This report revisits China’s property market through both cyclical and structural lenses, assesses the likely policy responses, and evaluates their investment implications.

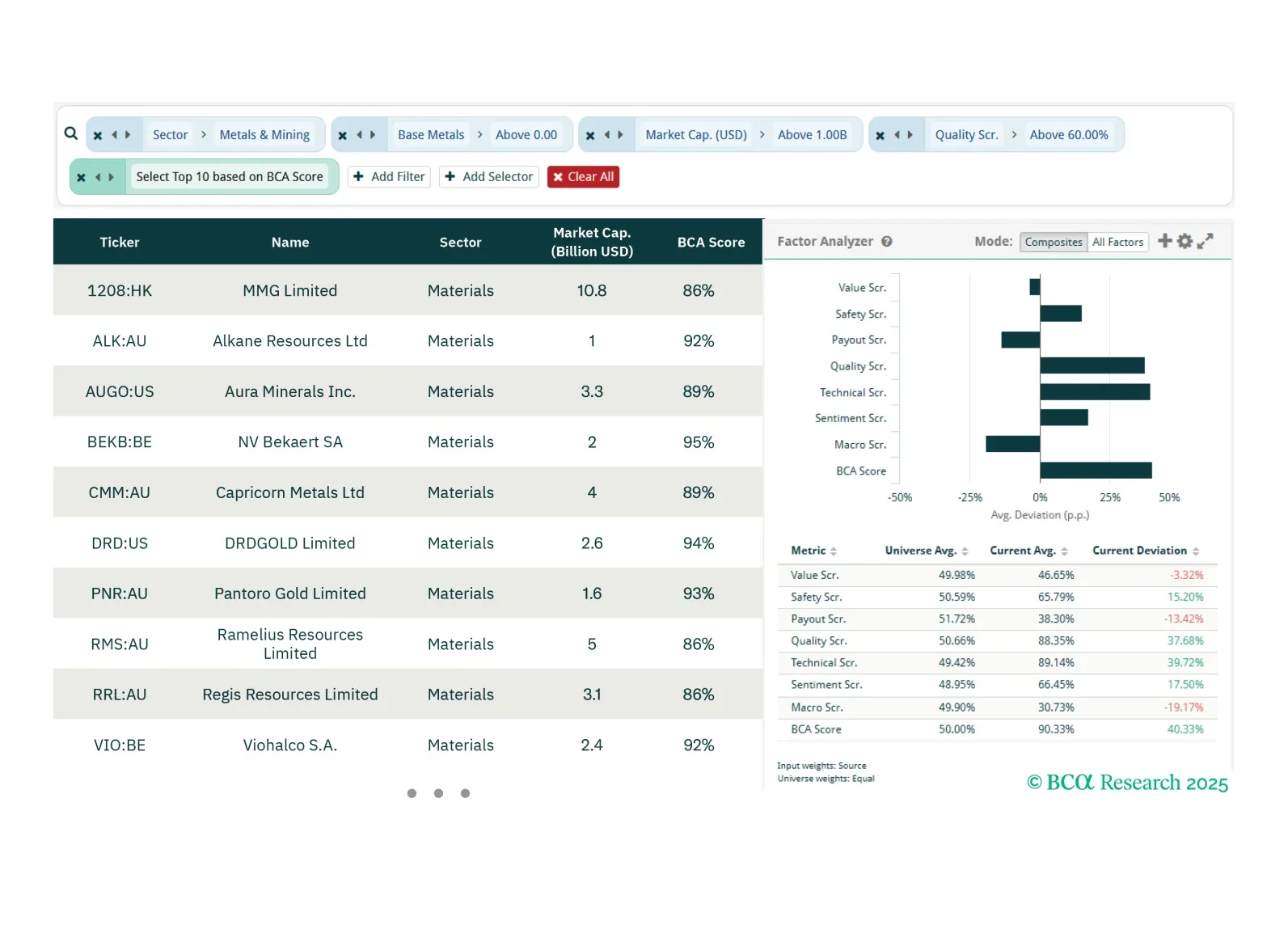

