Highlights US inflation expectations will continue to grind higher as commodity markets tighten, and financial markets price to an ultra-accommodative Fed over the next 2-3 years. The US stock-market rally is reducing equity yields…

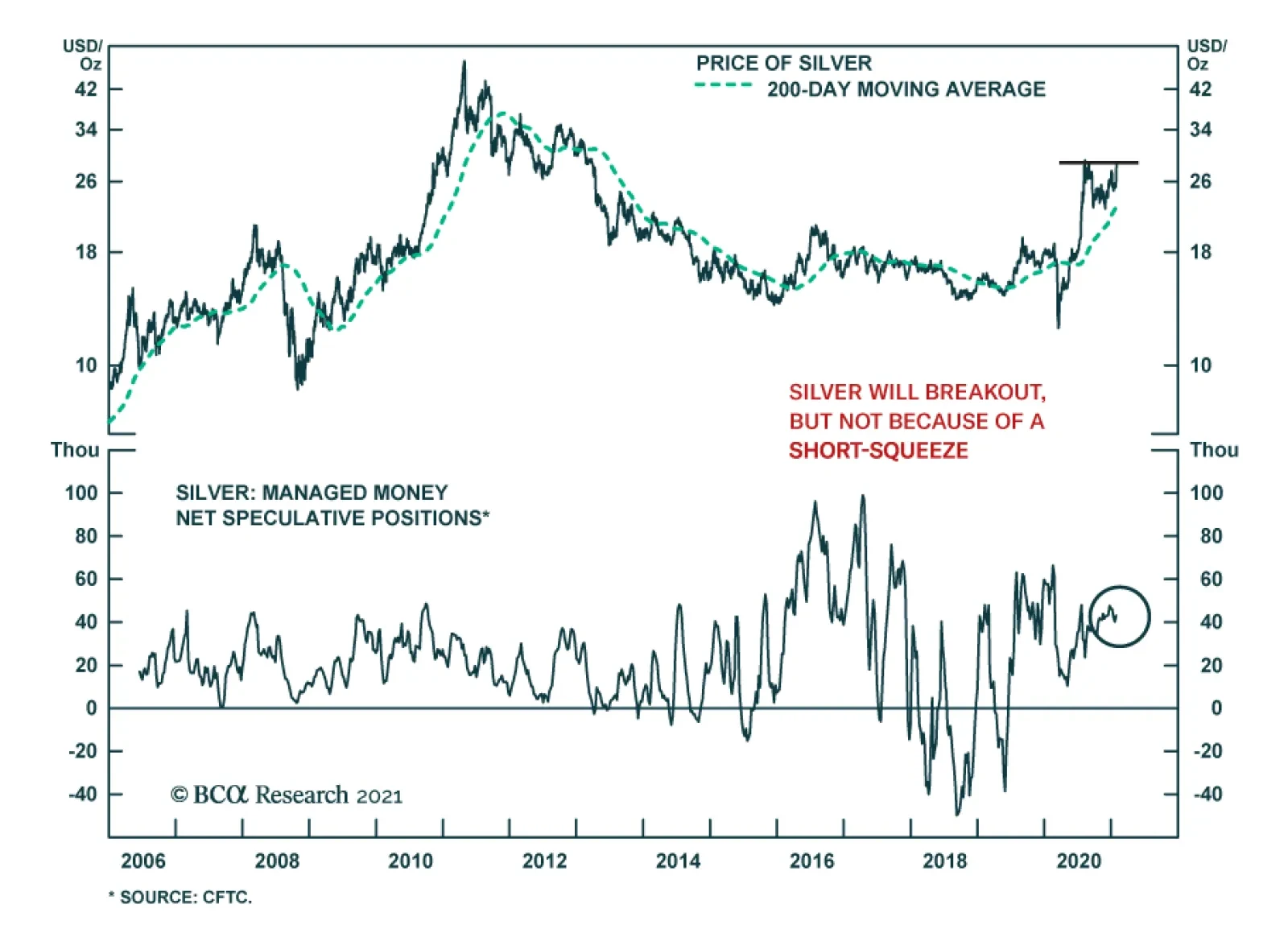

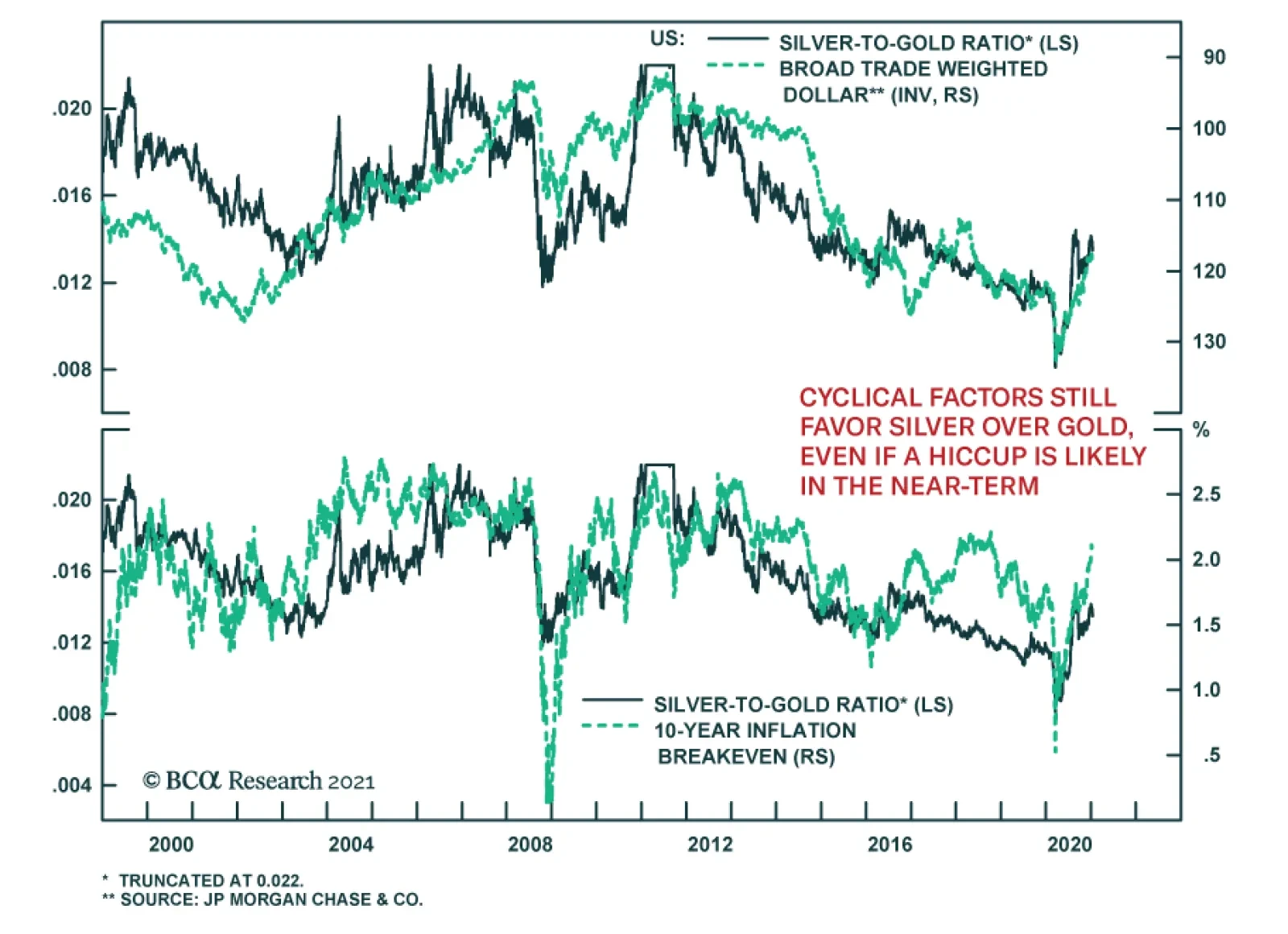

Silver has recently grabbed the headlines, with a rapid move to $30/oz. Silver has significant cyclical upside, but the near-term outlook remains nebulous, and consolidation under the $30/oz resistance is likely. The long…

On a long-term basis, silver will further outperform gold, however, it is vulnerable to a short-term pullback. While tactical trader should sell silver, we maintain our cyclical preference for the white metal. Like gold,…

Dear client, In lieu of our regular report next Friday, we will be sending you a special report on Australia next Tuesday, co-authored with our Global Fixed Income colleagues. We hope you will find the report insightful. Kind regards…

Highlights Markets largely ignored the uproar at the US Capitol on January 6 because the transfer of power was not in question. Democratic control over the Senate, after two upsets in the Georgia runoff, is the bigger signal. US…

Highlights With a vaccine already rolling out in the UK and soon in the US, investors have reason to be optimistic about next year. Government bond yields are rising, cyclical equities are outperforming defensives, international stocks…

