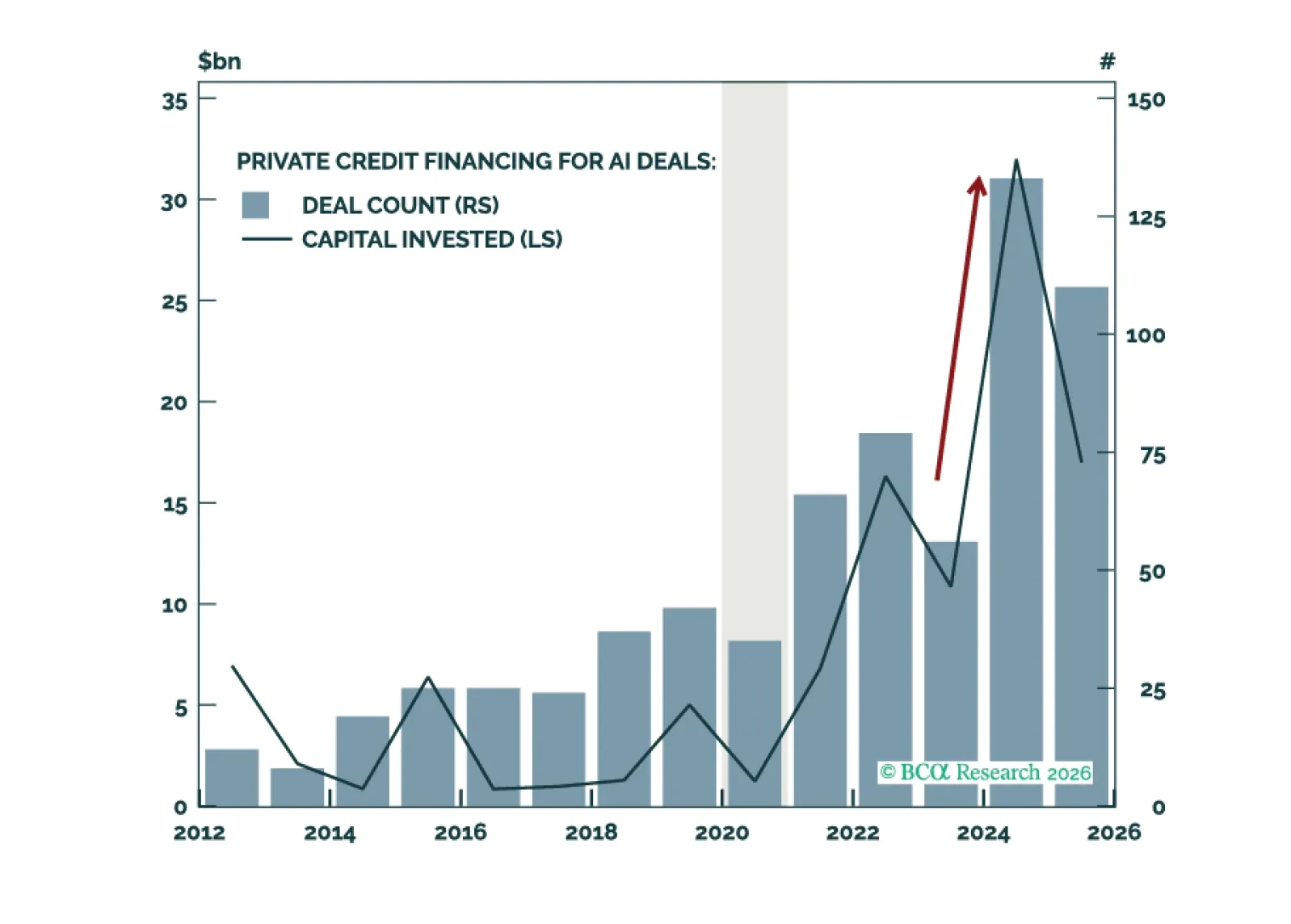

The AI trade has broadened beyond Public Markets, pulling Private Credit deeper into the ecosystem. Investors are right to understand their overlapping exposures between Public Equities, Venture Capital, Data Centers, and now Private…

Private Credit outsiders are skeptical, insiders are believers—but are becoming nervous now. In the highlight of this Quarterly Report, we dig beneath the surface to uncover the buried bodies in Private AND Public Credit. The ghosts…

