Our reinstated long XOP / short GDX pair trade hit its rolling 10% stop intraday yesterday, forcing us to crystalize 32% gains in just over a month. While our original thesis for this pair trade that was outlined in the April…

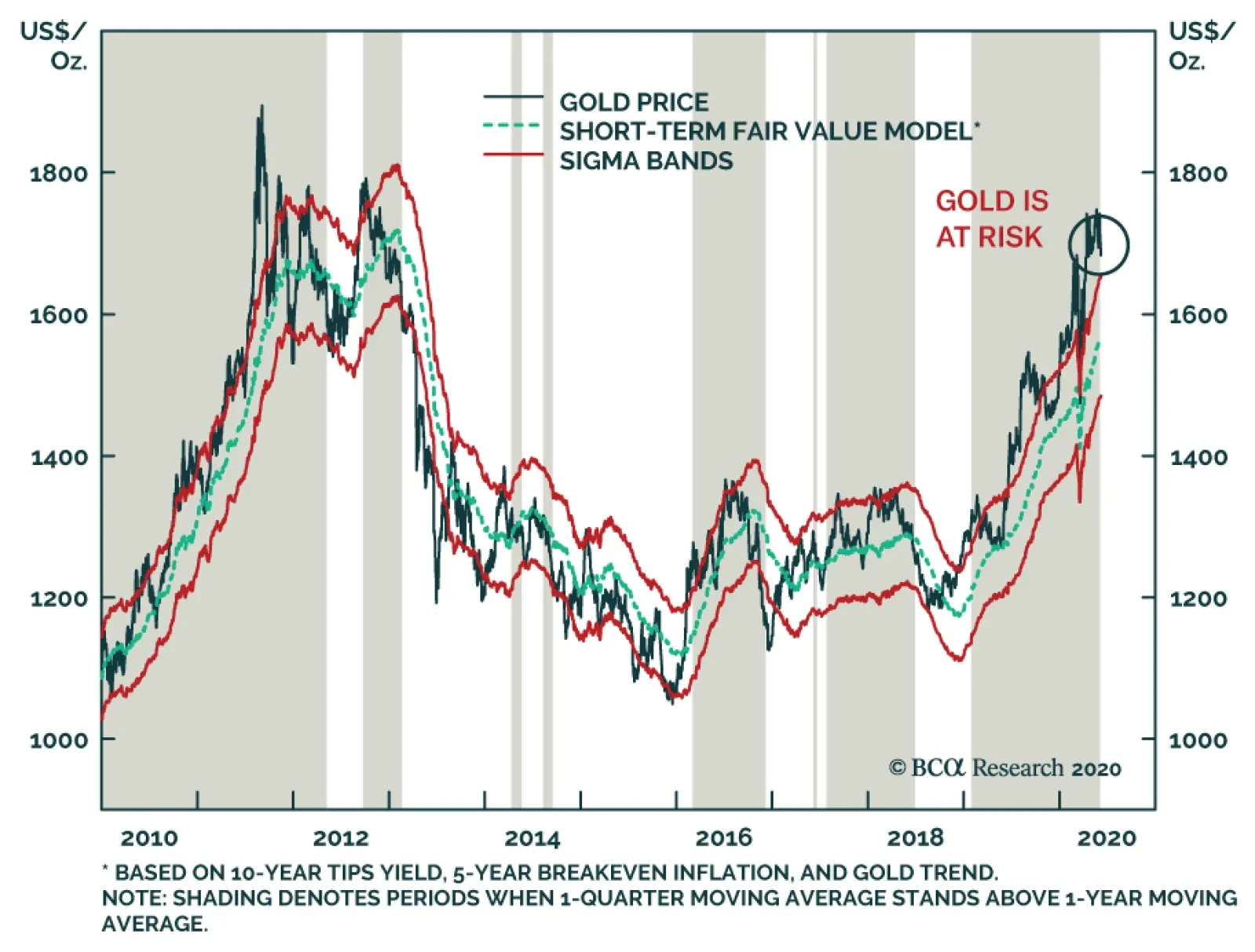

Gold will not benefit from the dollar’s depreciation. Gold has been overextended relative to our Short-Term Fair Value model for the bulk of 2020. Two factors allowed this development. First, the model itself was…

