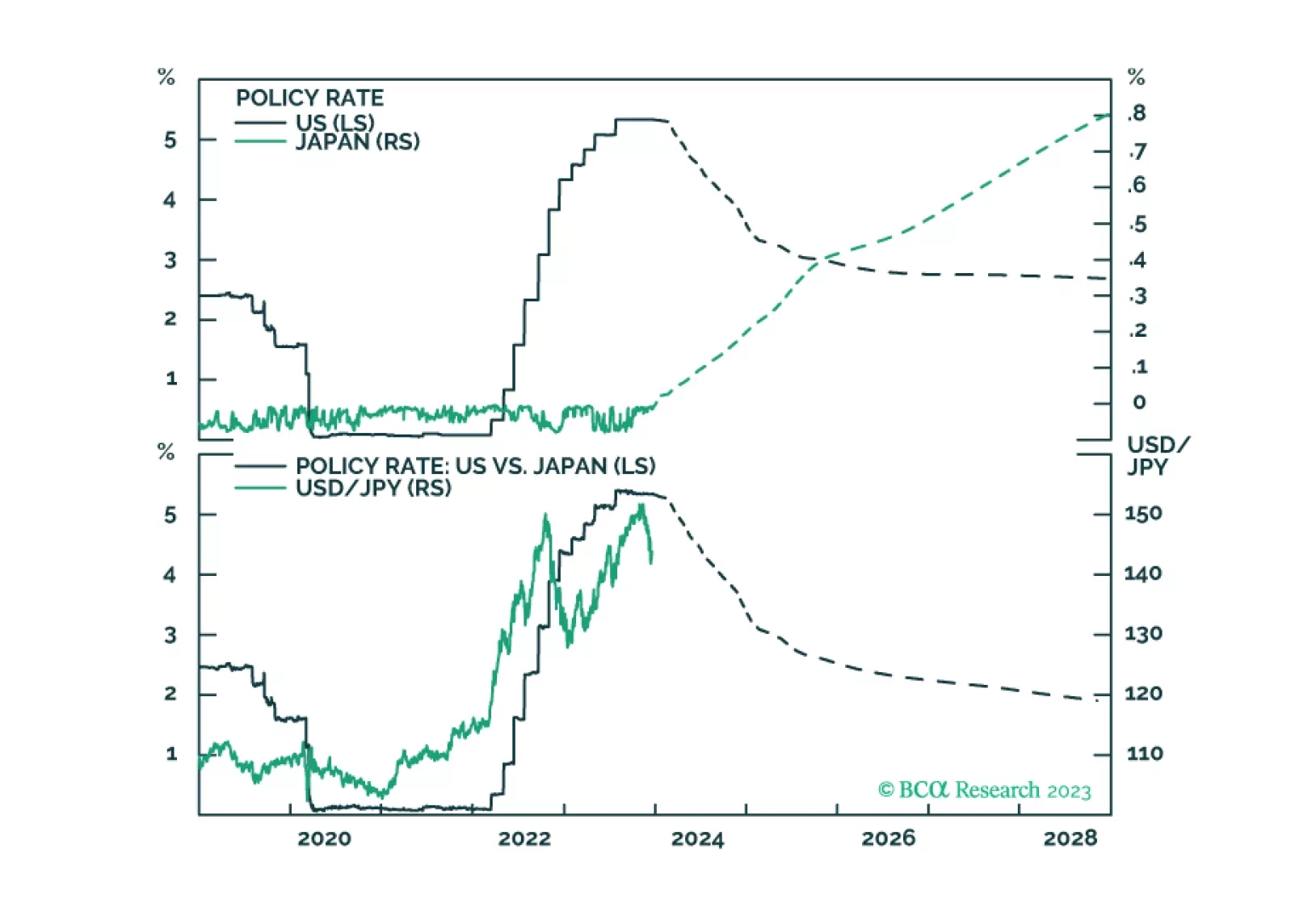

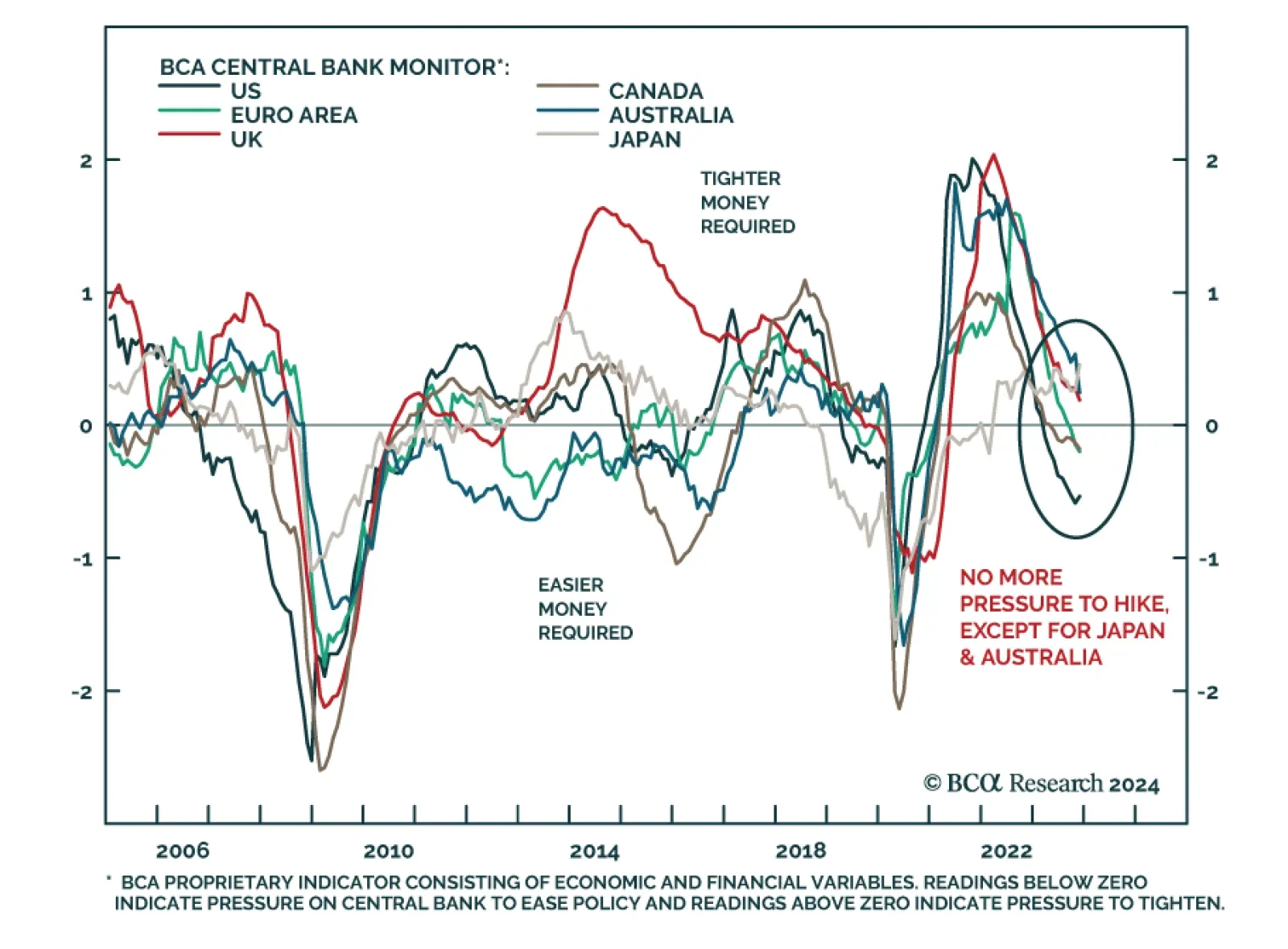

According to BCA Research’s Global Fixed Income Strategy service, the timing and pace of rate cuts in 2024 will differ across countries, representing a big sea change from the highly correlated rate hiking cycles of the…

A post-mortem of our trades for the year, and also comments on future yen and sterling moves from the recent BoJ meeting, and the UK inflation report.

