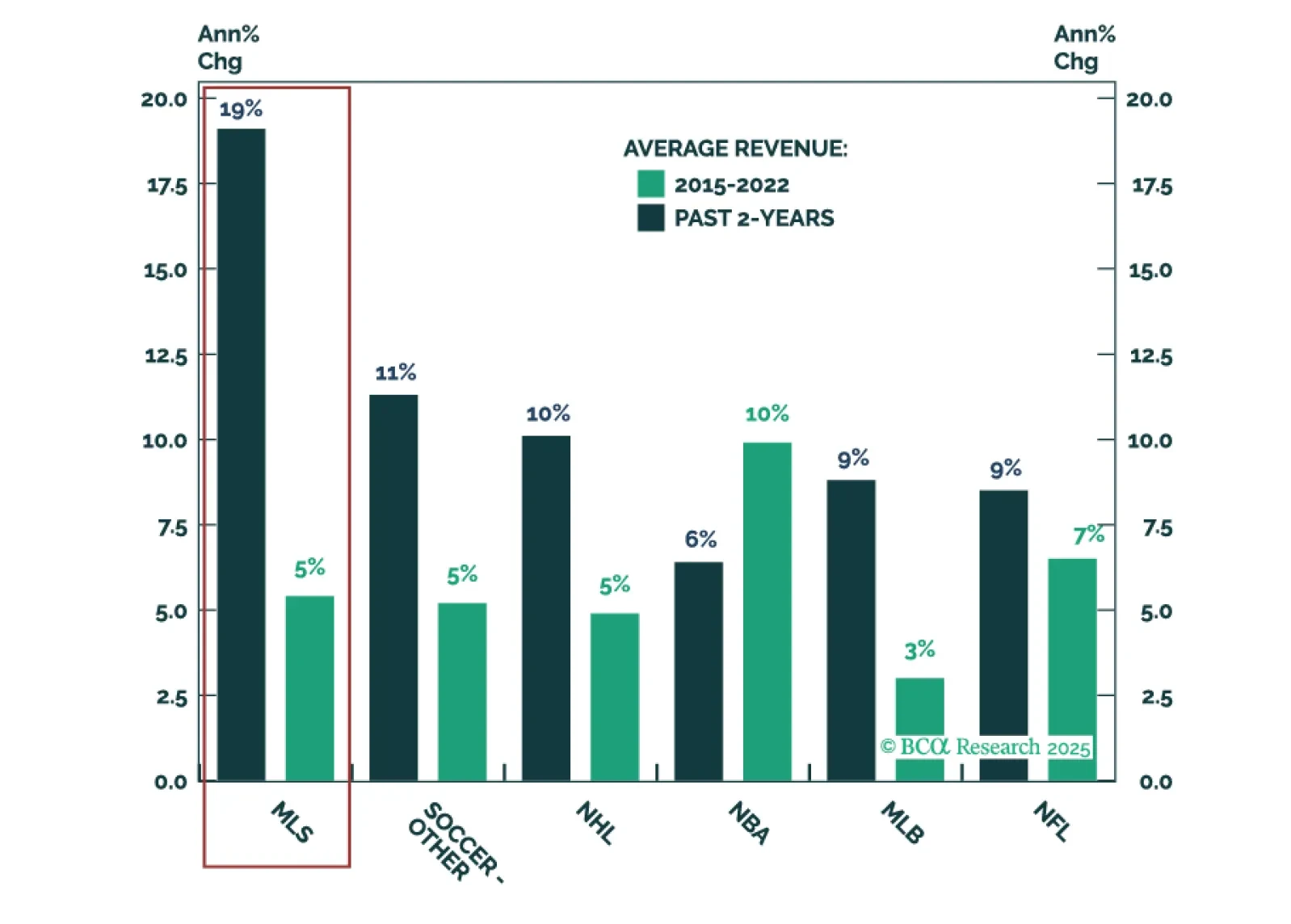

The NFL and NBA grab the headlines, but growth beats size. This report reveals the story behind Major League Soccer (MLS) growth. Valuations have jumped, yet plenty of upside remains—making the MLS relatively attractive compared to…

