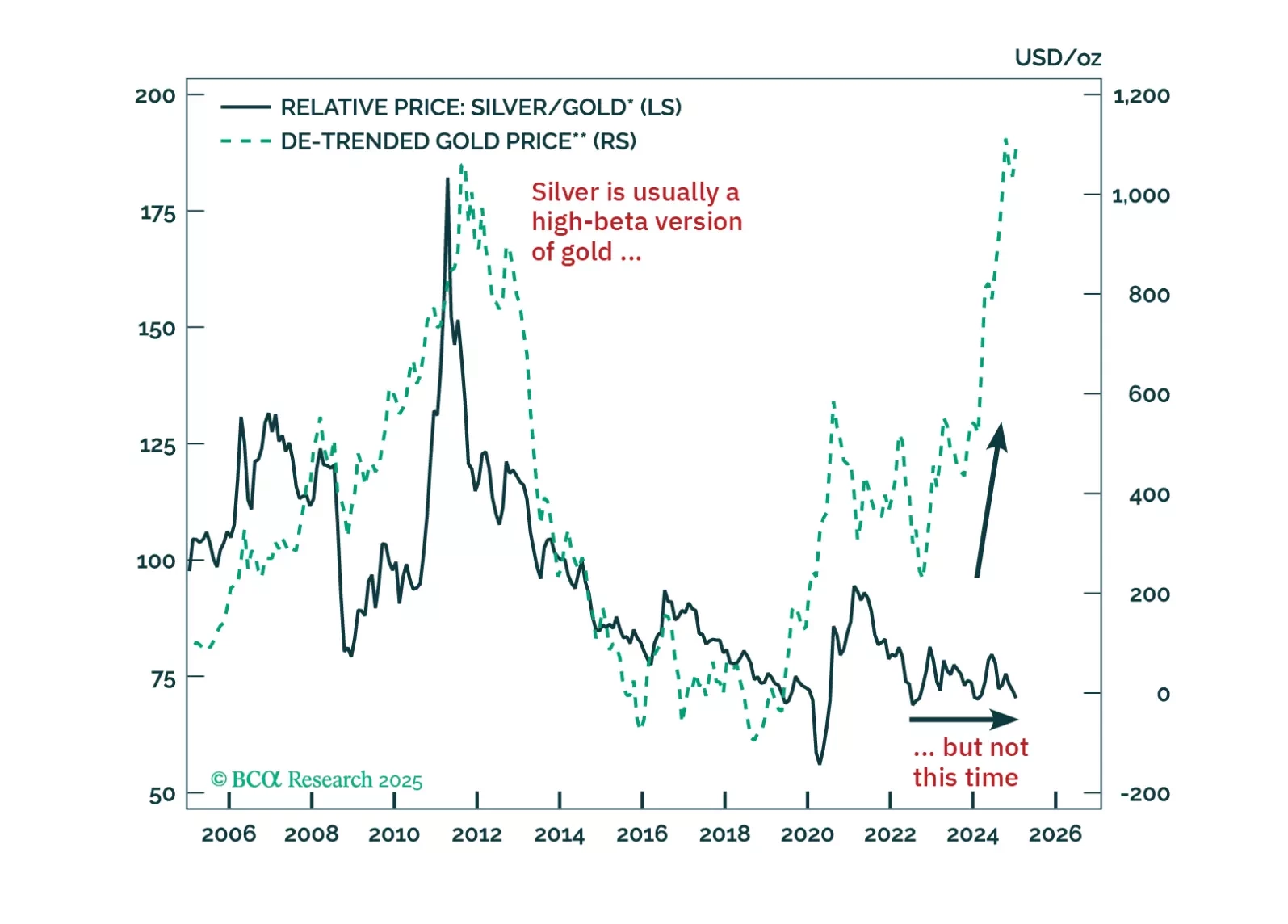

Gold is testing the $3,000/oz level. The yellow metal had a great run, outperforming every DM currency for the past few months. Despite rising real yields since the beginning of the year, gold prices are up nearly 15%.The…

