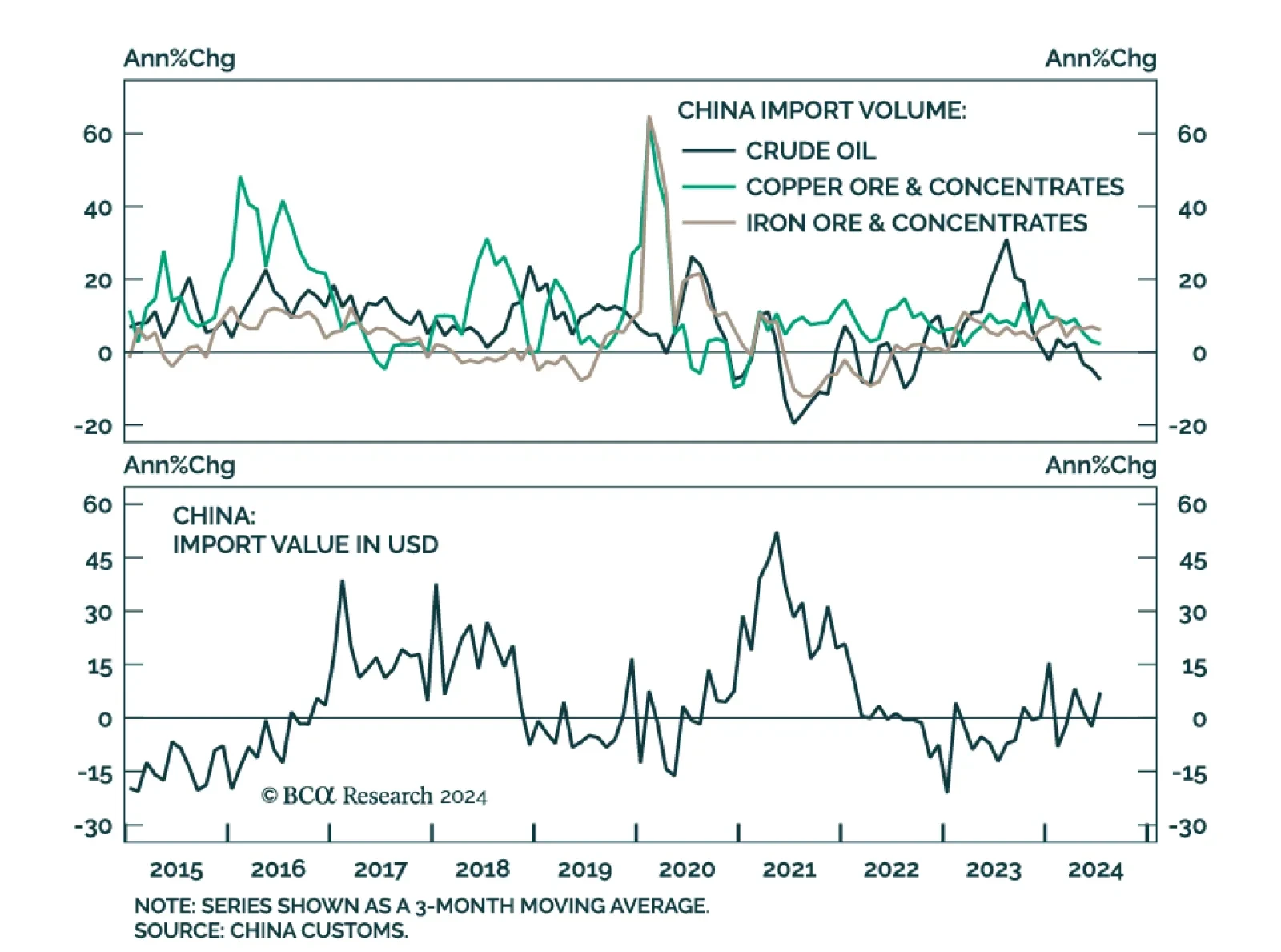

Chinese exports in USD terms missed expectations in July, growing by 7.0% y/y, down from 8.6% in June. Conversely, imports rebounded smartly from a 2.3% contraction, rising by 7.2% in July and upending expectations of 3.2%.…

