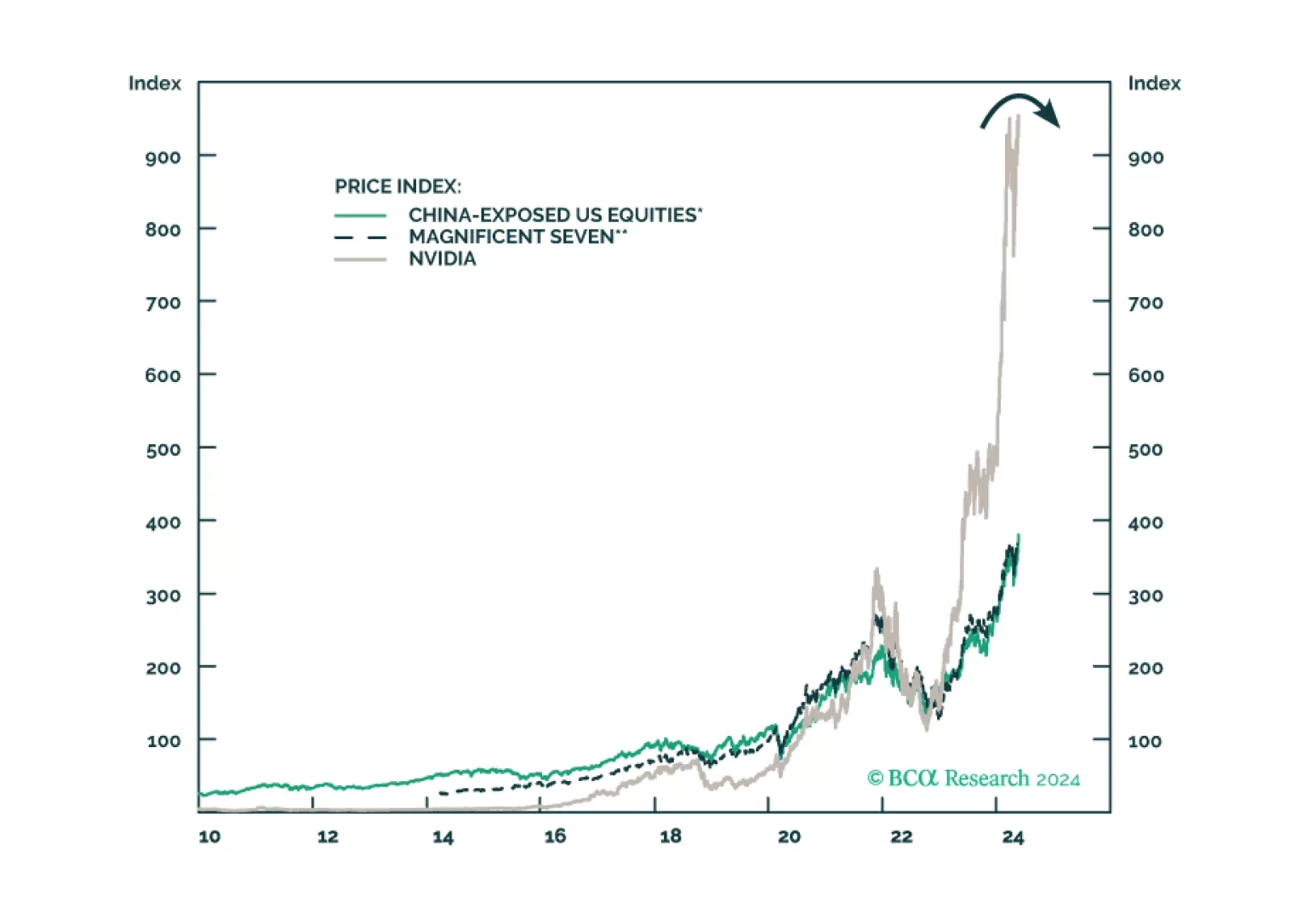

According to BCA Research’s Geopolitical Strategy service, Trump’s brand, legacy, and populist movement are based on the popular demand for a more hawkish US policy on trade and immigration. China has been the chief…

