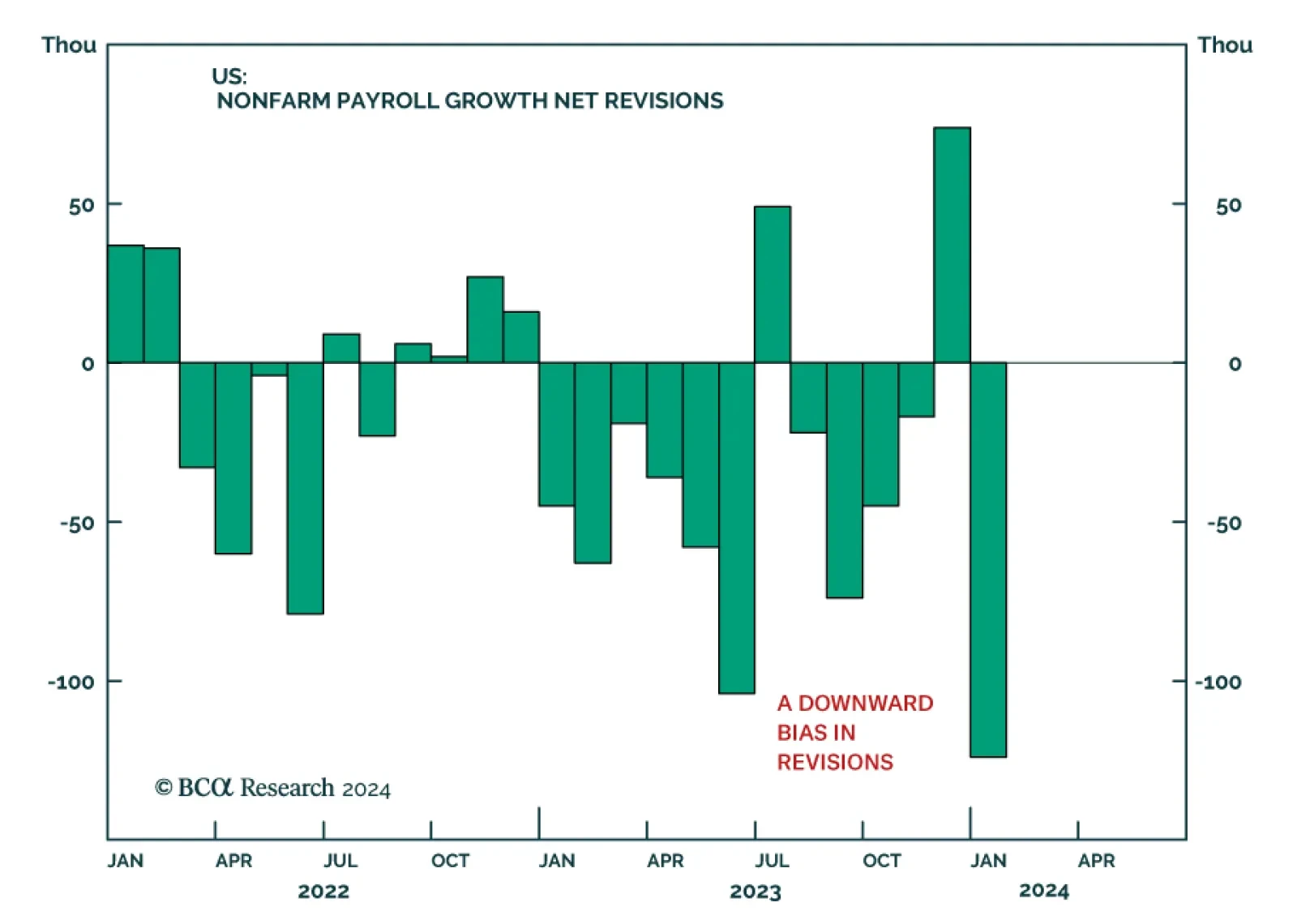

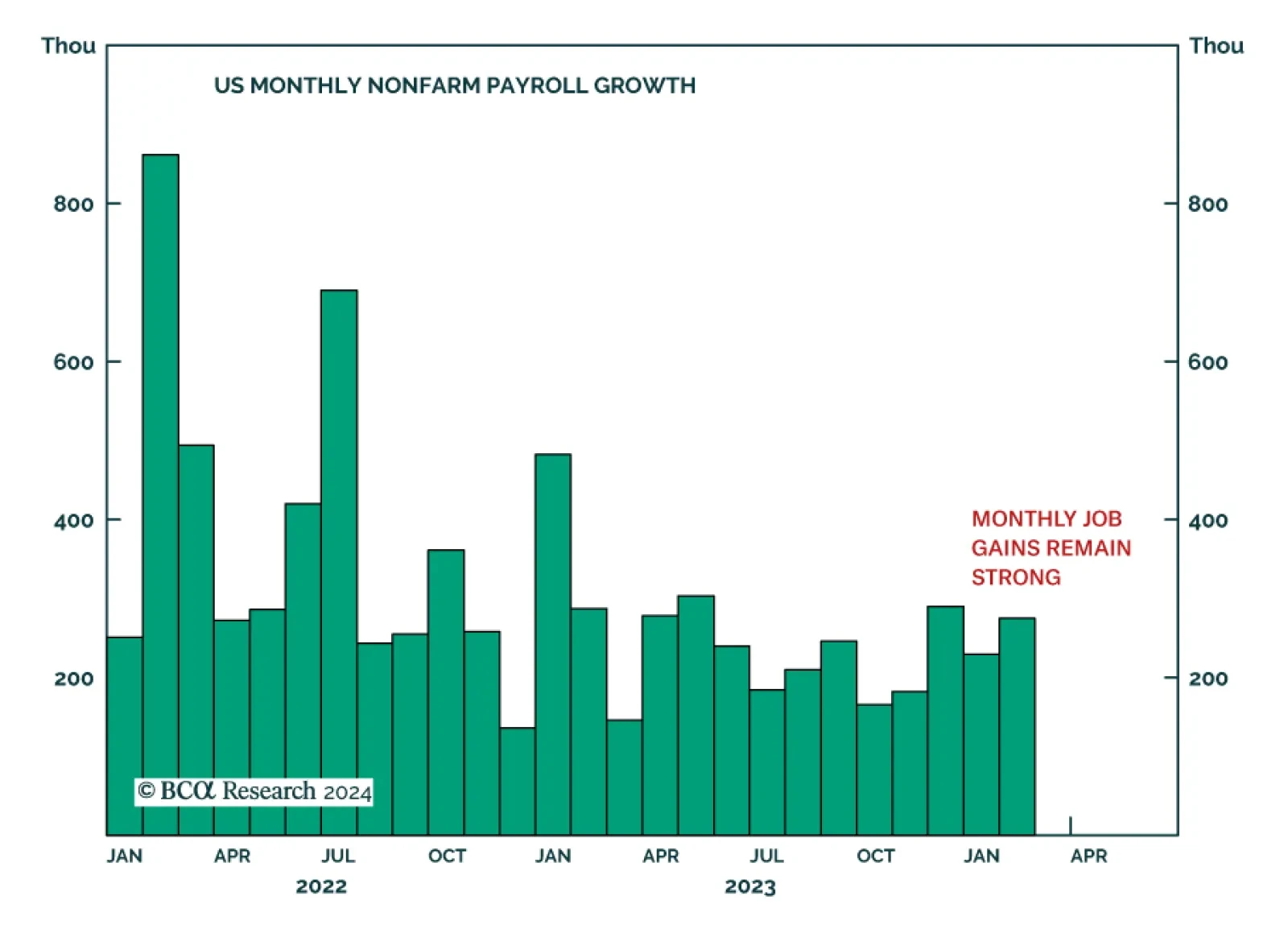

For the past year, relatively large downward revisions have been key features of the monthly US nonfarm payrolls reports. Friday’s release was no exception. Although it showed the magnitude of job gains beat expectations in…

The US employment situation report sent a mixed signal on Friday. While total nonfarm payrolls rose by 275 thousand jobs in February, exceeding the 200 thousand expected, the previous two months’ numbers were revised lower…