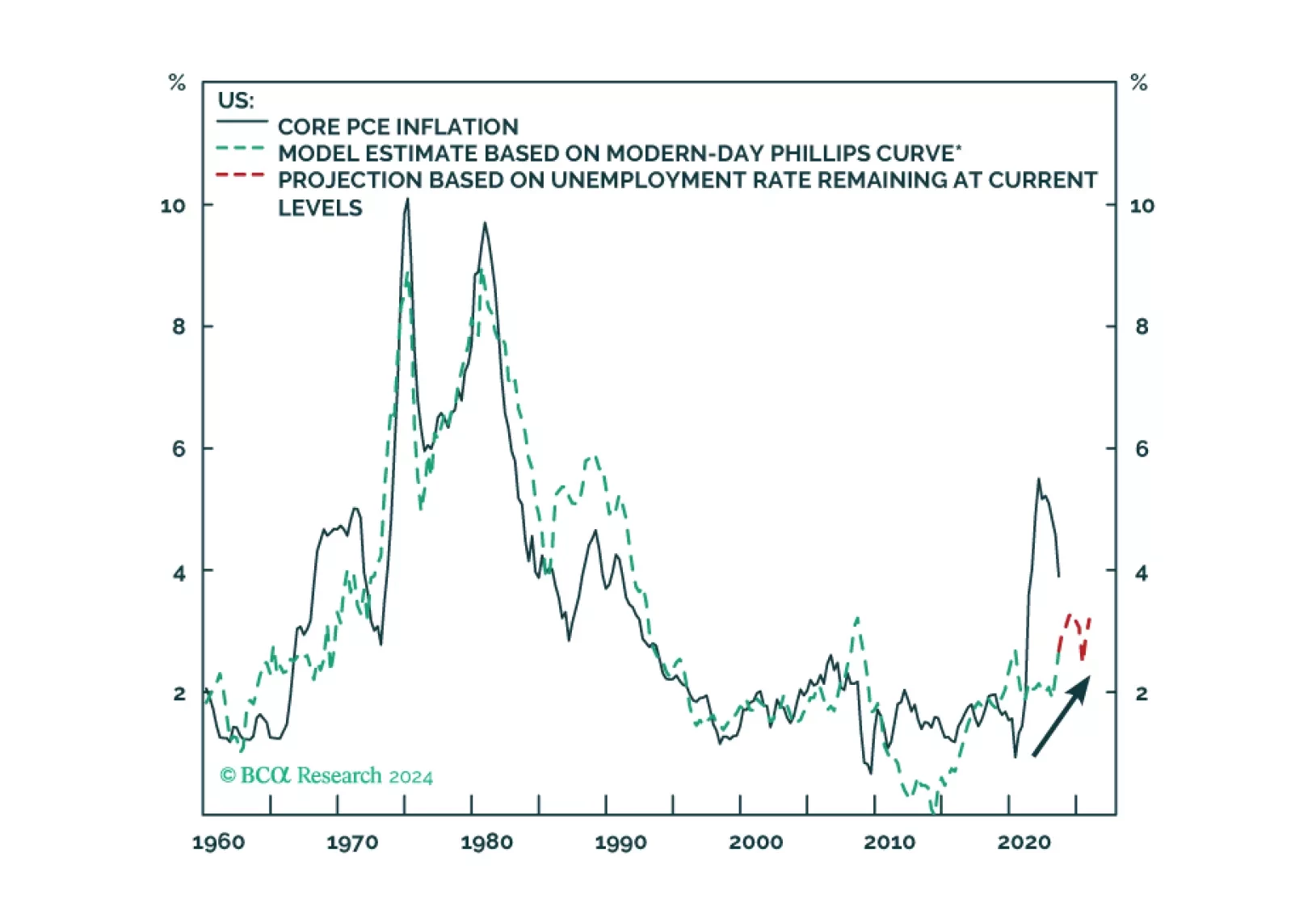

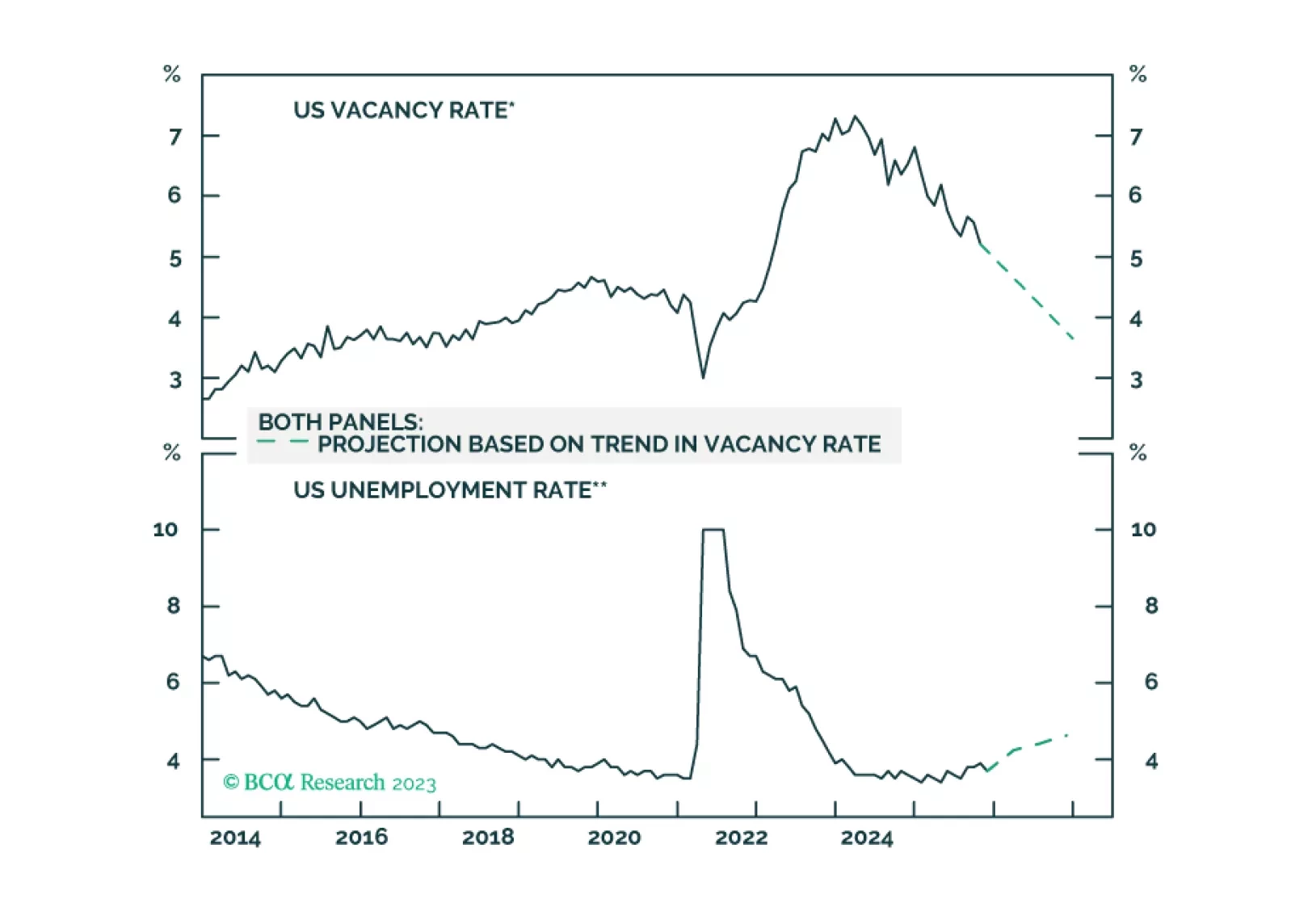

In Section I, we discuss the implications and potential risks of the Fed’s recent pivot. The near-term implications of the Fed's