Our reinstated long S&P oil & gas exploration & production (E&P)/short global gold miners pair trade is up again near the 20% mark. This parabolic rise compels us to re-institute a 10% rolling stop in order to…

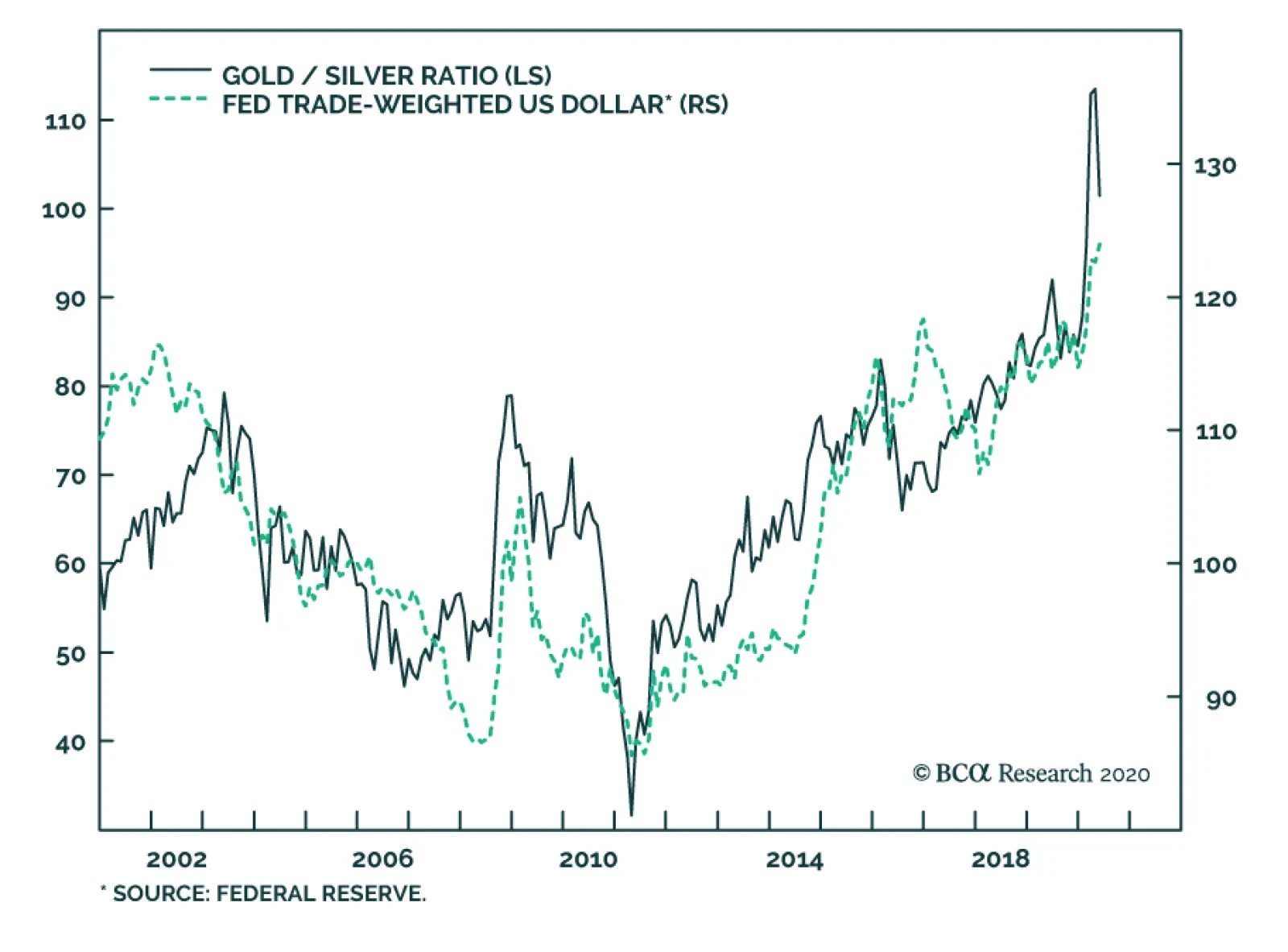

Last Friday, BCA Research's Foreign Exchange Strategy service concluded that a bearish view on the dollar can be expressed via shorting the GSR. With both first- and second-quarter GDP likely to contract severely around…

