Peripheral Europe is driving the region’s resilience, and finally closing the gap with the core. Our Chart Of The Week comes from Jeremie Peloso, Chief European Investment Strategist. The resilience of the European economy and strong…

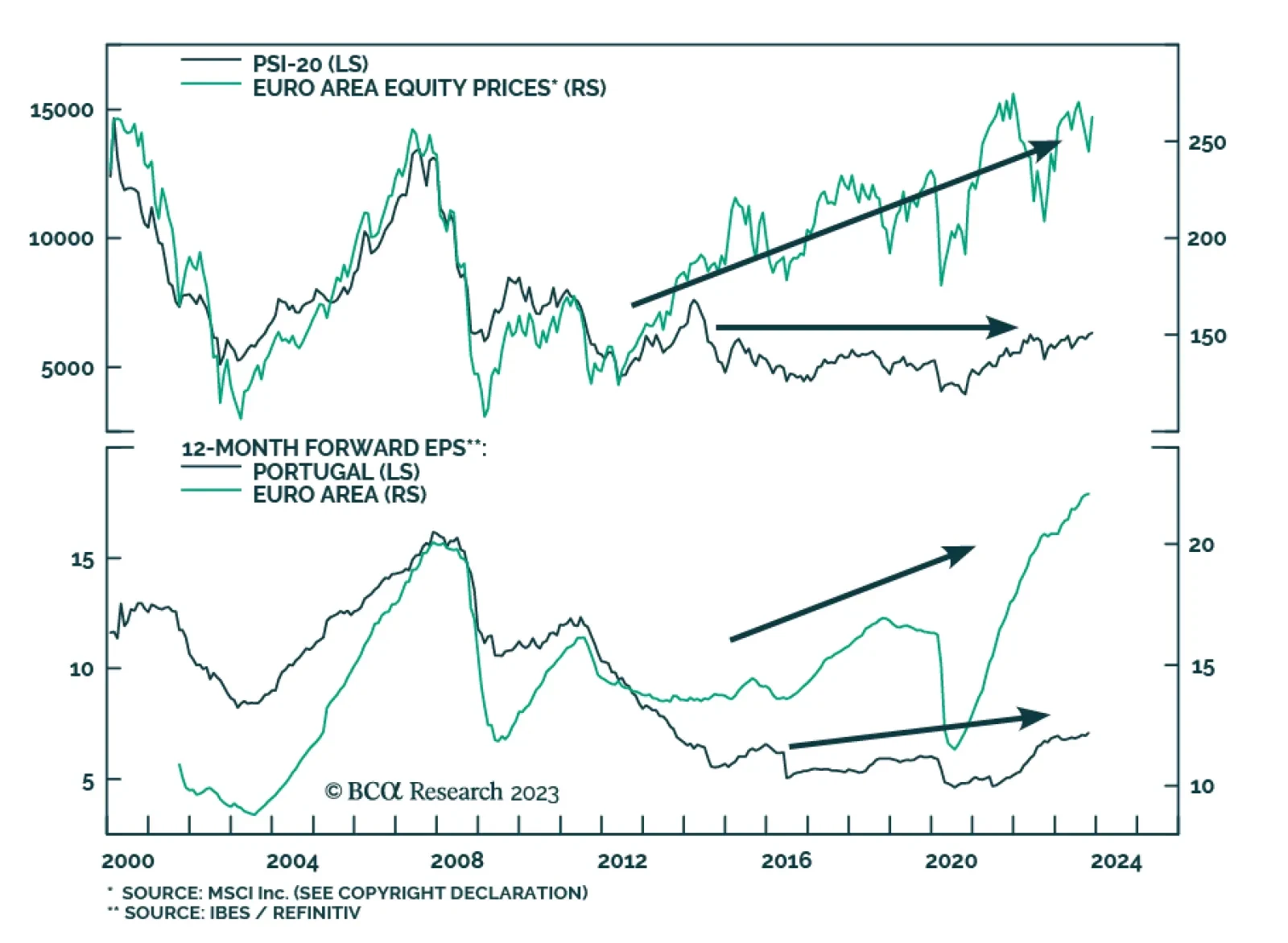

According to BCA Research's European Investment Strategy service, given the defensive nature of Portuguese equities and the team's recession view, investors should favor the Portuguese bourse relative to Euro Area…

