Highlights Long-term investors should place up to 5 percent of their assets in cryptocurrencies. As the drawdown risk of owning cryptocurrencies converges with that of owning gold, the cryptocurrency asset-class can reasonably…

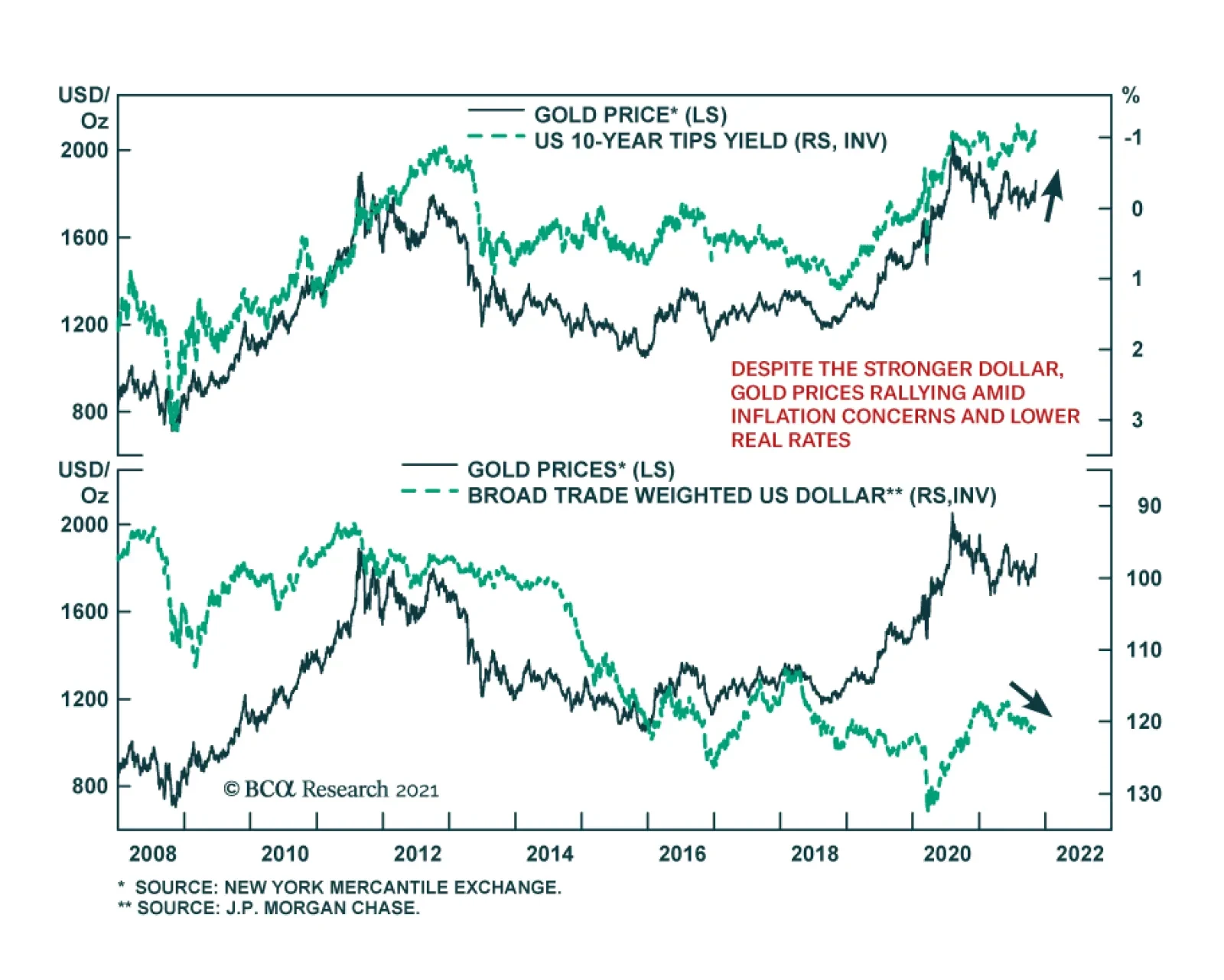

Recently, gold has been enjoying a sharp rally. The price of gold prices is up 4.5% so far in November to the highest level in nearly five months. Concerns that inflationary pressures will persist has renewed demand for the…