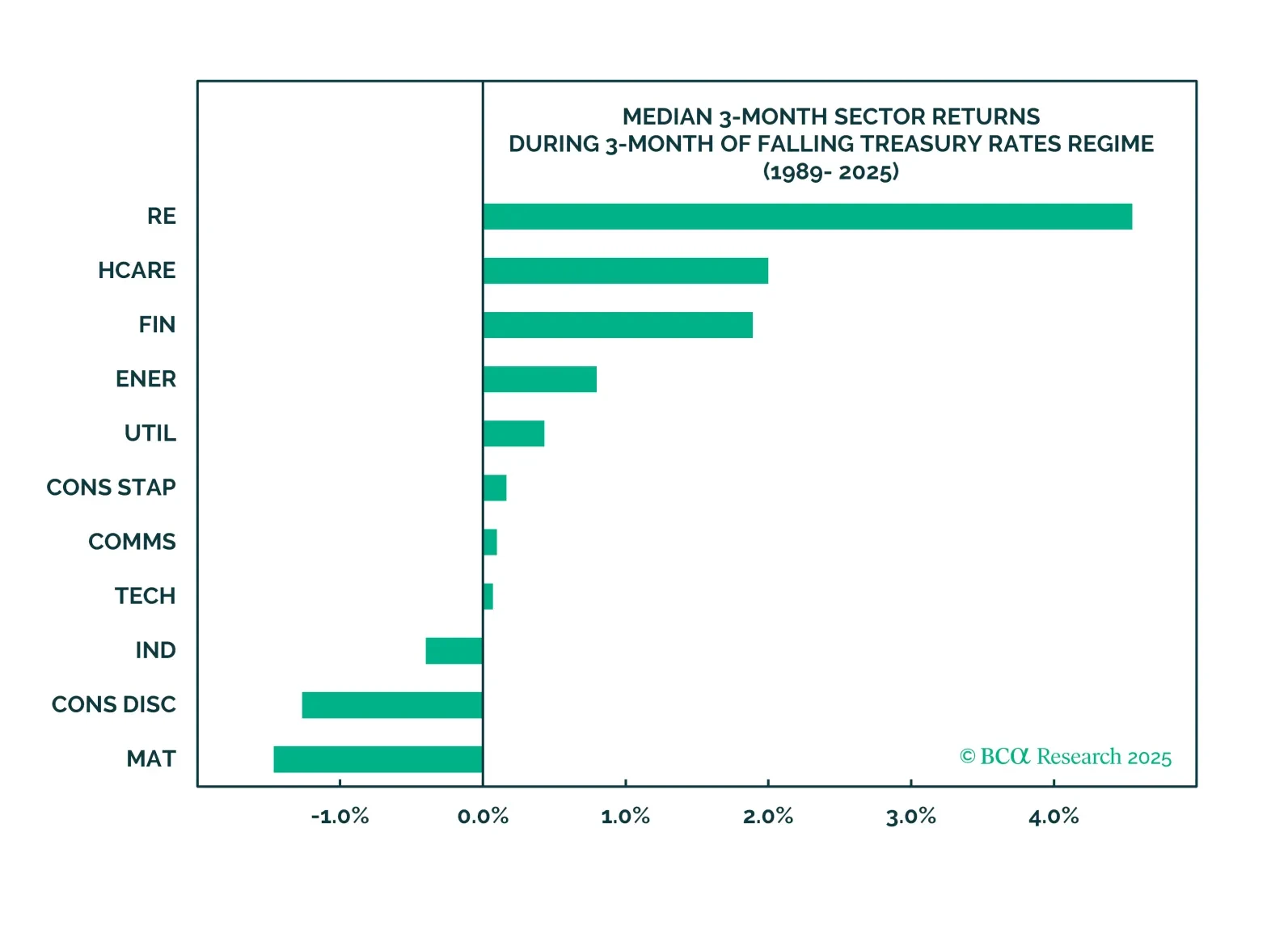

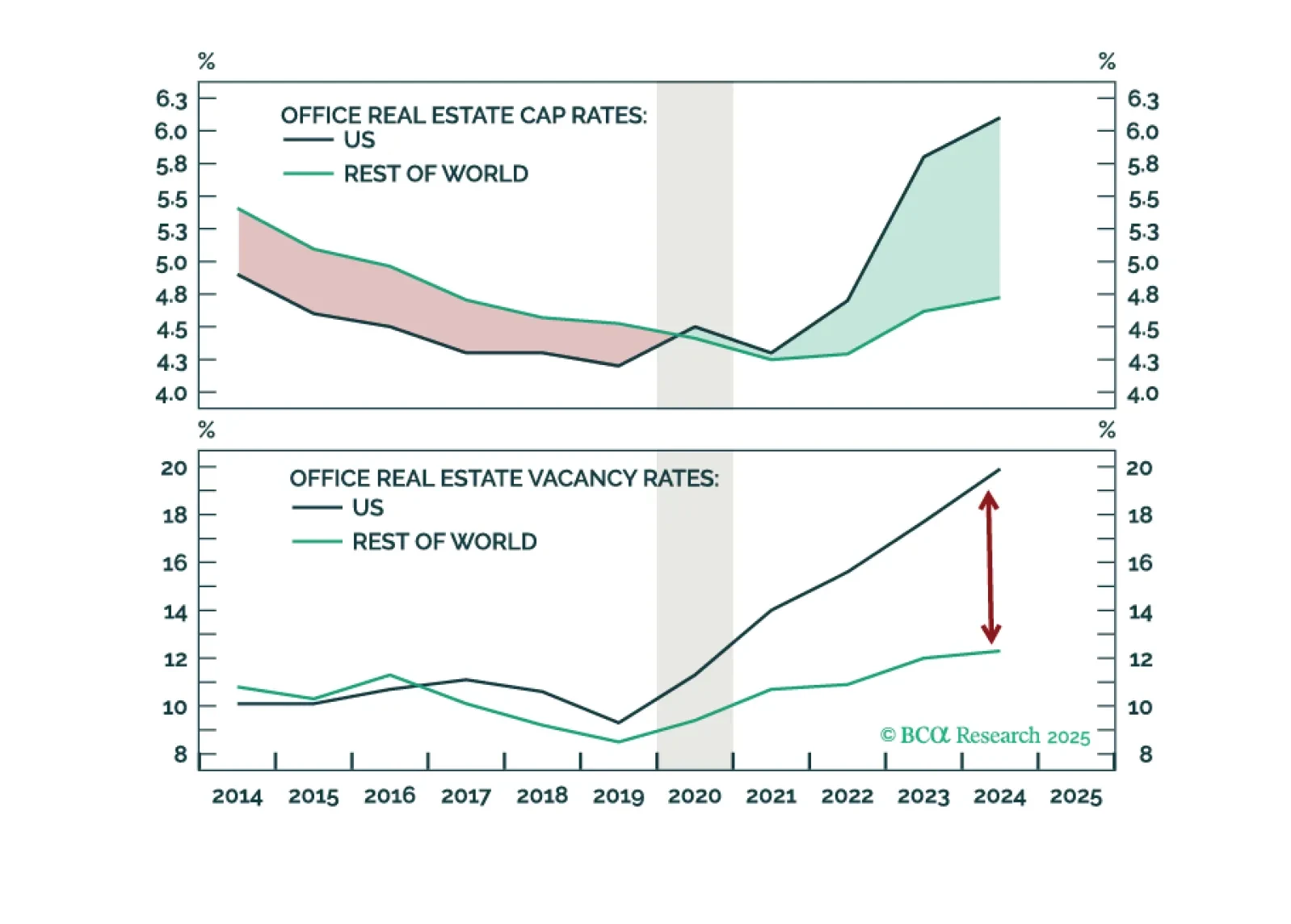

This week, our screeners explore ways to play a long-term bullish metals view, sub-sector REITS opportunities as well as Japanese Value stocks.

