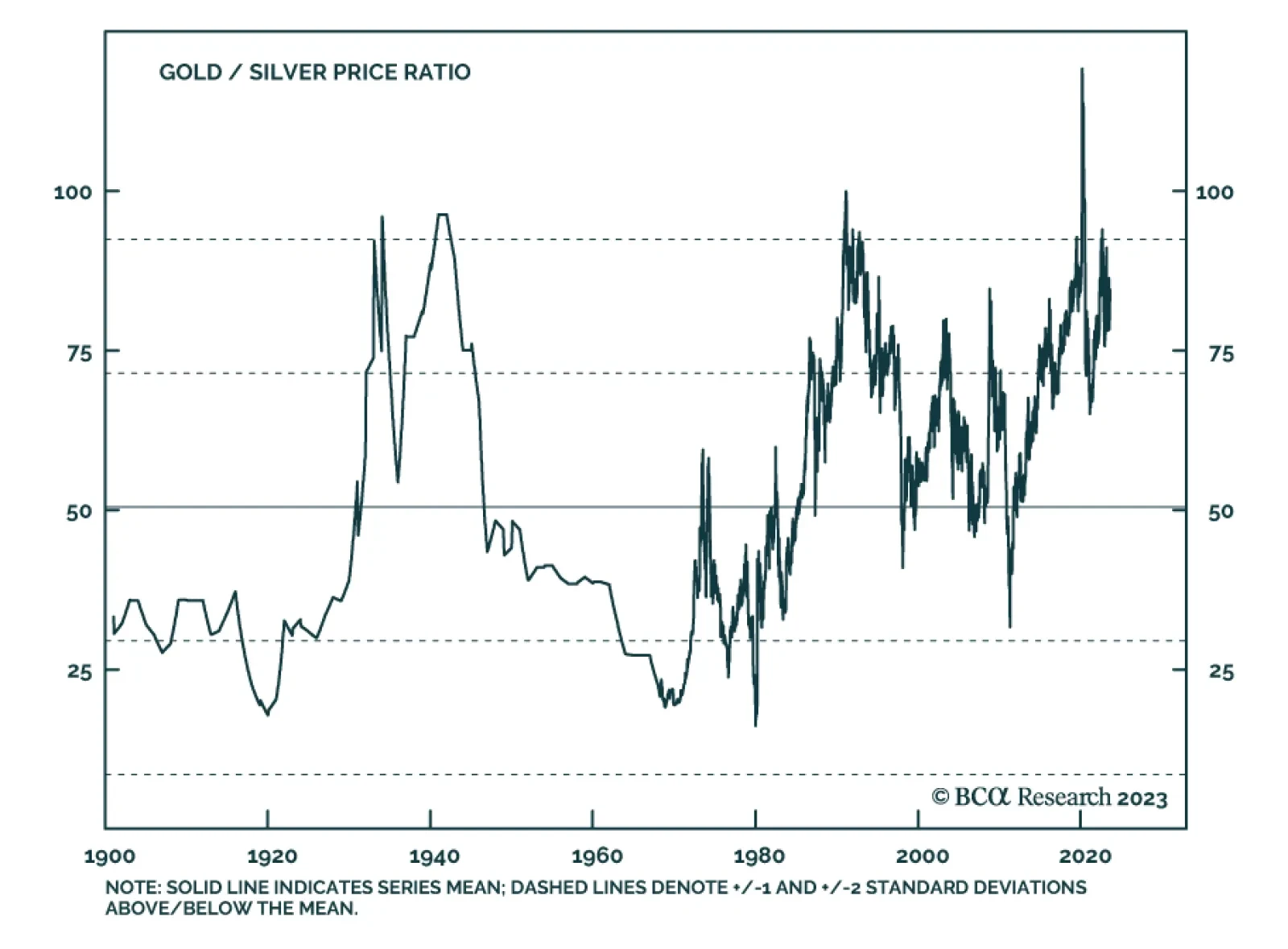

The gold/silver ratio (GSR) entered a well-defined tapered wedge formation with downside support near 80, and an upside breakout around the 90 level. Back in 2020, this ratio was caught up in a race towards major overhead…

