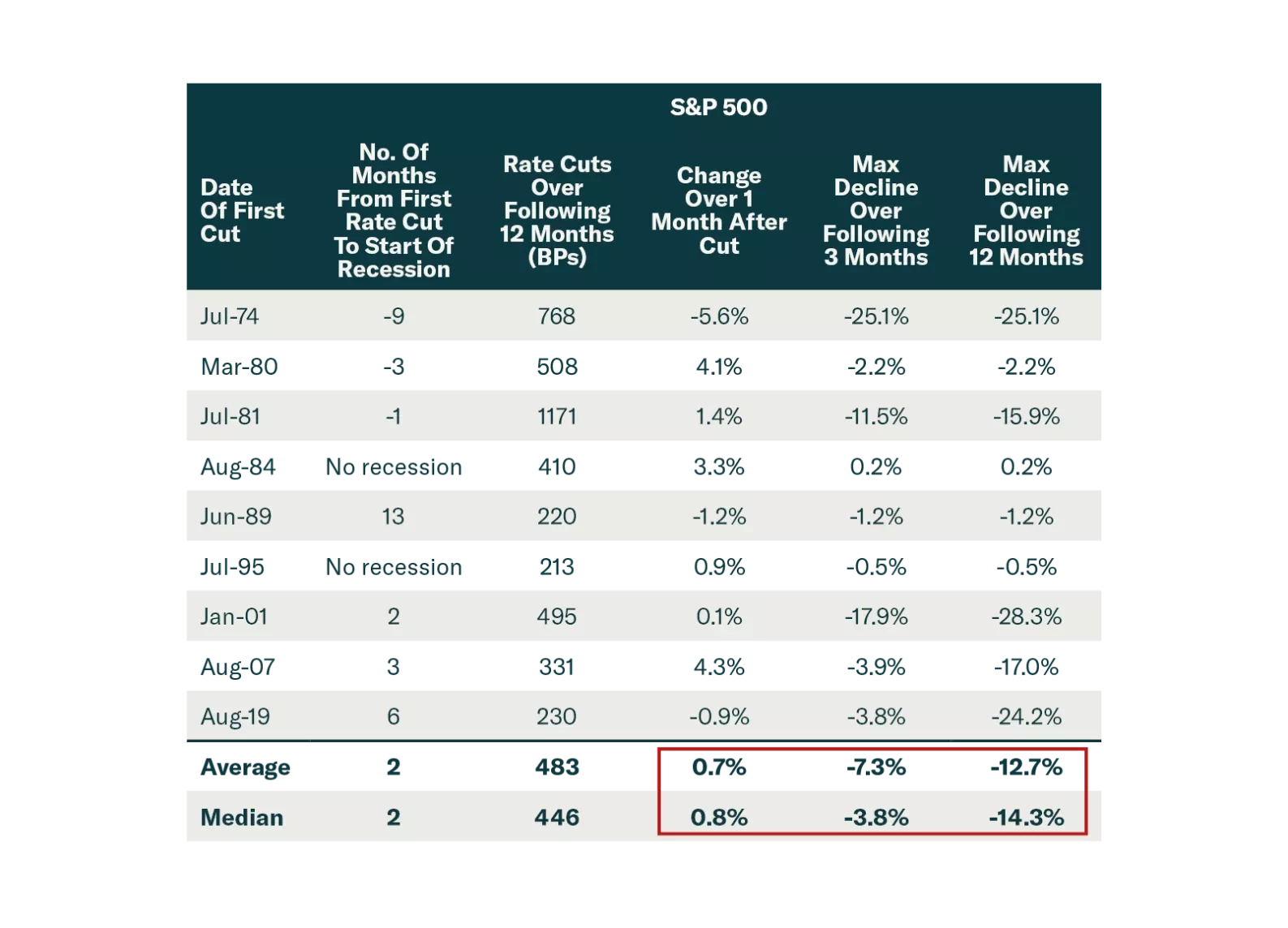

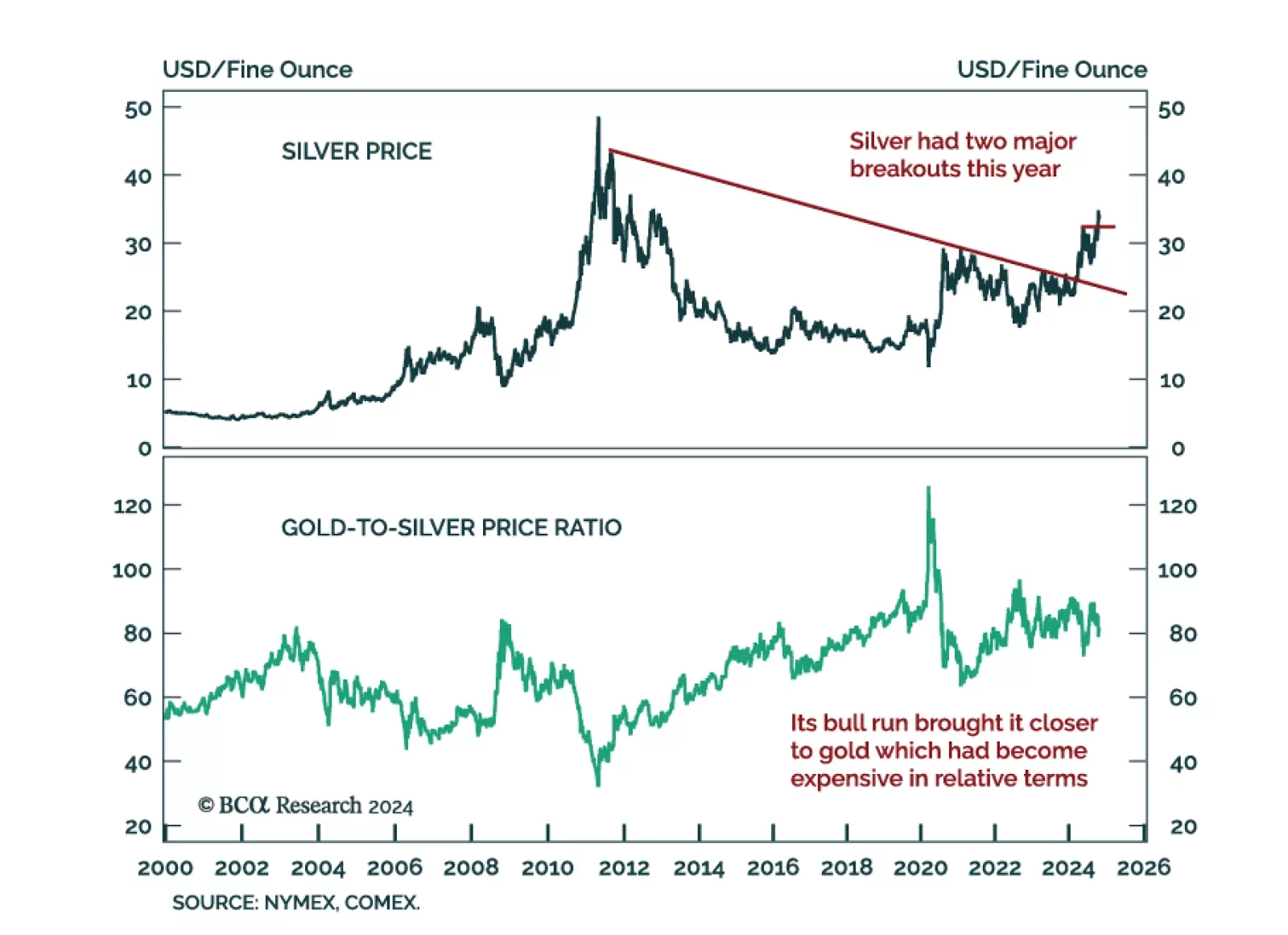

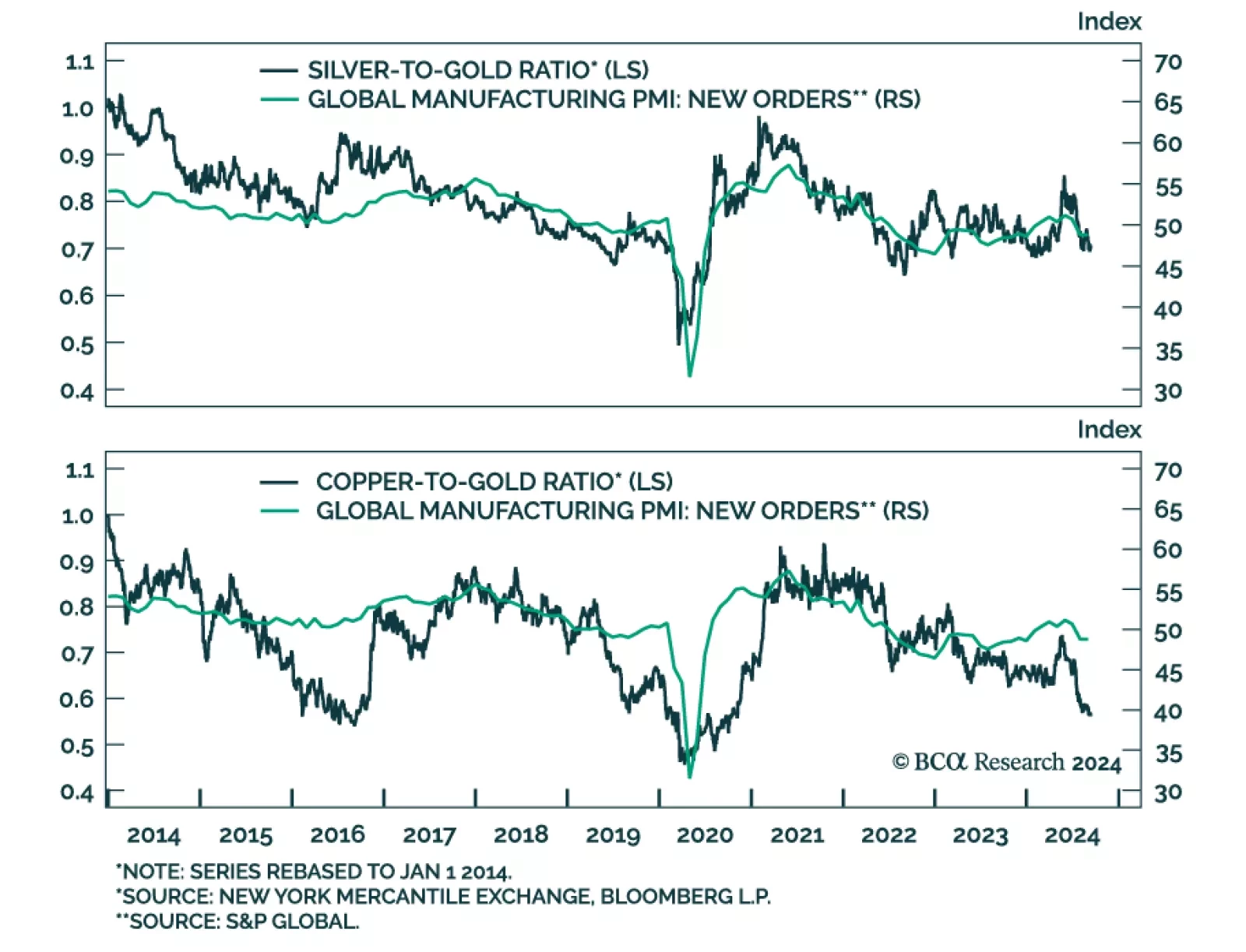

Silver has shone this year, especially after it breached a multi-decade downward slopping trendline. Silver is a precious metal, but its heavy usage in industrial processes makes us wonder whether it is sending a bullish message…

