Neutral - Downgrade Alert The transportation industry is a bellwether for the economy as rising freight hauling services demand is synonymous with firming economic activity and vice versa. The recent FedEx earnings report…

Underweight Our underweight S&P railroads call has moved into the black as CSX rattled the industry and chopped 2019 revenue growth from positive 1-2% to negative 2%. While UNP’s numbers were better than expected…

Last week’s release of traffic data showed further deterioration in freight volumes, the fundamental driver of pricing power, confirming our bearish thesis. Only four of the 20 commodity categories tracked by the…

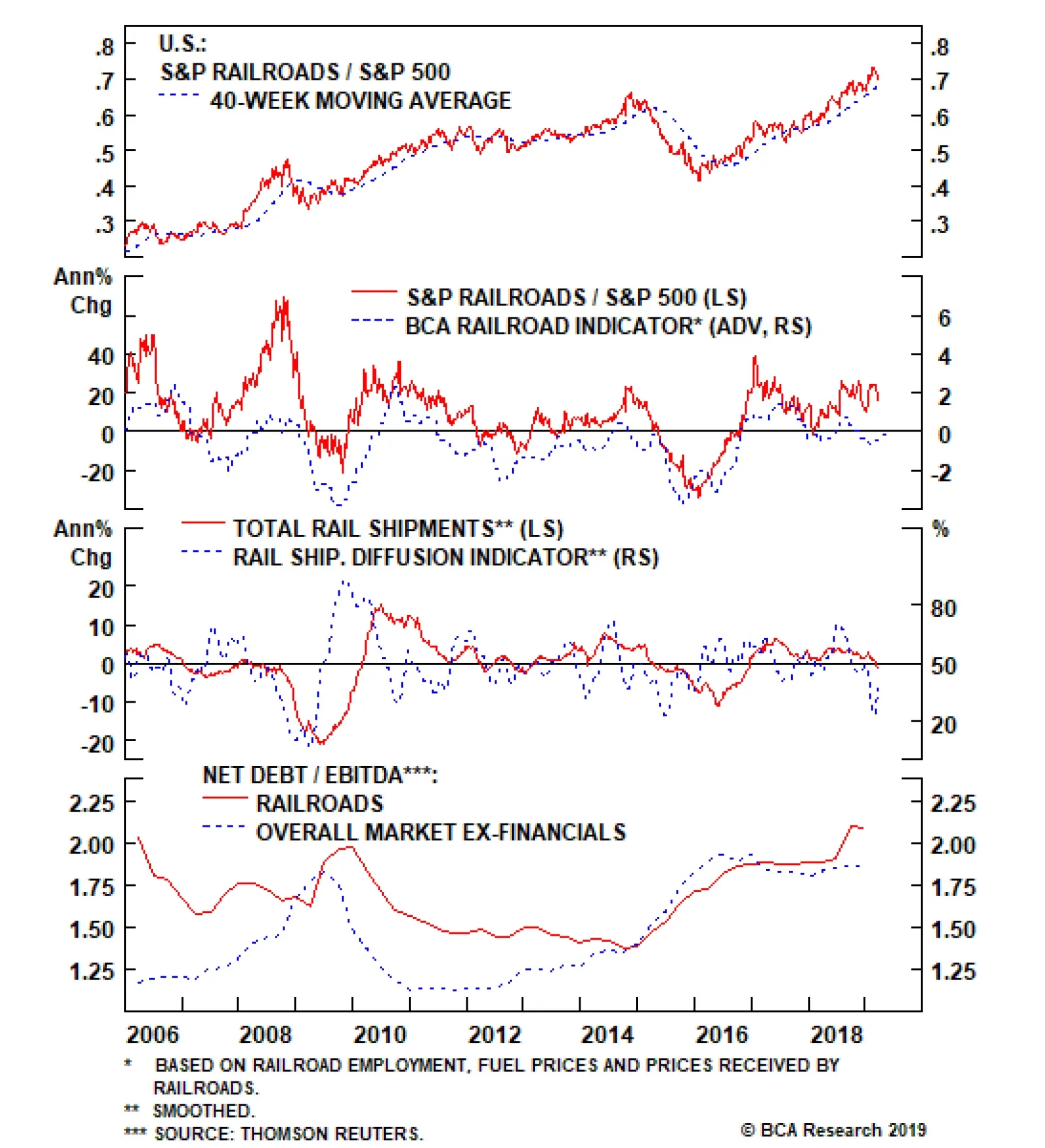

Underweight We downgraded the S&P railroads index to underweight last month based on falling rail traffic leading railroad pricing power down from its recent highs. Last week’s release of traffic data showed further…

The Railroad Indicator and our Rail Shipment Diffusion Indicator, have continued to deteriorate, as well as total rail shipments which have now started to contract for the first time since the 2015-16 manufacturing recession…

