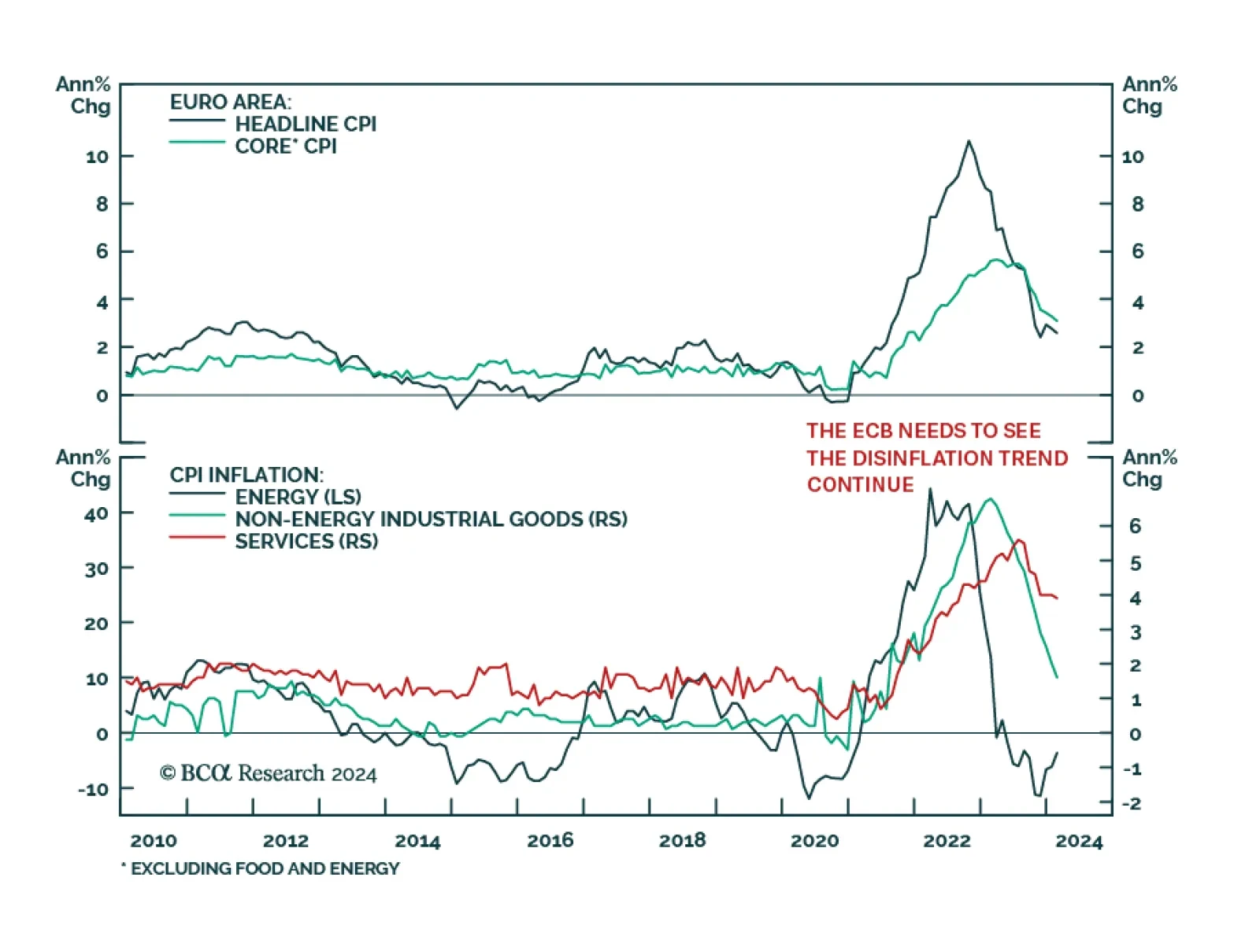

The preliminary Eurozone inflation release suggests that price pressures eased by less than anticipated in February. Headline CPI inflation slowed from 2.8% y/y to 2.6% y/y (slightly above expectations of 2.5% y/y. Similarly,…

