Highlights The pandemic has a negative impact on households and has not peaked in the US. But a depression is likely to be averted. Our market-based geopolitical risk indicators point toward a period of rising political turbulence…

Highlights The global economy is in the midst of a painful recession. Monetary and fiscal authorities are responding forcefully to the crisis, but the lengths of the lockouts and quarantines remain a major source of downside risk…

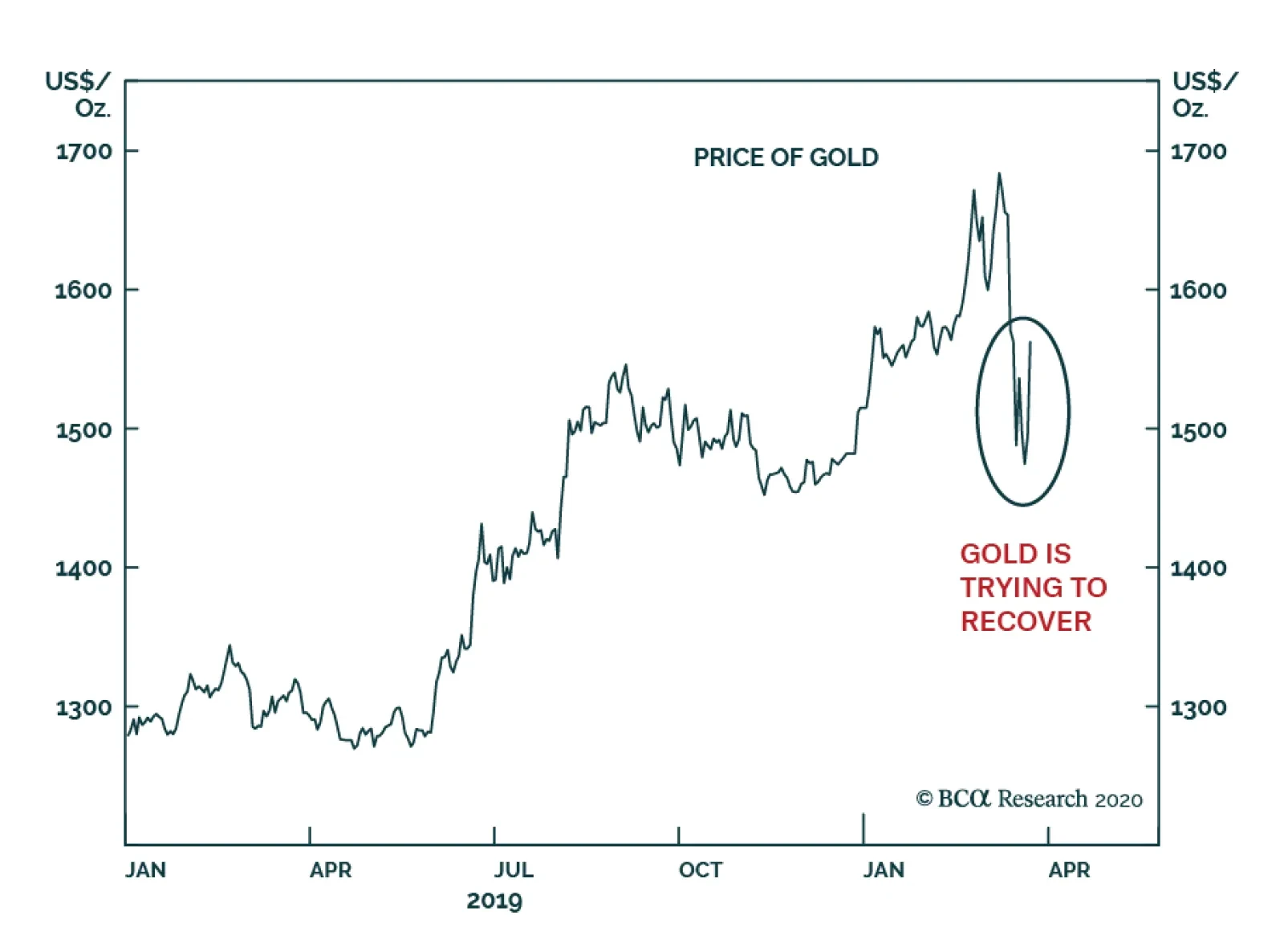

Gold’s weakness since March 9th was very concerning because it materialized as risk aversion and volatility spiked. Along with the weakness in the yen, it was the clearest symptom of the incapacity of the Fed to supply…

