The BCA Research Global Asset Allocation (GAA) Forum will take place online on May 18th. We have put together a great lineup of speakers to discuss issues of importance to CIOs and asset allocators. These include the latest thinking…

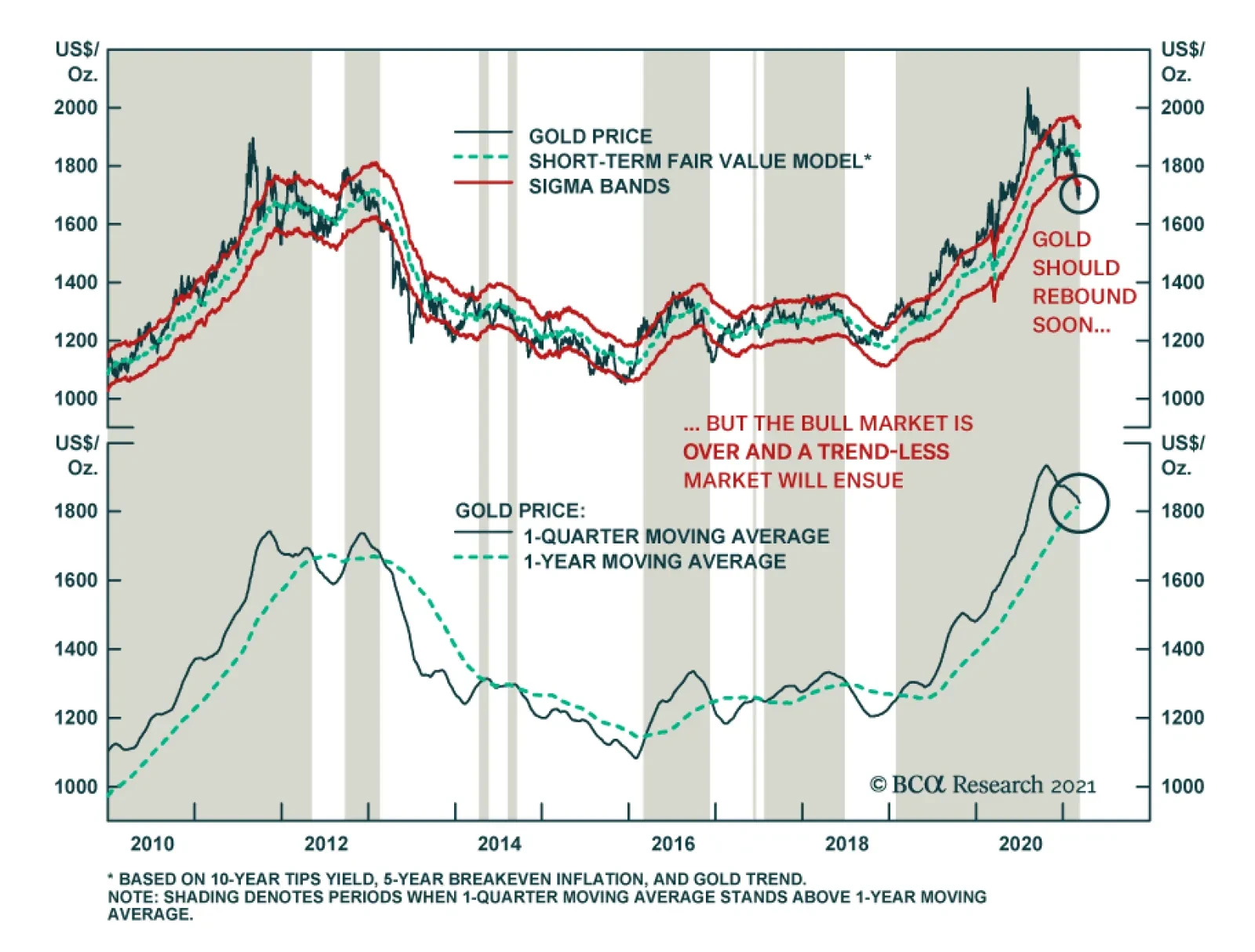

Gold looks set to stage a tactical rebound. It has become oversold and it is now trading at a significant discount relative to our short-term fair value model that encompasses both real interest rates and inflation expectations.…

Dear client, In addition to this week’s abbreviated report, we are also sending you a Special Report on currency hedging, authored by my colleague Xiaoli Tang. Xiaoli’s previous work mapped out a dynamic hedging strategy for…