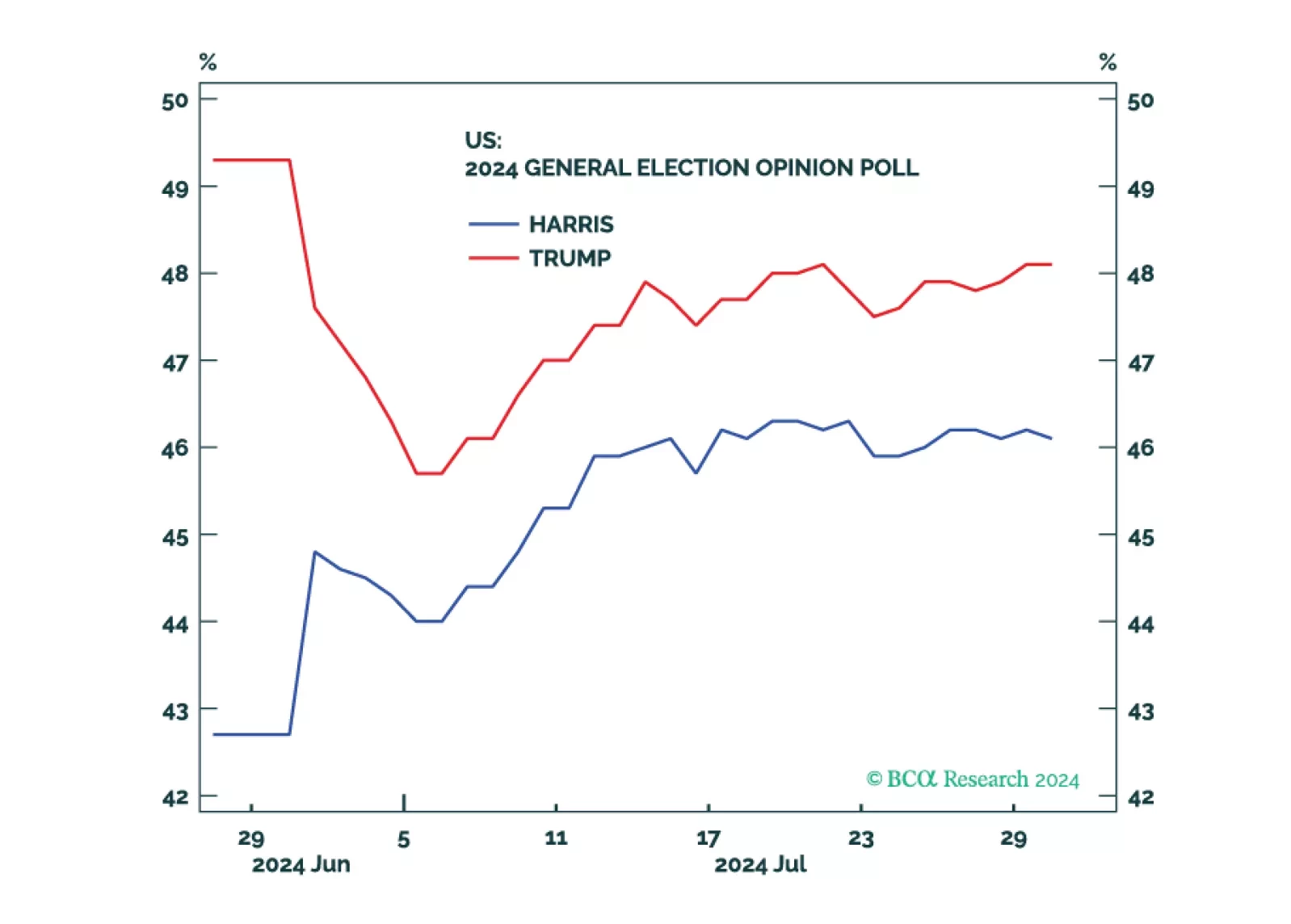