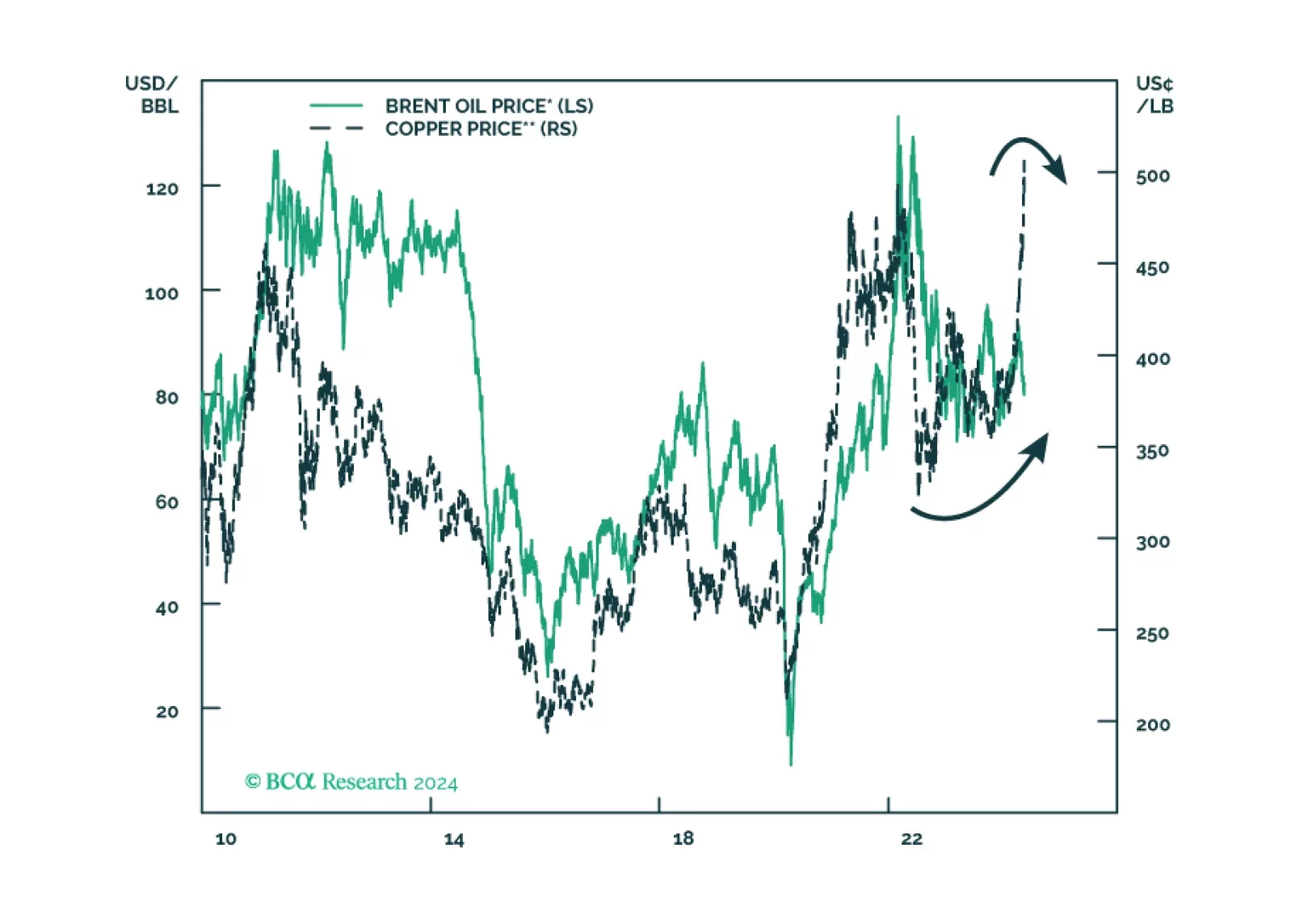

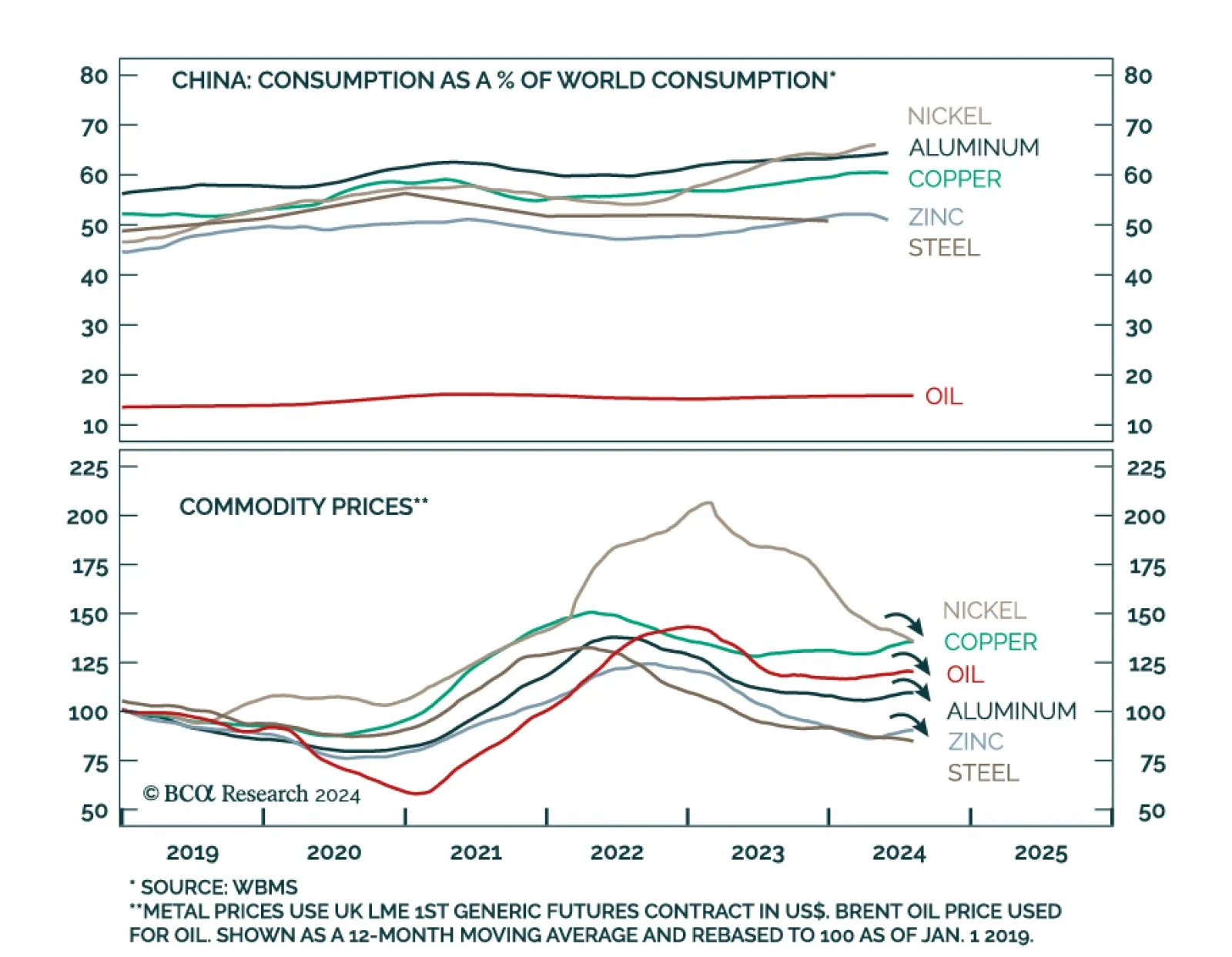

Industrial metals were one of the worst performing asset classes last month. Have prices declined enough to make them an attractive investment? The outlook for industrial commodity prices is bearish over a 12-month horizon…