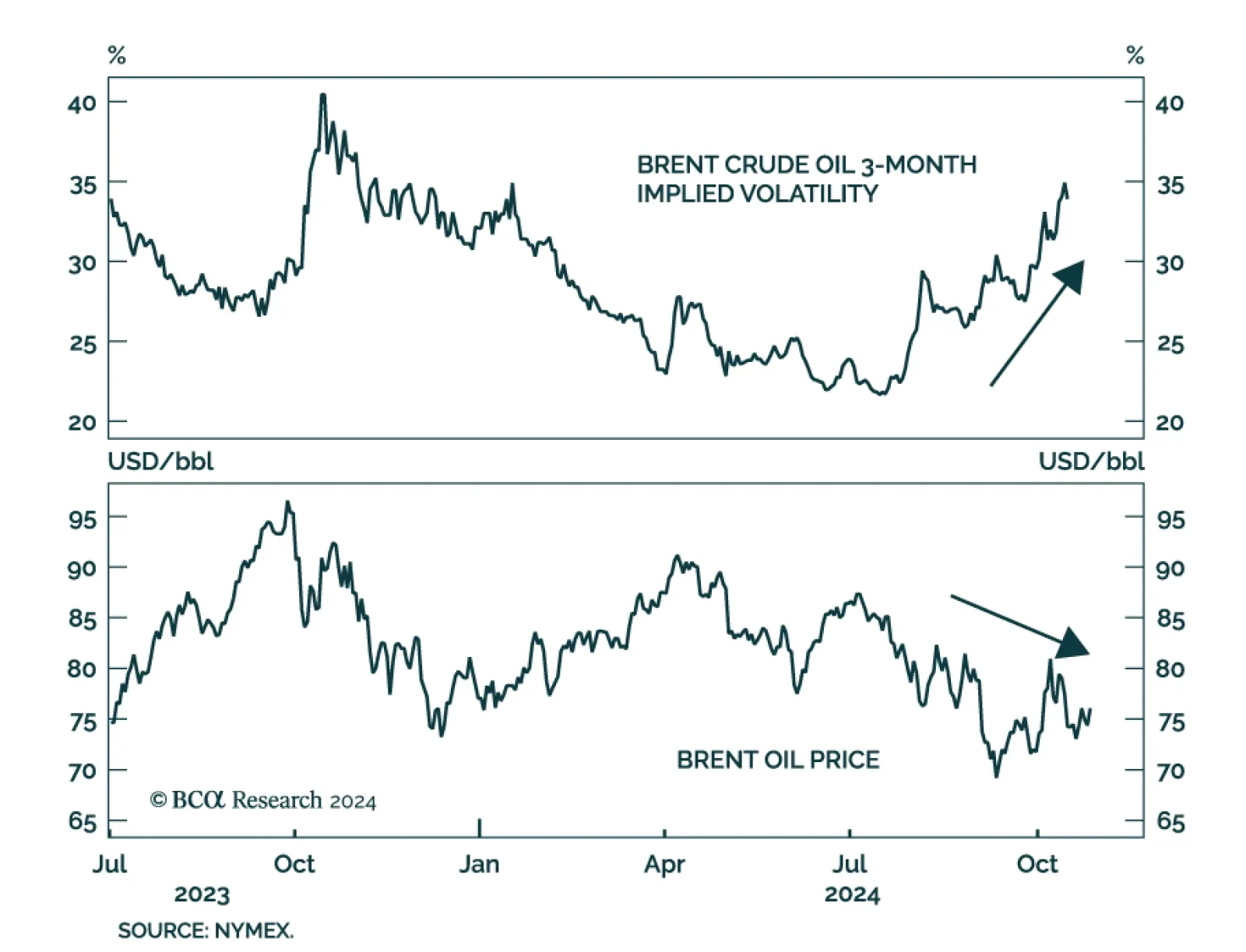

In a trendless yet volatile year for oil, Israel’s retaliatory attack on Iran this weekend is a reminder the outlook is fraught with geopolitical risks. Risks are usually expressed as a geopolitical price premium, but this…

