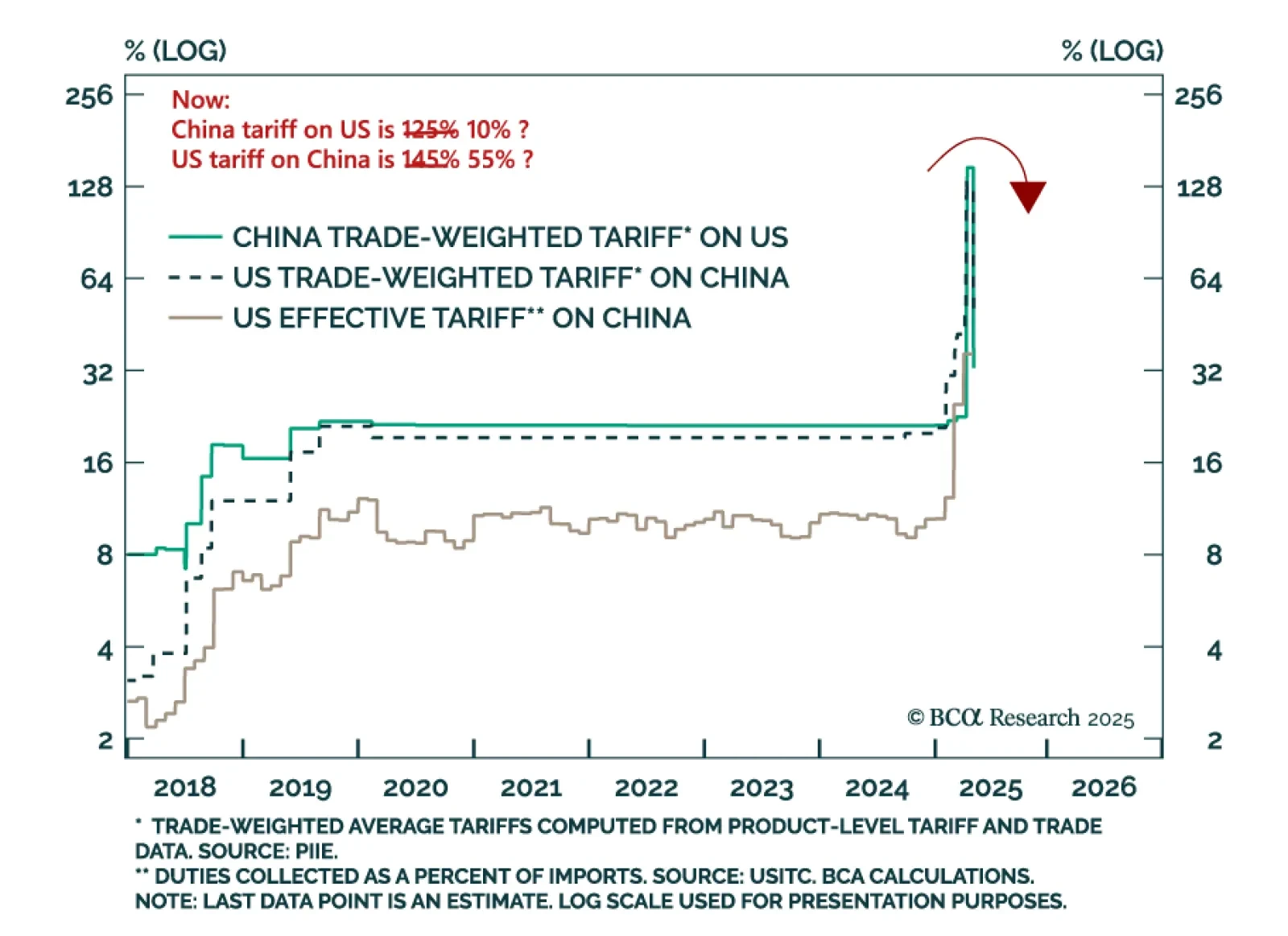

The US-China tariff deal confirms one thing: markets are still priced for perfection, with little upside even if a recession is