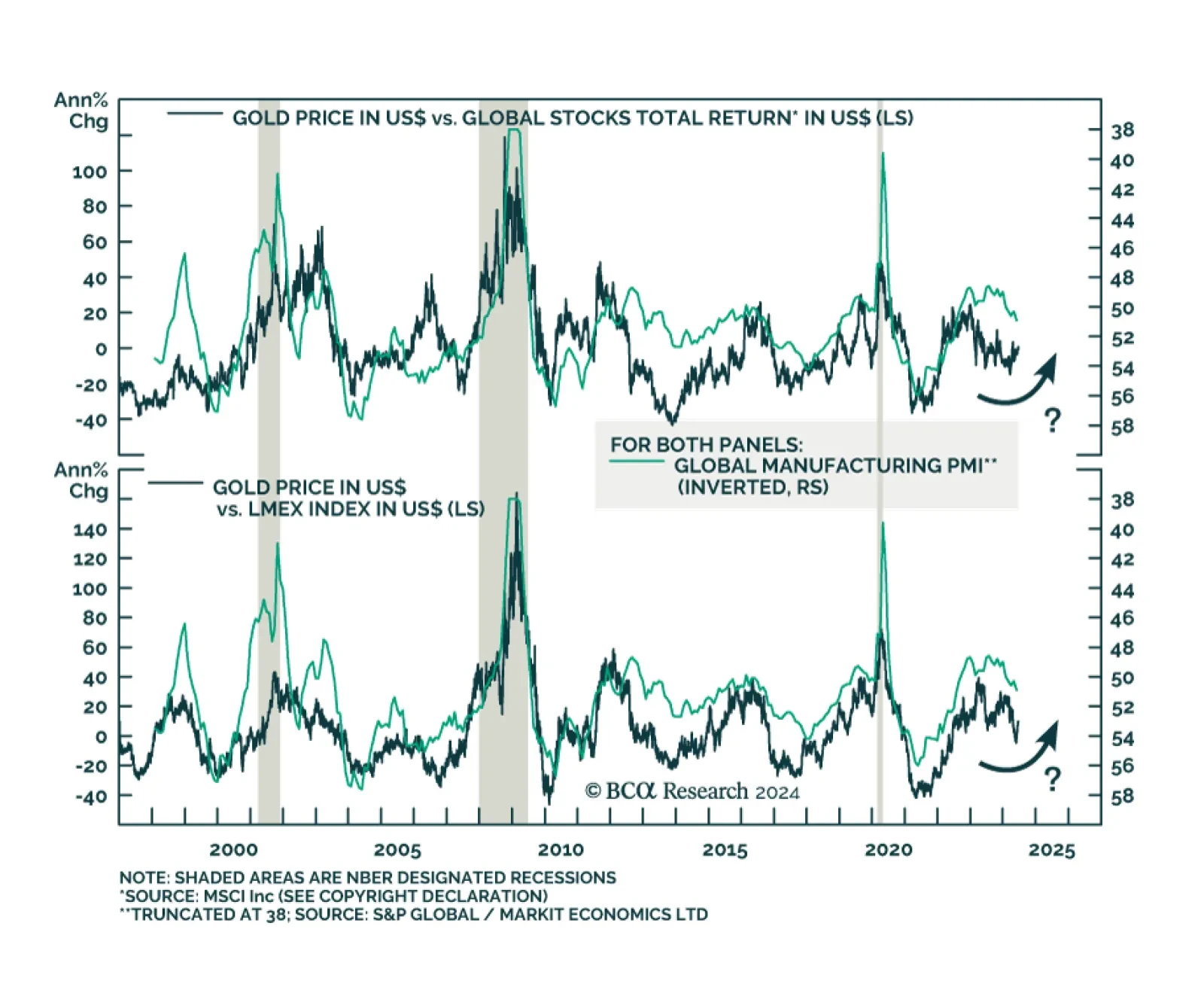

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

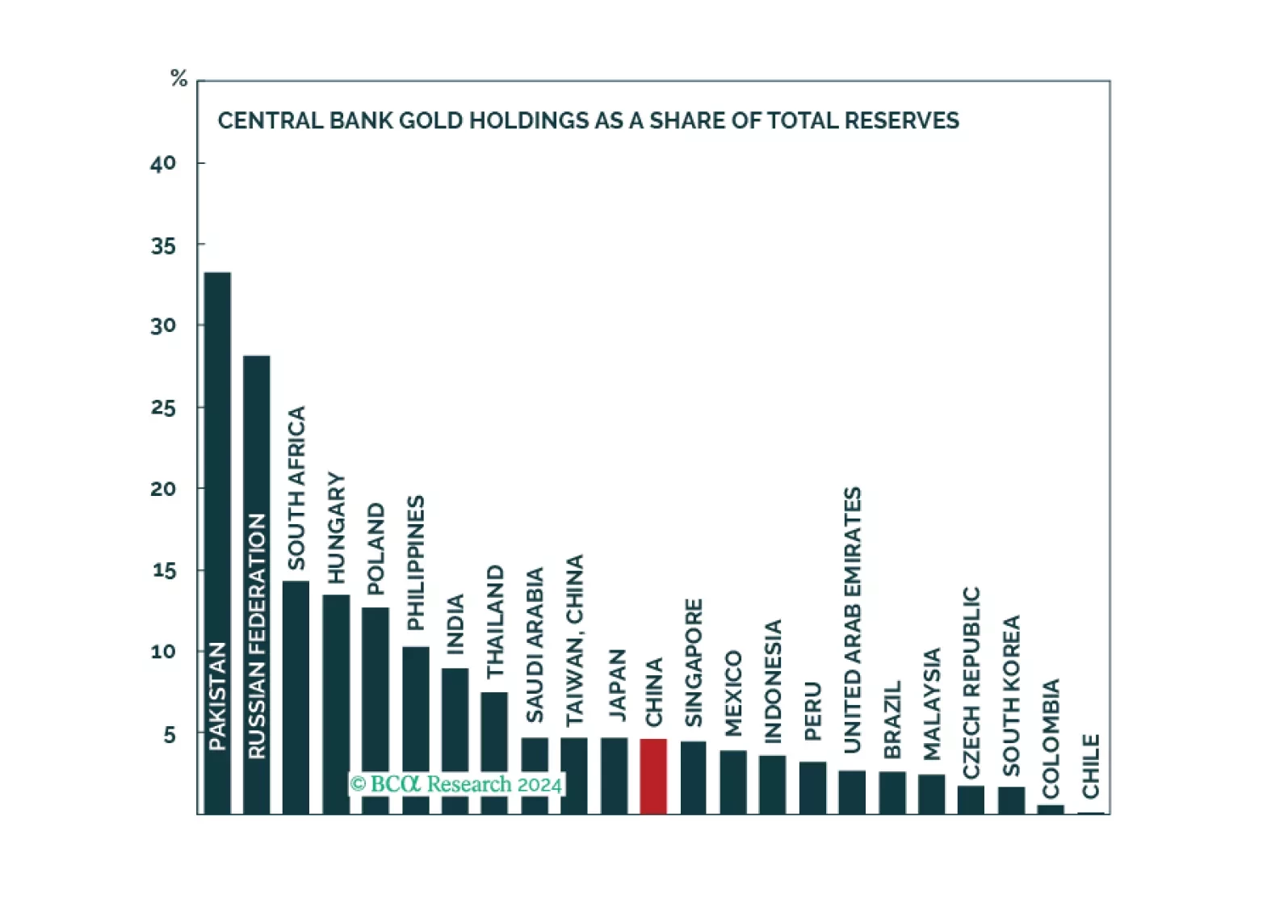

