Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook for the year ahead. This report is an edited transcript of our recent…

Highlights An expansion in the Federal Reserve’s balance sheet will increase dollar liquidity. This should be negative for the greenback, barring a recession over the next six to 12 months. Interest rate differentials have…

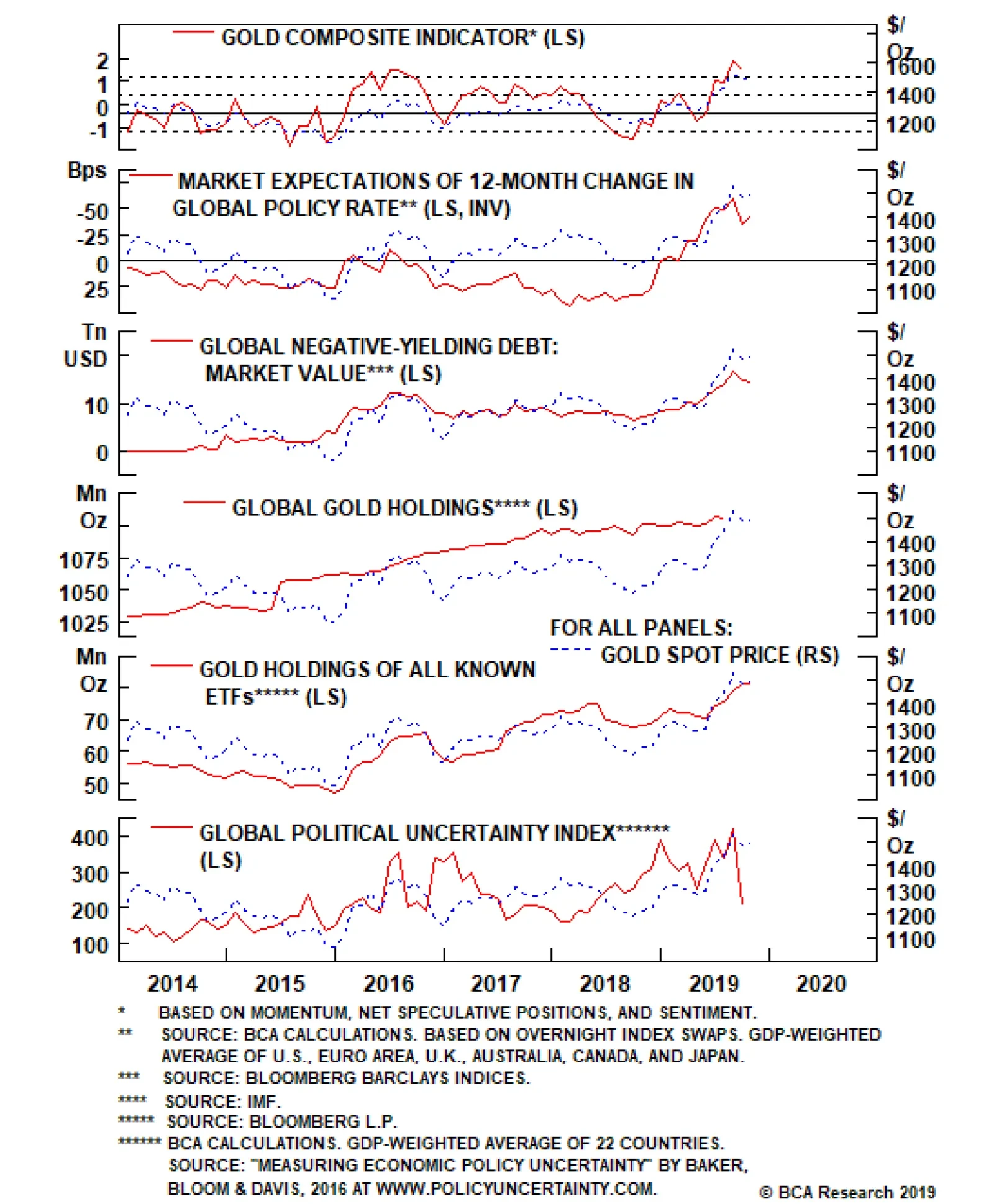

At present, economic policy uncertainty overwhelms the other variables that typically explain gold prices. Those other factors include: Demand for inflation hedges (which includes U.S. core inflation, commodity prices and U.S.…

