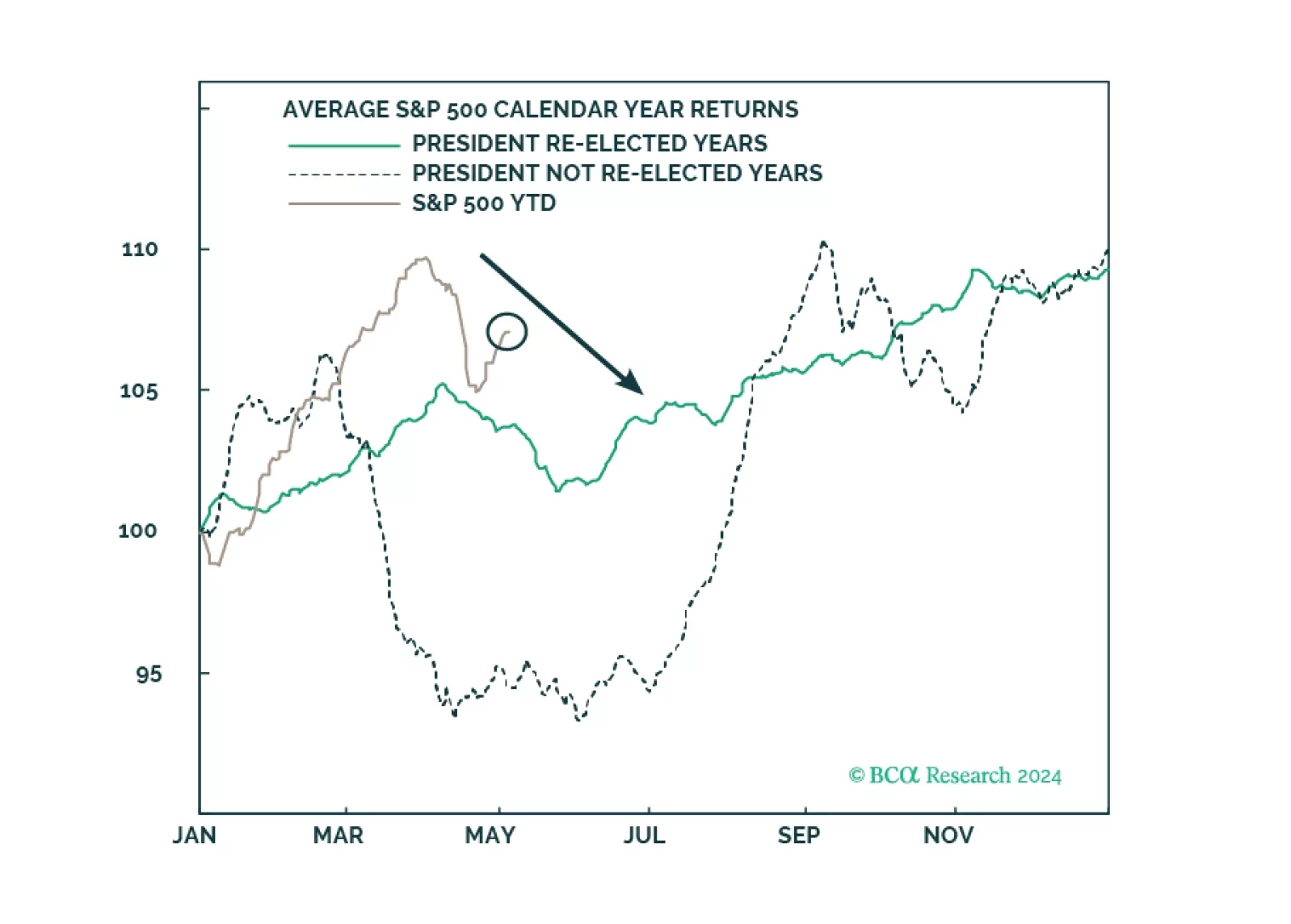

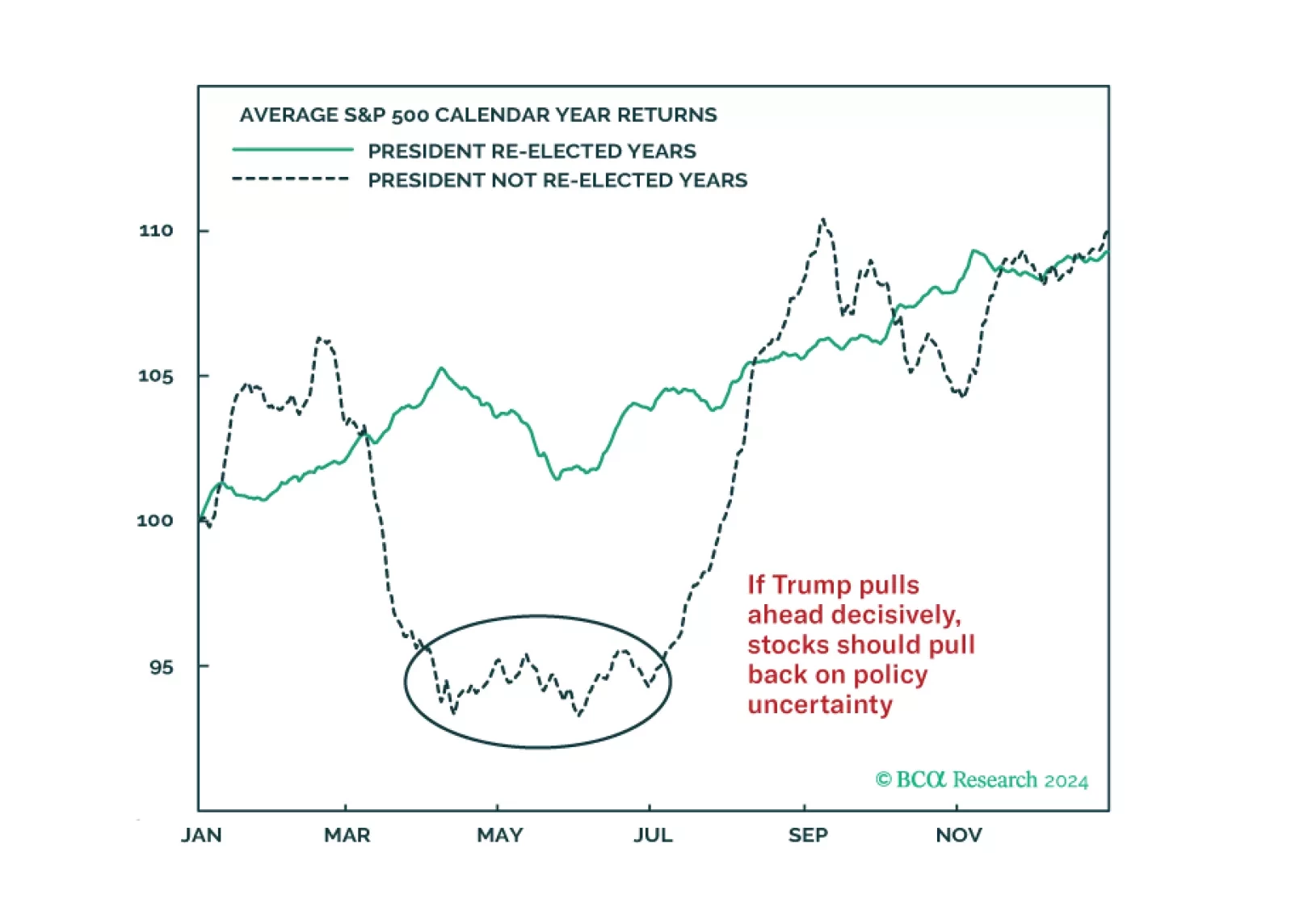

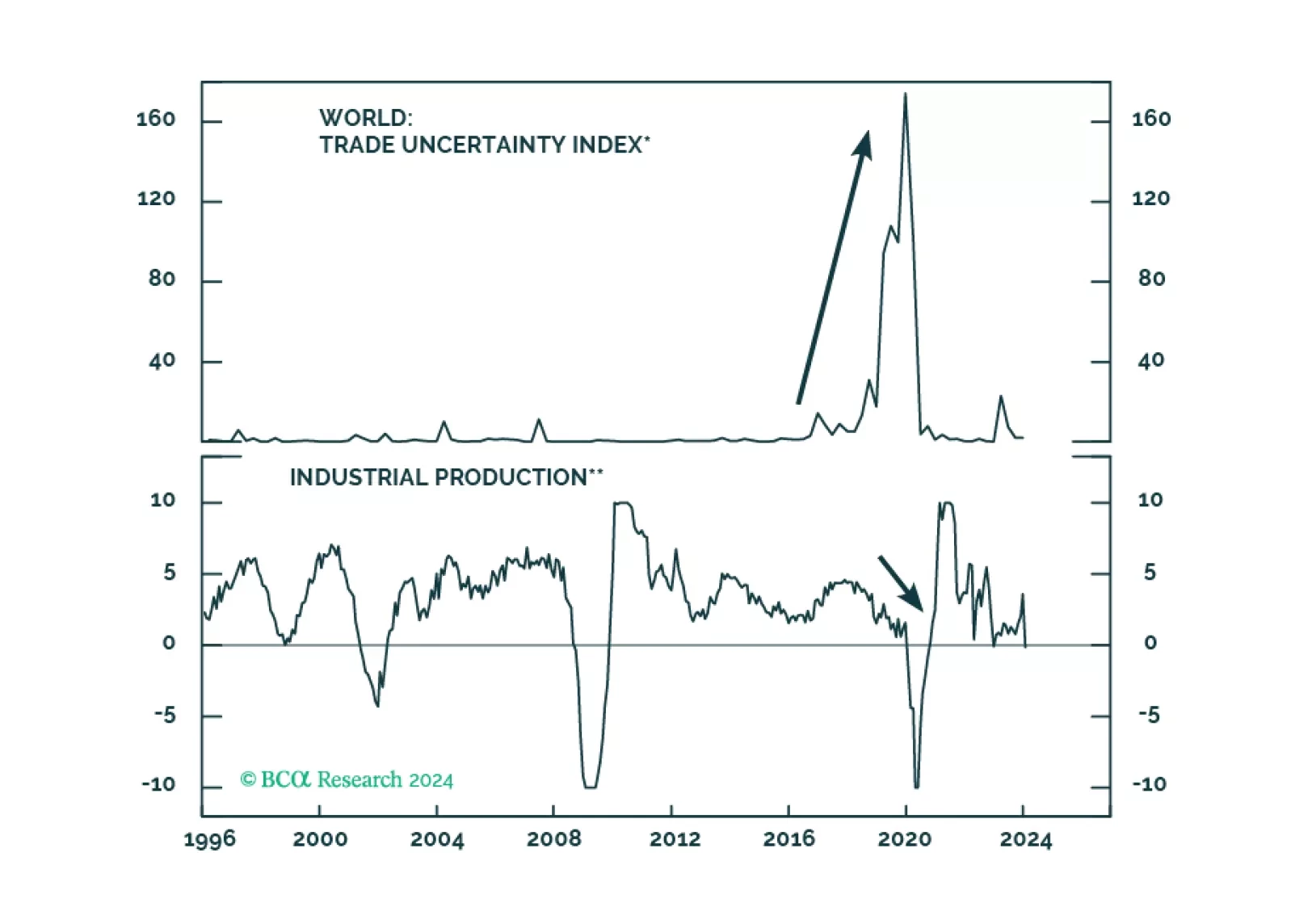

The stock market will suffer a setback from the weakening labor market and a rebound in US and global policy uncertainty.

