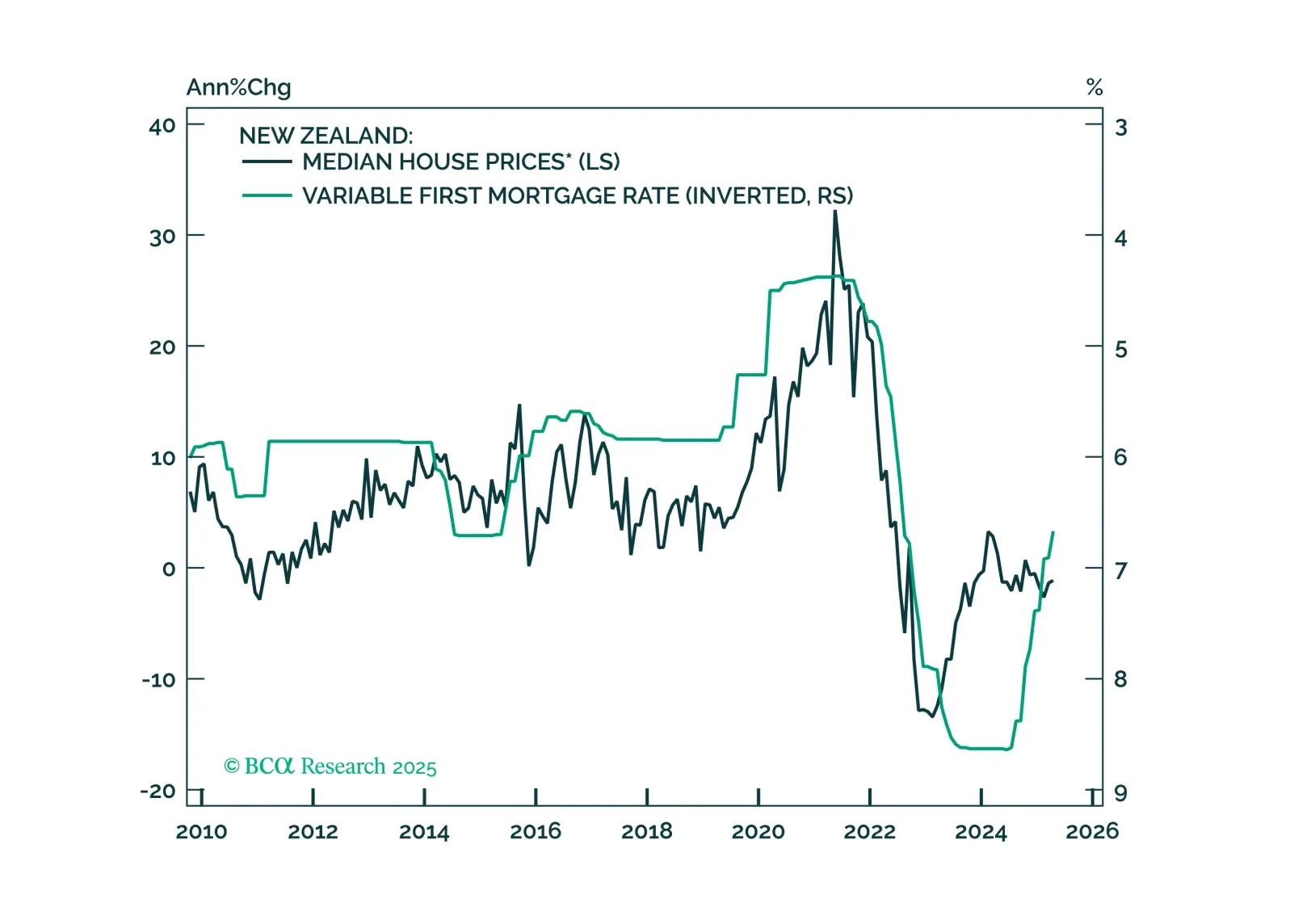

This Insight looks at the implications of the RBNZ’s rate cut on New Zealand assets.