The once-reliable negative correlation between gold and the USD was indefinitely suspended beginning in 4Q18 by the pervasive economic uncertainty we identified last week as the culprit holding back global oil demand growth via a super-…

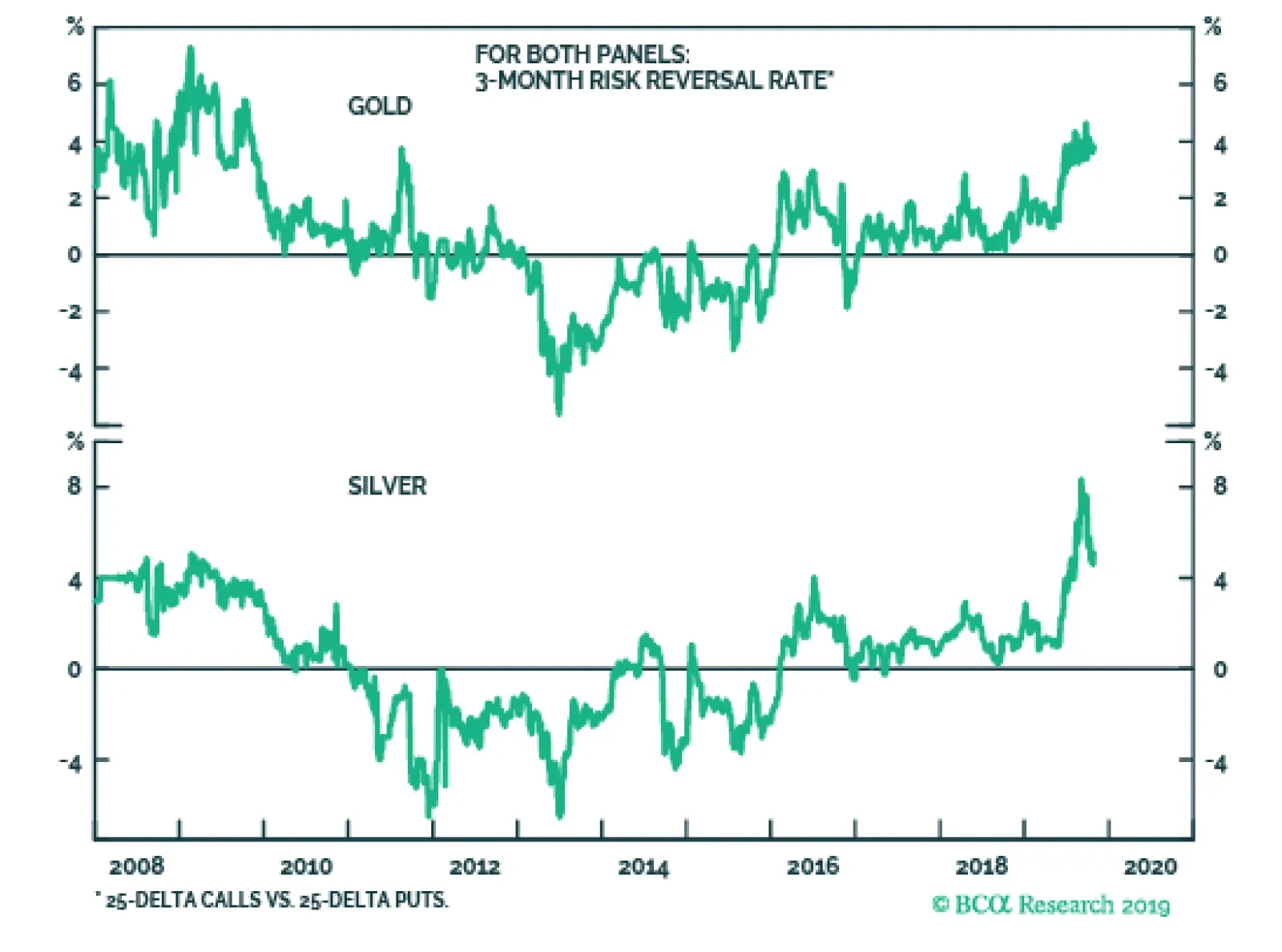

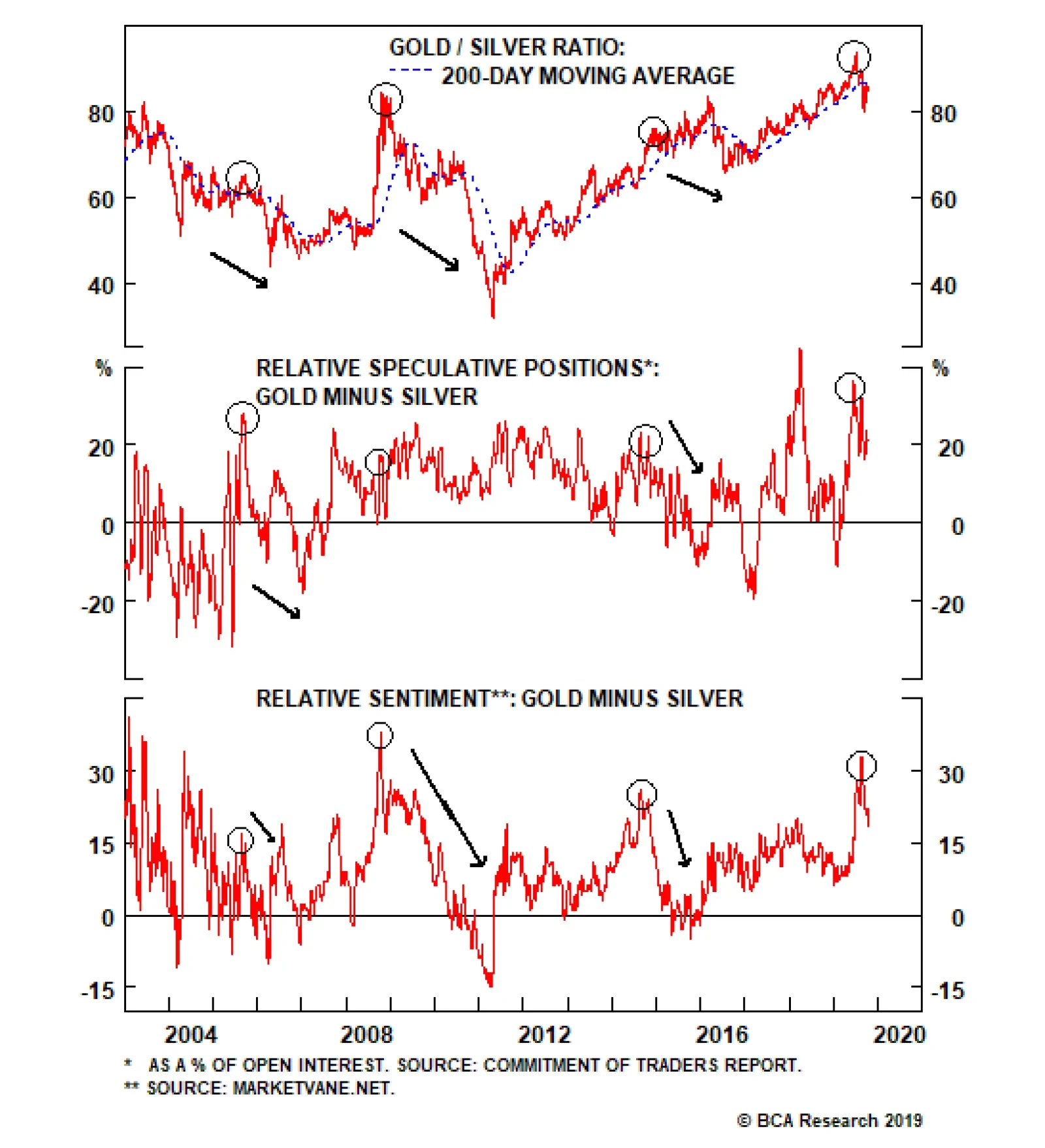

The gold/silver ratio (GSR) was in a race towards a major overhead resistance at 100 this summer, but after hitting a three-decade high of 93.3, it is now showing tentative signs of a reversal. Historically, these reversals tend…

Highlights The world remains mired in a manufacturing recession. This has historically not been bullish for pro-cyclical currencies. The velocity of money in the euro area will need to rise vis-à-vis the U.S. to confirm a…

Spot gold prices have increased 17% year-to-date, on the back of global growth weakness, dovish central banks, and rising political tensions. Should investors now pare back their gold exposure? Common sense would suggest they…

Highlights The global manufacturing cycle is likely to bottom soon, and consumption and services remain robust. The risk of recession over the next 12 months is low. This suggests that equities will continue to outperform bonds. But…