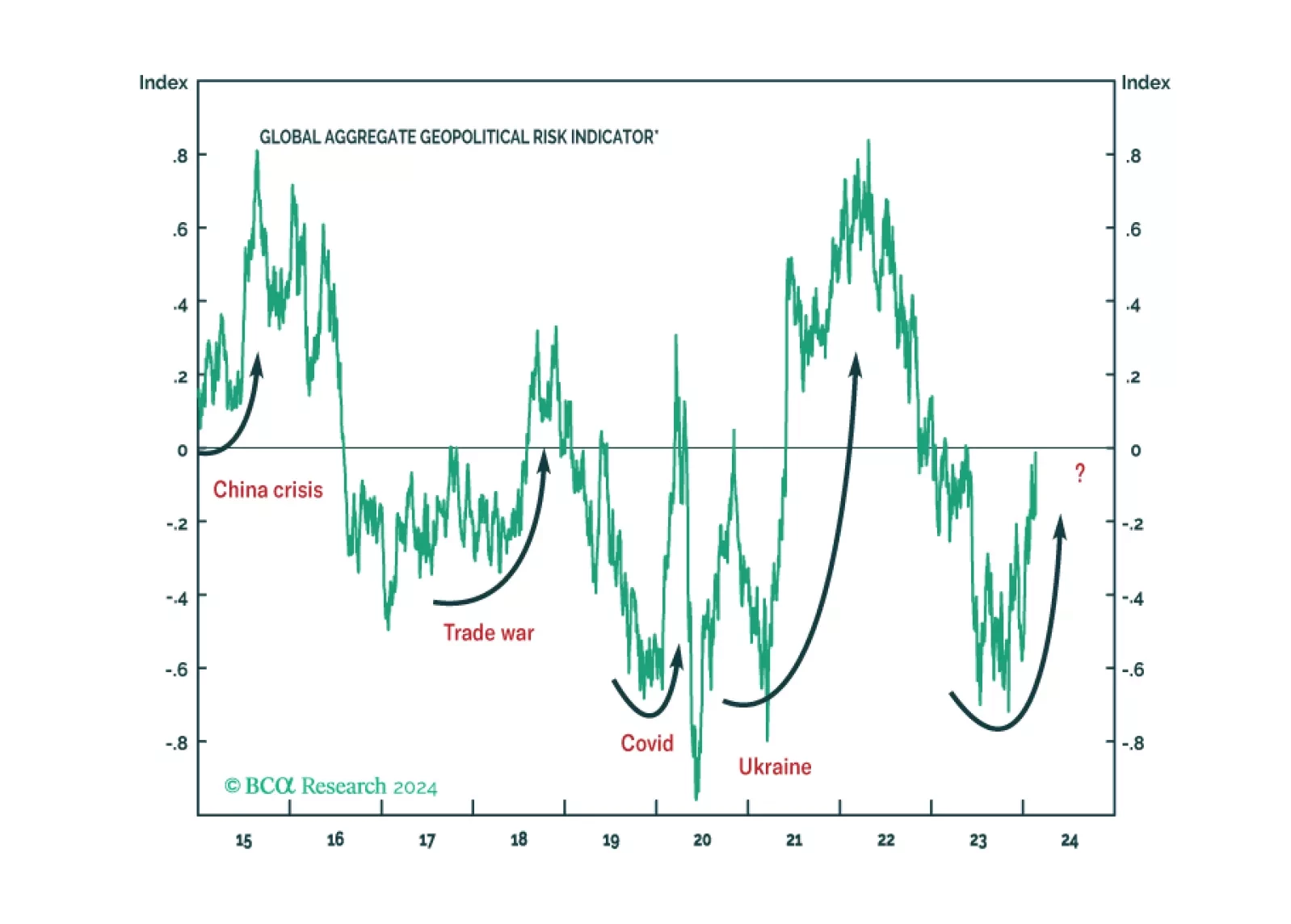

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.

