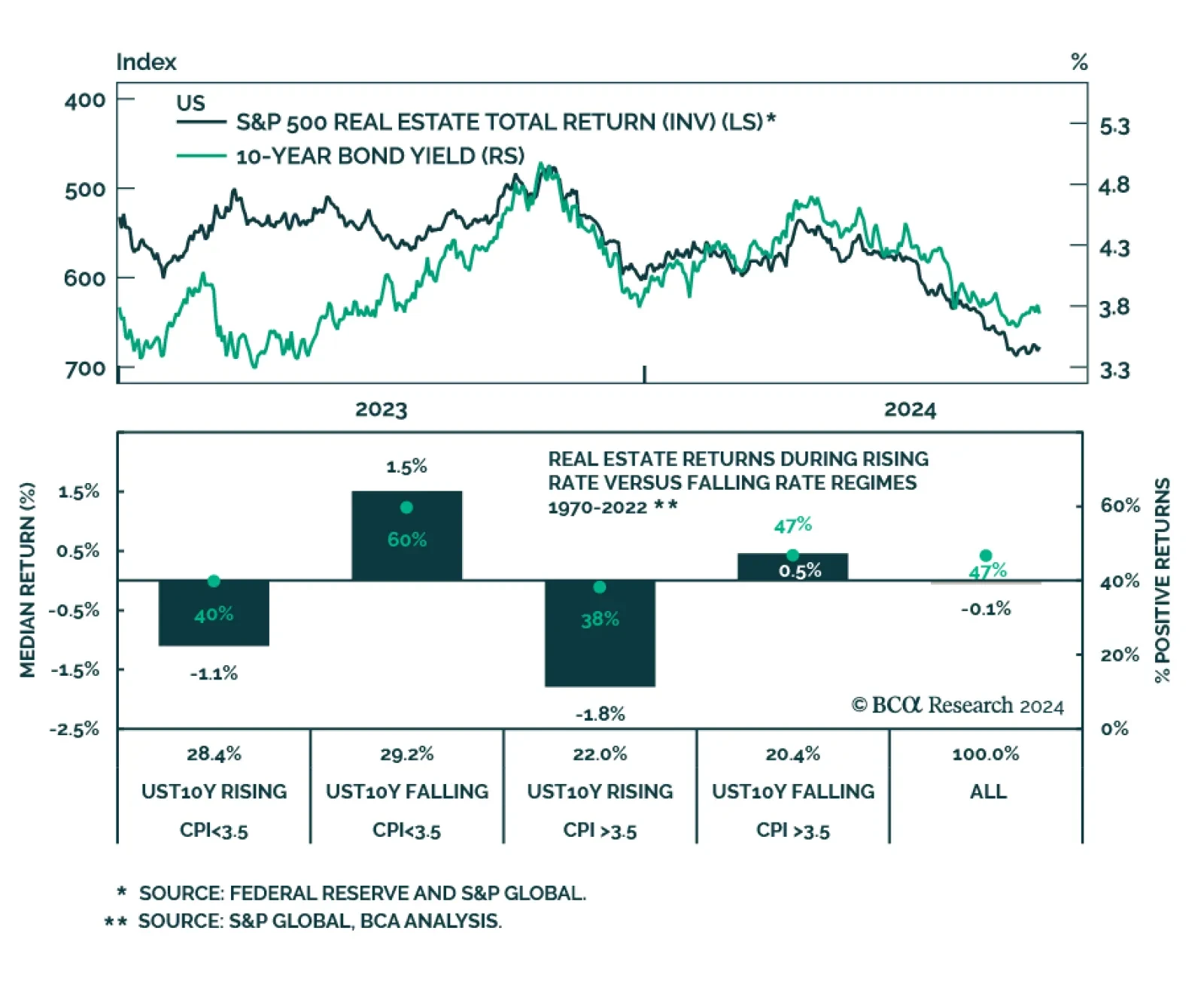

The prospects of Fed rate cuts powered the S&P 500 Real Estate index’s rally. Real estate was the best-performing sector in Q3, outperforming the S&P 500 by nearly 12%. Can this sector pursue its lead now that…

