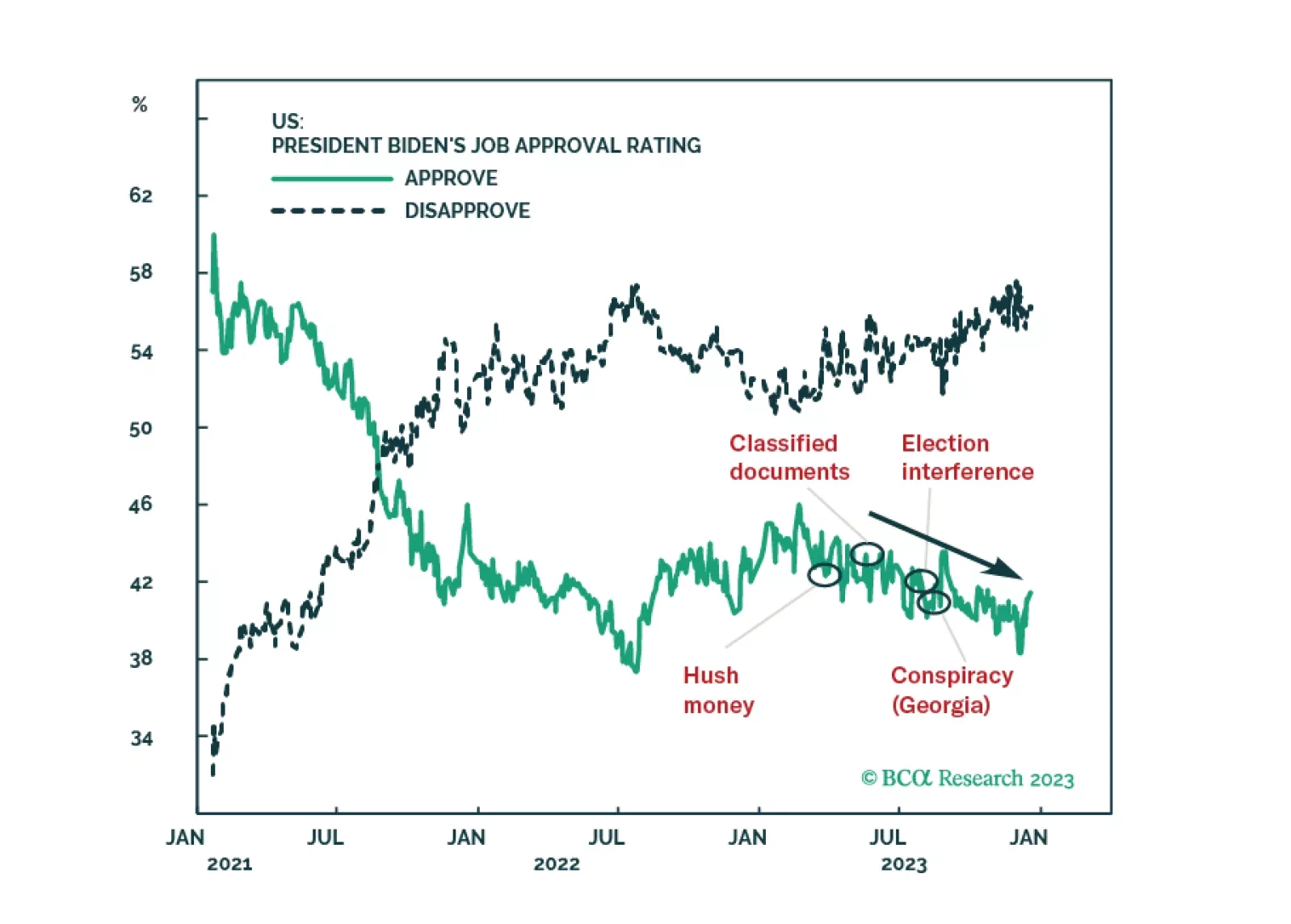

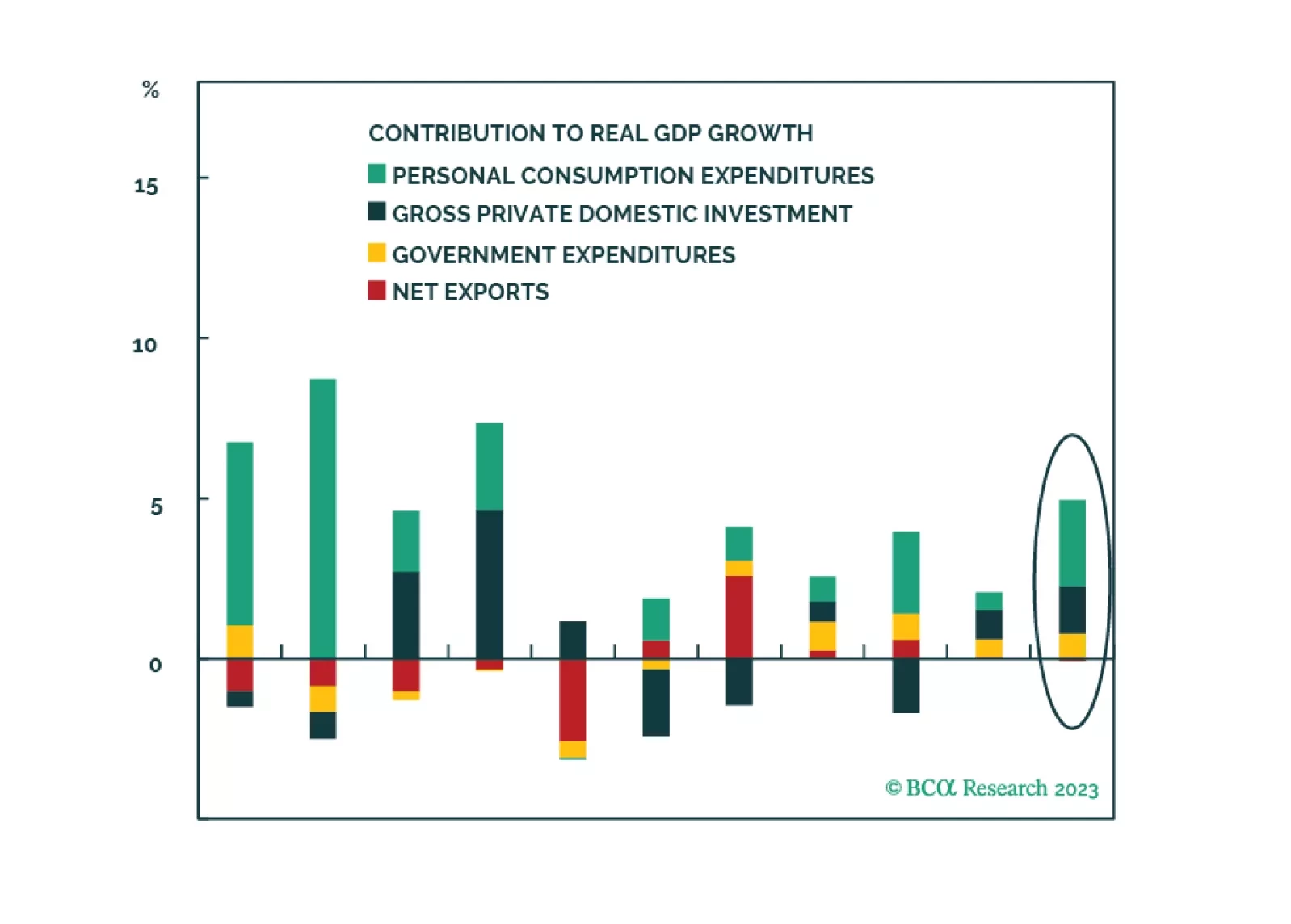

Democrats remain favored for reelection in 2024, which implies gridlock and policy status quo in 2025. That is not negative for stocks in the near term. However, economic, political, and geopolitical risks will escalate from here,…