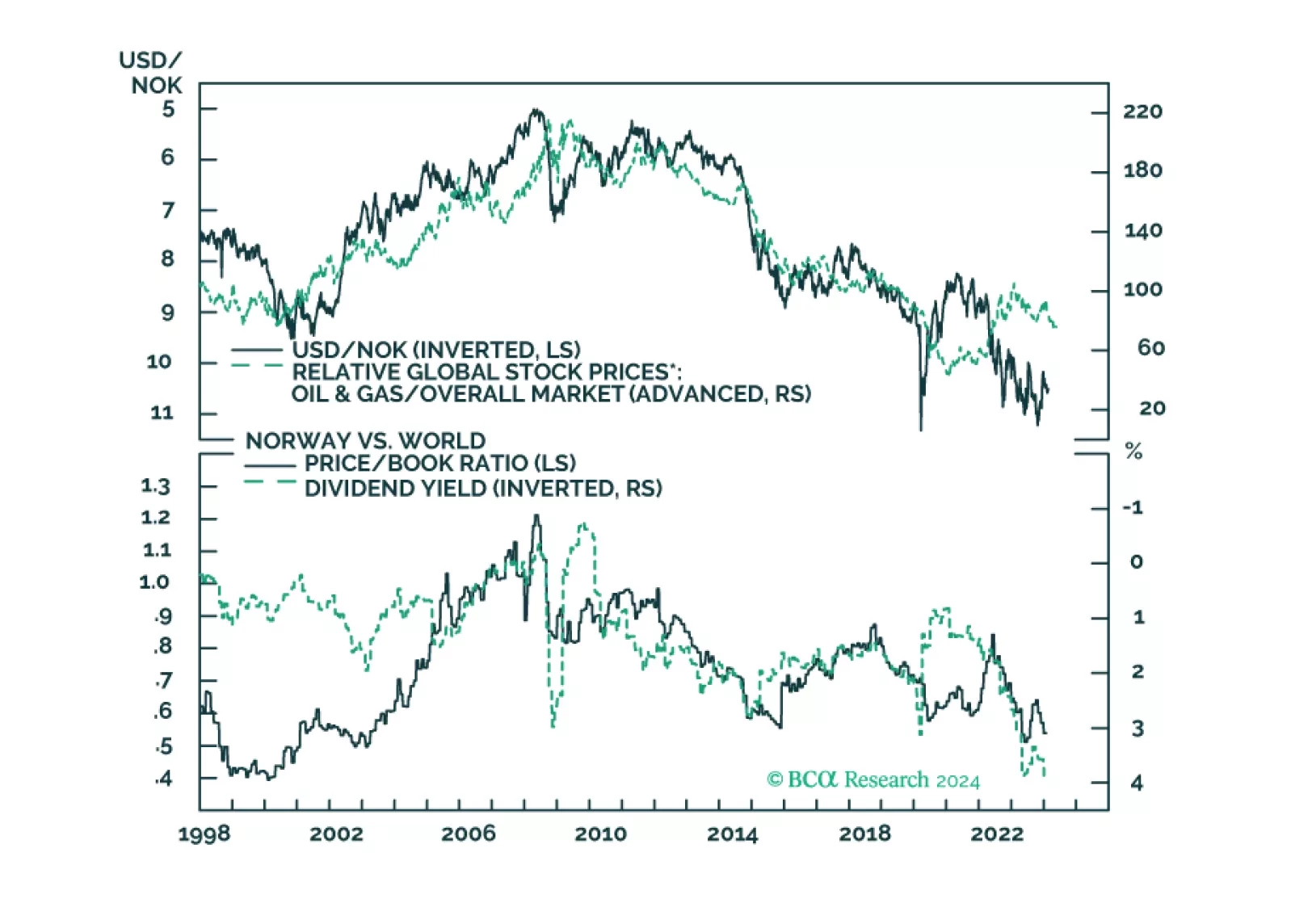

In this insight, we provide an update on the Norwegian krone, with attractive trade ideas over a long-term horizon. Shorter-term, our neutral-to-positive view on the dollar keeps us on the sidelines for USD/NOK.