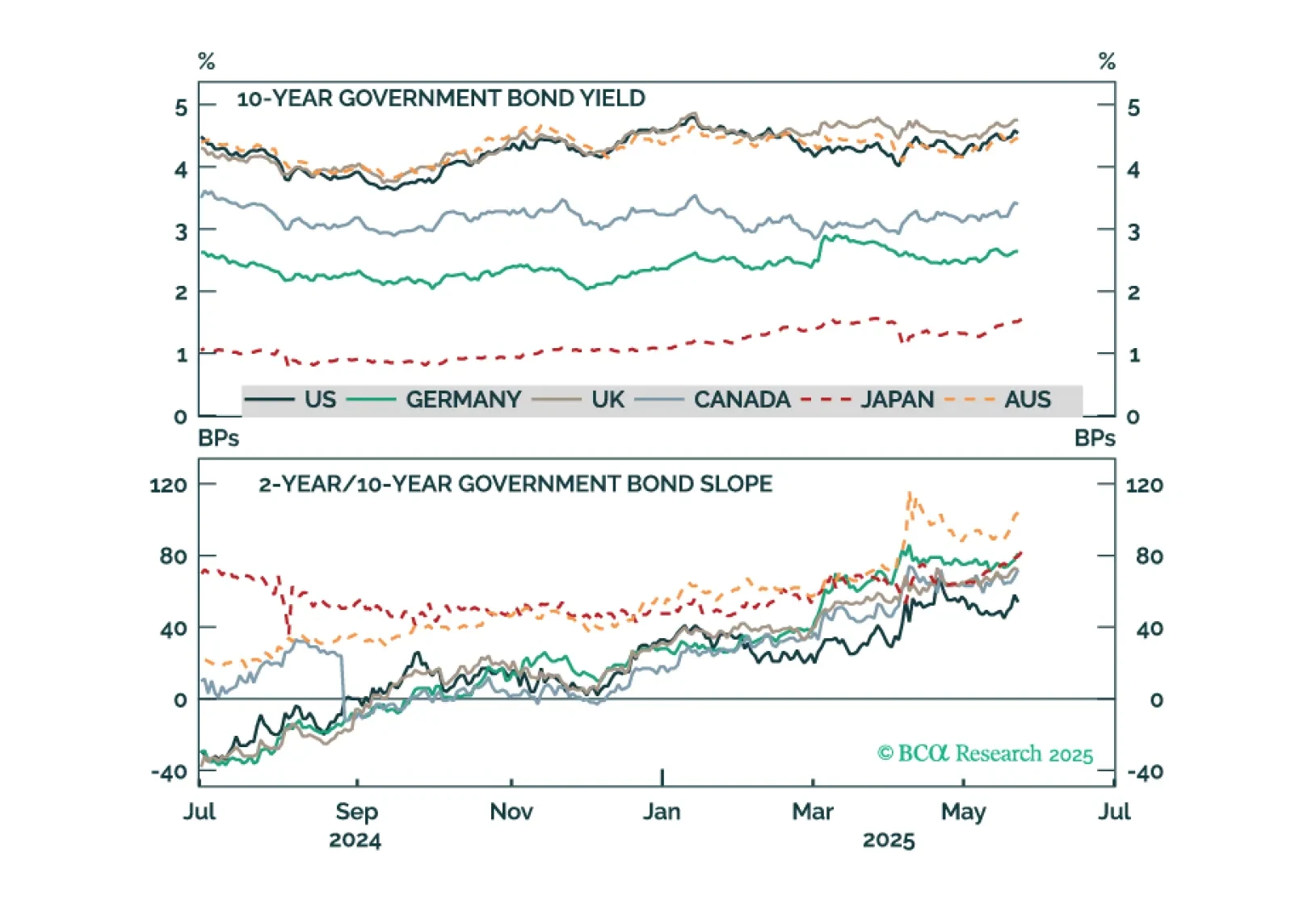

Rising bond yields may present an even greater danger to the global economy than the trade war. With equity valuations no longer discounting much economic risk, investors should position themselves defensively.