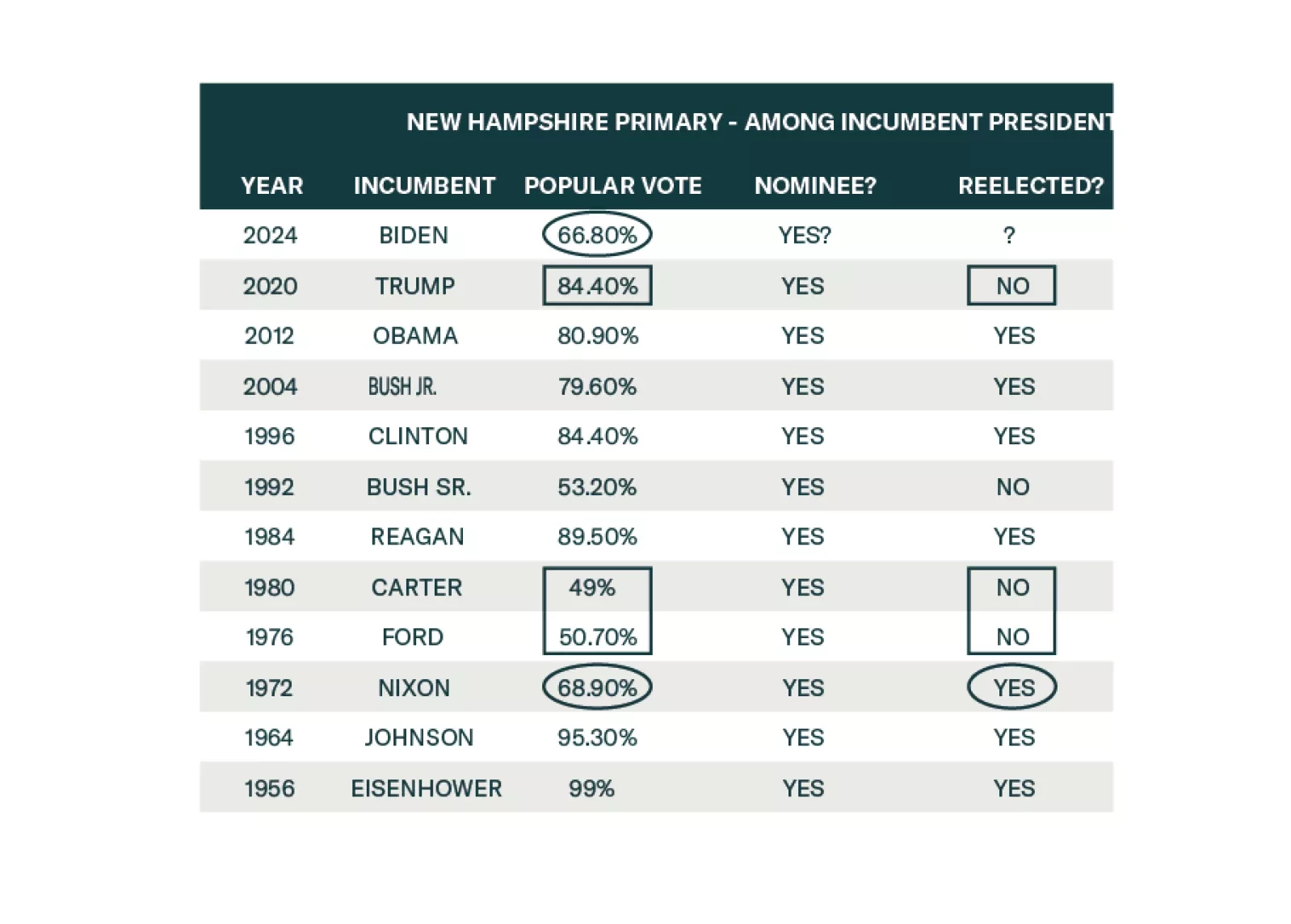

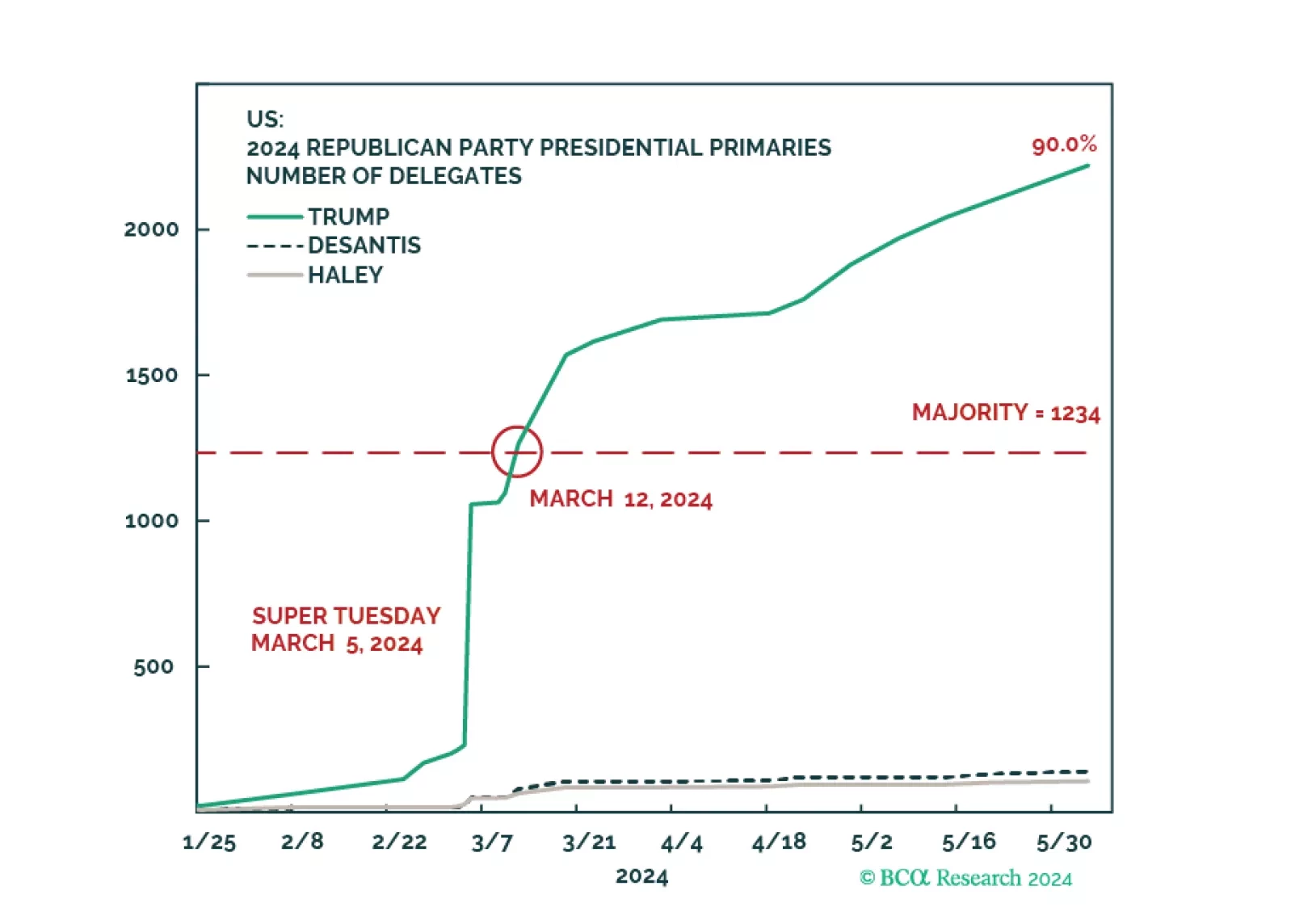

The US primary election is effectively over. The Biden-Trump rematch – our base case since 2022 – is all but set in stone. Only a health issue or freak incident could change that now.