dovish pivot are likely to continue to be bullish for risky asset prices, and a new high in global stock…

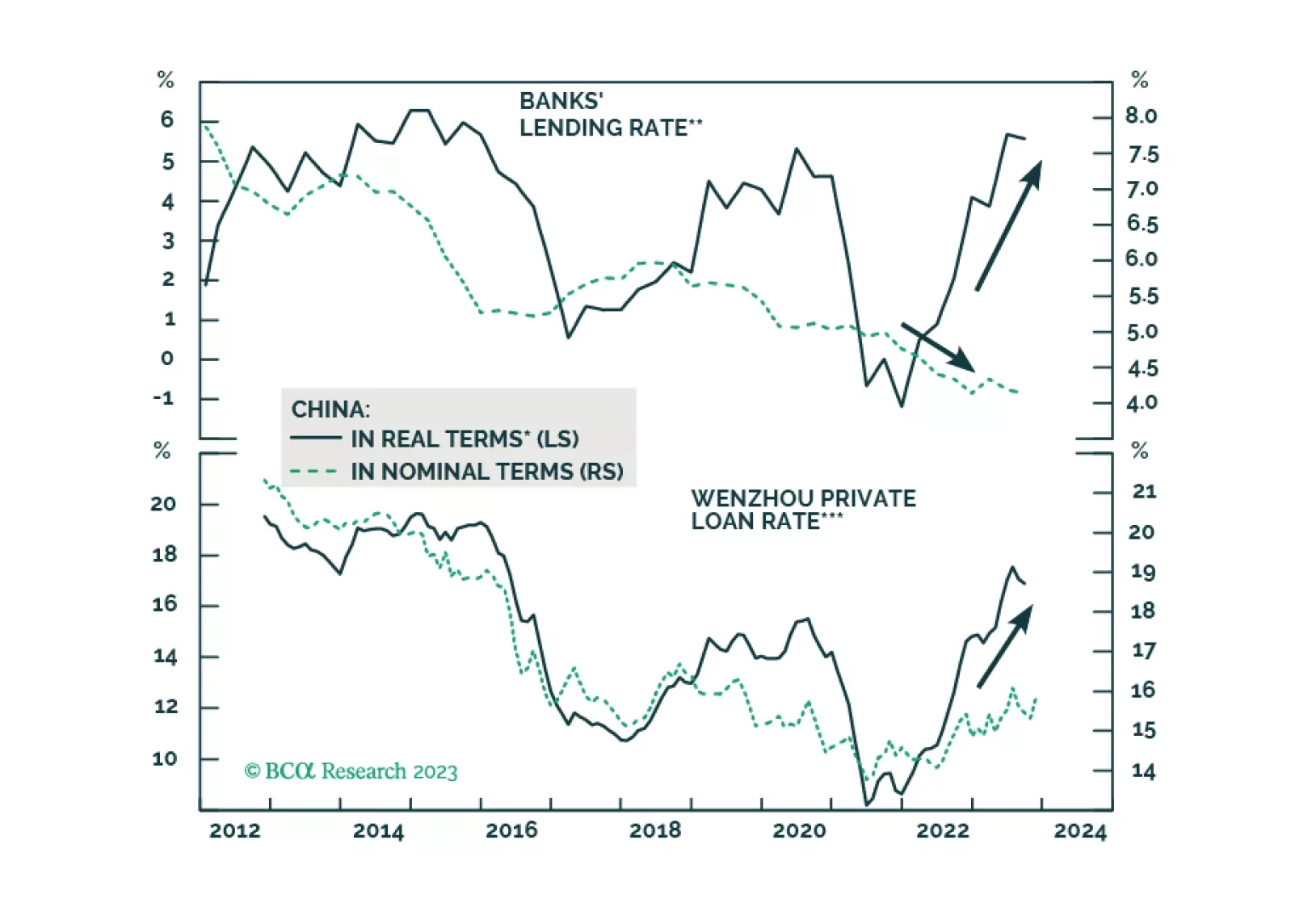

The statement from last week’s Central Economic Work Conference