Despite the economy being on the verge of a recession, the South African Reserve Bank will not ease policy meaningfully. Doing so will accentuate the currency depreciation, which, in turn, will push up bond yields – an outcome the…

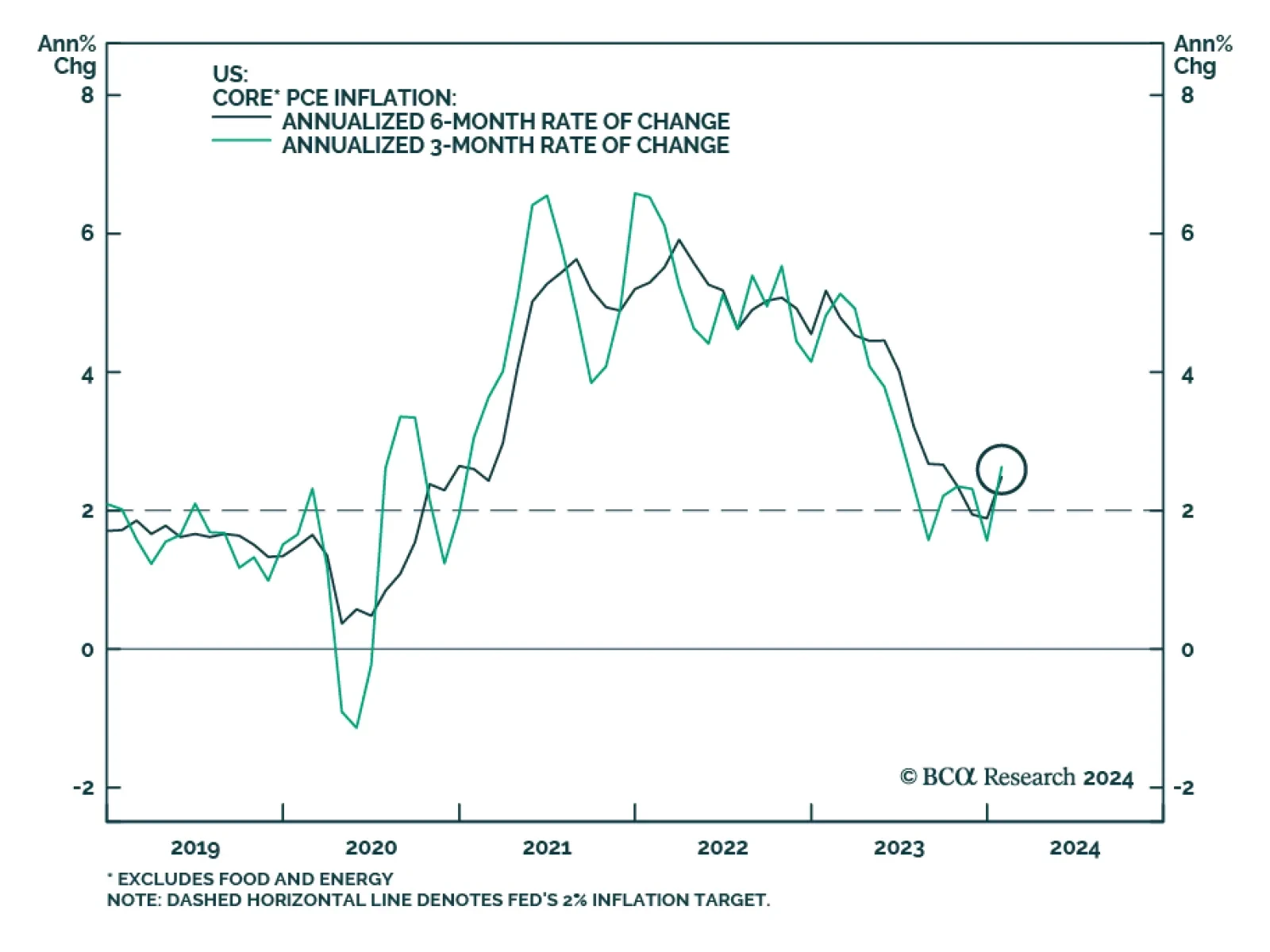

Aside from the 1.0% m/m jump in personal income – which beat expectations of a 0.4% m/m rise – the US January Personal Income and Outlays report was broadly in line with consensus estimates. Nominal personal spending…