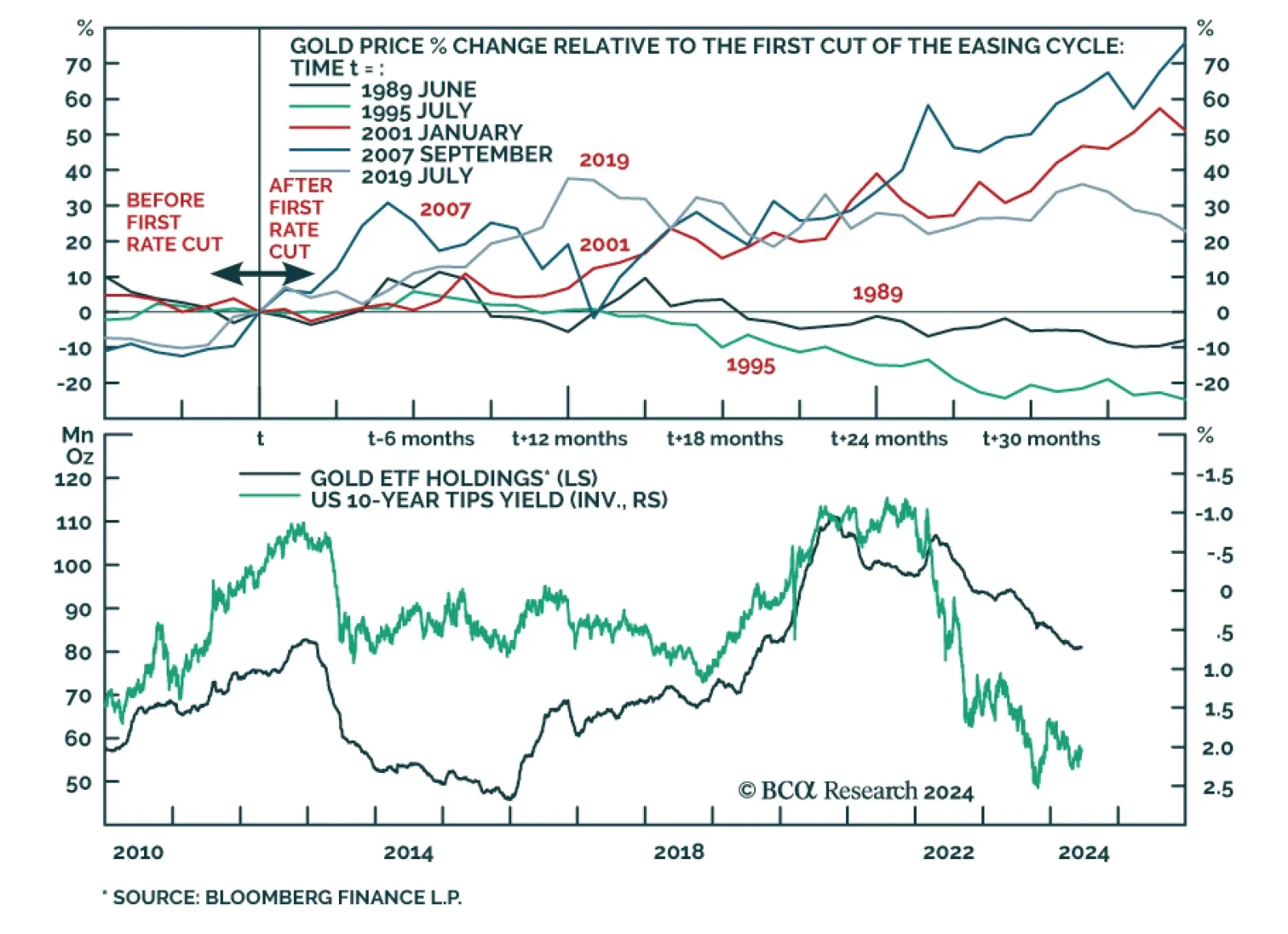

Historically, there has been a tight inverse relationship between the price of gold and US real rates. Elevated interest rates raise the opportunity cost of holding gold, making the yellow metal relatively less attractive for…