indicates that Chinese authorities are still not considering large-scale stimulus in 2024. Odds are that a full-fledged business cycle recovery in 2024 is unlikely.…

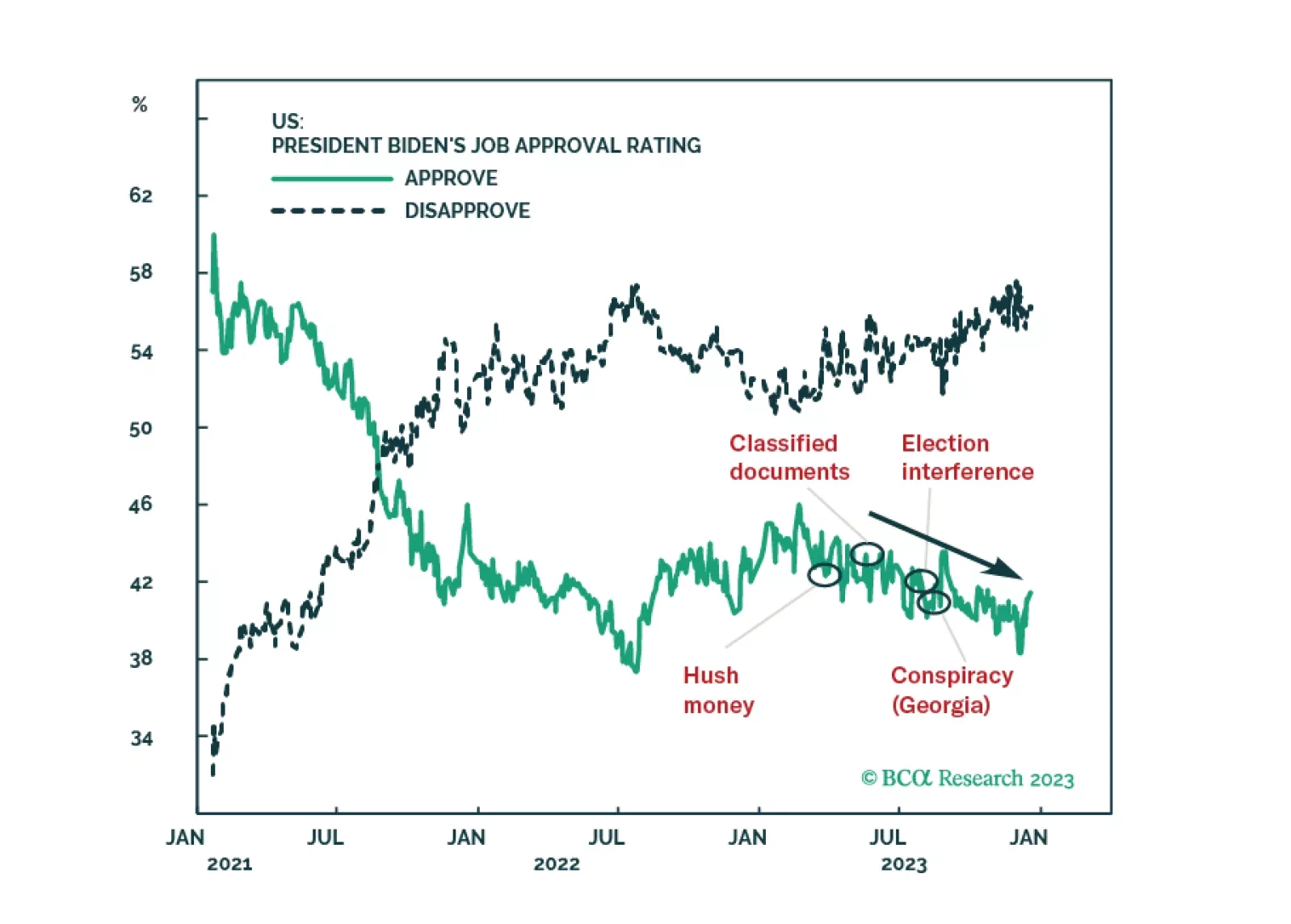