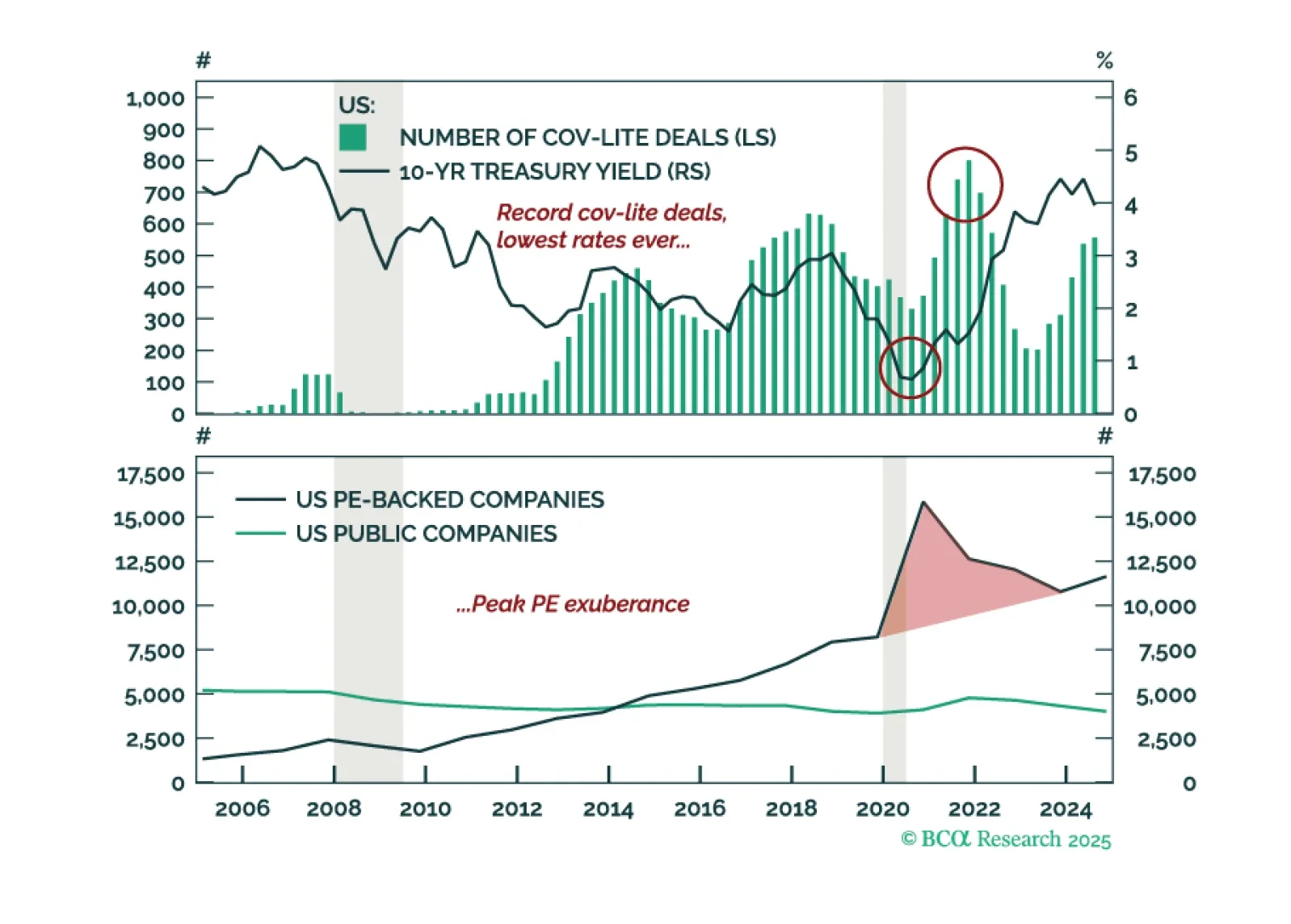

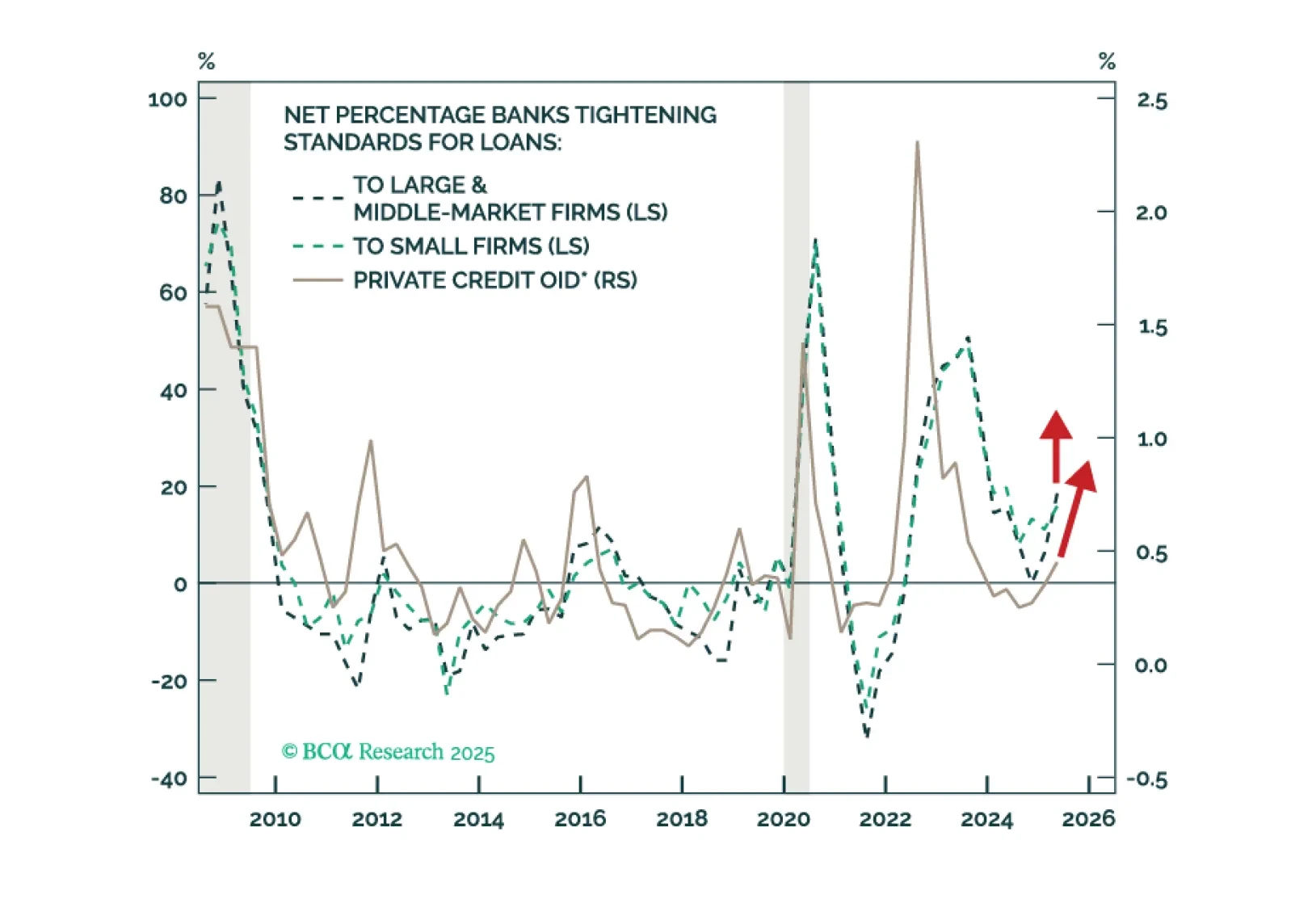

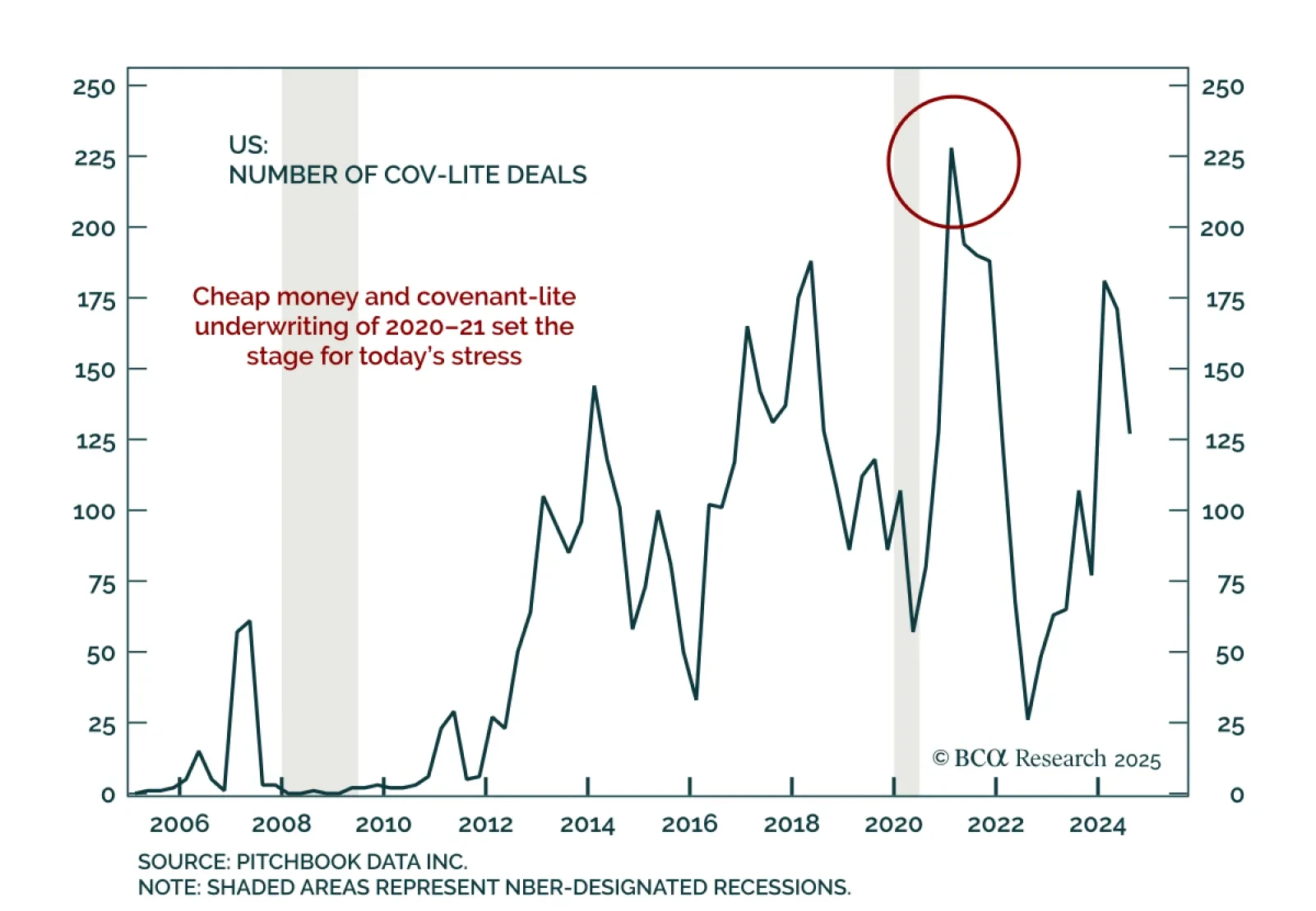

The unwind of 2020–21 froth is stressing floating-rate credit, with weak structures now meeting tighter funding. Our Chart Of The Week comes from Brian Payne, Chief Strategist for our Private Markets & Alternatives (PMA) service…

