In the short run, global risk assets are vulnerable due to rising oil prices and bond yields. Cyclically, a global economic downturn will weigh on global risk assets.

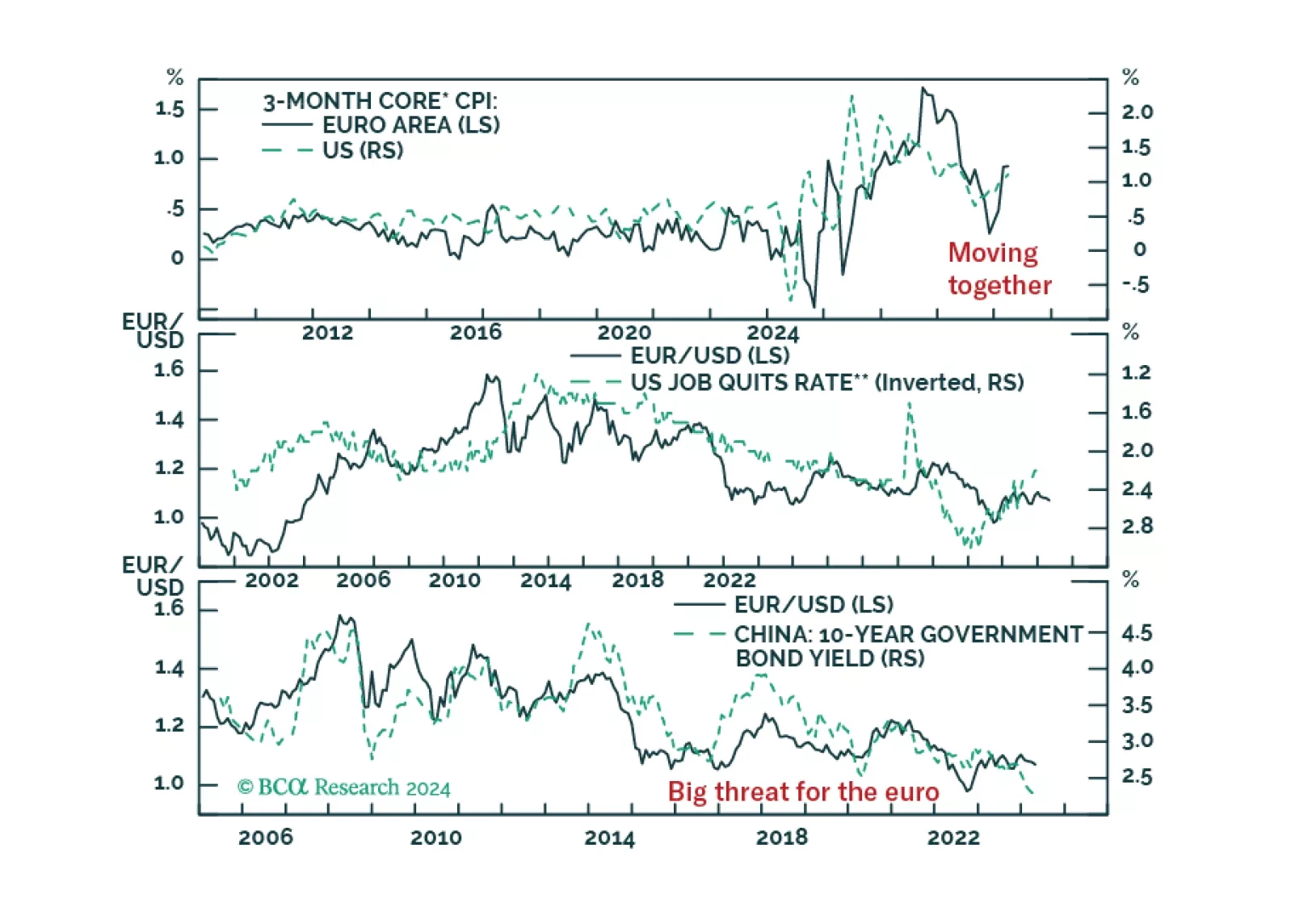