The Republican Party’s odds of winning the 2024 election will benefit, if anything, from state courts’ attempts to exclude President Trump from primary or general election ballots. Higher odds of a change of ruling party will…

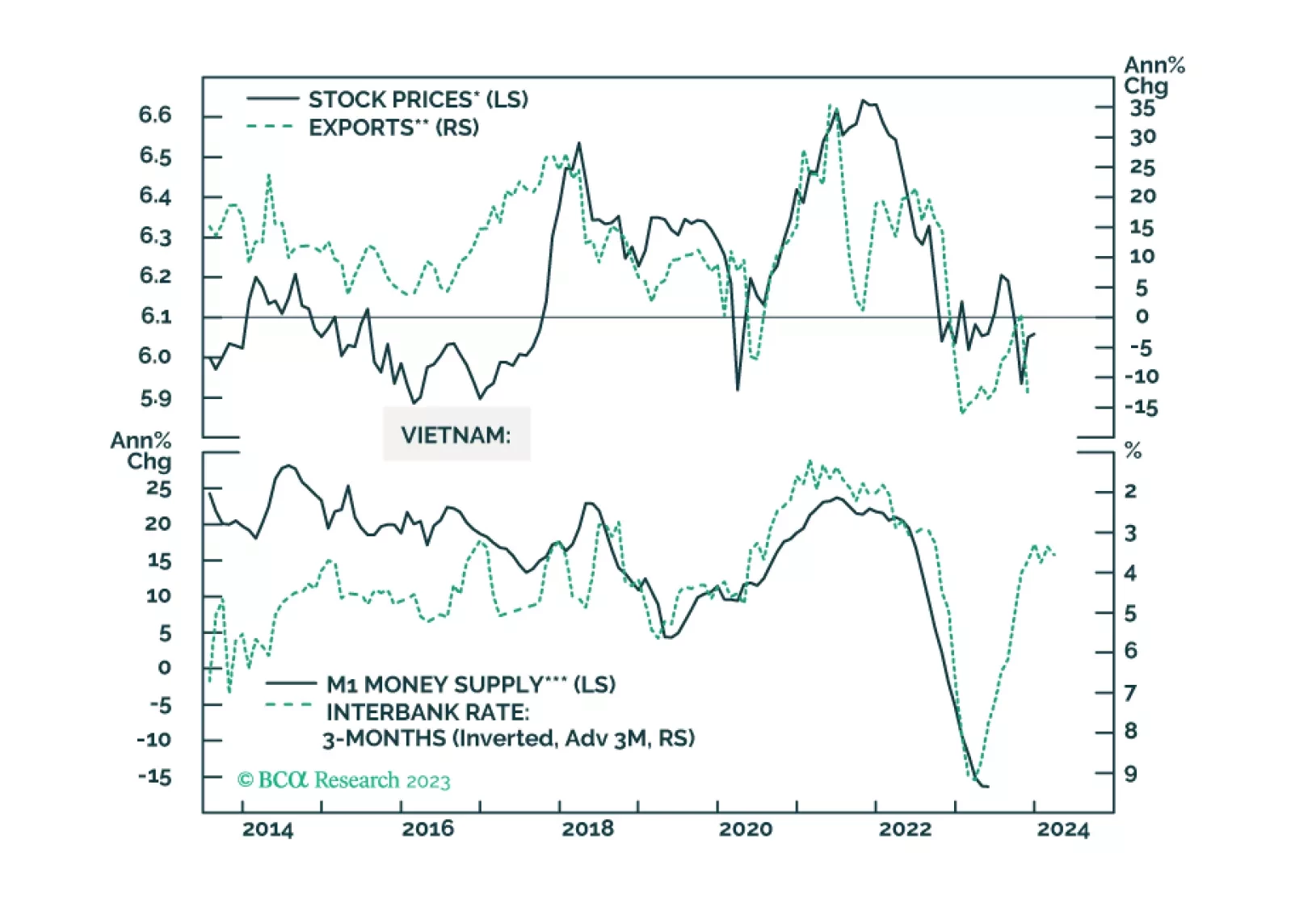

Vietnamese stocks may not see an immediate rally as global manufacturing and exports remain weak. But investors with longer-term horizons should stay overweight this market.

