Please note that we will be on our summer holidays next week. Our next report will come out on August 20. Highlights The 30-year bond yield is the puppet master pulling the strings of all other investments. Where 30-year bond…

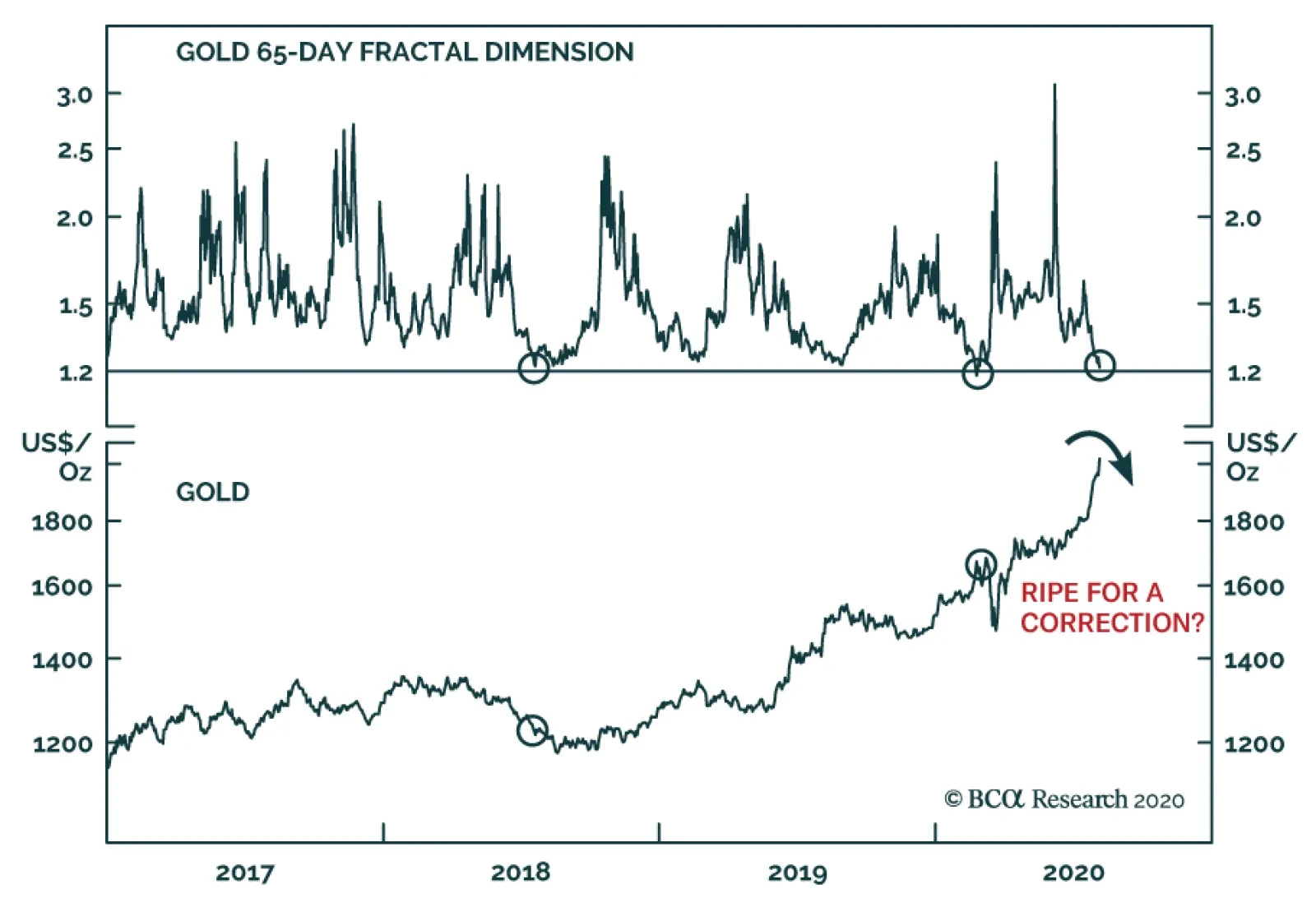

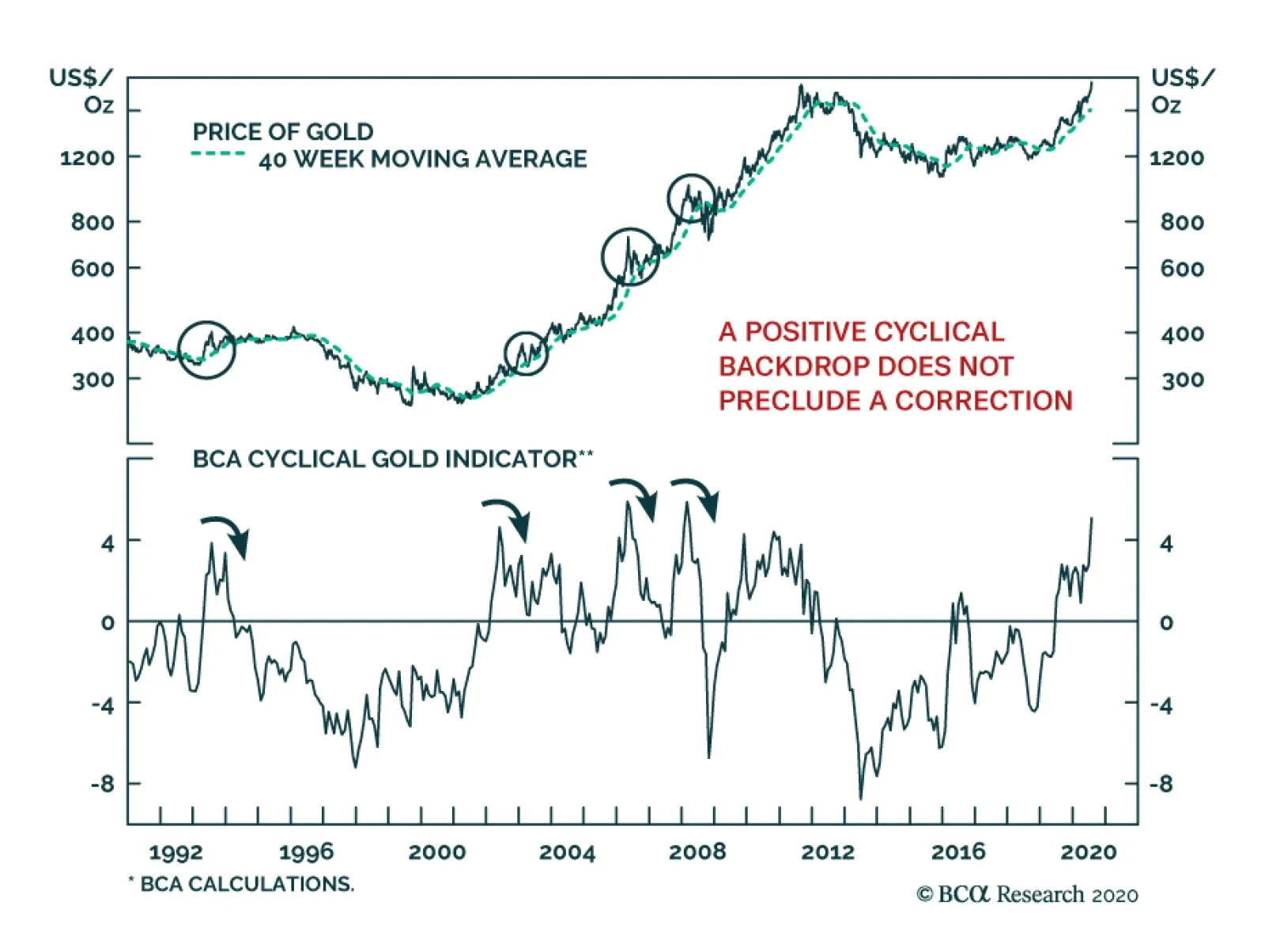

Boosted by declining real interest rates and rising inflation expectations, gold punched through the psychologically important $2000/oz level. From a tactical perspective, gold is now vulnerable to a countertrend correction. Our…

The FOMC’s dovishness further fed the rally in gold prices. An extended period of accommodative policy leads to lower real rates and a weaker dollar, which creates two major positives for gold prices. For now, cyclical…

