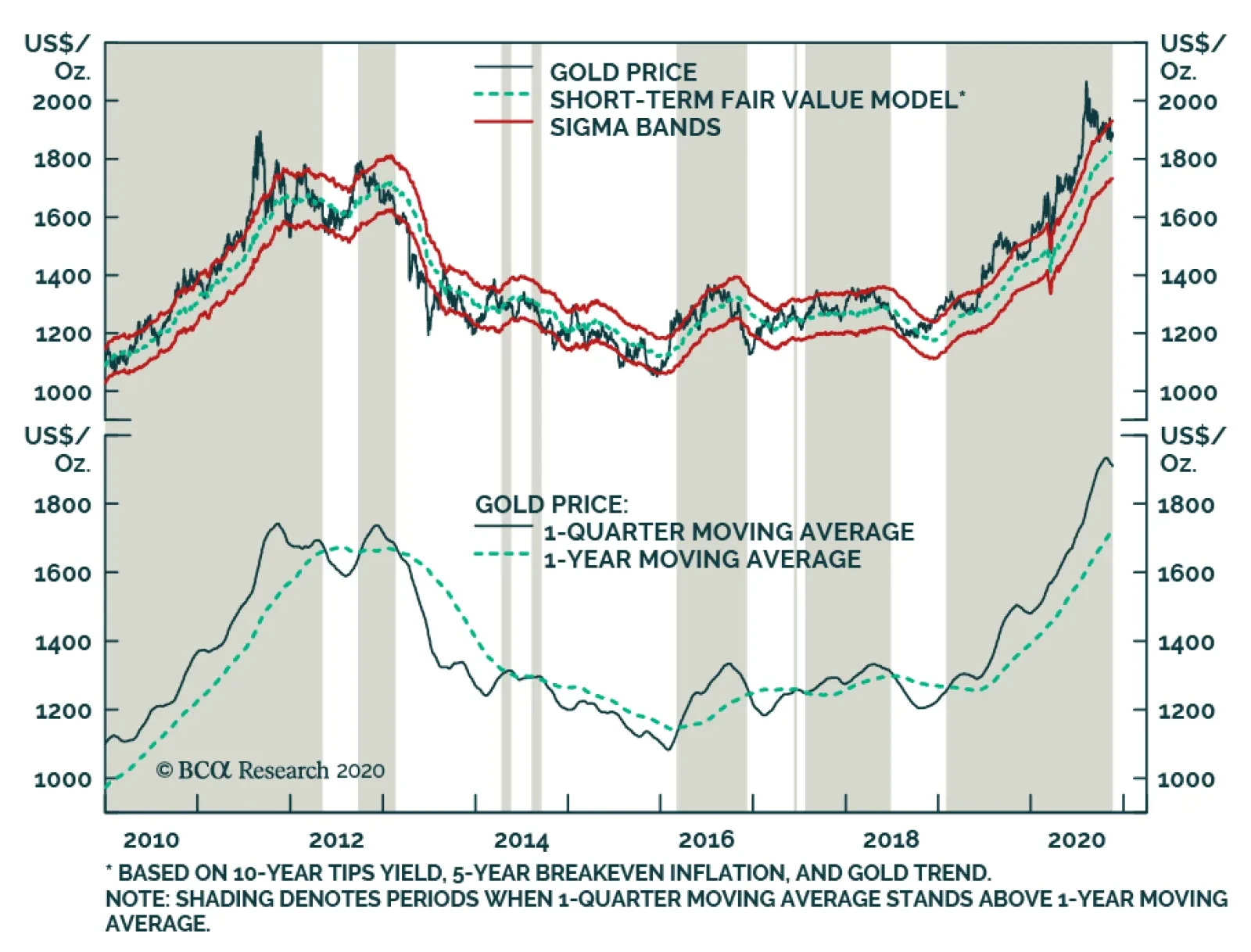

Gold has recently declined, as our short-term fair value model had predicted would occur. We recently highlighted that the price of gold was propelled higher by three factors: a safe-haven effect, a significant decline in real…

Gold has risen 25% this year, propelled higher by a set of three closely-related factors: A safe-haven effect, in response to a historic societal and economic disruption from the pandemic, A very significant decline in…