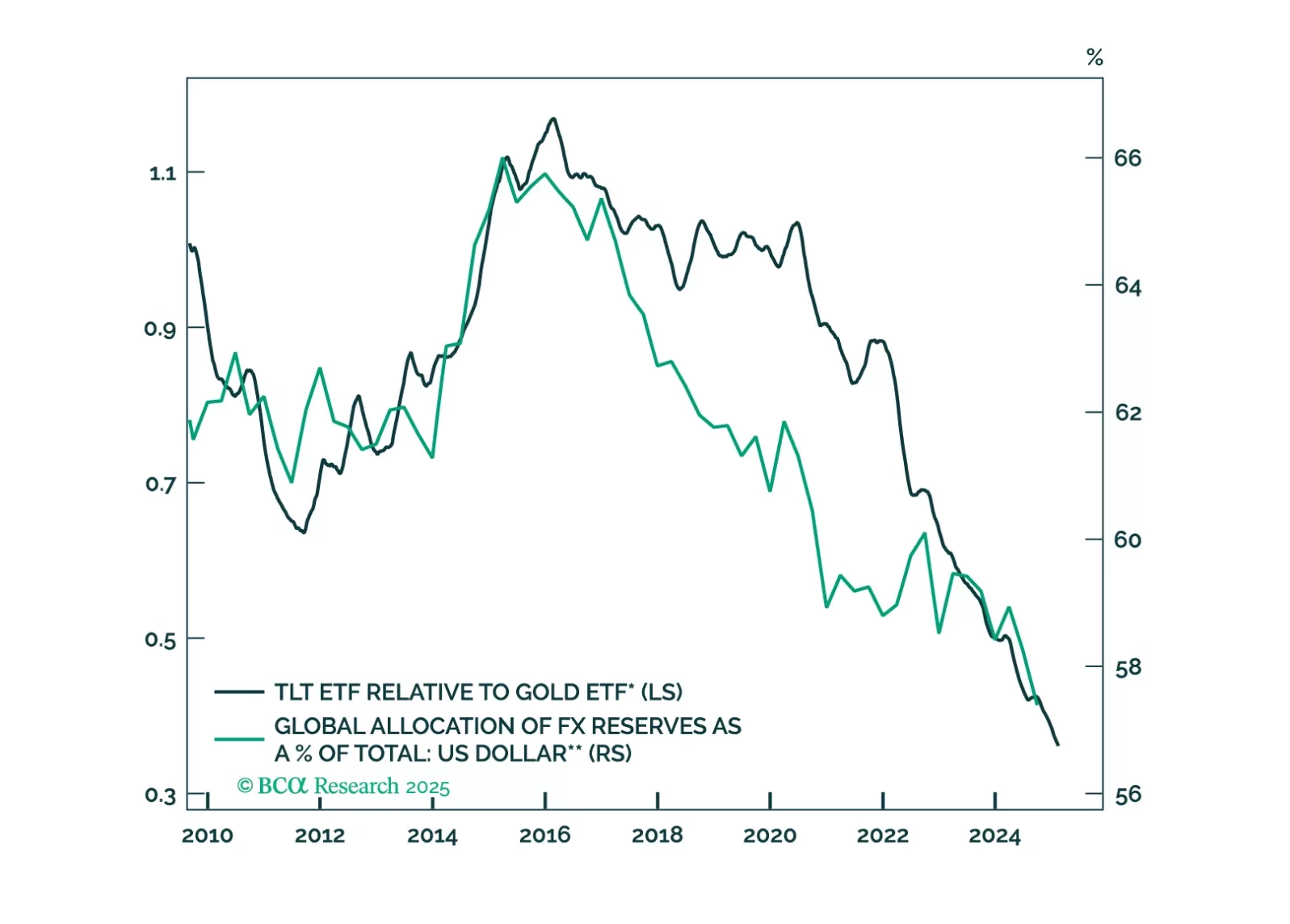

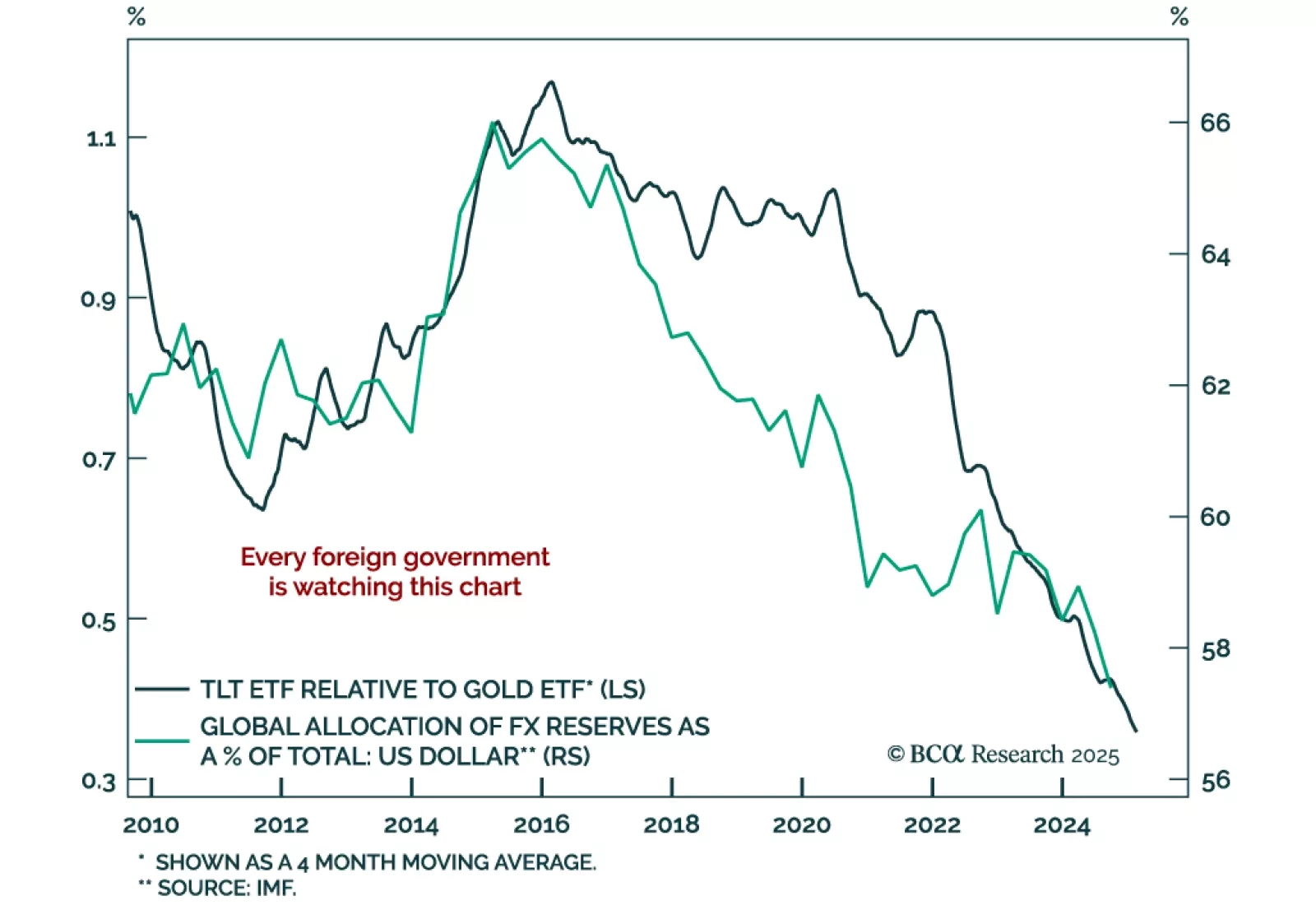

Our Chart Of The Week comes from Chester Ntonifor, Chief Strategist for our Foreign Exchange and Global Fixed Income Strategy services. A big macro trade over the last few years has been to shun US Treasuries, in favor of…

In lieu of all the geopolitical and economic news in media, this report looks at where next the dollar is likely to trend in the next one-to-three months. Our view is down, though on a cyclical horizon (six-to-twelve months), we…