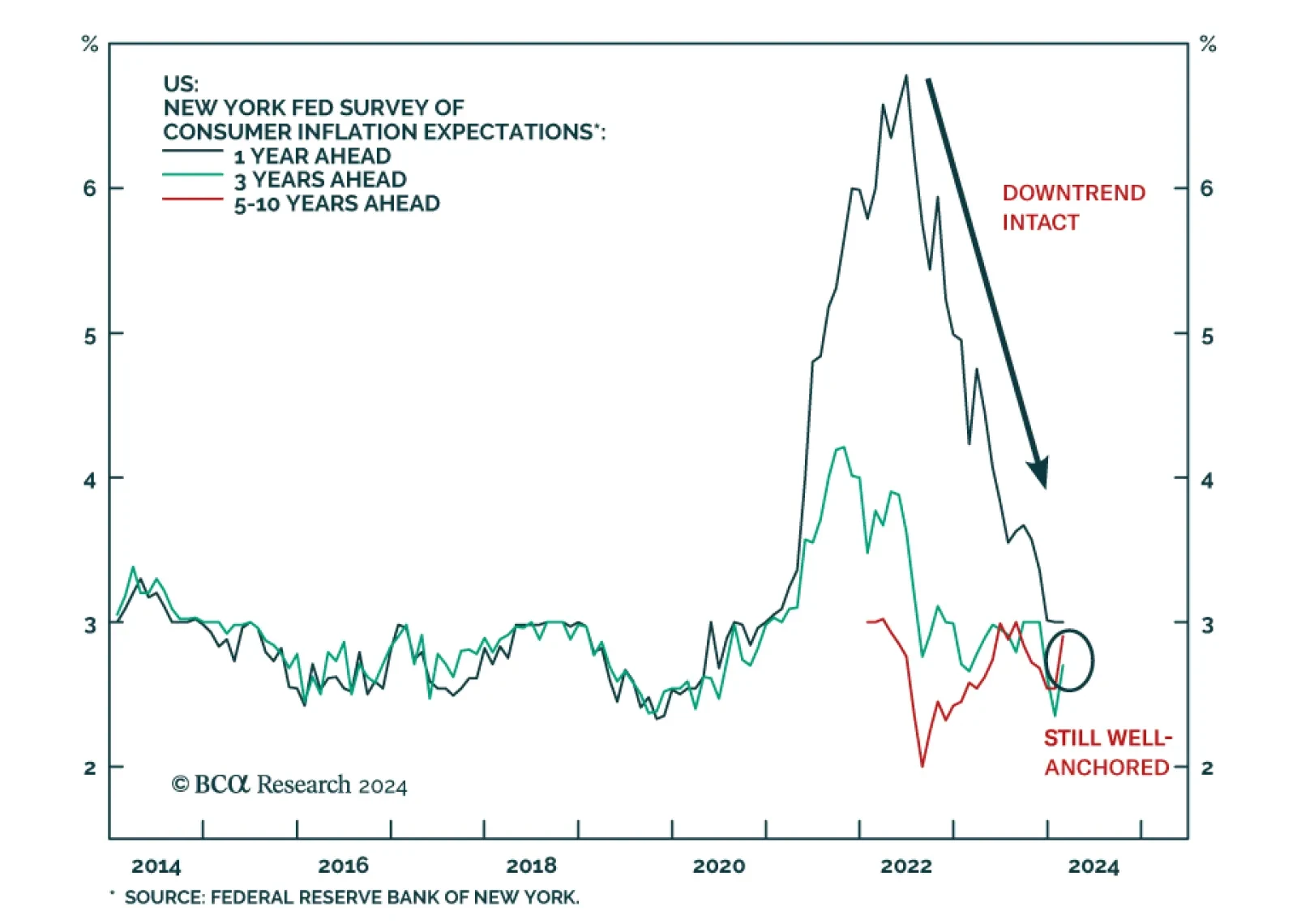

Results of the New York Fed’s Survey of Consumer Expectations showed an uptick in medium- and long-term inflation expectations in February. Specifically, the three-year ahead measure rebounded from a record low of 2.4% to 2…

