Falling core inflation in the US over the short run will boost real disposable household income, which will keep consumption – ~ 70% of US GDP – strong. Over the medium- to-longer term – 3 to 5 years out – inflation risks rise as…

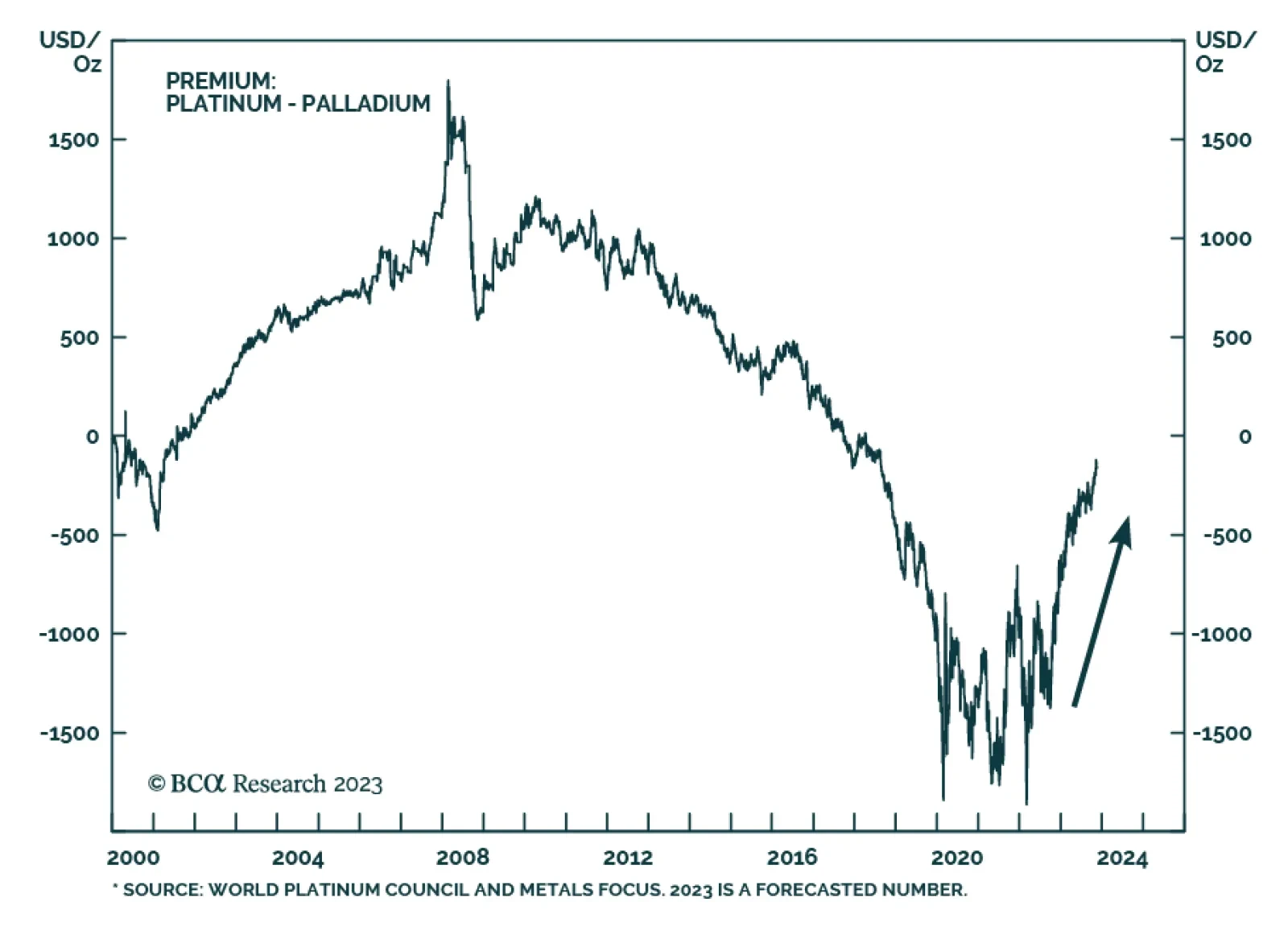

As we anticipated in an Insight we published in May, palladium continues to underperform platinum. Last week, platinum's discount to palladium shrunk to its smallest since August 2018. While the prices of both metals have…