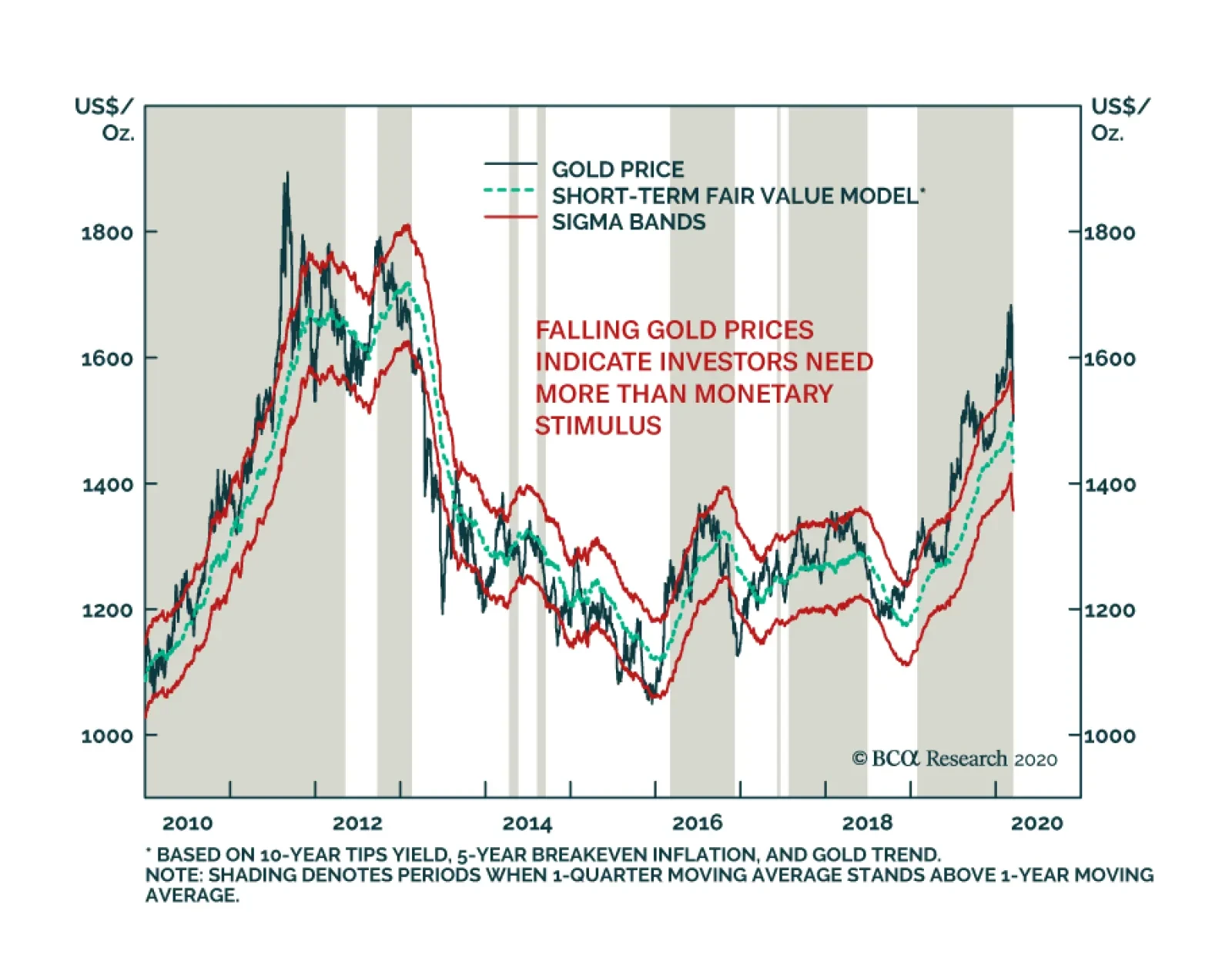

Investors and commentators have chalked up the fall in gold prices to margin calls. While this may have been true at first, fundamentals are now driving bullion prices lower. Our fair value model has turned lower as …