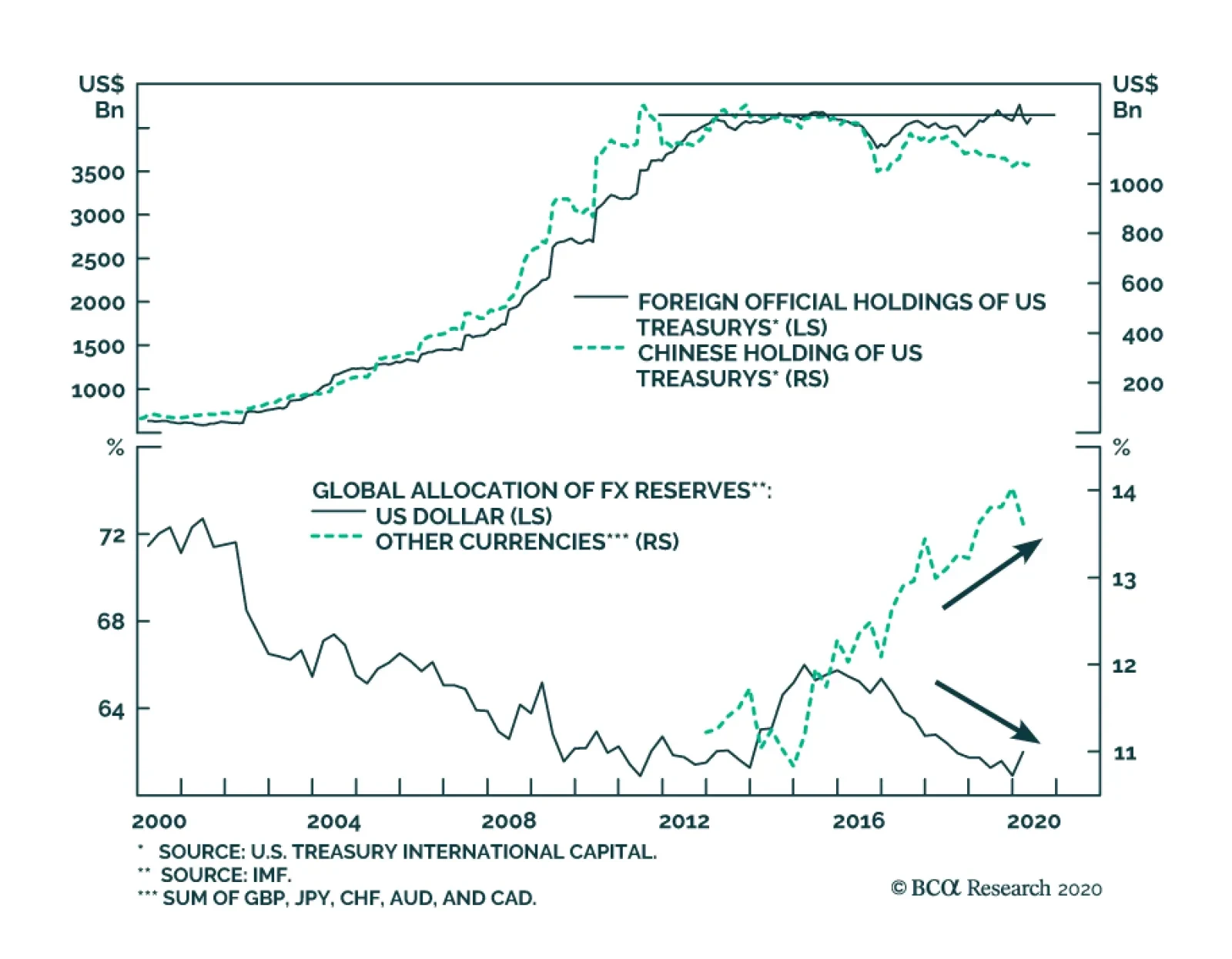

Highlights Most sentiment and technical indicators suggest the dollar is undergoing a countertrend bounce rather than entering a new bull market. However, the internal dynamics of financial markets remain short-term constructive for…