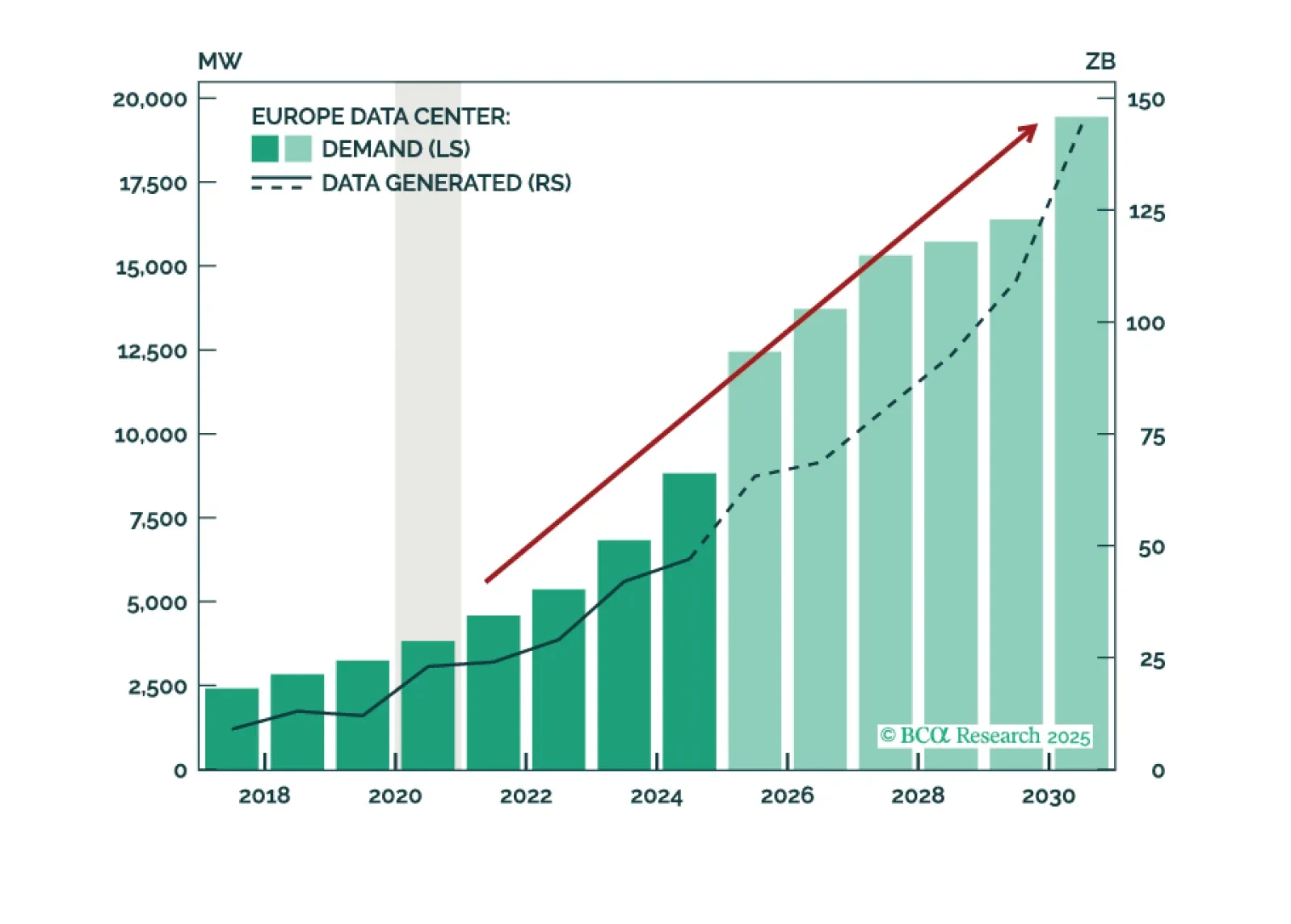

While the US is the pioneer, Europe will follow suit—more rapidly than expected. It is not a question of if GenAI will boom in Europe, but when. Europe’s Data Center growth is already strong today, but a US-style boom is just around…

