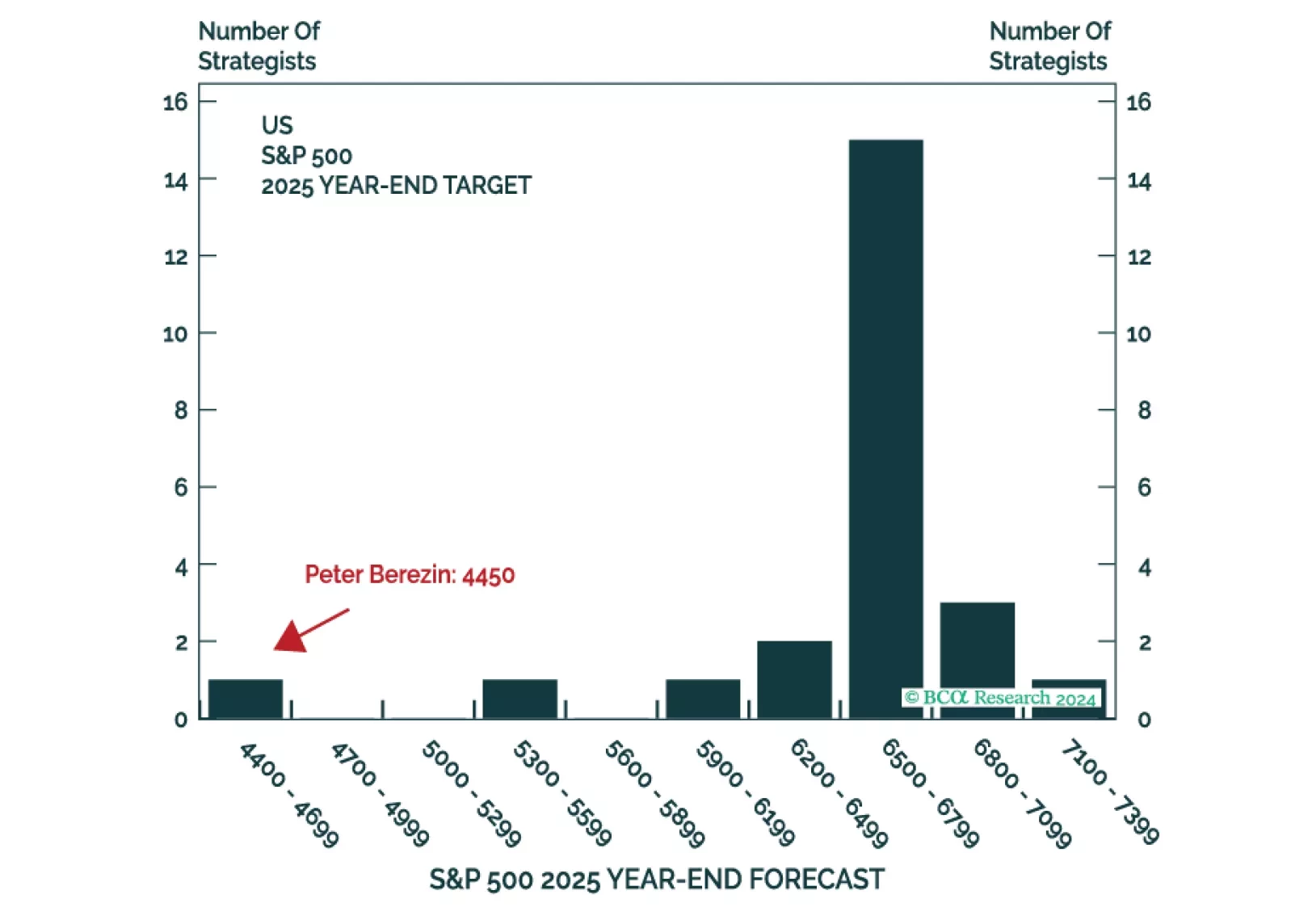

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

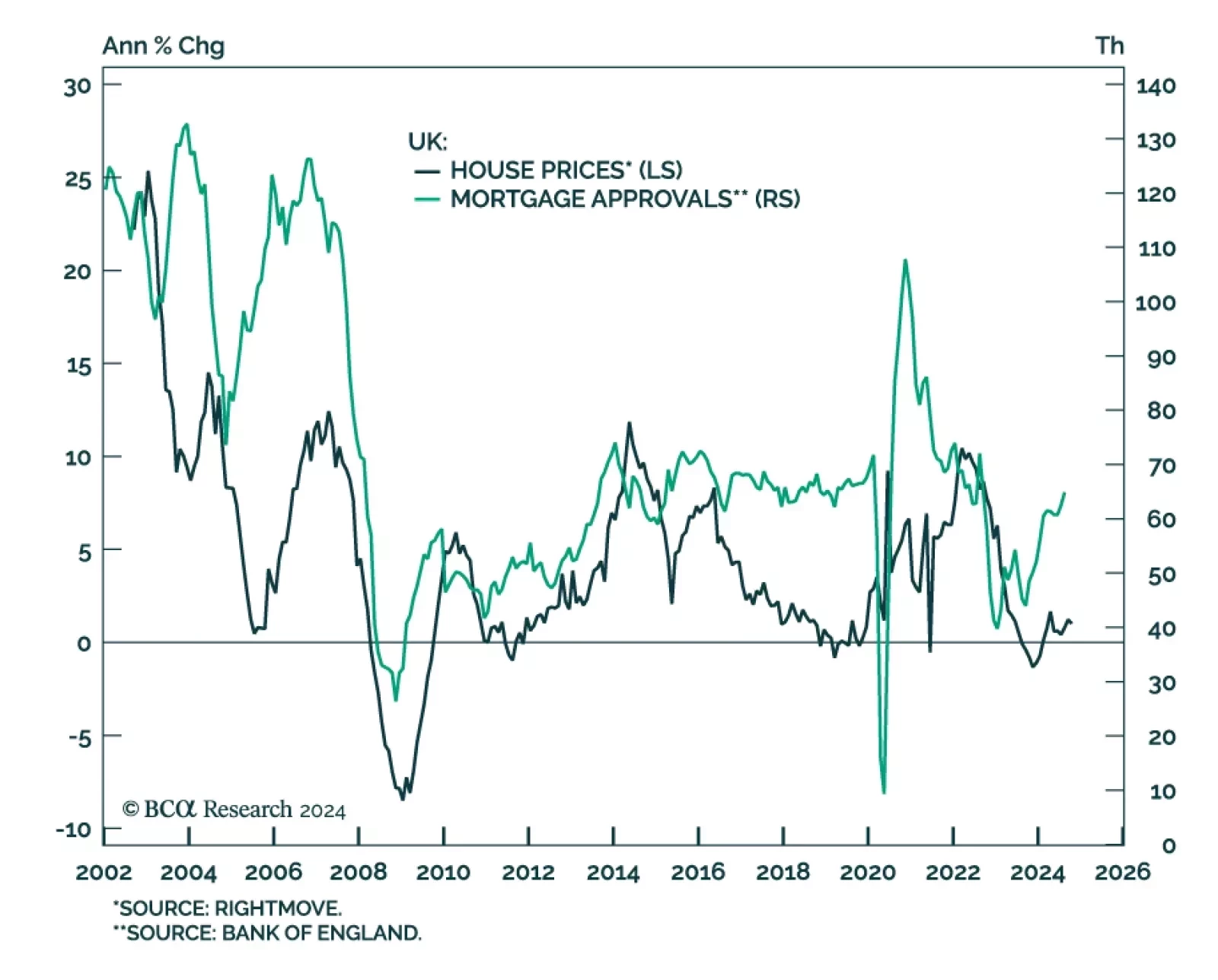

Despite elevated mortgage rates, UK home prices remain resilient. Average new seller asking prices were roughly flat in October, even as evidence of selling pressures are emerging. According to Rightmove, total home…

US housing starts and building permits eased below expectations in September. Permits, a proxy for future construction, dropped 2.9% after rising 4.6% in August. New construction fell 0.5% after rising 7.8% a month prior. These…

