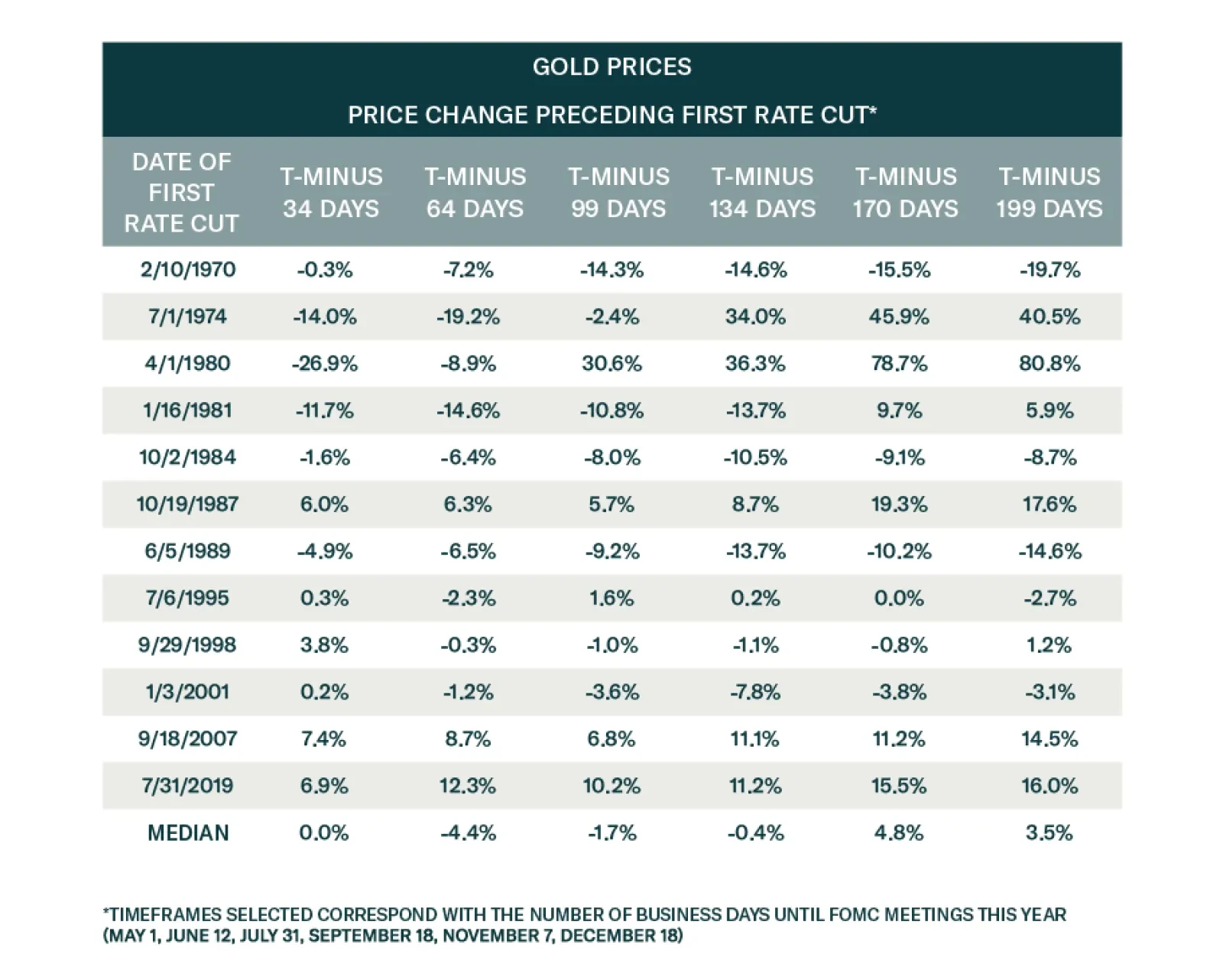

Gold has had a stunning rally over the past few weeks, gaining 9.2% since February 14 and reaching consecutive all-time highs last week before paring back some of its gains. Indeed, the drivers of gold have moved in a bullish…