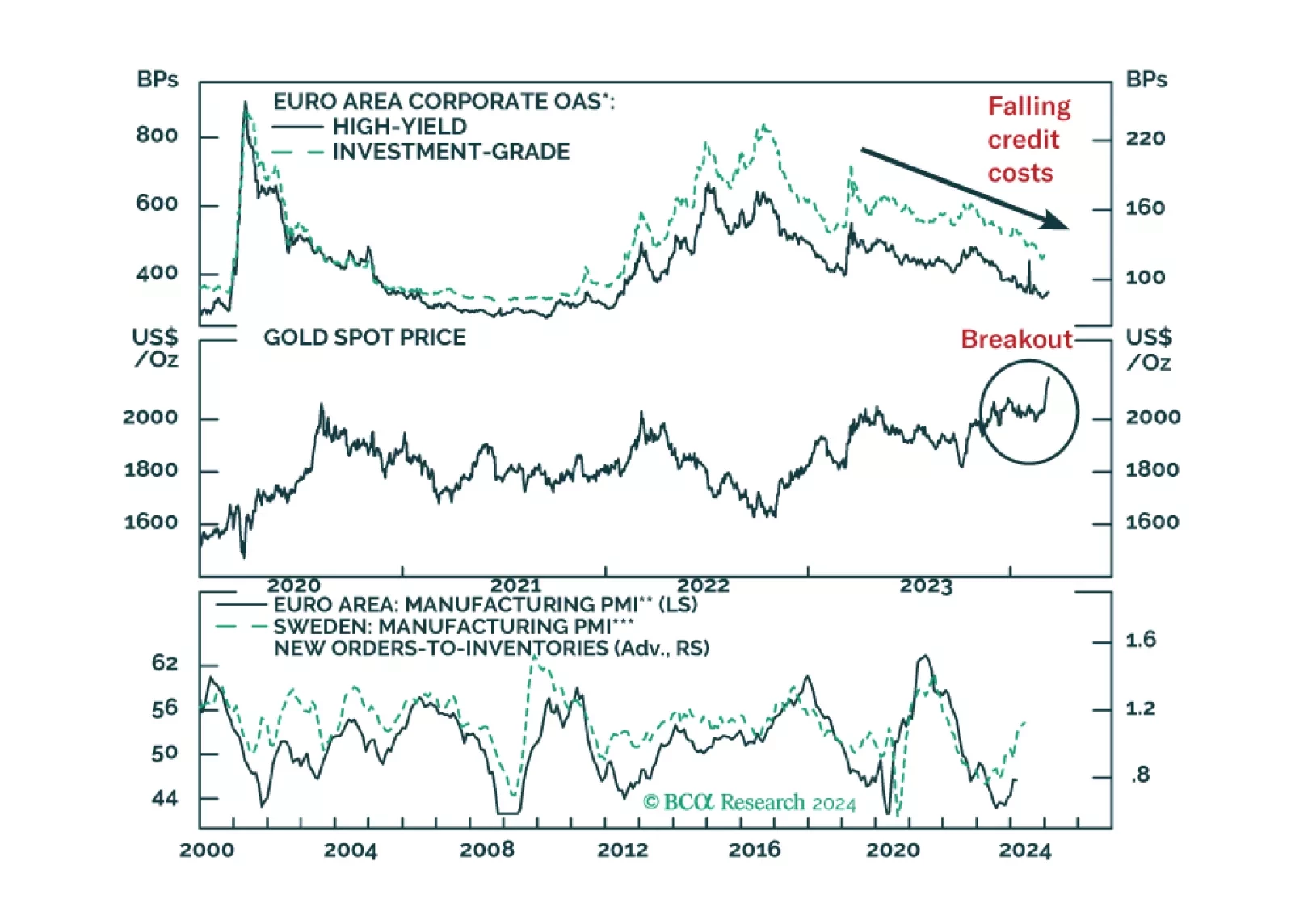

We are pushing back the anticipated start date for a Eurozone recession and assessing how it affects our equity stance.

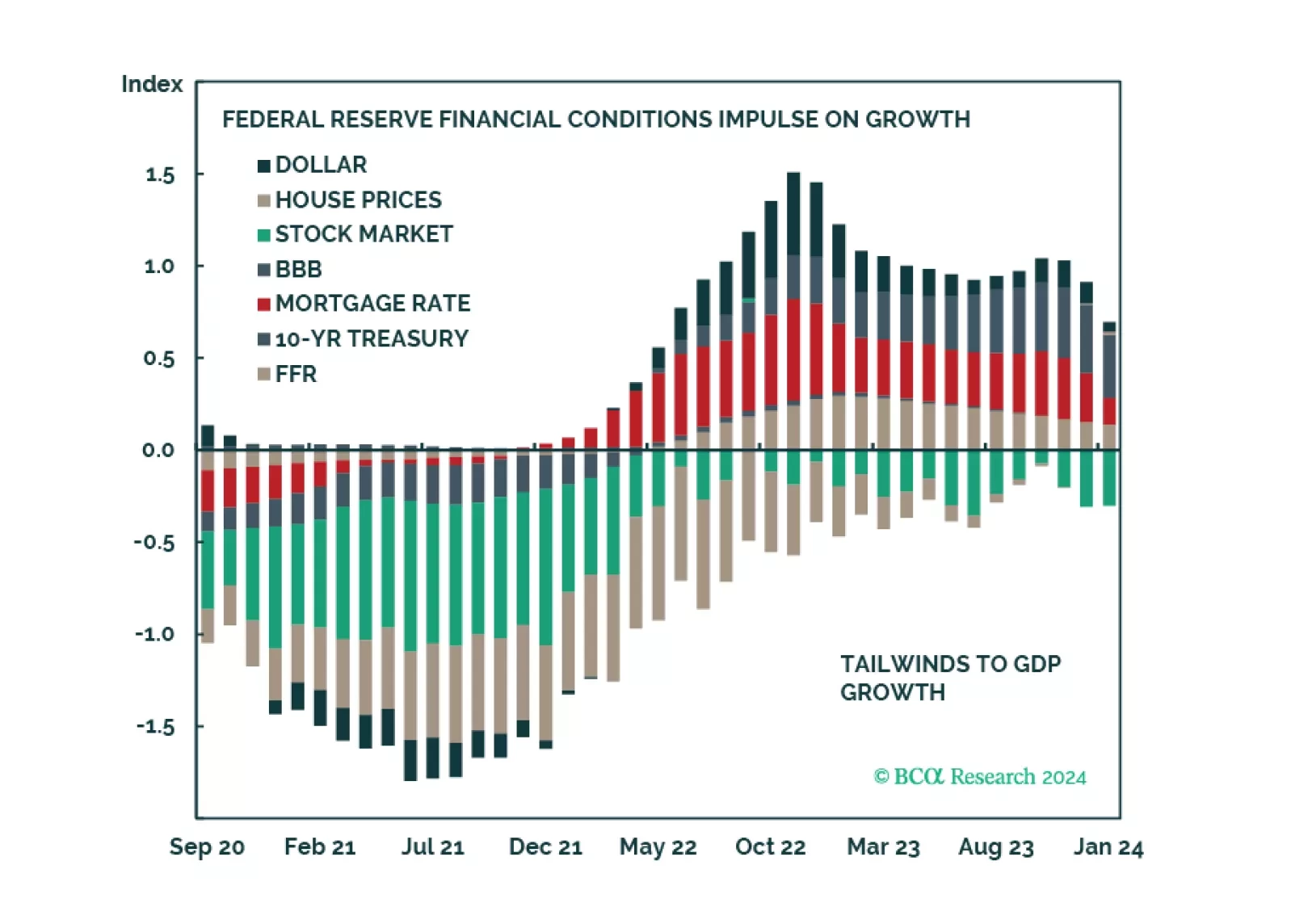

Clients are increasingly more positive about the US economy, but there are no signs of exuberance. The rally could continue as the majority is not fully invested. Financial conditions have already eased, and the Fed is unlikely to…