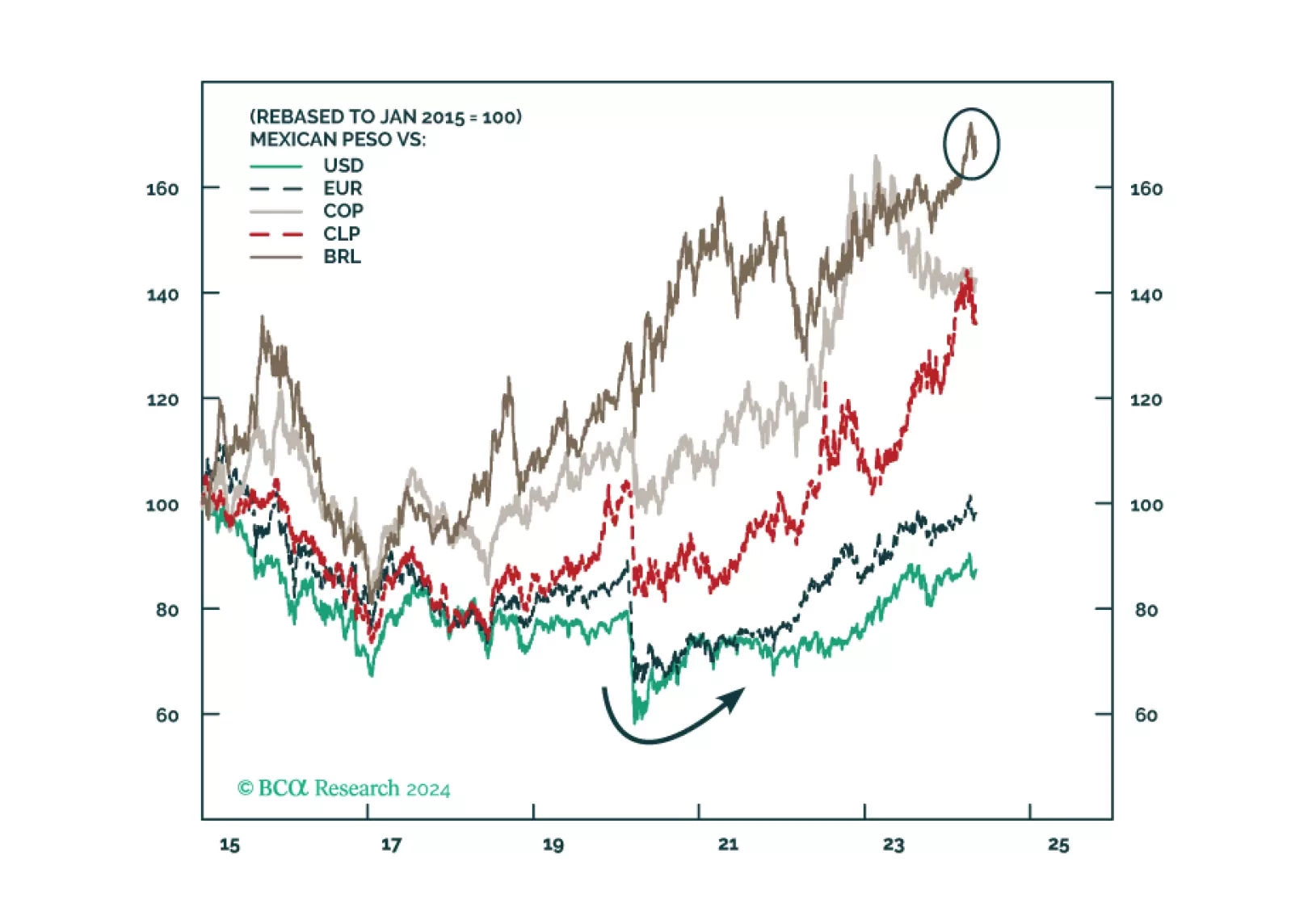

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

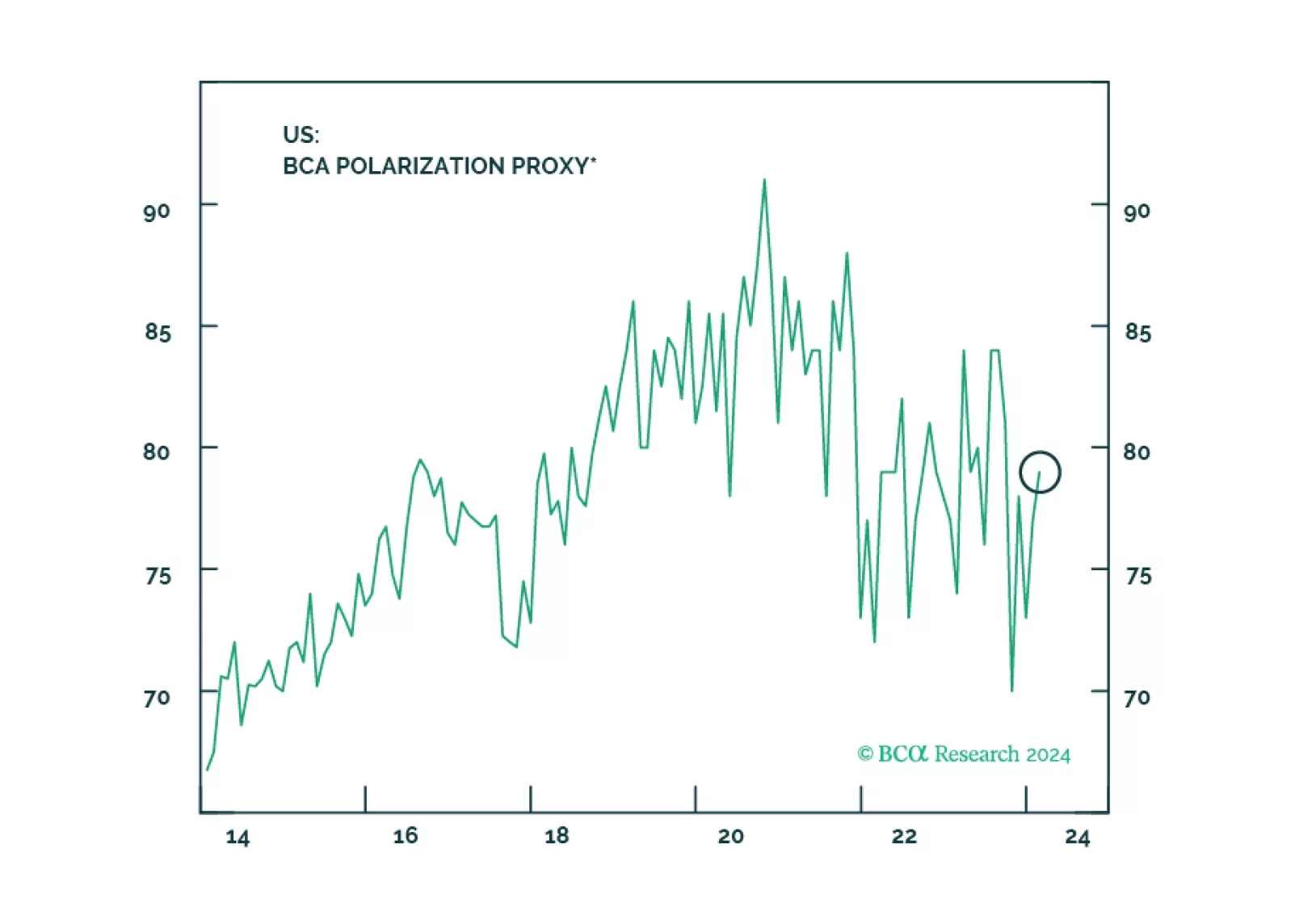