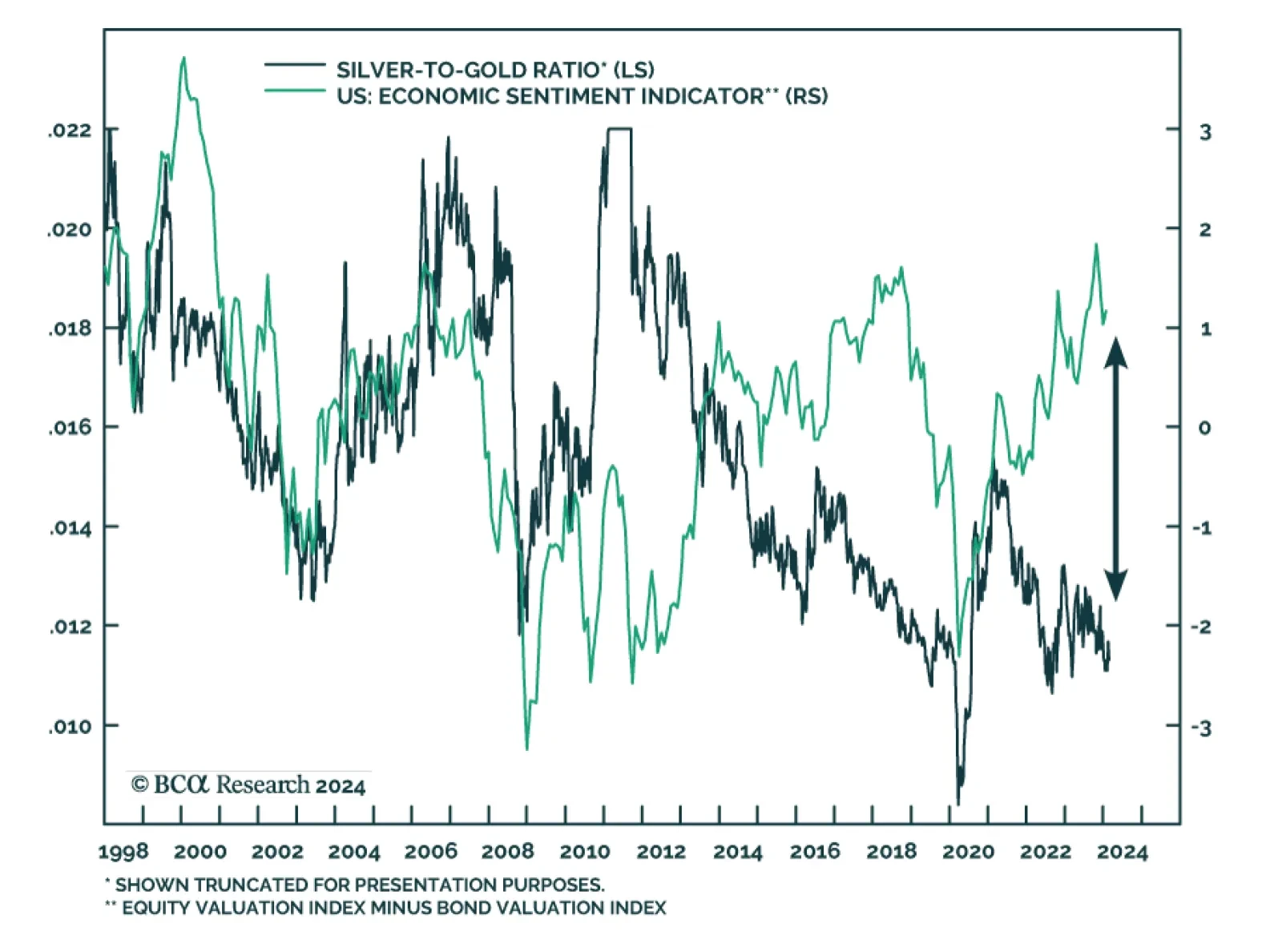

Our US economic sentiment indicator – which is based on the difference between our equity valuation index and our bond valuation index – remains on an uptrend since its pandemic trough. Investors are pushing US stocks…