dodged. The London negotiations yielded a partial agreement: The US will reduce tariffs, and China will…

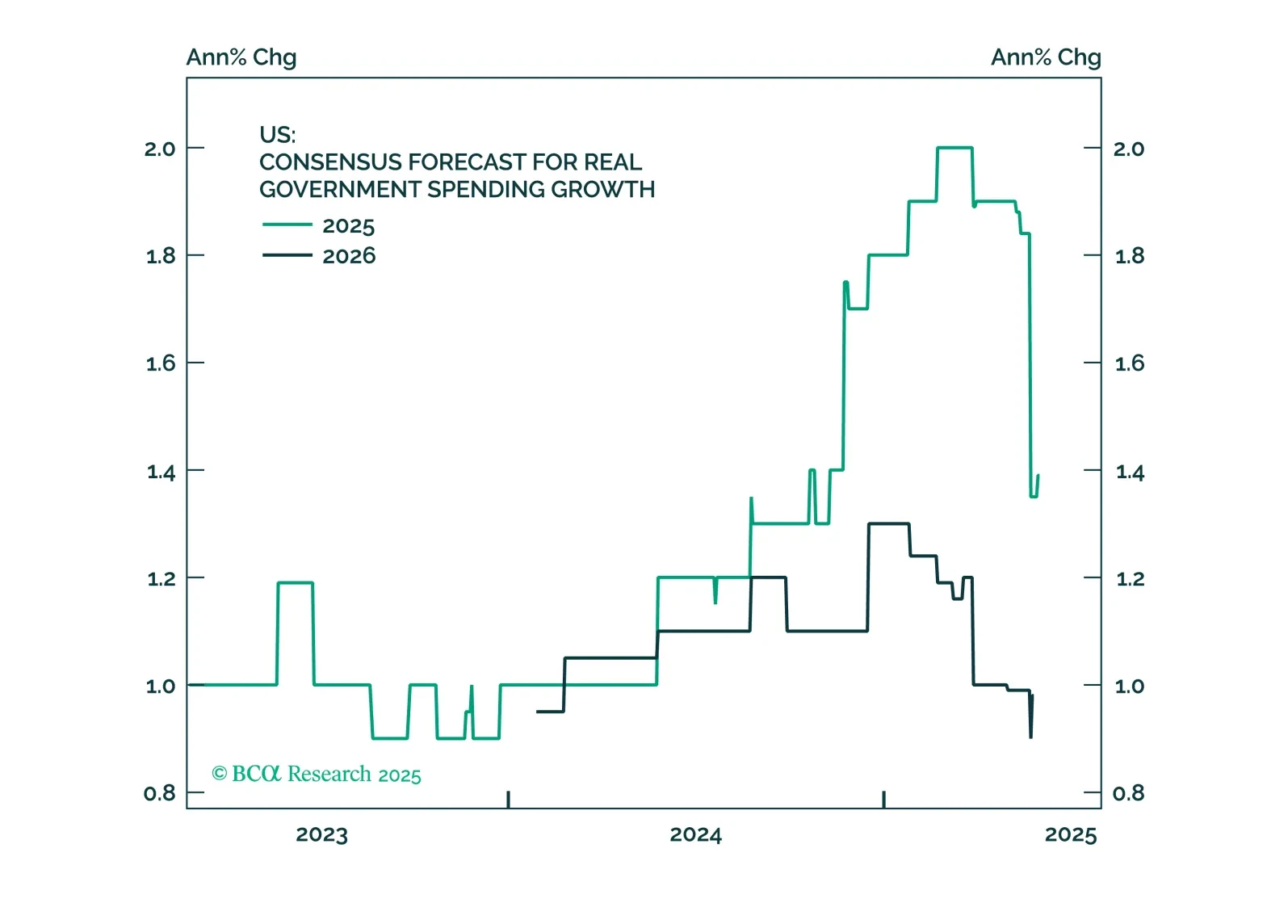