Earlier this year it looked like the spread between the rate of 10-year and 2-year Treasury notes was heading toward positive territory. Yet the 2s/10s spread peaked at -16 bps on January 16 and the inversion has been deepening…

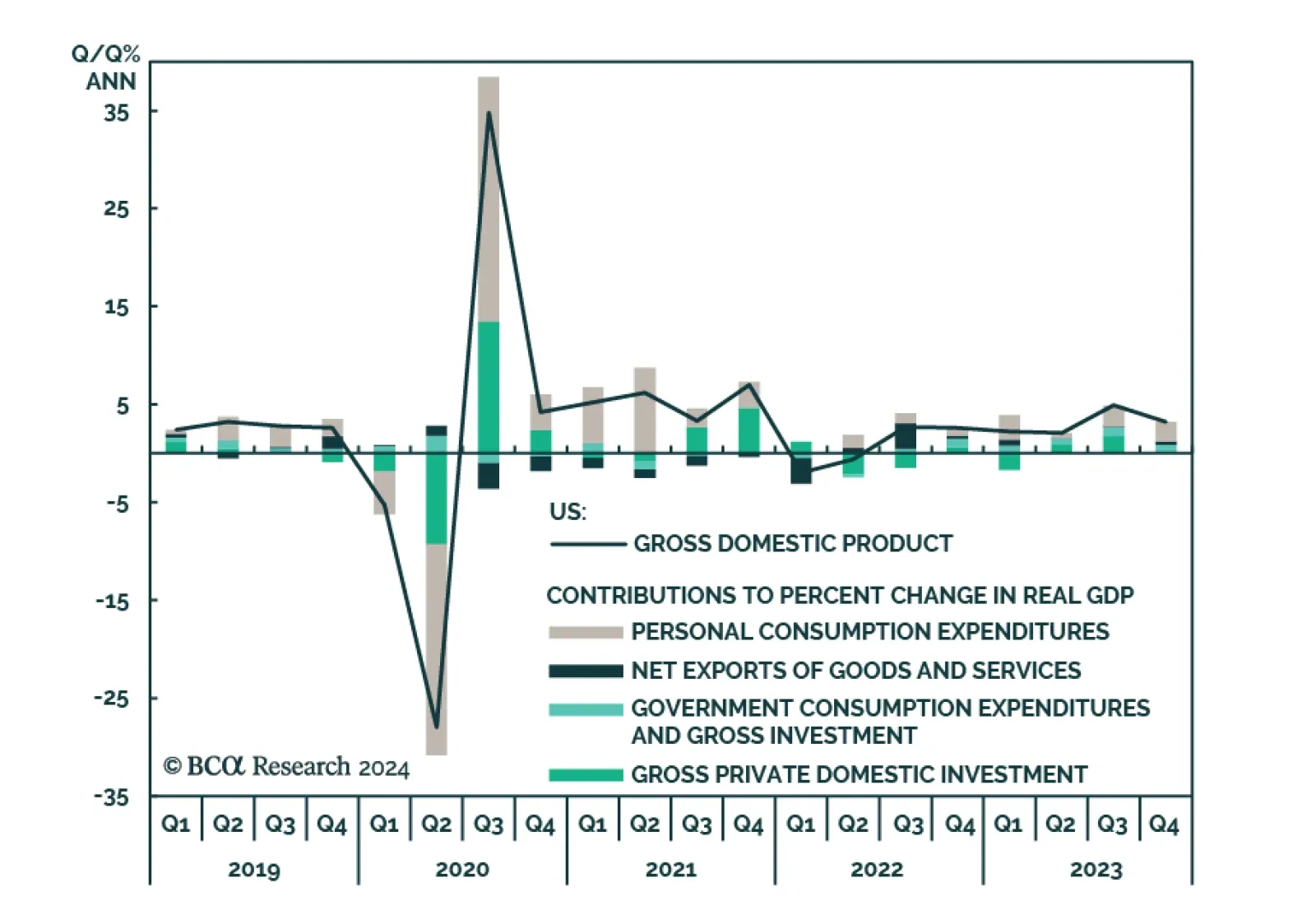

US GDP growth for Q4 was revised lower from 3.3% to 3.2% annualized, driven by a downward revision to private inventory investments (now detracting 0.27 points from a previous 0.07 contribution to GDP). However, consumer spending…