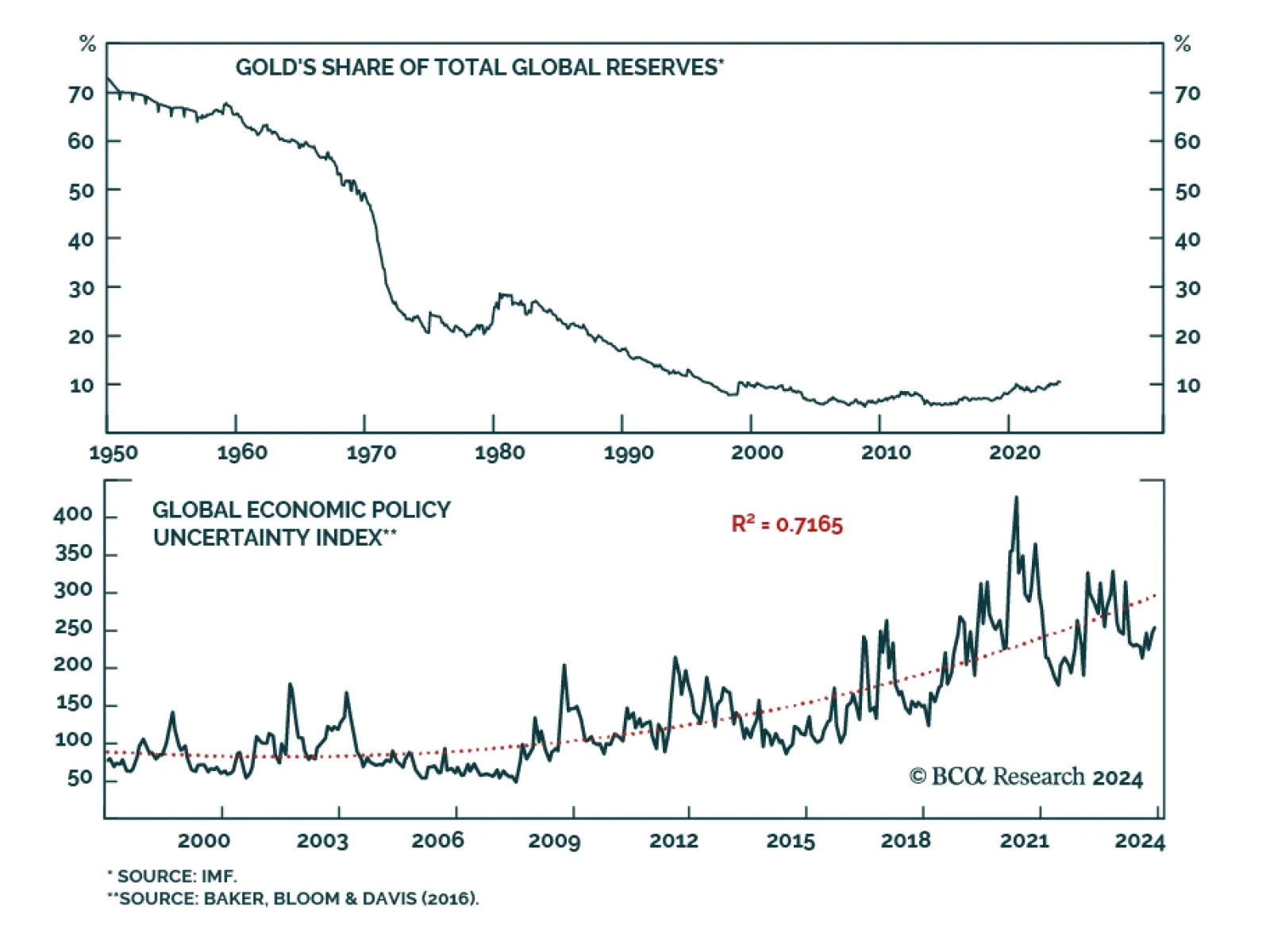

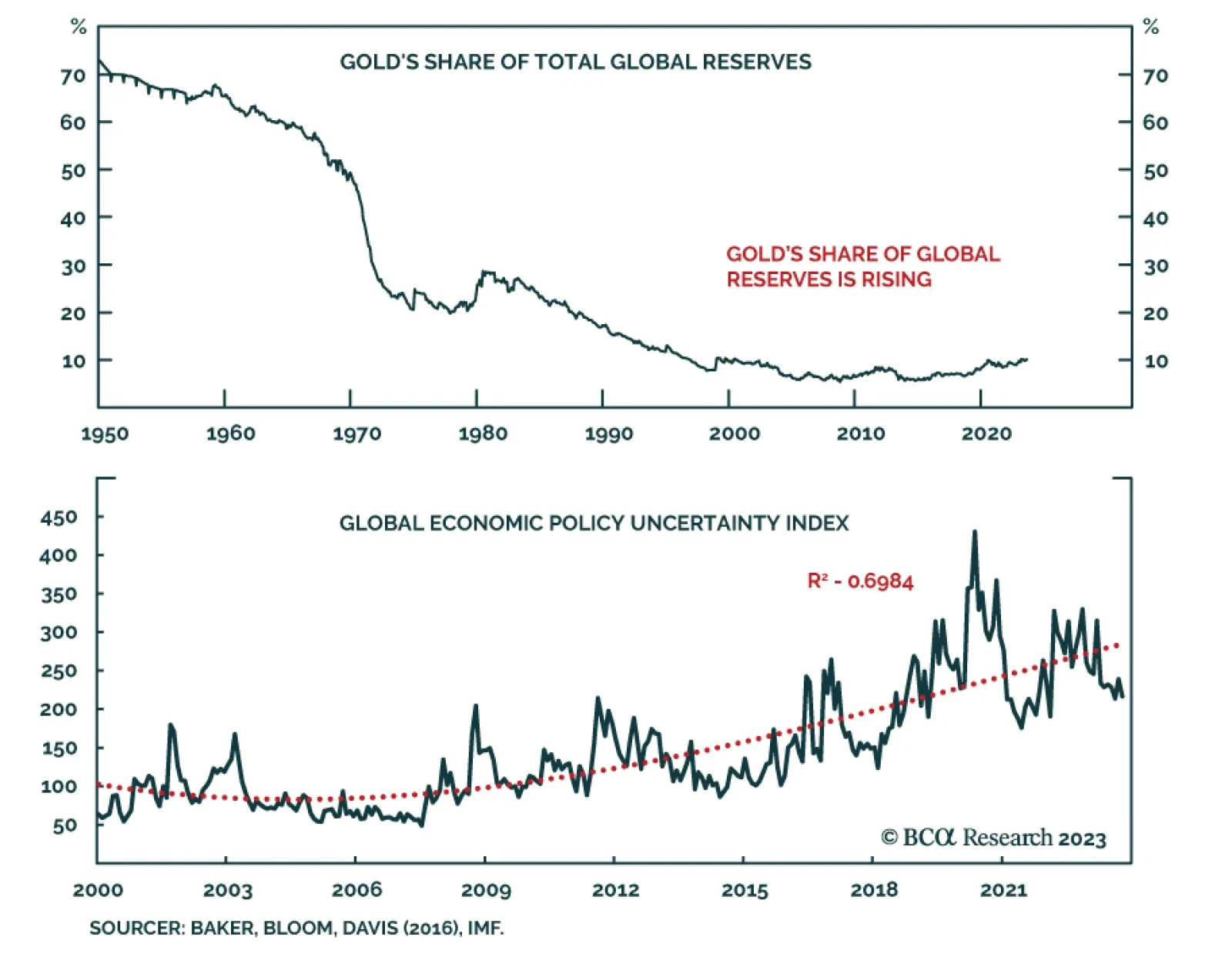

According to BCA Research’s Commodity & Energy Strategy service, gold purchases by central banks will continue apace, as they diversify away from USD foreign reserves. Amid elevated geopolitical risk, arising from…

