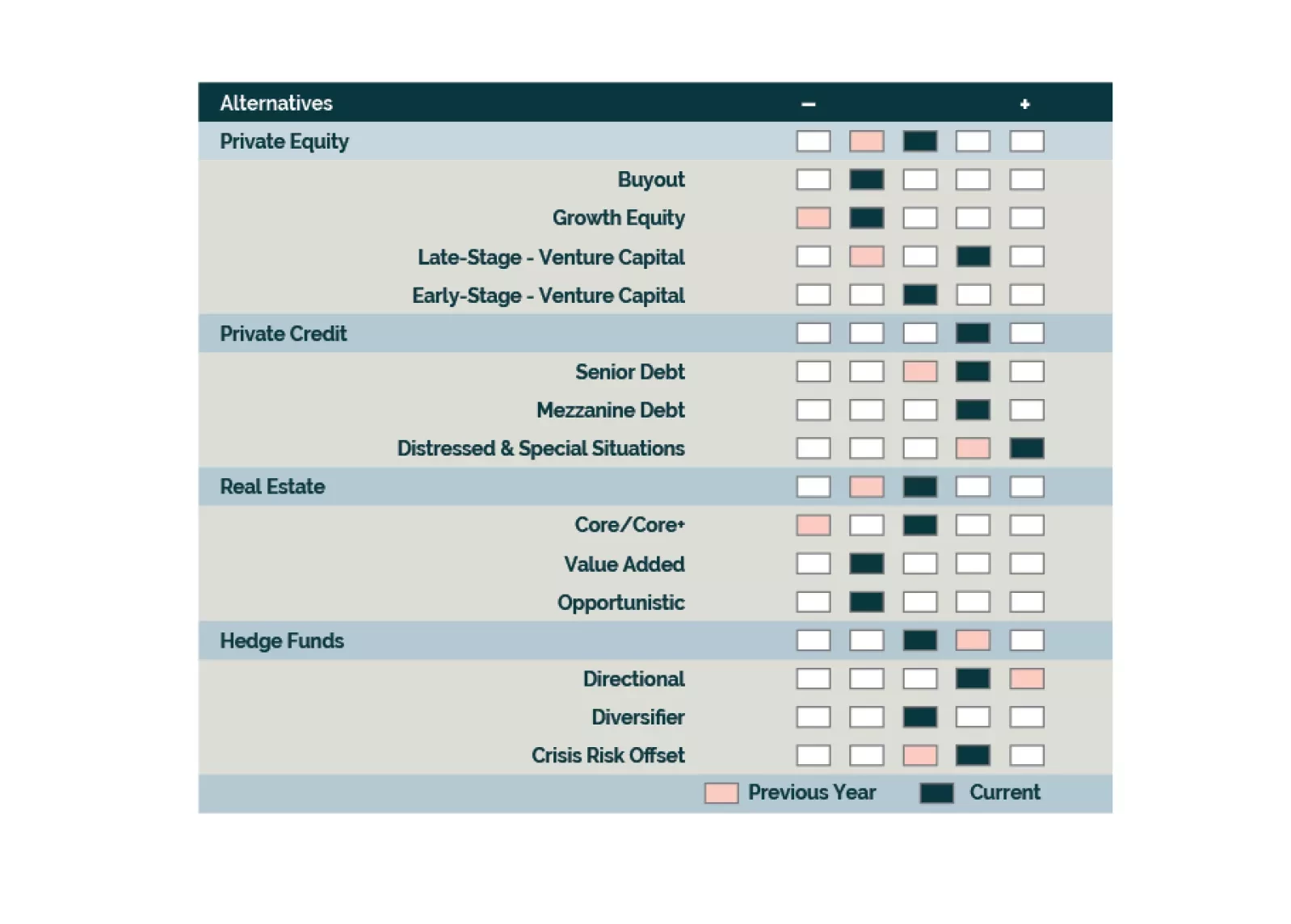

We go overweight Late-Stage Venture Capital and APAC Private Equity but remain underweight North America Buyouts. We maintain our neutral outlook towards Hedge Funds and are positive on Long-Short Equity, Event Driven, and CRO…

Investors should be tactically tilting allocations towards Direct Lending, Distressed Debt, and Directional Hedge Fund strategies at the expense of Real Estate, Private Equity, and Diversifier Hedge Funds. Structural opportunities…

