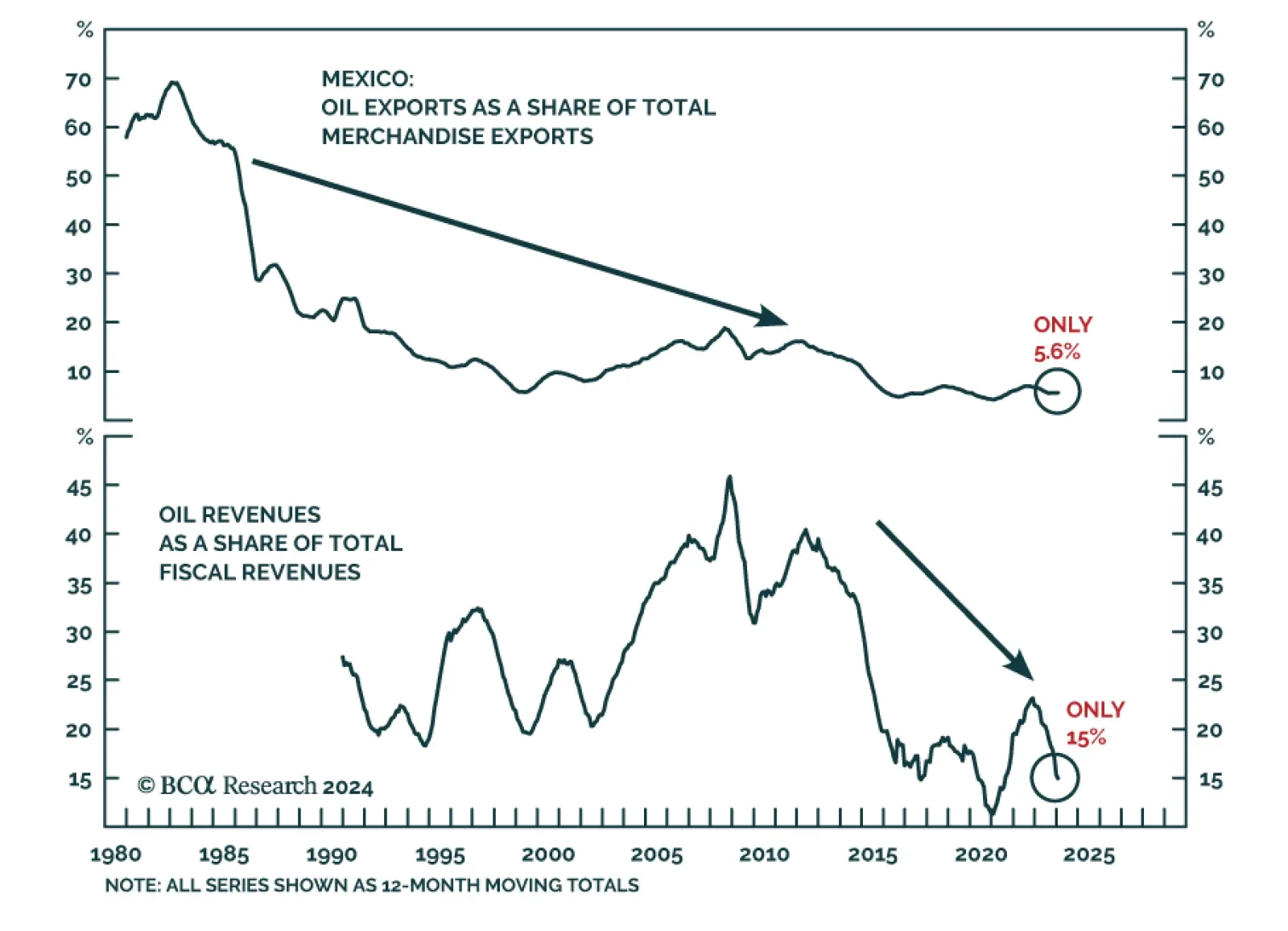

In the past couple of years, Mexico has been among the favorite markets for investors within the EM space. As our Emerging Markets Strategy team argued in a recent report, the cyclical and structural outlook for Mexican risk…