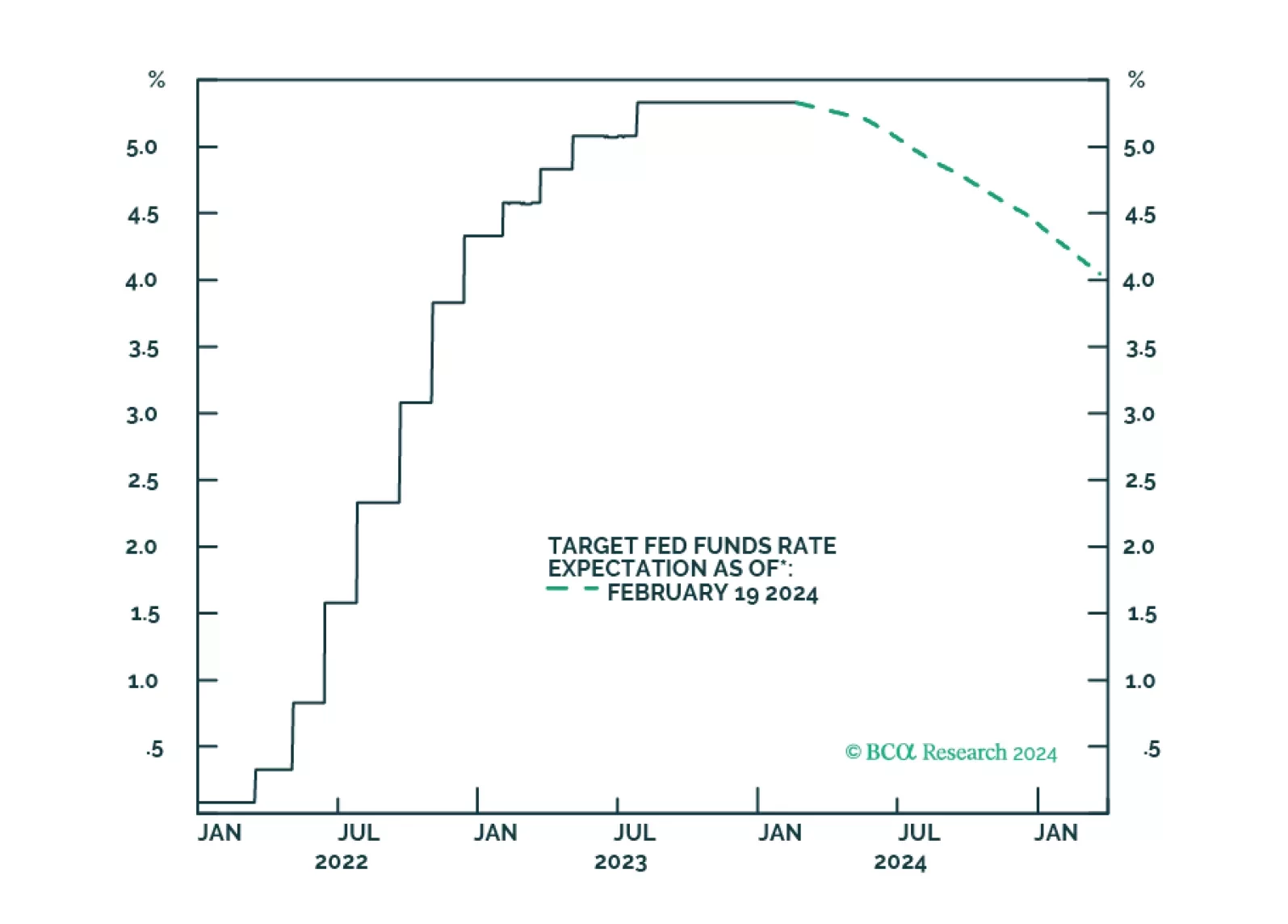

Seasonal weather and price variability in the first quarter will dissipate, which will reduce the agita caused by the recent inflation scare. This will increase the Fed’s comfort level in initiating a rate-cutting cycle in June with…

