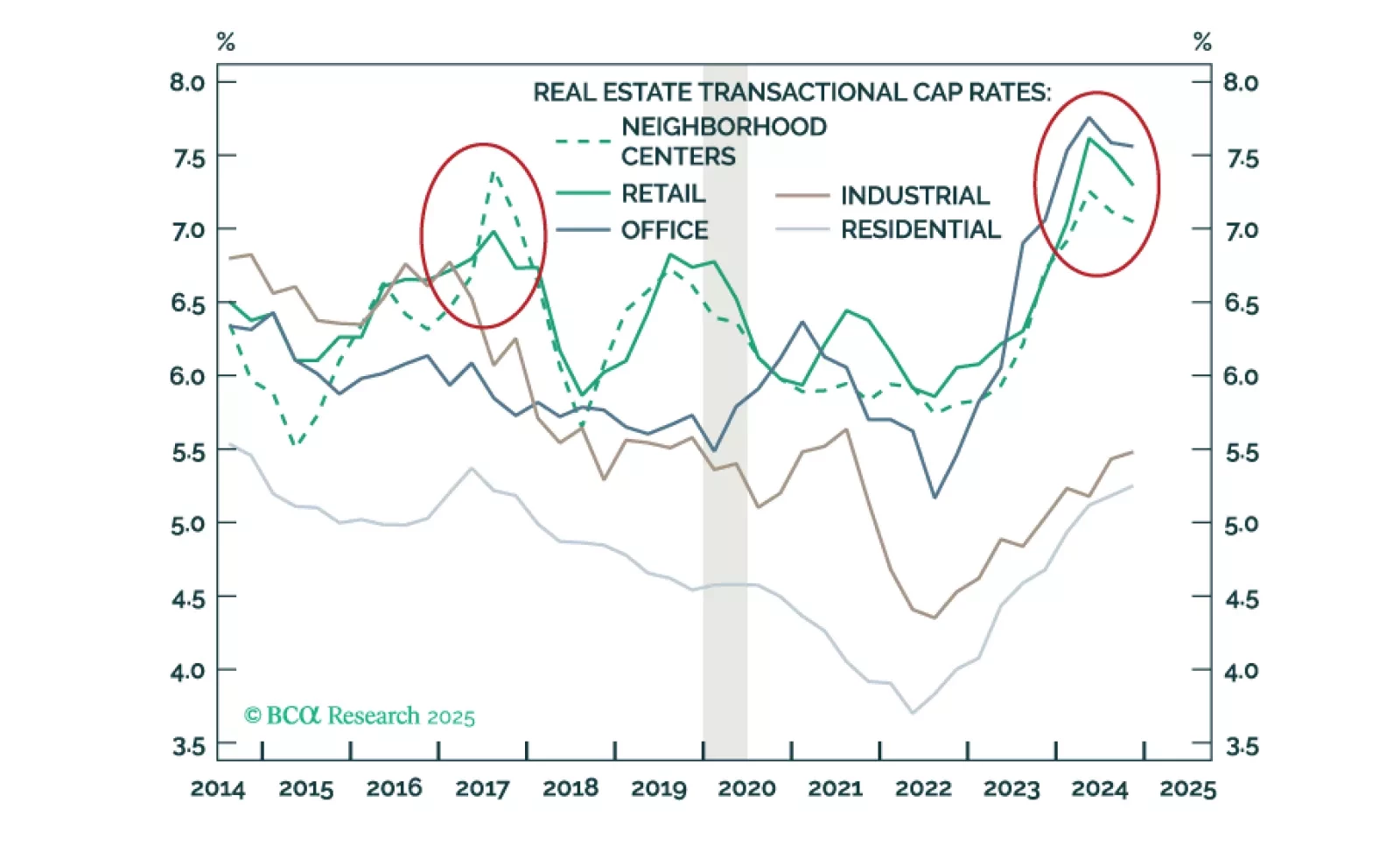

It is time to bet on brick-and-mortar again. The next time you step around your partner's Amazon package on your way to a physical store, consider this: Rock-bottom investor expectations, attractive initial fundamentals, and ongoing…