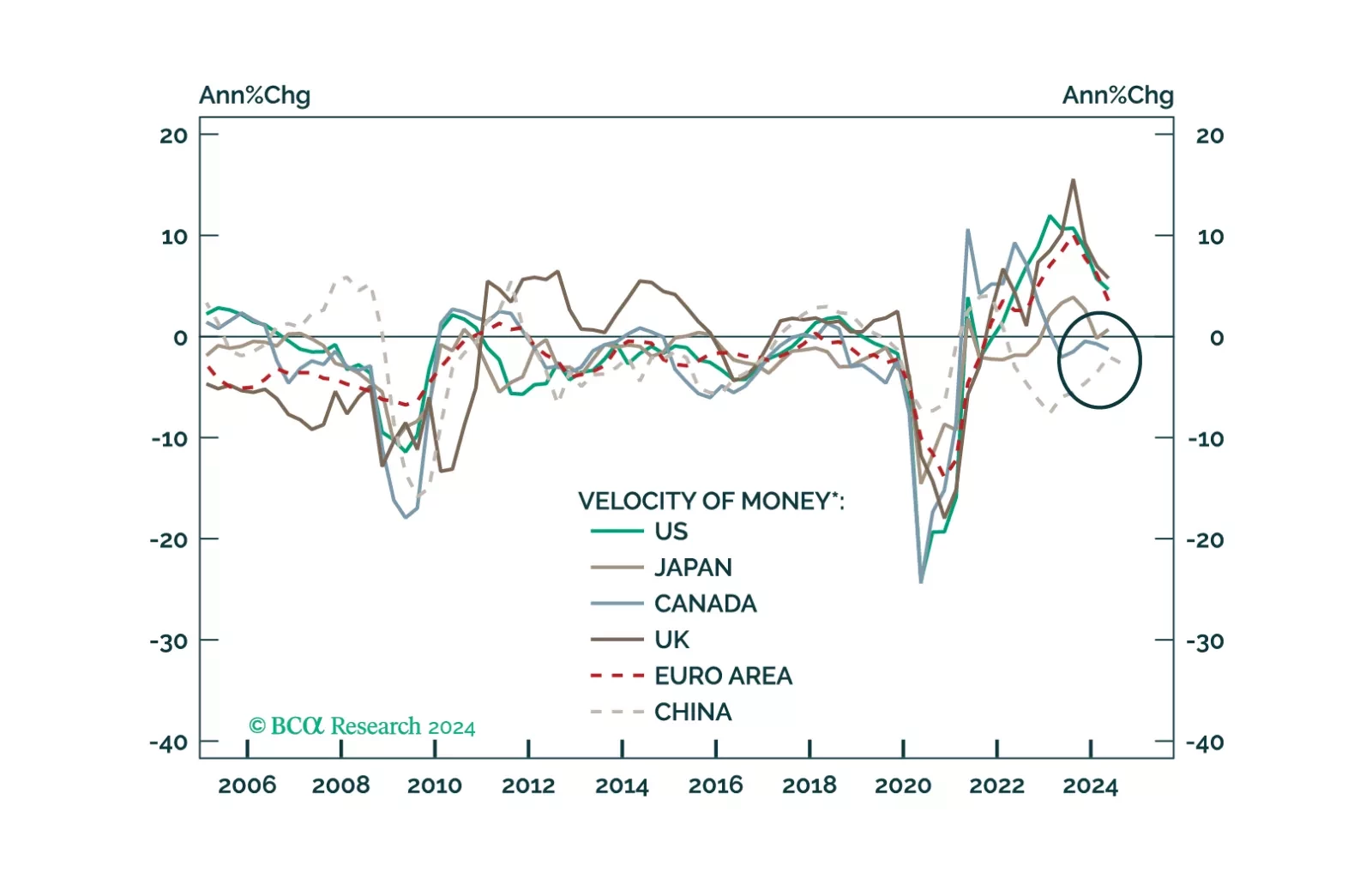

This Insight looks at the likely direction of bond yields and the dollar, from the lens of money velocity.

This Insight looks at the likely direction of bond yields and the dollar, from the lens of money velocity.