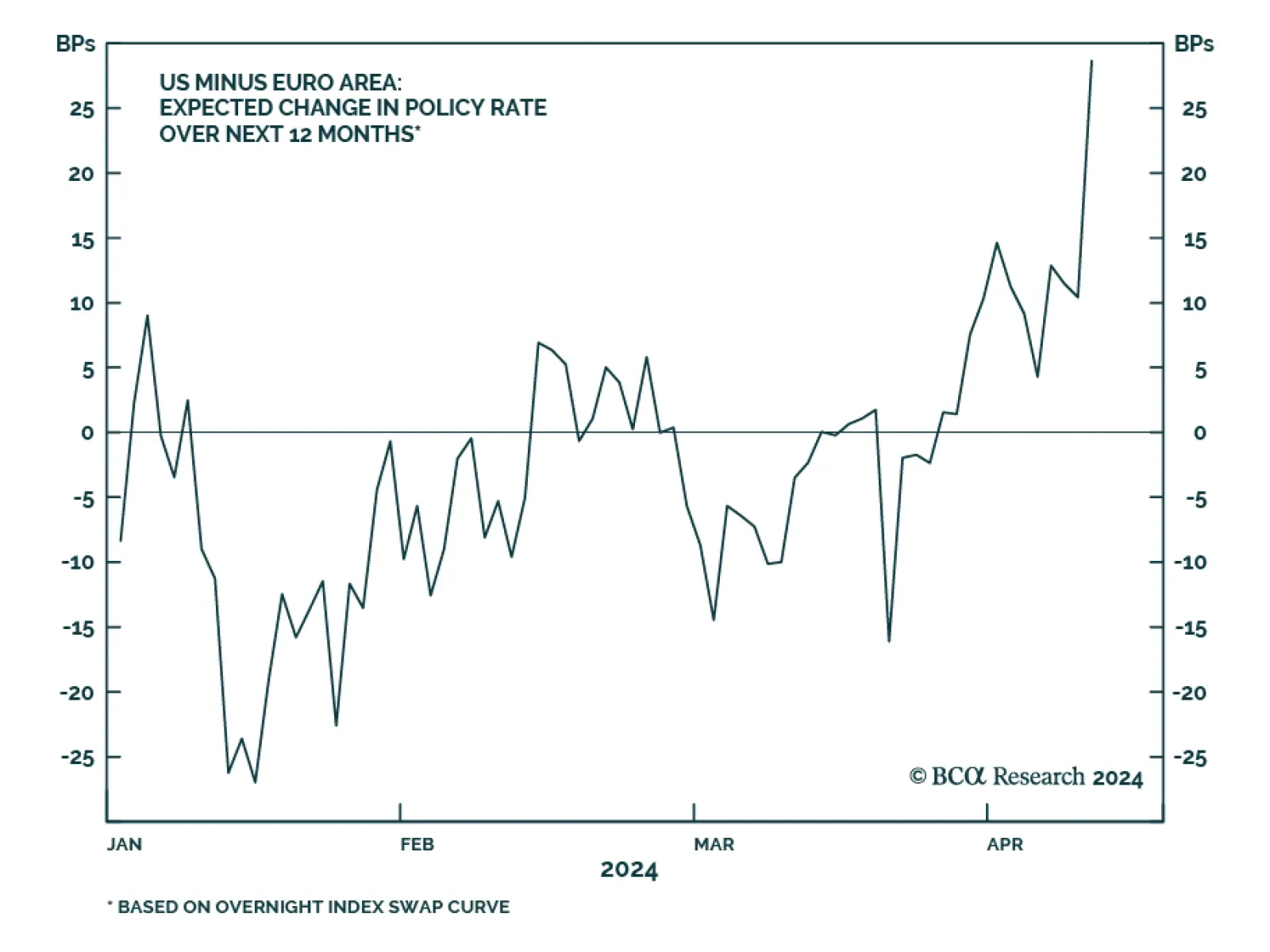

EUR/USD collapsed in the wake of last week’s hotter-than-expected US CPI report. Is this pessimism warranted and will the euro’s trading range that has prevailed since 2023 breakdown?