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

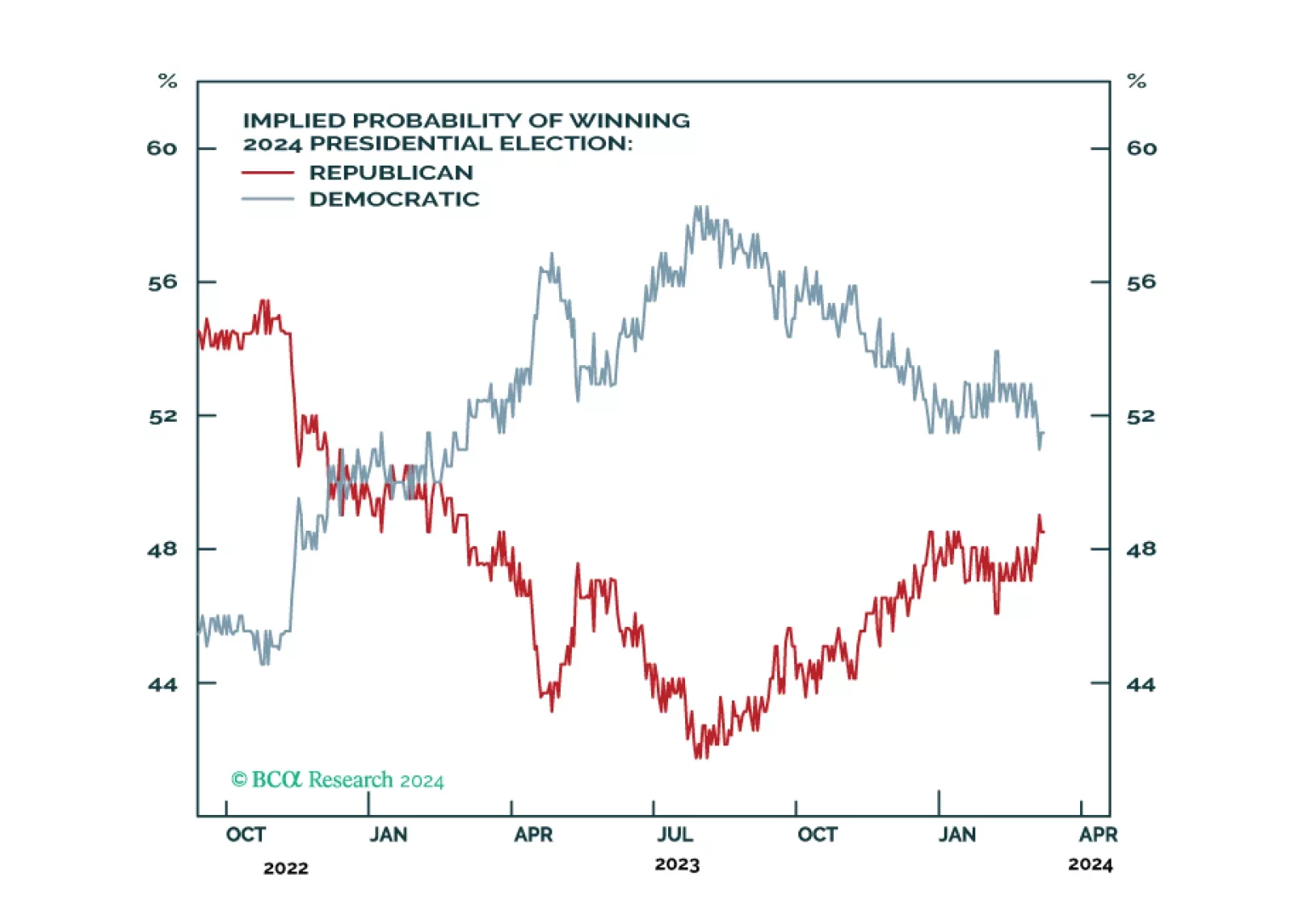

The US Presidential election is eight months away. In this report, we will be looking at what is left of President Biden’s political capital and his room for actions in the next few months which may include market-negative actions…

