What’s going on? The market-weighted stock market is up. But the equally-weighted stock market is not up. Neither is credit. Neither are industrial metal prices. Neither is the oil price, despite two waves of OPEC output cuts. We…

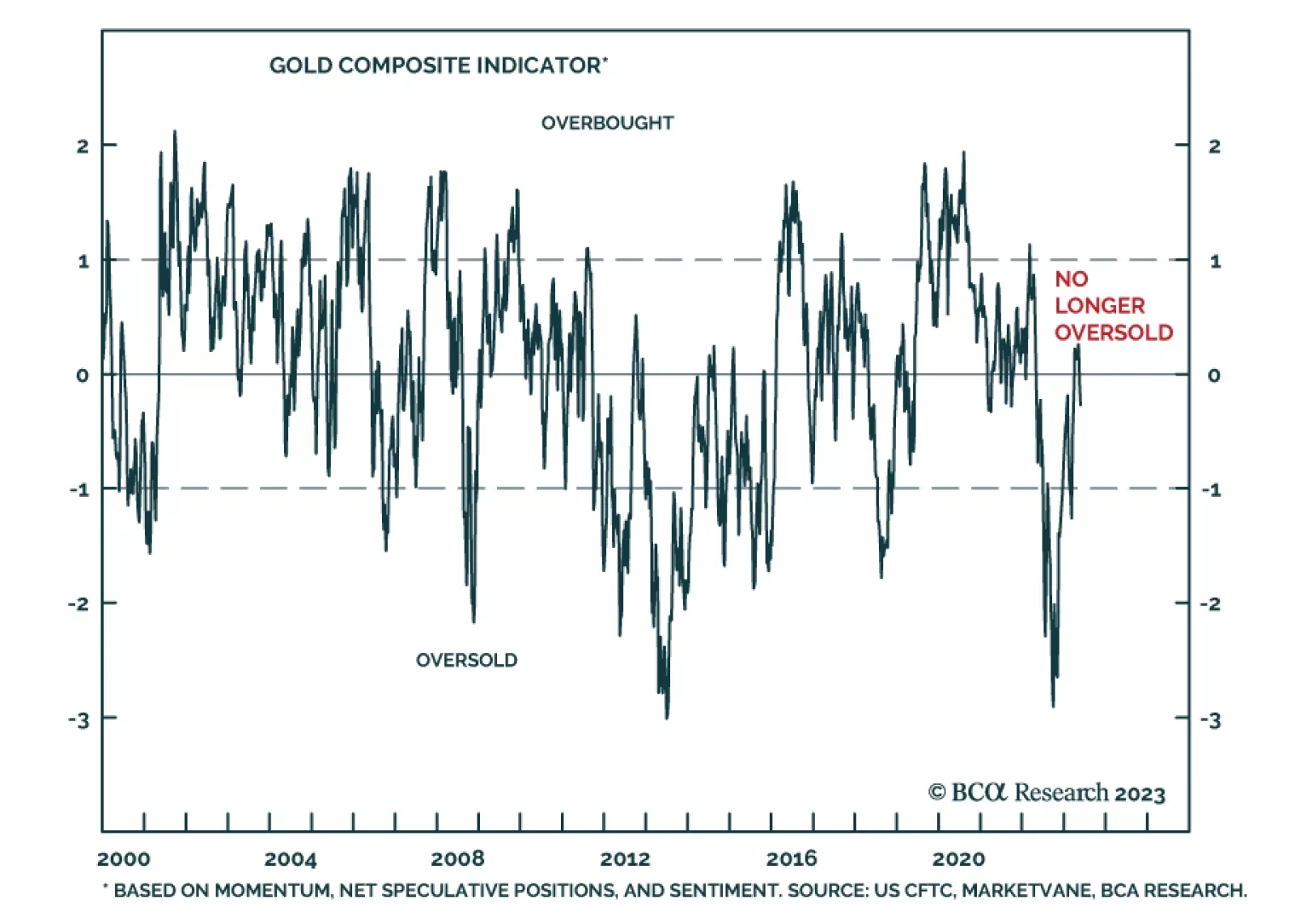

The rally in gold fizzled out in May. The price of the yellow metal dropped by 5.2% over the past few weeks following a 26% gain between late-September and early-May. Indeed, the forces that supported the late-2022/early-2023…

In Section I, we review the three possible economic scenarios over the coming year, and underscore that the “soft landing” scenario remains improbable. A “no landing” scenario could occur, but it would ultimately lead back to the…

The crisis hitting regional and local banks in the US is adding to oil-price volatility and gold demand. The crisis arguably is fallout from the Fed’s aggressive monetary policy tightening, and contributes to the upending economic…

Inflation is hot, but inflation expectations are not. We explain the answer to this apparent puzzle and discuss the investment implications. Plus we identify two commodities that are at imminent risk of reversal.

We are increasing our gold price target to $2,200/oz, given the increasing risk of fiscal dominance in the US, rising geopolitical risk, the return of trading blocs and currency debasement risk. These risks also will increase…

China’s housing market adjustment will be protracted, causing several years of sub-par growth in the world’s second largest economy. We go through the major investment implications.