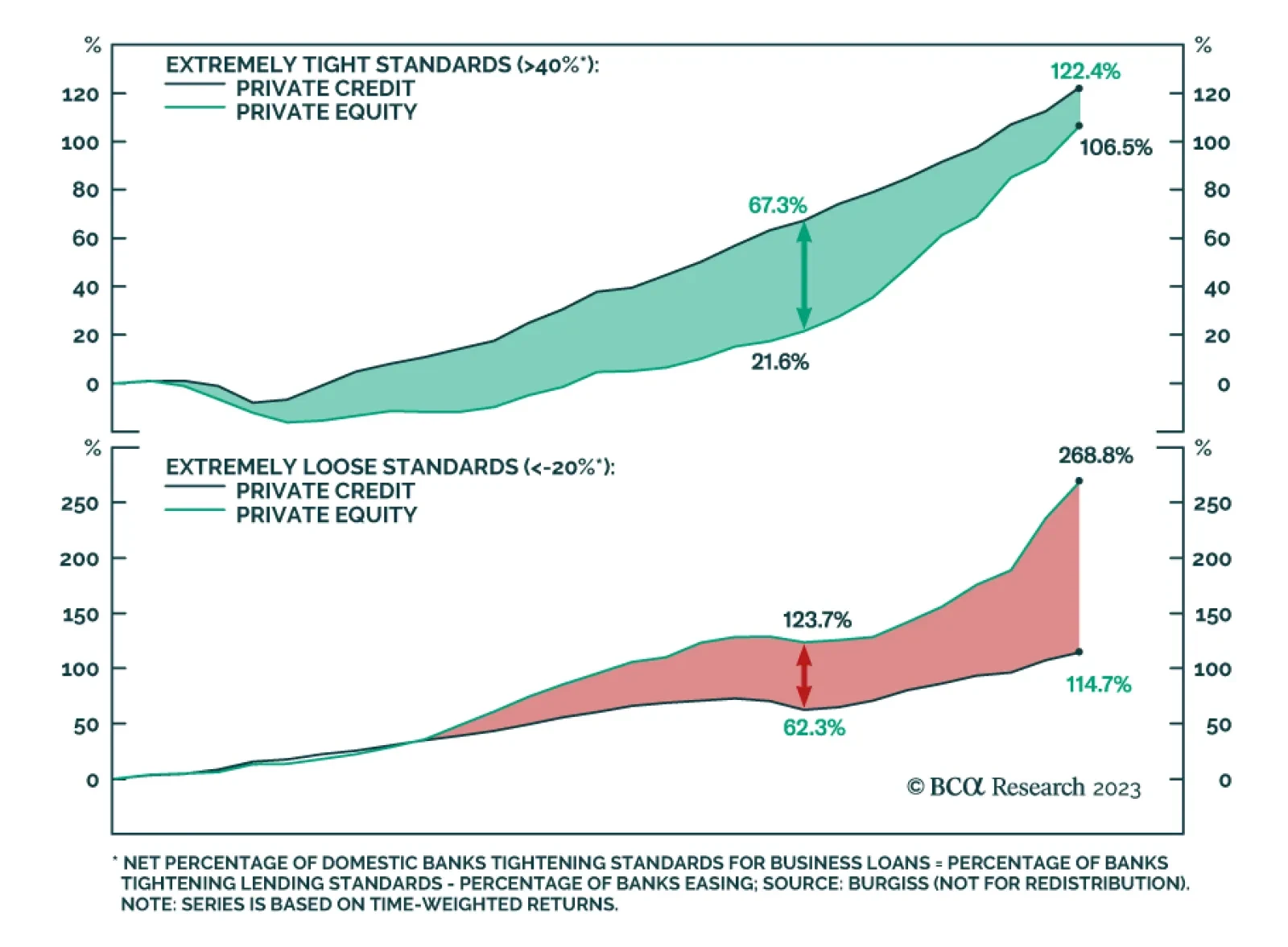

Within alternatives, BCA Research’s Global Asset Allocation service favors Private Credit since yields are in double-digits and lenders are in a strong negotiating position. Private Credit (Overweight): …

We see challenges ahead for Global Buyout across geographies as valuations need further resetting. While we are concerned with capital controls and flight risk in Asia-Pacific Venture Capital, the upside potential from AI may be…

We see a more positive backdrop for credit providers, with bilateral and structuring features as tailwinds for Private Credit. While there may be potential green shoots in some areas of Private Equity, current valuations are not…