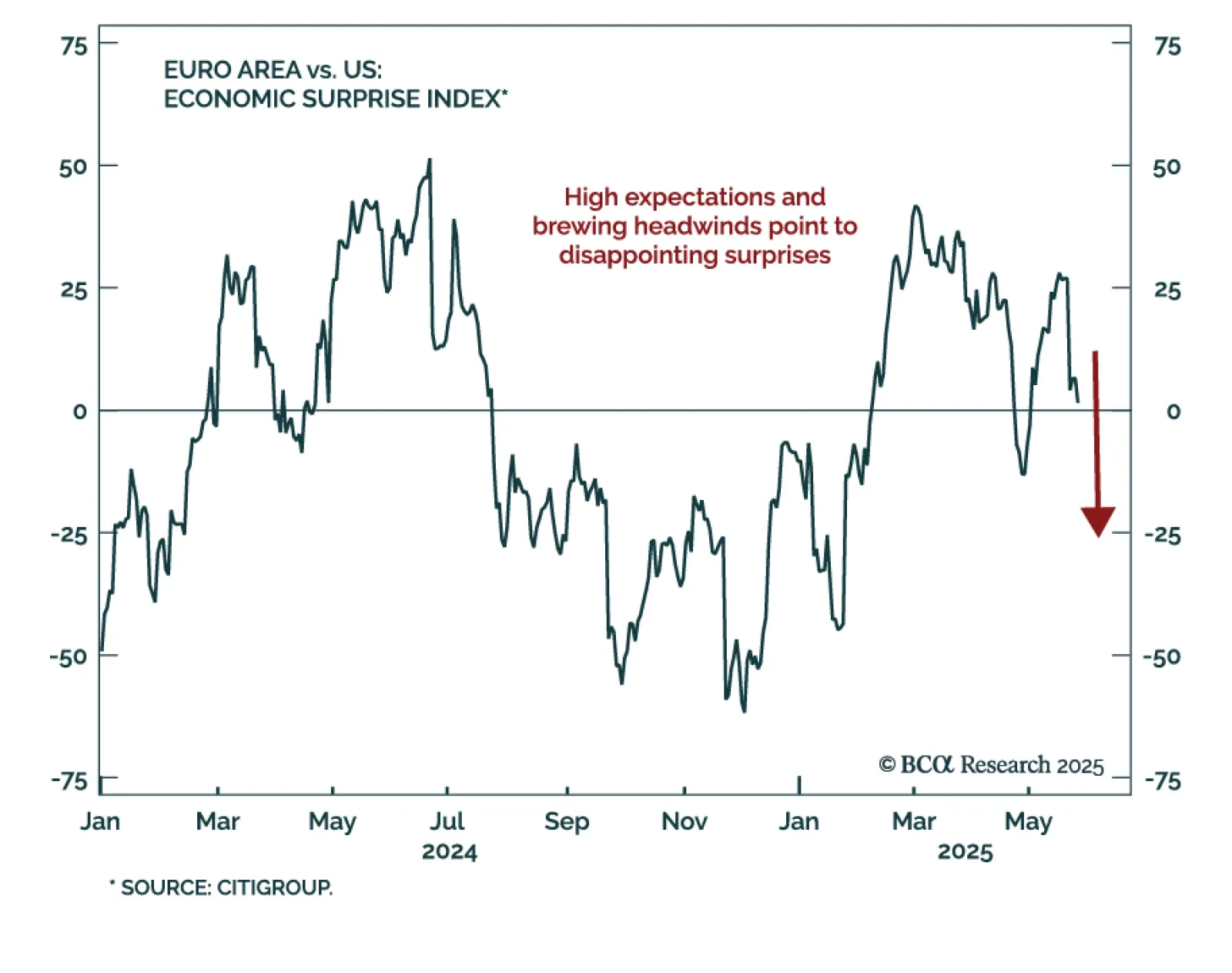

The structural outlook for European assets remains bright, but near-term headwinds argue for longer duration and caution on equities. Here are three takes that call for a temporary pullback in European assets, and two that explore…

