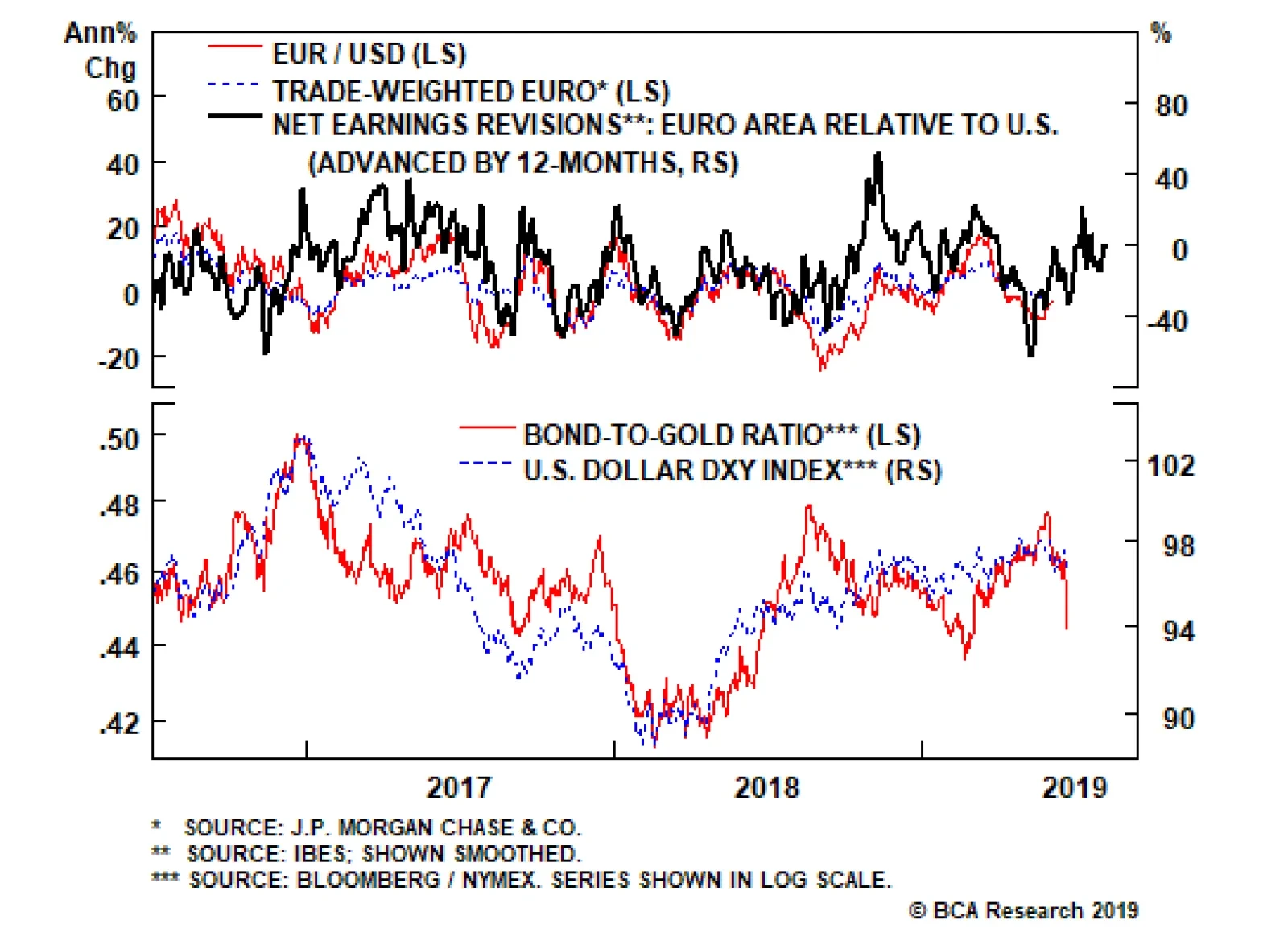

Highlights The sharp fall in the bond-to-gold ratio is an important signal to pay heed to. It might suggest that confidence in the U.S. dollar is finally waning. If correct, the sharp rally in crypto currencies over the past few…

The U.S. economy remains near full employment. Investors therefore concluded that the “insurance cut” telegraphed by the Fed ahead of next month’s FOMC meeting stands a very good chance of finally goosing…