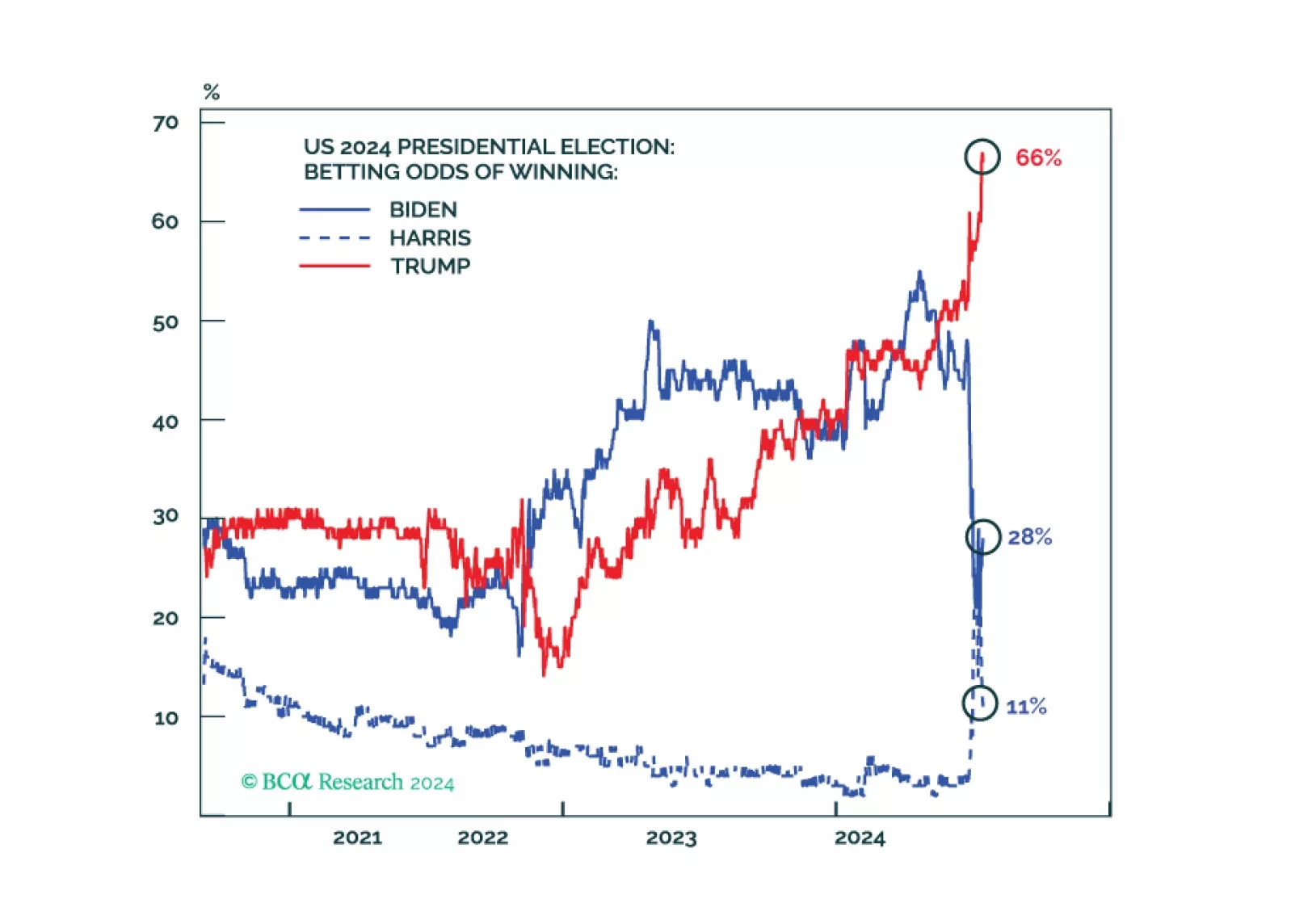

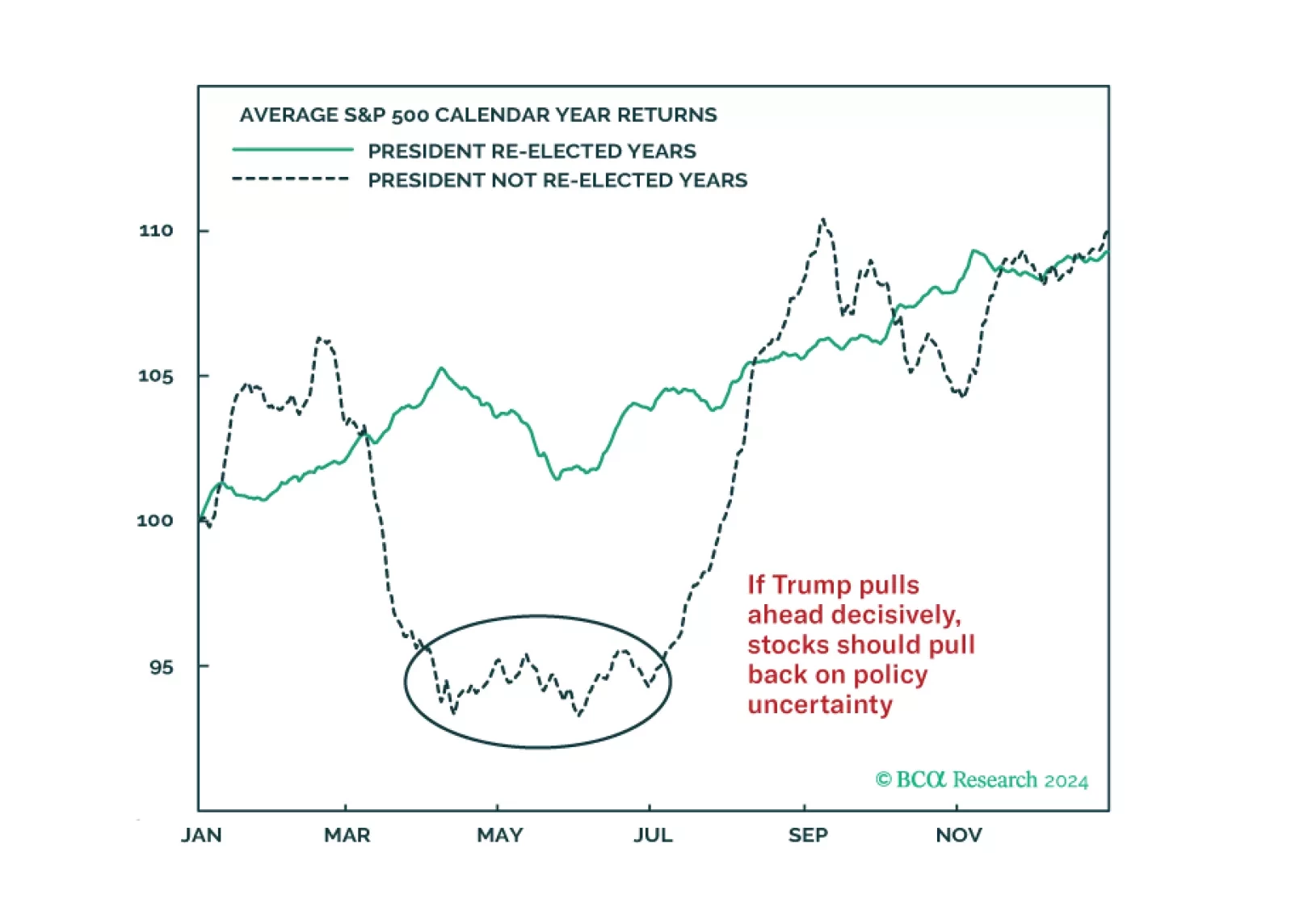

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.