Highlights Portfolio Strategy Corporate sector selling price inflation is nil while leading wage inflation indicators signal additional labor cost increases in the coming months. The risk is that profit margins have already peaked for…

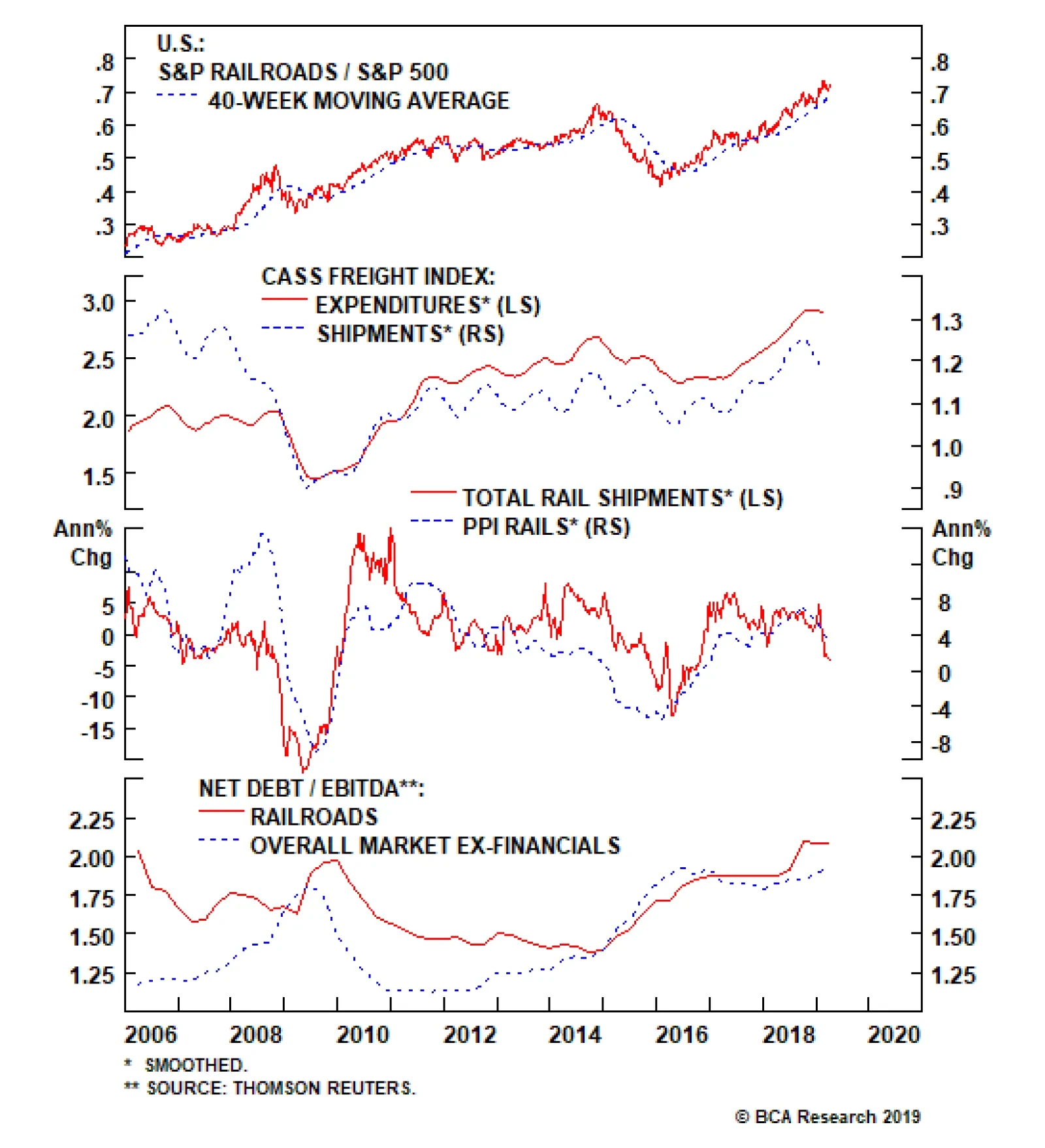

Underweight Our previous Insight referenced the deterioration of indicators that caused us to grow more negative in last year’s downgrade of the S&P railroads index to a benchmark allocation but what kept us…

Underweight In our downgrade of the S&P railroads index late last year to a benchmark allocation, we highlighted that two of our key industry Indicators, the Railroad Indicator and our Rail Shipment Diffusion Indicator,…

Neutral We have been riding the rails juggernaut for roughly 16 months, but the time has come to get off board. As shown in the chart at the side, technical conditions are overbought and relative valuations are pricey, hovering near…

We do not want to overstay our welcome on the S&P rails index for a number of reasons. First, it is quite perplexing why this capital-intensive industry has been cutting capex as the rest of the non-financial corporate…