Underweight Last December when we penned the 2021 high-conviction calls Strategy Report, we put global gold miners in the “also rans” section as we did not have the courage to go underweight despite our view of an economic…

Highlights Portfolio Strategy The selloff in the long end of the Treasury bond market and related yield curve steepening, rising loan growth and a turnaround in bank net interest margins, all signal that a durable re-rating phase is…

Highlights The multiple paid for oil sector profits is collapsing because the market fears that the profits slump will not be short-lived. The fear is not just of a lasting hit to aviation and a slower recovery in road mobility, but…

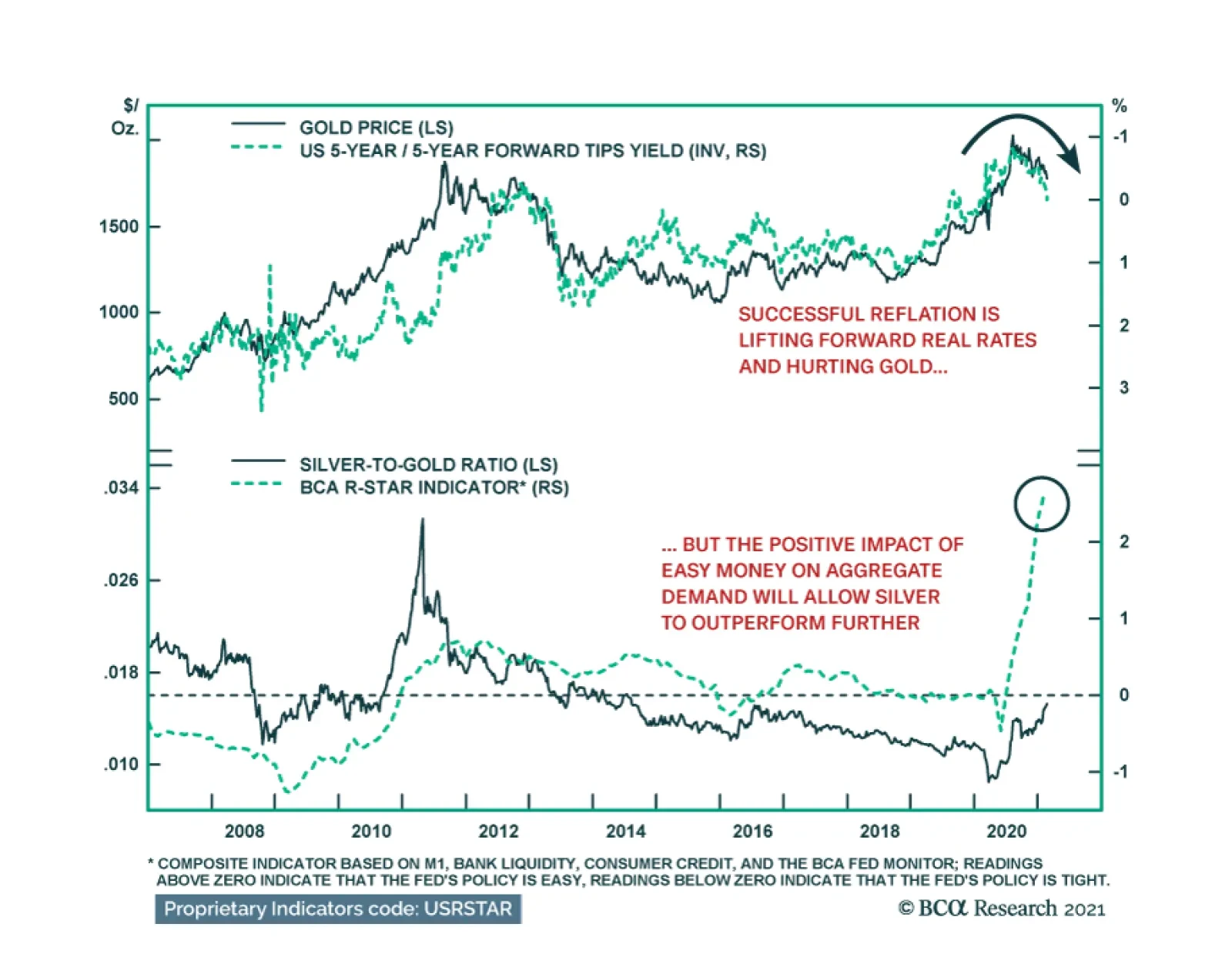

The paradox of reflation is that if it is successful, investors should begin to expect a better future today, and thus higher interest rates down the road. This process has begun. Since August 2020, 5-year / 5-year…