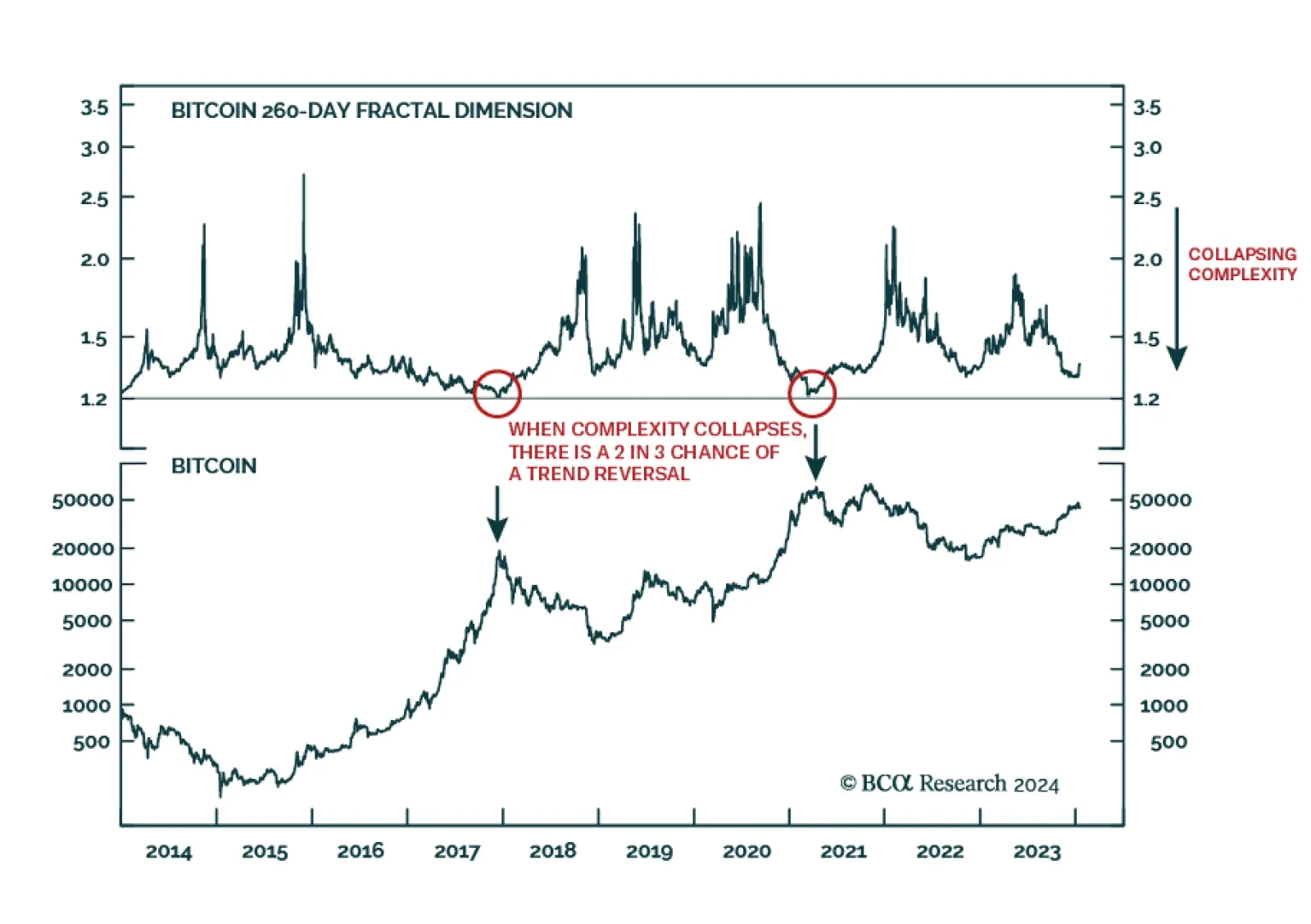

According to BCA Research’s Counterpoint service, the structural uptrend in bitcoin is still intact. The intrinsic value of bitcoin is that it cannot be confiscated by the state, either through monetary inflation, or…