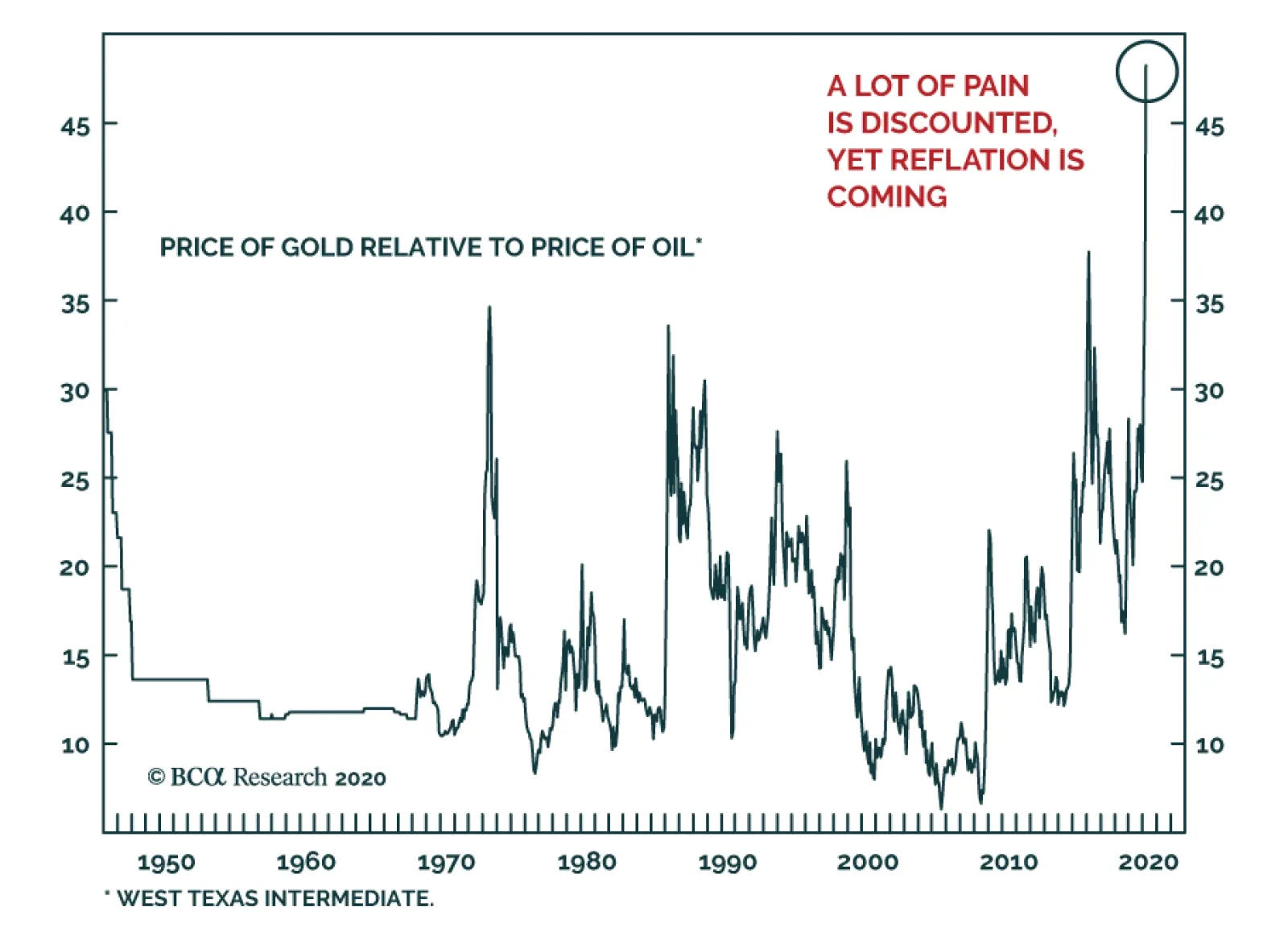

In response to the negative impact on economic activity of COVID-19 and to the supply shock created by the Saudi-Russia market-share war, the gold-to oil ratio has made a new all-time high. Moreover, the recent surge is,…

On Monday, gold suffered from the indiscriminate selling wave prompted by margin calls. In an environment where yields fell to an intraday low of 0.31% and the dollar sold off violently against both the yen and the euro, gold…