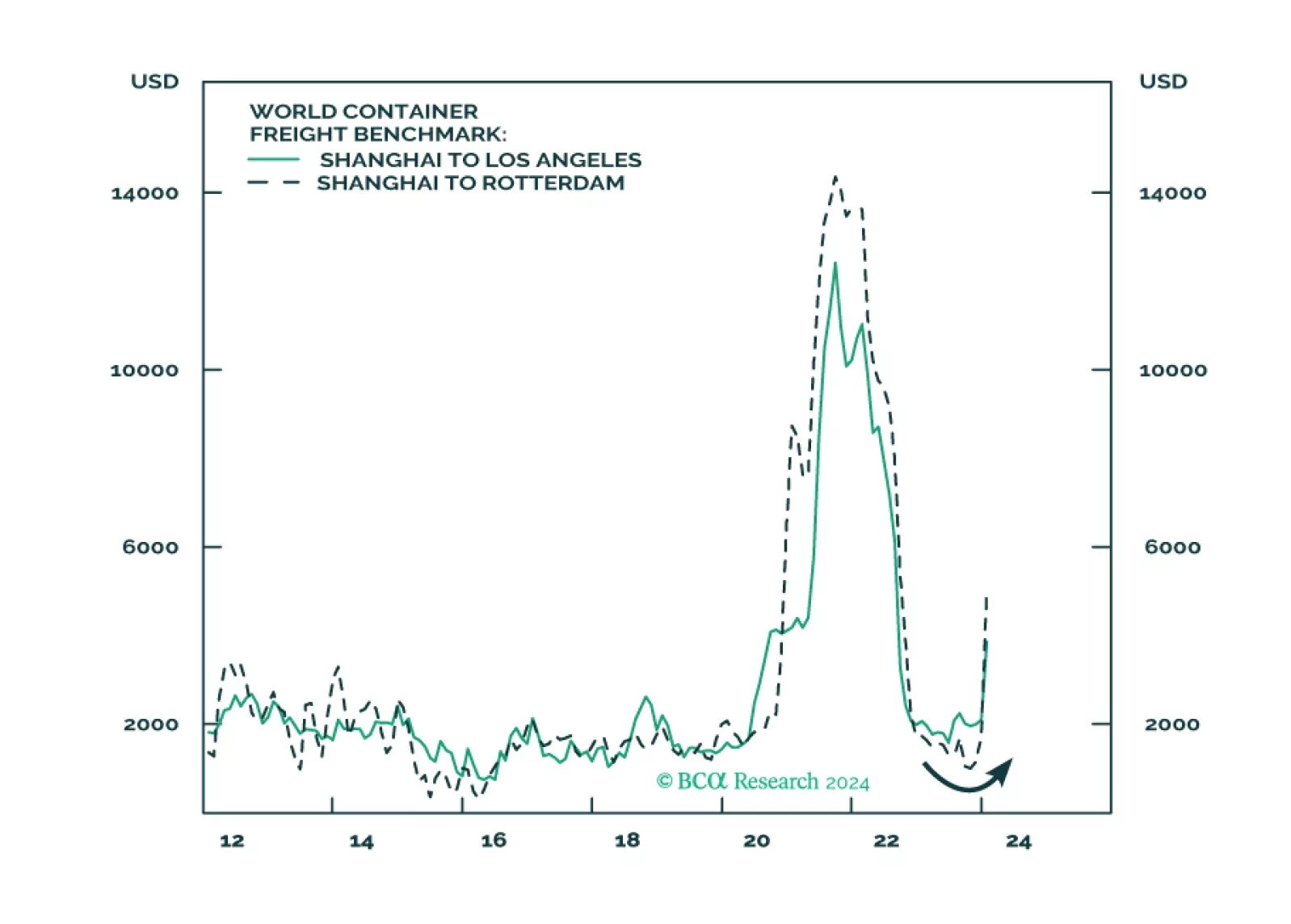

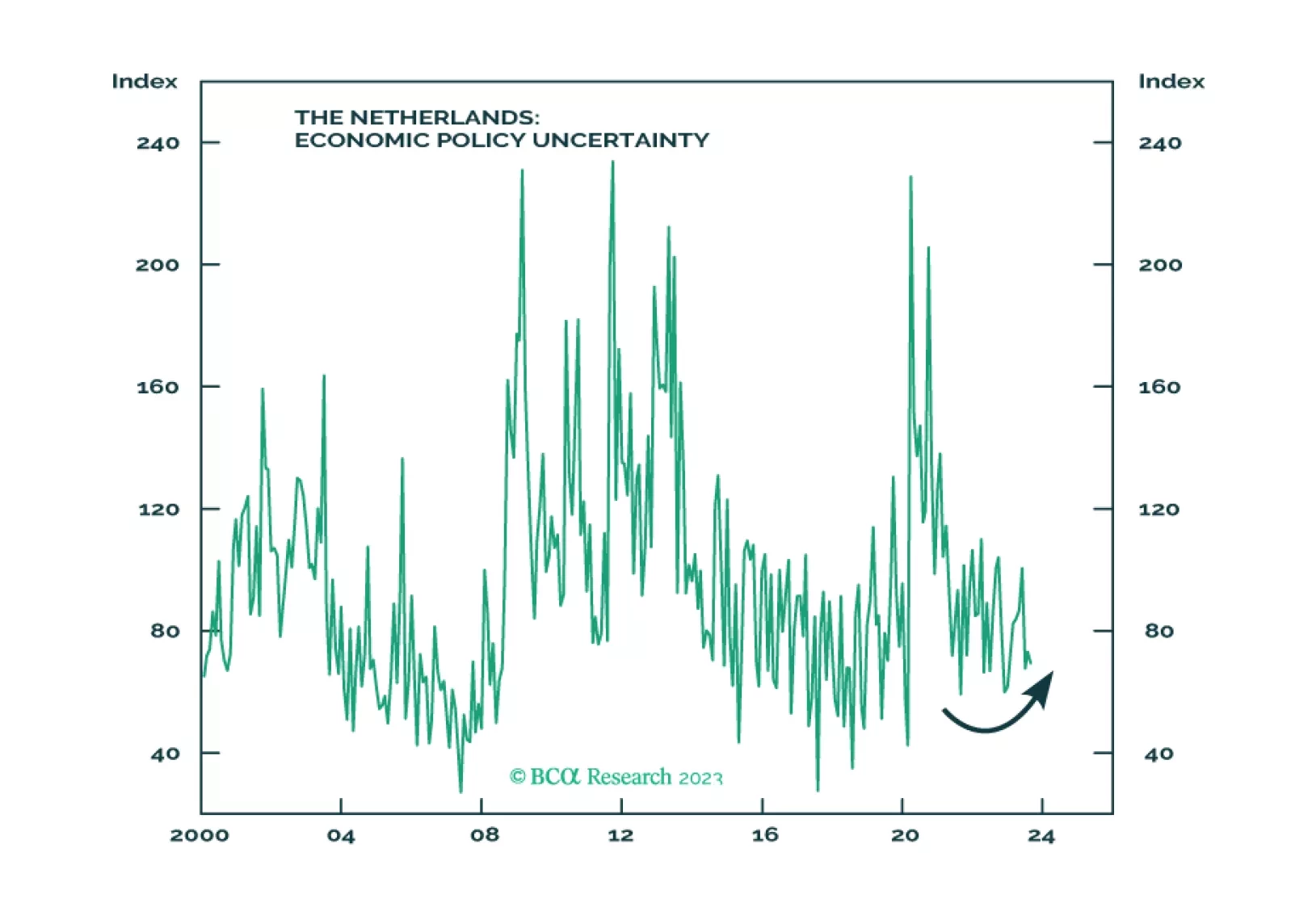

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

The market will eventually be forced to react to rising odds of a sharp US national policy reversal. Investors should overweight government bonds and defensive equity sectors.