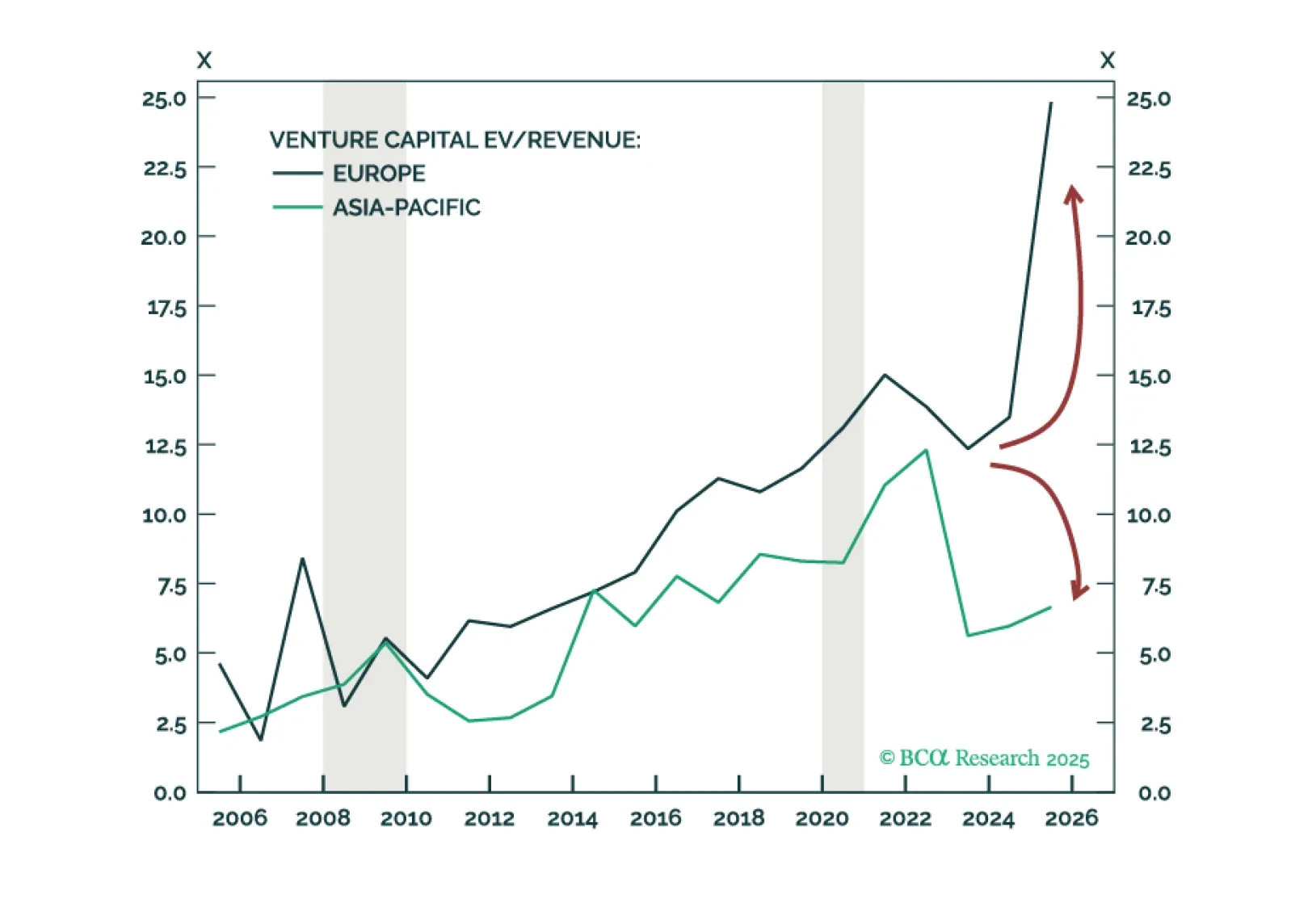

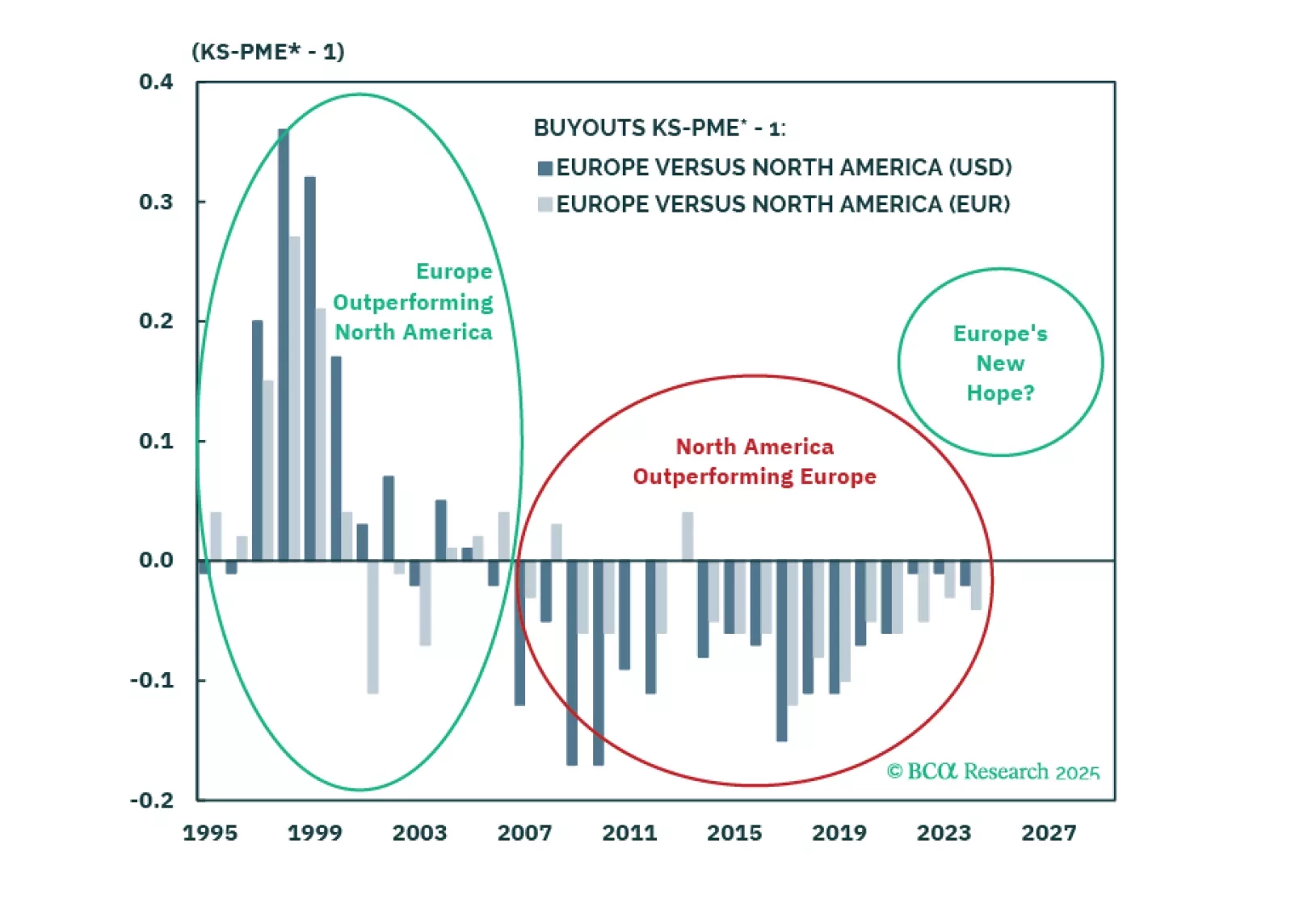

European euphoria is overdone. The most exceptional asset class in Europe is Infrastructure, but granular opportunities span other asset classes by sector and country. Venture Capital is a North America and Asia-Pacific play. We…