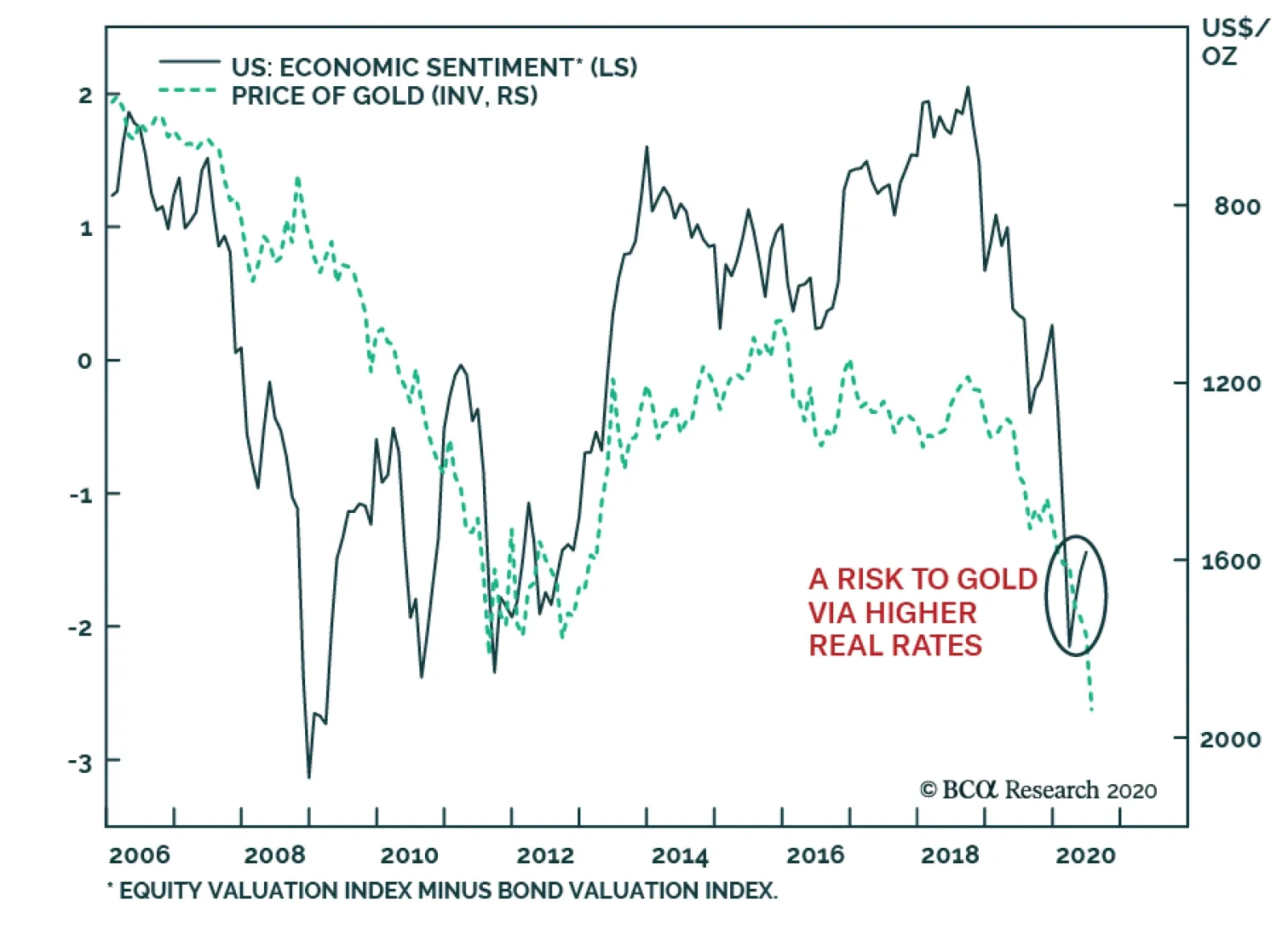

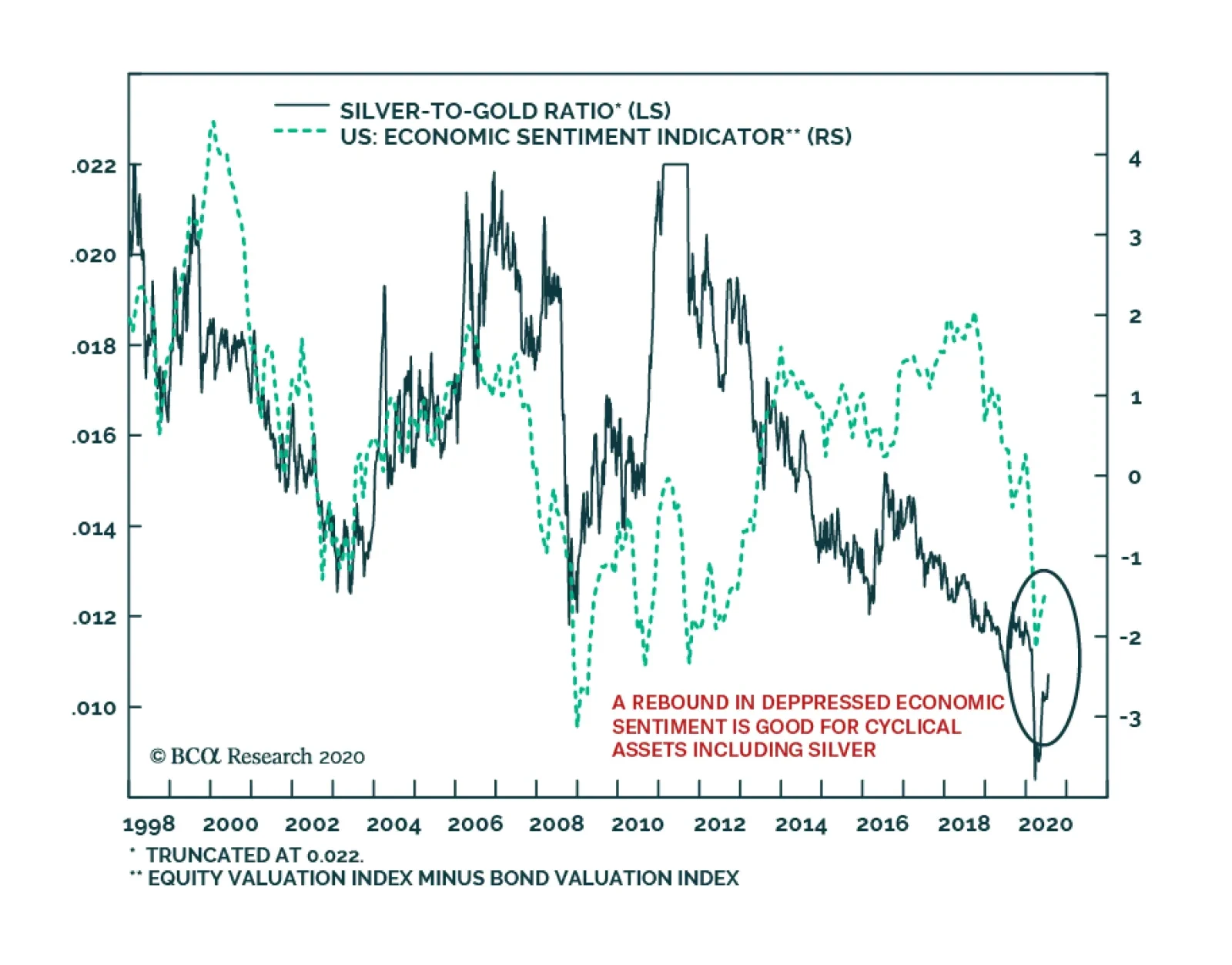

The recent rally in gold prices has happened in conjunction with a marked deterioration in our Economic Sentiment Index. This index reflects the difference between our Valuation Index for stocks relative to that of bonds. When…