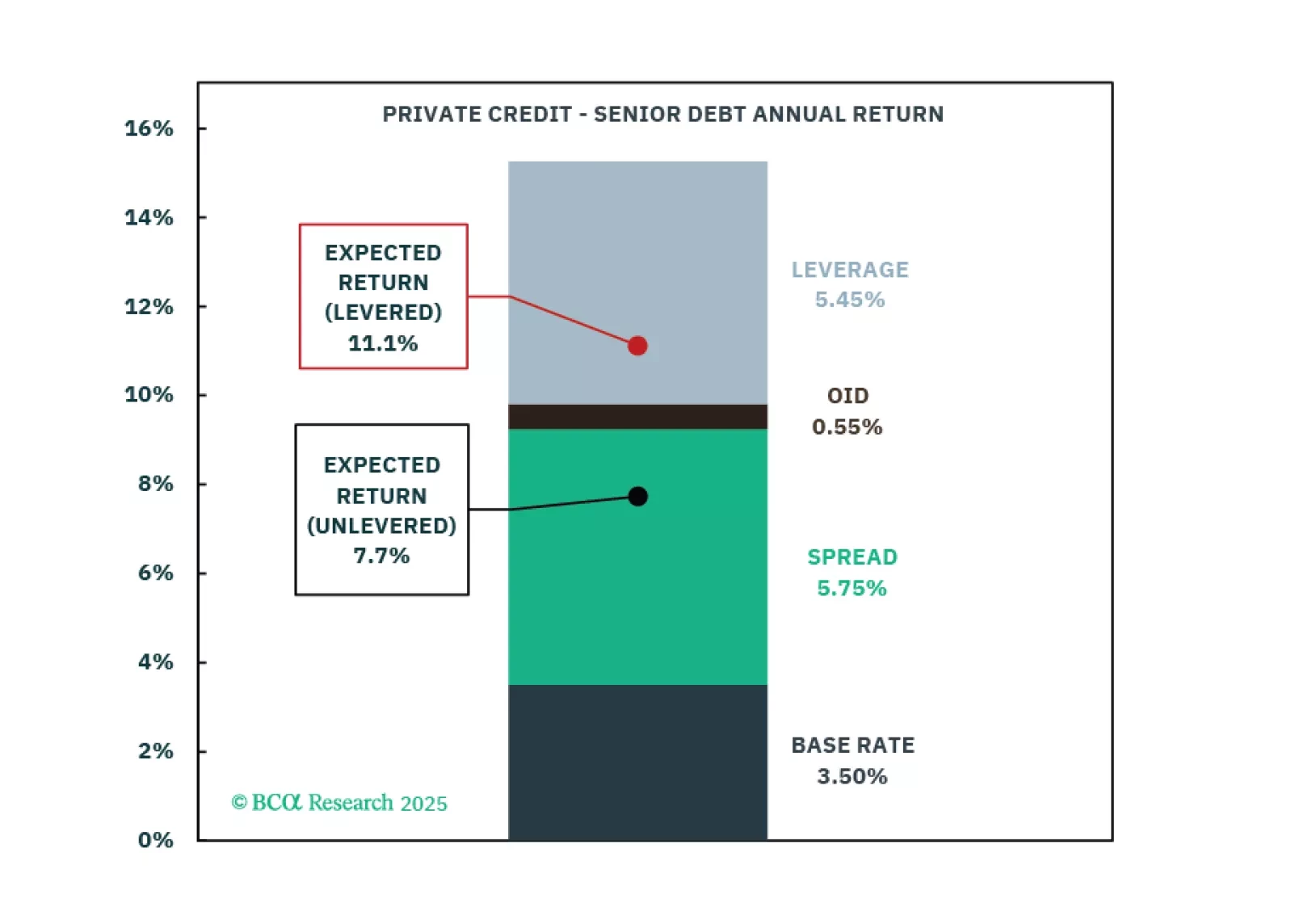

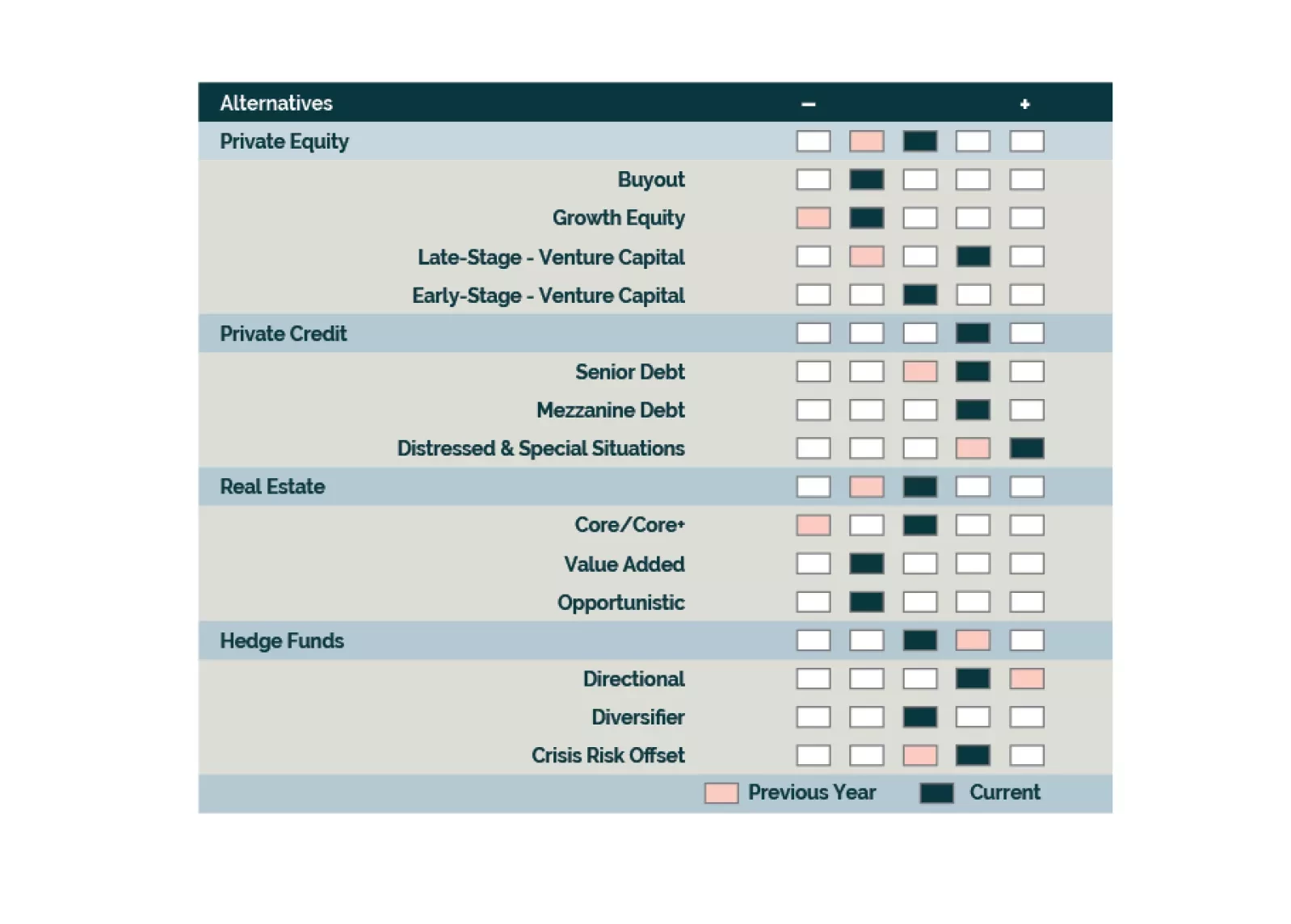

Asset class expectations show mixed shifts from 2024, with Real Estate seeing substantial upgrades and Private Equity benefiting from Venture Capital improvements. Private Credit return expectations decline from 2024 but remain…