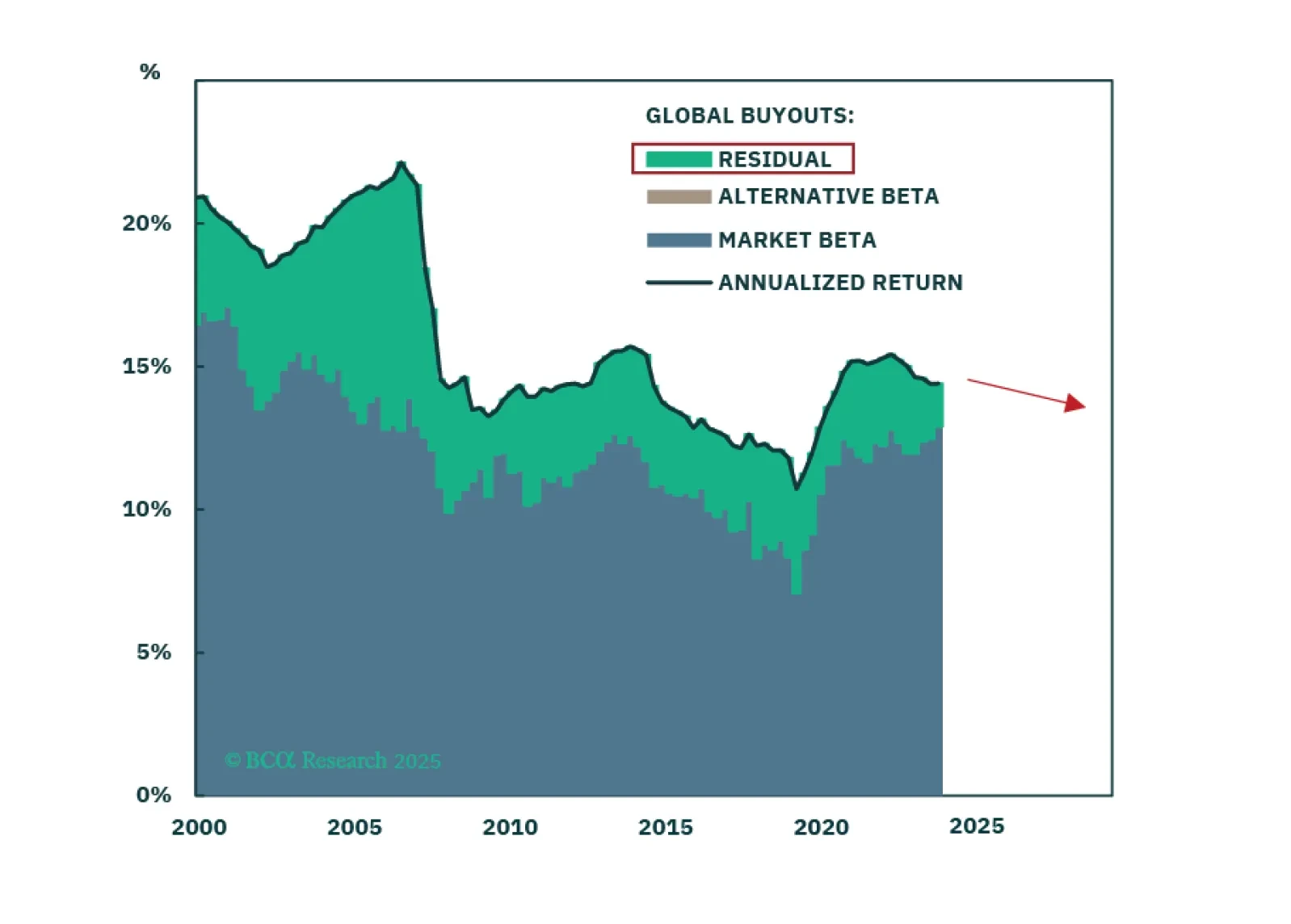

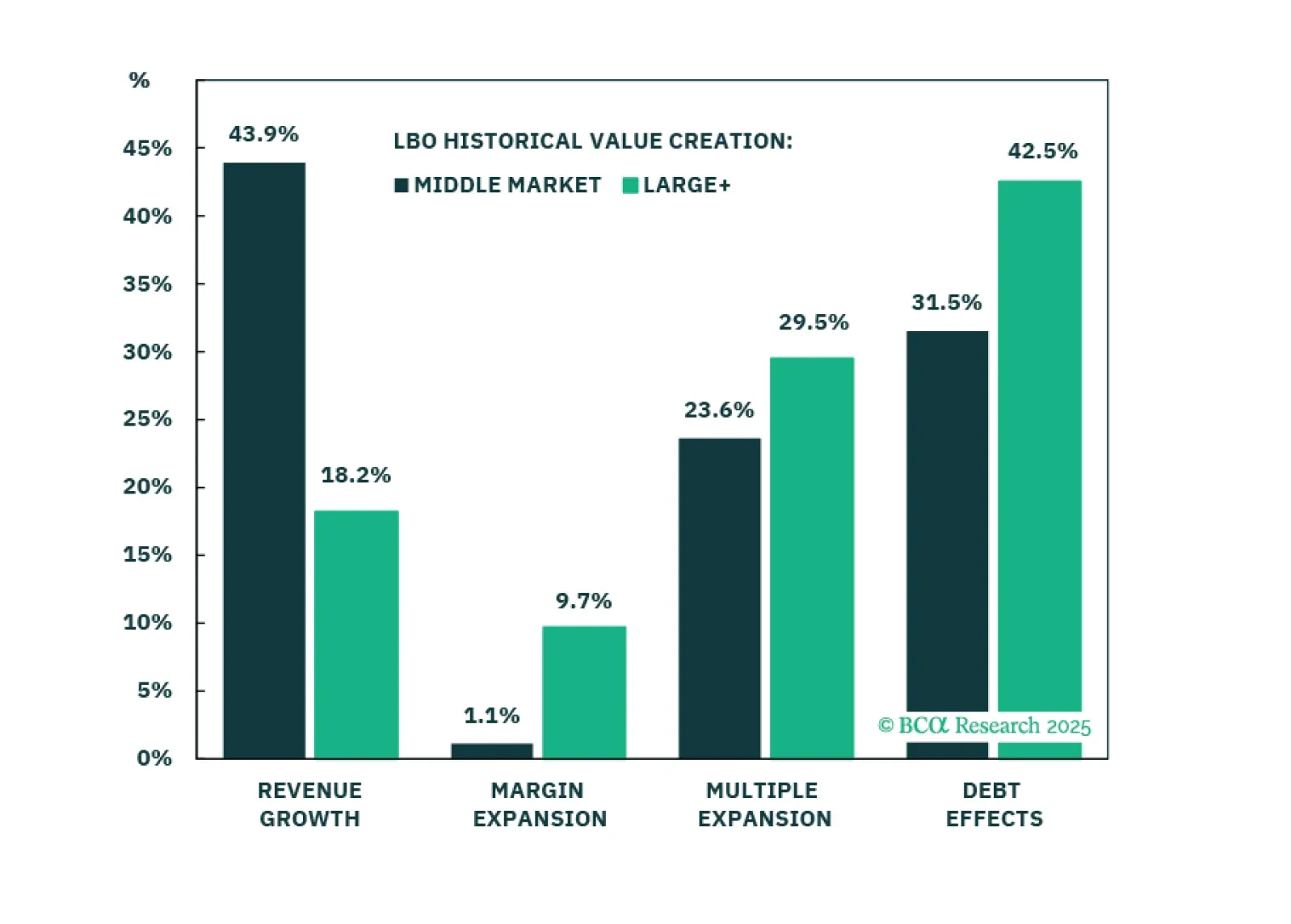

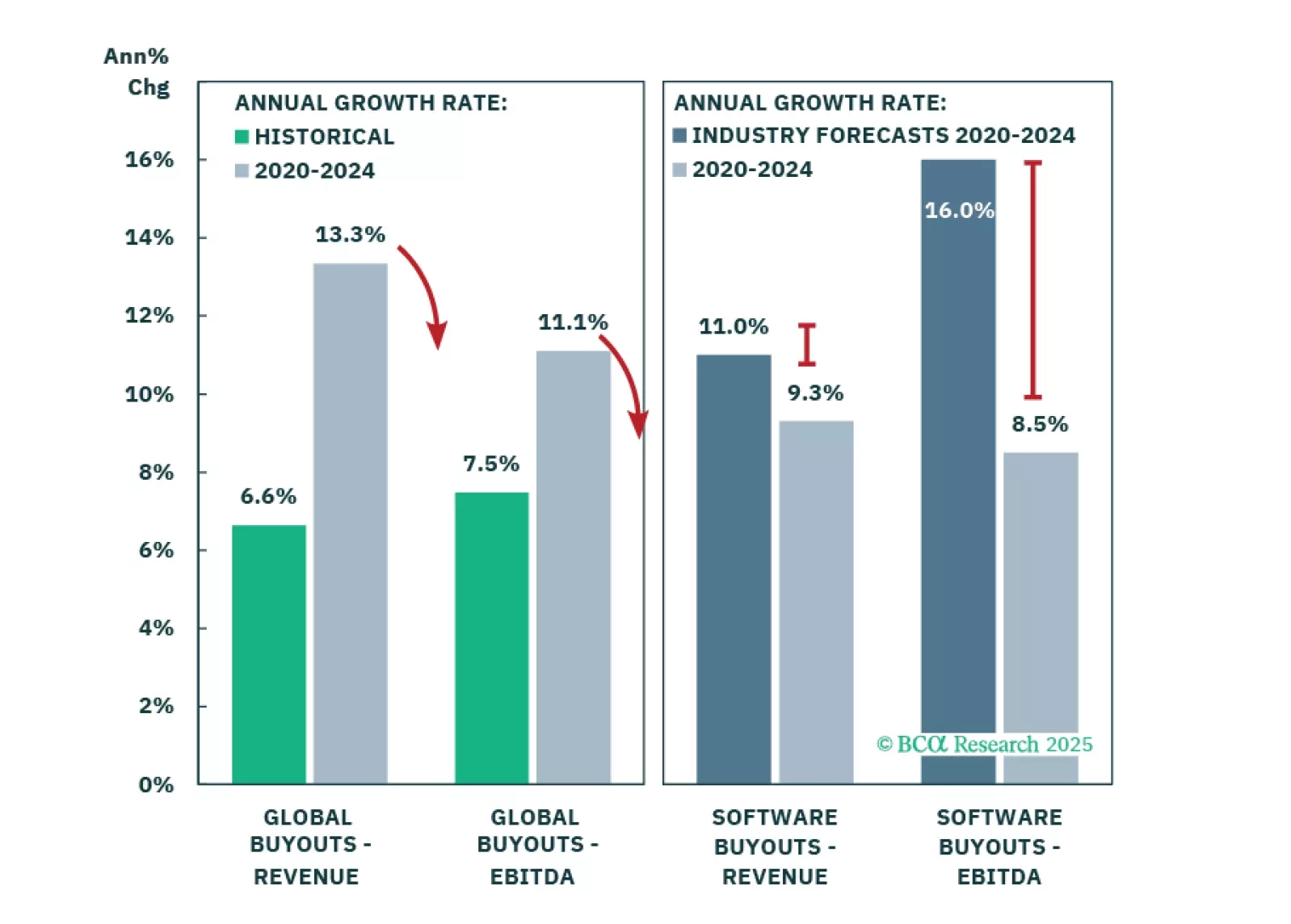