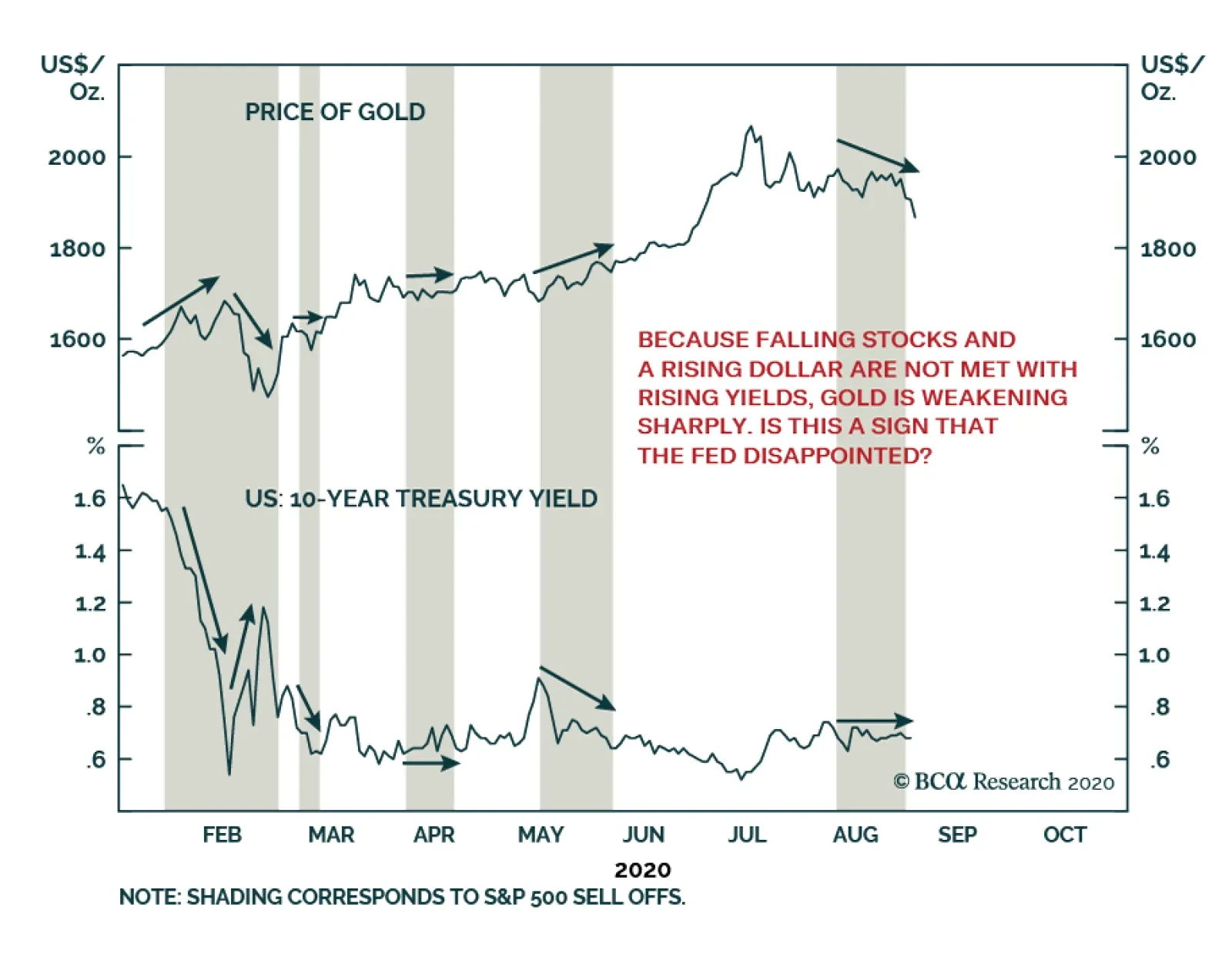

The current weakness in the price of gold is intriguing in the context of heightened uncertainty surrounding fiscal policy and the economic outlook. Some of the decline can be attributed to the dollar’s rebound and the fact…

Highlights We remain bearish on the US dollar over the next 12 months. The best vehicle to express this view continues to be the Scandinavian currencies (NOK and SEK). Precious metals remain a buy so long as the dollar faces downside…