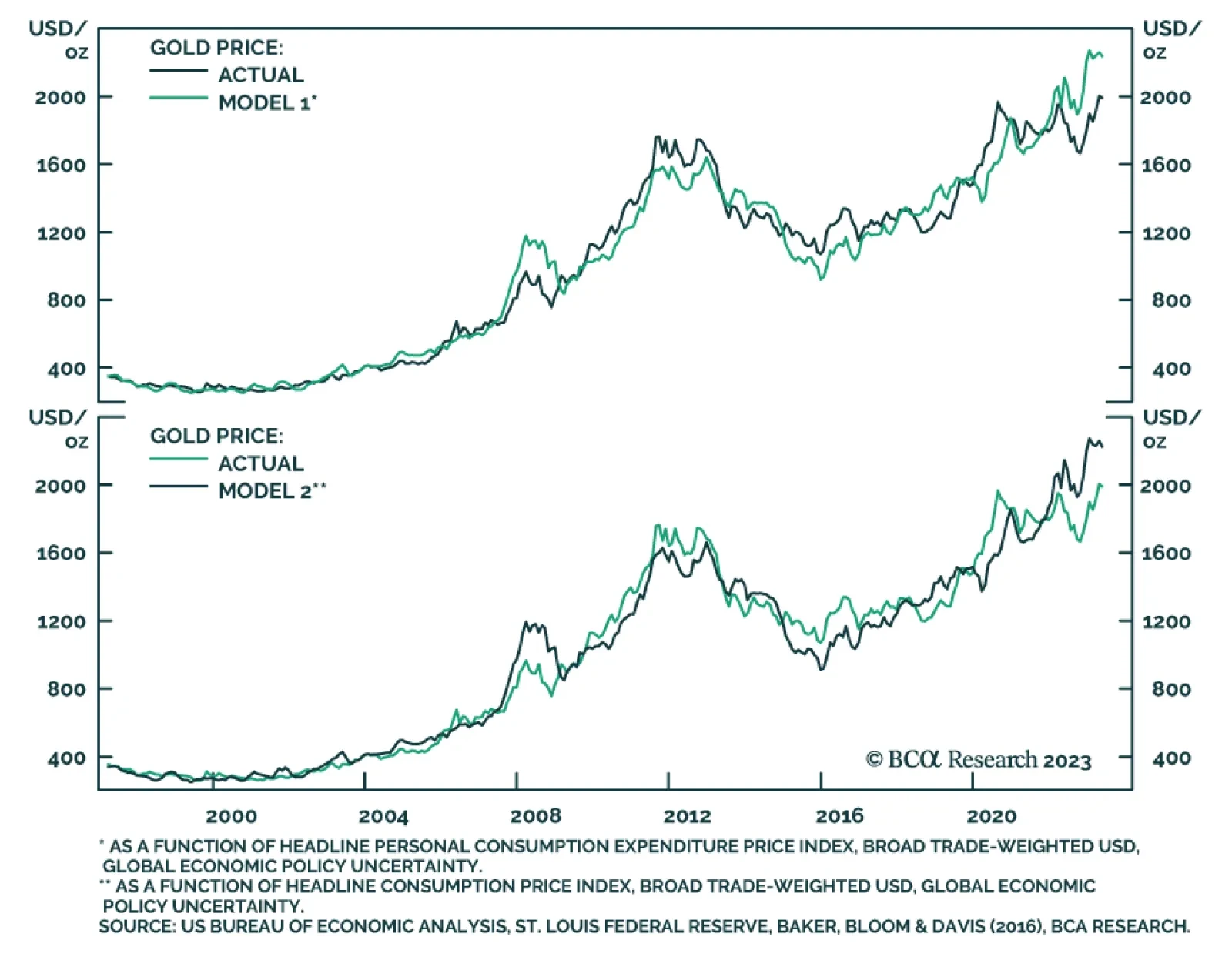

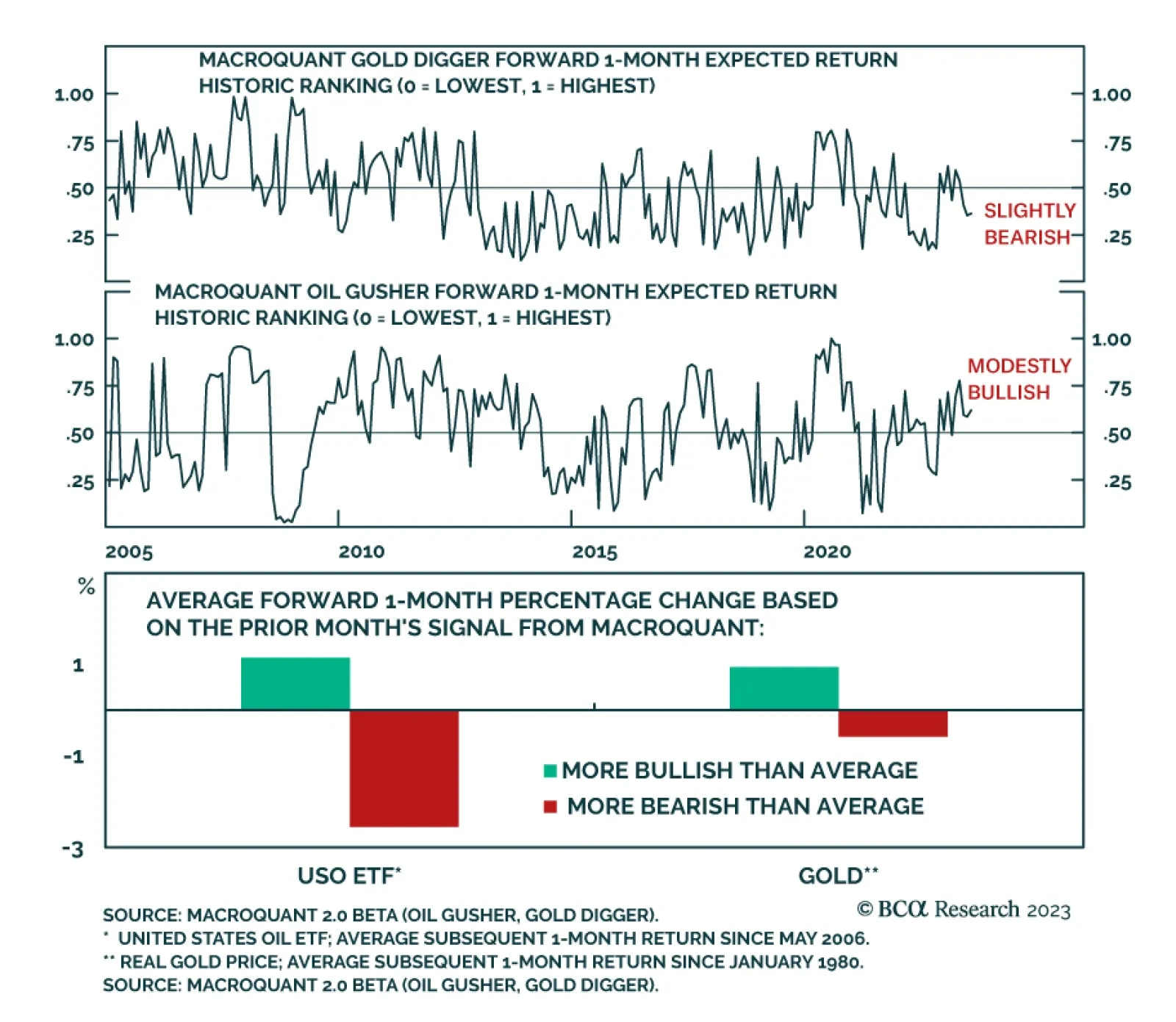

According to BCA Research’s Commodity & Energy Strategy service, gold’s appeal as a safe haven and store of value will increase as fiscal dominance overtakes monetary dominance at the Fed. Fitch’s…

The downgrade of the US credit rating highlights the risk of fiscal dominance overriding the Fed’s long-standing monetary dominance focused on its dual mandate. This threatens to push inflation and long-term interest rates higher. It…