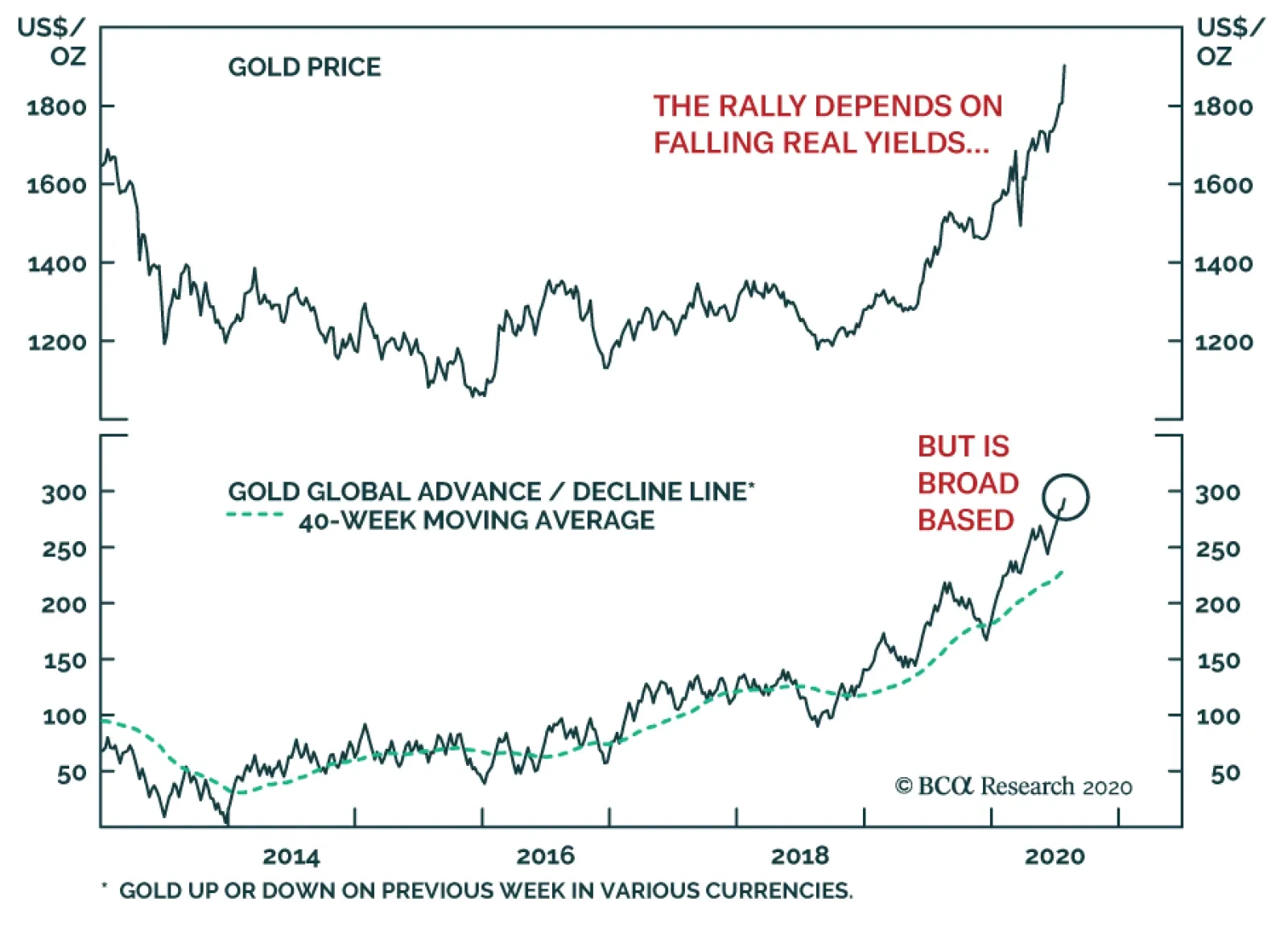

The weakness in the US dollar has supercharged the rally in gold. However, more than the greenback’s depreciation supports gold prices. Our advance/decline line for gold shows that the yellow metal’s strength is…

Highlights The dollar is on the verge of a significant breakdown. If the DXY punches through 94, it will likely mark the beginning of a structural bear market. The most recent catalyst – fiscal support in the euro zone –…

Our global growth sentiment indicator remains depressed. This indicator is simply the difference between our equity valuation index and our bond valuation index. Investors pushing equities in overvalued territory relative to…