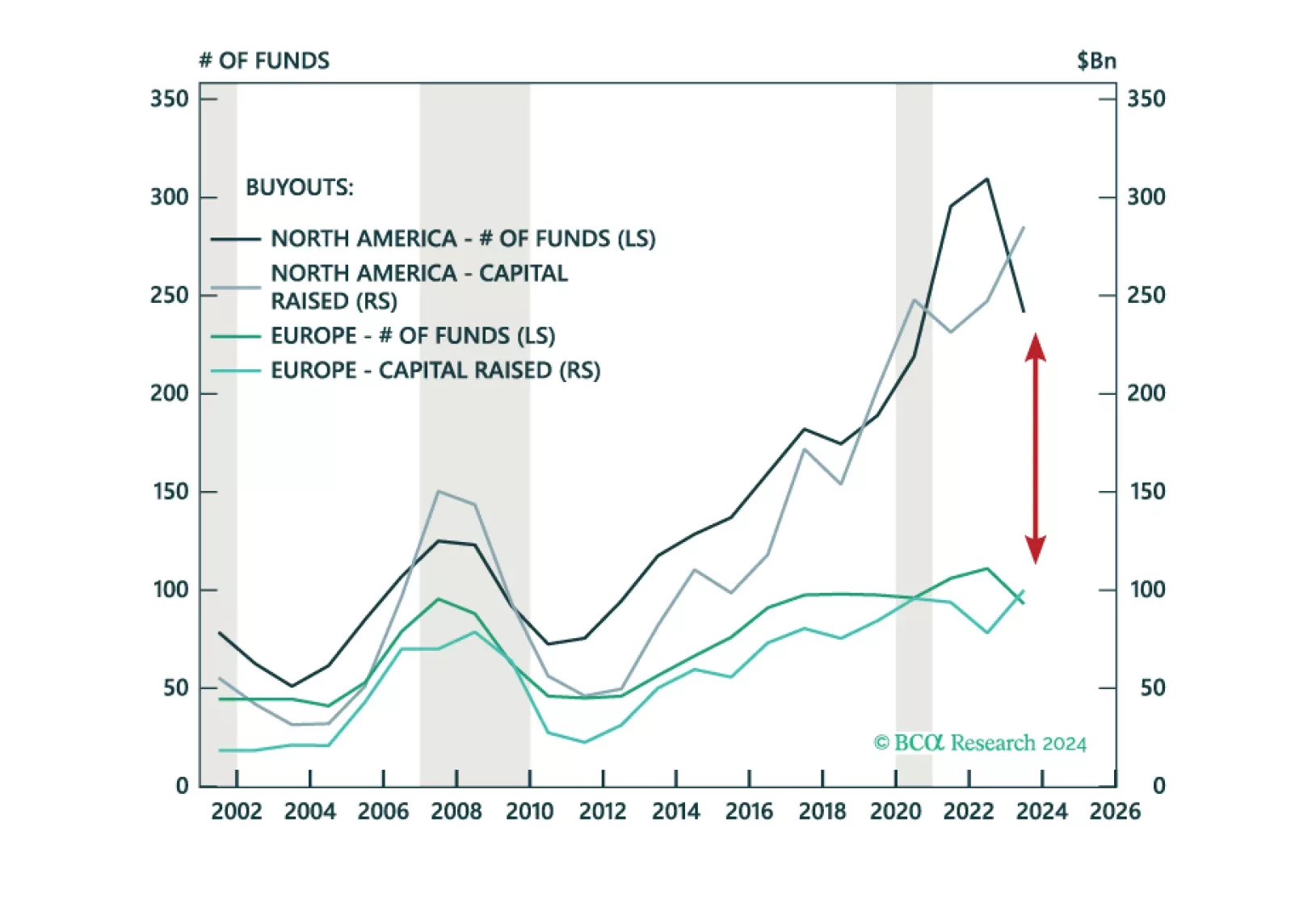

We are growing positive on Growth assets with recession expectations increasing our optimism on entry points. Equities are led by APAC Private Equity, North America Venture Capital, and Europe Buyouts. Our outlook continues to…