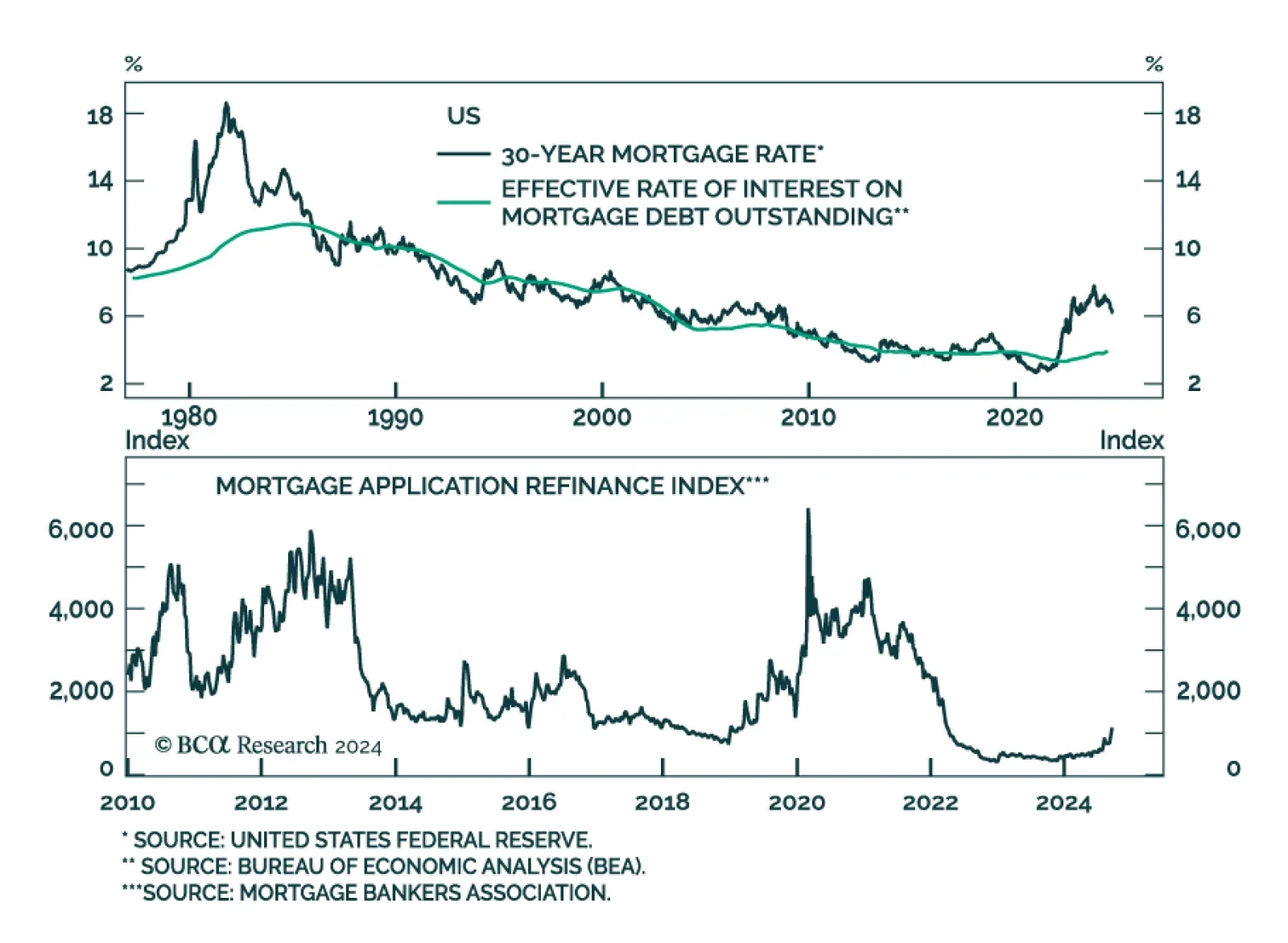

The conventional 30-year mortgage rate eased further to 6.2% from above 7% back in the spring, spurring a 20.3% surge in refinancing activity last week. Mortgage applications rose 11.0%, marking a fifth consecutive week of…