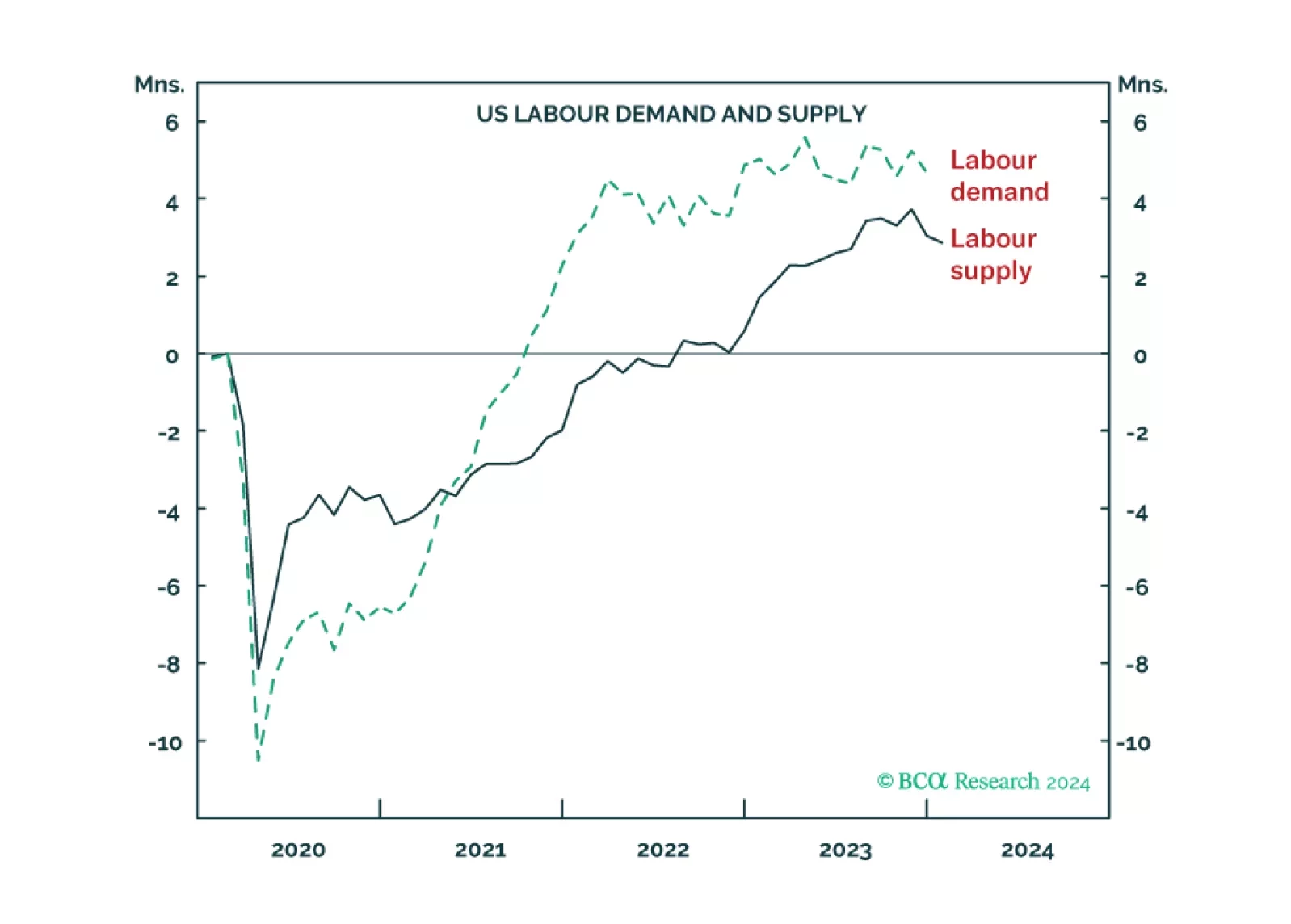

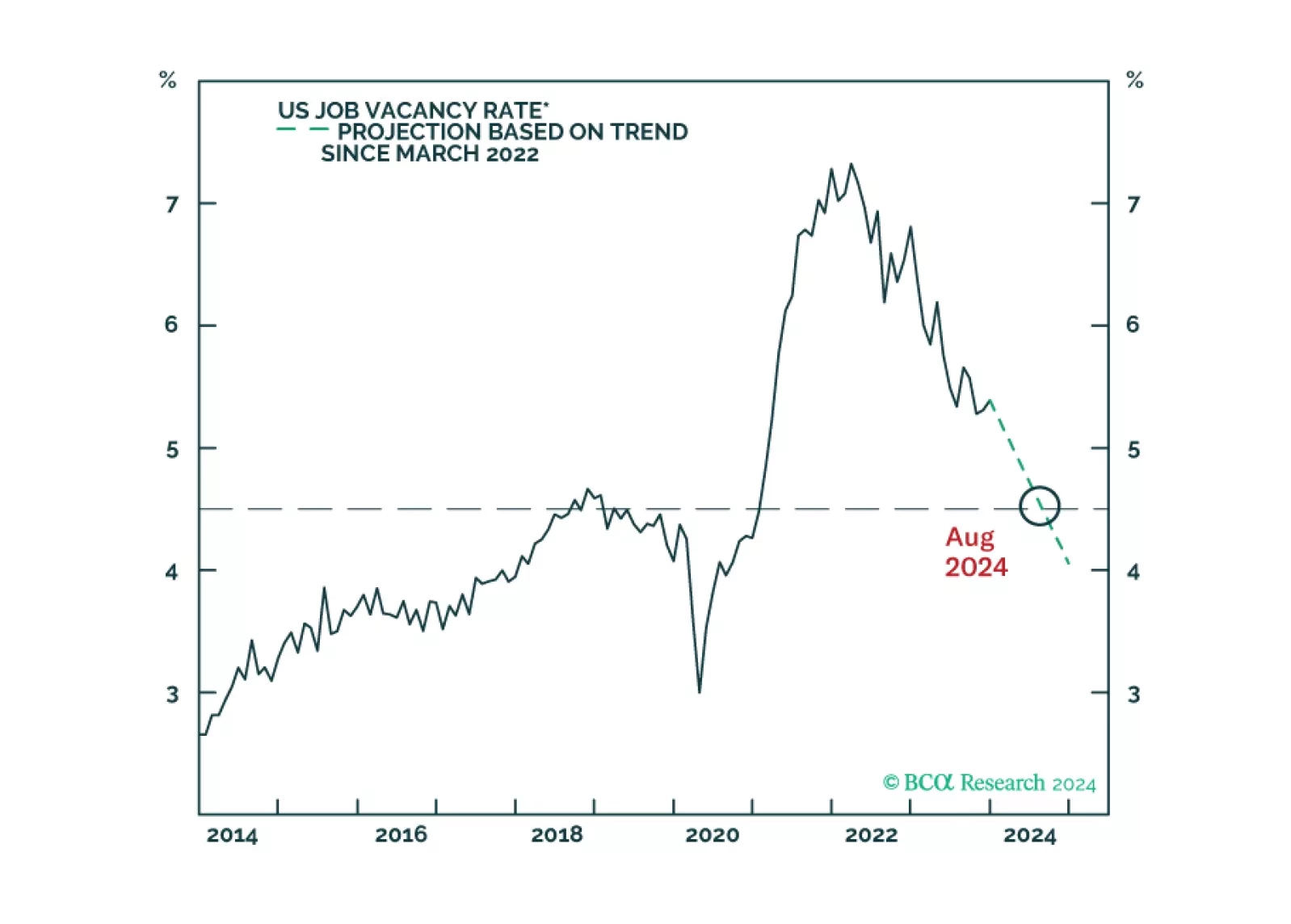

The US ‘immaculate disinflation’ has run its course, given that labour force participation is topping out. This leaves the Fed with a dilemma. Settle for price inflation stabilising at 3 percent, and cut rates early to avoid higher…

