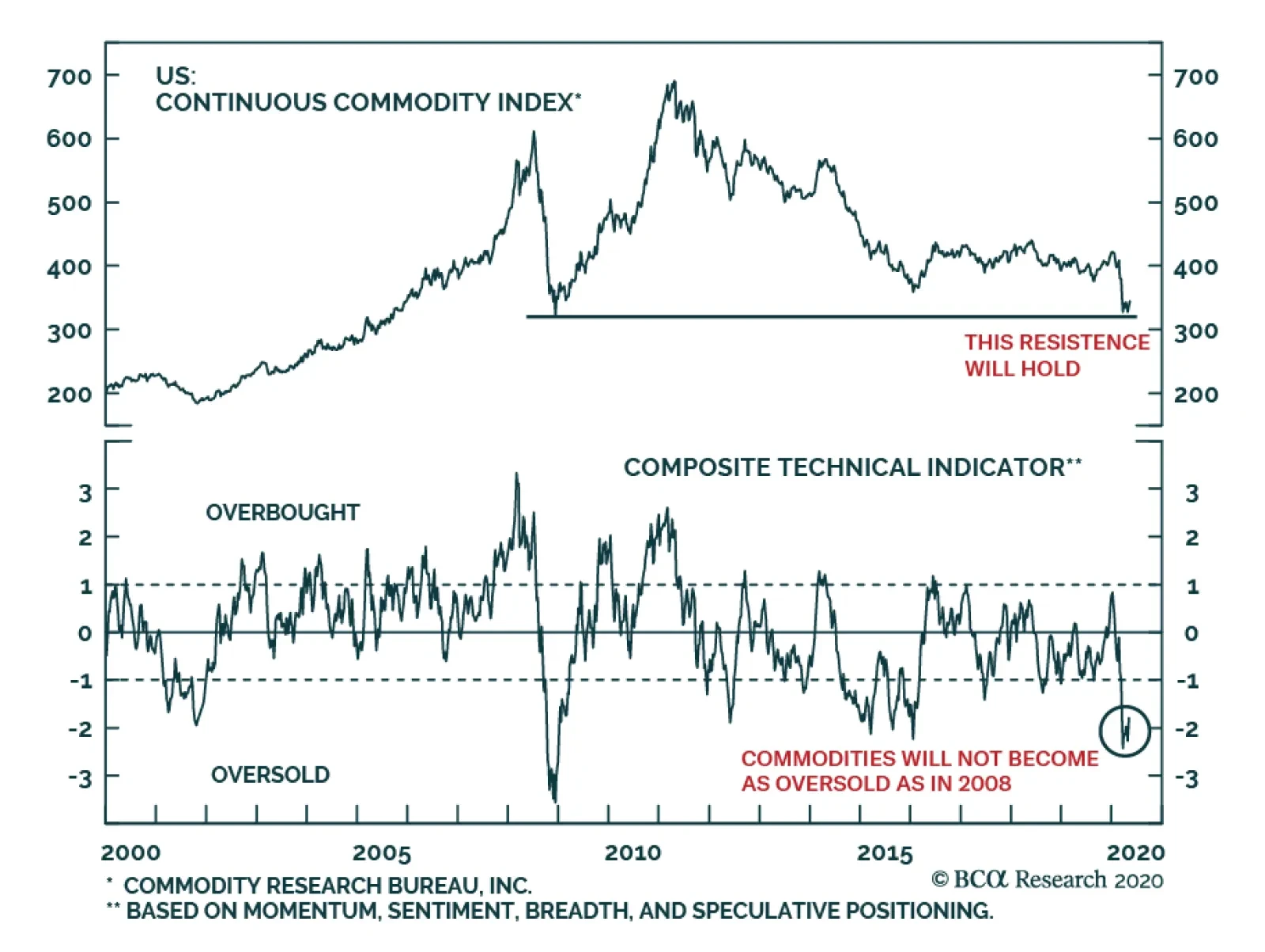

The continuous commodity index lingers near its April trough, which corresponds to the lowest levels since the depth of the GFC. We do not anticipate this important technical resistance to be breached. Our composite technical…