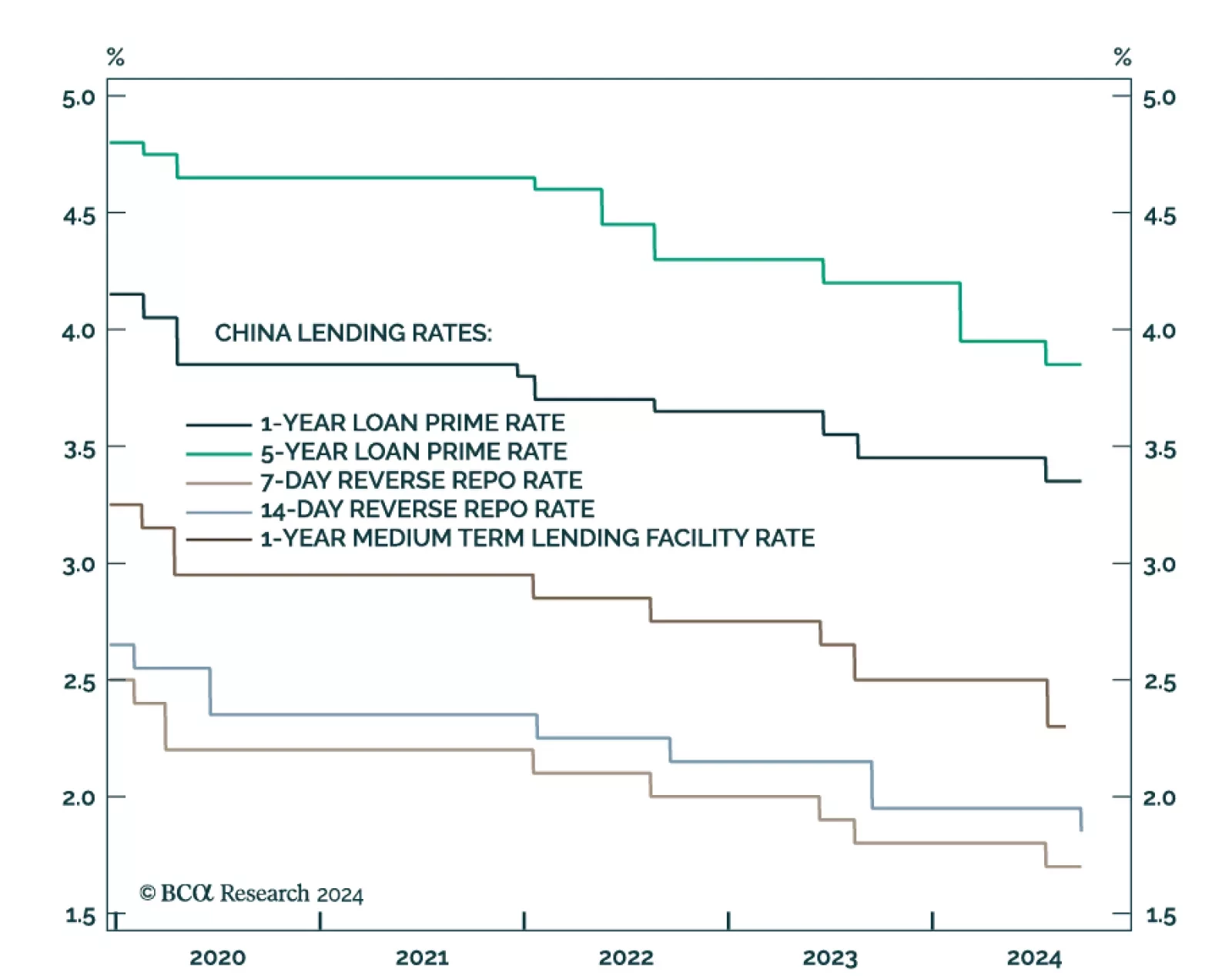

The PBoC lowered the 14-day reverse repo rate by 10 bps on Monday, a move that follows a string of easing measures in late July when the central bank lowered the 7-day reverse repo rate, several maturities of the loan prime rate…