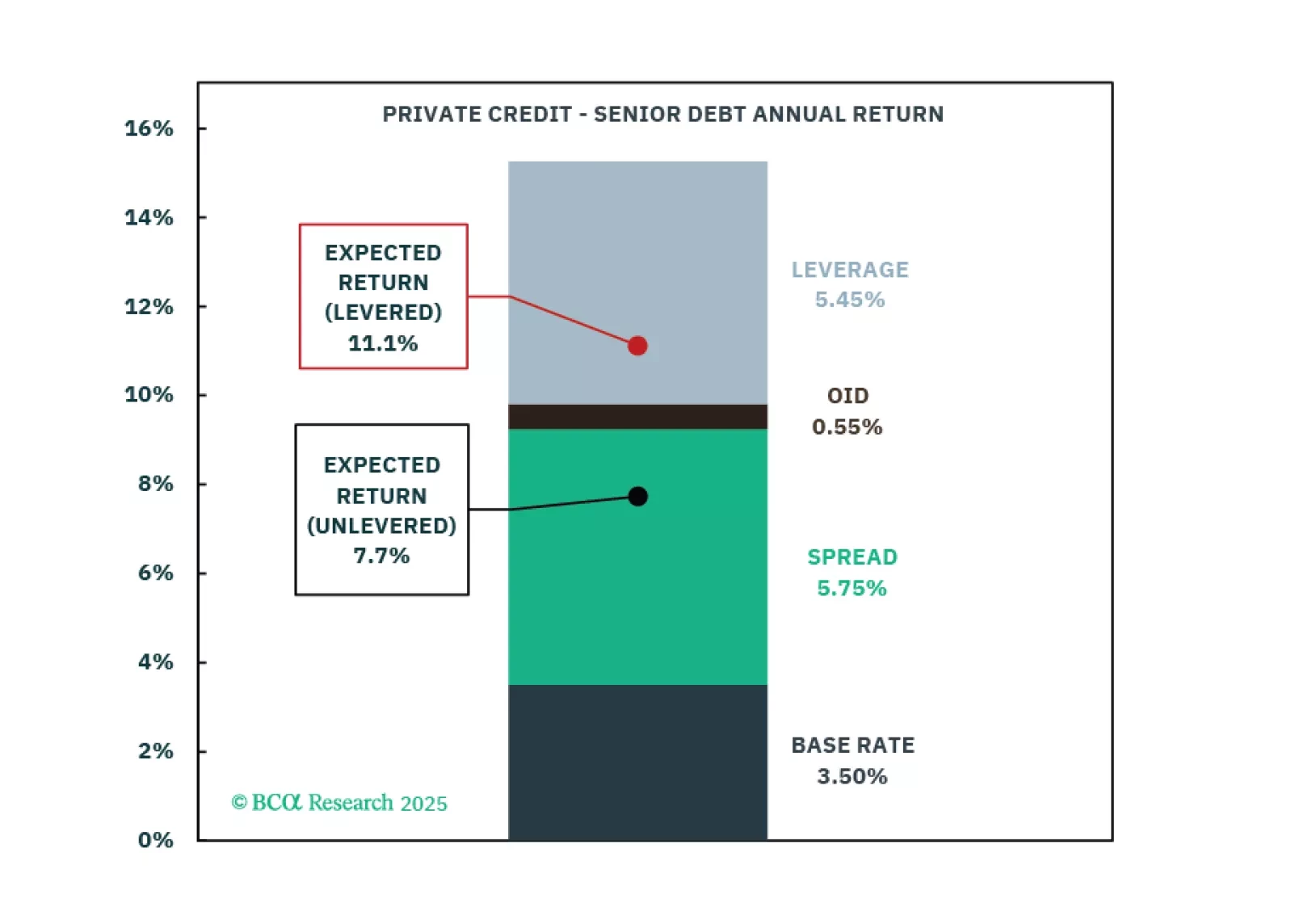

Private Credit return expectations edge lower. Middle Market Direct Lending remains attractive, rivaling Middle Market Buyouts.