Dear client, In lieu of our regular weekly report next week, we will hold a webcast on Thursday at 10:00 am ET discussing both tactical and strategic currency considerations. The format will be a short presentation, followed by a Q&…

Highlights German bunds and Swiss bonds are no longer haven assets. The haven assets are the Swiss franc, Japanese yen, and US T-bonds. Gold is less effective as a haven asset. During this year’s coronavirus crash, the gold…

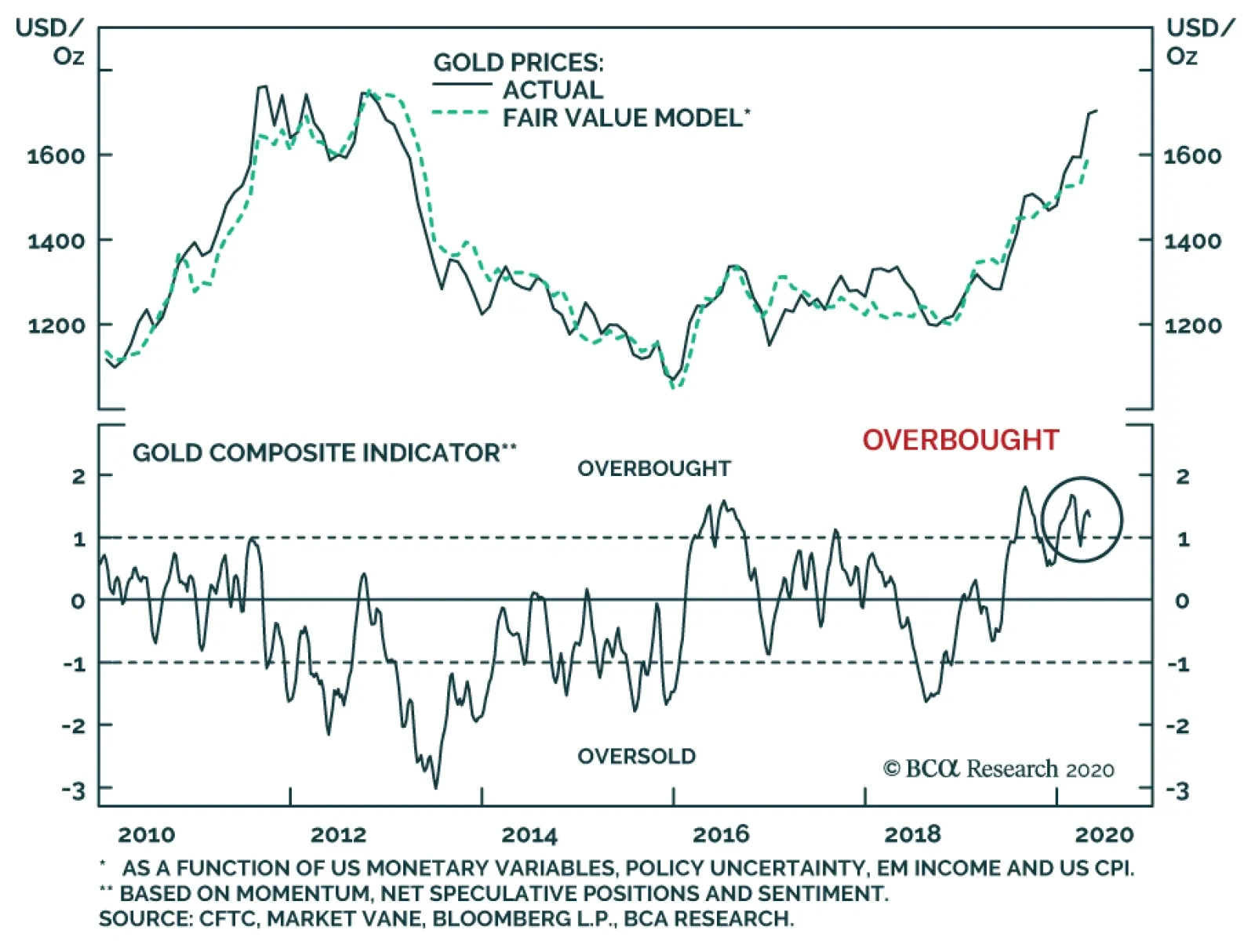

Highlights Fear of deflation – especially at current debt levels – will keep central-bank policy looser for longer. As a result, monetary authorities will do whatever it takes to revive inflation and inflation expectations…