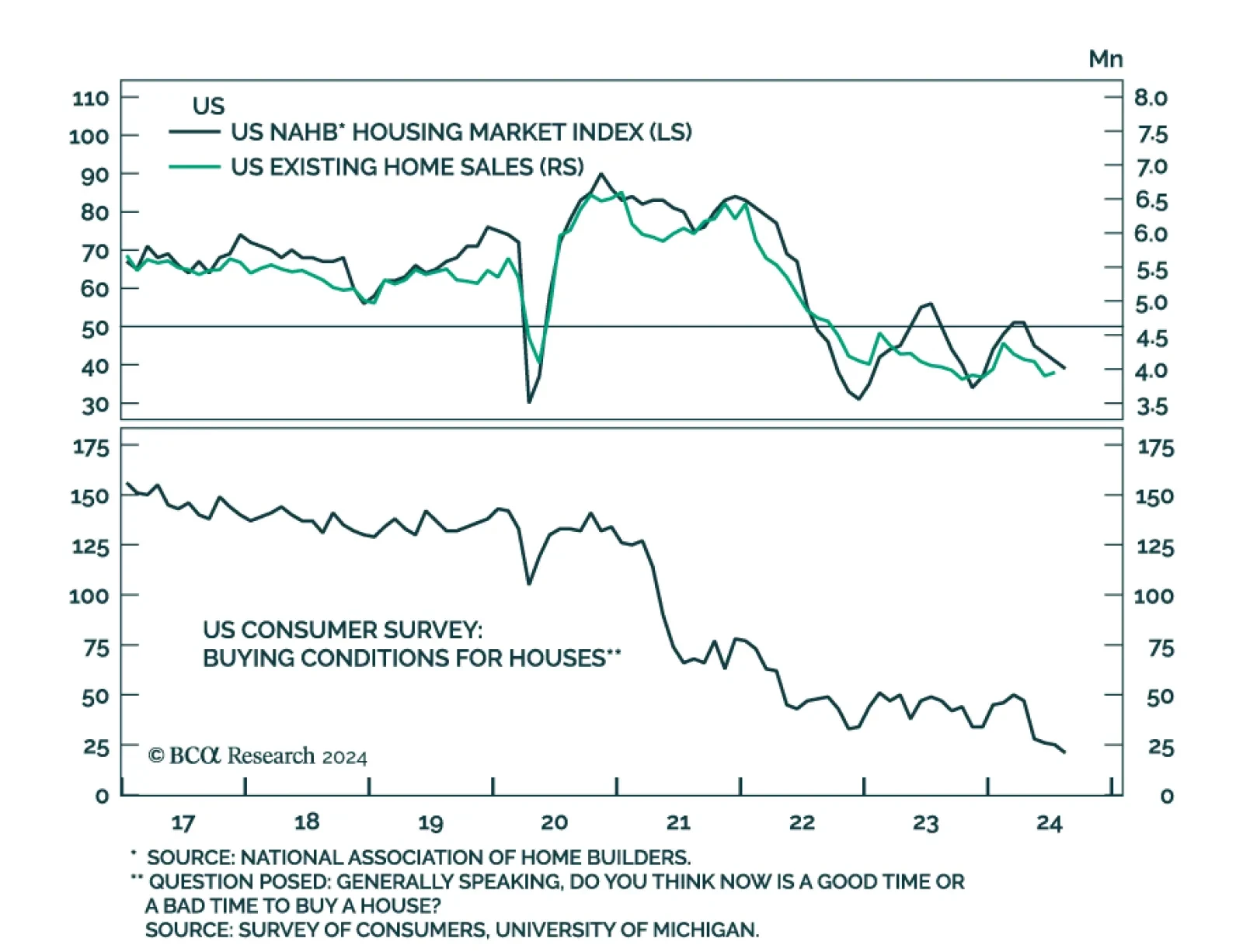

US housing market data have been mixed. In June, the FHFA House Price index unexpectedly declined 0.1% m/m and the NAHB housing market index unexpectedly eased to 39 from a 41 reading. In July, starts and permits both…