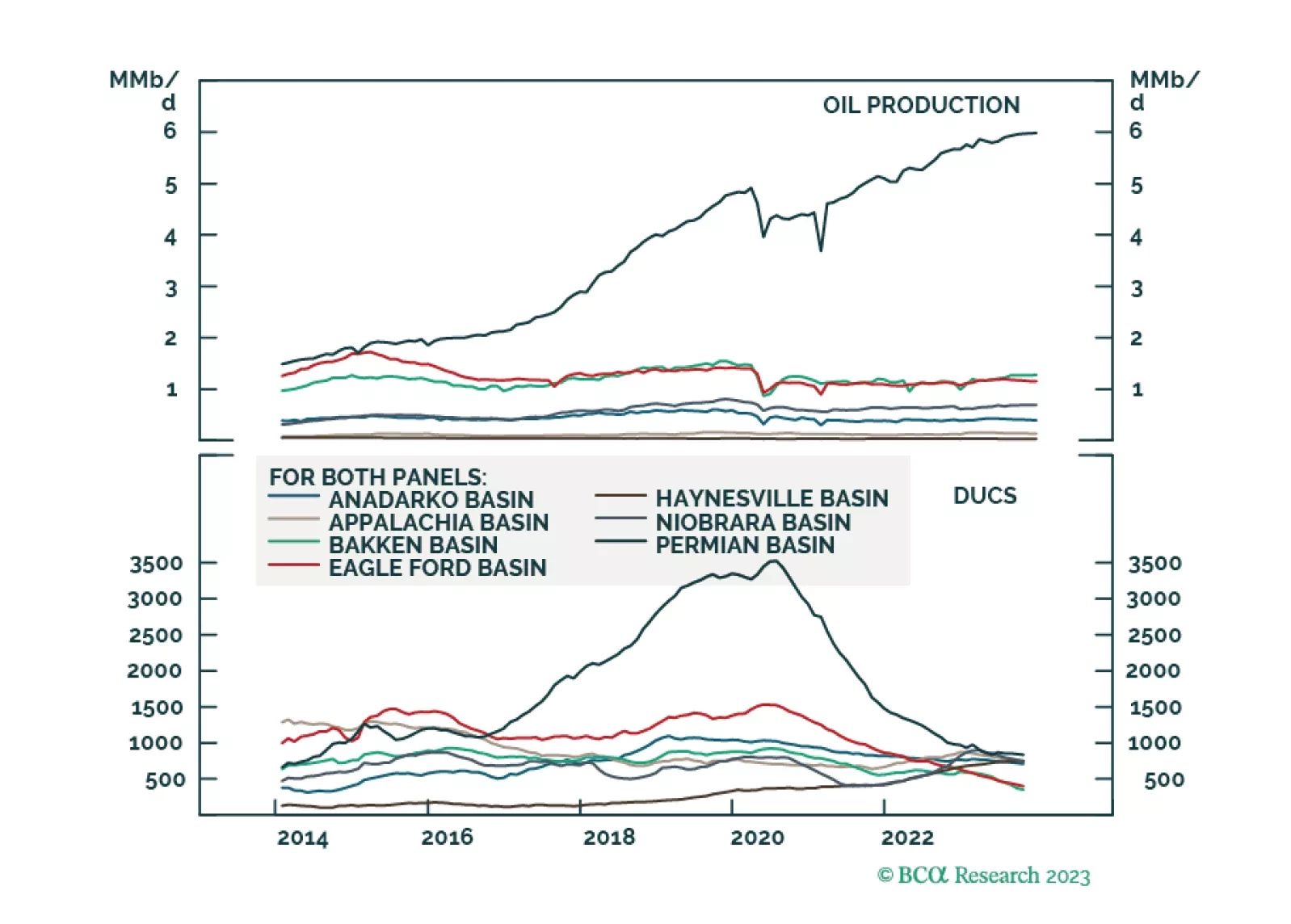

The commodity complex performed exceptionally poorly last year. Industrial metals and crude oil were among the few major financial assets we track that posted negative z-scores in 2023. Indeed, the 12% drop in the Golman Sachs…