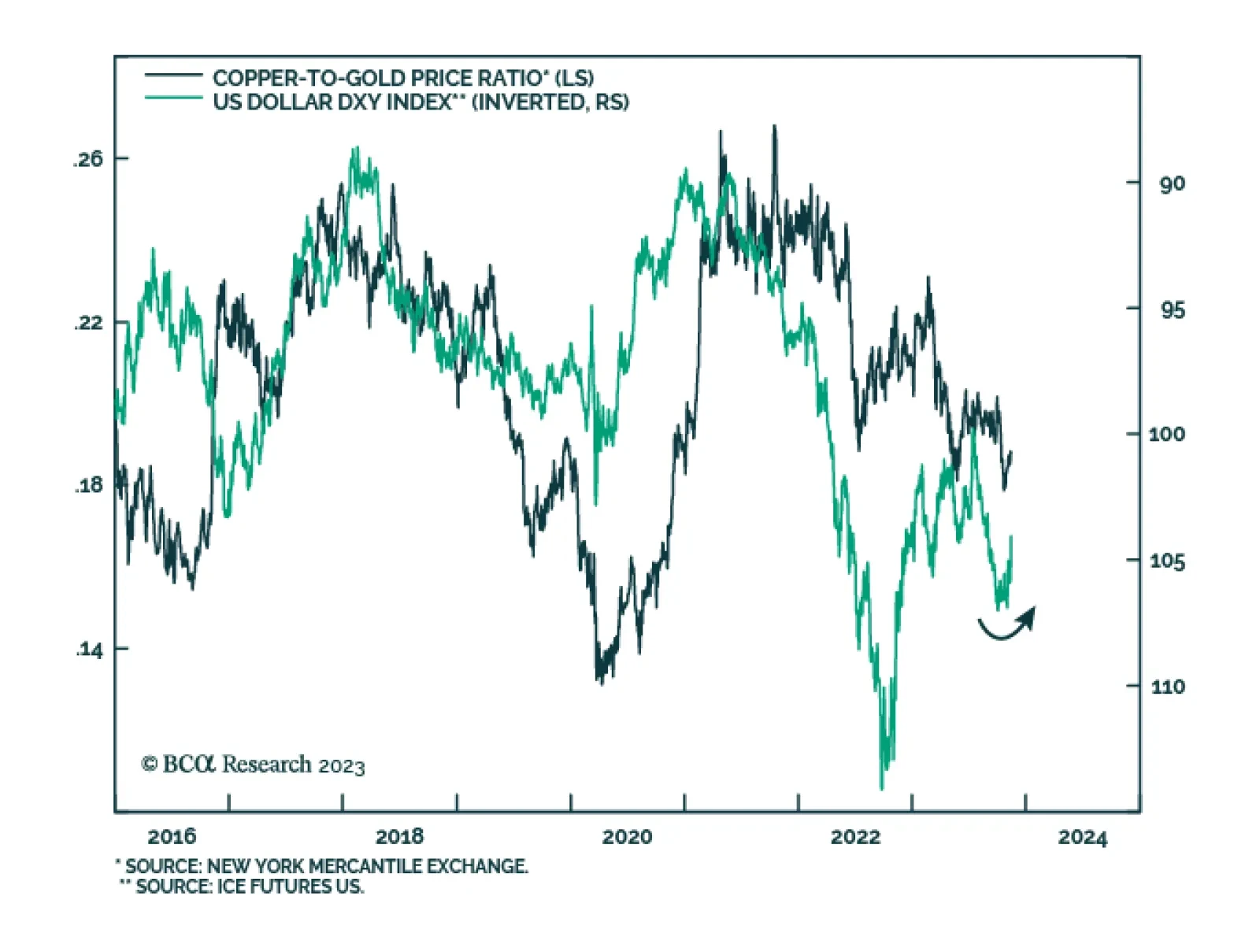

Throughout most of the second half of this year, the copper-to-gold ratio has been relatively stable, gyrating within a tight range. However, it is starting to show some tentative signs of bottoming. After the copper-to-gold…