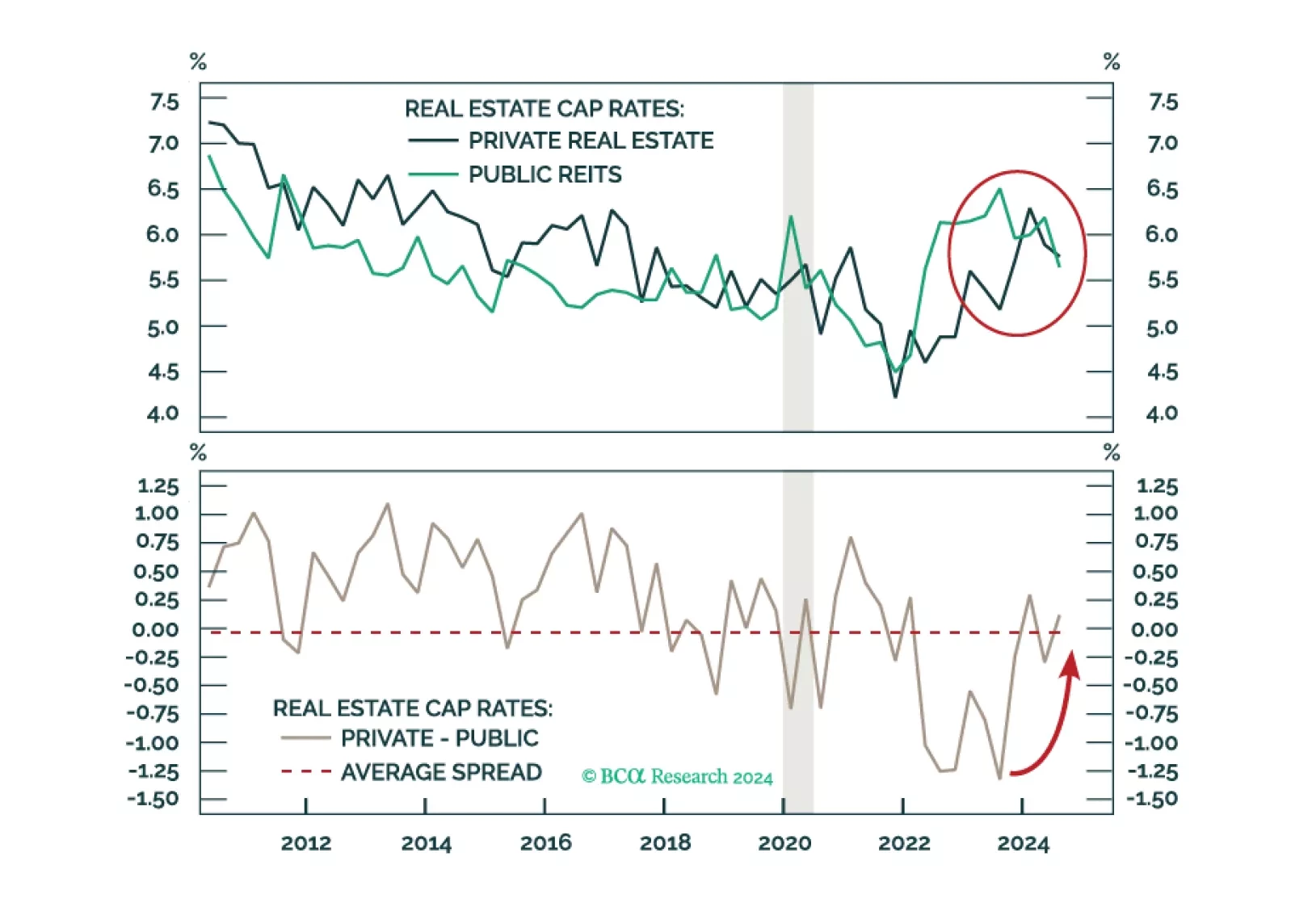

Investors should be tactically tilting allocations towards Direct Lending, Distressed Debt, and Directional Hedge Fund strategies at the expense of Real Estate, Private Equity, and Diversifier Hedge Funds. Structural opportunities…