Highlights U.S. consumption remains robust despite the recent intensification of global growth headwinds. The G-20 meeting will not result in an escalation nor a major resolution of Sino-U.S. tensions. Kicking the can down the road is…

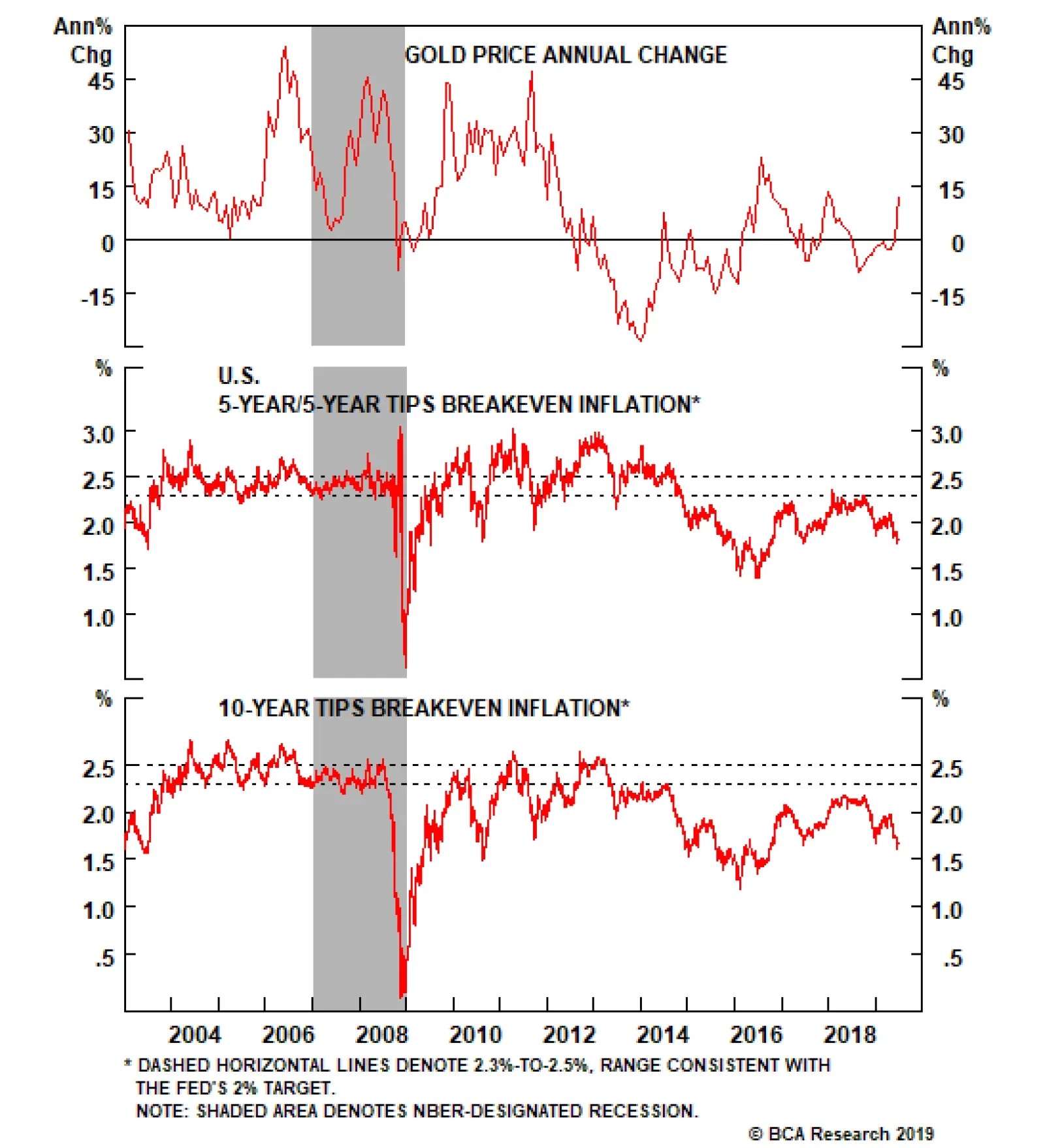

Highlights A rare market trifecta – propelled by investors seeking safe-haven assets, inflation hedges in the wake of the Fed’s dovish turn this past week, and portfolio diversification – will continue to keep gold well…

Interest rate differentials are moving against the dollar, but our important takeaway – that gold continues to outperform Treasurys – is an ominous sign. Gold has stood as a viable threat to dollar liabilities, any sign…