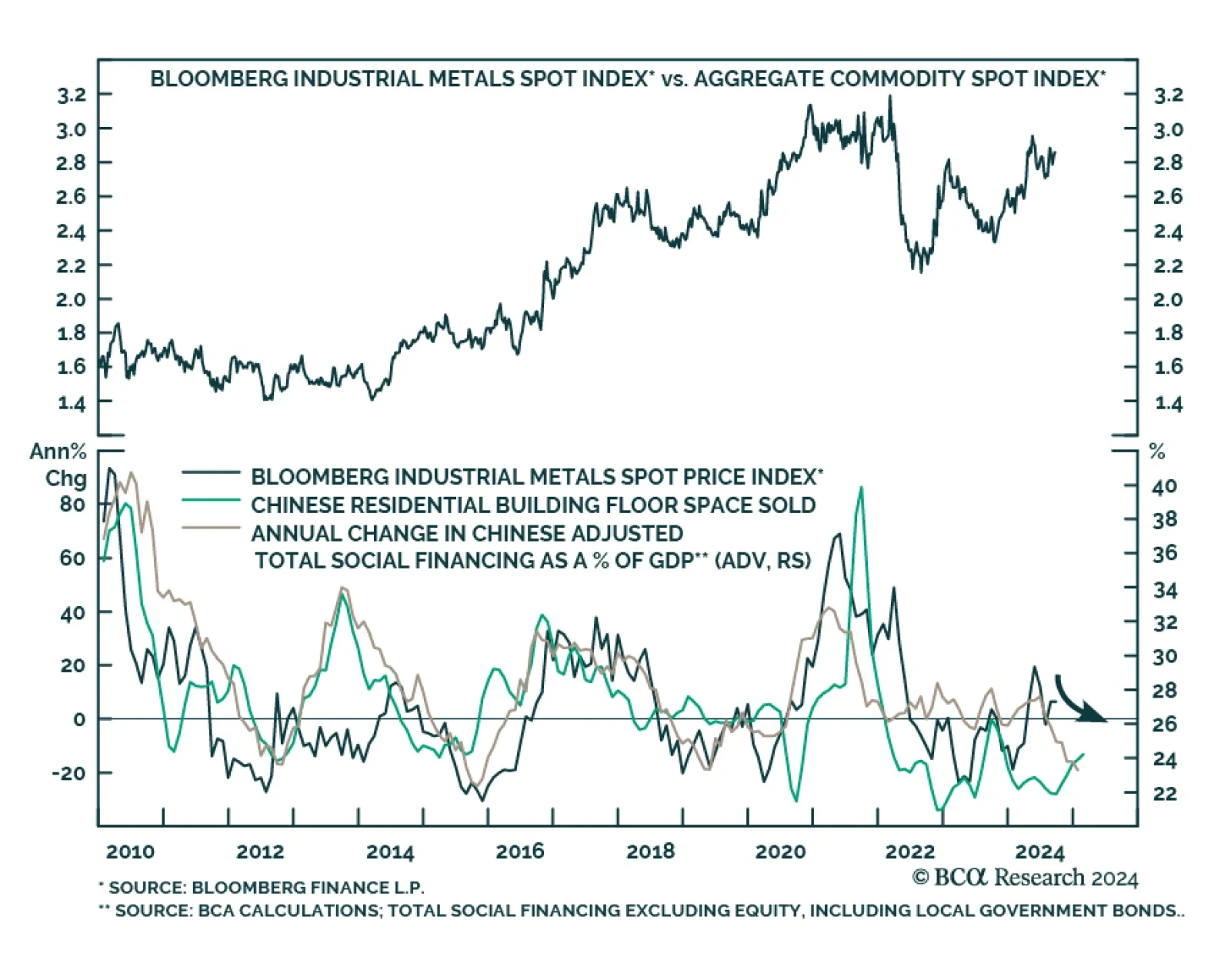

While recent cross-asset developments have sent a risk-on signal, with equities and bond yields both higher, the commodity complex has recently been sending a more somber message. “Dr. Copper” is a bellwether for…