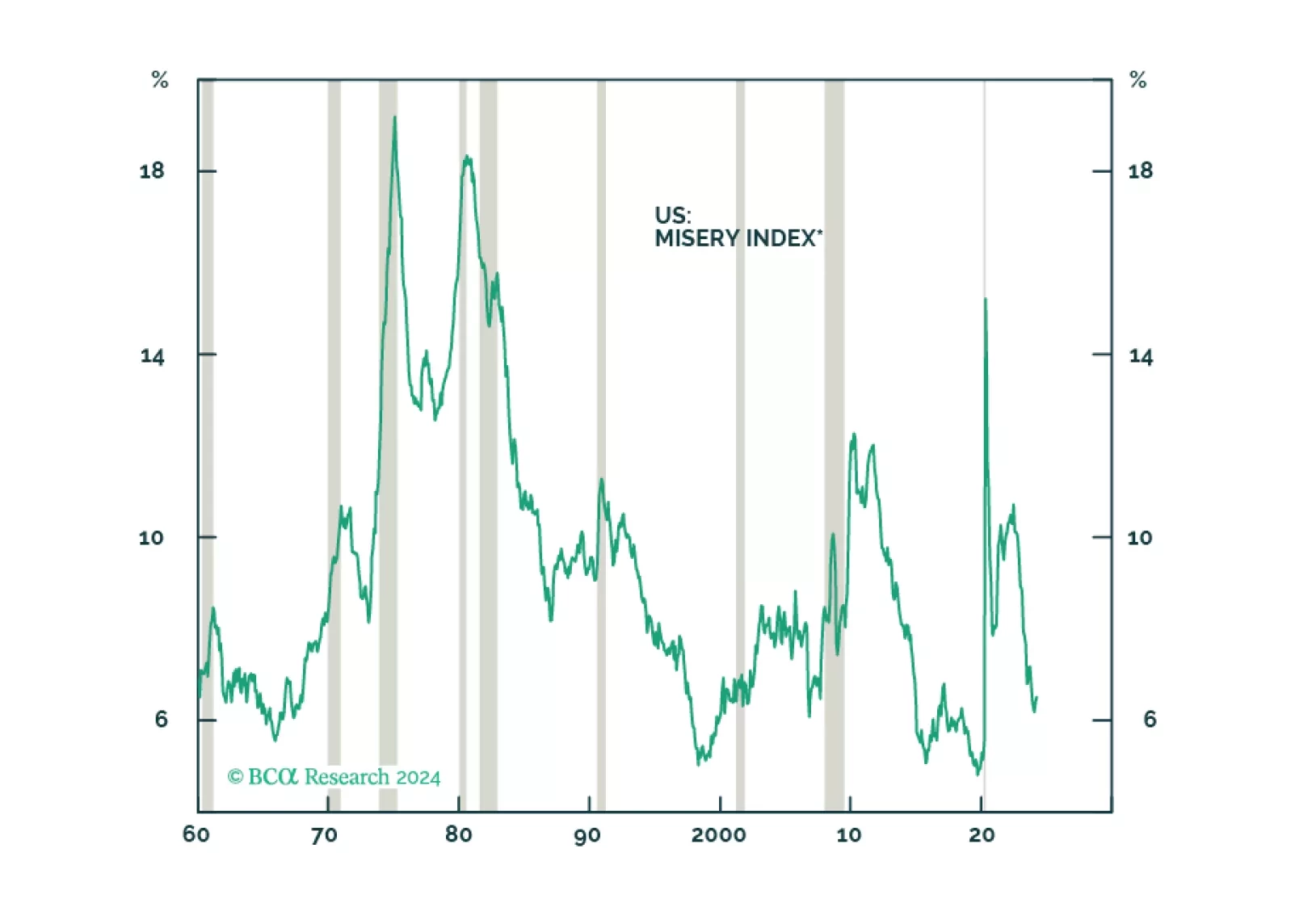

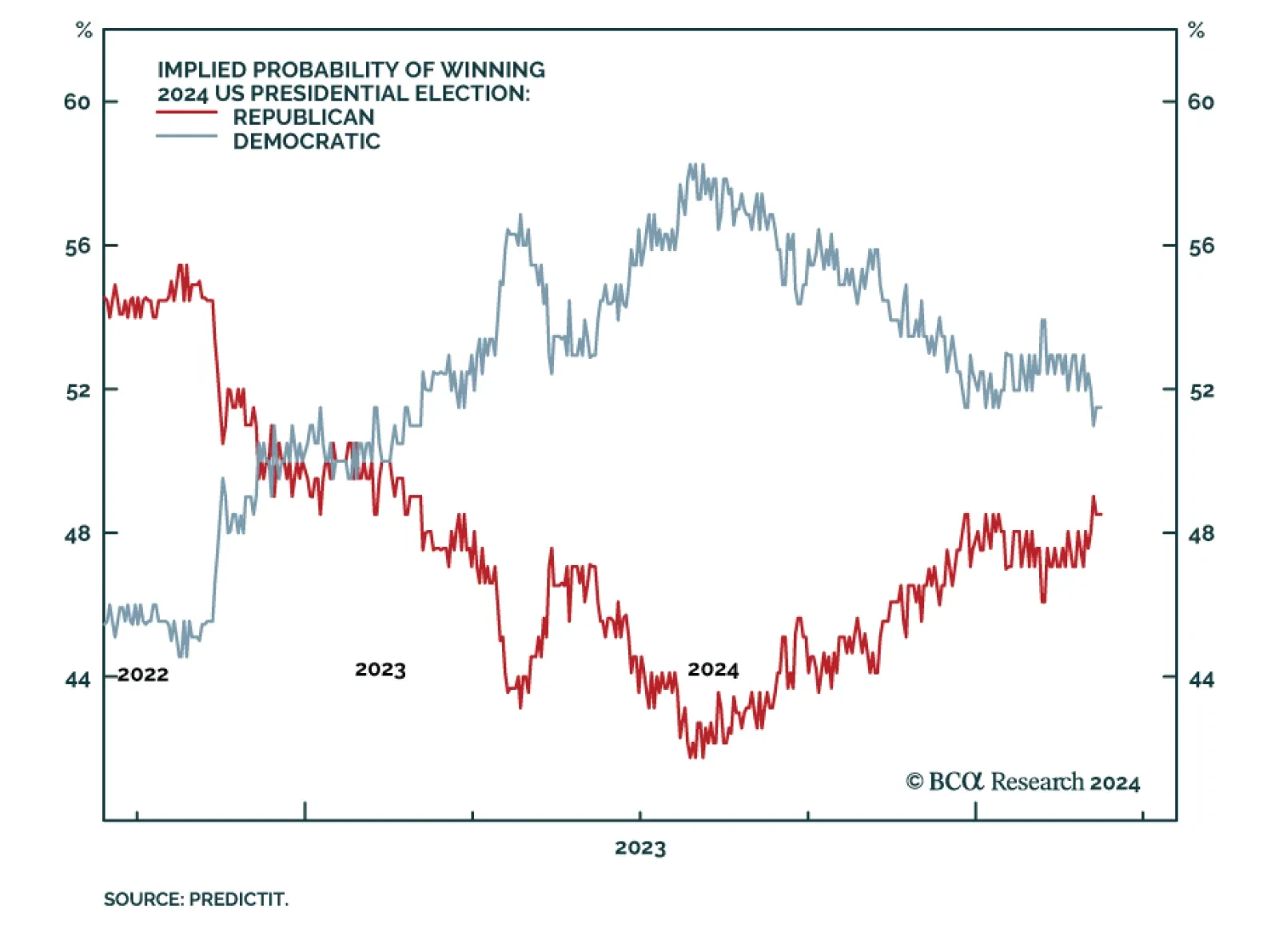

According to BCA Research’s US Political Strategy service, the Democrats are still favored for reelection due to the resilient economy, but President Biden’s victories on Super Tuesday had not positively affected his…

Democrats are still slightly favored for reelection as the incumbent party is presiding over a growing economy. However, Biden’s strong showing in the primary election is not lifting his popular approval yet, and that is a worrying…

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…