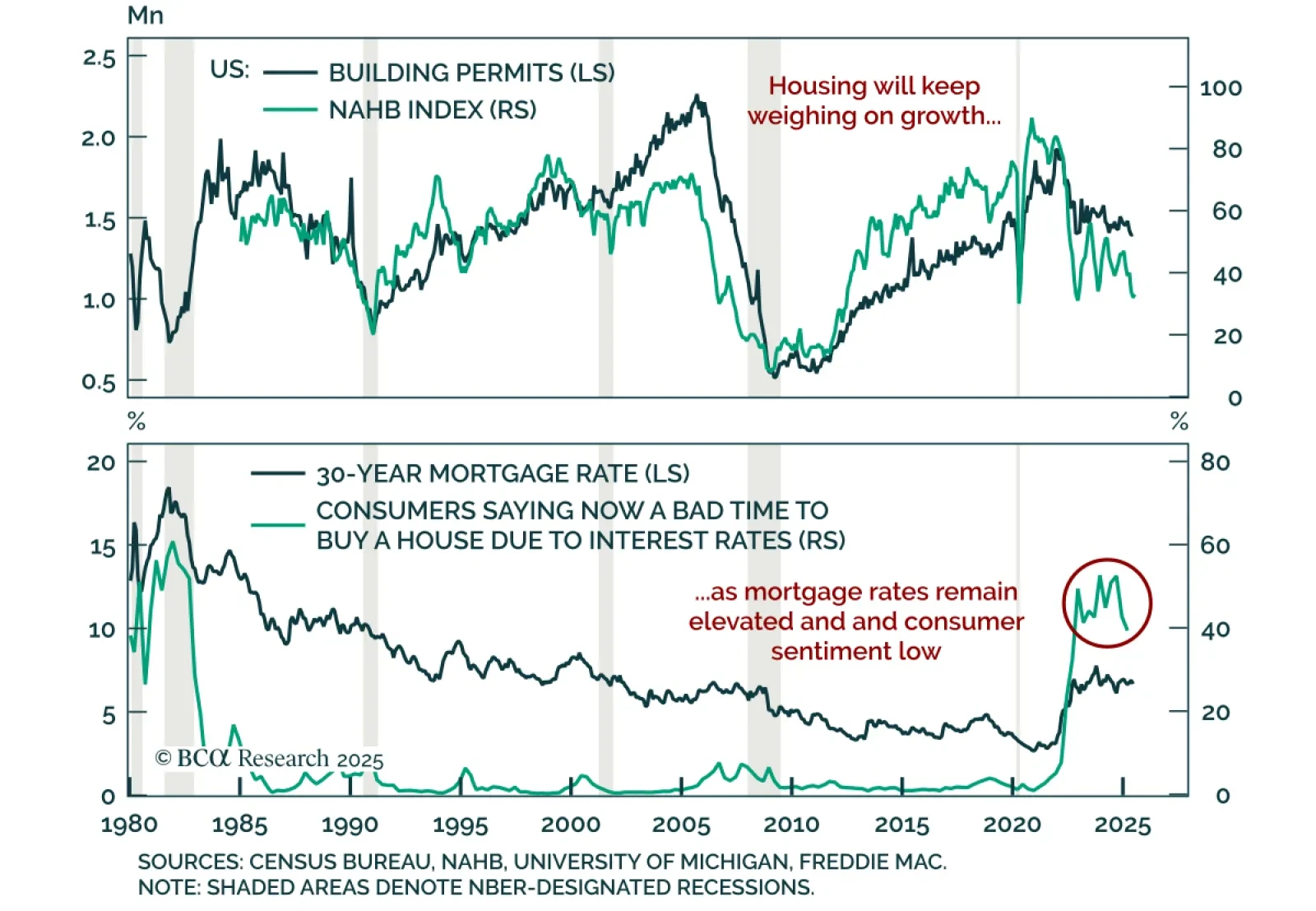

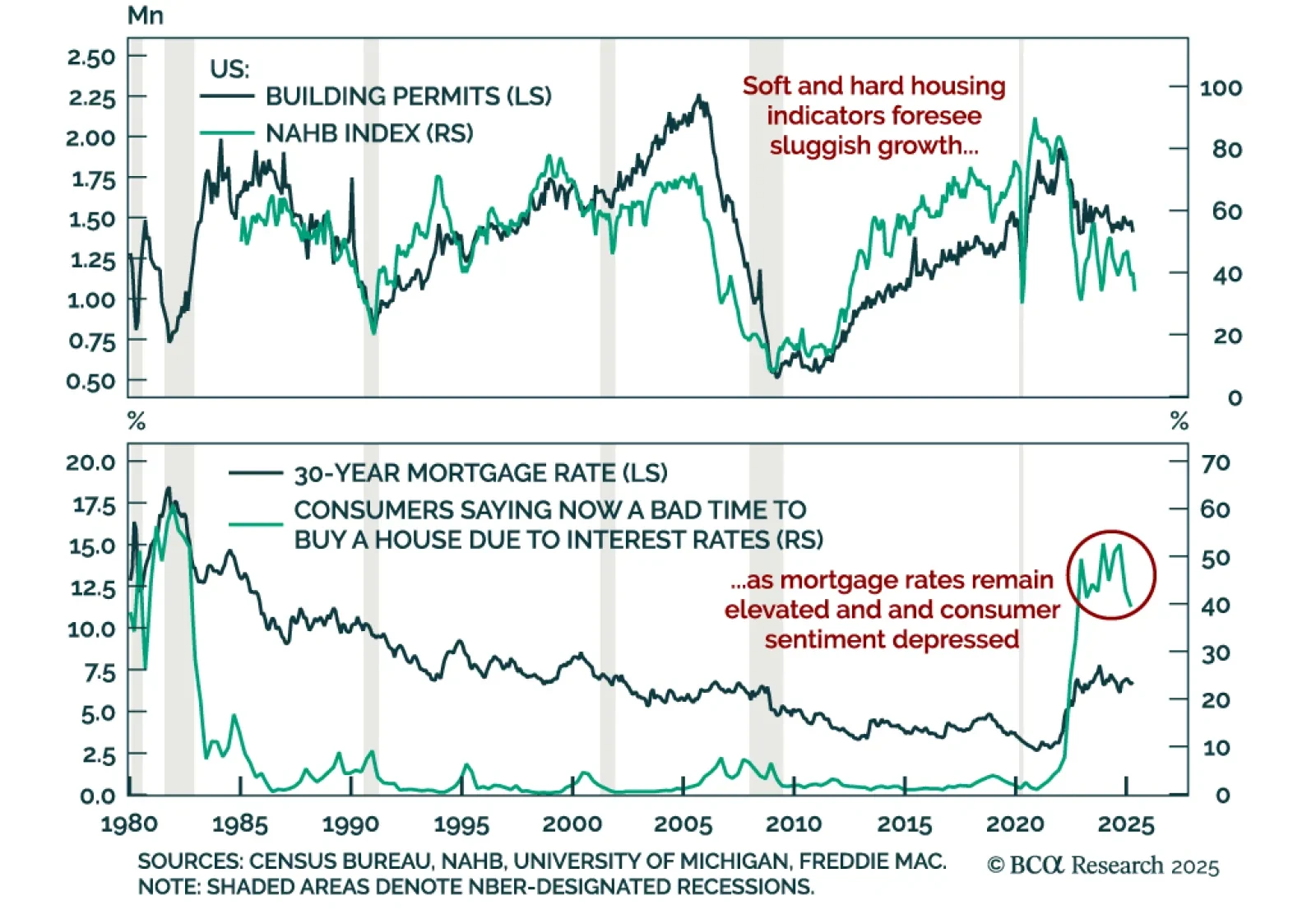

June US housing data surprised to the upside, but the broader sector is still weak, reinforcing our modest underweight on equities. Housing starts rose an annualized 4.6% m/m, and building permits ticked up 0.2% after a 2.0%…