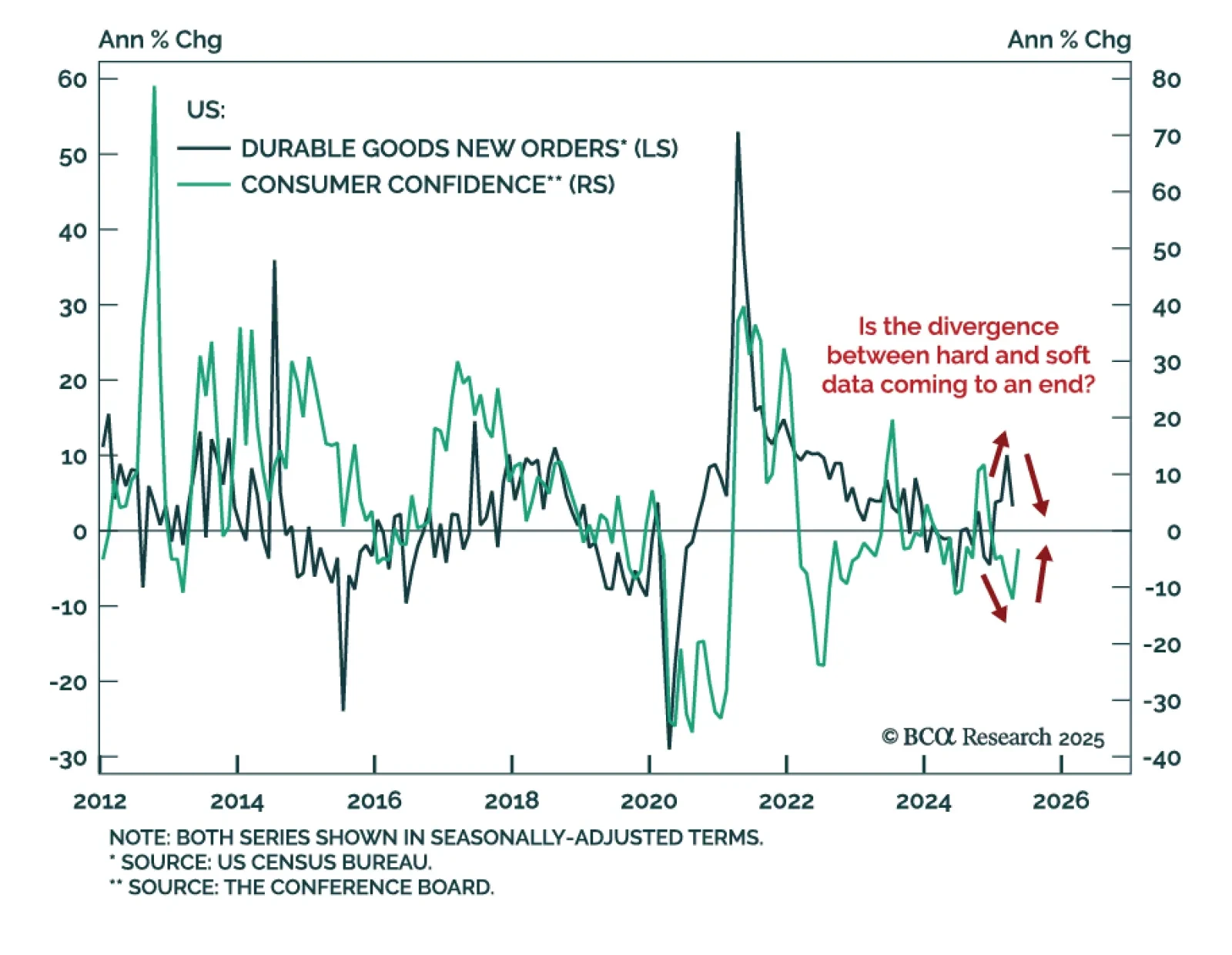

The latest US durable goods orders and consumer confidence figures suggest that hard and soft data are converging, but stocks remain at risk. After months of rising prints, new orders for manufactured goods sank by 6.3% in April…