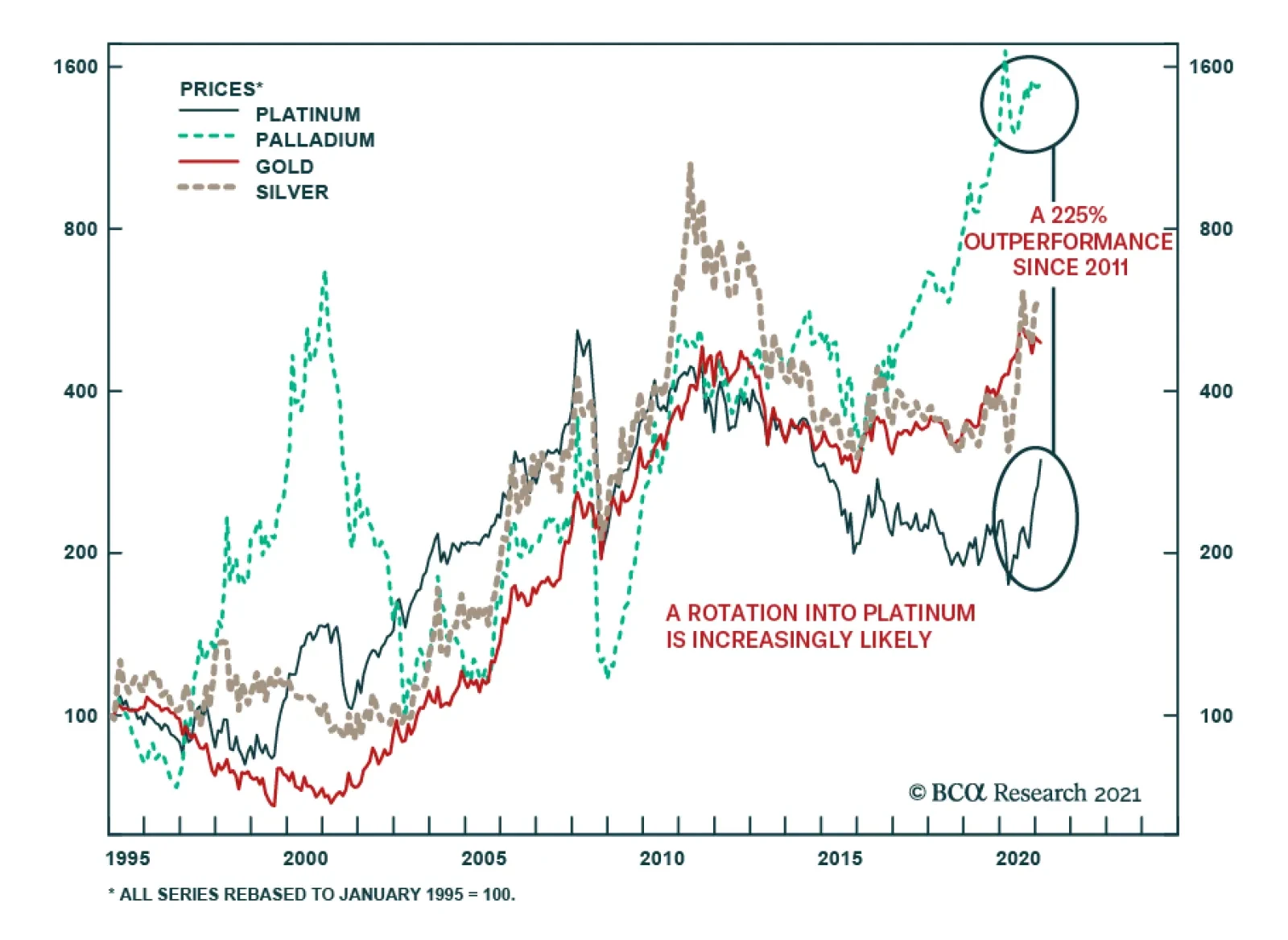

Precious metals have been a prime beneficiary of the reflation efforts of global central banks. Low real rates and a weak dollar are generally positive for the complex, albeit the reaction amongst each of these metals has not…

Highlights For the month of February, our trading model recommends shorting the US dollar versus the euro and Swiss franc. While we agree a barbell strategy makes sense, we would rather hold the yen and the Scandinavian currencies.…