BCA Research continues to favor precious metals as portfolio hedges. Our Commodity & Energy Strategy service estimates that gold should benefit from the re-emergence of geopolitical tensions, particularly the growing Sino-US…

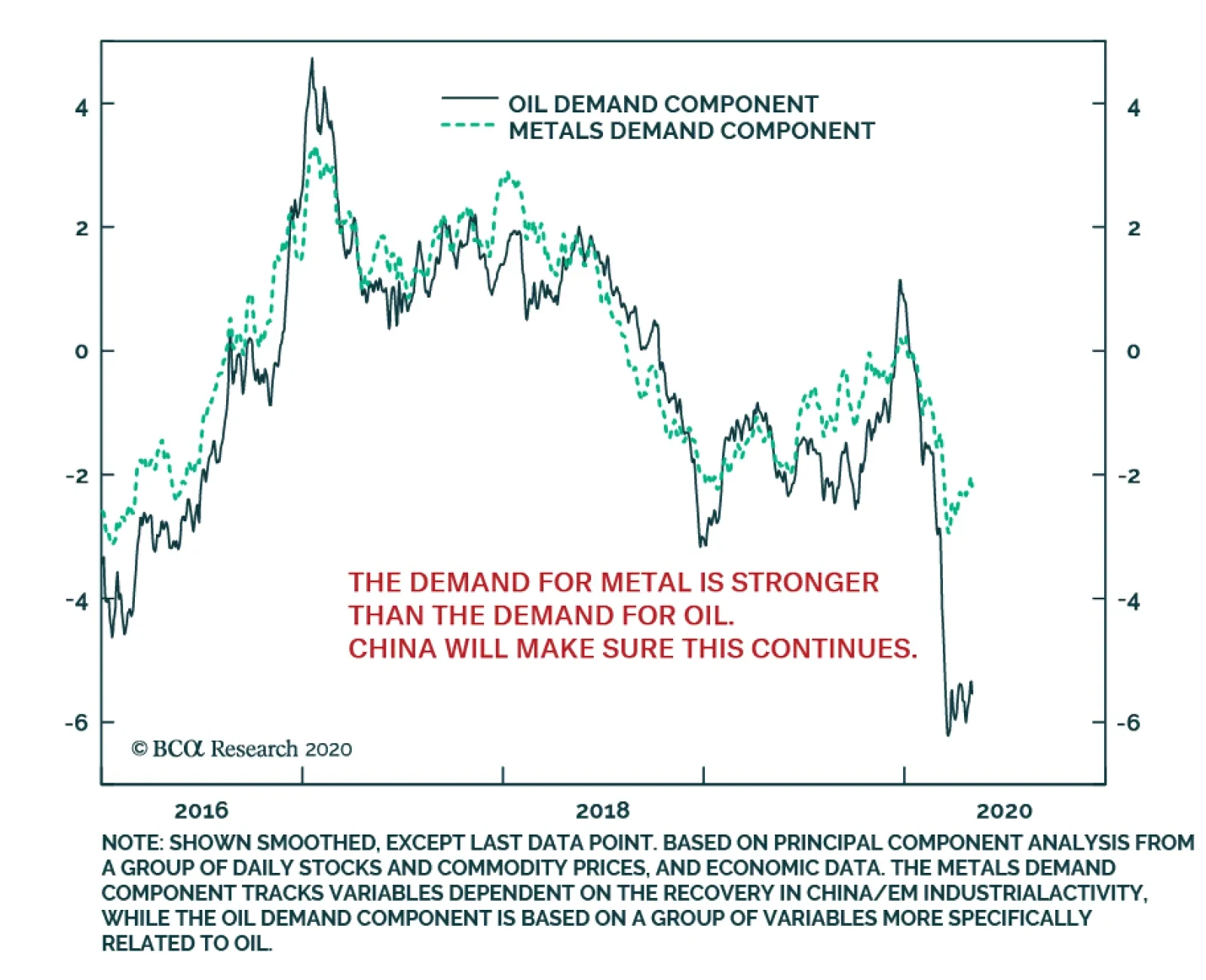

Yesterday, BCA Research's Commodity & Energy Strategy service examined the outlook for the demand for industrial metals. Prices for base metals likely will continue to rebound from the collapse in GDP caused by…