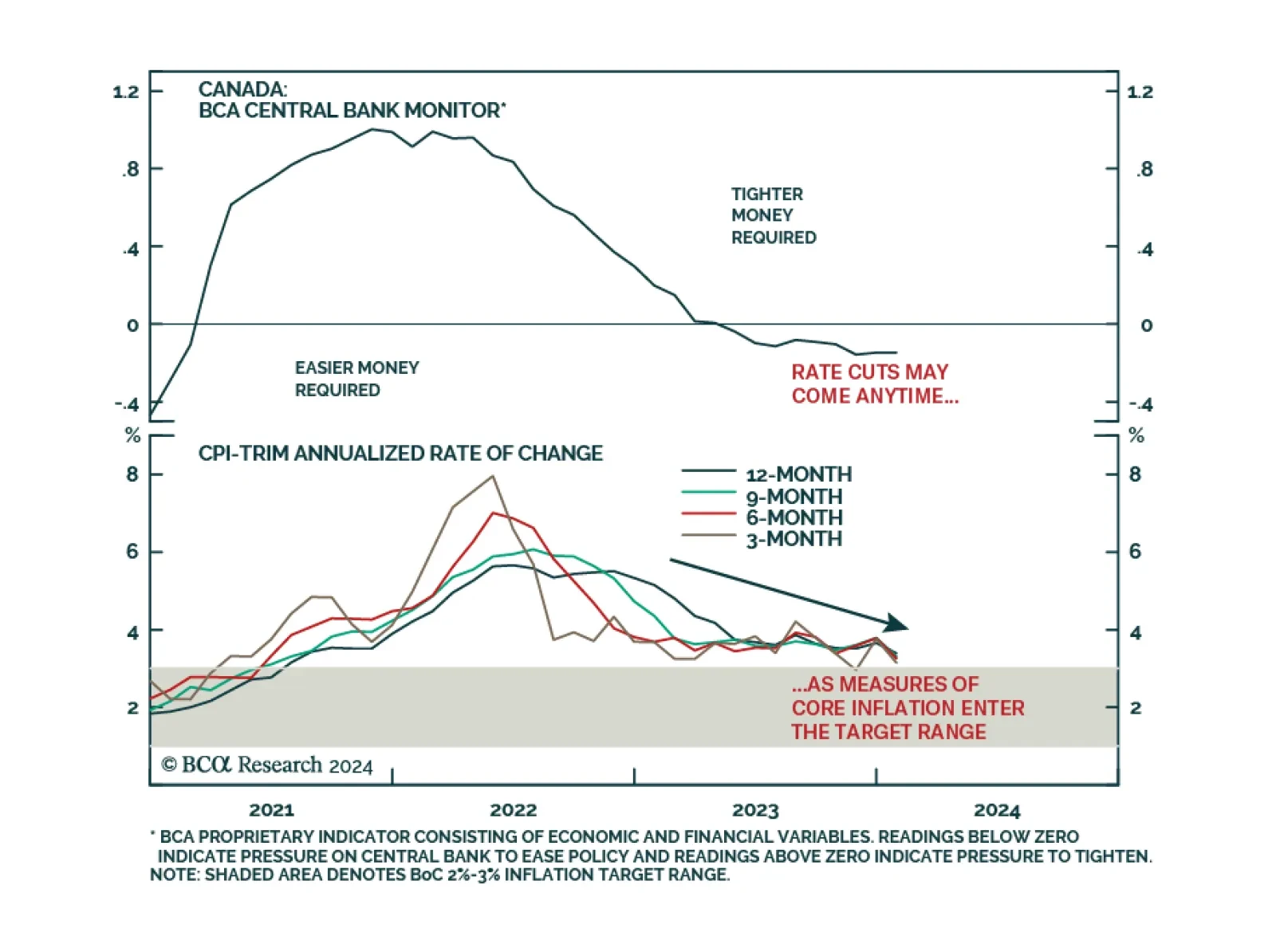

The Bank of Canada (BoC) kept its policy rate steady at 5% for the sixth consecutive meeting yesterday, in line with expectations. The BoC, which has changed its communication policy to now provide a press conference after every…