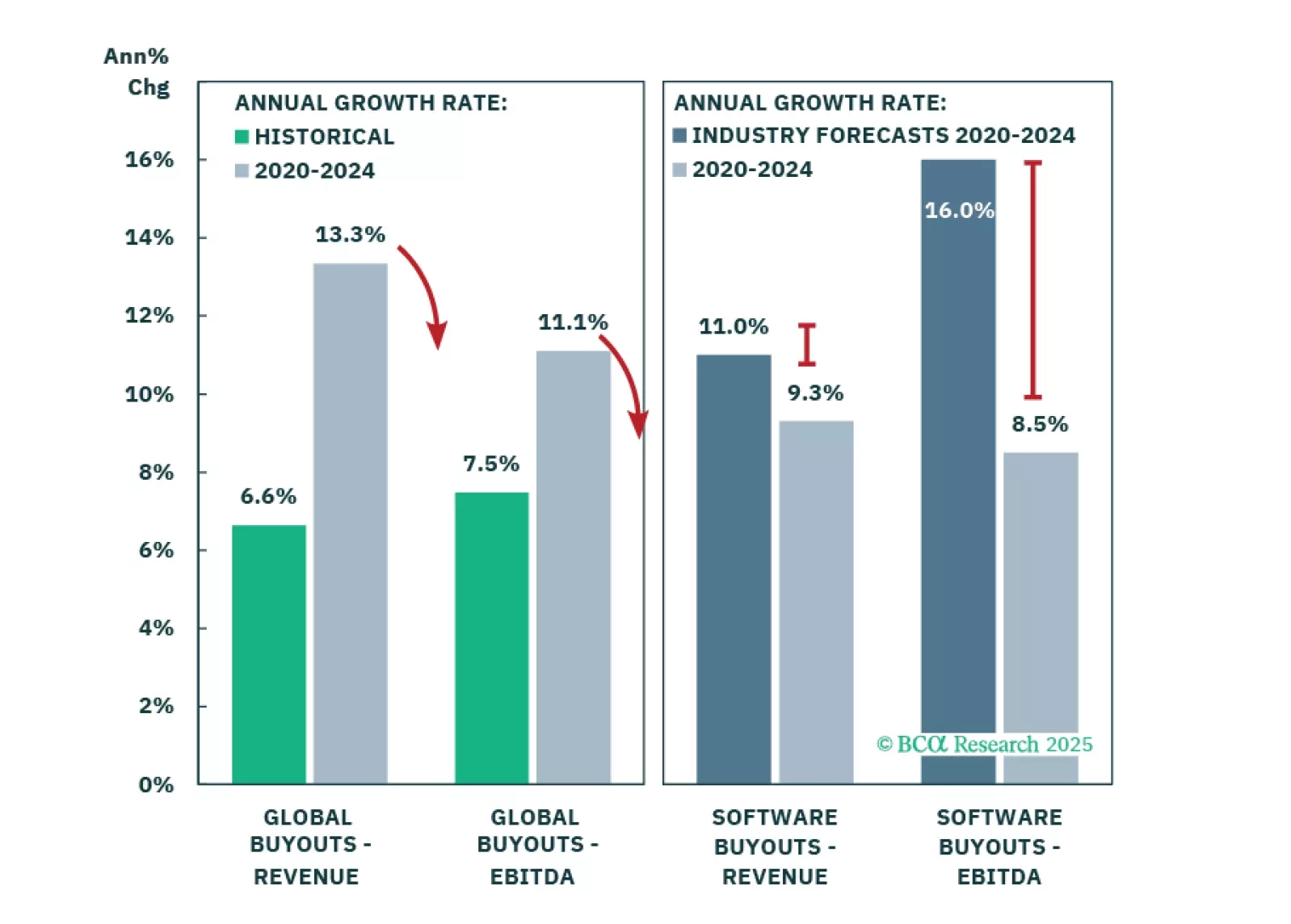

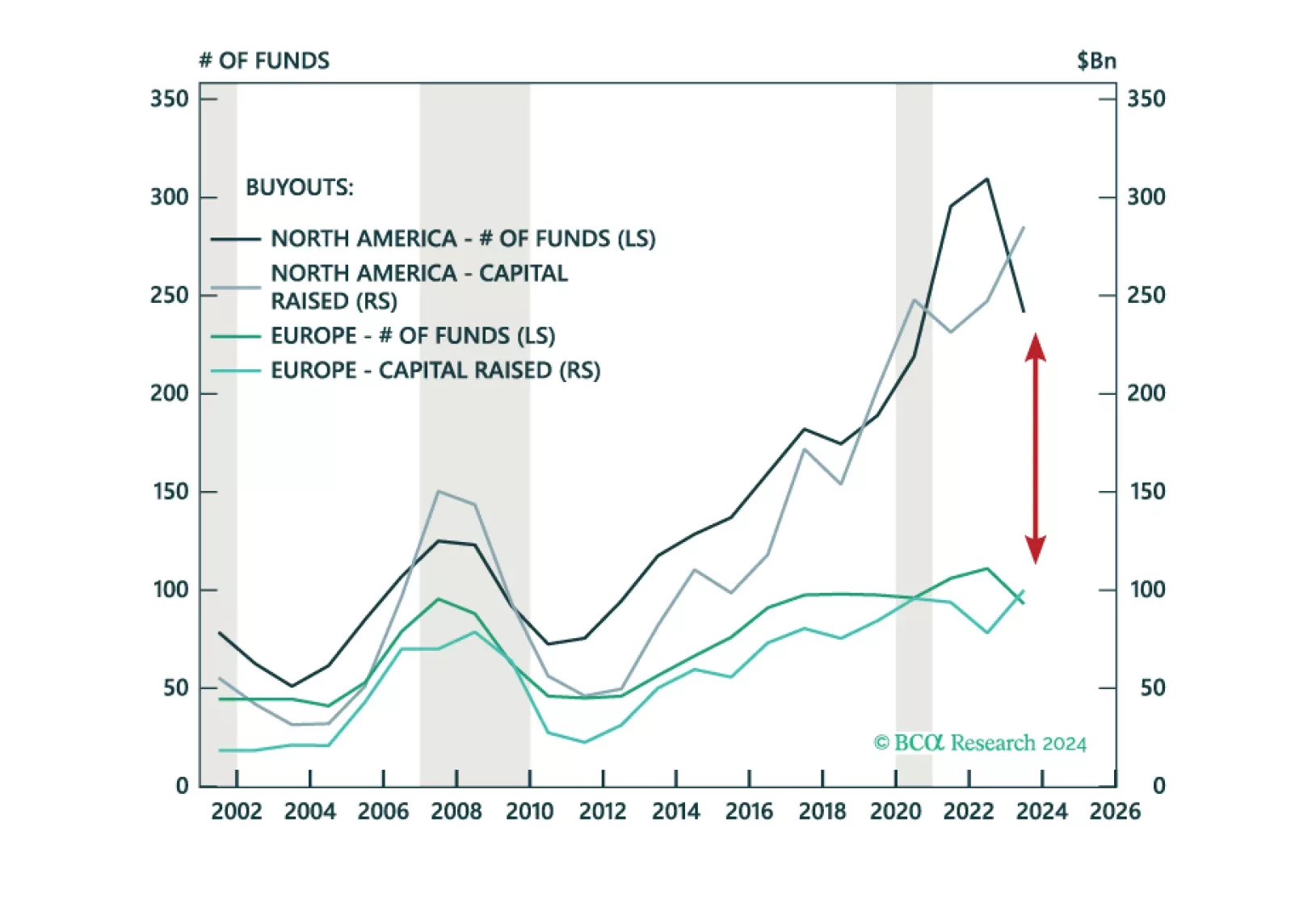

Tariffs may trigger the recession, but the economy was already vulnerable from unsustainable growth and inflated expectations. Private Equity is most exposed, though this situation neither emerged suddenly nor will it unfold…

Please join Chief Private Markets & Alternatives Strategist Brian Payne for a Webcast on Wednesday, February 26, at 10:30 AM EST (3:30 PM GMT, 4:30 PM CET).