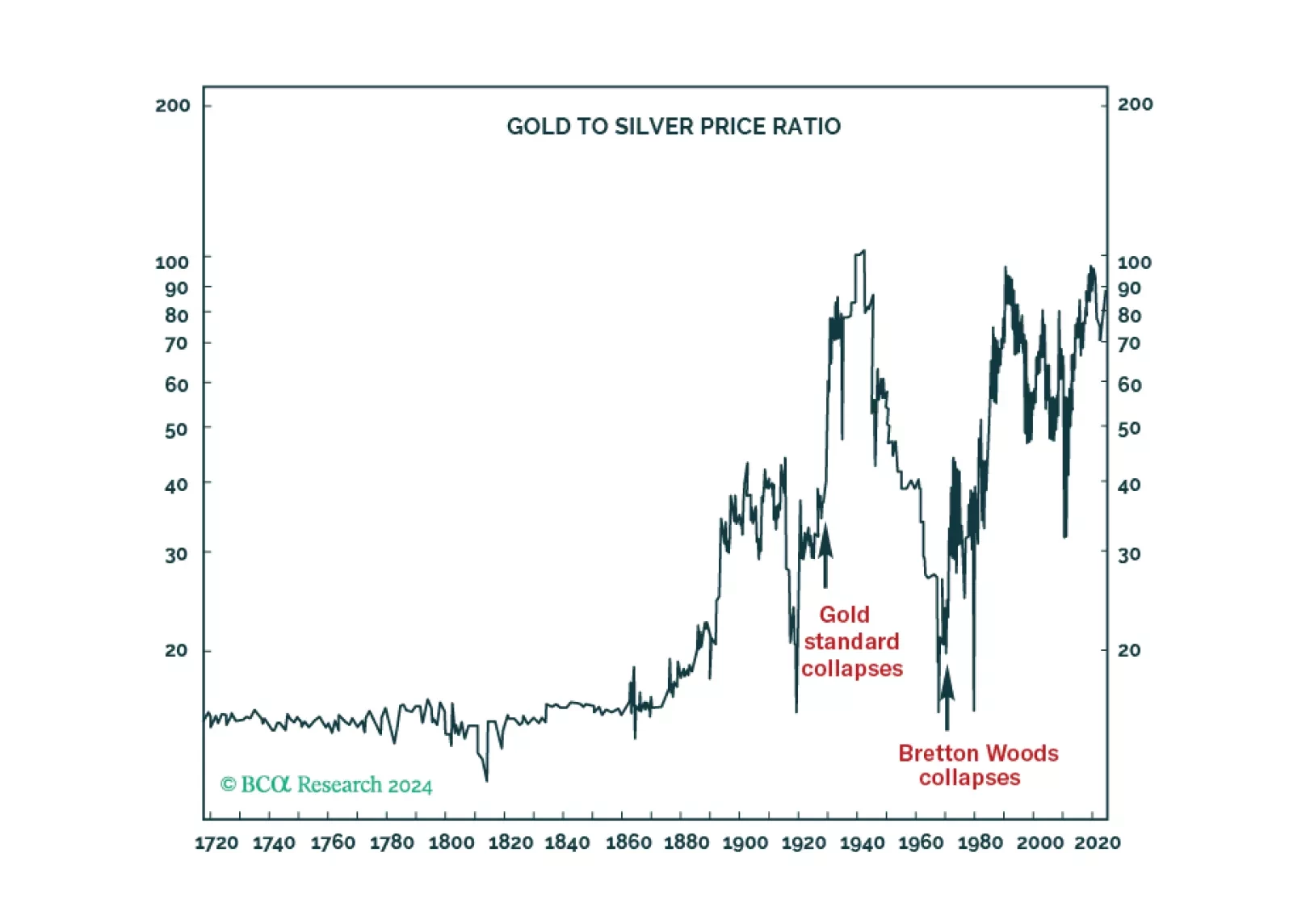

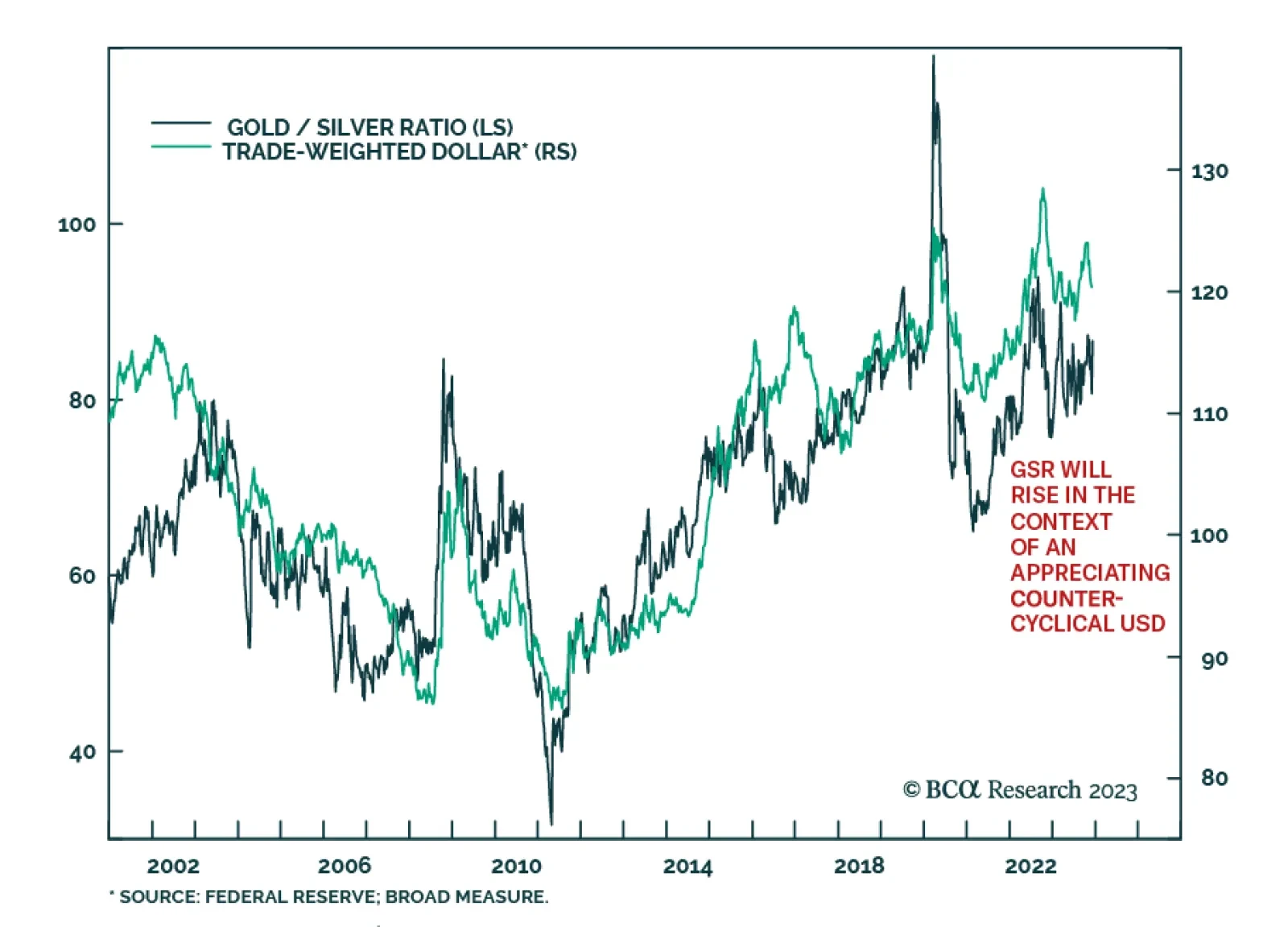

The gold/silver ratio (GSR) confirmed the improvement in global risk sentiment in November. It declined on the back of a 9.2% rally in silver, which outpaced the 1.9% rise in gold. Since then, the GSR has soared amid a more…

According to BCA Research’s Commodity & Energy Strategy service, as the world splits into East-West trading blocs, the continuing trend of trade fragmentation will challenge the need for a USD-centric monetary system,…