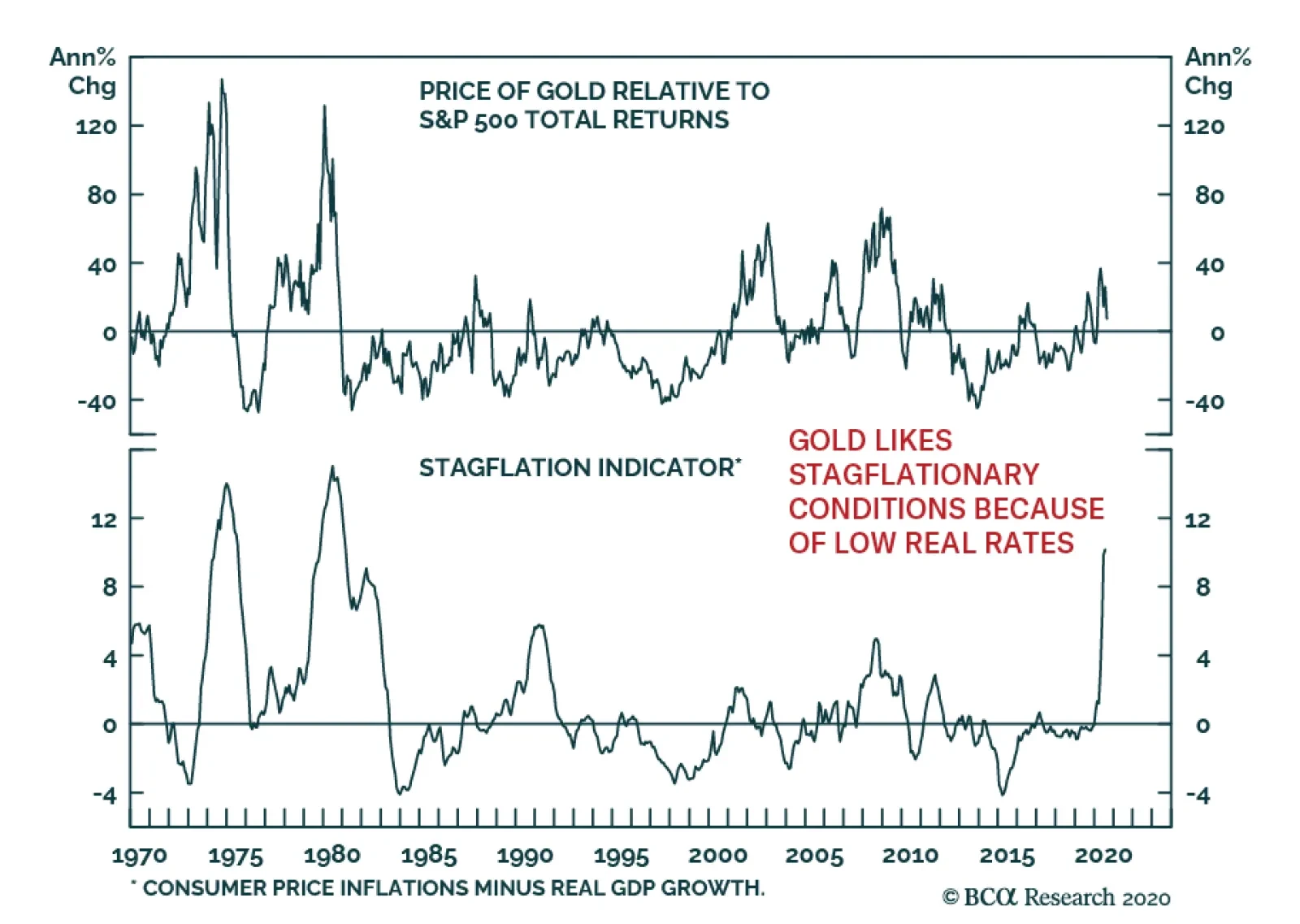

The nearly 70% rally in gold prices over the past two years has been spectacular and has allowed the yellow metal to outperform the S&P 500 by 40% over the same period. Historically, gold outperforms equities when…