Last week’s tariff debacle kicks off a period of heightened global policy uncertainty under the new US administration. That is bad news for financial assets exposed to the business cycle. Meanwhile, it creates an opportunity for safe…

While the US dollar has outperformed every single DM currency in the past few months, the only monetary asset it did not outperform is gold. The greenback is up between 5-10% against DM currencies since September of last year, but…

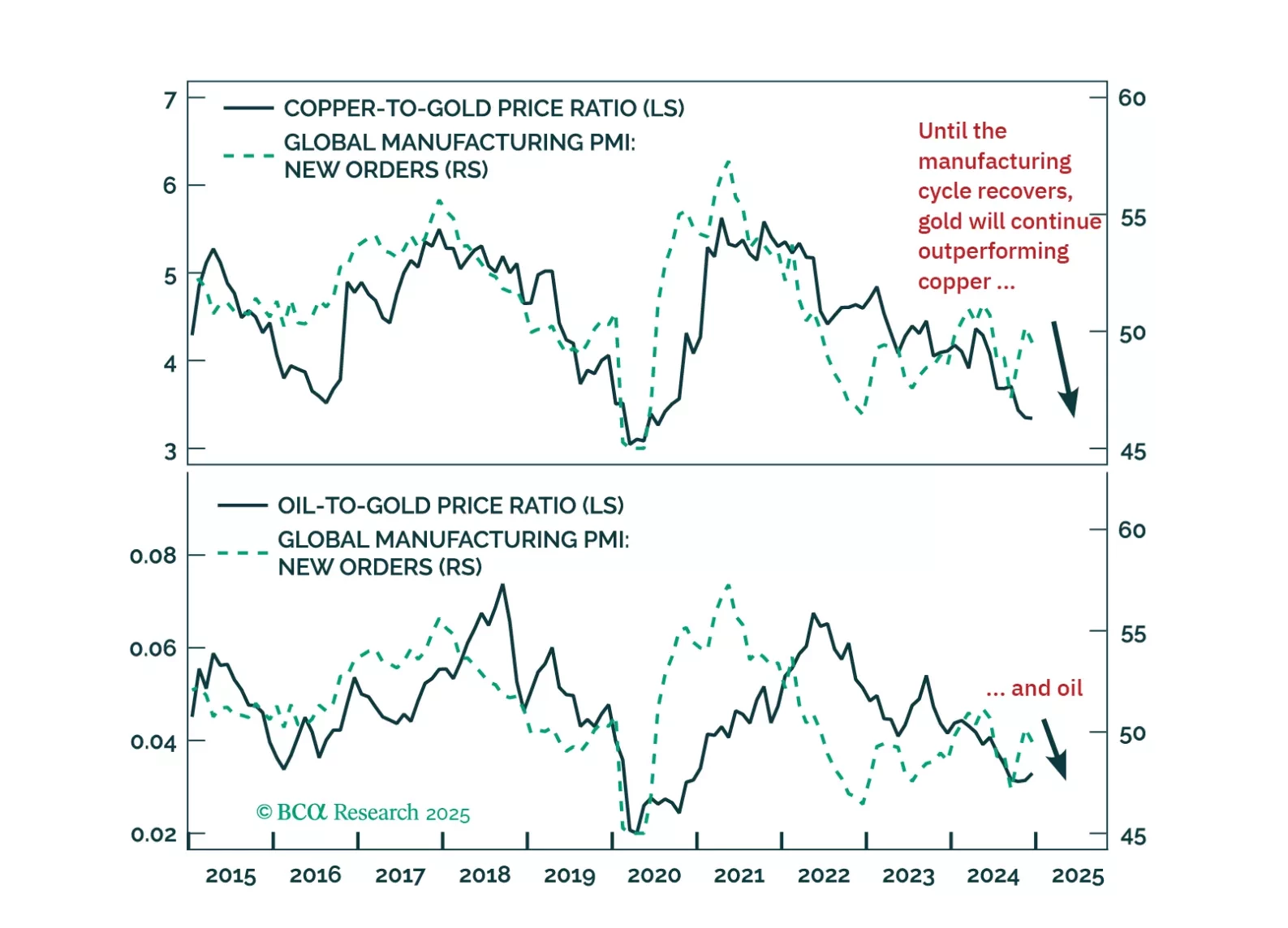

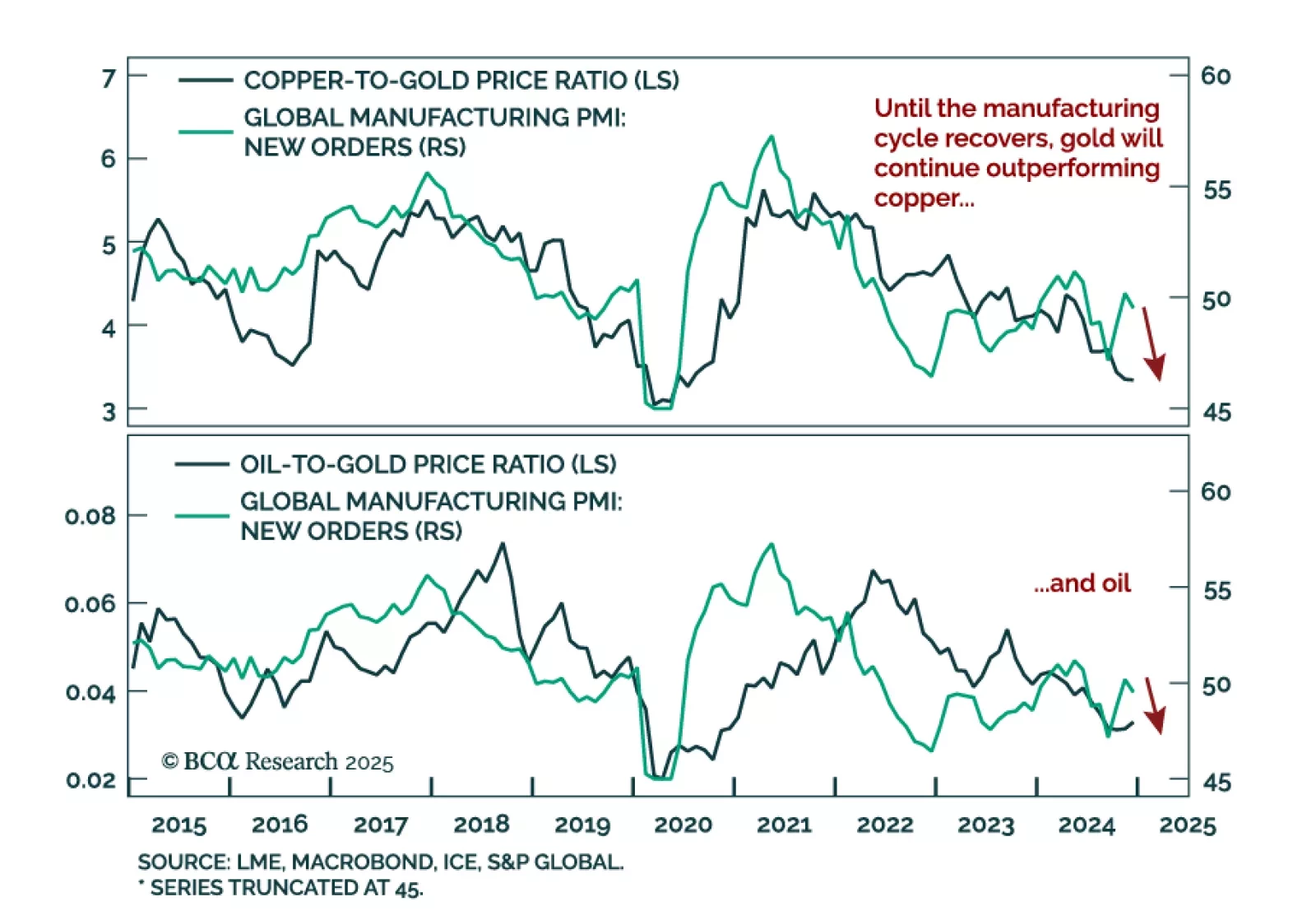

Our Commodities & Energy strategists published a special report outlining three themes they see in the space for 2025. The themes are the following: Sluggish global demand and weak industrial activity will likely weigh…