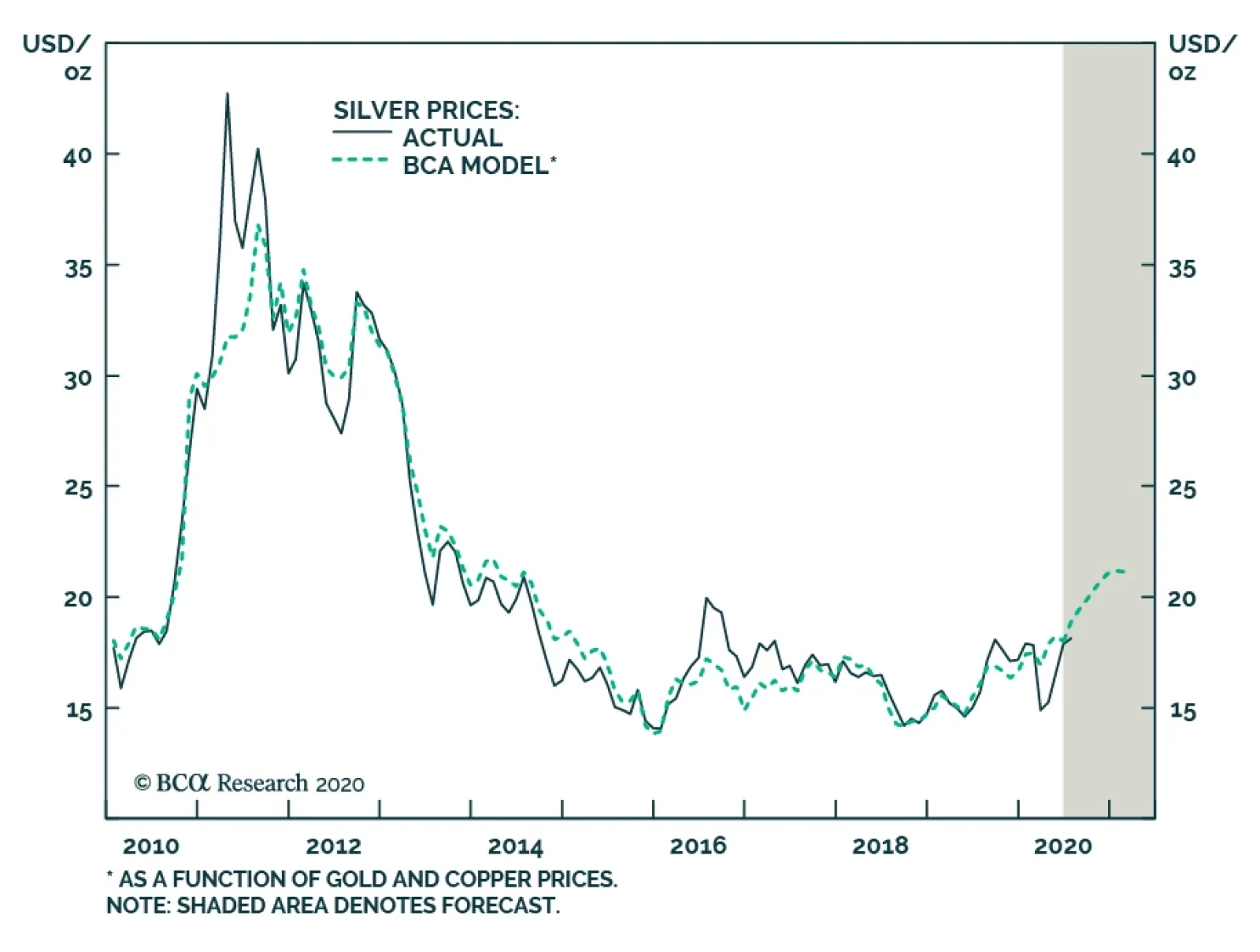

Highlights Silver will outperform gold in 2H20, as industrial production and consumer-product demand revives on the back of the massive global stimulus deployed to reverse the hit to aggregate demand inflicted by the COVID-19 pandemic…

BCA Research's Commodity & Energy Strategy service's model indicates that silver will outperform gold in 2H20. They recommend going long the December 2020 COMEX silver contract. We expect silver to end the year at…

Highlights Recommended Allocation The coronavirus pandemic is not over. Enormous fiscal and monetary stimulus will soften the blow to the global economy, but there remain significant risks to growth over the next 12 months…