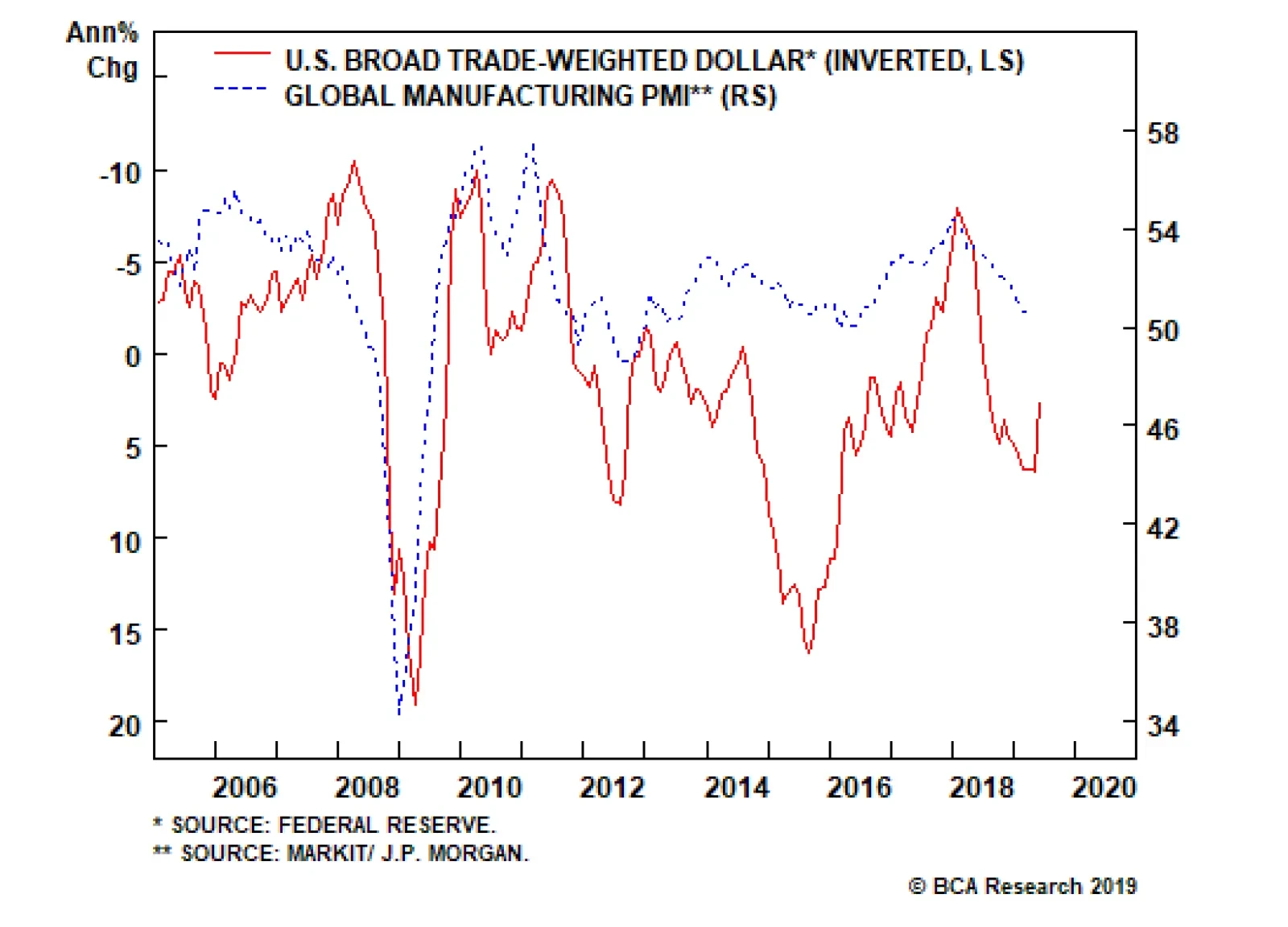

Highlights The Federal Reserve’s monetary policy stance is slightly accommodative for the U.S., but it is too tight for the rest of the world. Inflation is likely to slow further before making a durable bottom toward year-end.…

Investors expect the Fed to cut rates by 62 basis points by the end of next year. While rates could come down in the event of a major trade war, on a probability weighted-average basis, they are more likely to rise. The U.S.…