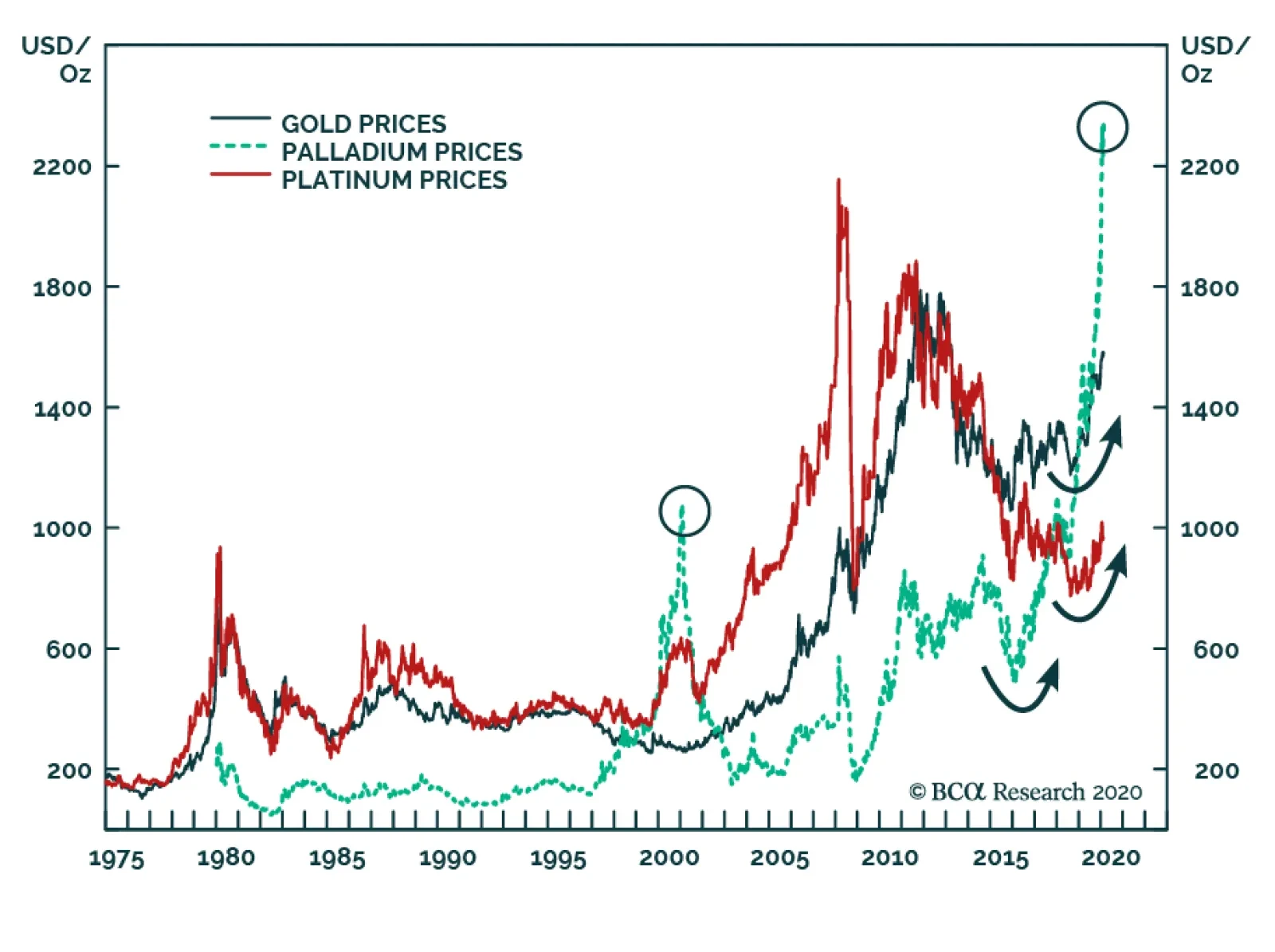

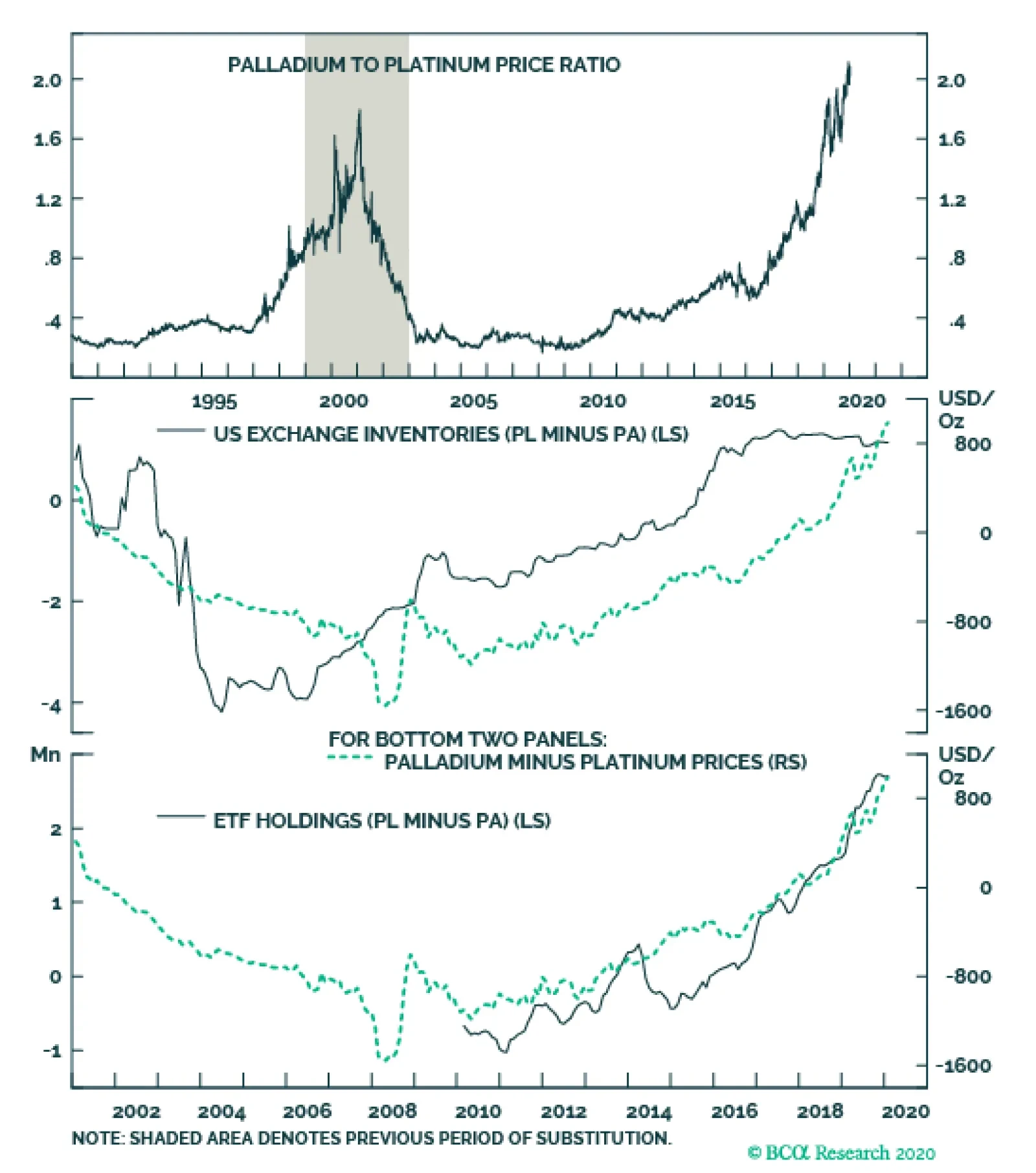

Palladium prices bottomed at $167/oz in the aftermath of the financial crisis and have since skyrocketed to $2458/oz, making it the most expensive precious metal in the PGM space. In annual terms, this constitutes a total return…