This month, we focus on the One Big Beautiful Bill Act (OBBBA). Our assessment in the Alpha report is that there won’t be any remaining alpha to harvest by shorting duration. The team that coined the “Human Steepener” moniker for…

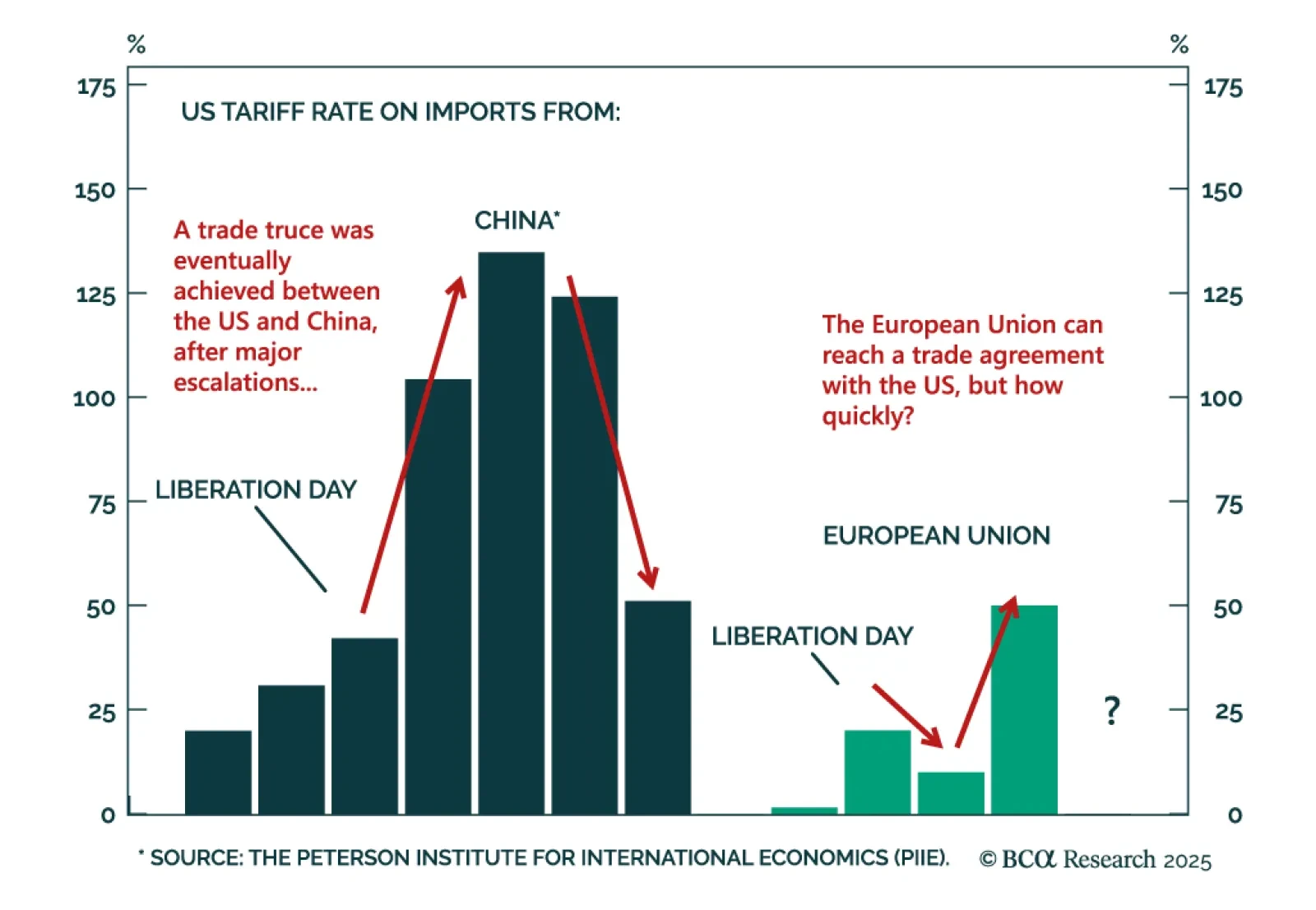

Last Friday, President Trump announced new 50% tariffs on imported goods from the European