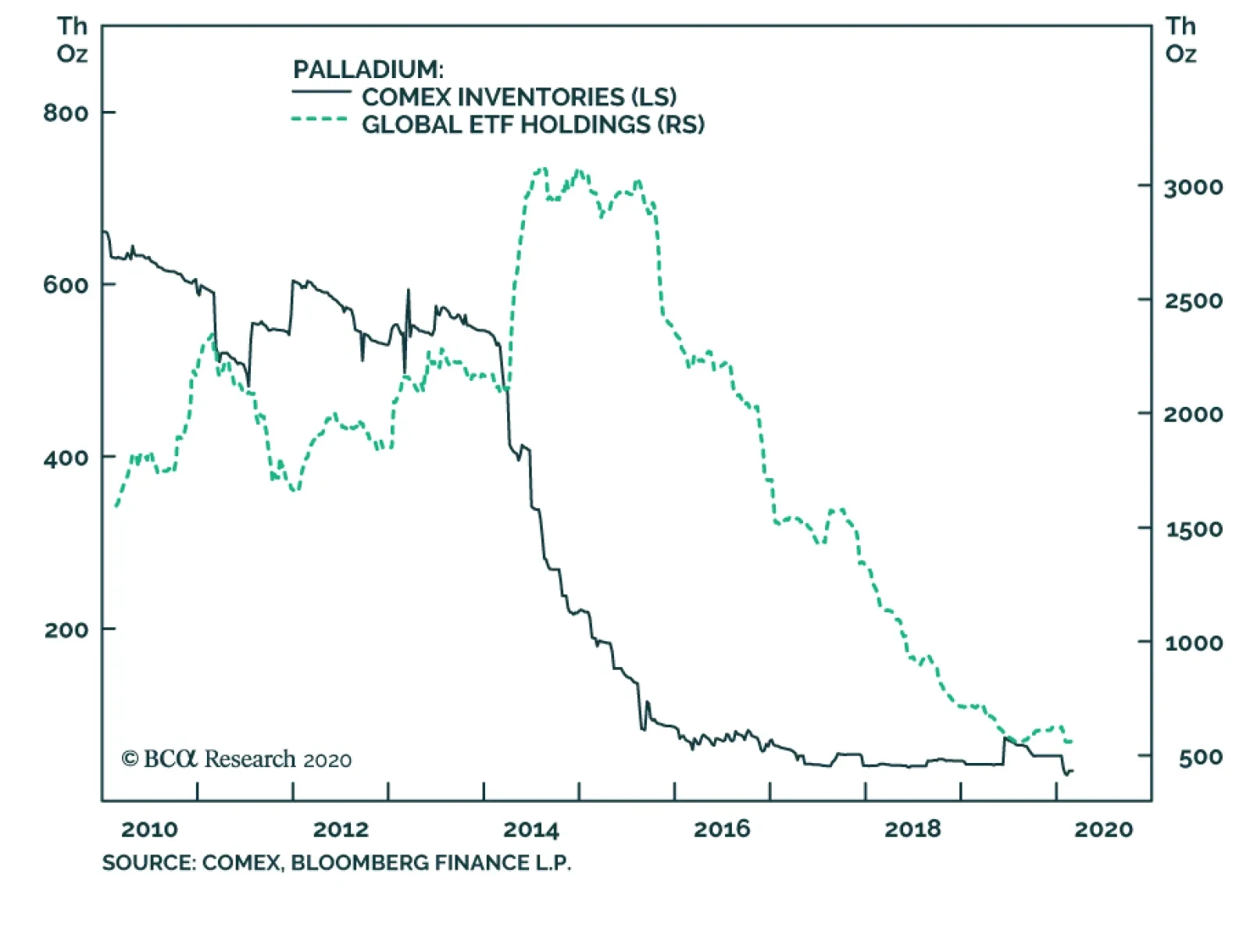

Yesterday, BCA Research's Commodity & Energy Strategy service wrote that it expects palladium prices will move higher on the expanding deficit, and backwardation in the forward curve will persist in incentivizing the…

Highlights Supply constraints and unstoppable demand growth – the result of stricter regulations requiring higher loadings in autocatalysts to treat toxic pollution in automobile-engine emissions – will continue to push…