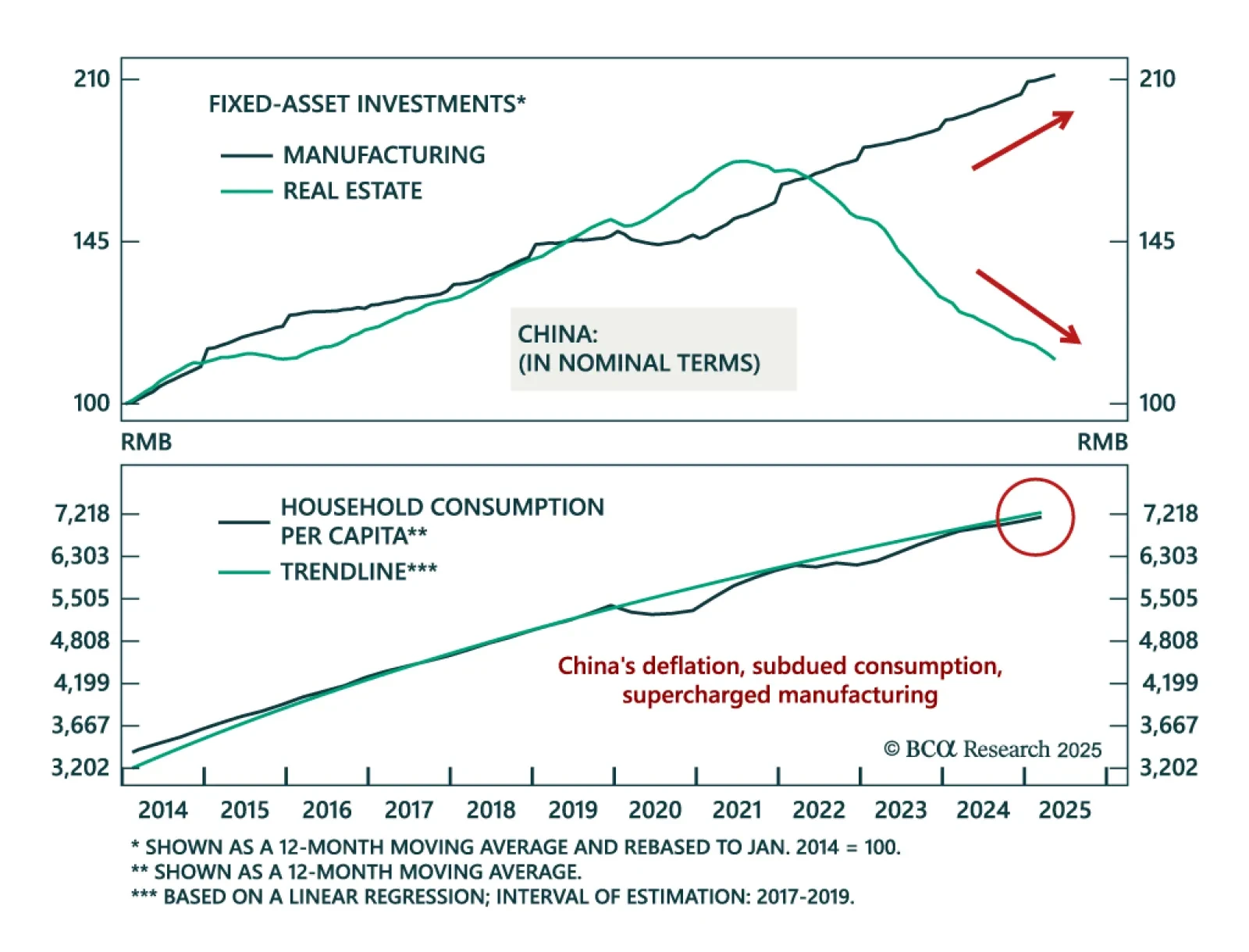

Our China strategists maintain a defensive stance on equities, favoring government bonds and high-dividend sectors as deflation persists. China’s deflationary pressures are supply-driven, with manufacturing capacity expanding faster…

Weak April housing data and deteriorating builder sentiment reinforce our defensive stance, as recession risks remain underpriced. Housing starts rose at a 1.6% m/m annualized rate, missing expectations. Similarly, building permits,…