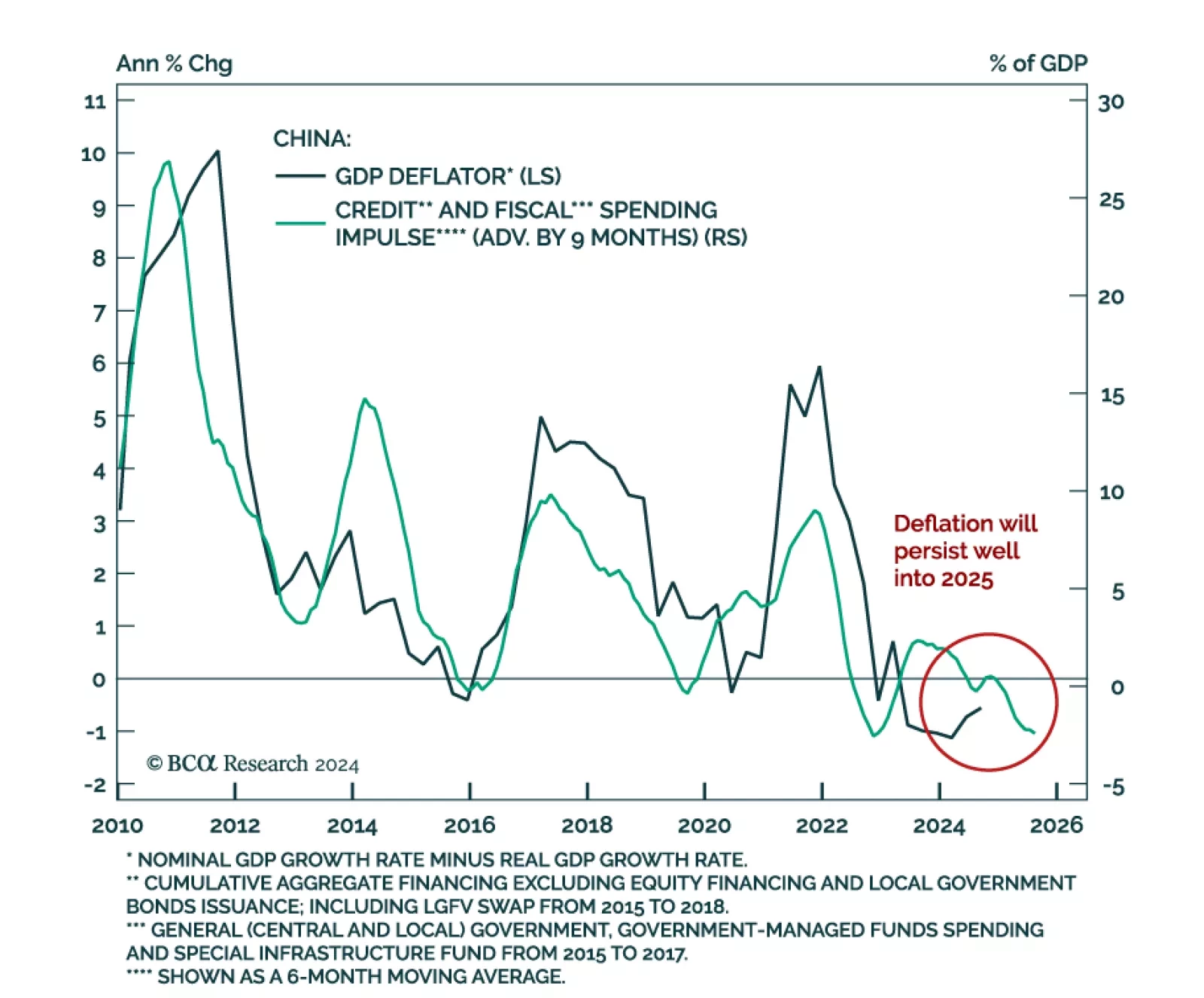

Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

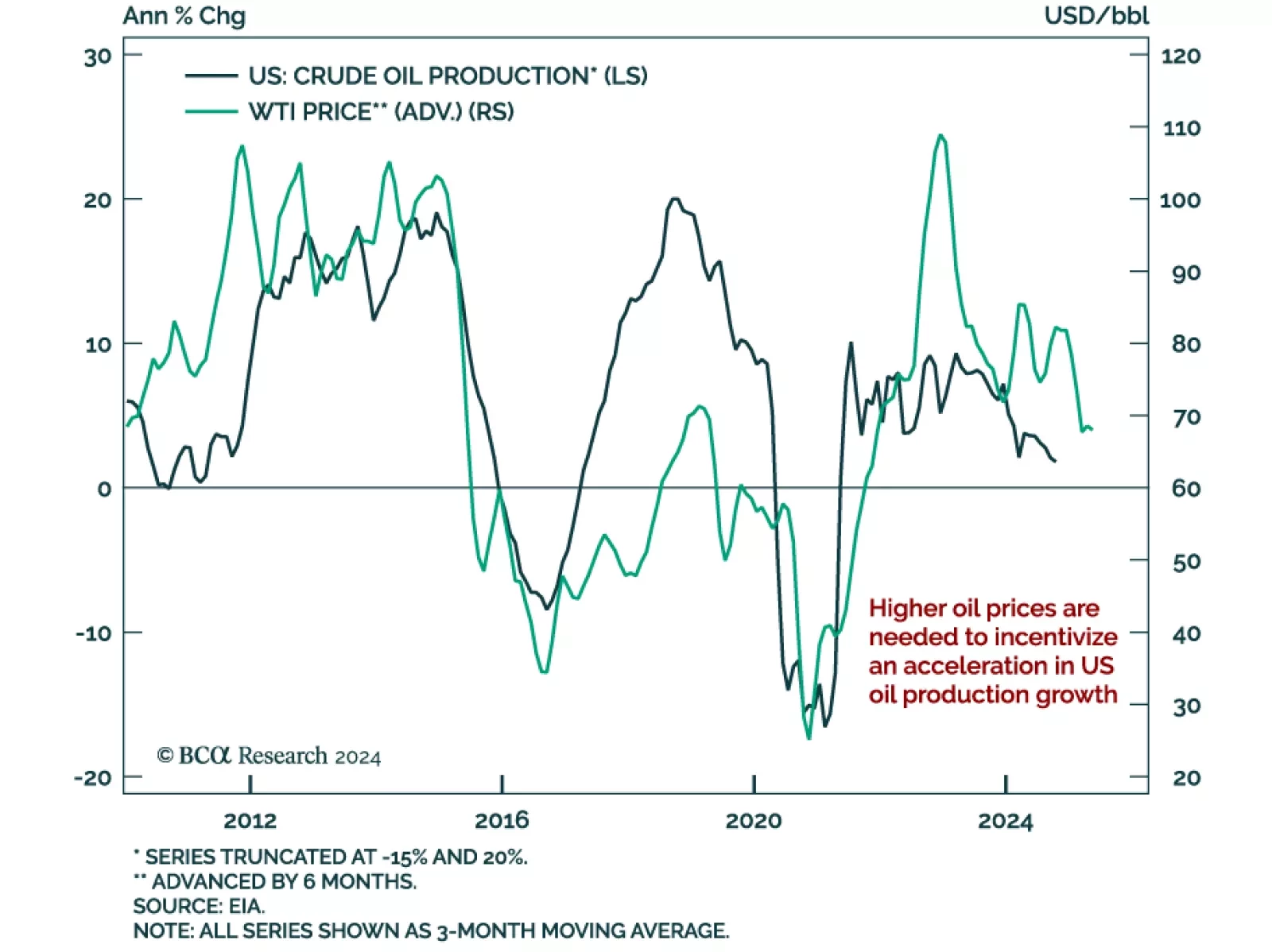

Our Commodity & Energy Strategy team evaluated the impact of president-elect Trump’s policies on commodity markets. Trump’s energy policies, while promoting increased domestic oil production, are unlikely to…