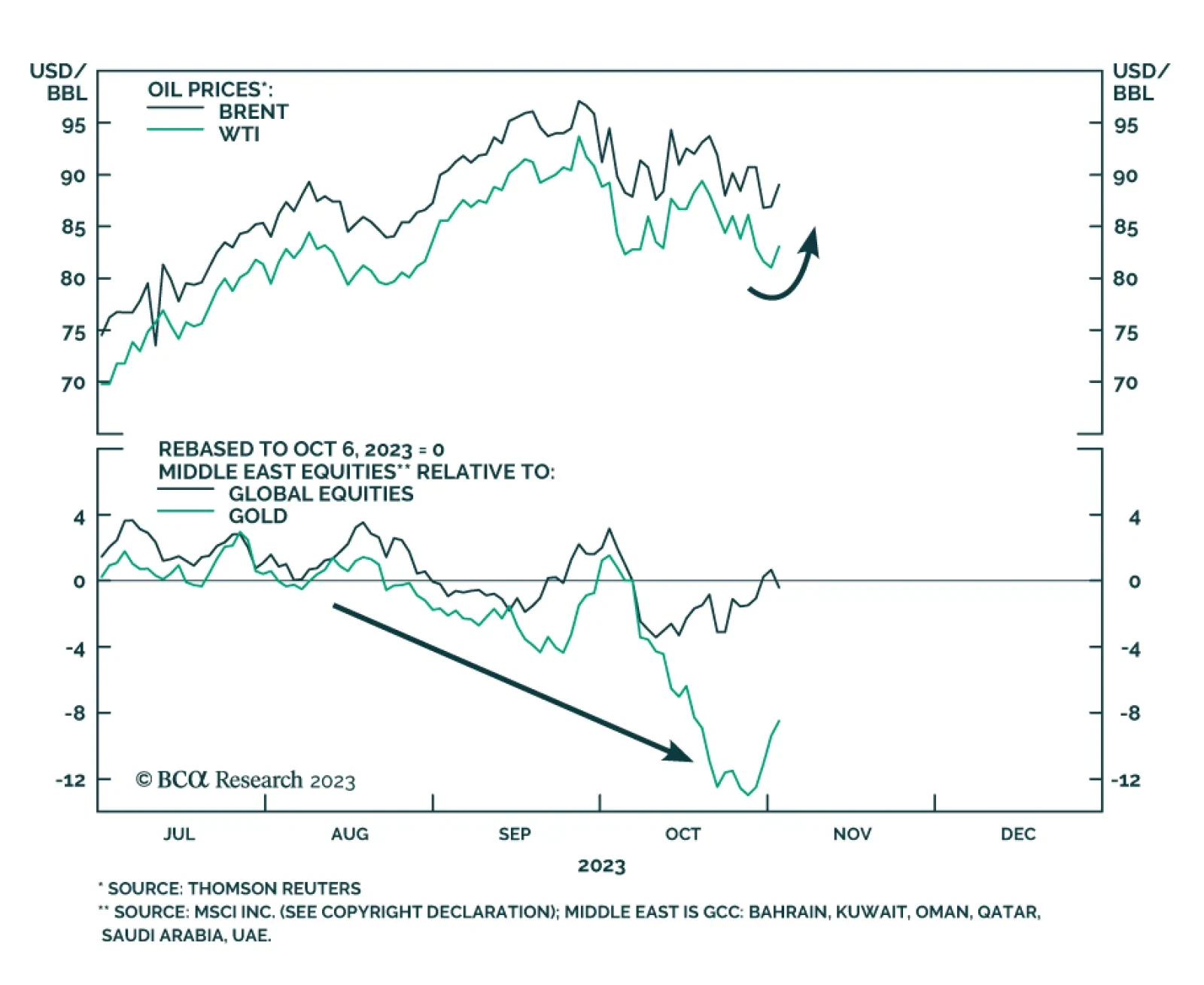

According to BCA Research's Geopolitical Strategy service, investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the…