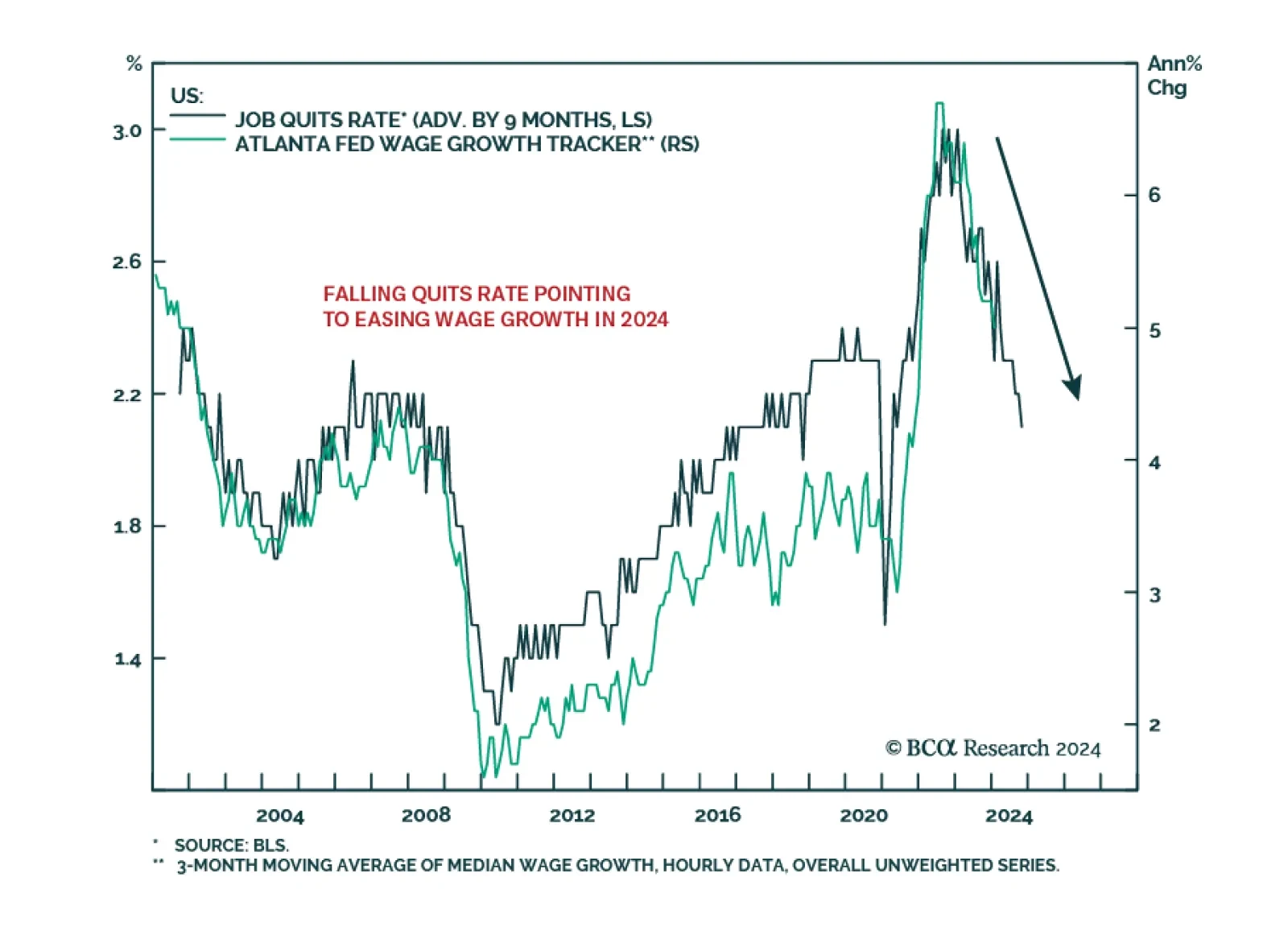

The US January JOLTS data released yesterday was in line with expectations, with job openings clocking in at 8.86 million versus a downwardly-revised 8.89 million in December. Importantly, US job openings are likely to continue…