The markets were deluged by a lot of information in late October. Several central banks made surprise moves towards tightening (the Bank of Canada, for example, ended asset purchases, and the Reserve Bank of Australia…

Highlights The surge in energy prices going into the Northern Hemisphere winter – particularly coal and natgas prices in China and Europe – will push inflation and inflation expectations higher into the end of 1Q22 (Chart of…

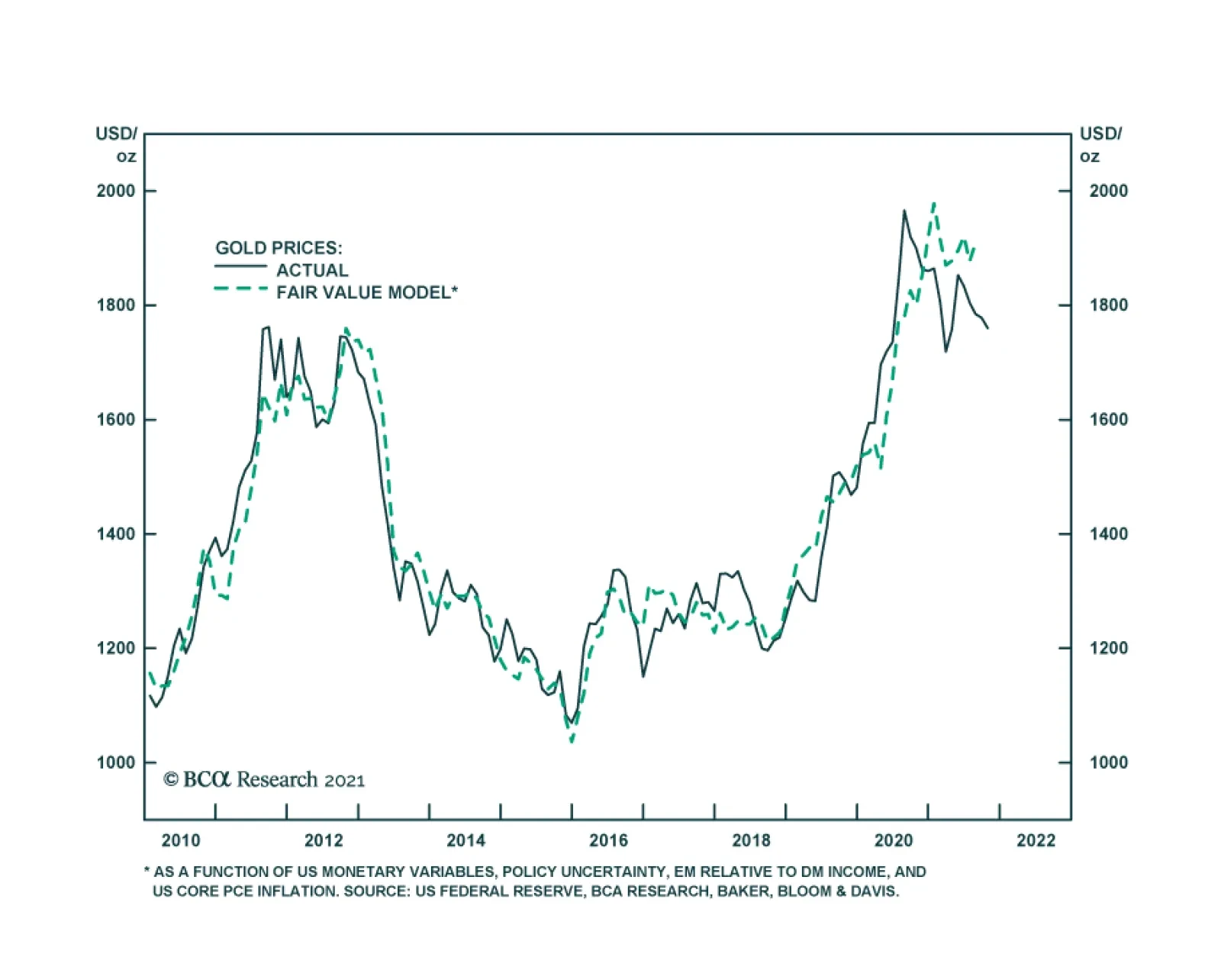

According to BCA Research’s Commodity & Energy Strategy service, gold prices will continue to be challenged by conflicting information flows. Transitory effects – chiefly supply-chain bottlenecks and a global scramble for…