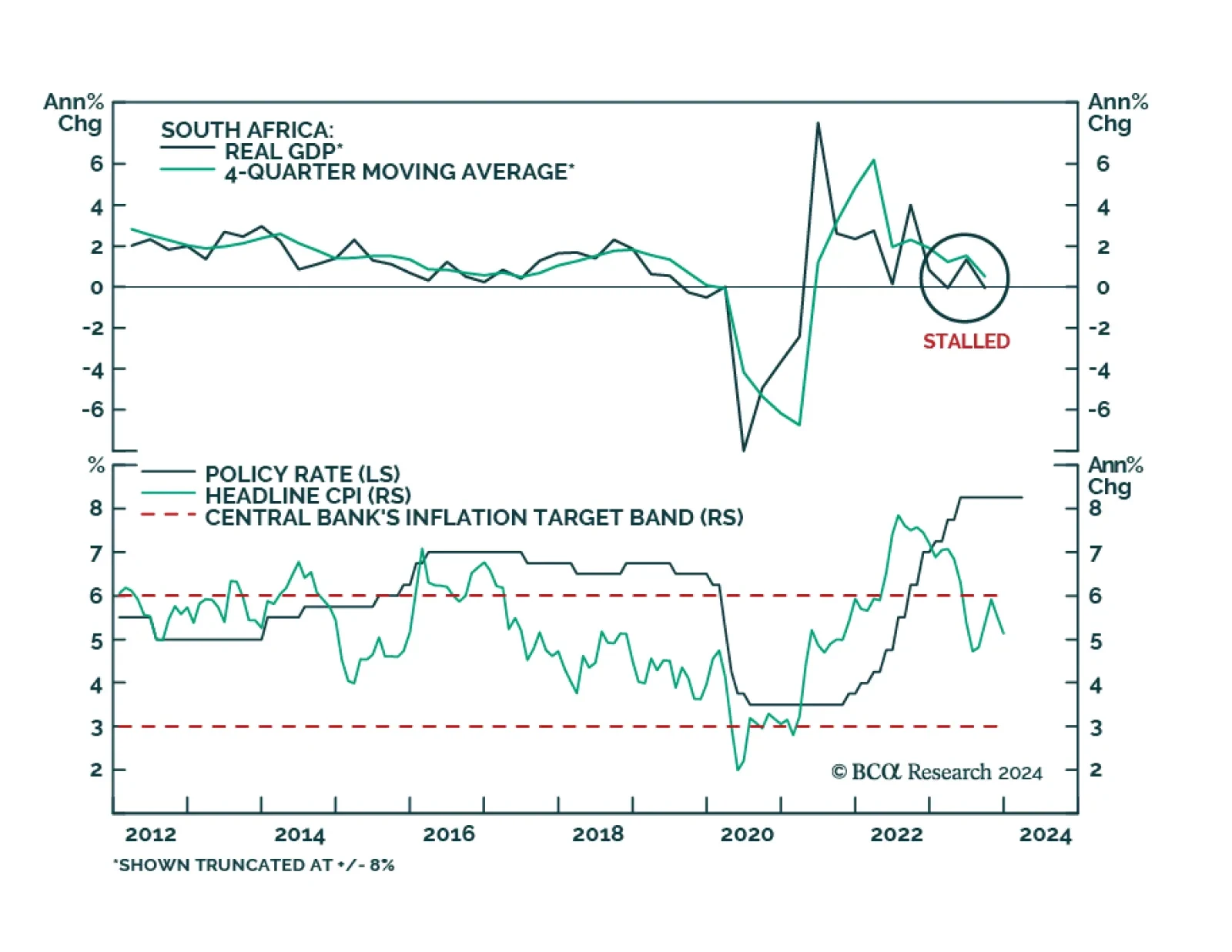

Our Emerging Markets Strategy team posits that the South African economy is heading into a recession later this year. The South African government refrained from announcing any stimulus measures in its recent budget proposals.…