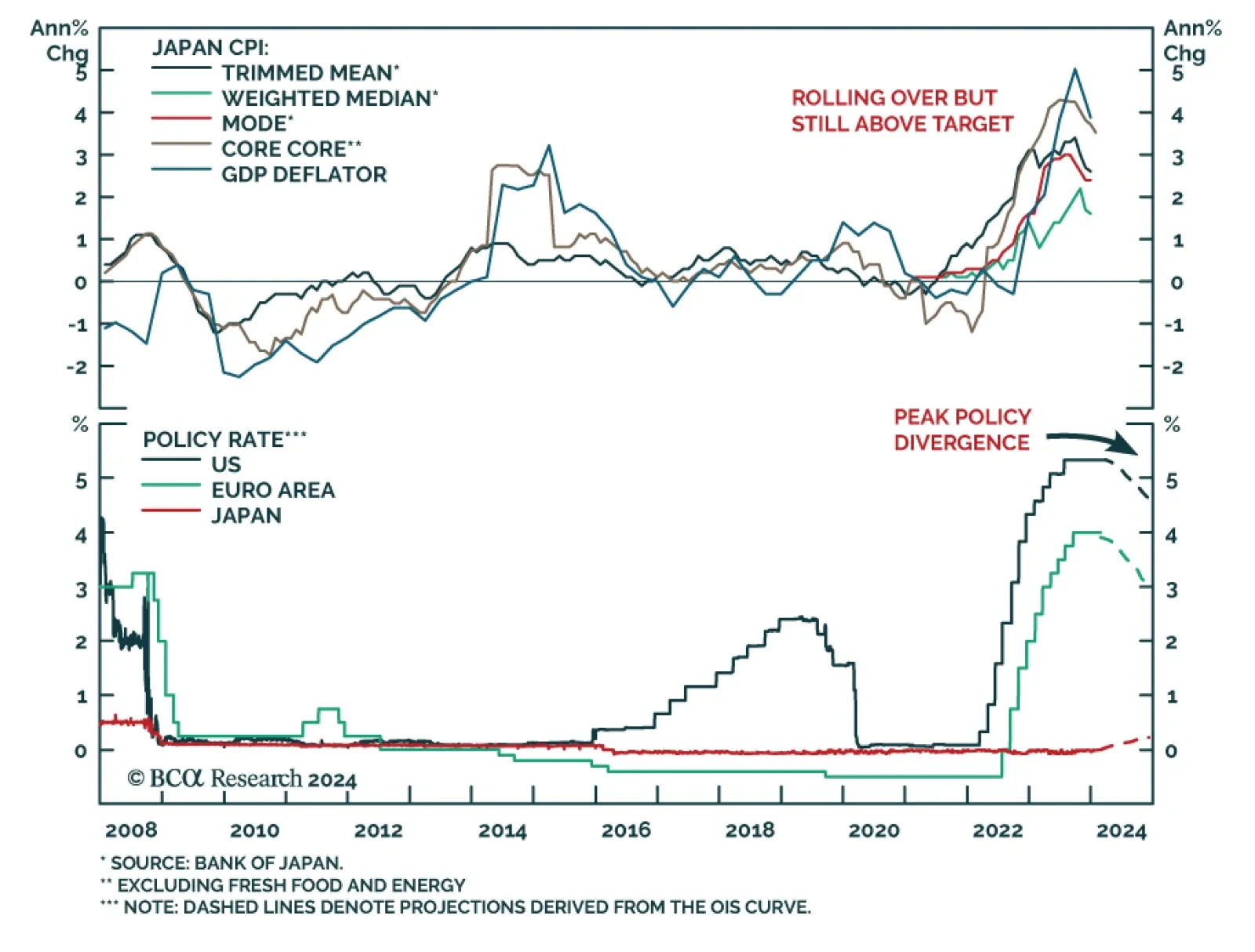

Japan’s CPI inflation dropped from 2.6% to 2.2% y/y in January. However, the sharp slowdown comes on the back of falling energy prices. Meanwhile, the BoJ’s core-core measure of underlying inflation (CPI excluding…

