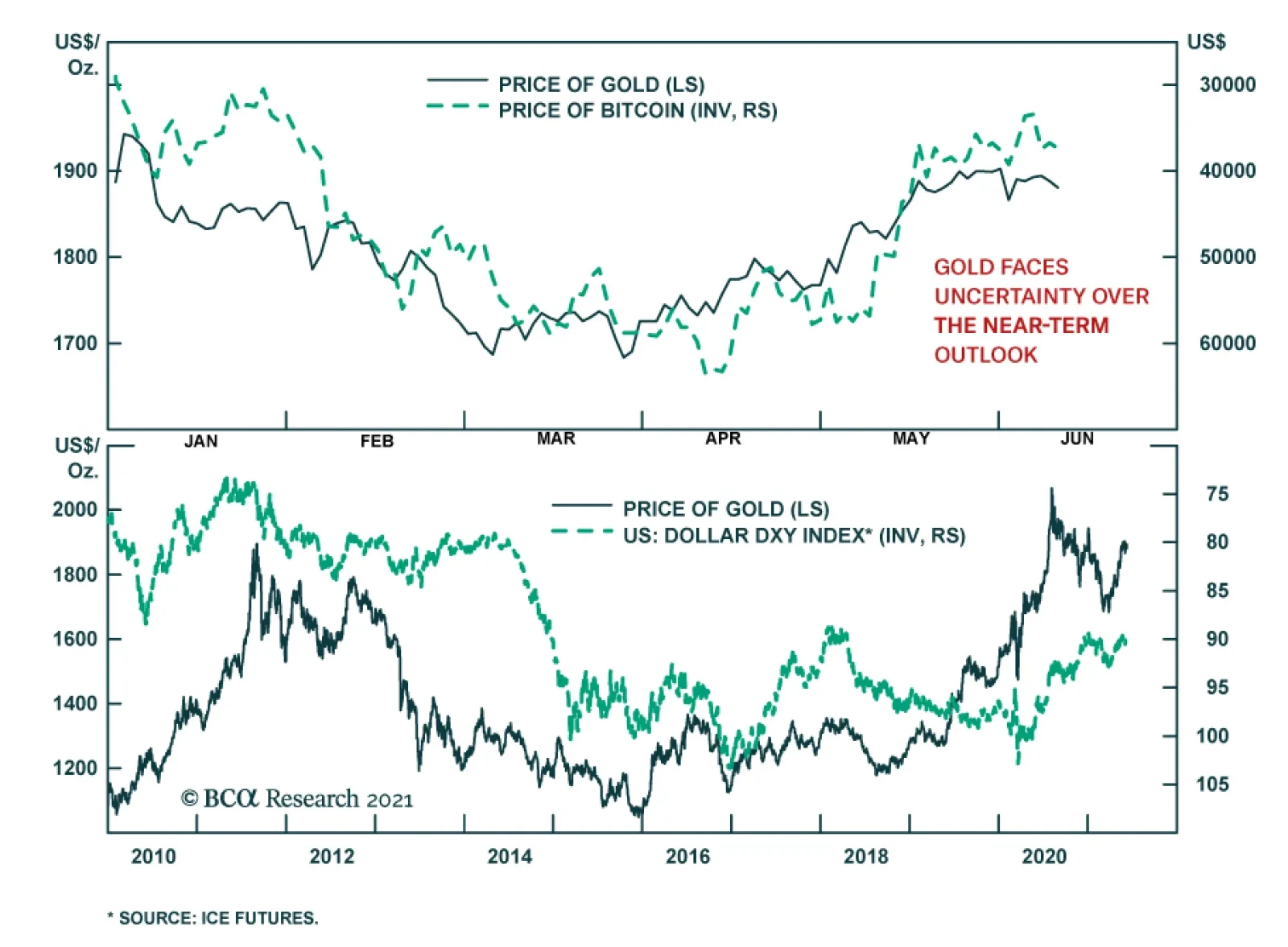

Highlights Our sense remains that the dollar is undergoing a countertrend bounce, rather than entering a new bull market. The litmus test for this view is if the DXY fails to break above the 93-94 level that marked the March highs.…

Highlights Over the short term – 1-2 years – the pick-up in re-infection rates in Asia and LatAm states with large-scale deployments of Sinopharm and Sinovac COVID-19 vaccines will re-focus attention on demand-side risks to…