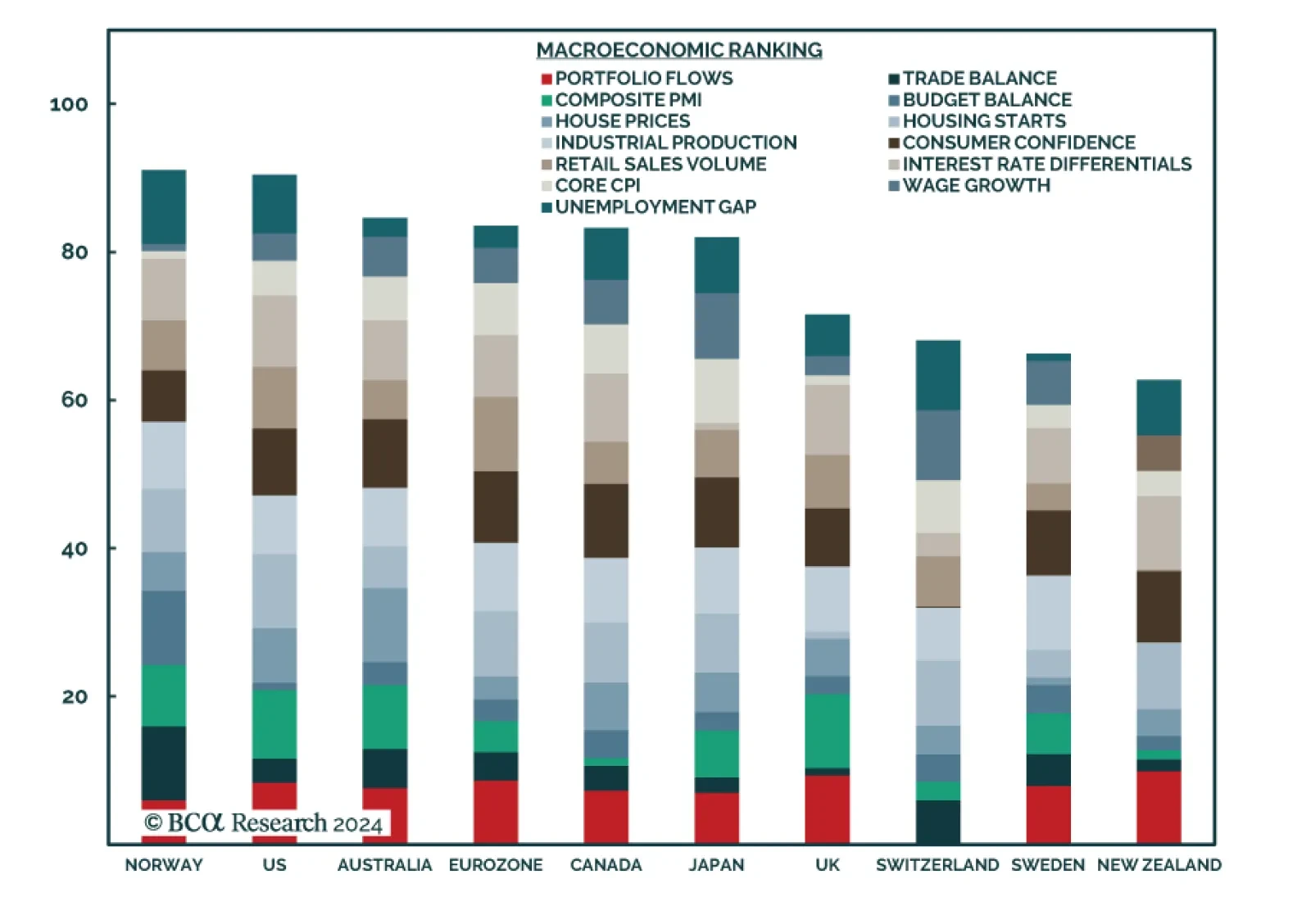

As we discussed in a recent Insight, the krone is the top pick for our Foreign Exchange Strategy team. The krone upgrade is one of the most significant changes in our colleagues’ attractiveness ranking model. Norway has the…