Asset class expectations show mixed shifts from 2024, with Real Estate seeing substantial upgrades and Private Equity benefiting from Venture Capital improvements. Private Credit return expectations decline from 2024 but remain…

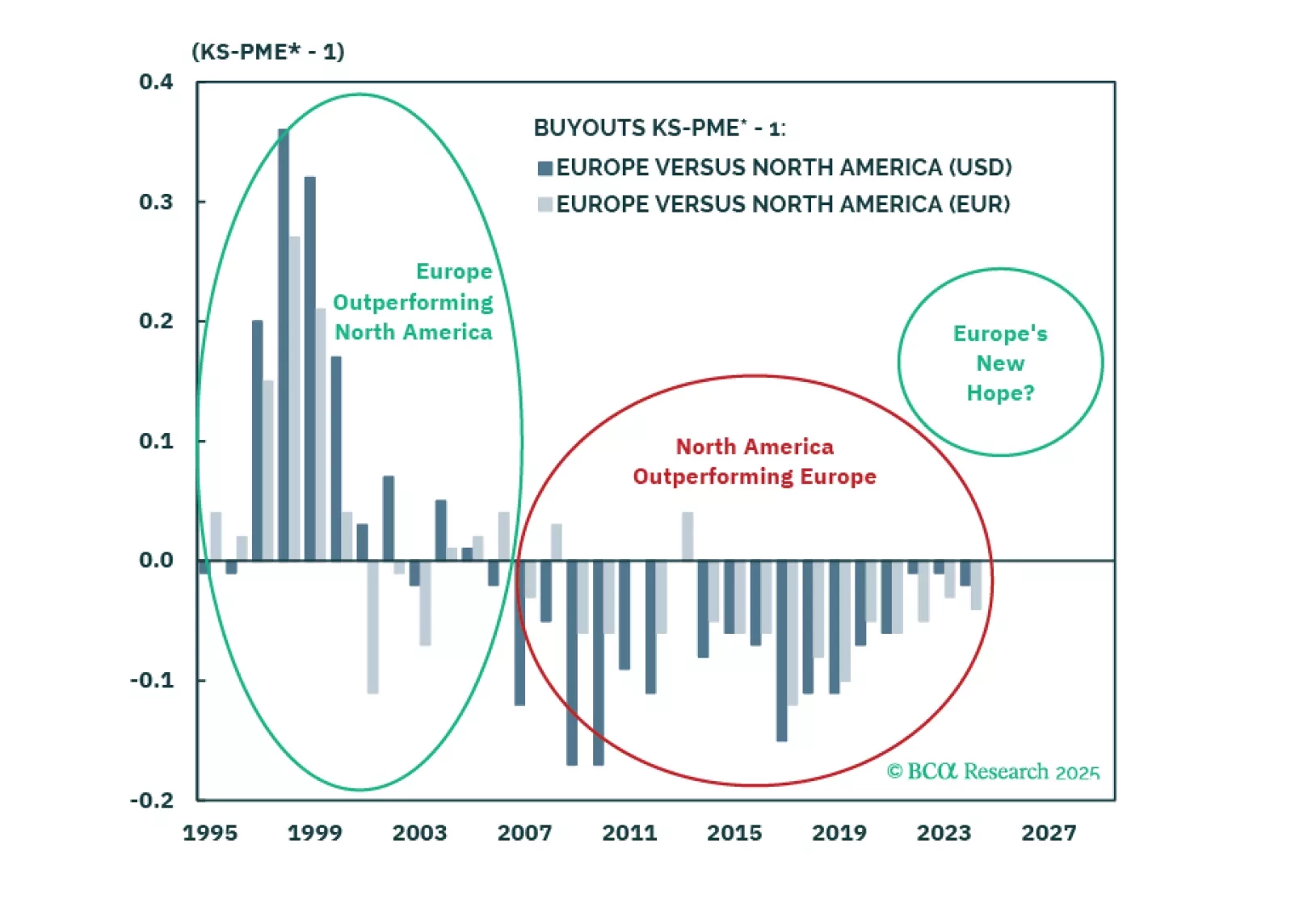

We are growing positive on Growth assets with recession expectations increasing our optimism on entry points. Equities are led by APAC Private Equity, North America Venture Capital, and Europe Buyouts. Our outlook continues to…