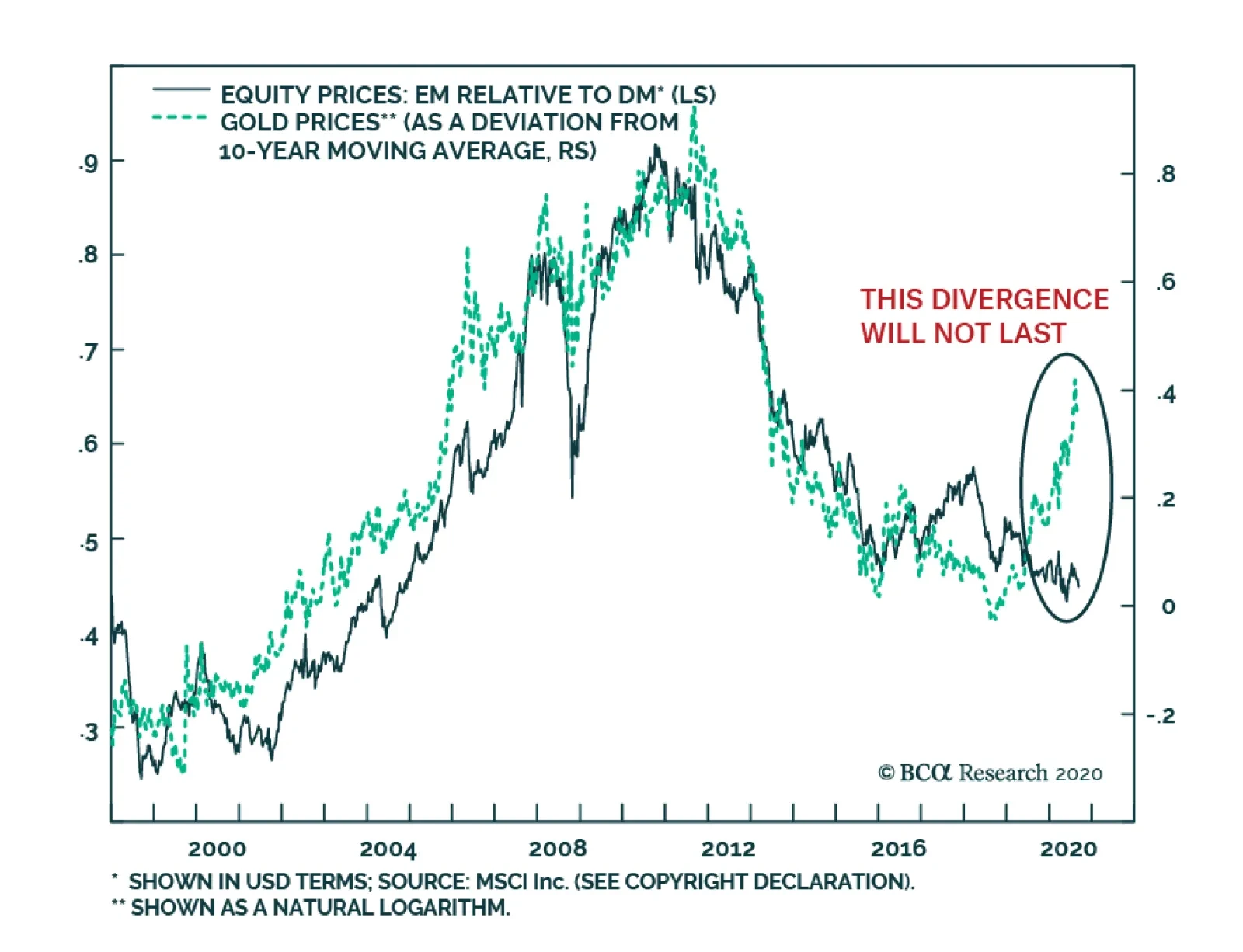

Historically, strong gold prices have coincided with an outperformance of EM equities, but not this time. Can the divergence between gold and EM stocks continue? The strong correlation between the relative performance of EM…