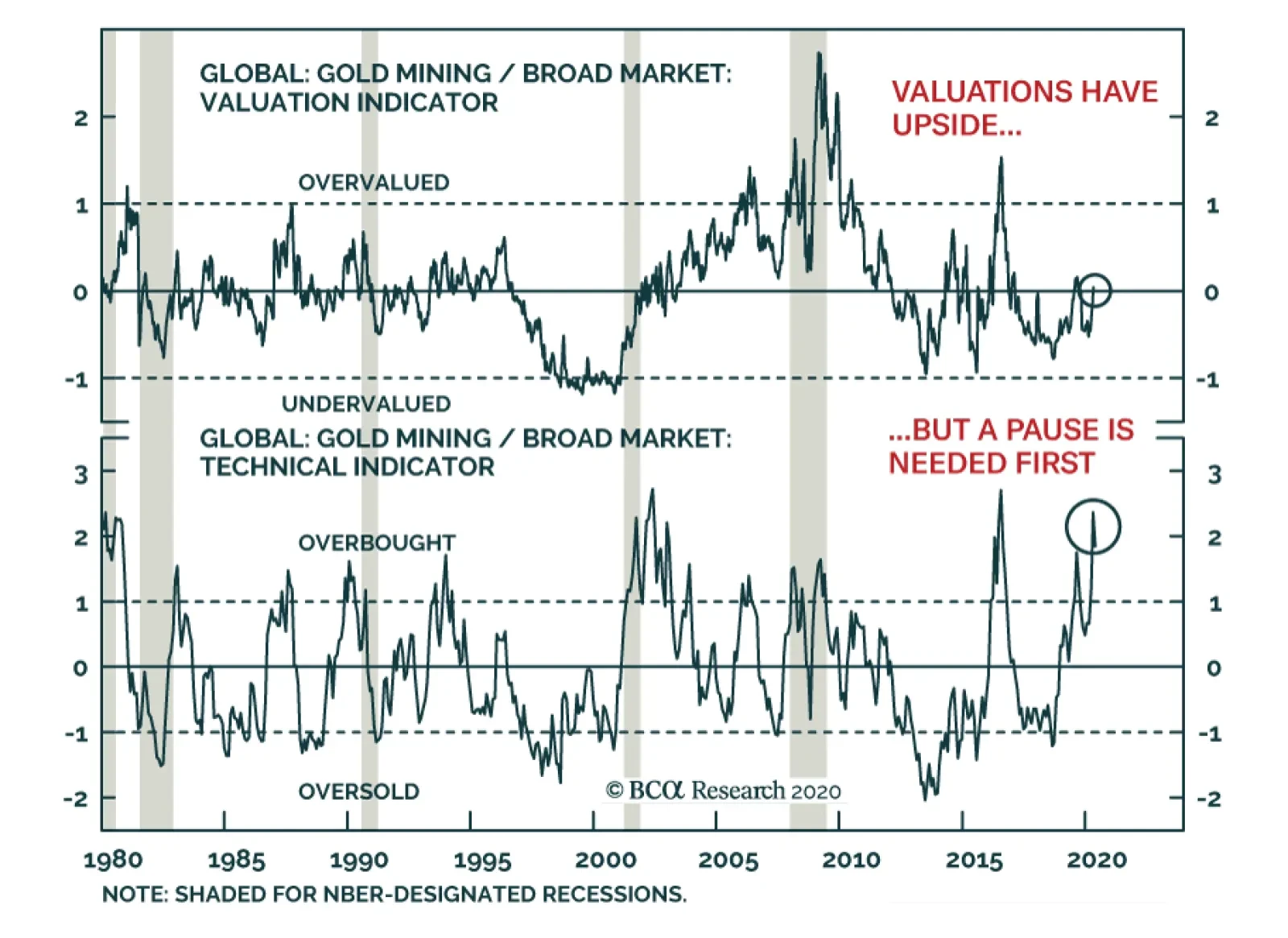

Since January, gold miners have outperformed global equities by nearly 50%. Can this sector continue to outperform the broad market? On a cyclical basis, gold miners likely have more relative upside. According to our US Equity…

Yesterday our 10% rolling stop got triggered on the long S&P oil & gas exploration & production (E&P)/short global gold miners pair trade. We are compelled to reinstate this intra-commodity pair trade, despite…