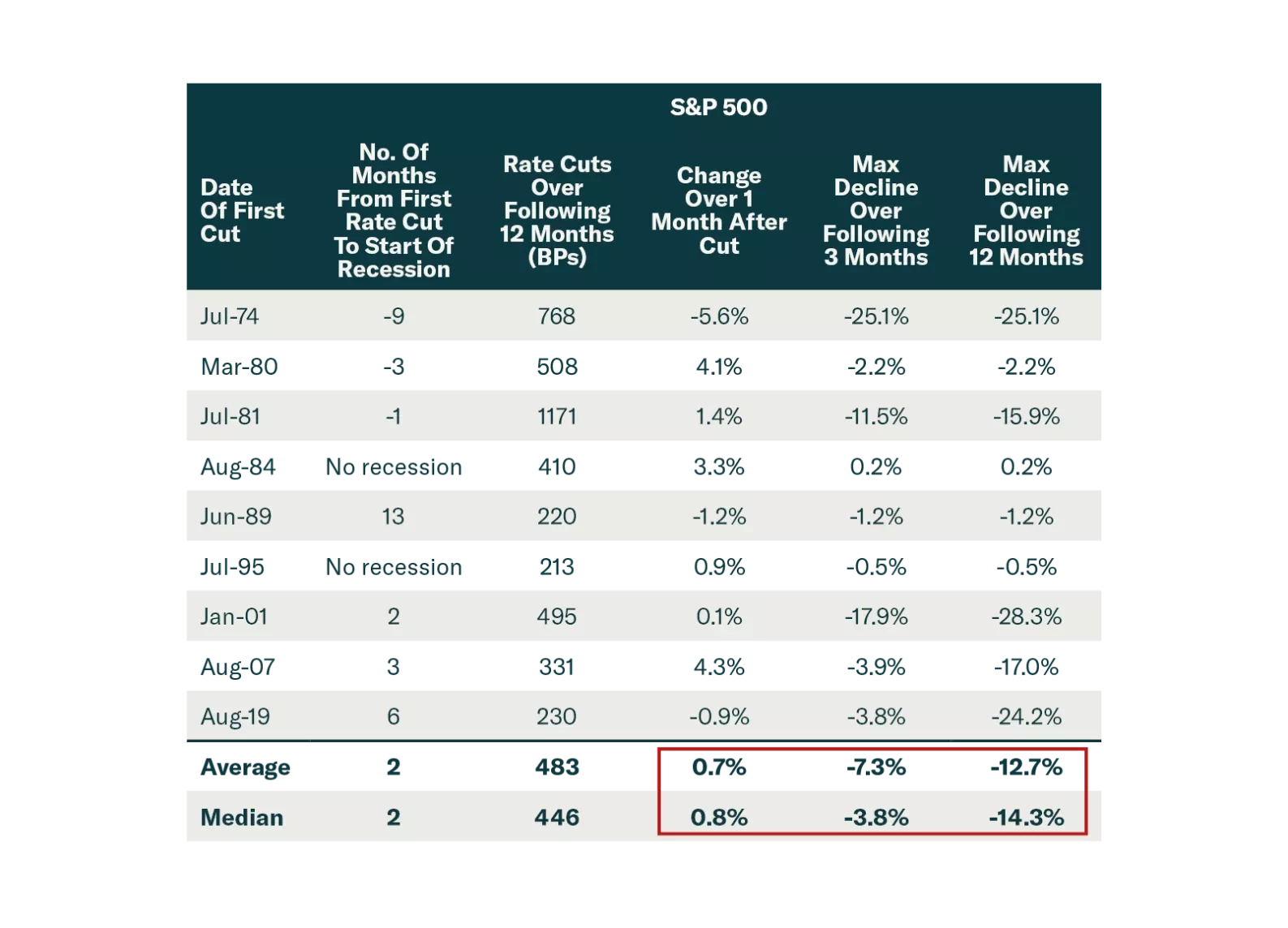

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…

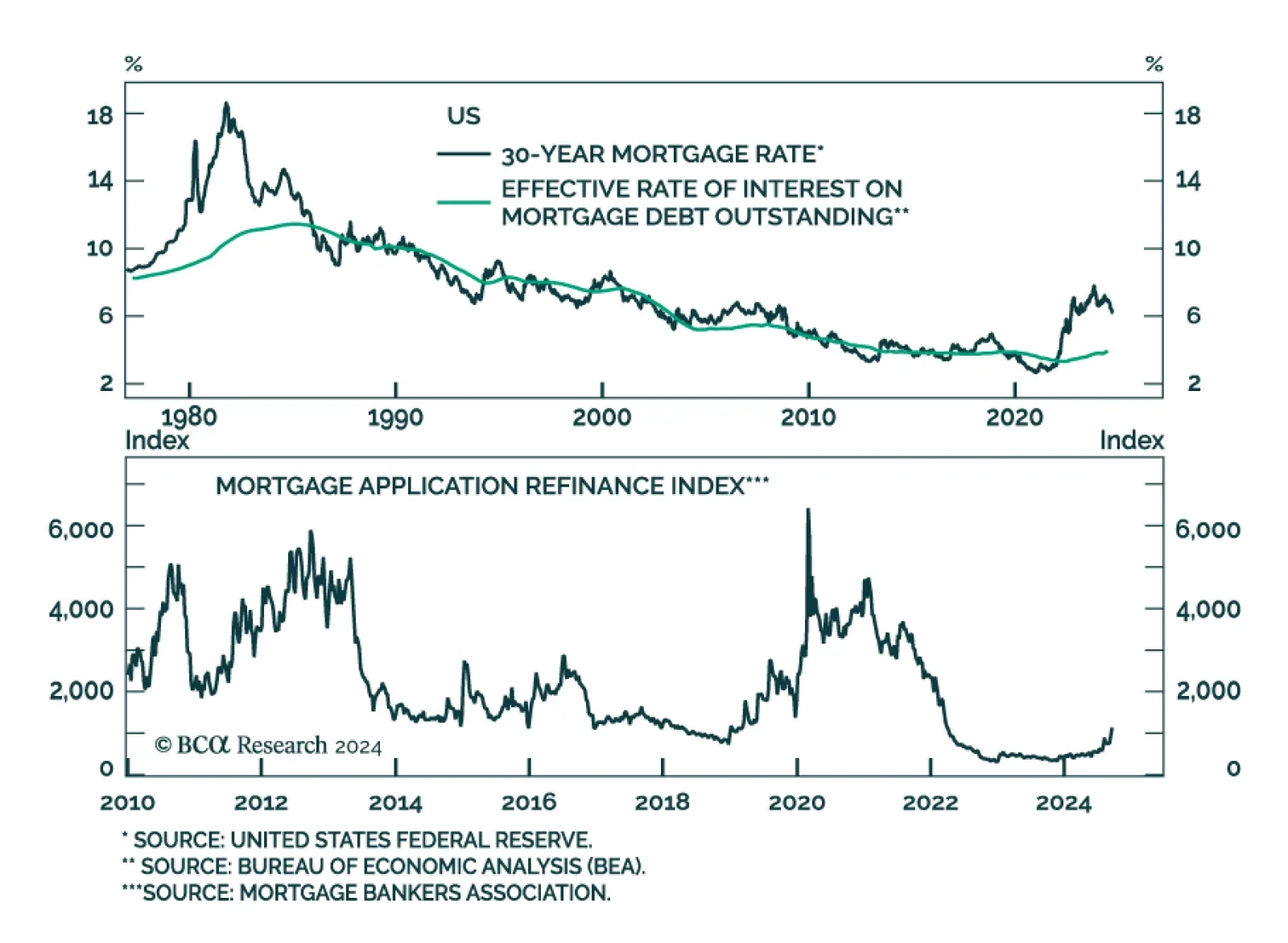

The conventional 30-year mortgage rate eased further to 6.2% from above 7% back in the spring, spurring a 20.3% surge in refinancing activity last week. Mortgage applications rose 11.0%, marking a fifth consecutive week of…