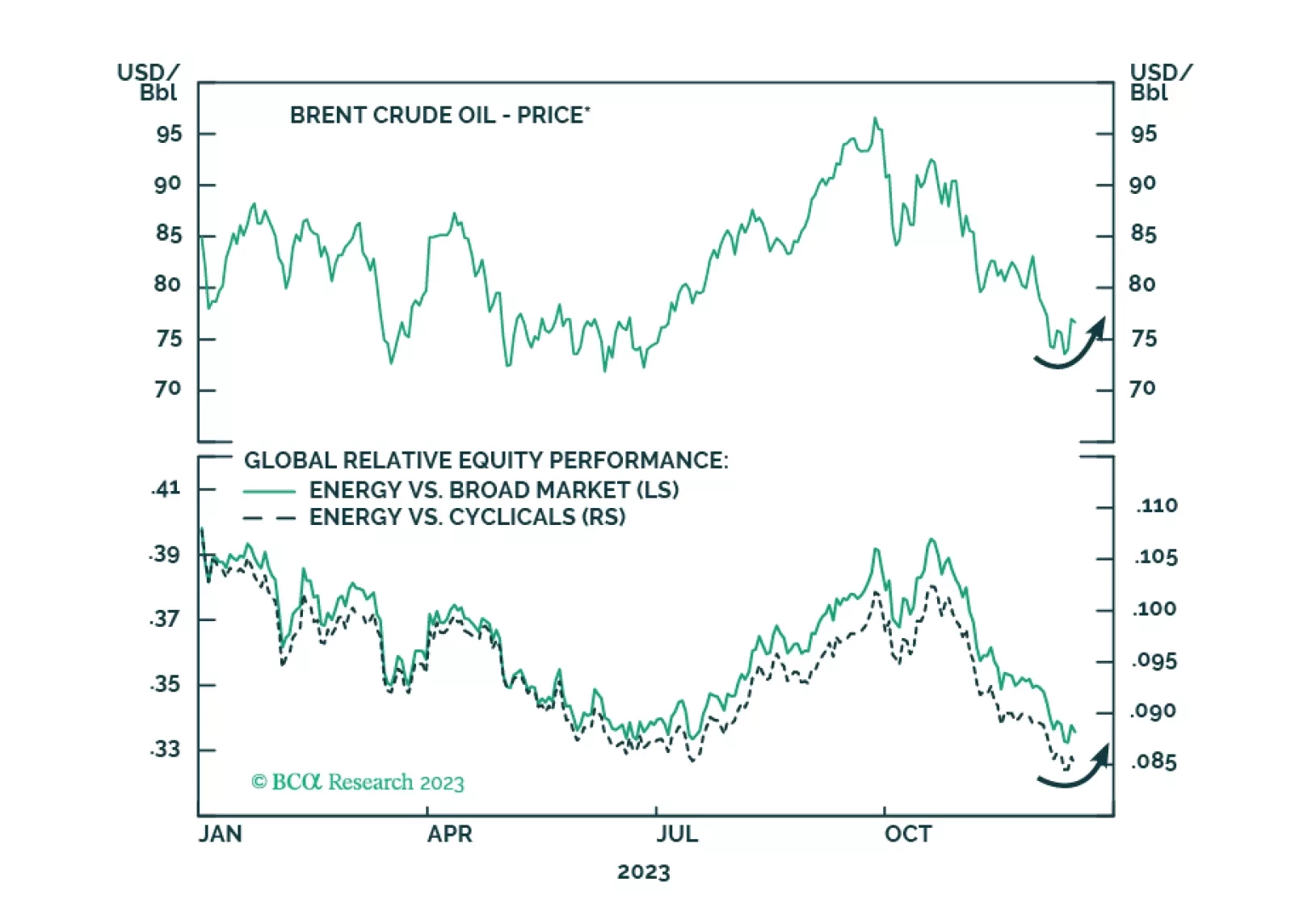

Oil prices will rise tactically due to supply risks. Recent developments indicate escalation of the conflict with Iran in the Middle East and confirm our expectation of energy supply disruptions and oil price spikes in the short run…