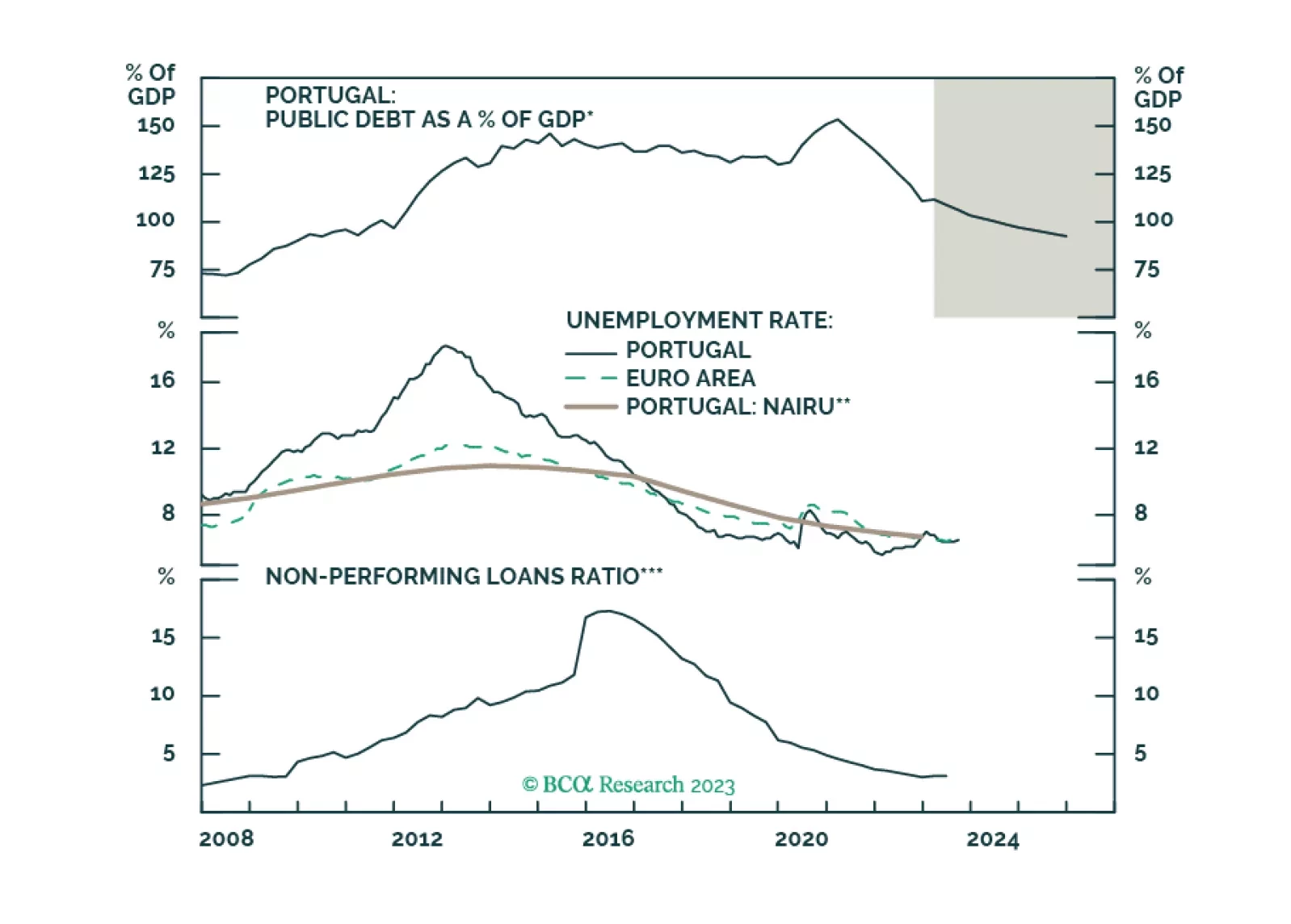

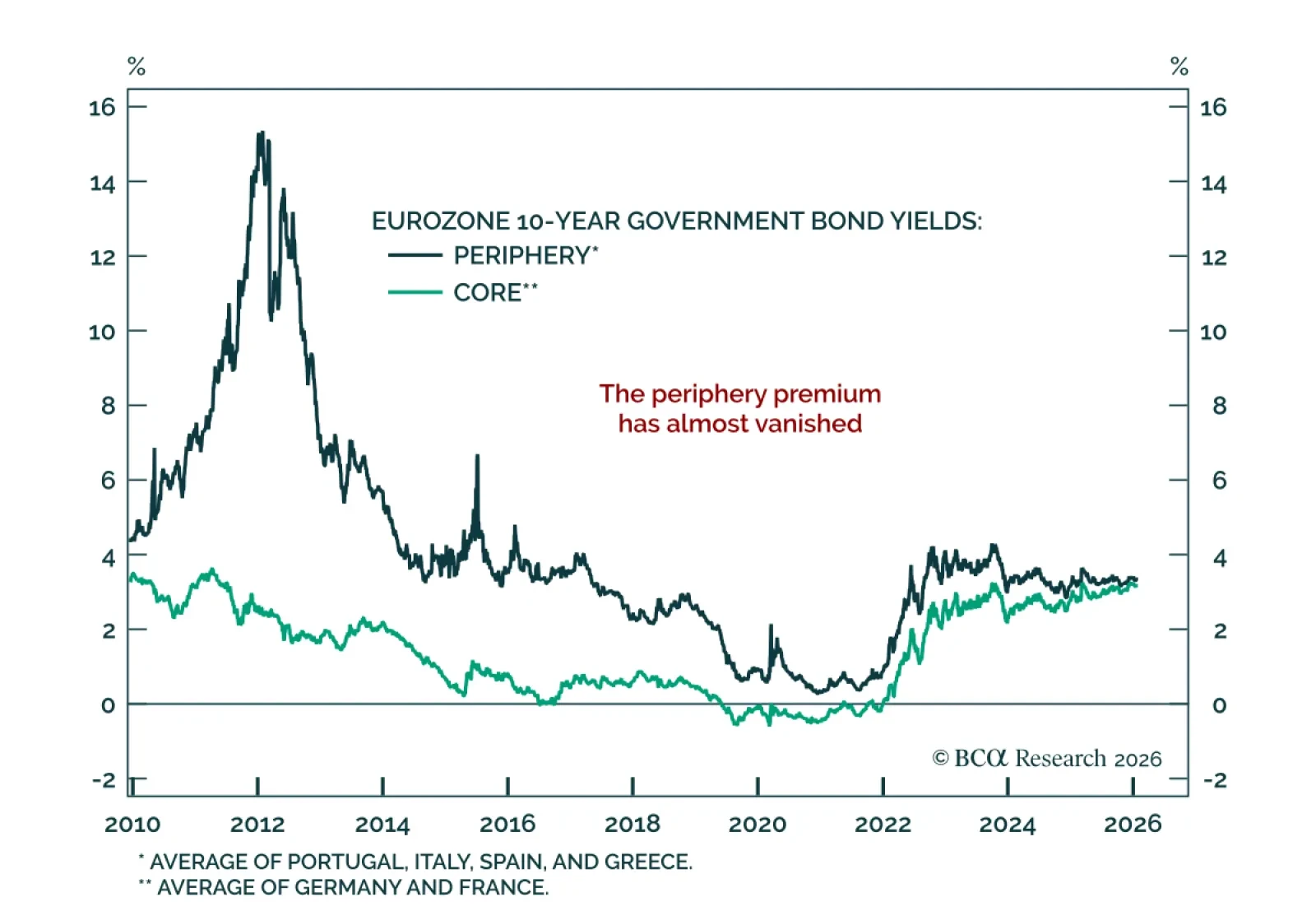

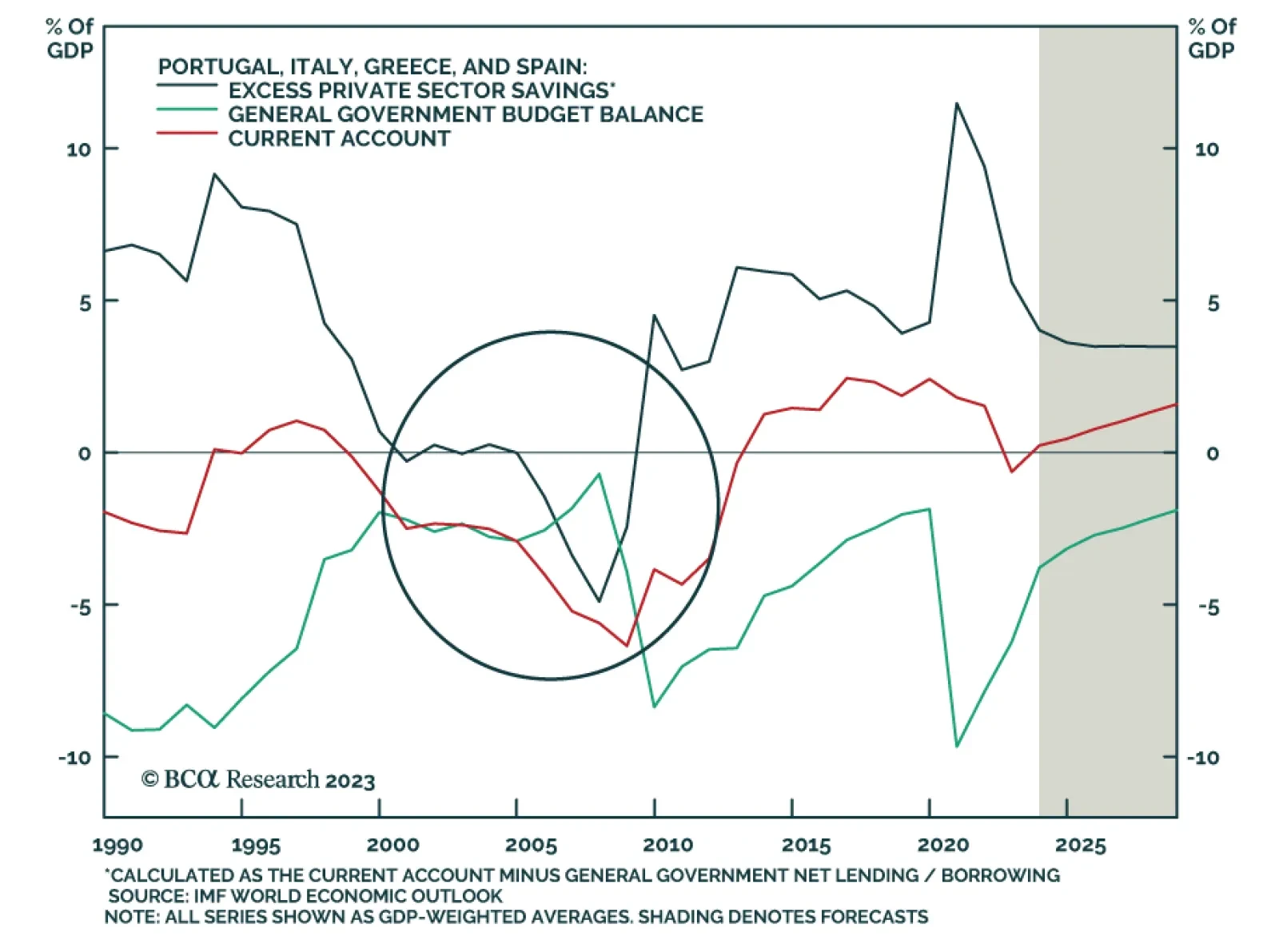

According to BCA Research’s European Investment Strategy service, the Mediterranean bloc’s move from current account deficit to current account surplus nations greatly limits the risk of a new sovereign debt crisis…

Highlights Duration: The opposing forces currently pulling on global bonds - softer growth and core inflation readings vs. tightening labor markets - are keeping yields locked into narrow trading ranges. We expect the strength of the…

A benchmark overall duration stance is still warranted, as central banks will maintain exceptionally accommodative monetary policies to offset potential Brexit-related shocks to confidence.