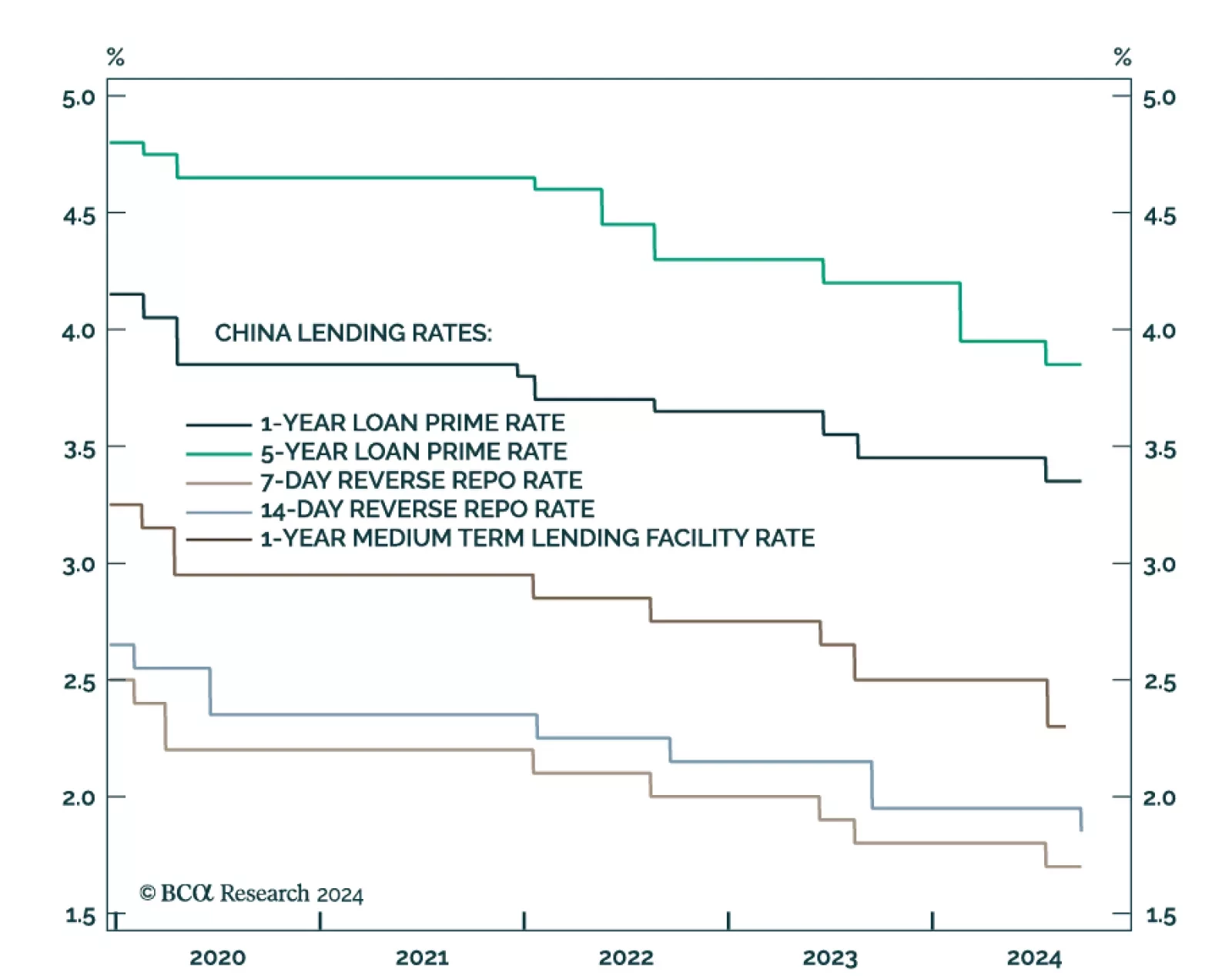

The PBoC lowered the 14-day reverse repo rate by 10 bps on Monday, a move that follows a string of easing measures in late July when the central bank lowered the 7-day reverse repo rate, several maturities of the loan prime rate…