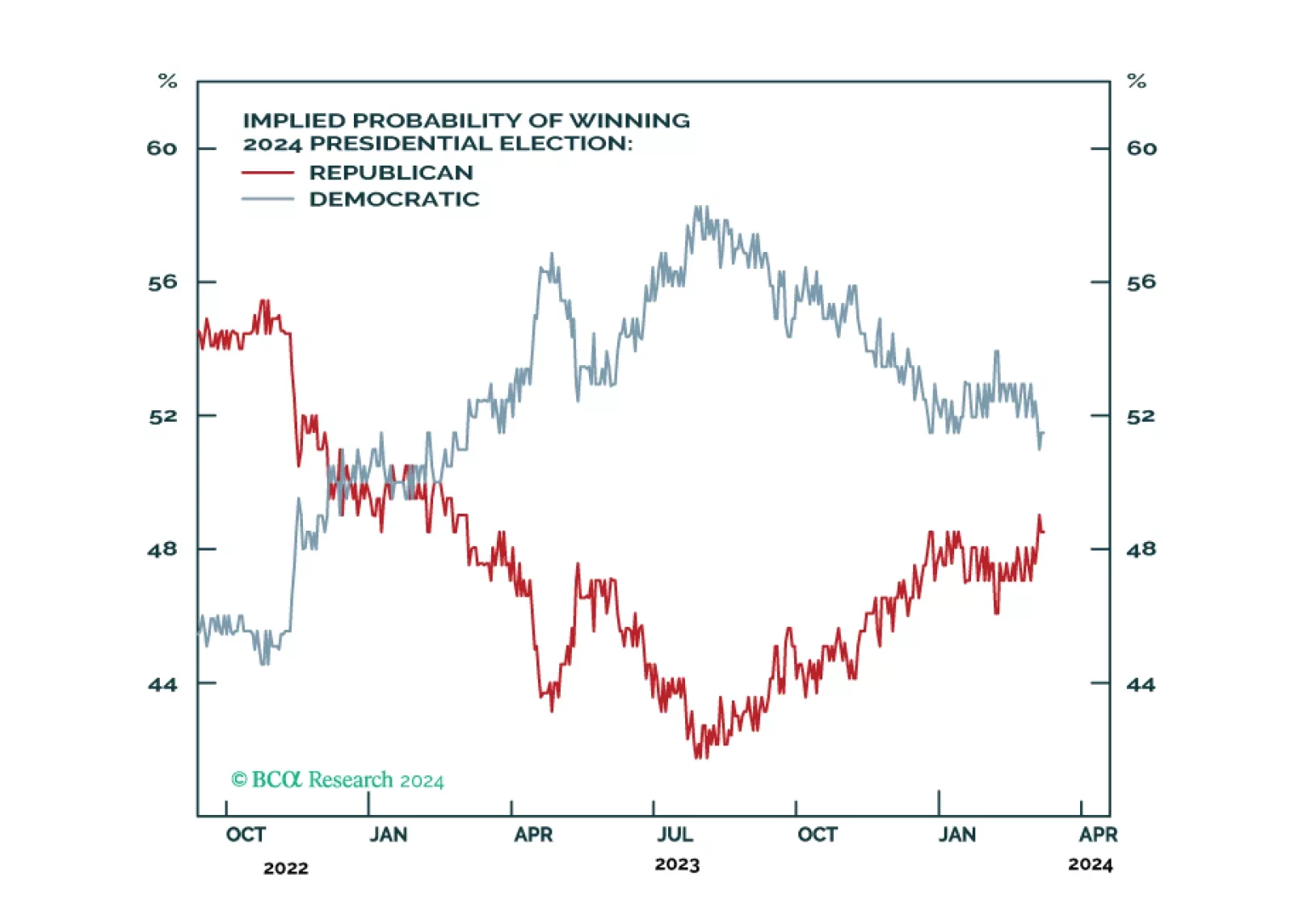

Democrats are still slightly favored for reelection as the incumbent party is presiding over a growing economy. However, Biden’s strong showing in the primary election is not lifting his popular approval yet, and that is a worrying…