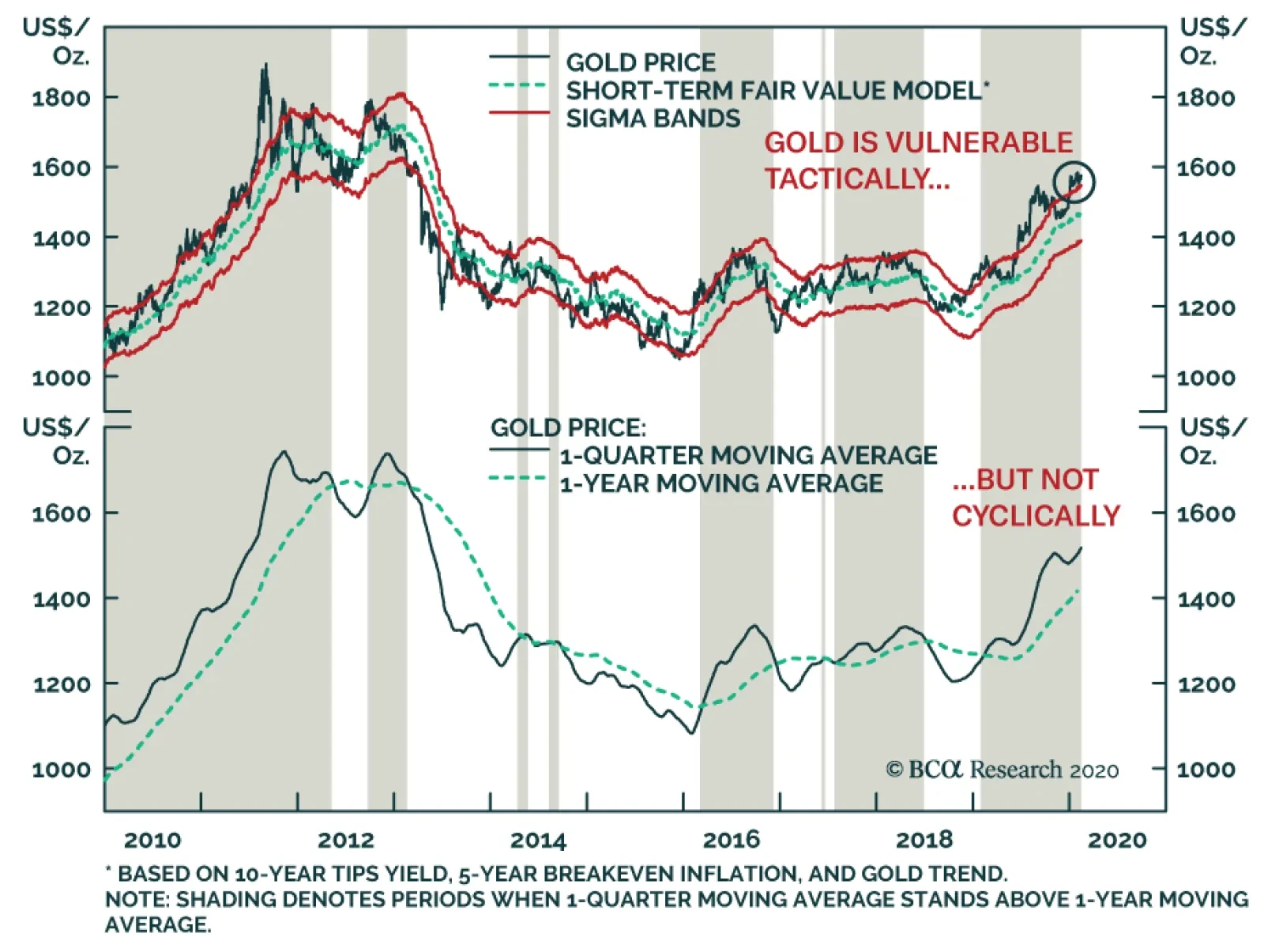

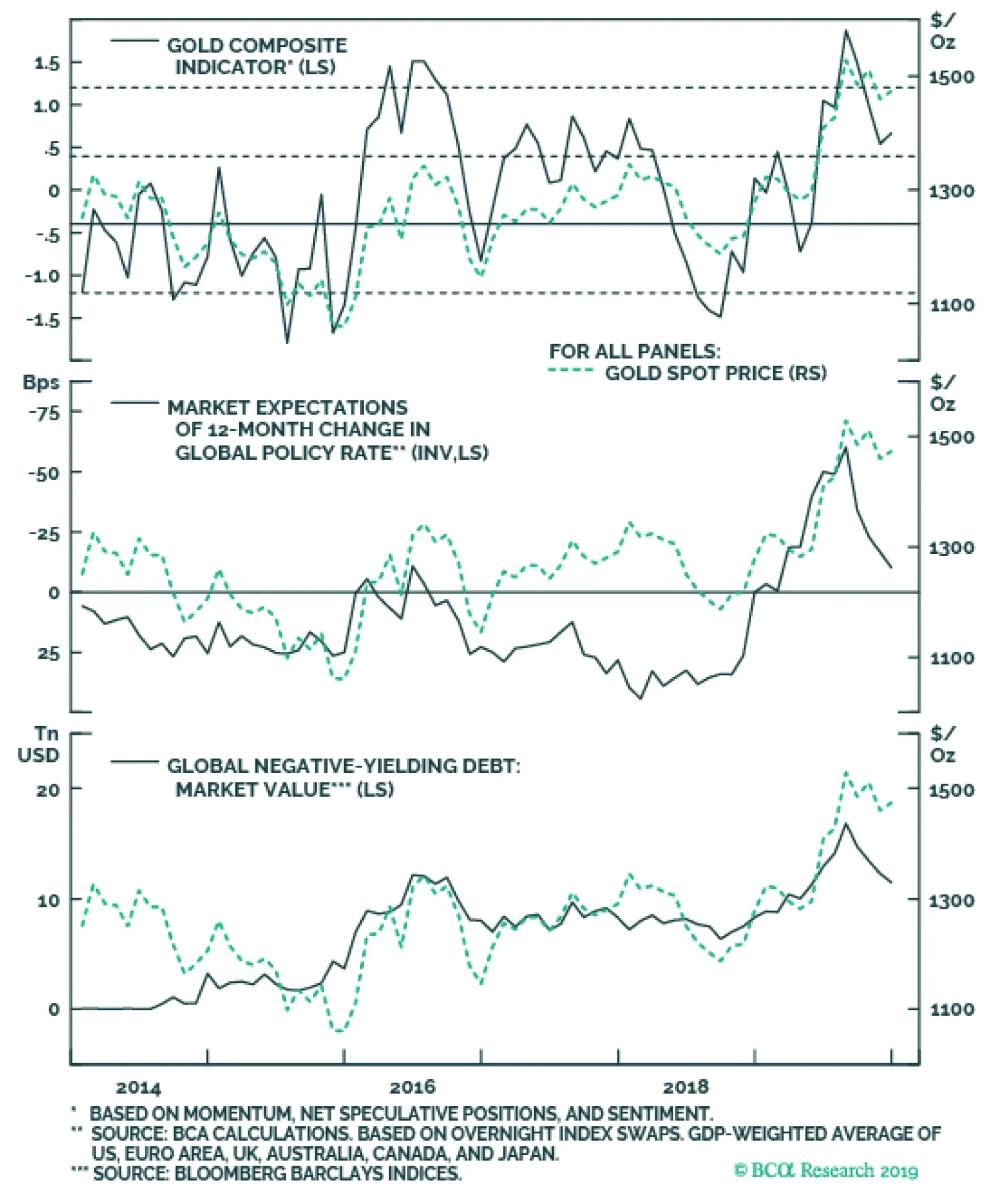

The rally in gold prices has been relentless, but tactically, the yellow metal is due for a correction. Gold prices are a negative function of real interest rates and a positive function of inflation expectations. Moreover,…

Highlights Collective market signals suggest a low but non-negligible probability of a dollar spike due to the coronavirus. Stay long the yen as a portfolio hedge. Short CHF/JPY bets also make sense. Our limit sell on the gold/…