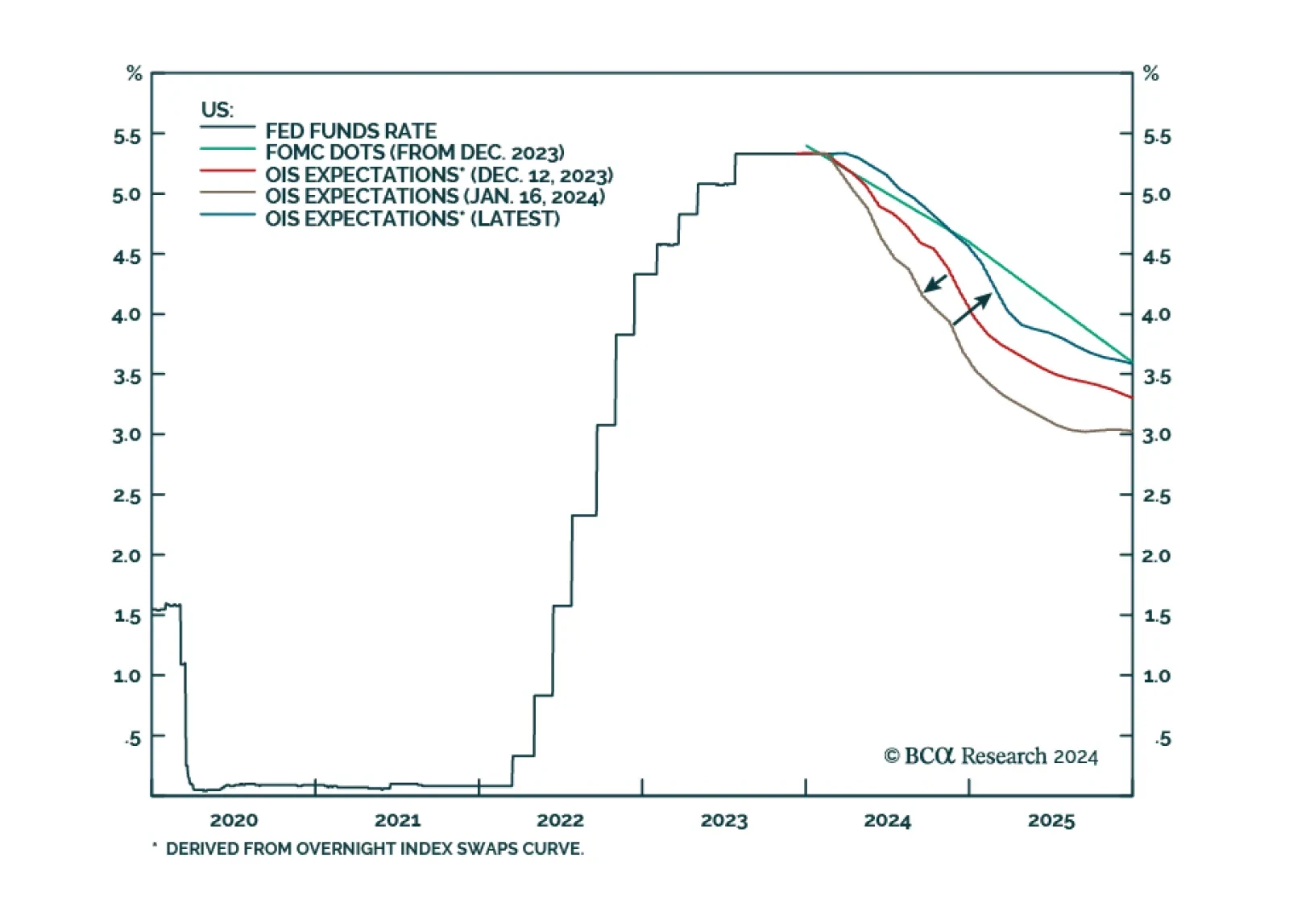

The first in a series of Strategy Insights where we present a checklist for extending duration in each major government bond market. This first entry focuses on the US.