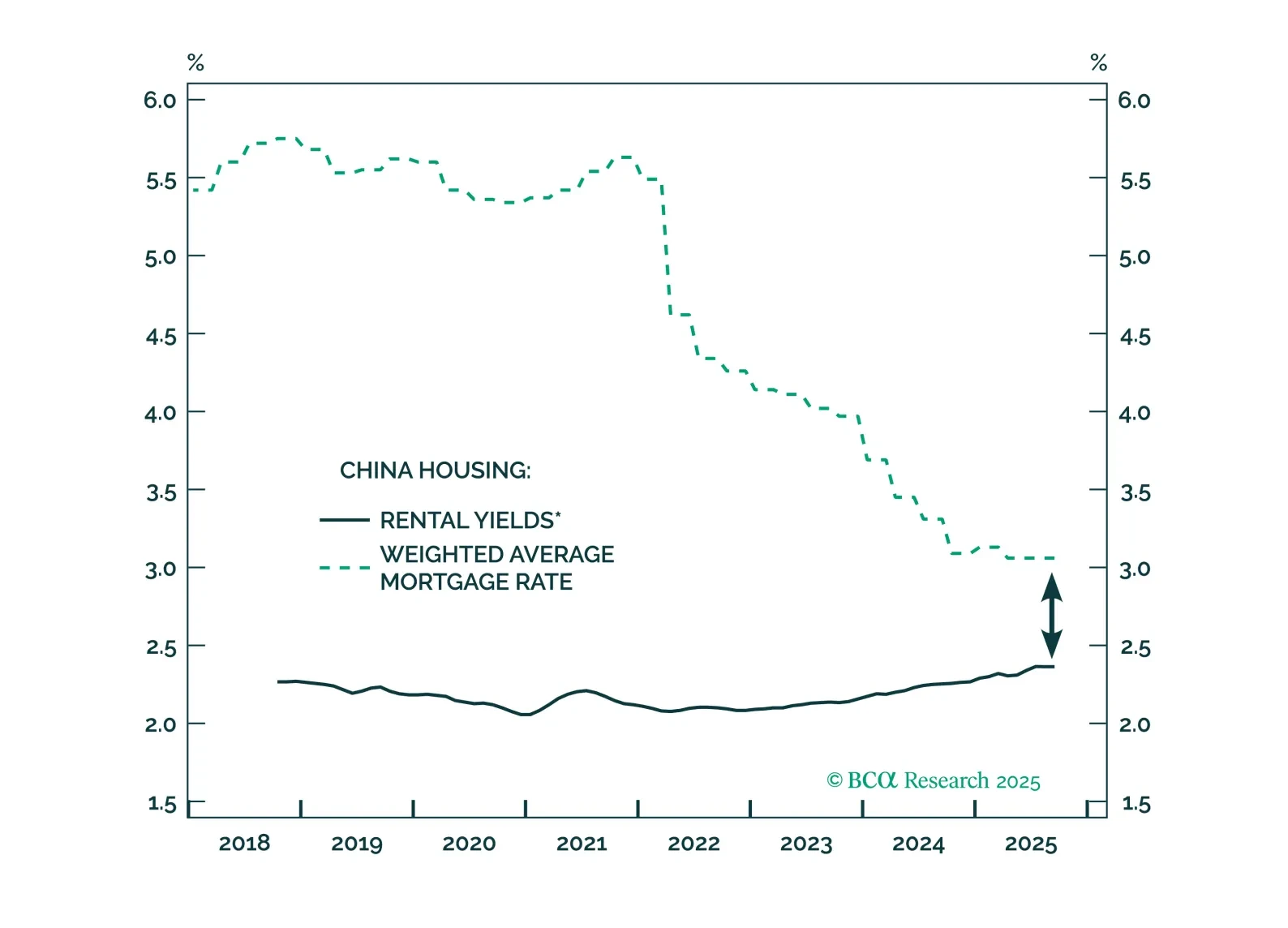

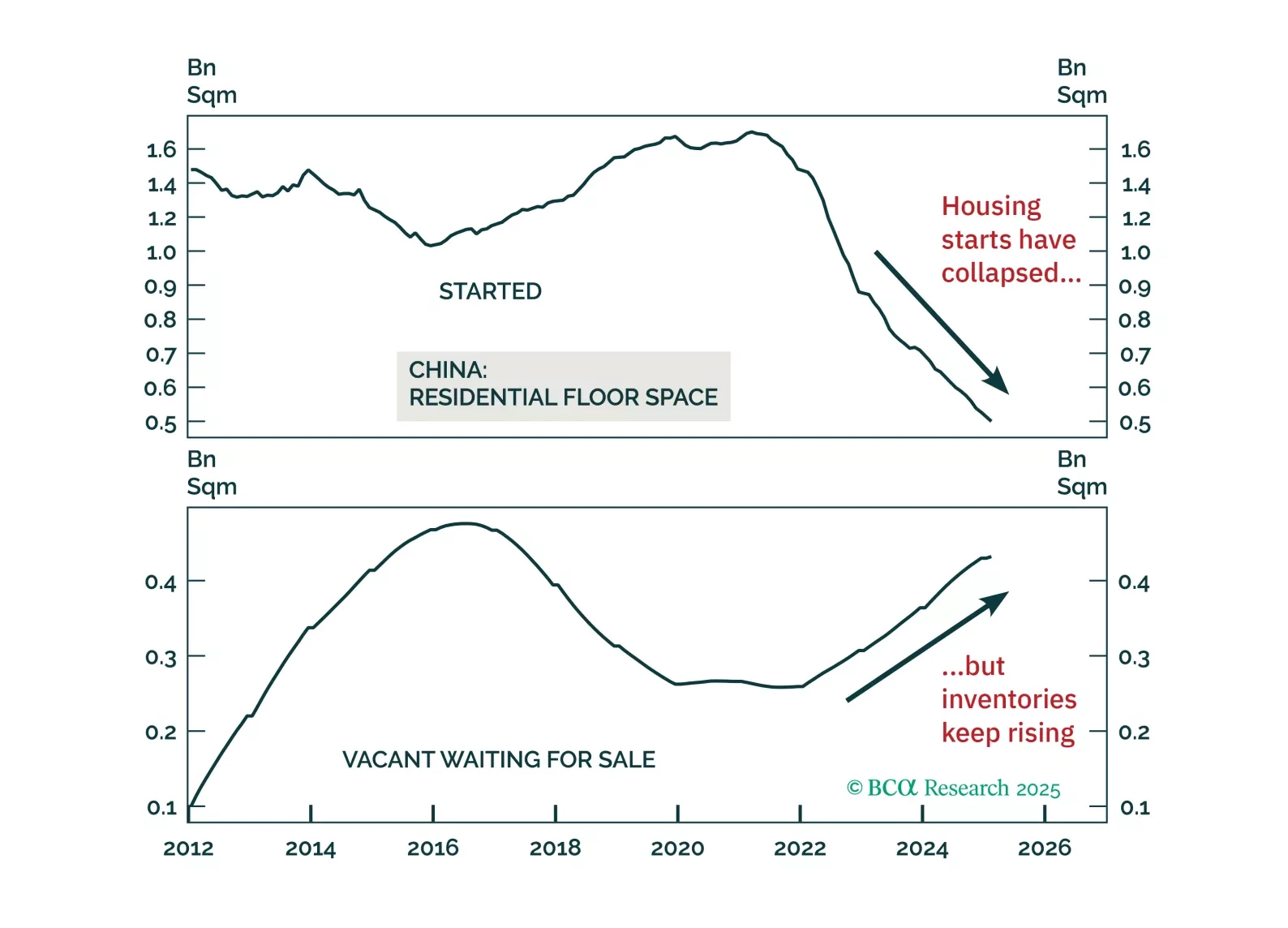

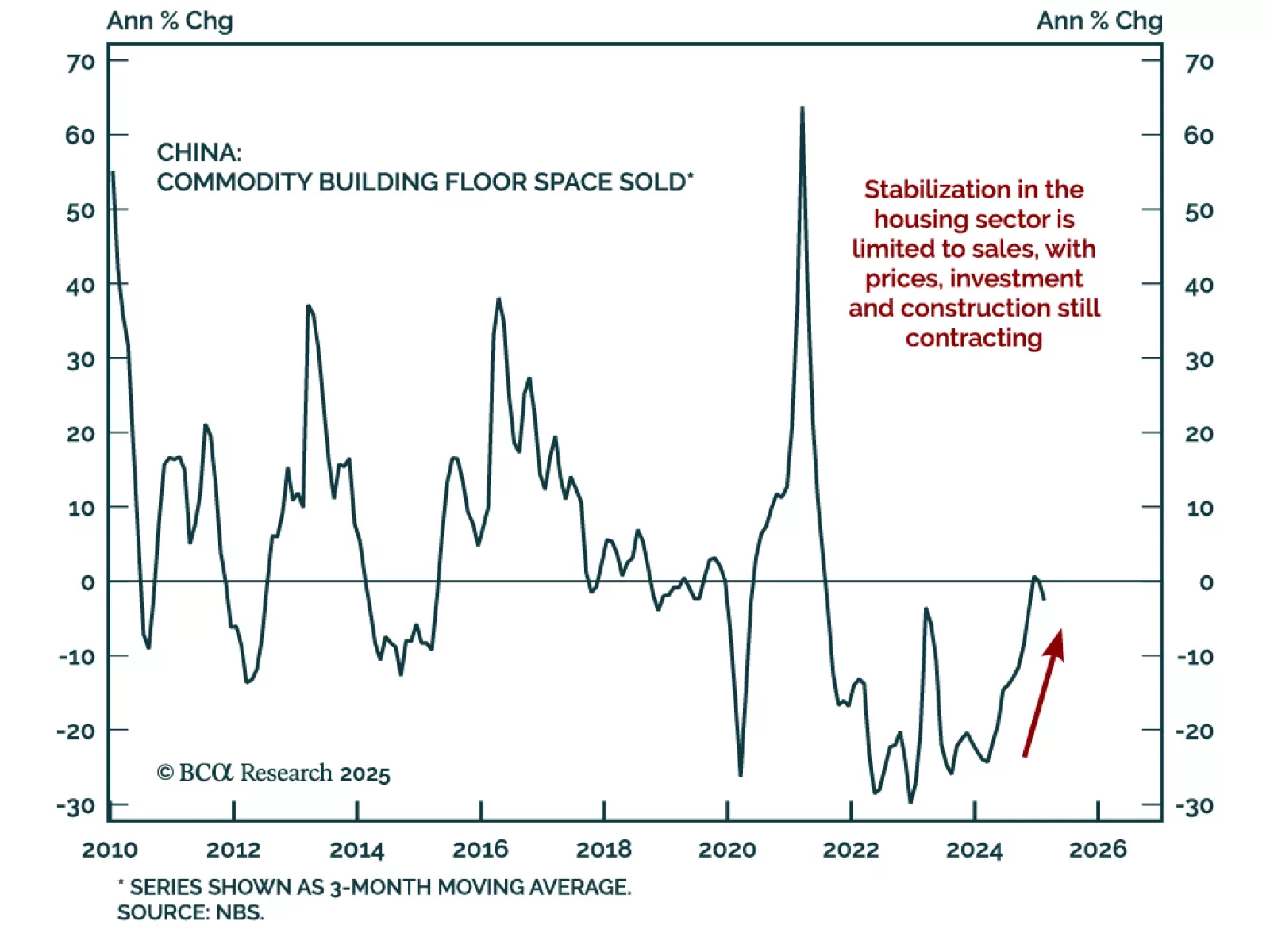

Our China strategists published a quick note on China’s property market following the release of housing data earlier this week. China’s housing market is showing early signs of stabilization after three years of crisis, though…

Data released this Monday suggests that while China’s housing market is no longer worsening, the secular adjustment remains ongoing. Although aggregate housing demand may be stabilizing at a low level, supply will continue to…