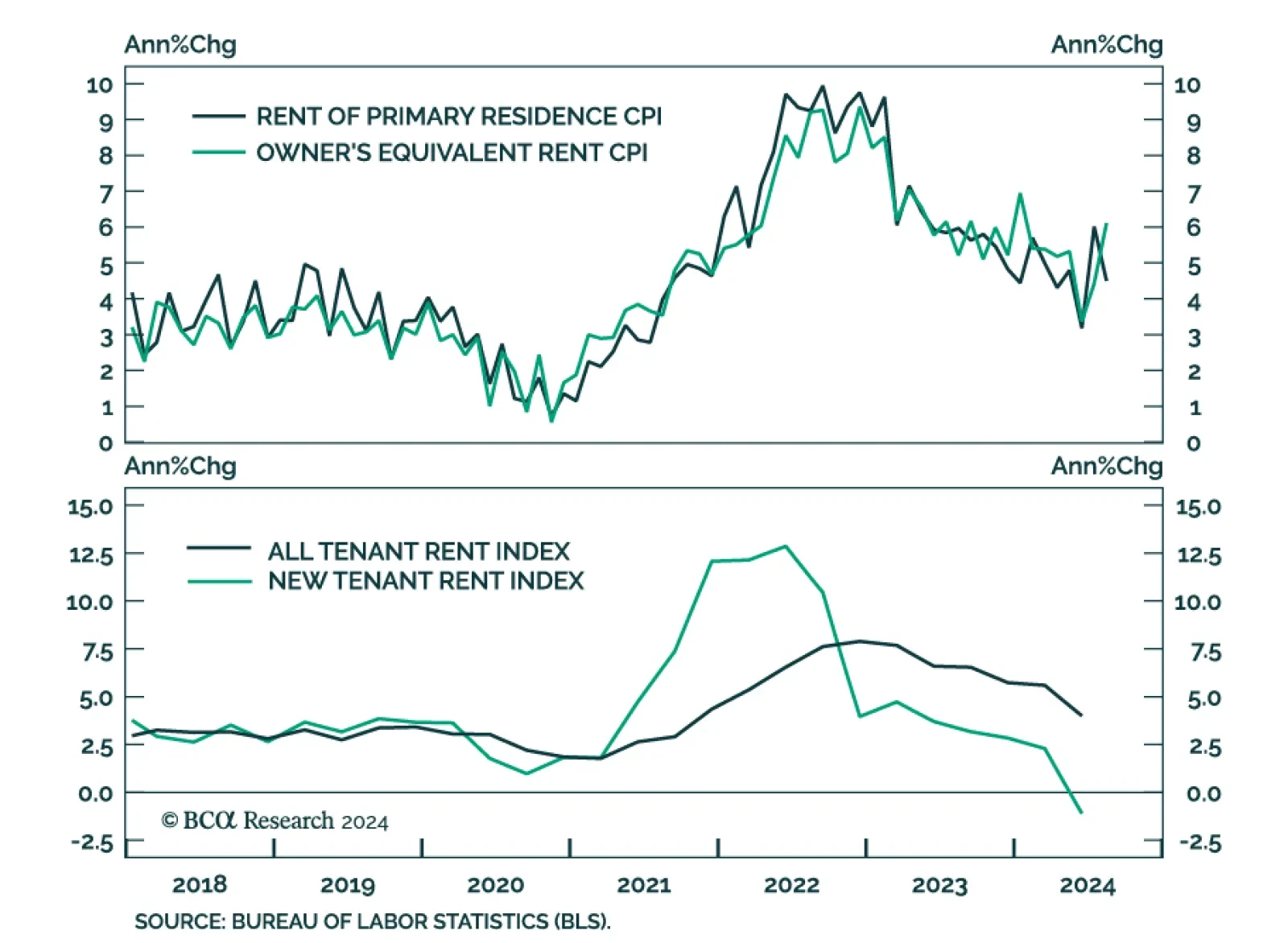

US headline CPI eased from 2.9% y/y to 2.5% in August in line with consensus predictions. However, core CPI unexpectedly accelerated from 0.2% m/m to 0.3%. Aside from airfares -- a highly volatile series which is likely to…