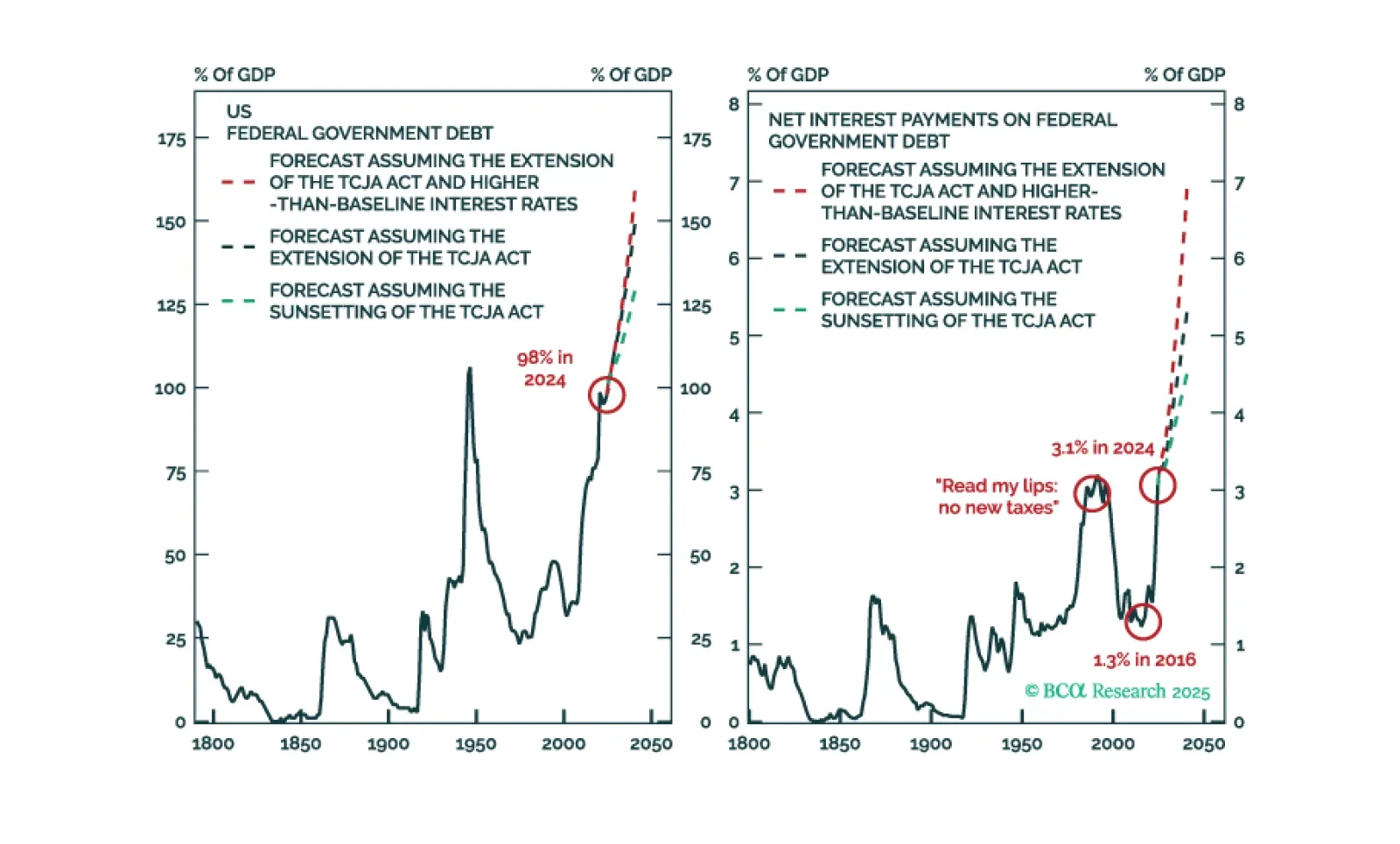

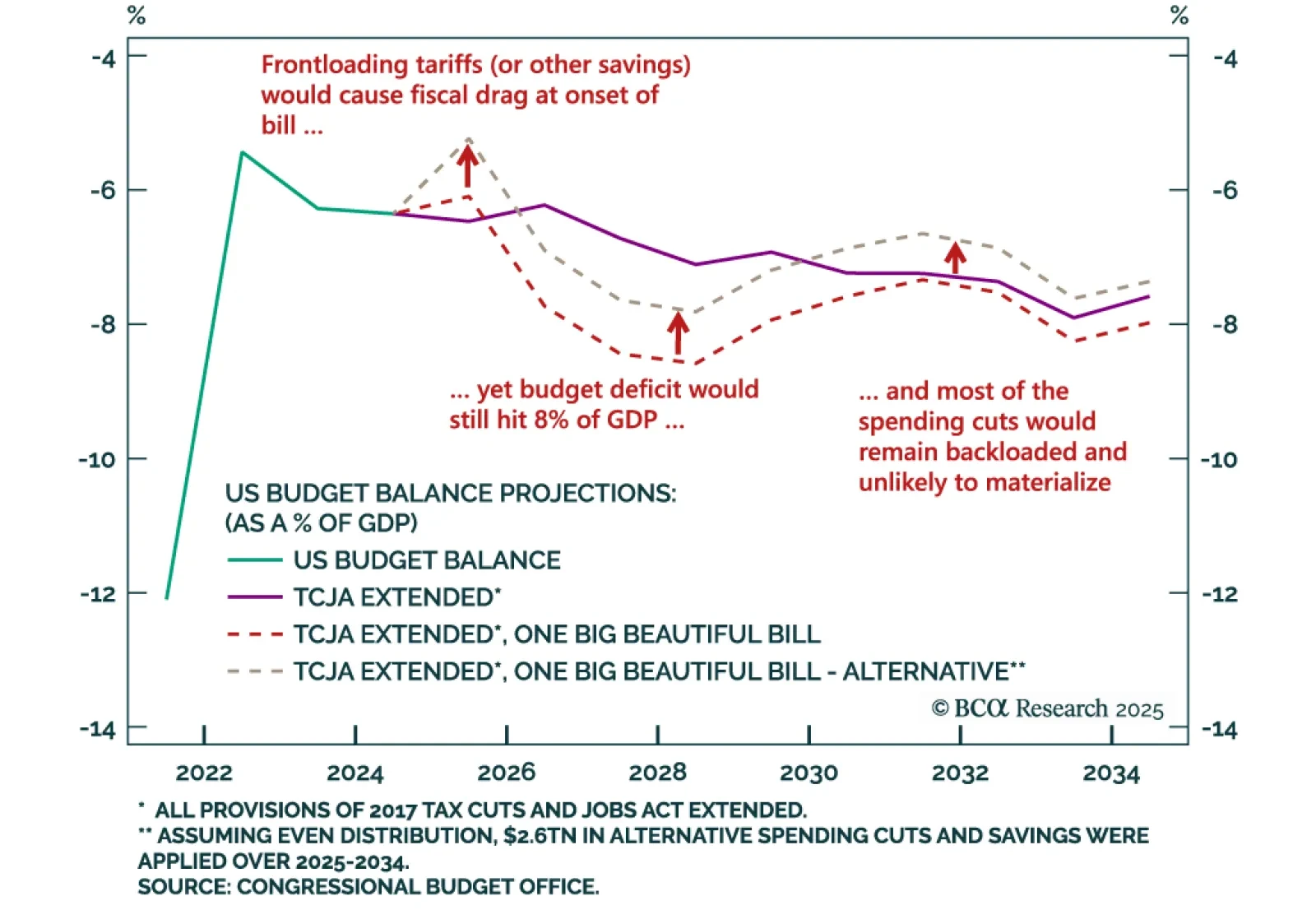

President Trump’s signature bill is surprising to the upside with budget deficits, as predicted by our Geopolitical Strategists. Some form of the bill is guaranteed to pass, no matter how many tries it takes. The bill…