Union (EU), effective June 1st, and threatened US company Apple with 25% tariffs unless it made iPhones in the US. Global stock markets…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

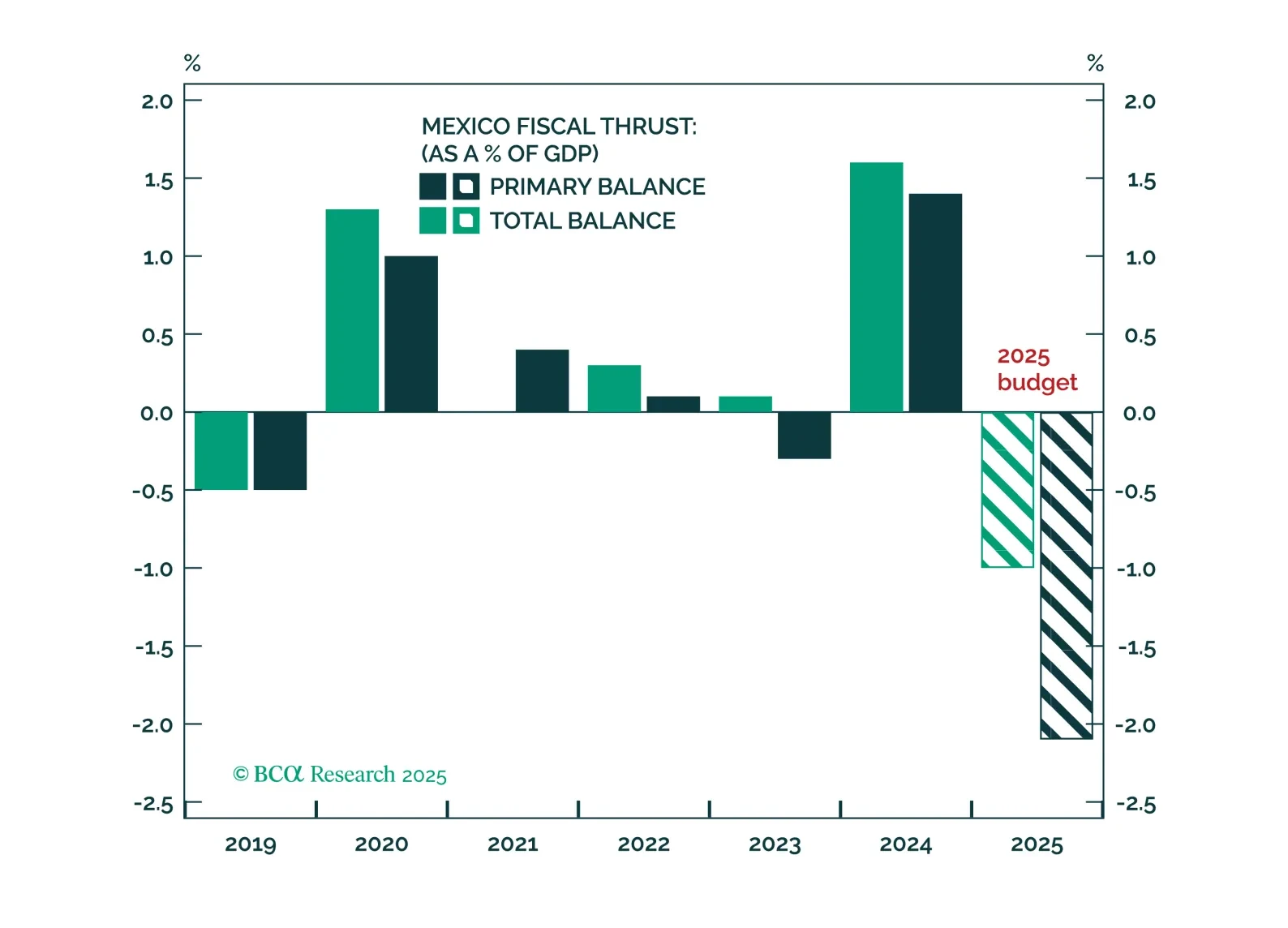

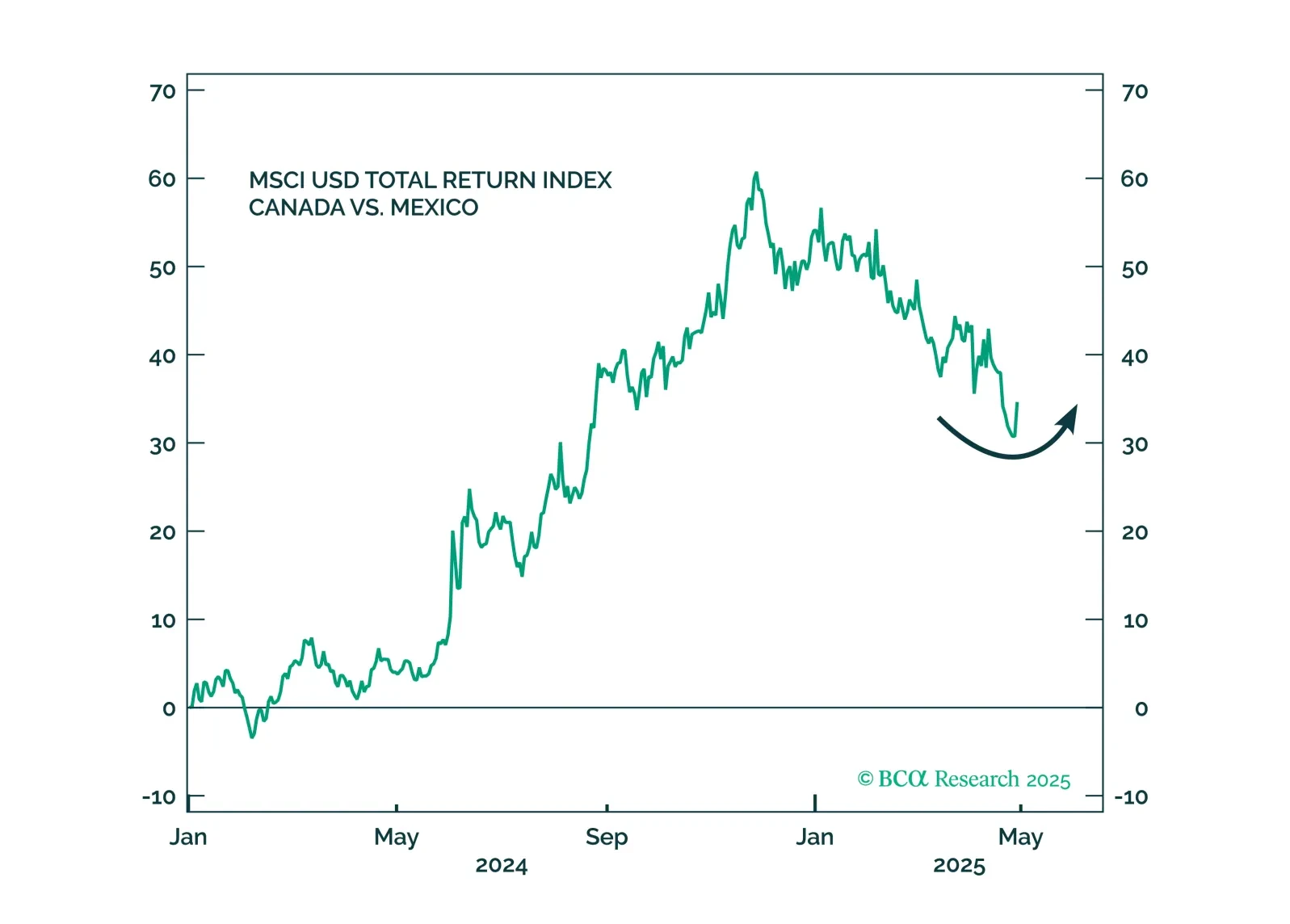

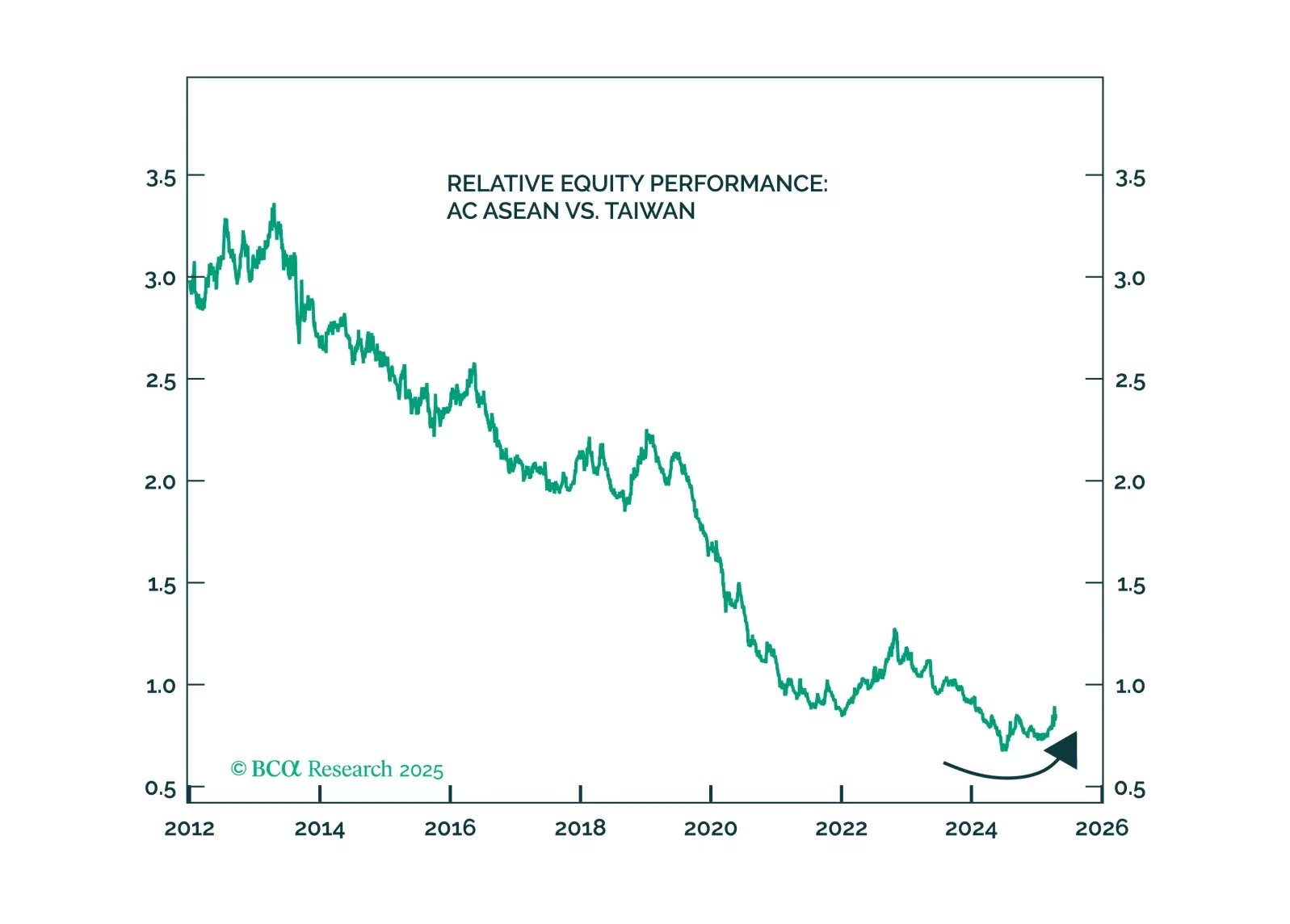

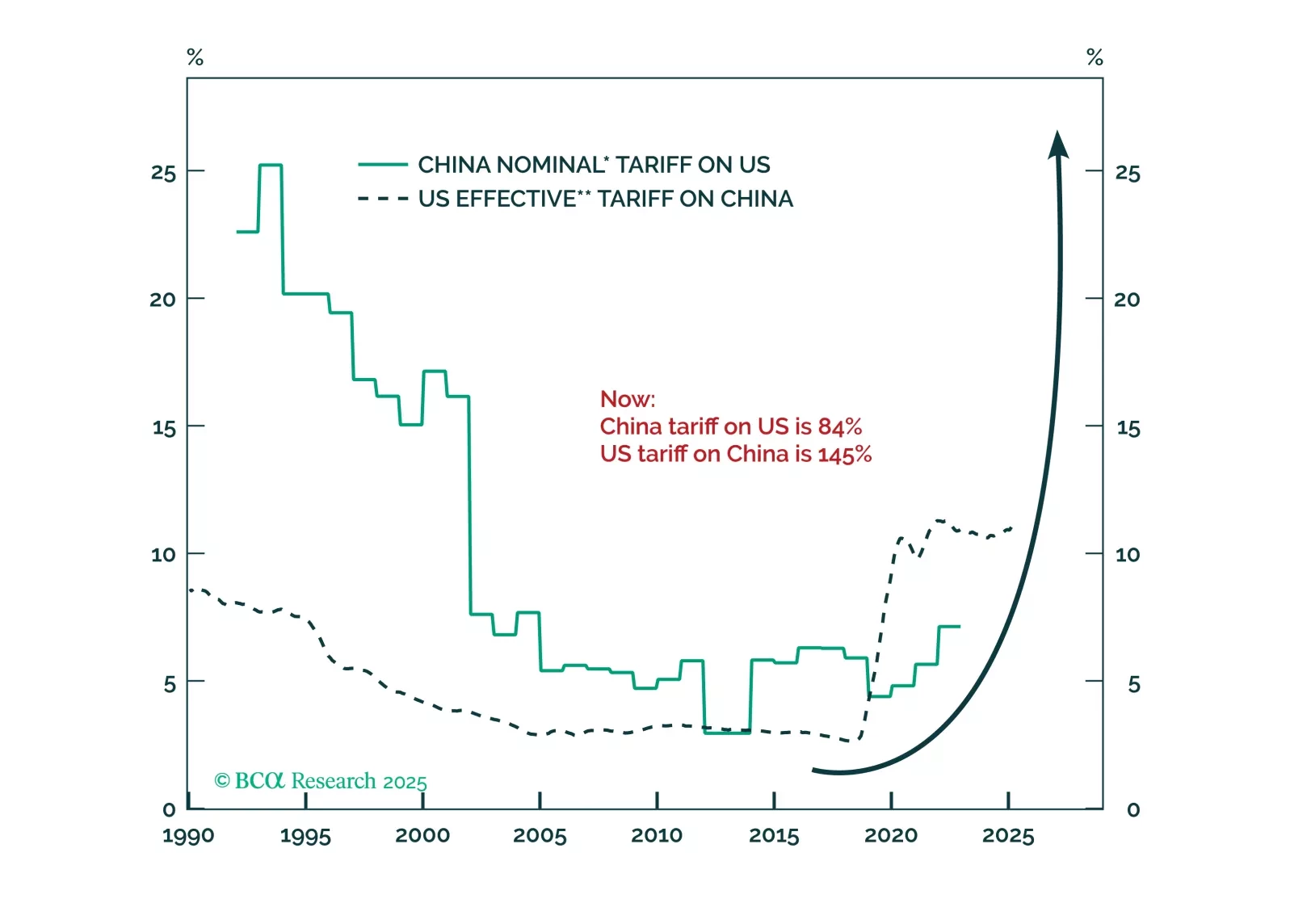