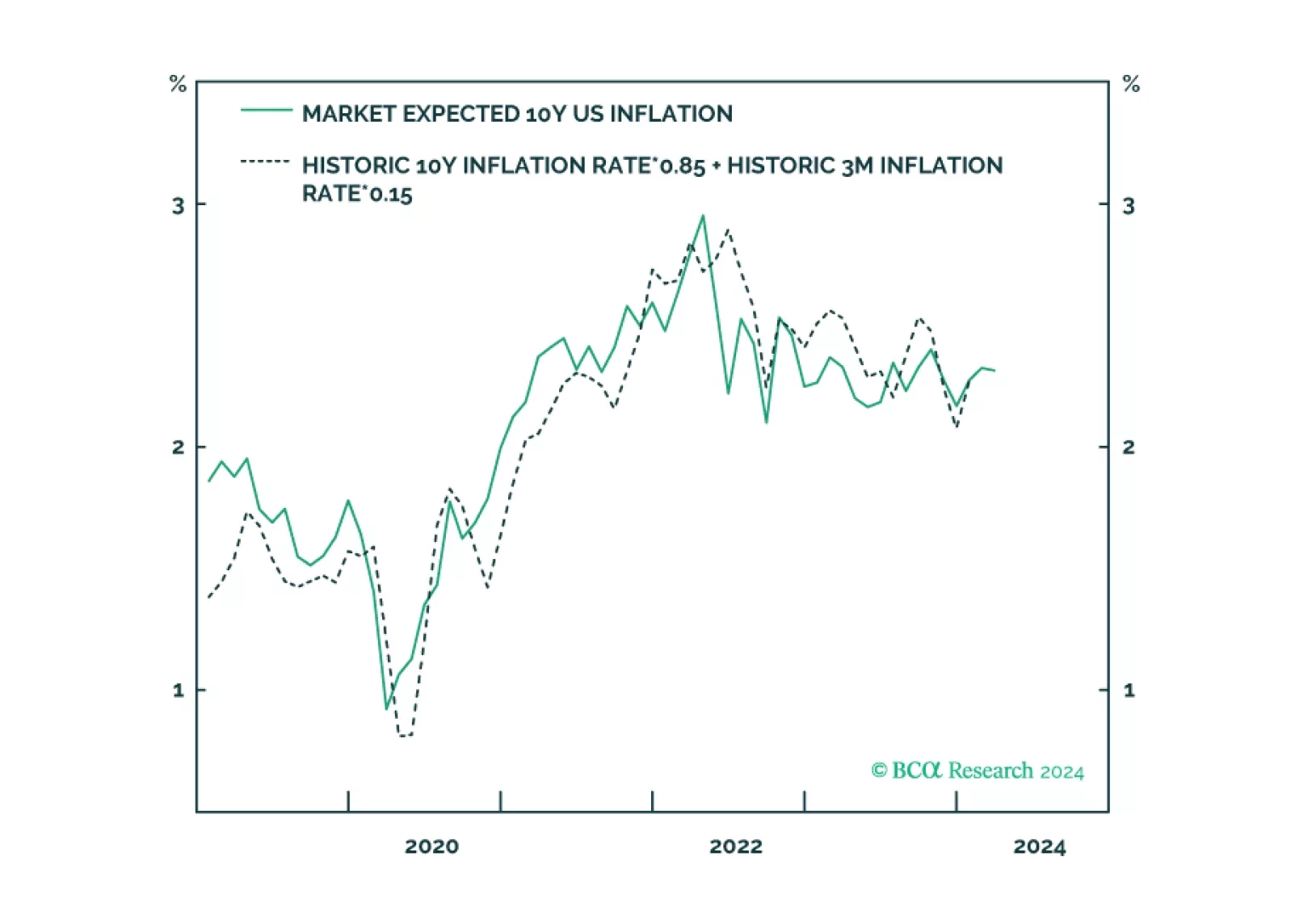

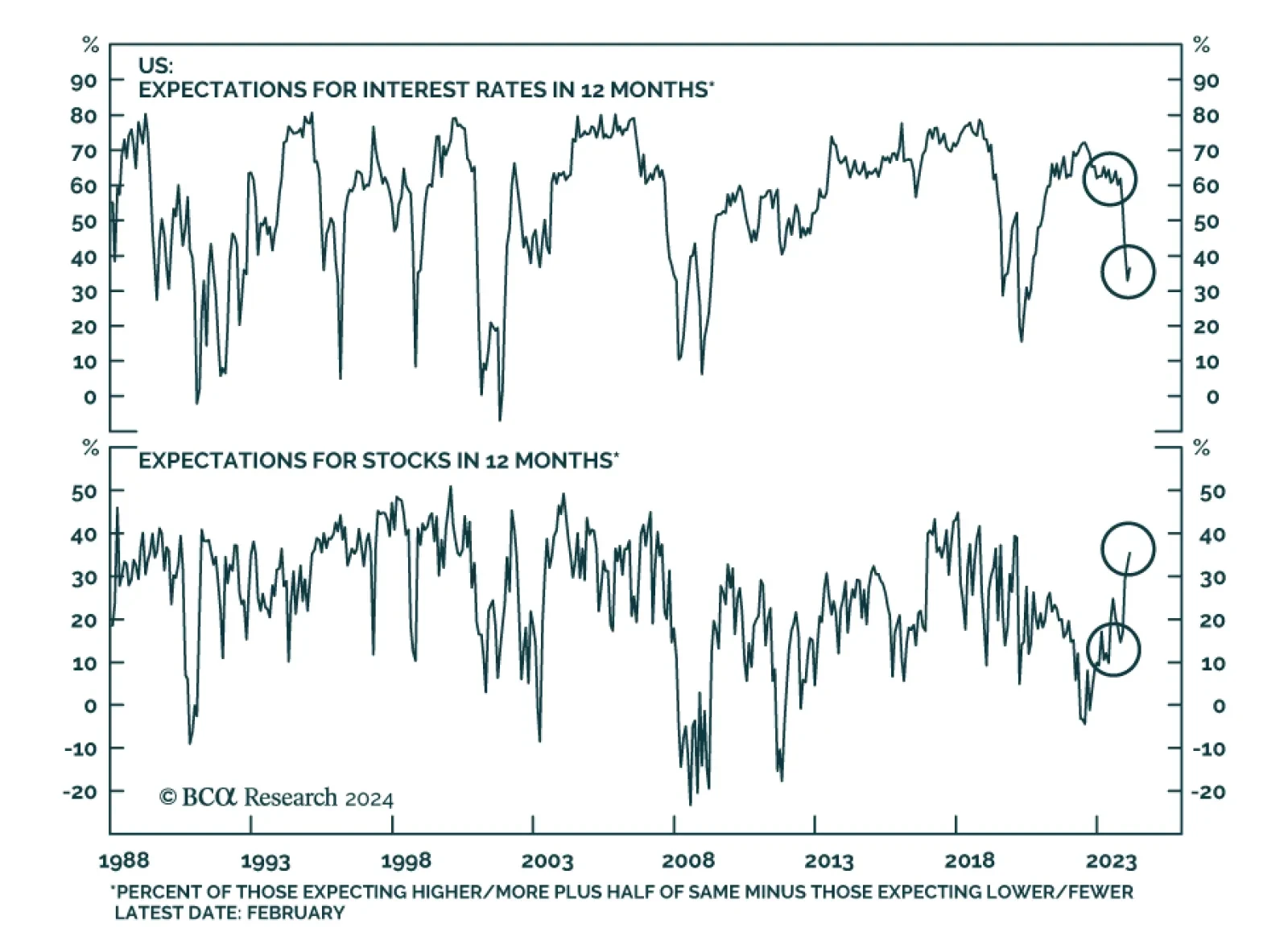

Expected inflation has surged to its highest level in a year. This has surprised many people, but expected inflation is behaving just as expected. Expected inflation is not a prophecy, it is just a mathematical function of delivered…

