Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

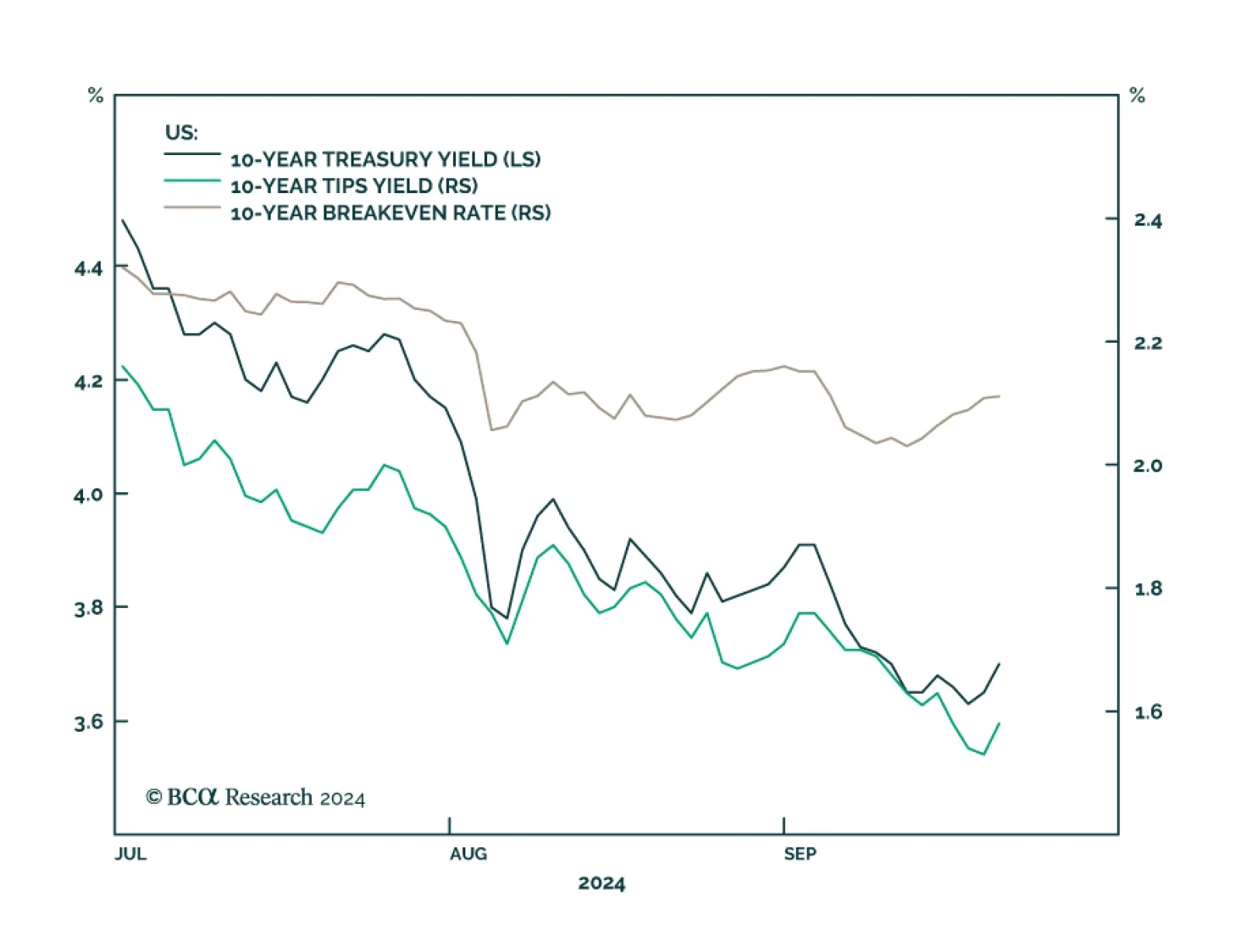

The 10-year Treasury yield rose in the aftermath of the Fed’s jumbo rate cut on Wednesday. Our US Bond strategists noted that this move reflects the fact that the downward revisions to the dots still fall short of the…

Overweight We are currently overweight the S&P railroads index in anticipation of financial sector liquidity morphing into real economic growth and thus propelling domestic oriented railroad stocks. There is also another…

Overweight The inevitable economic reopening due to the population’s inoculation along with President Biden's freshly signed fiscal spending bill will pump fresh blood into the US economy that railroads –…

Highlights Portfolio Strategy Firming leading rail freight indicators signal that intermodal, coal and commodity (ex-coal) carloads are in high demand. Tack on the global economic reopening in the back half of the year and rising…

This week we upgraded the S&P railroads index to neutral locking in 6.4% in relative gains since inception. The defensive nature of rails is most evident in industry pricing power (third panel). Railroad selling prices are holding…

Highlights Portfolio Strategy The Fed’s unorthodox monetary policy is aimed at quashing volatility, lifting asset prices and debasing the currency, all of which are equity market bullish. Grim, but backward looking, macro data…

Underweight – Upgrade Alert Two recent positive developments in railroad operating metrics compel us to put rails on an upgrade alert. Specifically, our operating margin proxy is expanding at a healthy pace (second…

Underweight Transports have taken a beating recently with the heavyweight S&P railroads index leading the pack lower. Our underweight stance is paying handsome dividends and there are more gains in store in the coming…