Highlights Gold prices will continue to be challenged by conflicting information flows regarding US monetary policy; higher inflationary impulses from commodity prices and supply-chain bottlenecks; global economic policy uncertainty,…

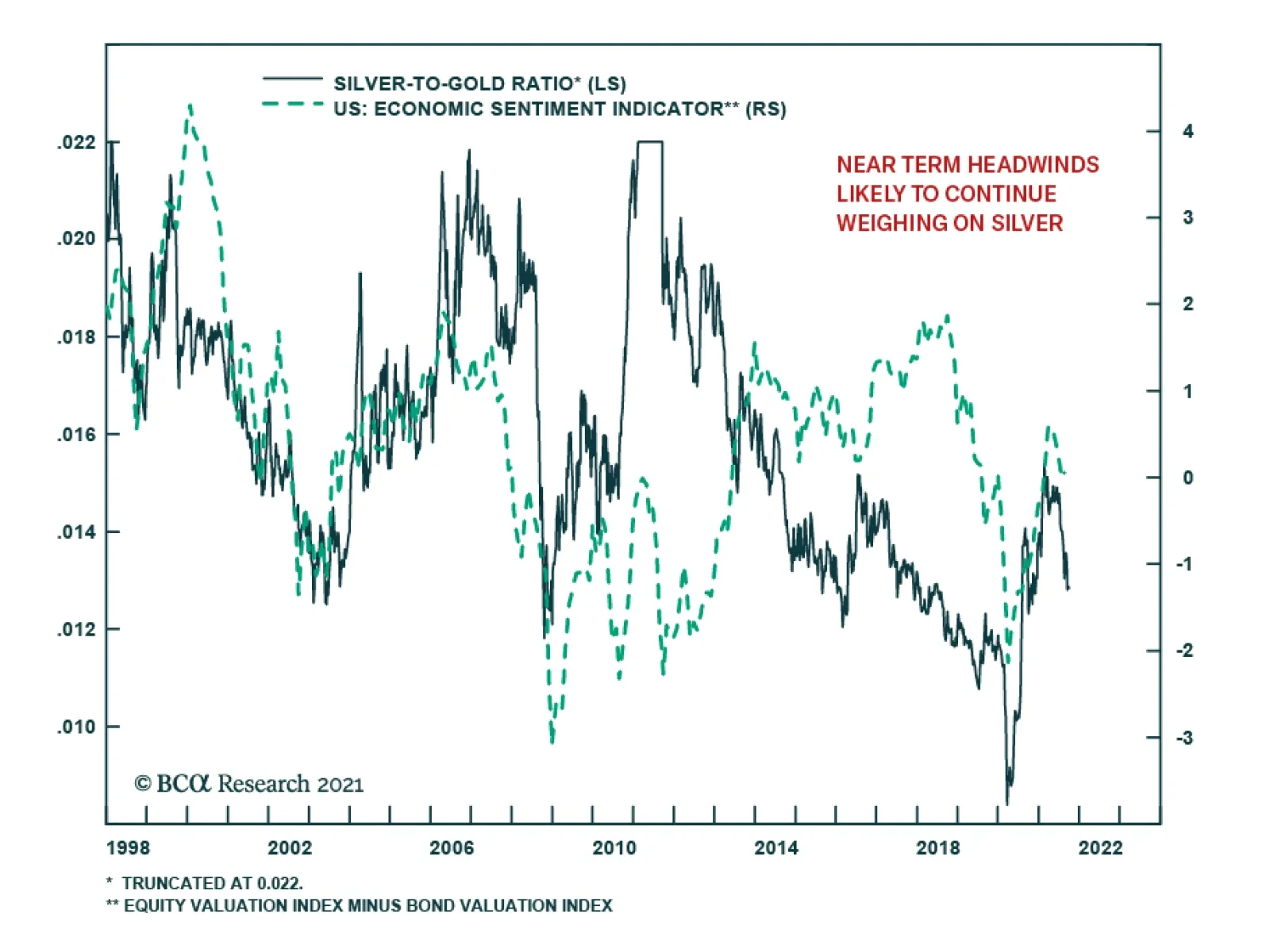

Silver has been among the worst performing financial assets recently. It is down nearly 20% since mid-June and has underperformed gold over this period. Back in June, we noted that the near-term outlook for silver was…