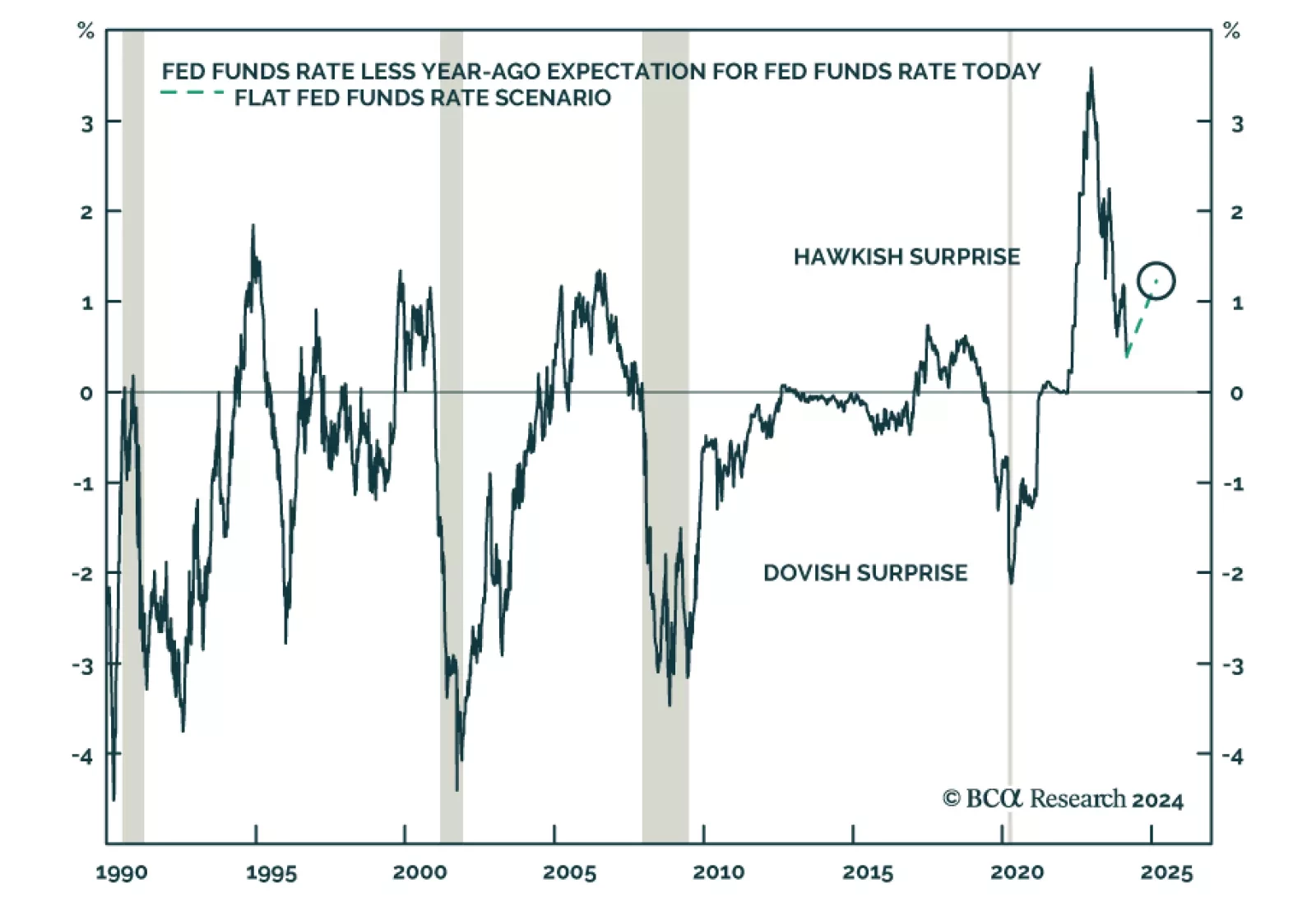

We noted in a previous Insight that recent comments from Raphael Bostic, President of the Federal Reserve Bank of Atlanta, may reflect a growing realization among policymakers that they have inadvertently caused a…

Economic sentiment has improved since the December FOMC meeting, with positive momentum extending into February. The chart above neatly summarizes the impact that the Fed’s projected easing has had on sentiment, both on…