The Republican Party’s odds of winning the 2024 election will benefit, if anything, from state courts’ attempts to exclude President Trump from primary or general election ballots. Higher odds of a change of ruling party will…

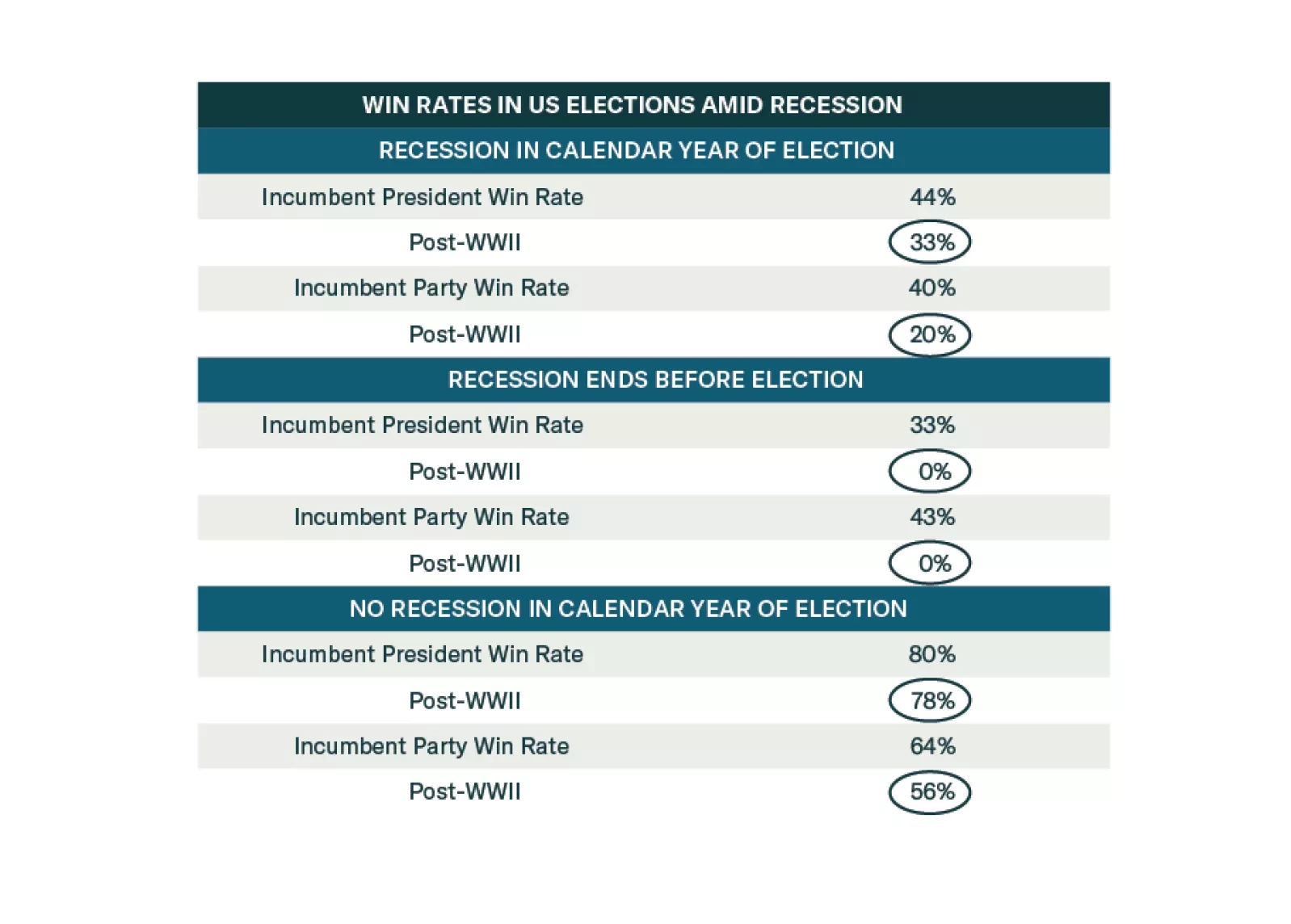

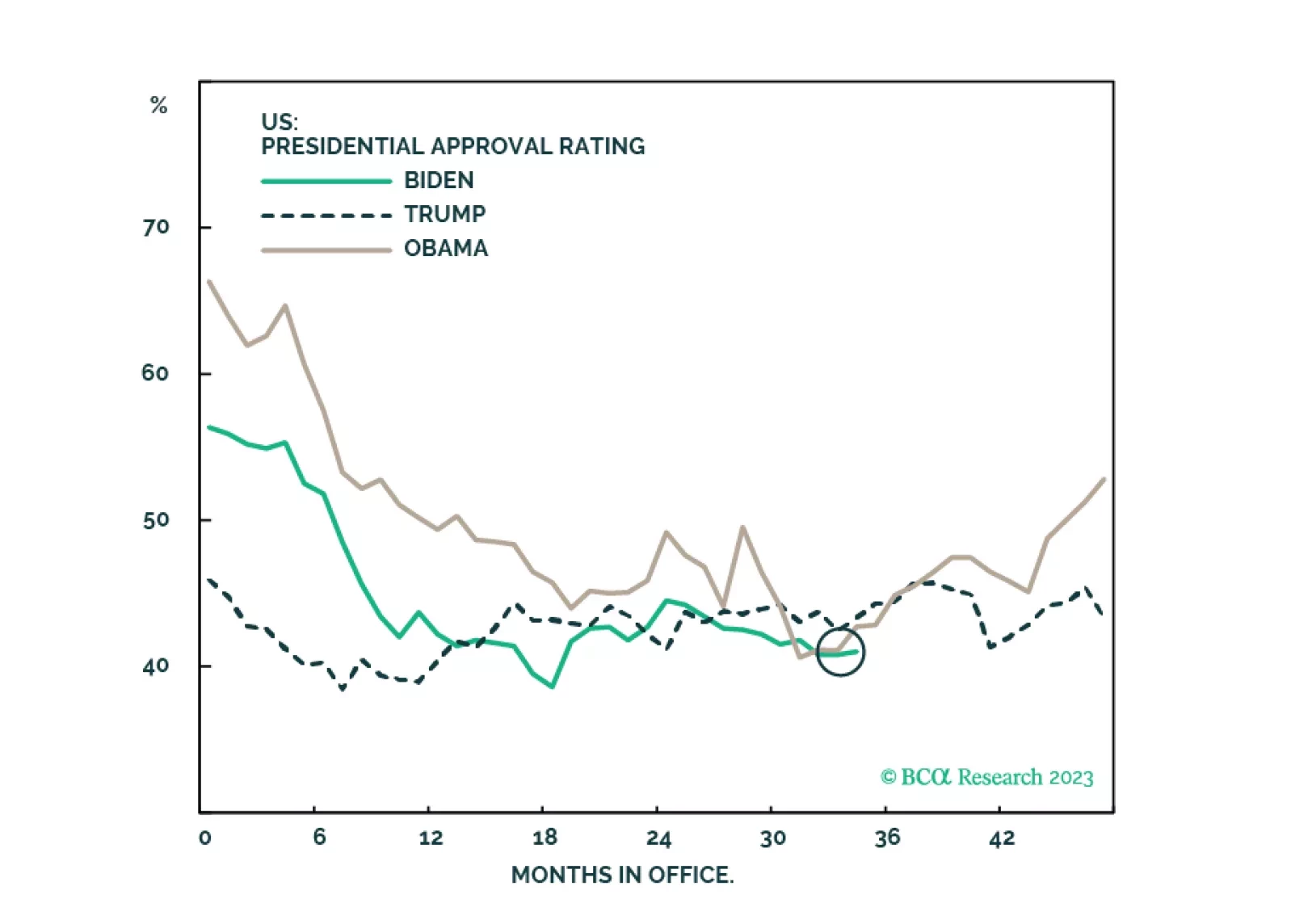

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

According to BCA Research’s US Political Strategy service, the results of the 2023 off-year elections are positive marginally for the equity market according to the team's “Golden Rule of the 2024 Election,…

Results from Tuesday’s elections suggest that the Democrats are doing better than what their 2024 polling are showing. While the results are marginally positive for equities, investors should not overrate this off-year election,…

Stronger US growth elicits a response from the House Republicans. But a government shutdown is not devastating to the economy. What is more devastating would be a crisis in the Middle East, Europe, and Asia. Stay long US defense,…