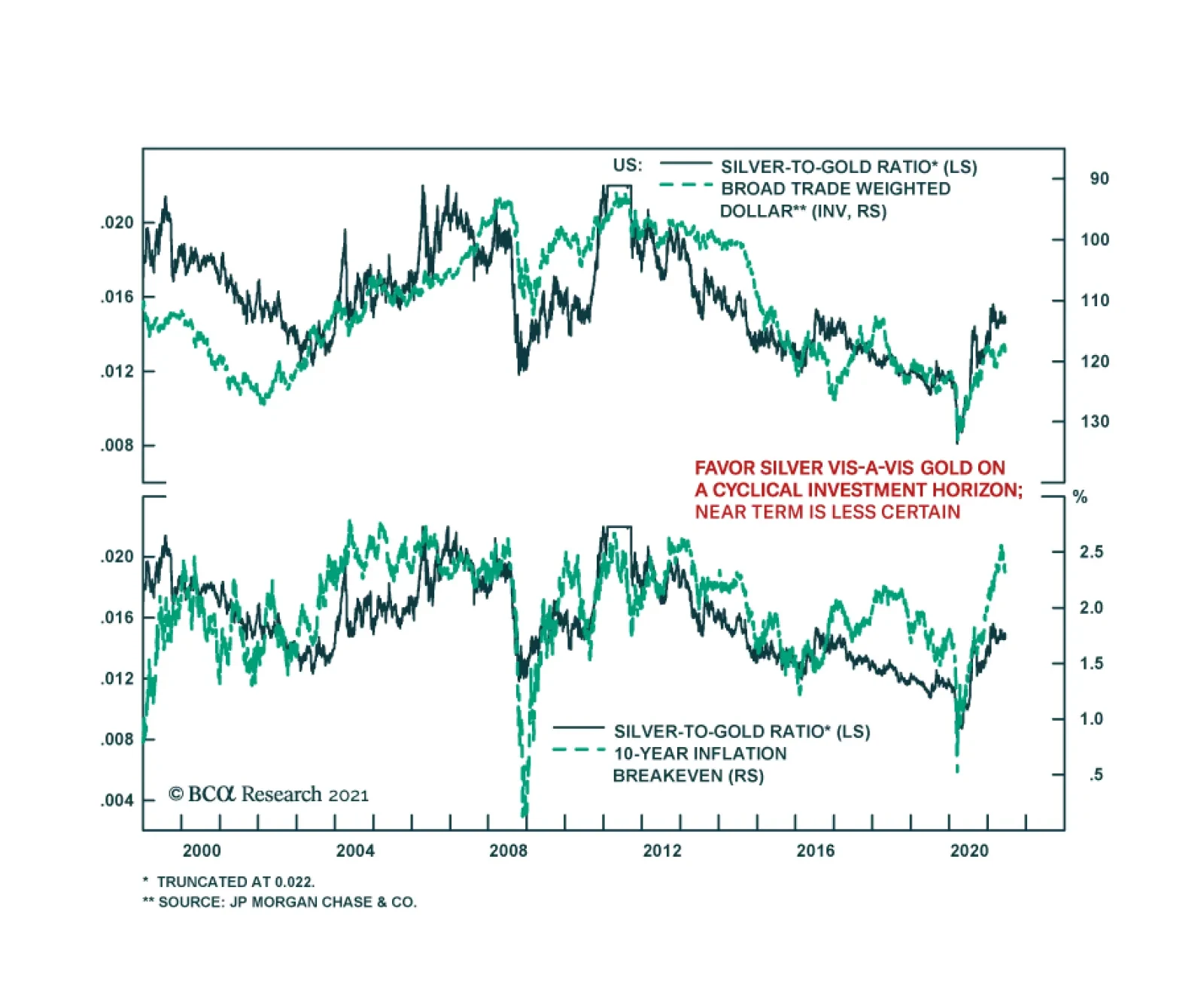

Highlights Gold is – and always will be – exquisitely sensitive to Fed policy and forward guidance, as last month's "Dot Shock" showed (Chart of the Week). Its price will continue to twitch – sometimes…

Highlights Entering 2H21, oil and metals' price volatility will rise as inventories are drawn down to cover physical supply deficits brought about by the re-opening of major economies ex-China. As demand increases and oil and…

Gold was a major victim of the FOMC’s recent shift to a more hawkish tone. It is down more than 4.8% since Wednesday’s FOMC meeting, taking it to levels last seen at the end of April. Although we remain positive on…

Dear Client, Next week, instead of our regular report, we will be sending you a Special Report from BCA Research’s MacroQuant tactical global asset allocation team. Titled “MacroQuant: A Quantitative Solution For Forecasting…

Highlights Oil demand expectations remain high. Realized demand continues to disappoint. This means OPEC 2.0's production-management strategy – i.e., keeping the level of supply below demand – will continue to dictate…

Gold is down more than 2% so far in June following a sharp rally earlier this quarter. Even last Thursday’s inflation surprise failed to help the yellow metal, which despite gains immediately following the inflation release…

Highlights US labor-market disappointments notwithstanding, the global recovery being propelled by real GDP growth in the world's major economies is on track to be the strongest in 80 years. This growth will fuel commodity demand,…

Highlights Political and corporate climate activism will increase the cost of developing the resources required to produce and deliver energy going forward – e.g., oil and gas wells; pipelines; copper mines, and refineries. Over…