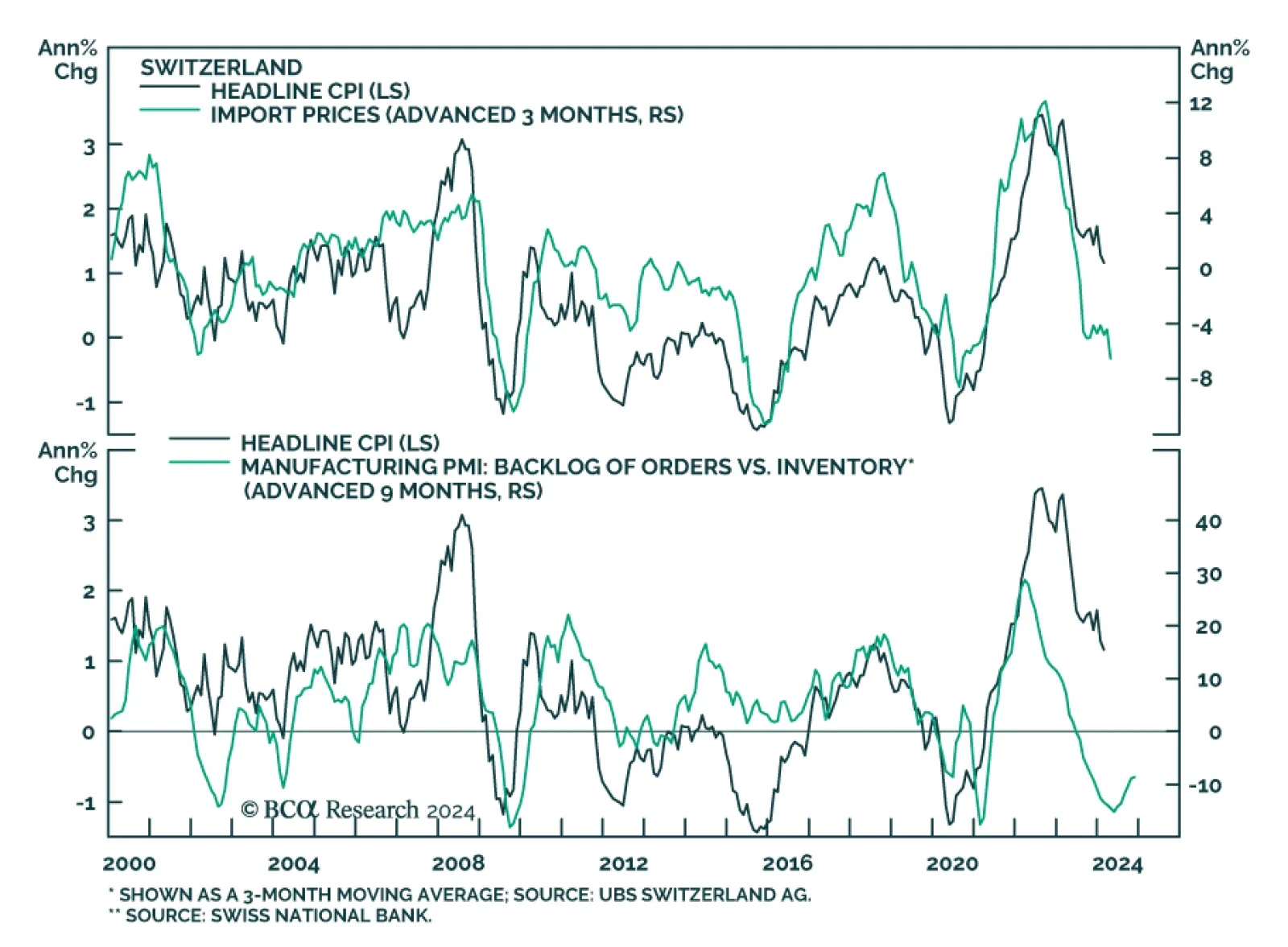

Swiss annual inflation continued to decelerate in February, with headline CPI now at 1.2% and core at 1.1%. This is remarkable since inflation continues to track well below the 1.8% forecast by the Swiss National Bank (SNB) for…