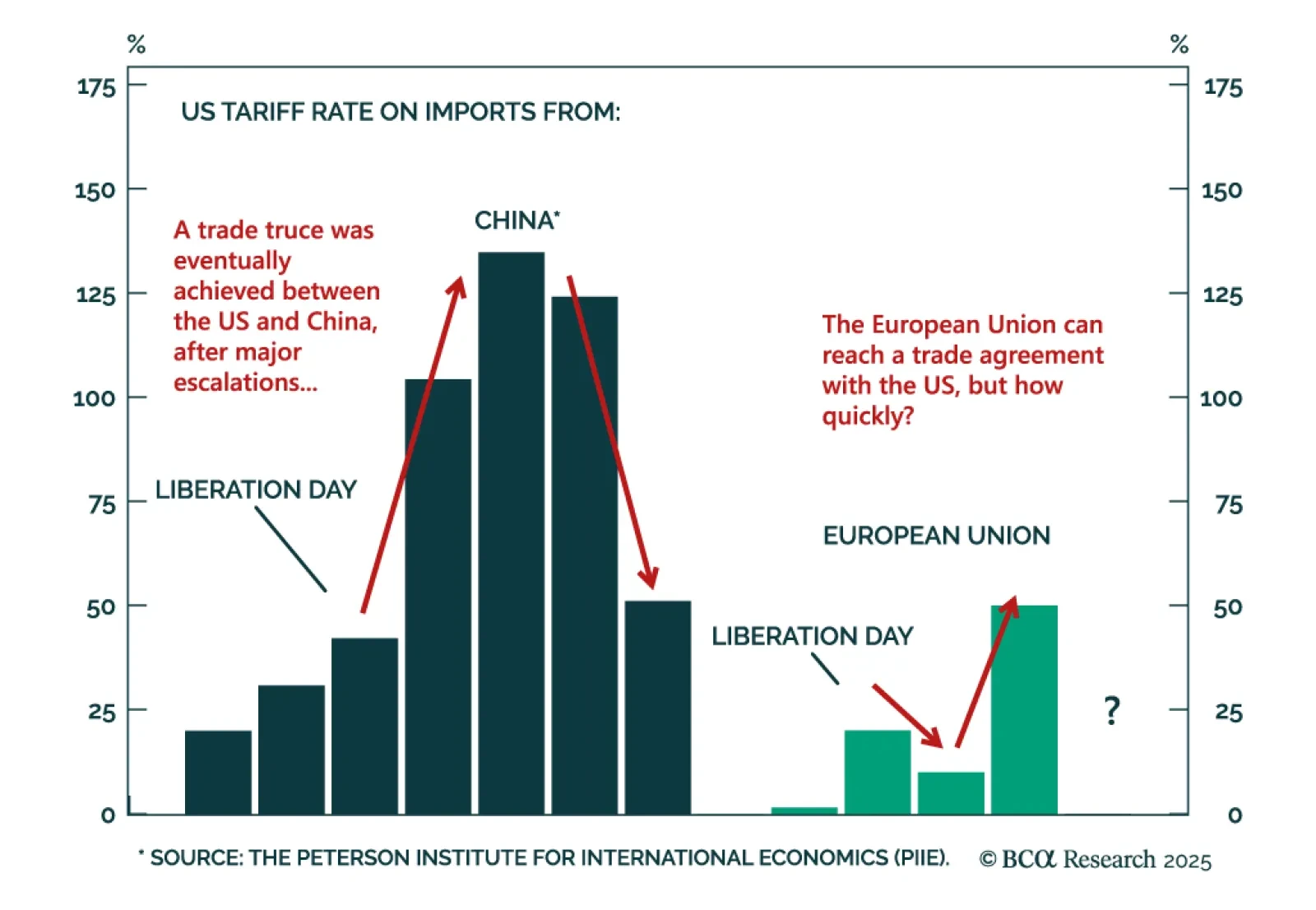

Last Friday, President Trump announced new 50% tariffs on imported goods from the European Union (EU), effective June 1st, and threatened US company Apple with 25% tariffs unless it made iPhones in the US. Global stock markets…