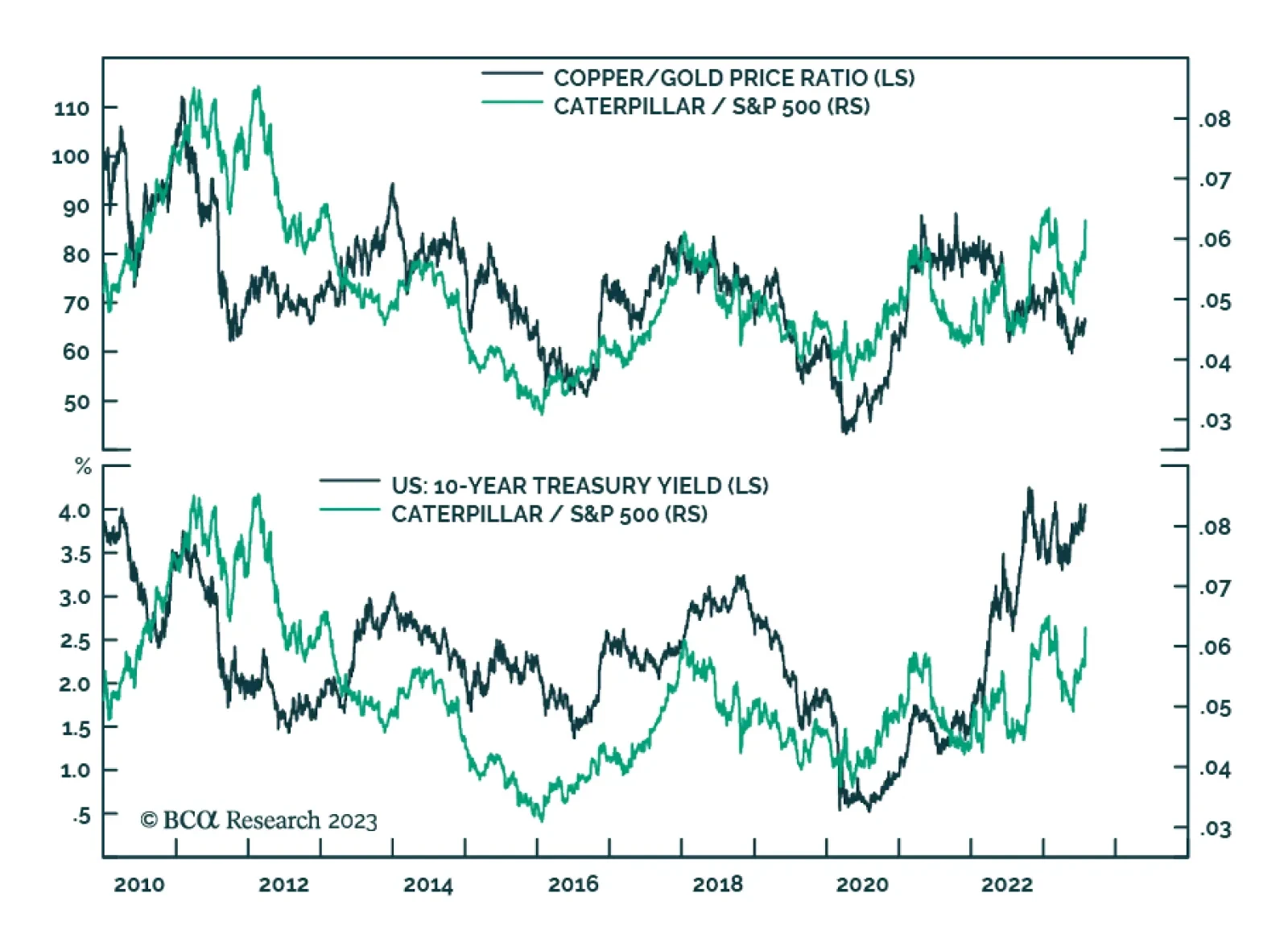

Caterpillar’s Q2 earnings results released on Tuesday beat consensus estimates by a wide margin. Second quarter profit of $2.92 billion ($5.67 per share) came in well above expectations of $2.38 billion ($4.46 per share).…

The Global Investment Strategy (GIS) service has been bearish on gold since the end of March, when it recommended a shift from neutral to underweight. Real gold prices are still quite elevated relative to their long-term history…

