While we remain bullish on global equities and other risk assets over 12 months, we went tactically short the S&P 500 last Friday following the market’s complacent reaction to the Trump Administration’s further tariffs increases…

Highlights U.S. growth remains robust, despite some temporary softness in recent months. Ex U.S., growth continues to fall but, with China probably now ramping up monetary stimulus, should bottom in the second half. Central banks…

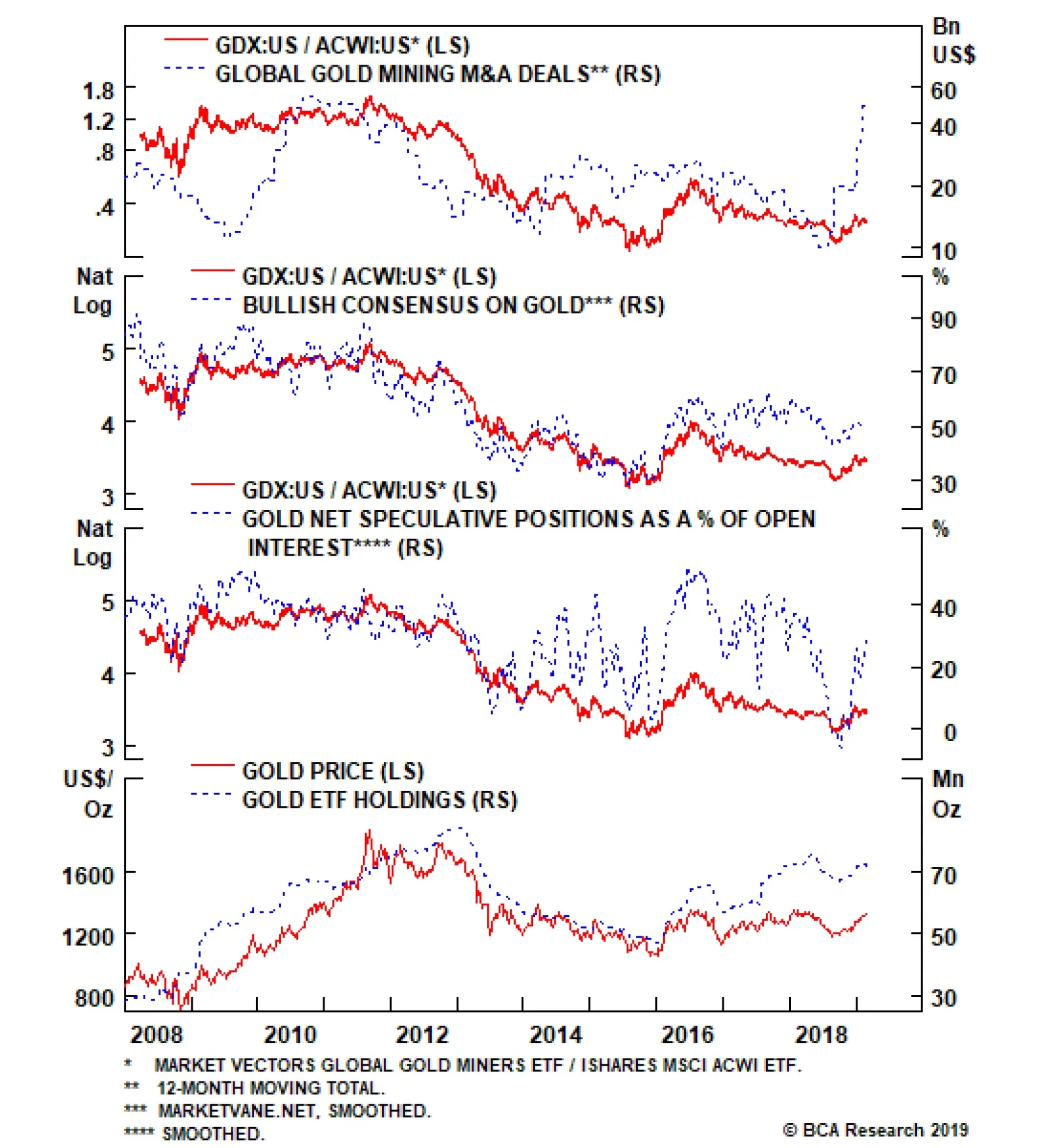

Overweight Within our broad-based U.S. equity sector and subsector coverage, we continue to recommend a modest gold-related hedge via being overweight the global gold mining index (given that the S&P gold index only…

Not only is there a tight inverse correlation with the trade-weighted U.S. dollar, but over the past three years the Chinese renminbi has moved in lockstep with gold. Now that Chinese policymakers are tentatively injecting…