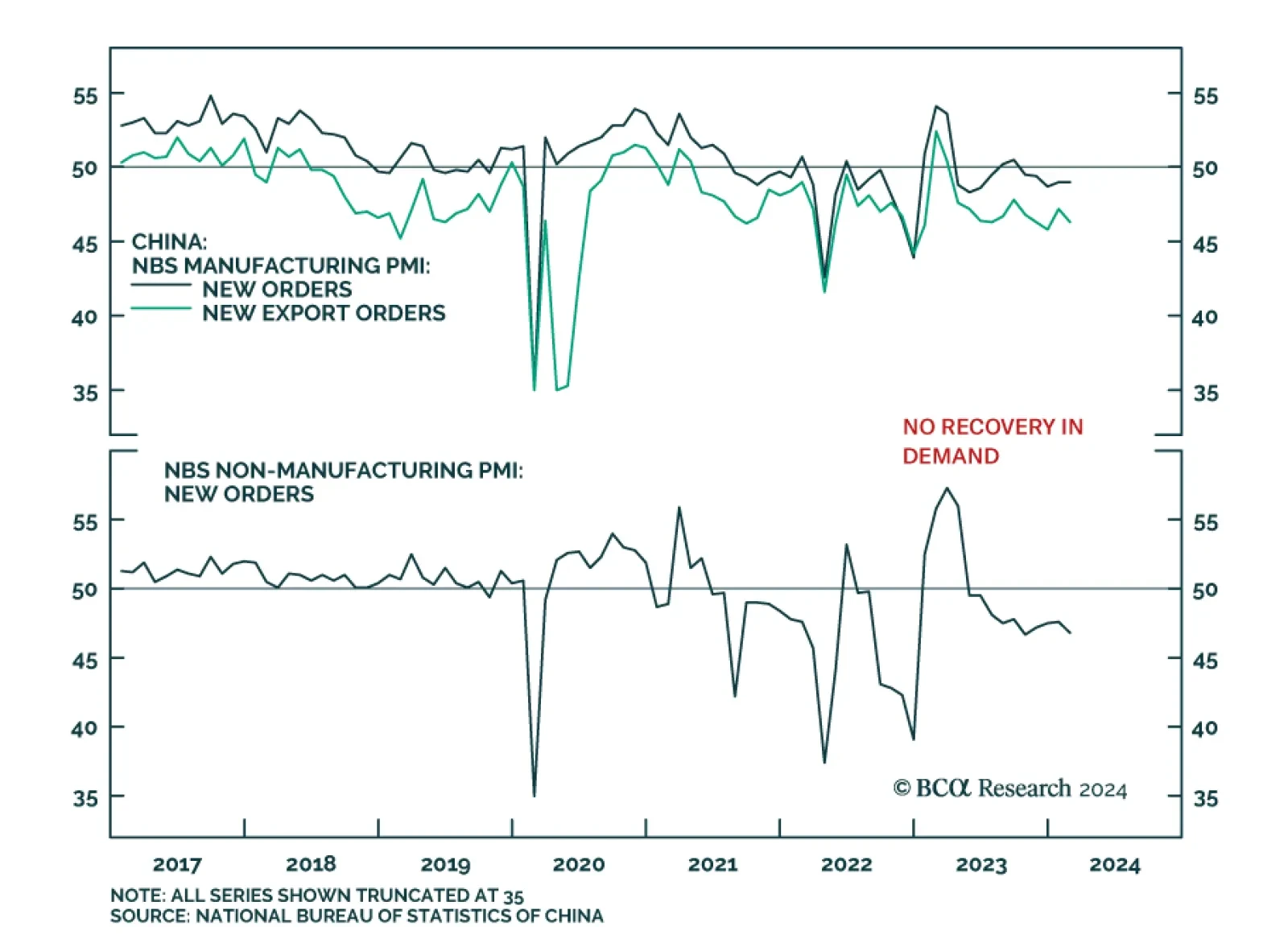

China’s NBS PMI release indicates that the Chinese growth is stabilizing at a low level. The composite PMI came in at 50.9 – unchanged from January. The stabilization was led by the non-manufacturing sector though…