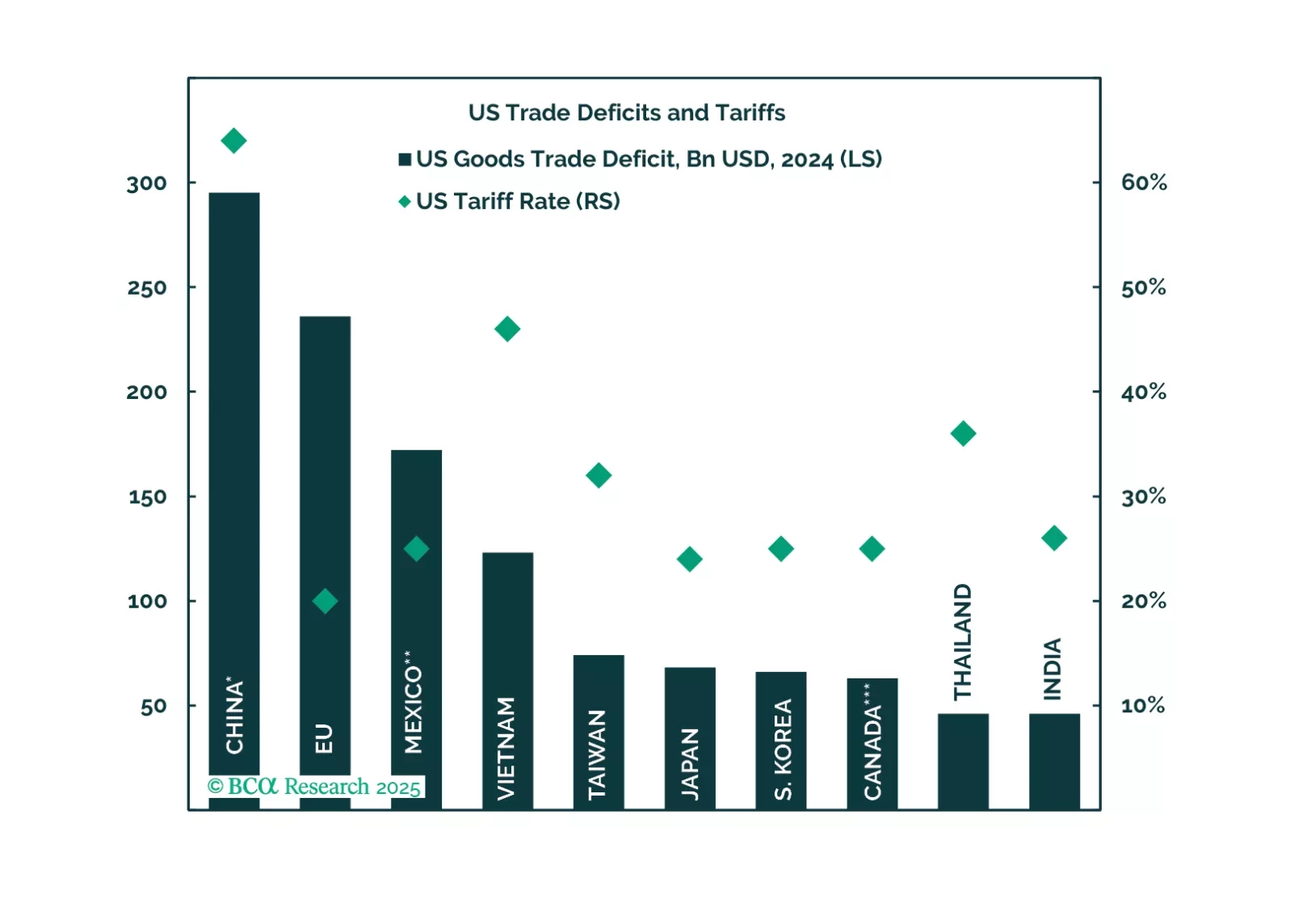

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…

Trump's Tariff D-Day brings a negative surprise to financial markets already anxious over a declining US cyclical economy. Investors should sell risky assets, increase safe havens, and overweight US assets in the near term.