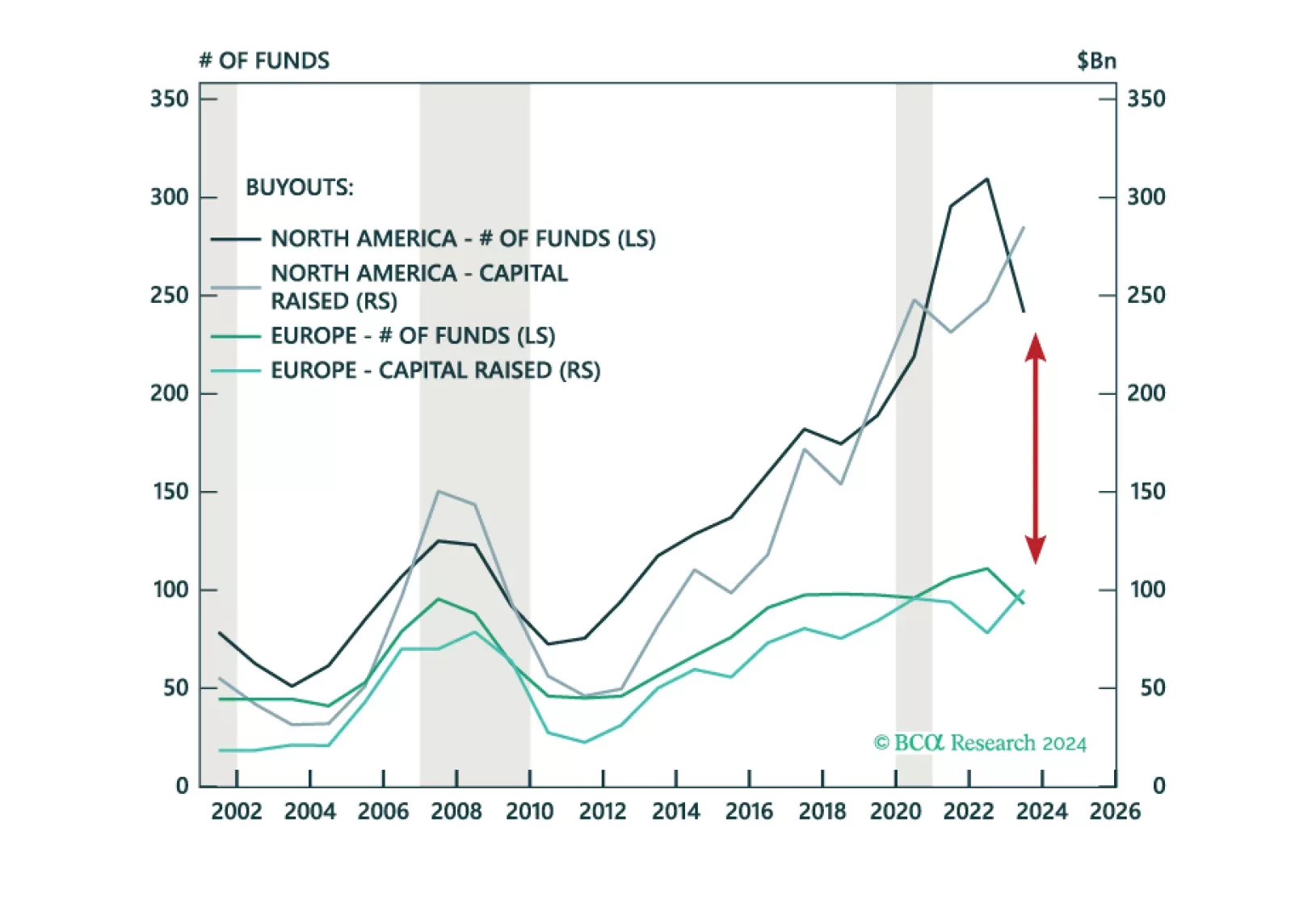

Return expectations have changed for Buyouts, but not equally for Large+ and Middle Market deals. While tariffs are dramatically reducing investor expectations, our return expectations are modestly increasing—with Large+ leading. In…