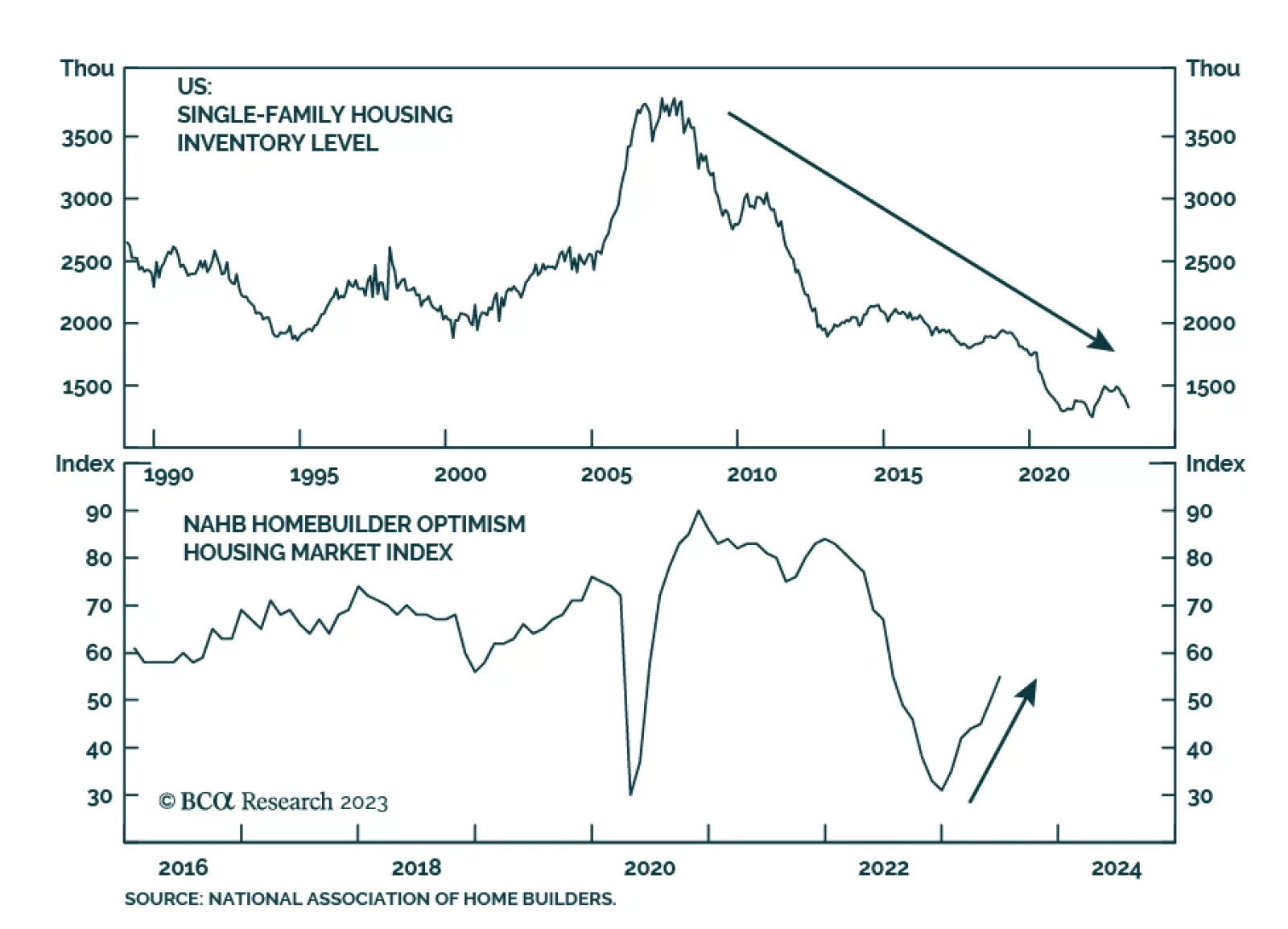

According to BCA Research’s US Equity Strategy service, residential REITs, homebuilders, and durable goods manufacturers are the beneficiaries of the negative supply shock in residential housing. Shortage of inventories…

This week we are sending you a Style Chart Pack, which now includes a standalone macro section, as well as macro, fundamentals, valuations, technicals, and uses of cash charts for the S&P 500, Defensives vs. Cyclicals, Growth vs…