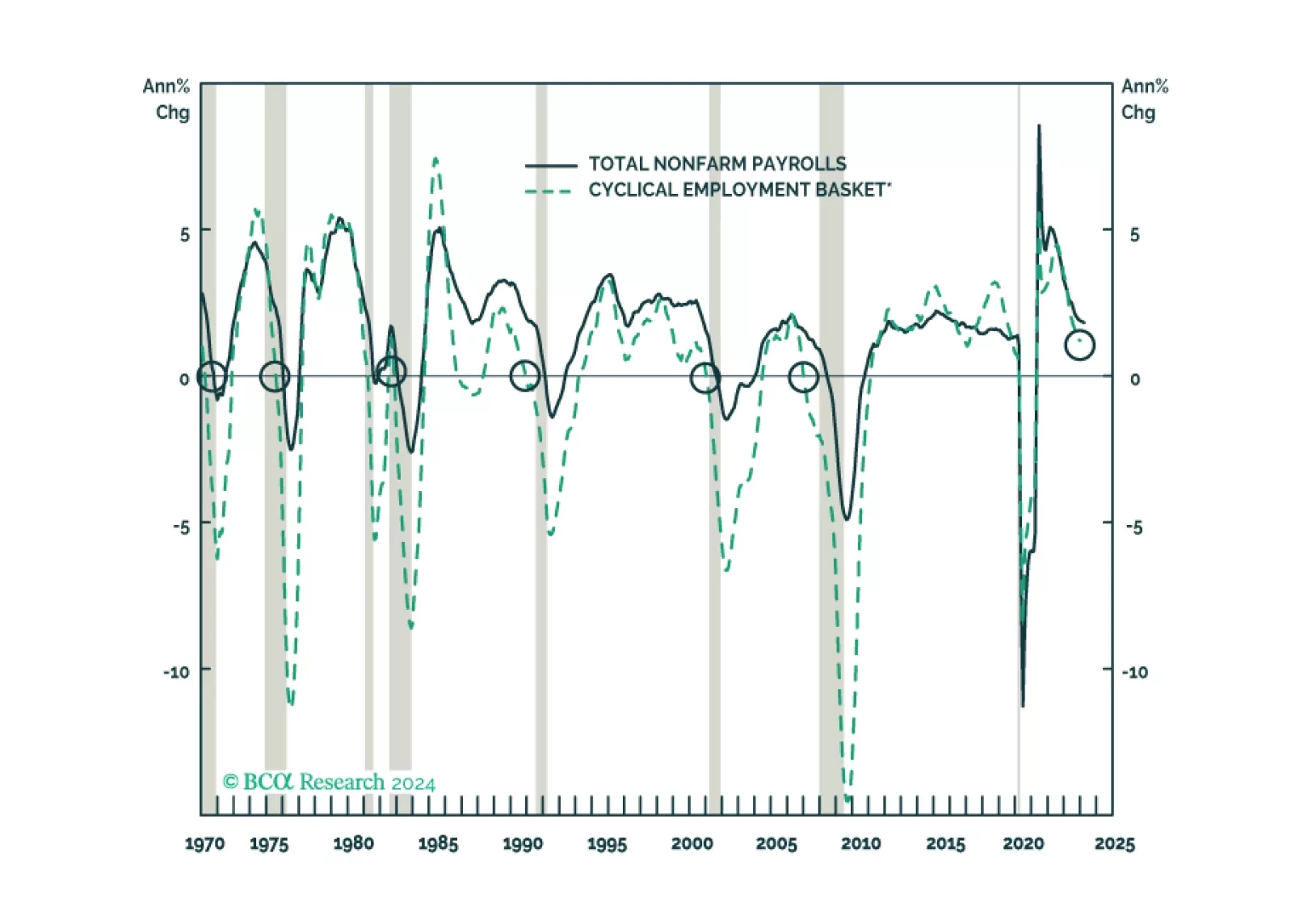

We look beneath headline data to assess the state of the labor market in cyclical goods-producing industries that have previously led overall nonfarm payrolls and in the services segments that have recently been leading the charge.…

In this report, we present our quarterly review of our Model Bond Portfolio. The anti-growth bias of the portfolio allocations hurt the portfolio performance in Q1/2024 as global growth surprised to the upside. However, we anticipate…