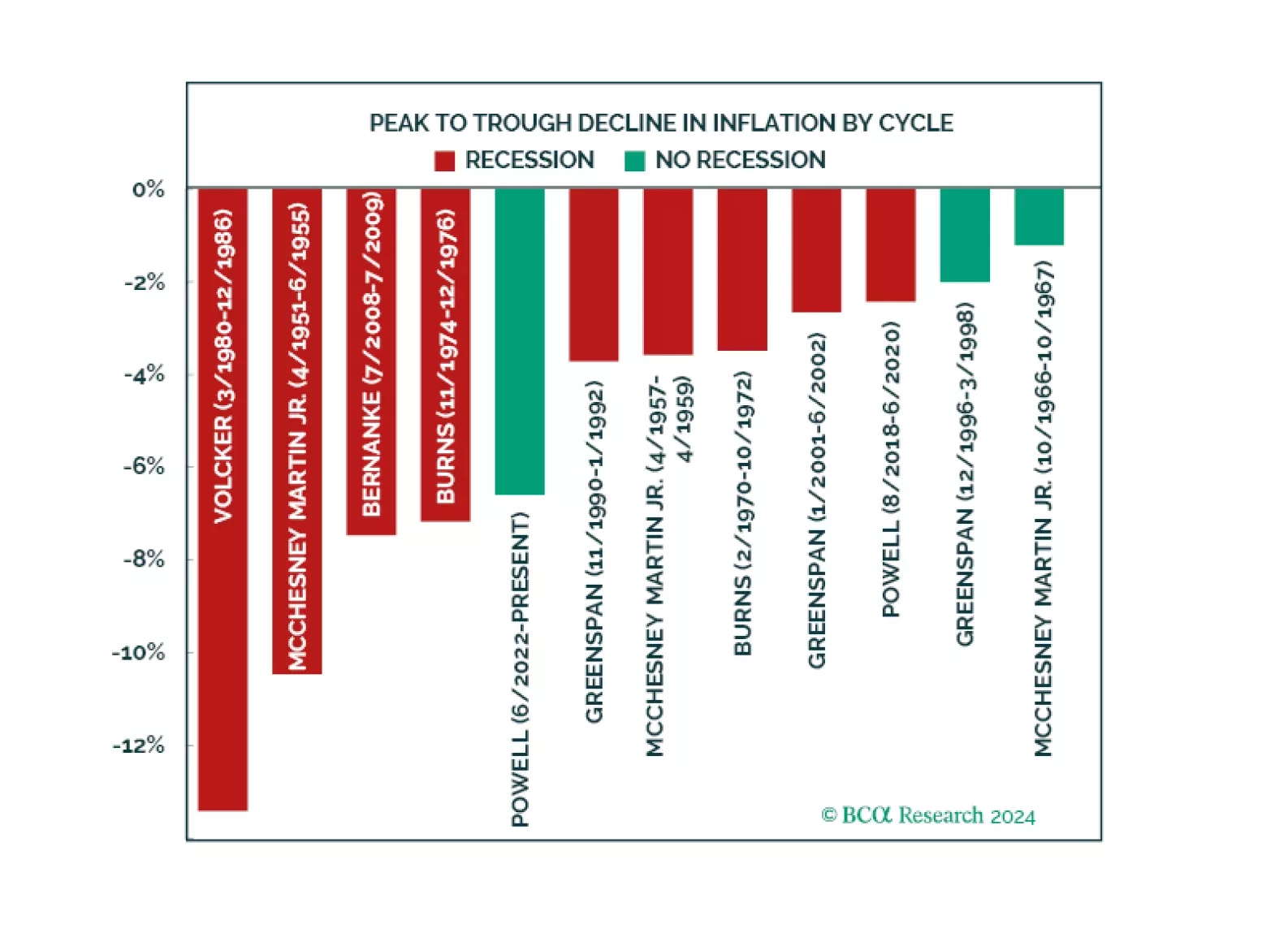

Can Powell achieve a soft landing? There are some indications he is doing it. We examine why our negative stance was wrong and analyze the four growth engines that kept recession at bay. Half of these forces remain while the other…