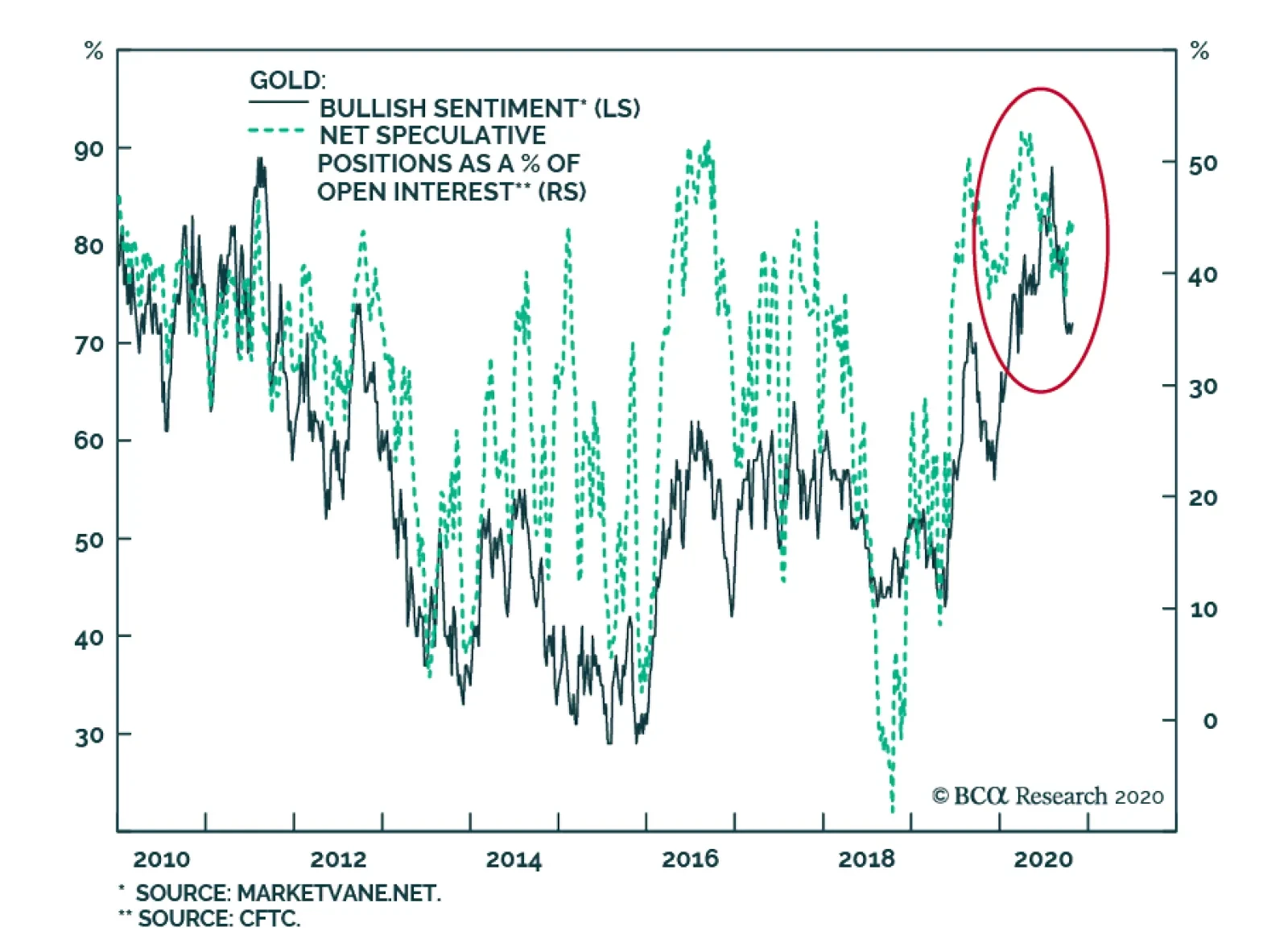

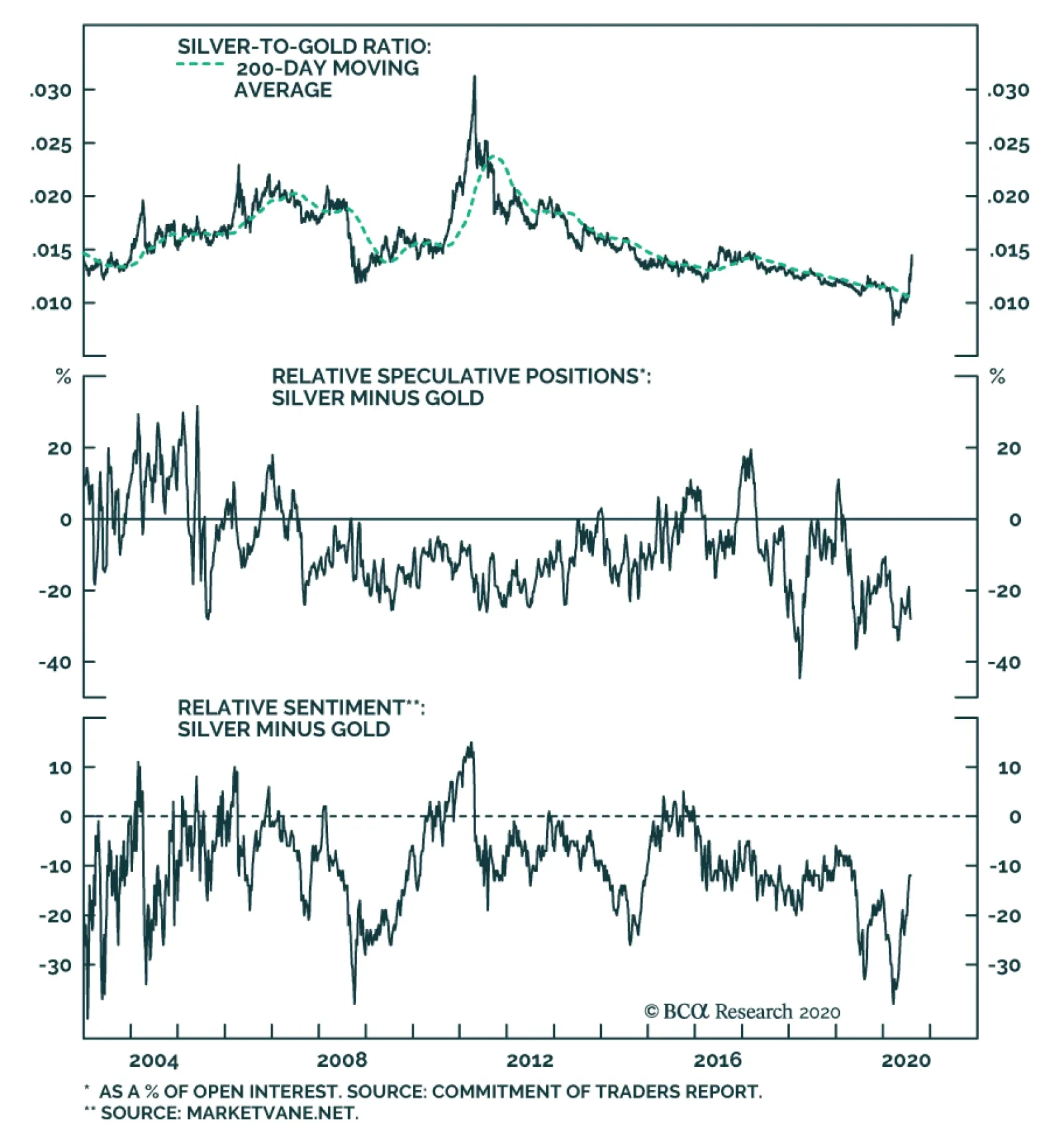

Precious metals saw a spike in volatility on August 11. Silver fell 15%. Gold is down 6% over the past five days. The trigger was probably the deflationary implications of a premature tightening in US fiscal policy, given the…

The biggest developments overnight Sunday were geopolitical. President Donald Trump signed an executive order to provide more relief to Americans. Then China fired a new salvo in the geopolitical war with the US. In a nutshell,…

Highlights While difficult to forecast, the trajectory of global auto sales likely will follow that of GDP growth (Chart of the Week). As a result, palladium’s supply constraints will re-emerge, but its “epic rally”…