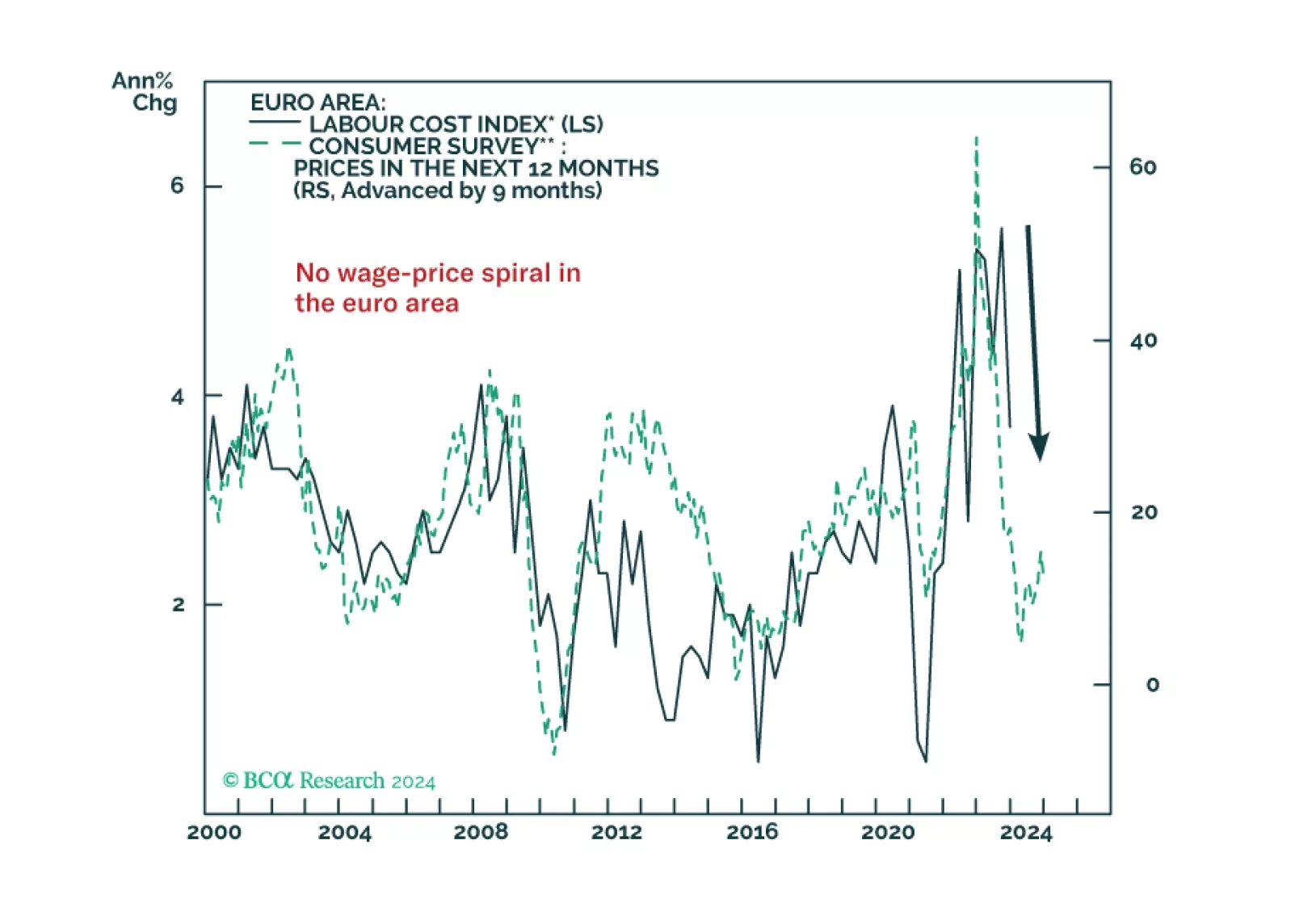

At today’s monetary policy meeting, the ECB gave strong hints that rate cuts will begin as soon as the next meeting in June. In this Insight, we share our thoughts on today’s meeting and discuss the implications for European bond…