Dear Client, We are sending you our Strategy Outlook today, where we outline our thoughts on the macro landscape and the direction of financial markets for 2021 and beyond. Next week, please join me for a webcast on Thursday, December…

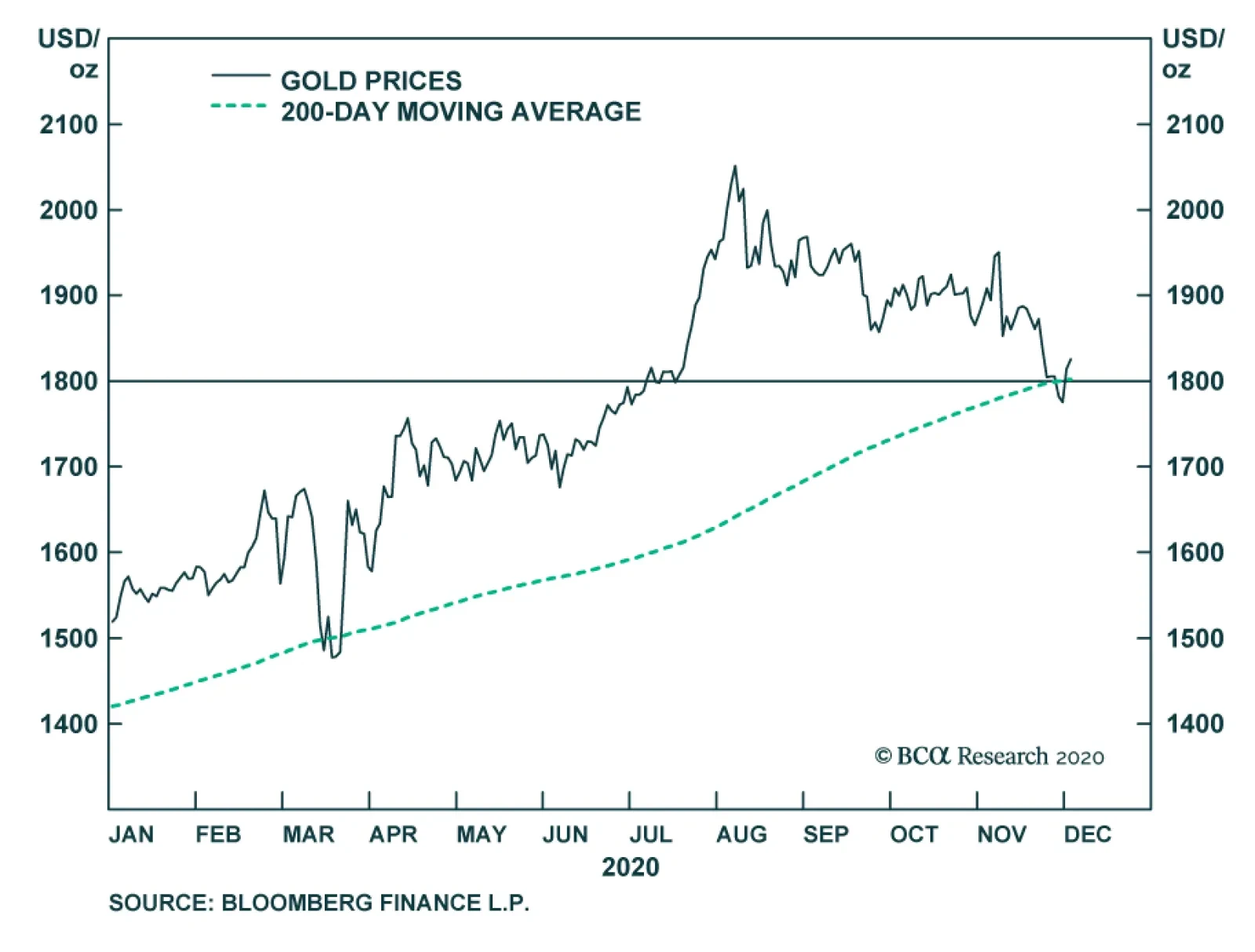

BCA Research’s Commodity & Energy Strategy service concludes that gold prices will soon recover as markets once again focus their attention on a falling USD and flat real rates in the US next year. We remain long spot…

Mr. X and his daughter, Ms. X, are long-time BCA clients who visit our office toward the end of each year to discuss the economic and financial market outlook for the year ahead. This report is an edited transcript of our recent…