Highlights Portfolio Strategy While equities will likely be higher in the coming 9-12 months, we would refrain from committing fresh capital to the market at this juncture. A better entry point lies ahead. Tactically, this market…

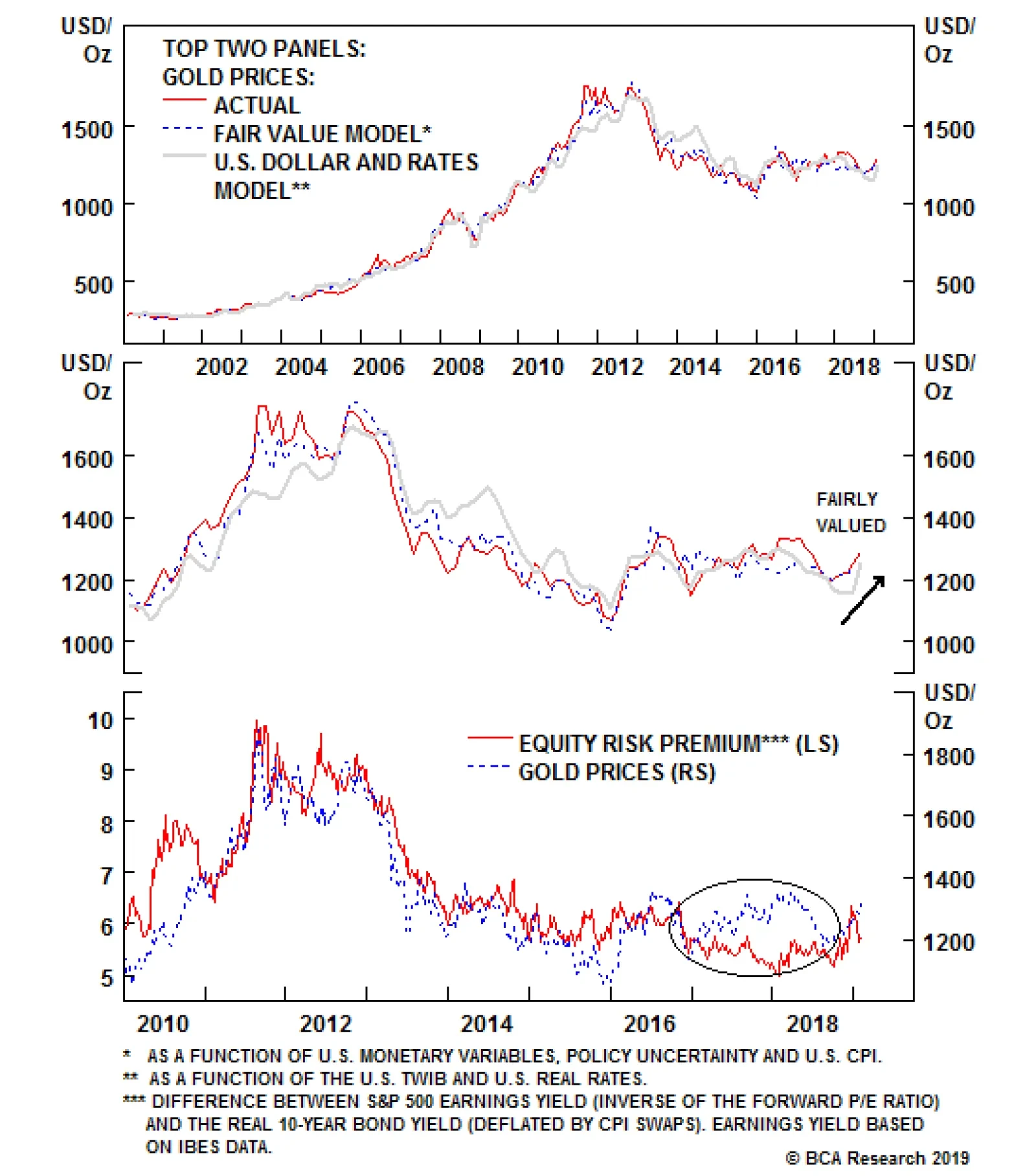

For most of 2018, the U.S. dollar and real rates were the primary determinants of investor sentiment and positioning toward gold. As these variables rose, investors’ sentiment and positioning turned overly bearish; this…

The hiatus in the Fed’s rates-normalization policy in 1H19 in the wake of its capitulation to financial markets, supports our bullish view on gold prices, as it raises the risk of an inflation overshoot later this year. Per the Fed…

… quick’s the word and sharp’s the action. Jack Aubrey1 Idiosyncratic supply-demand adjustments – some induced by head-spinning reversals of policy (e.g., the U.S. about-face on Iran oil export sanctions)…