Overweight Global bourses broke down yesterday, succumbing to immense pressure from the coronavirus epidemic gripping South Korea, Italy and Iran. Finally, lower profit growth expectations are weighing on extreme equity…

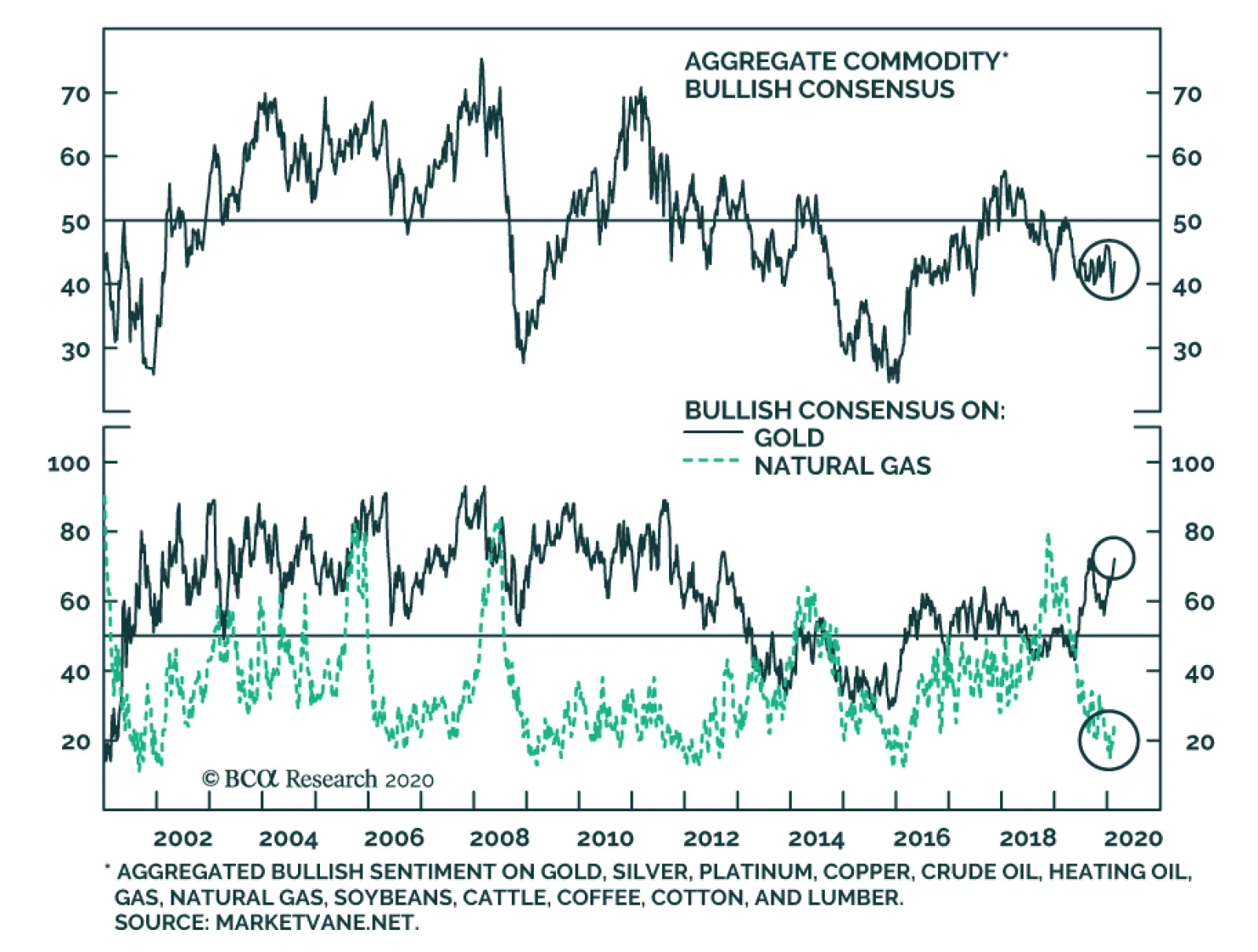

The broad commodity complex is oversold, but there has been a stark divergence in the performance of the underlying subsectors. Sentiment towards energy-related commodities such as crude oil and natural gas has soured, while…