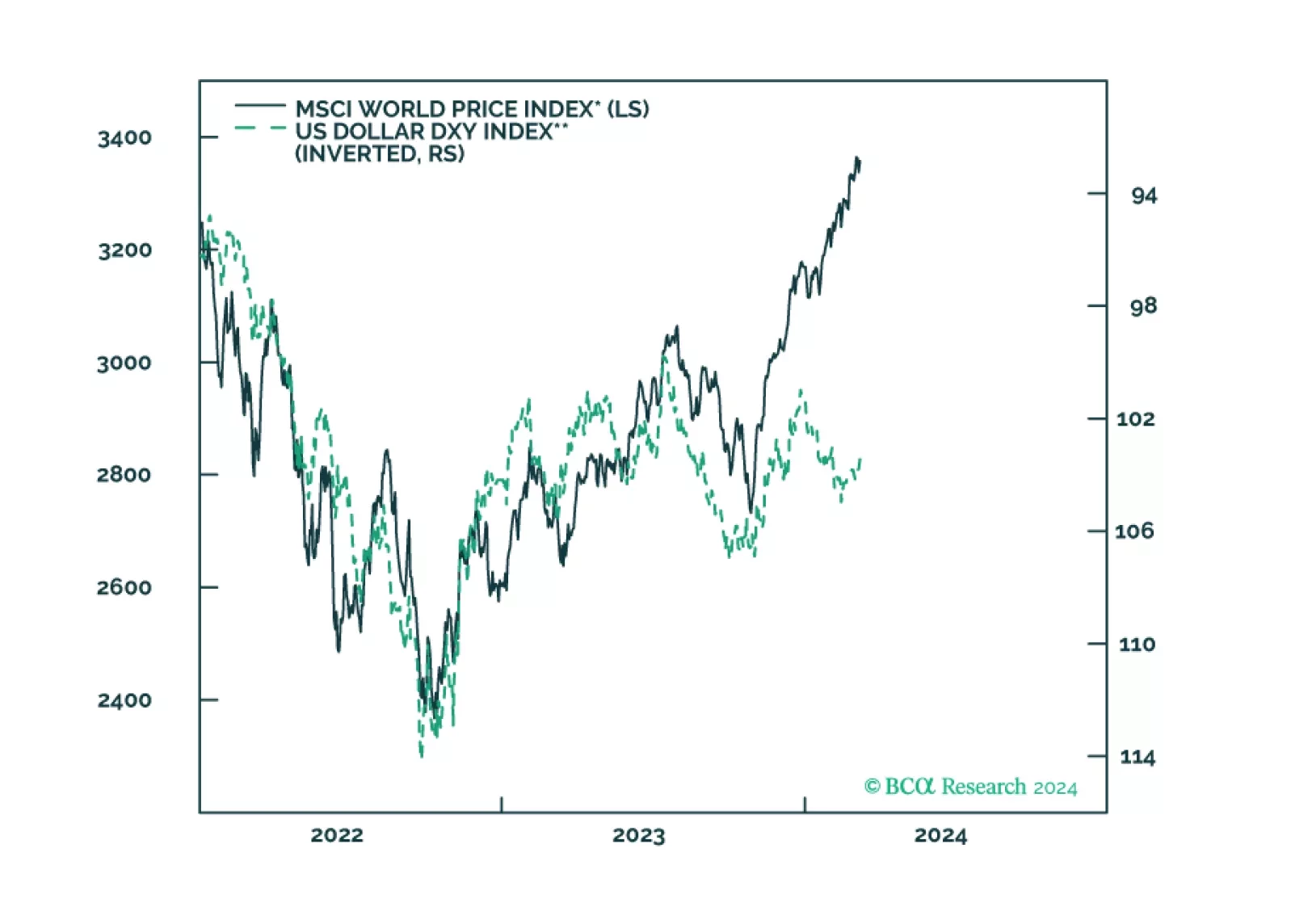

This week, we review our currency positions, based on the latest data from G10 economies.

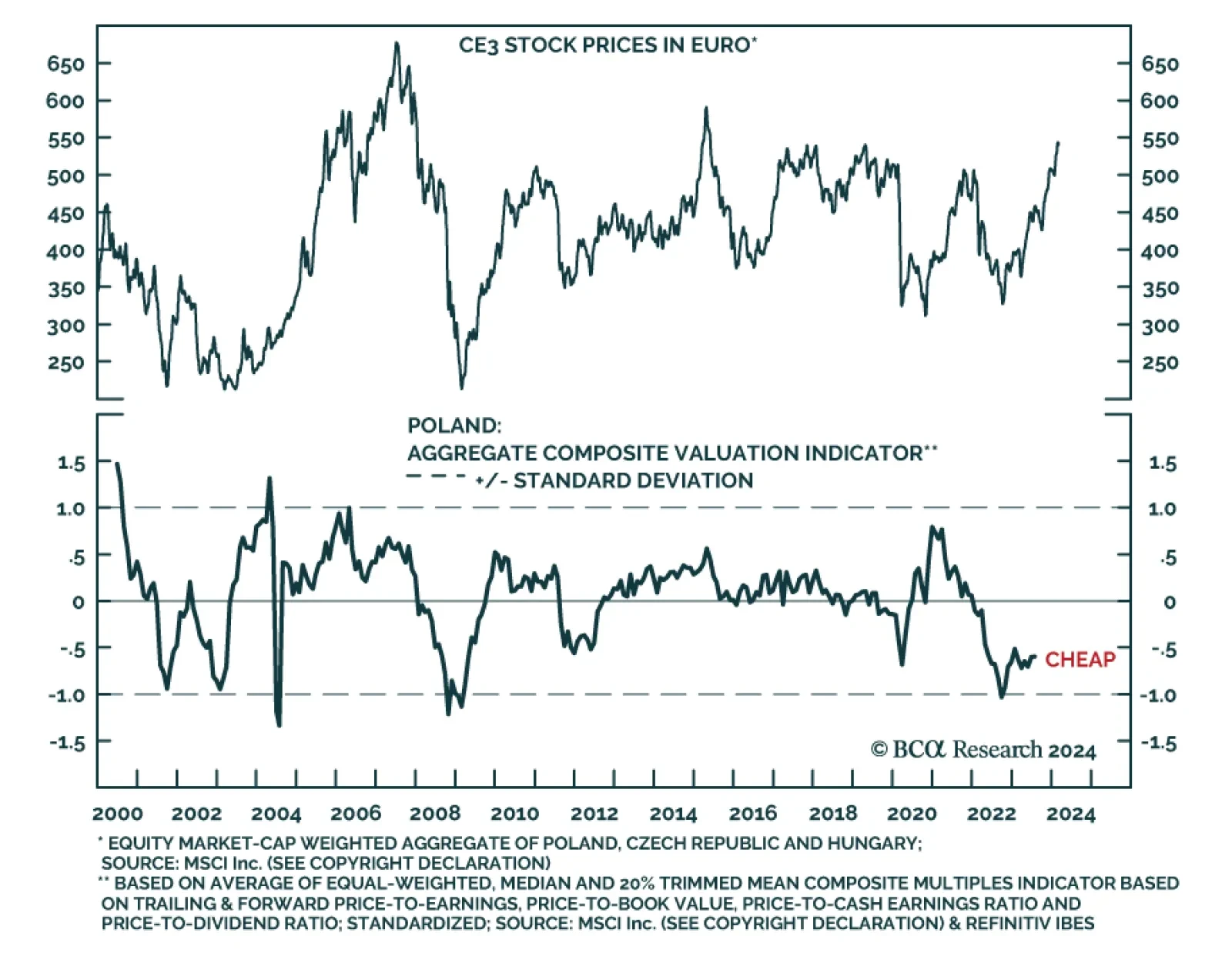

A market-cap weighted index of CE3 economies (Poland, Hungary and Czechia) returned a whopping 64% in common currency terms since its 2022 low. Polish and Hungarian equities led the rally, advancing by a respective 86% and 78% in…