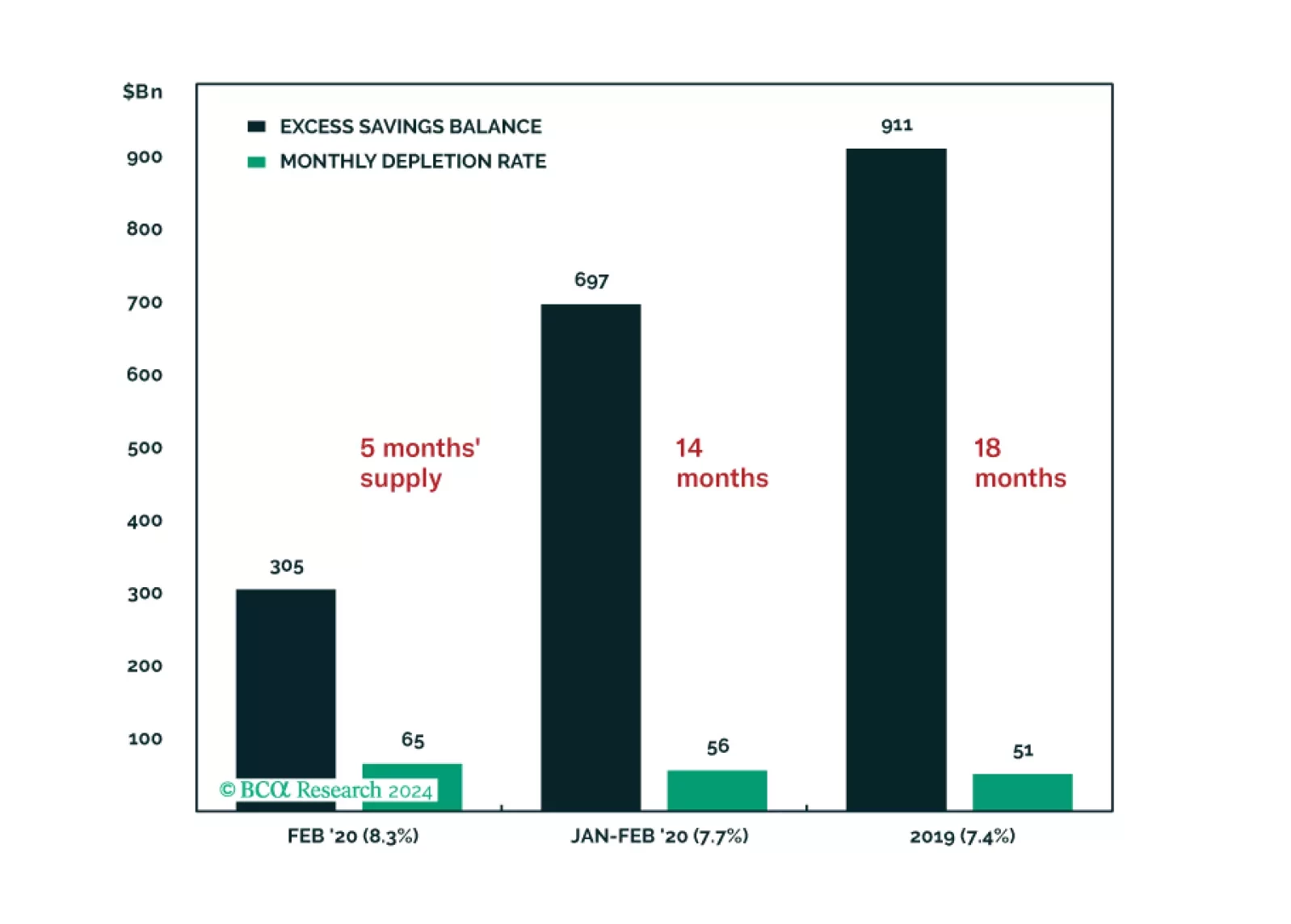

We feel as good about spurning the soft-landing narrative today as we did about spurning the recession narrative a year ago, but we are not giving into complacency. This week’s report looks at two key ways that we may be getting it…

According to BCA Research’s Geopolitical Strategy and The Bank Credit Analyst services, trade policy under a second Trump presidency represents the greatest cyclical risk to investors. In 2018, the Trump administration…