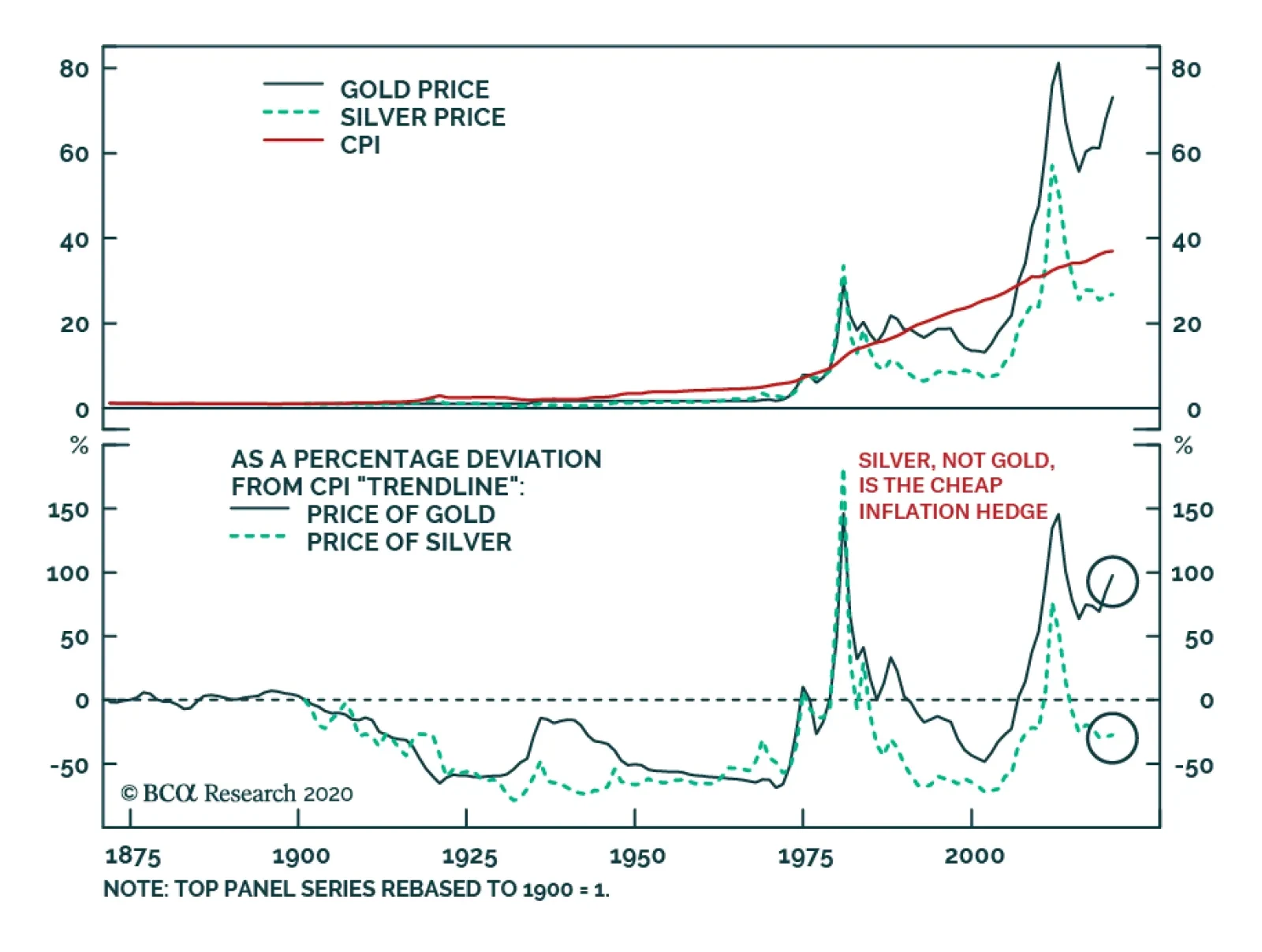

Gold has attracted a lot of attention from investment managers. Gold is perceived as an excellent inflation hedge that will perform well if global central banks try to debase their currencies and monetize the flood of government…