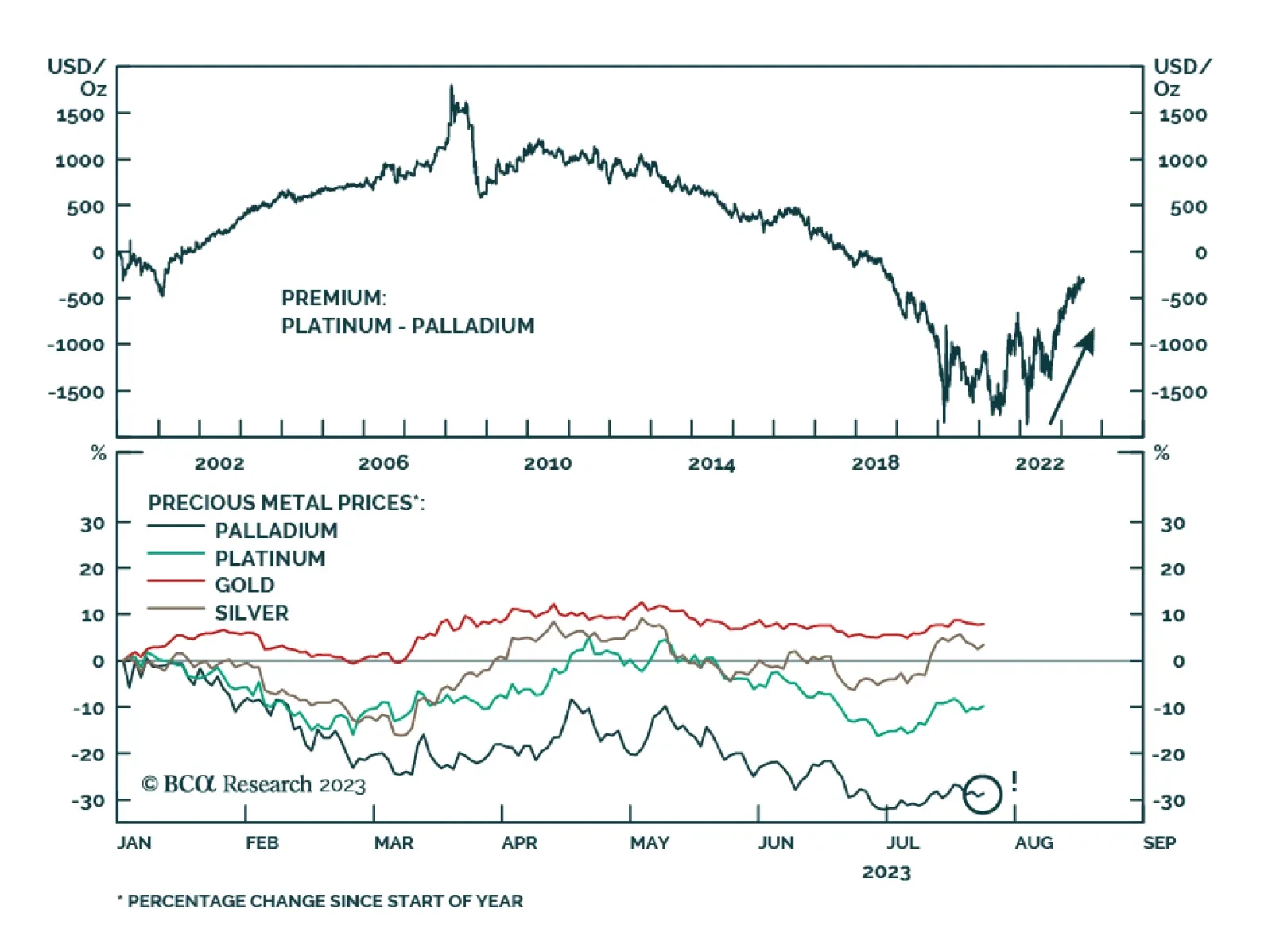

Palladium is by far the worst performing precious metal so far this year. The 30% year-to-date price decline is significantly worse than platinum’s 10% loss and contrasts with higher gold (+8%) and silver (+4%) prices.…

In this short weekly report, we review some of the most common questions clients asked us in the last few weeks.

Markets continue to be tossed to and fro by central-bank policy, and risks of higher commodity prices. These are due to fiscal stimulus and exogenous weather and war-related risk, which could send food and energy prices higher this…

Recession is on track to start around year-end. Stocks usually peak shortly before recession begins. So, position defensively but be prepared for a few more months of the rally.