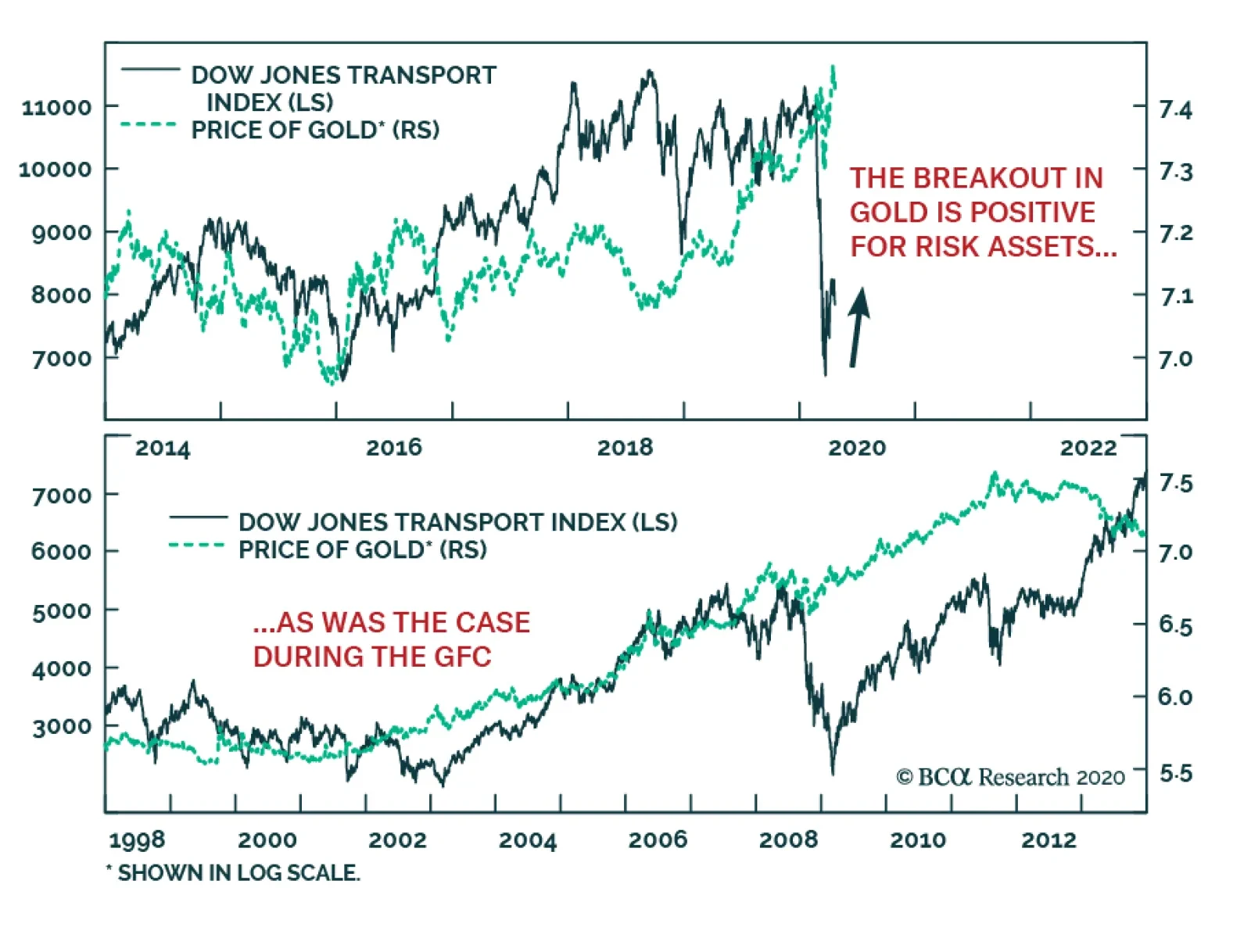

We previously wrote that the broad market would not stabilize until transportation stocks hit a floor. So far, the Dow Jones Transport Index seems to have done so on March 23, the same day as the broad market. Moreover, despite…

Highlights With interest rates near zero around the world, balance sheet policy will become an important driver for currencies. Should the global economy need another dose of monetary stimulus, yield curve control (YCC) and direct…

Silver has traveled on a wild rollercoaster. After peaking in April 2011 near $50/oz., it has nearly continuously underperformed gold, and in early March, traded at a record low relative to the yellow metal. At first, the recent…