Tariffs may trigger the recession, but the economy was already vulnerable from unsustainable growth and inflated expectations. Private Equity is most exposed, though this situation neither emerged suddenly nor will it unfold…

Please join Chief Private Markets & Alternatives Strategist Brian Payne for a Webcast on Wednesday, February 26, at 10:30 AM EST (3:30 PM GMT, 4:30 PM CET).

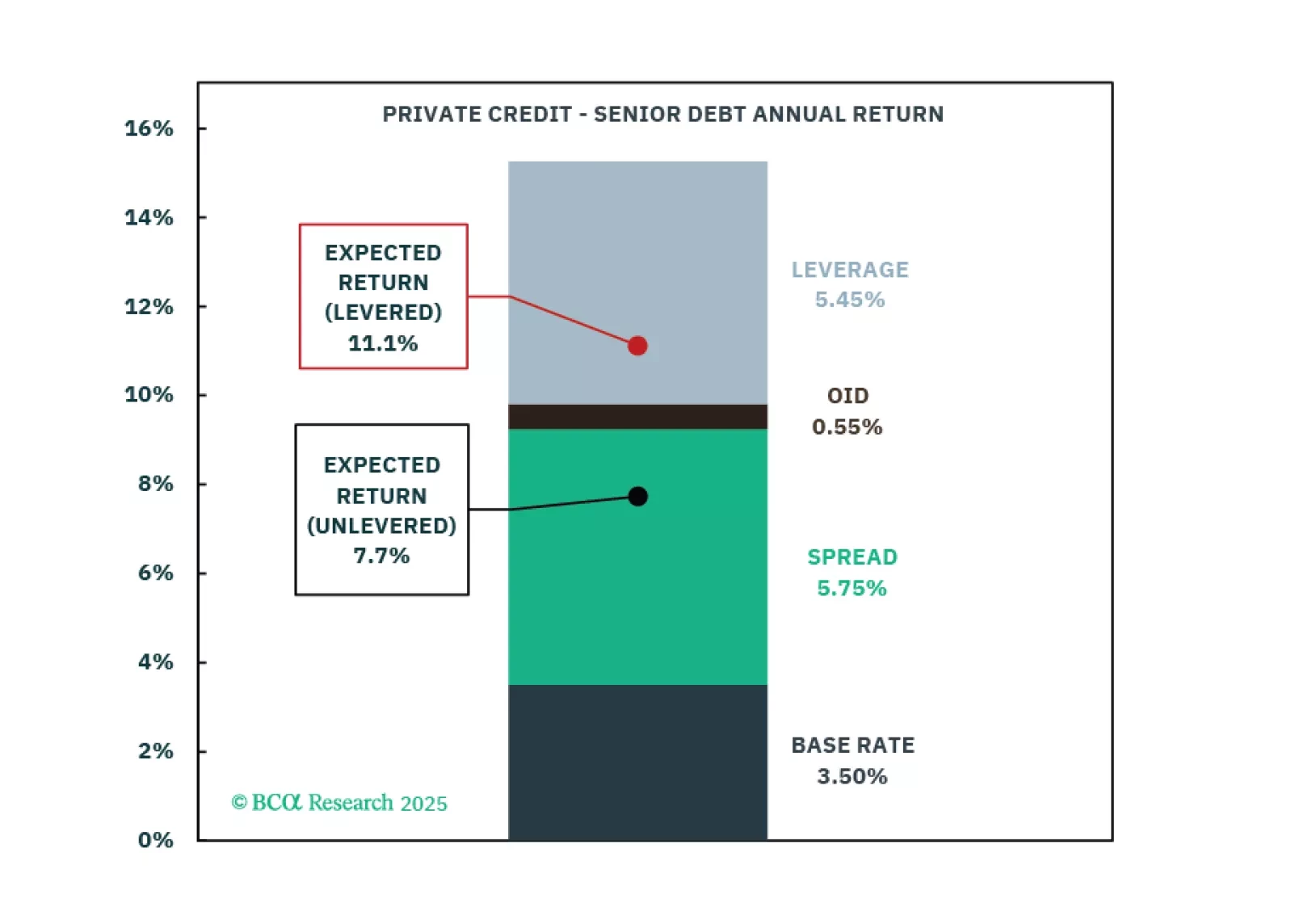

Asset class expectations show mixed shifts from 2024, with Real Estate seeing substantial upgrades and Private Equity benefiting from Venture Capital improvements. Private Credit return expectations decline from 2024 but remain…