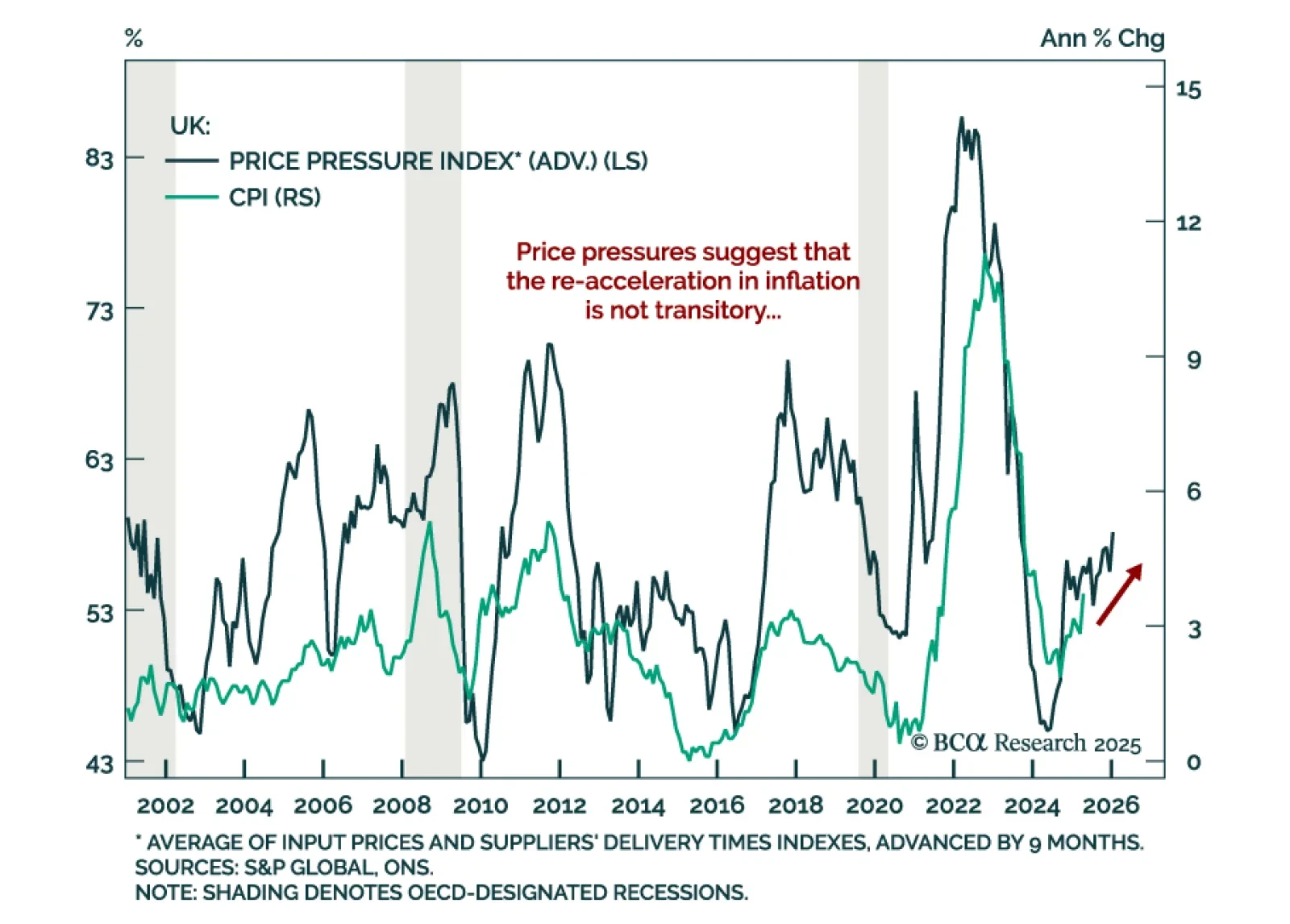

UK inflation surprised to the upside in April. Headline inflation rose to a 15-month high of 3.5%, from 2.6% the month before. Core inflation also surprised above estimates, printing 3.8% vs. 3.4% in March. Services inflation climbed…