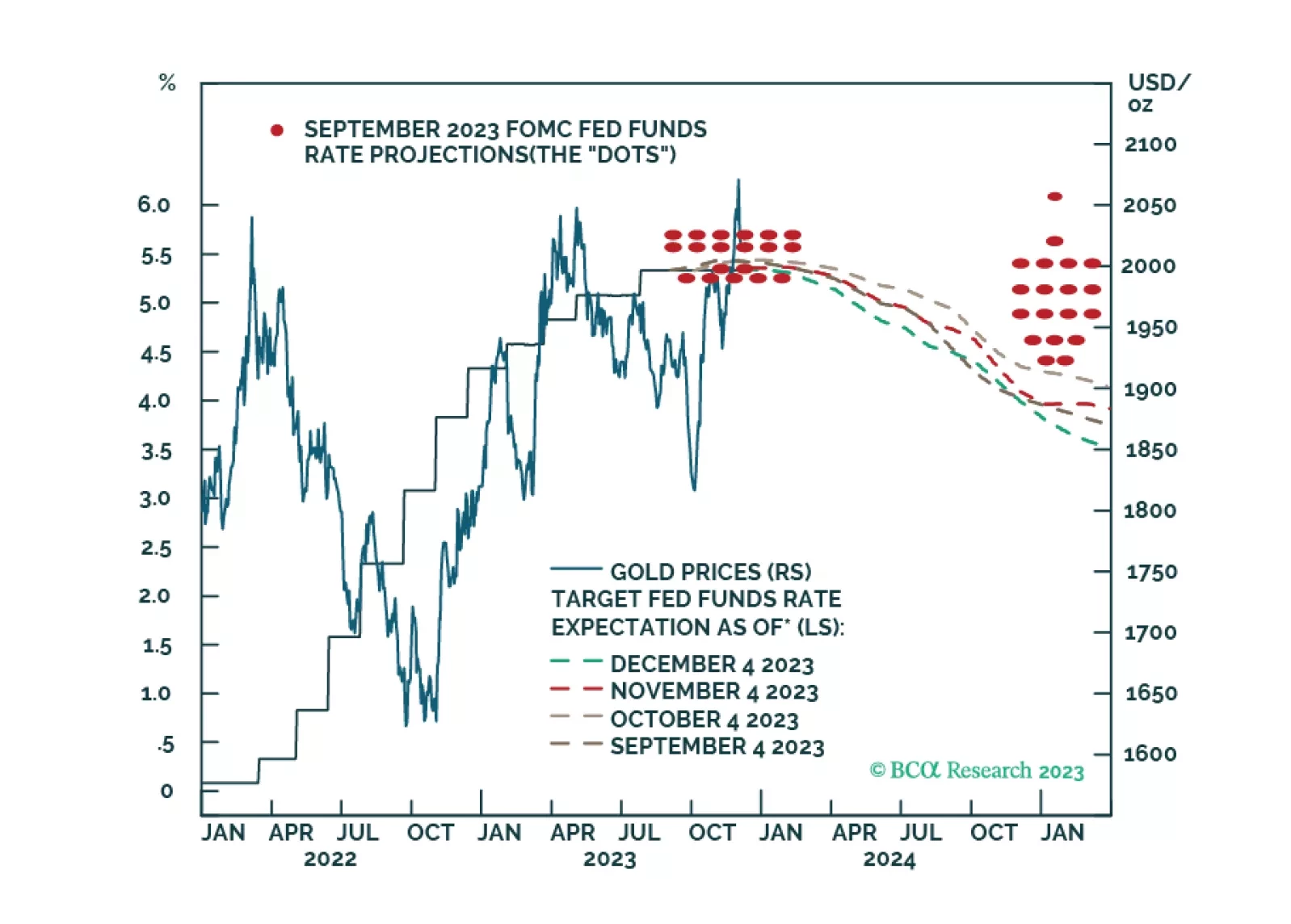

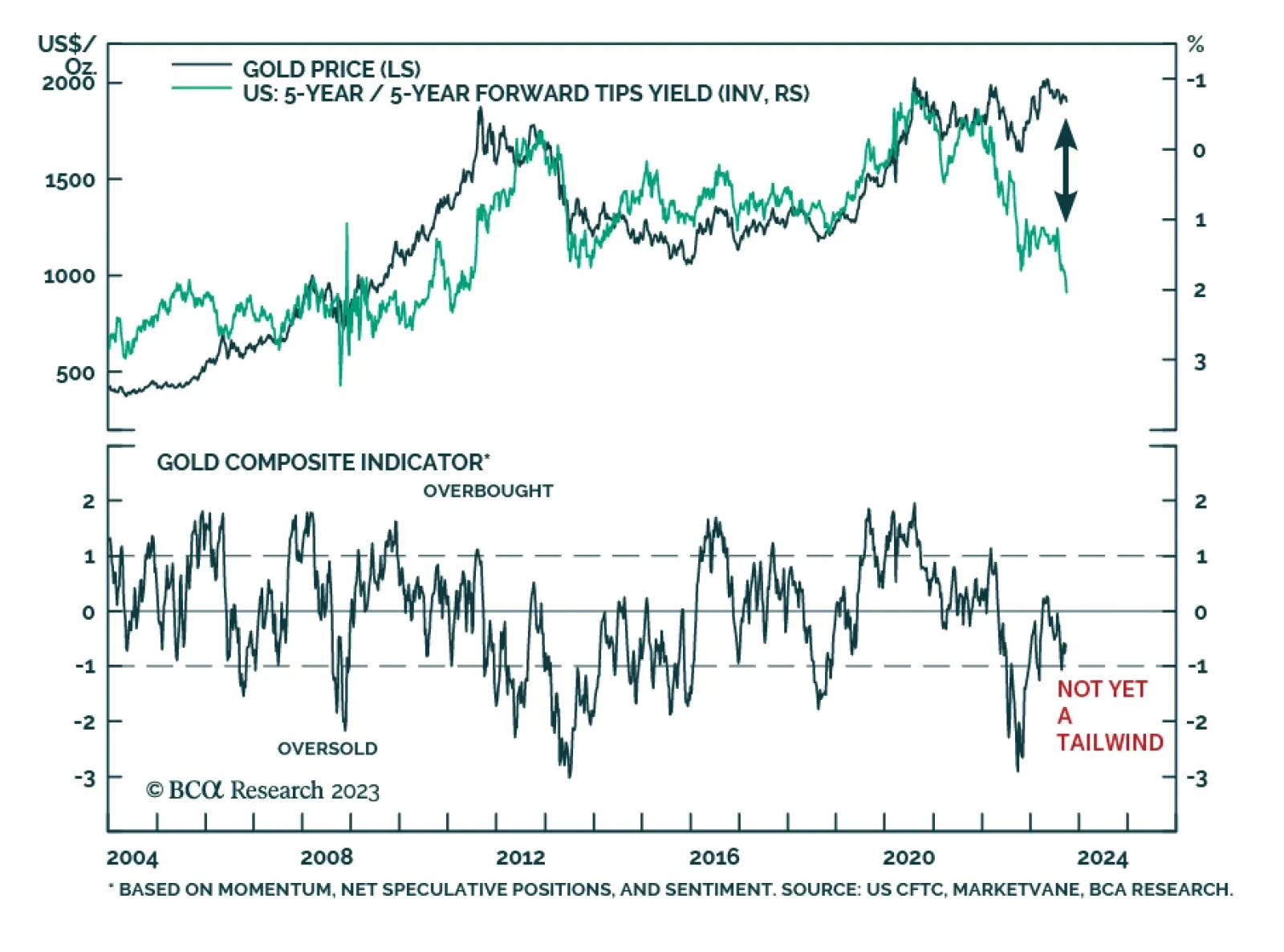

The price of gold has rallied by 9.2% since October 5, reaching a 5-month high by Wednesday's close. Notably, this latest rally comes despite real bond yields having been trending higher for the past two weeks. Given that…

In this report, we explore some trading opportunities after a volatile few weeks for FX markets.

The “September Effect” was in full force again this year as the broad-based selloff continued. Nearly all major financial assets generated outsized returns last month. In particular, the “higher for longer…

Aggressive monetary tightening has always led to recession, although the timing is uncertain. The effects of high interest rates are starting to be felt. Investors should stay risk off and buy government bonds as a safe haven…

US dollar strength and rising real rates have created a toxic mix for the yellow metal over the past few months. Gold prices have fallen by 7.3% from the May peak and are on track to erase the year-to-date gains. Conditions…