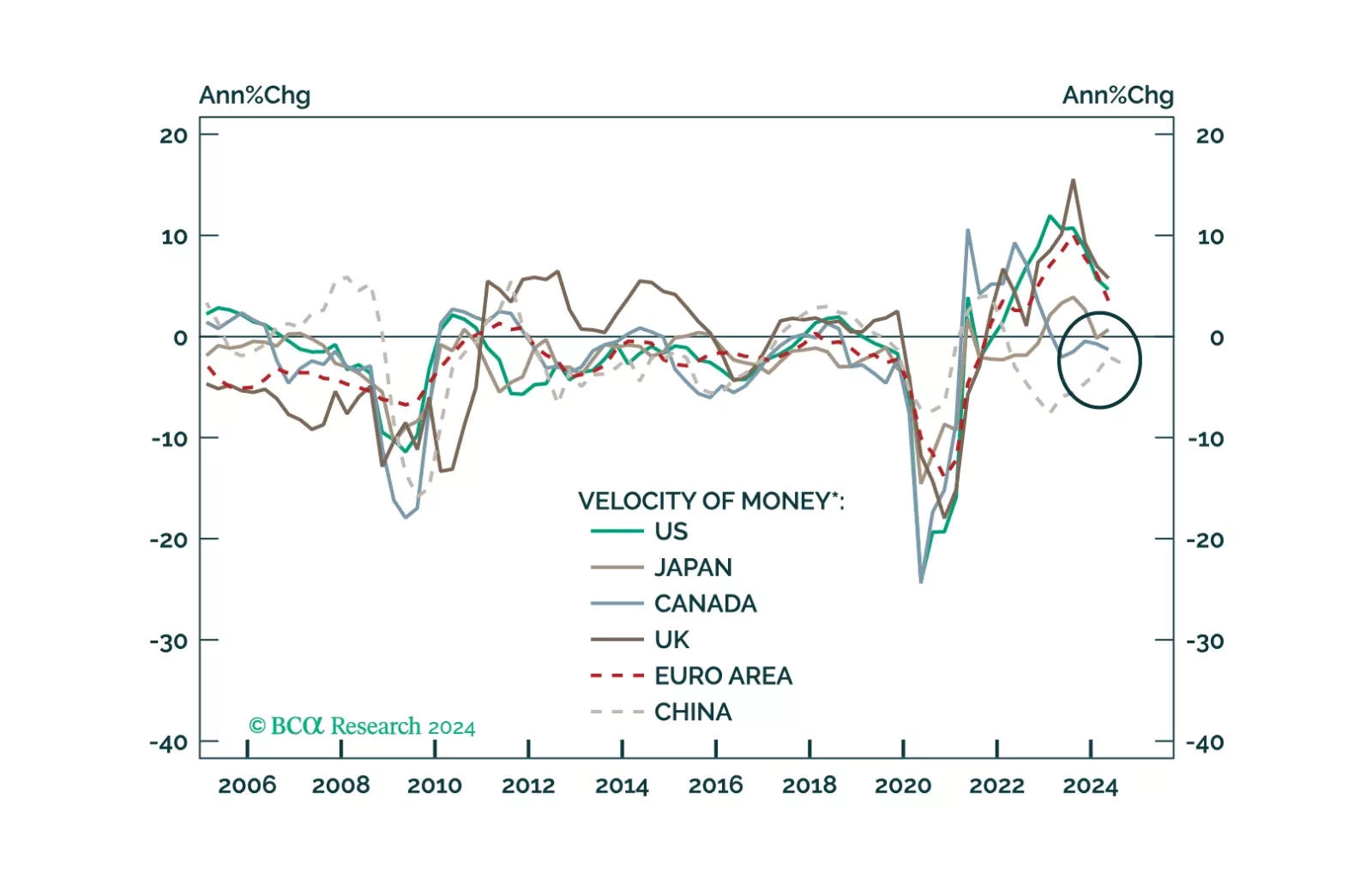

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay…

Industrial metals returned a whopping 6% over the past week. Bullish investor sentiment is likely driving these gains. The soft-landing narrative has been gaining traction in recent days with markets pricing in increased odds…