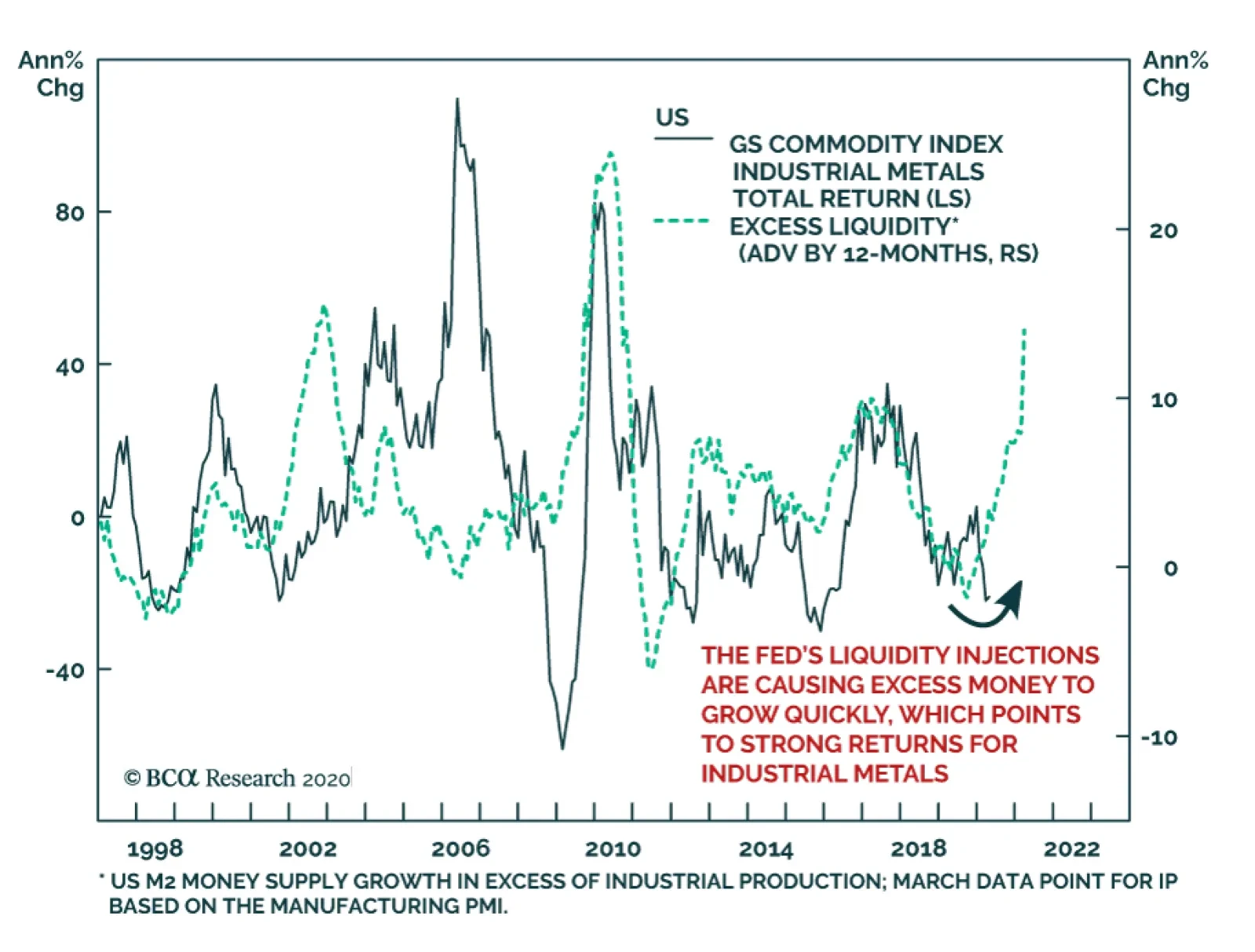

The Fed is lifting the monetary base as it aggressively injects excess reserves in the banking system via its QE program. Moreover, the Fed is now supporting the corporate bond market and will also start buying small business…

Highlights Extreme global economic uncertainty has pushed demand for USD higher, and forced investors to liquidate gold holdings to raise cash for margin calls and to provide precautionary balances. Gold endured a succession of down…

Highlights Recommended Allocation The outlook for markets over the next few months is highly uncertain. On the optimistic side, new COVID-19 cases are probably close to peaking (for now), and so equities could continue to…

Dear Client, I will be discussing the economic and financial implications of the pandemic with my colleague Caroline Miller this Friday, March 27 at 8:00 AM EDT (12:00 PM GMT, 1:00 PM CET, 8:00 PM HKT). I hope you will be able to join…