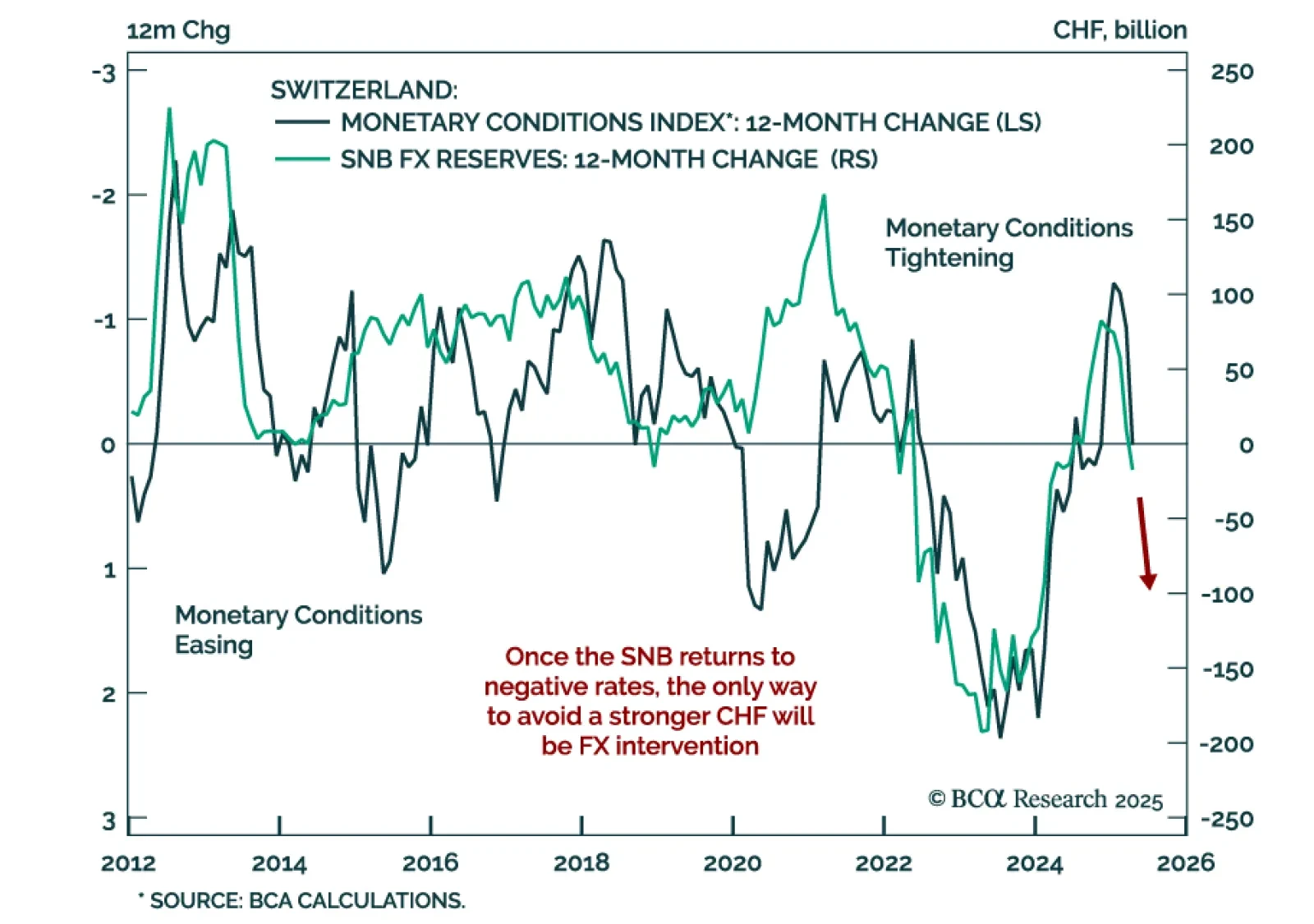

Swiss National Bank will have to resort to negative interest rates and FX intervention before year-end. Swiss inflation fell to 0% year-over-year in April, or the lower end of the SNB’s 0%-2% target range, and the continued…

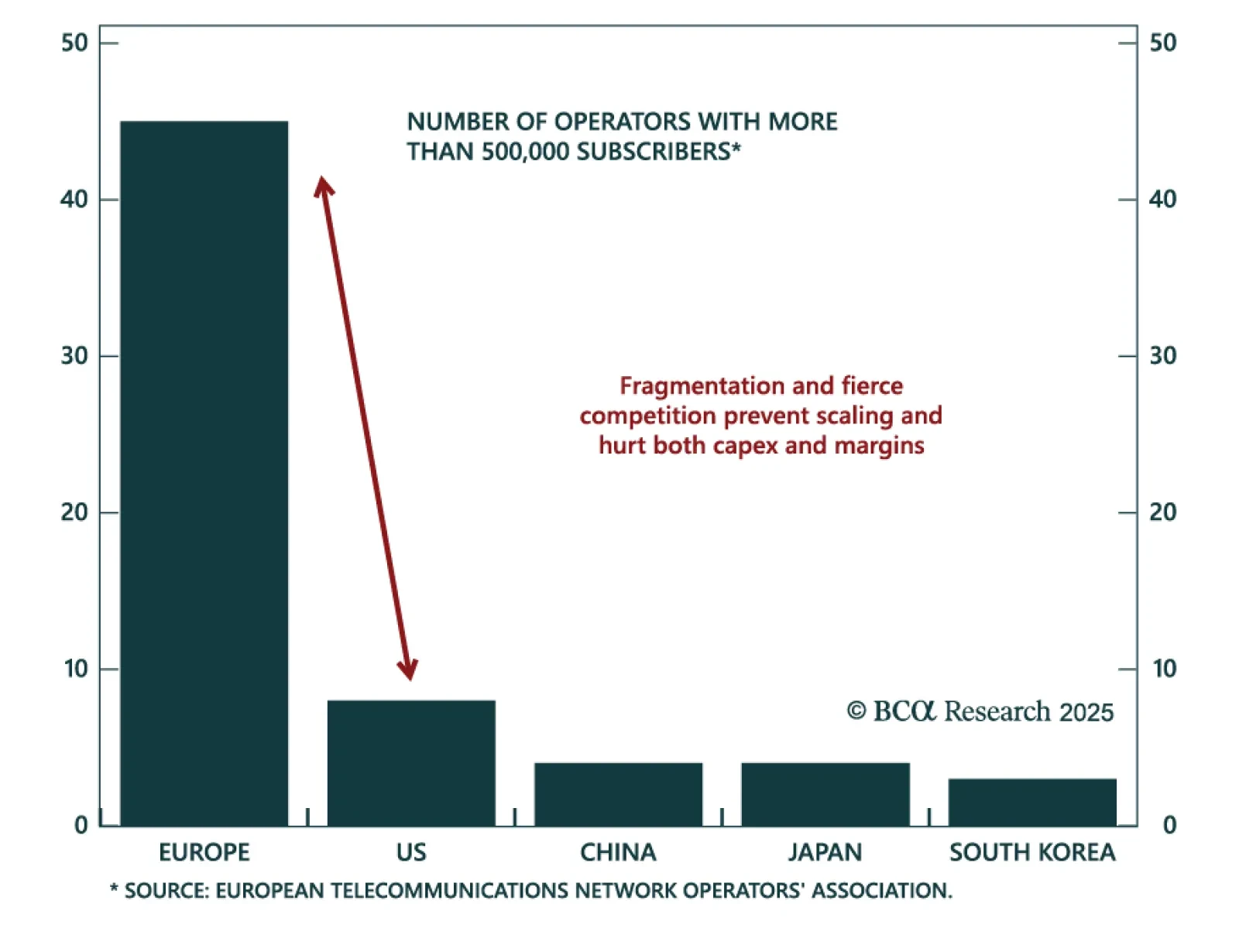

Our European strategists are upgrading the communication services sector to overweight on a structural investment horizon. In March, they highlighted the sector's near-term attractiveness. Since the Great Financial…