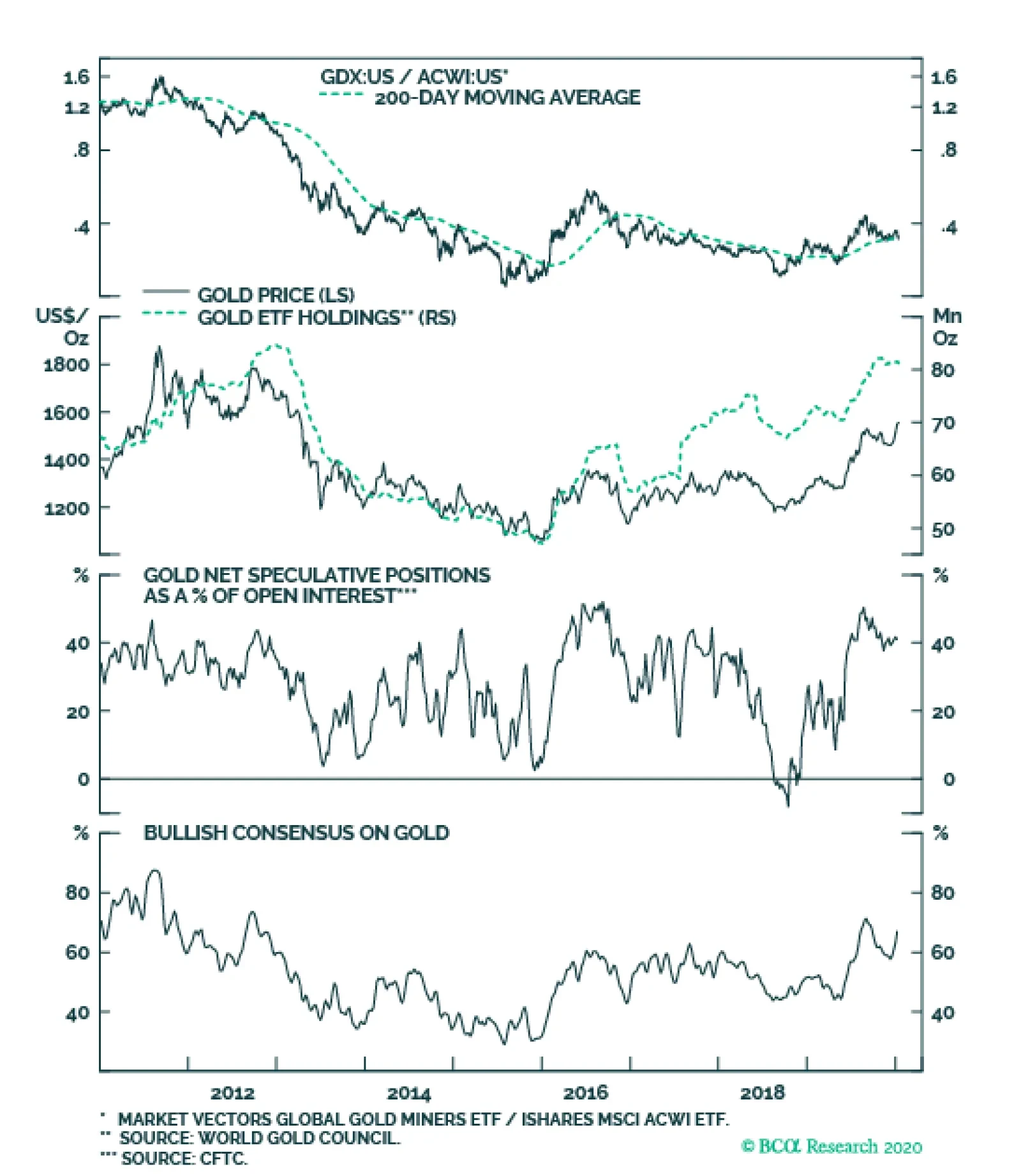

Overweight This week we reintroduced a modest portfolio hedge via augmenting exposure to global gold miners to overweight. Global gold miners have a lot going for them. Rising global policy uncertainty plays to their…

According to our Technical Indicator (TI), the extremely overbought situation in global gold miners has been worked out. Following a parabolic bull run from May to September, our TI is now drifting to the neutral zone. Relative…

Highlights Portfolio Strategy Gold bullion is on the move again, and falling real yields, a soft economic backdrop, a depreciating US dollar and resurgent geopolitical uncertainty, all argue for reintroducing a modest portfolio hedge…

The platinum-to-palladium ratio is at a level that would incentivize substitution in the pollution-control technology in gasoline-powered engines, and supports higher platinum content in diesel catalyzers. Nonetheless, swapping…

Gold looks a little overbought in the short term, and less monetary stimulus and a rise in rates next year would be negative factors. Nonetheless, the yellow metal remains a good hedge against our positive economic view going…

Highlights OPEC 2.0 production discipline and the capital markets’ parsimony in re funding US shale-oil producers will restrain oil supply growth. Monetary and fiscal stimulus will revive EM demand. These fundamentals will push…