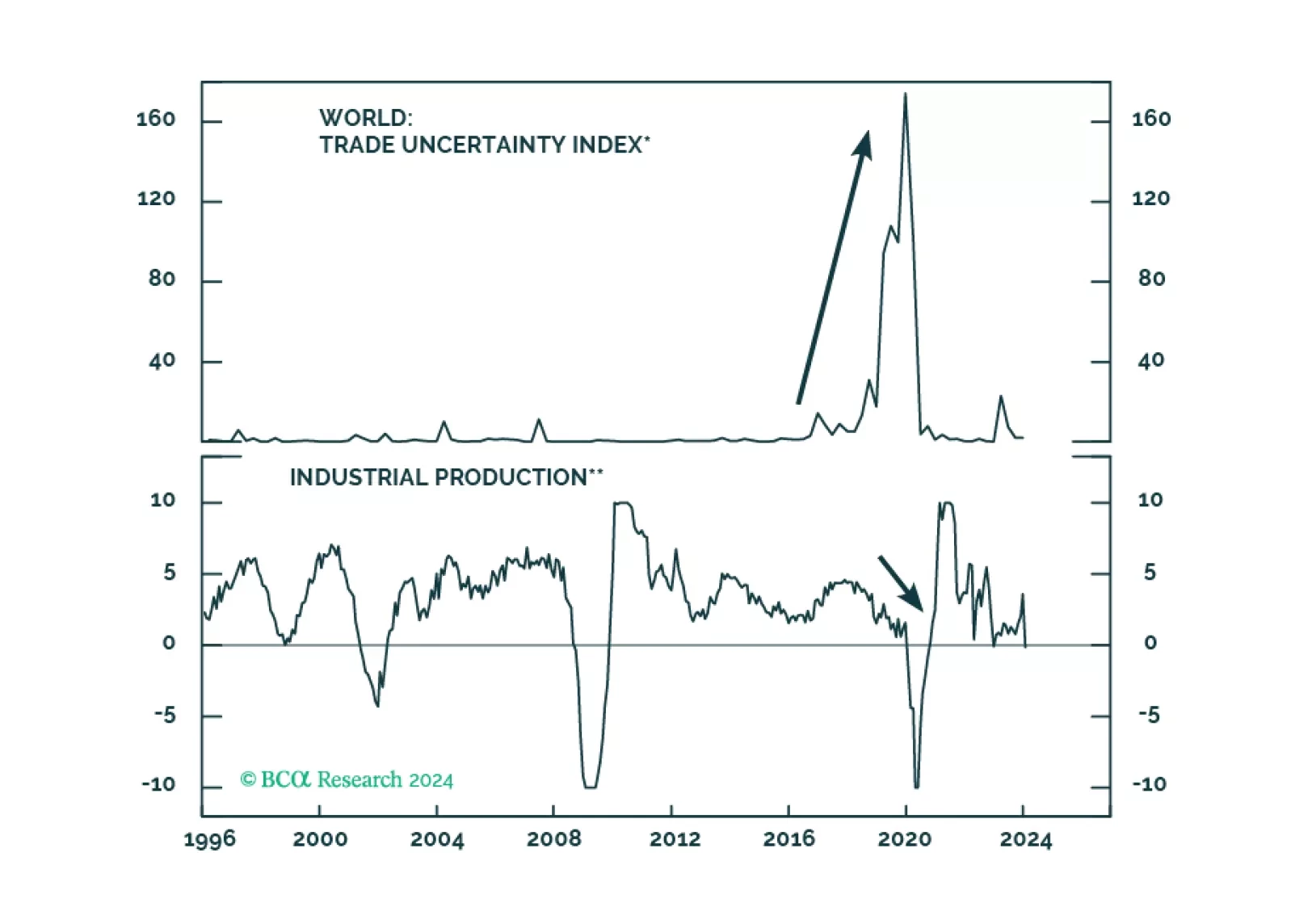

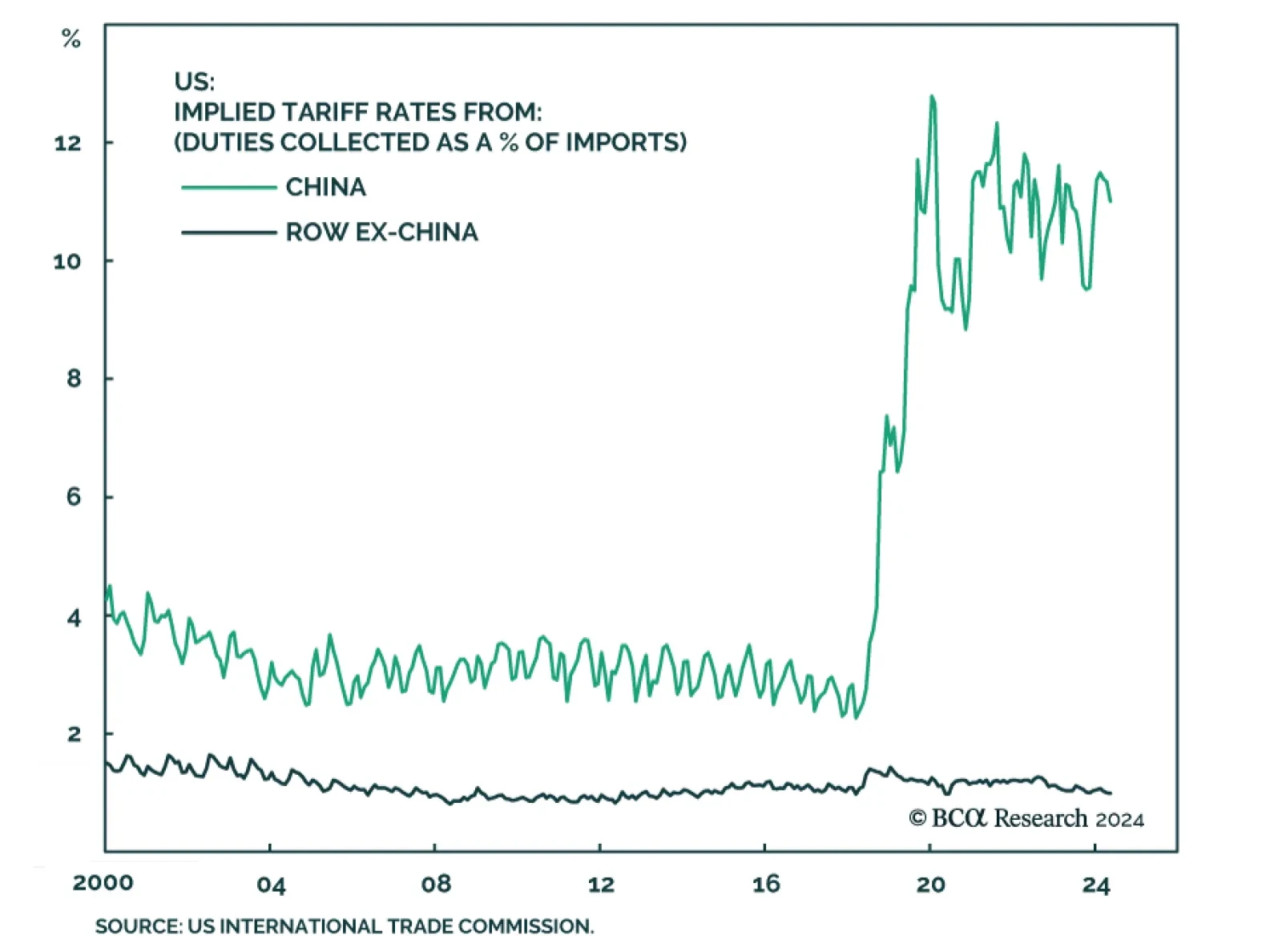

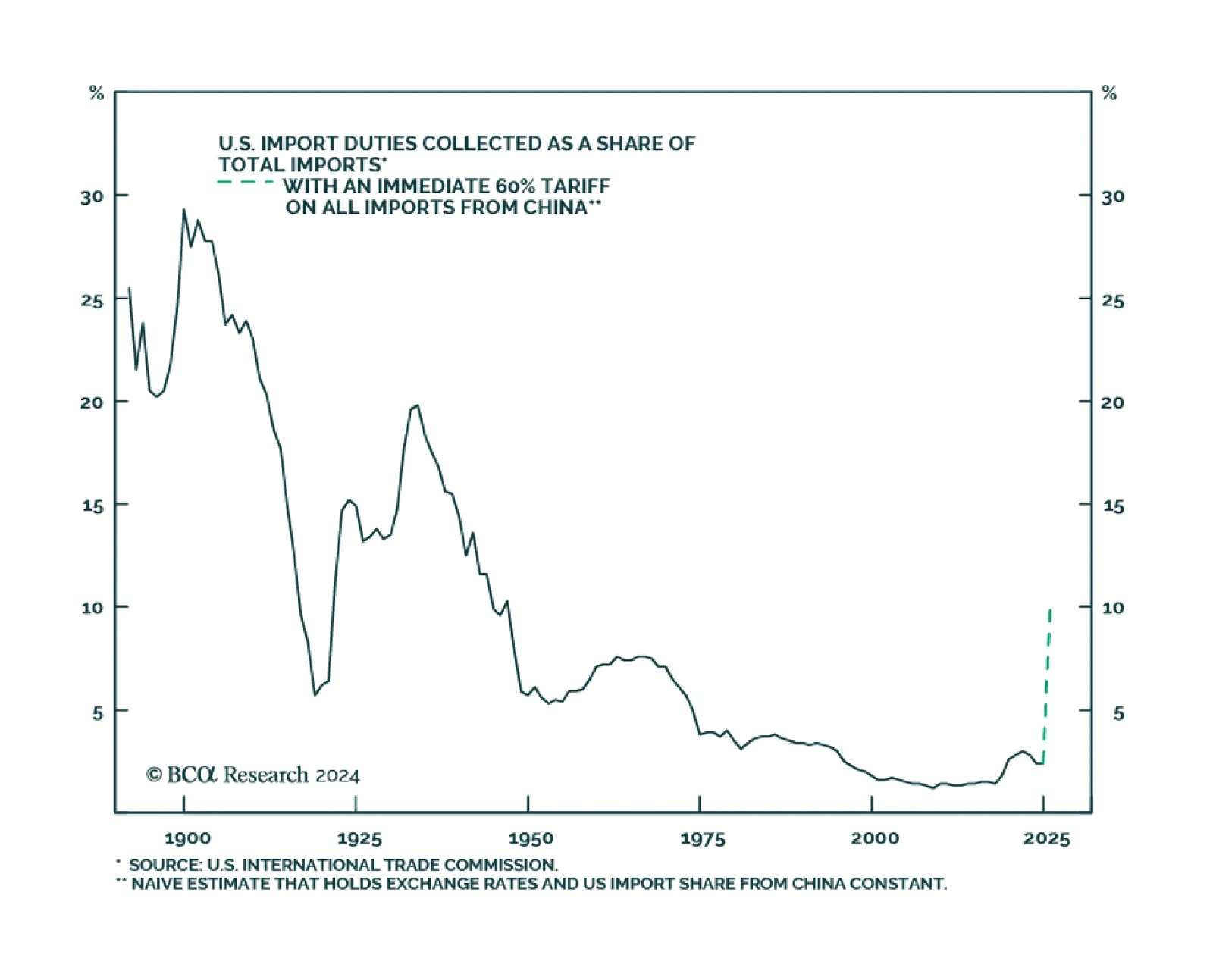

According to BCA Research’s Bank Credit Analyst service, trade policy under a second Trump presidency represents one of the greatest cyclical risks to investors. A key question for investors is whether tariffs are…

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

On Wednesday, the European Commission announced it would impose tariffs ranging between 17% and 38% on imports of Chinese EVs starting next month. These duties will be applied on top of existing 10% across-the-board tariffs on…

Although a strategic détente between the US and China would benefit both sides, BCA Research’s Geopolitical Strategy service warns that the trade war will continue. The team has argued that Biden and Xi would fail to…

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

According to BCA Research’s Geopolitical Strategy and The Bank Credit Analyst services, trade policy under a second Trump presidency represents the greatest cyclical risk to investors. In 2018, the Trump administration…