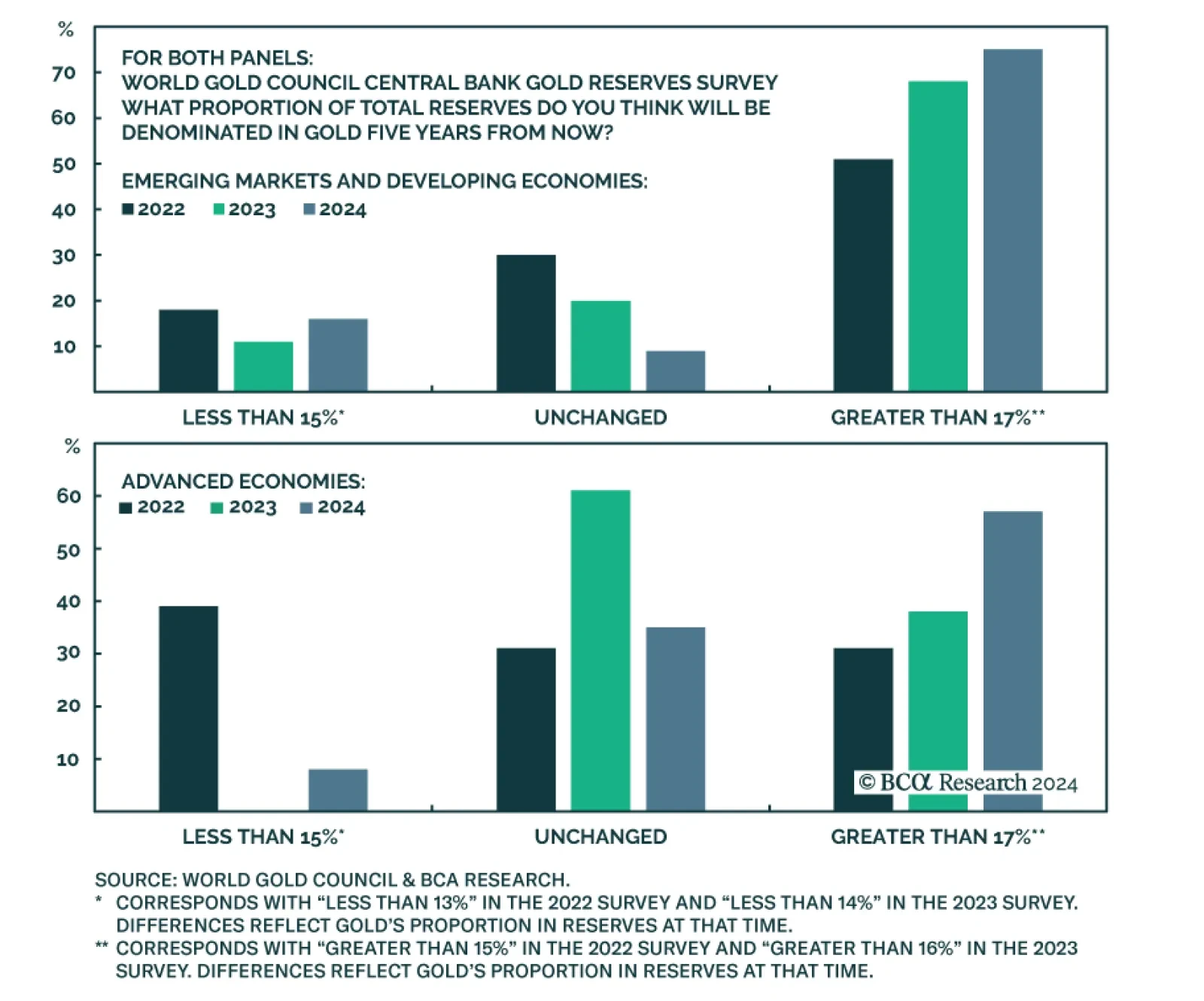

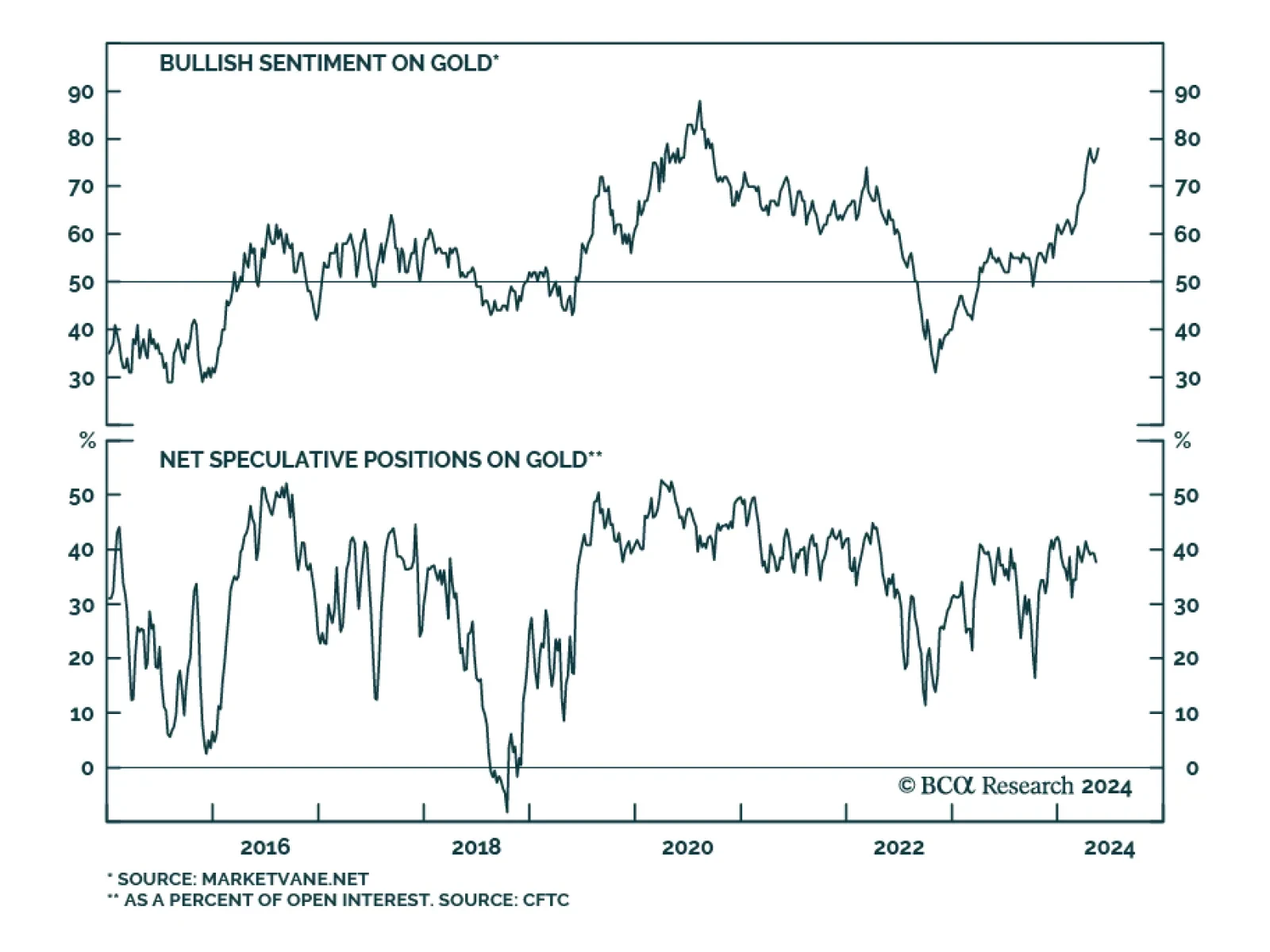

Gold spot prices have returned a whopping 25% YTD, with the bulk of this performance having occurred in the last three months. Interestingly, these gains have occurred despite the rise in real yields, with which they are…

According to BCA Research’s Commodity & Energy Strategy service, a Fed pivot to rate cuts will provide gold prices with a tailwind. At first blush, the historical evidence is mixed. While gold rallied in the three…

Gold prices might experience a correction or consolidation over the near term. However, cyclical and structural forces will ultimately cause the yellow metal to trend upwards.

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…

The rally in gold continues and spot prices flirted with their all-time highs last week. Interestingly, these gains have occurred despite the rise in real yields, with which they are usually strongly inversely correlated.…