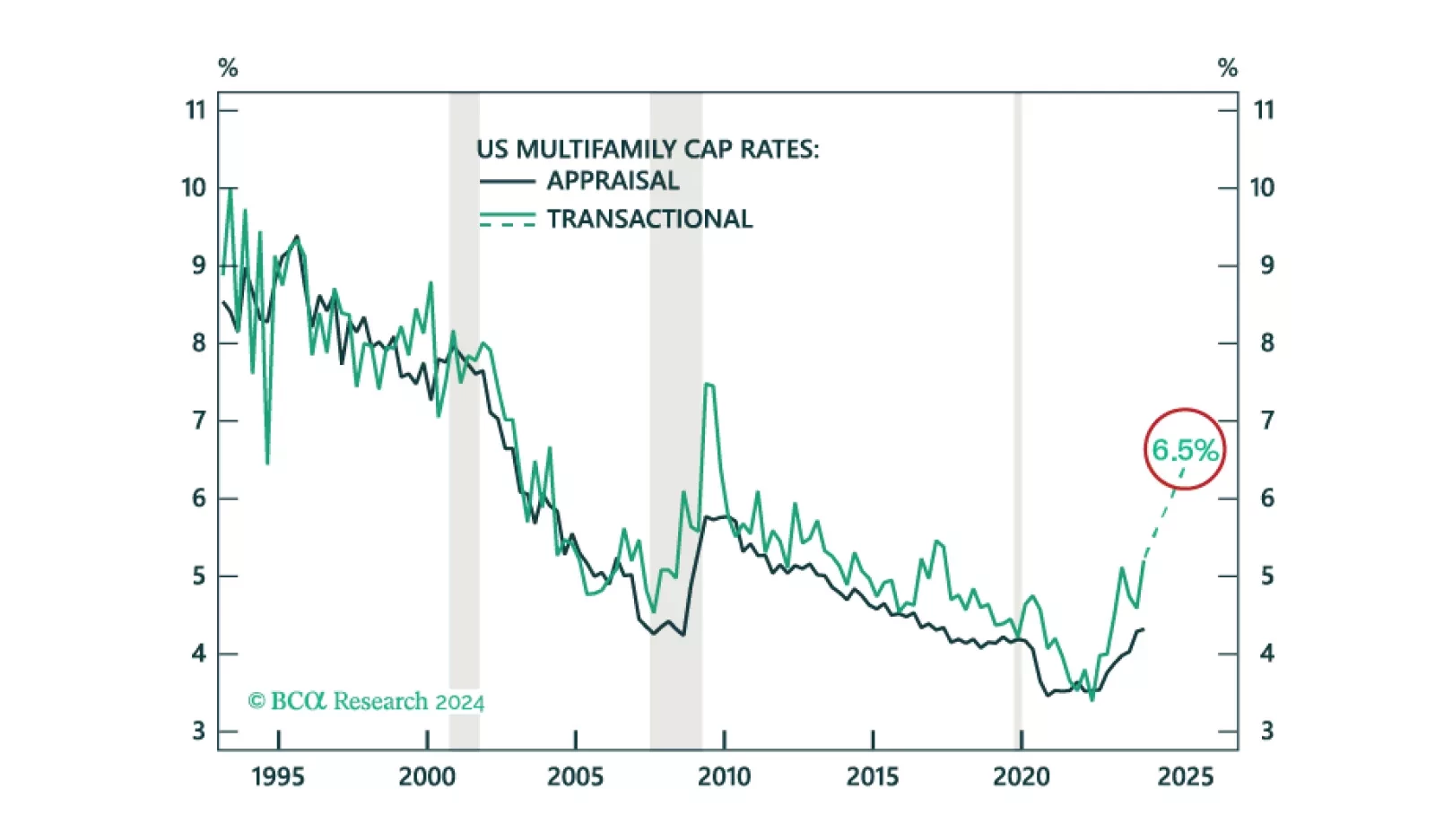

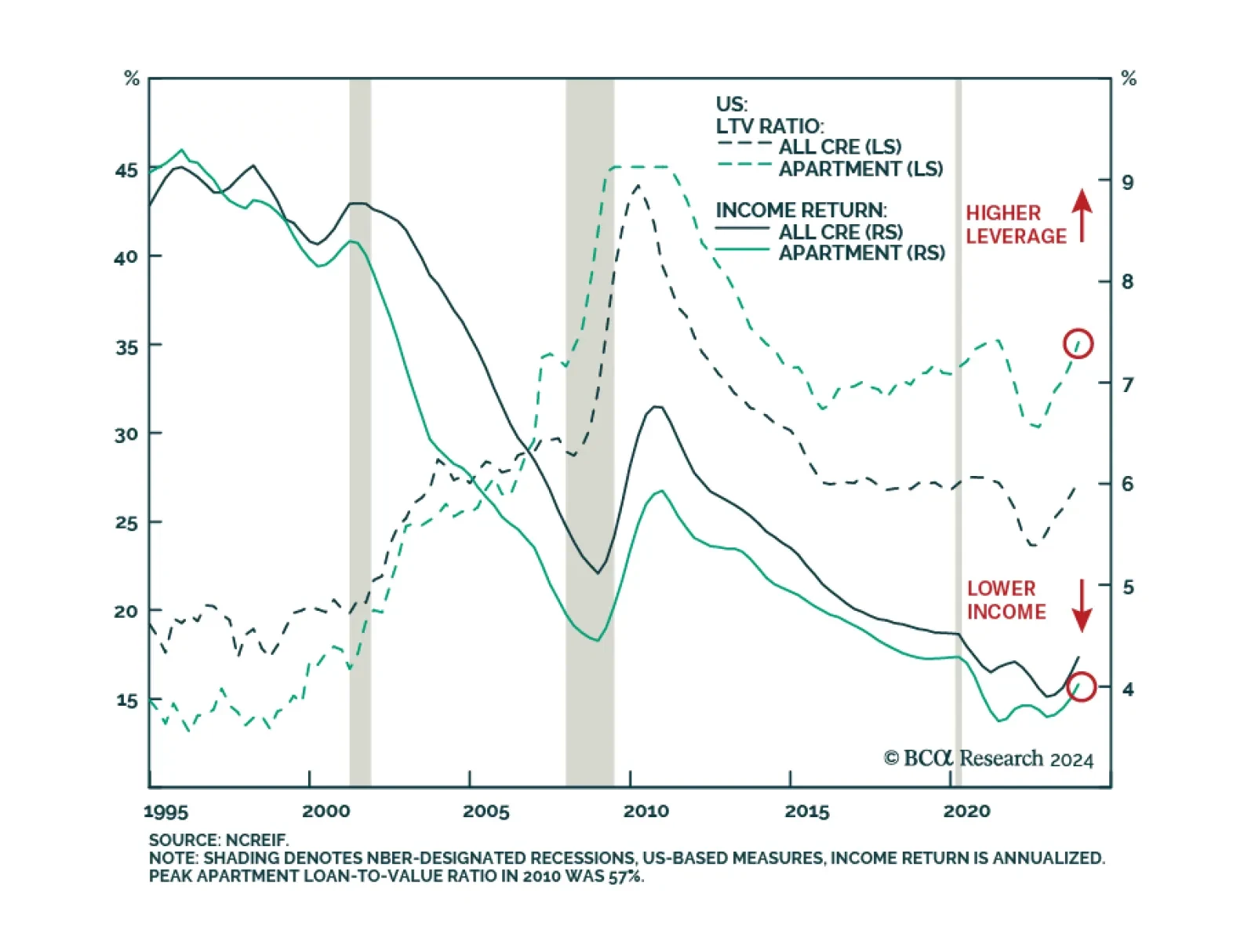

We project US Multifamily cap rates to increase from 5.2% to 6.5%. While we find an unfavorable risk-adjusted return on the asset, especially relative to other opportunities in CRE, cap rates are moving closer to peak.

We go overweight Late-Stage Venture Capital and APAC Private Equity but remain underweight North America Buyouts. We maintain our neutral outlook towards Hedge Funds and are positive on Long-Short Equity, Event Driven, and CRO…

According to BCA Research’s Private Markets & Alternatives service, fundamentals show US Multifamily assets to be akin to picking up pennies in front of a steamroller. Multifamily, and Office, have long served as…

Investors should be tactically tilting allocations towards Direct Lending, Distressed Debt, and Directional Hedge Fund strategies at the expense of Real Estate, Private Equity, and Diversifier Hedge Funds. Structural opportunities…

We see challenges ahead for Global Buyout across geographies as valuations need further resetting. While we are concerned with capital controls and flight risk in Asia-Pacific Venture Capital, the upside potential from AI may be…

We see a more positive backdrop for credit providers, with bilateral and structuring features as tailwinds for Private Credit. While there may be potential green shoots in some areas of Private Equity, current valuations are not…