HighlightsThe power shortage in China due to depleted coal inventories and low hydro availability will push copper and aluminum inventories lower, as refineries there – which account for roughly one-half of global capacity – are shut to…

Highlights Asian and European natural gas prices will remain well bid as the Northern Hemisphere winter approaches. An upgraded probability of a second La Niña event this winter will keep gas buyers scouring markets for supplies…

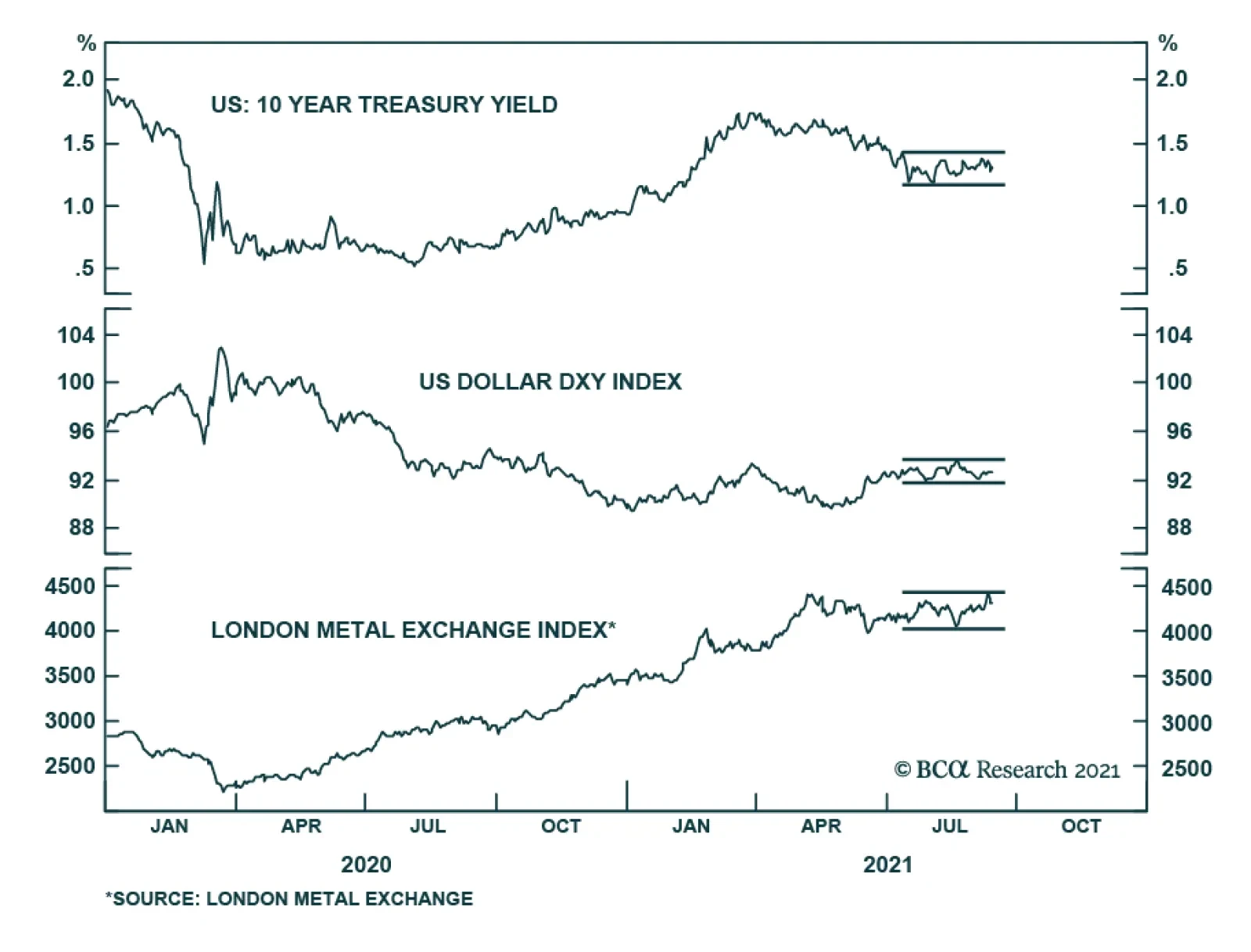

Several key financial assets are failing to send a strong signal and instead have been in a state of stasis. Abstracting from day-to-day moves, Treasury yields, the LMEX, and EUR/USD have not been on a clear trajectory since the…