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that…

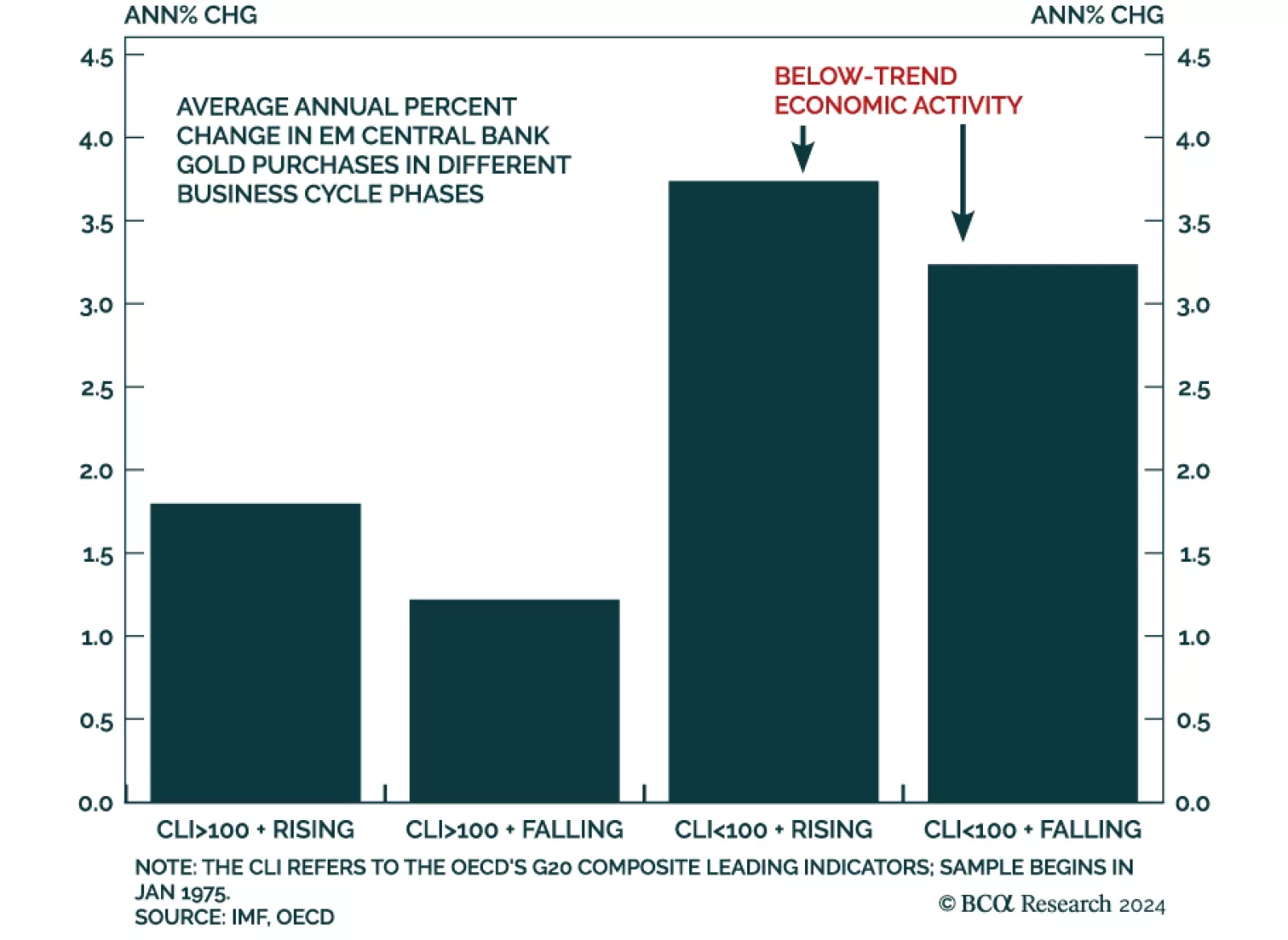

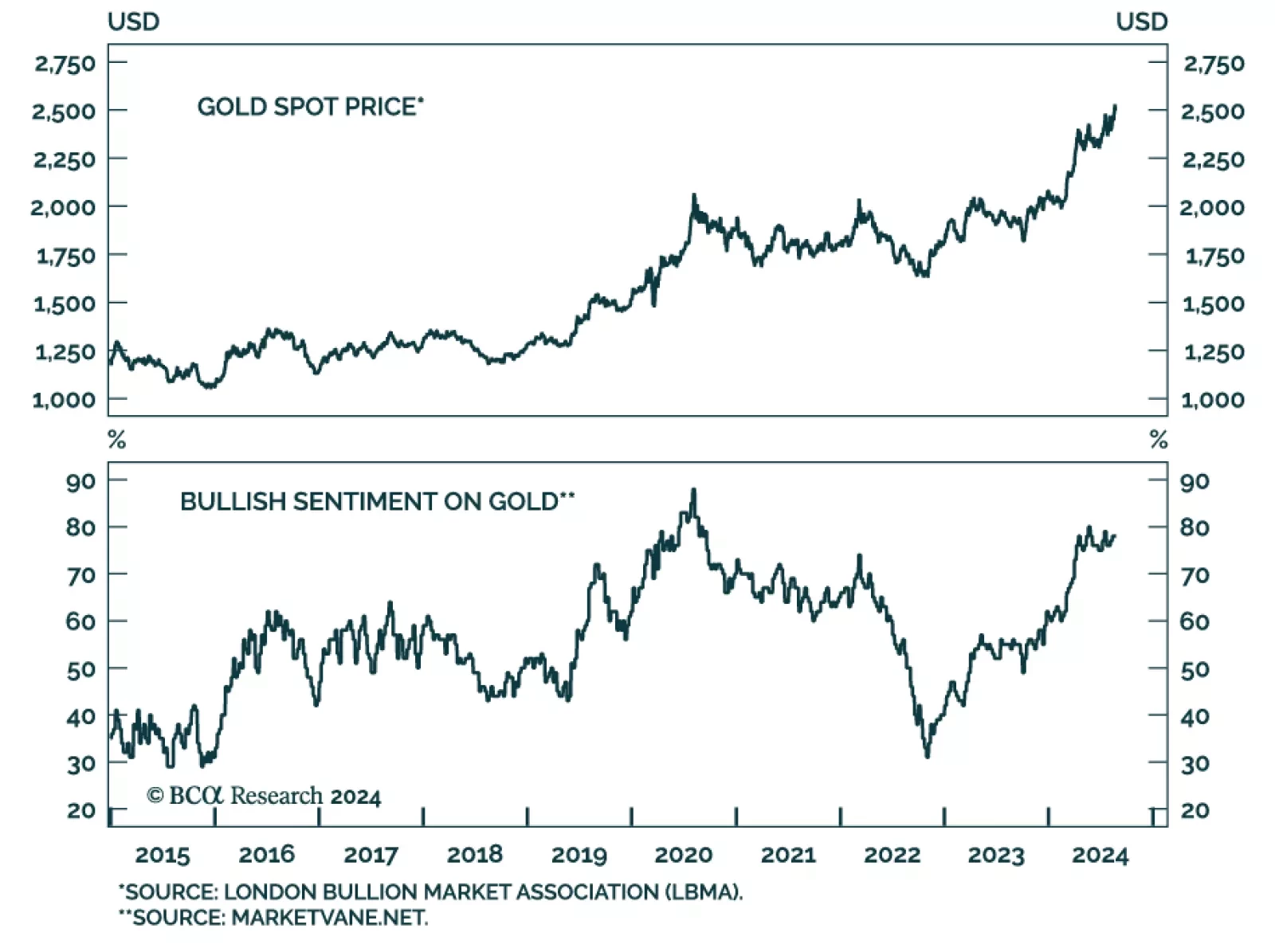

According to BCA Research’s Commodity & Energy Strategy service, central banks will continue to be a key source of gold demand. Central bank purchases in the first half of this year exceeded first-half purchases in…

Gold reached new all-time highs earlier this week. The yellow metal has returned a whopping 20.2% YTD, with the rally reaccelerating over the past month. Gold prices are inversely correlated with the dollar, and the expectations…