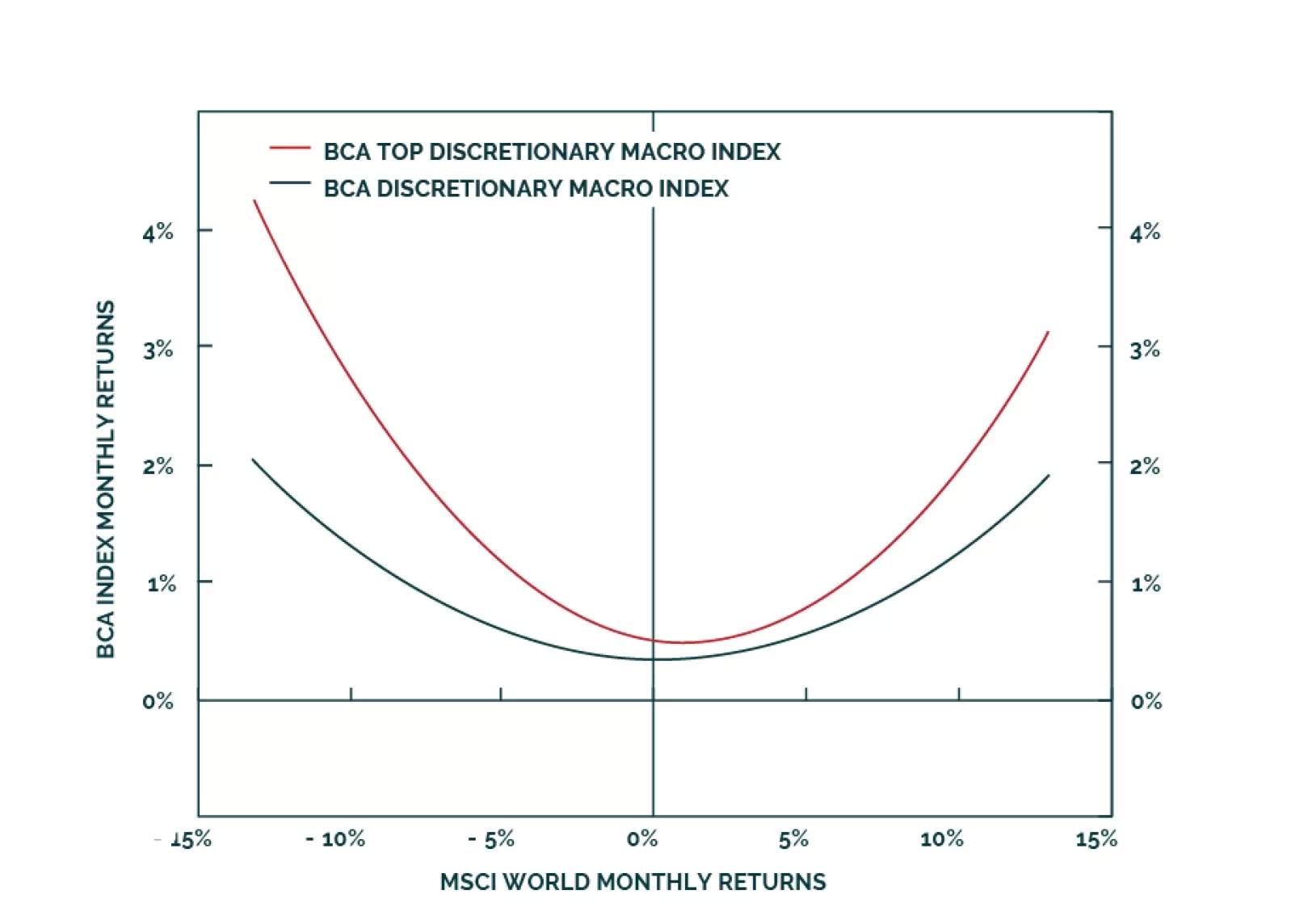

We are growing positive on Growth assets with recession expectations increasing our optimism on entry points. Equities are led by APAC Private Equity, North America Venture Capital, and Europe Buyouts. Our outlook continues to…