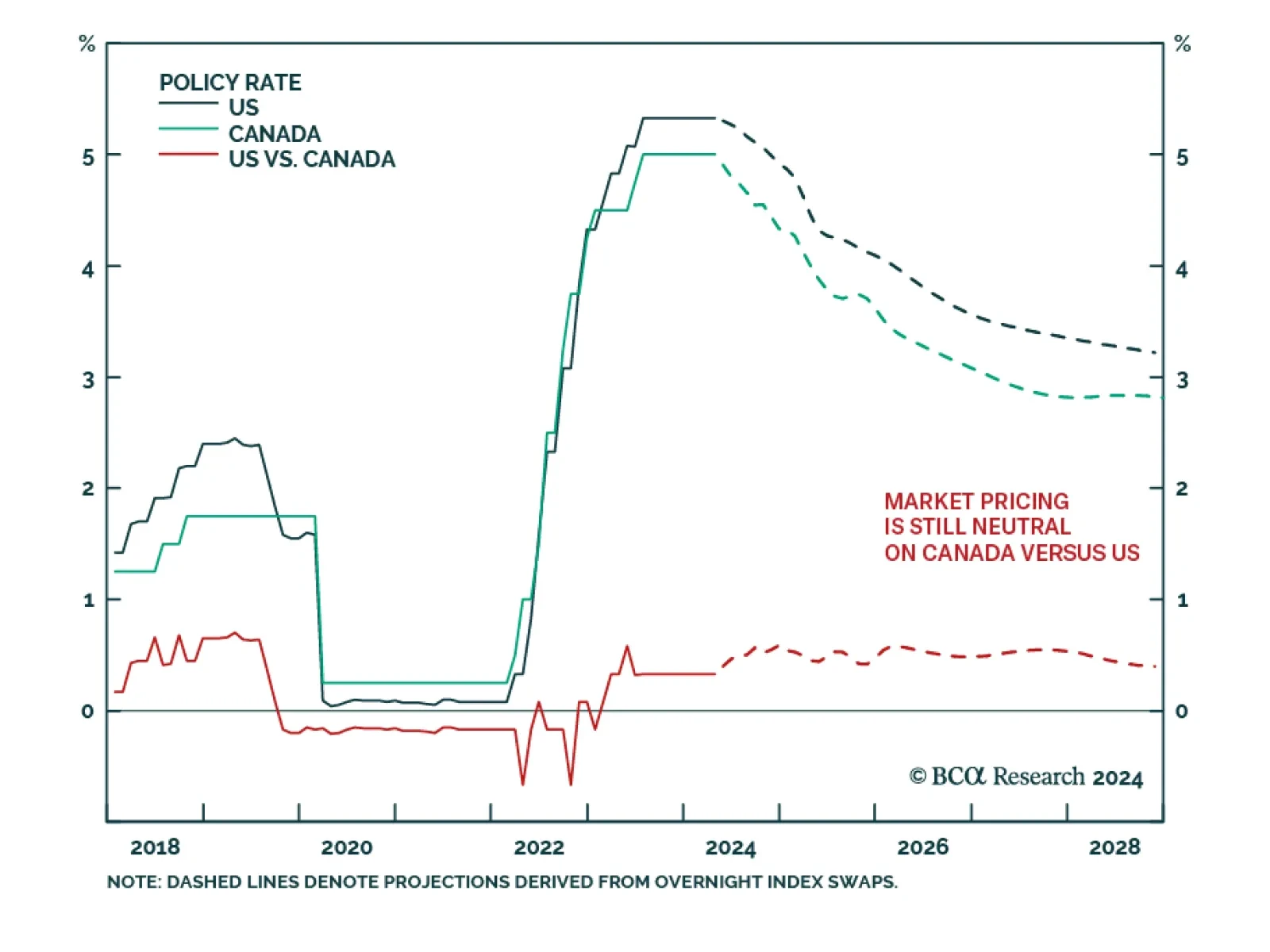

In terms of interest rate bets, markets are now roughly neutral on whether the Fed or Bank of Canada move the most in the next 12 months. BCA Research’s Foreign Exchange Strategy service’s bias is that it will be the…

As expected, the Governing Council of the ECB kept interest rates unchanged on Thursday. In its statement, the ECB reiterated that most measures of underlying inflation were easing, wage growth was moderating, and firms were…

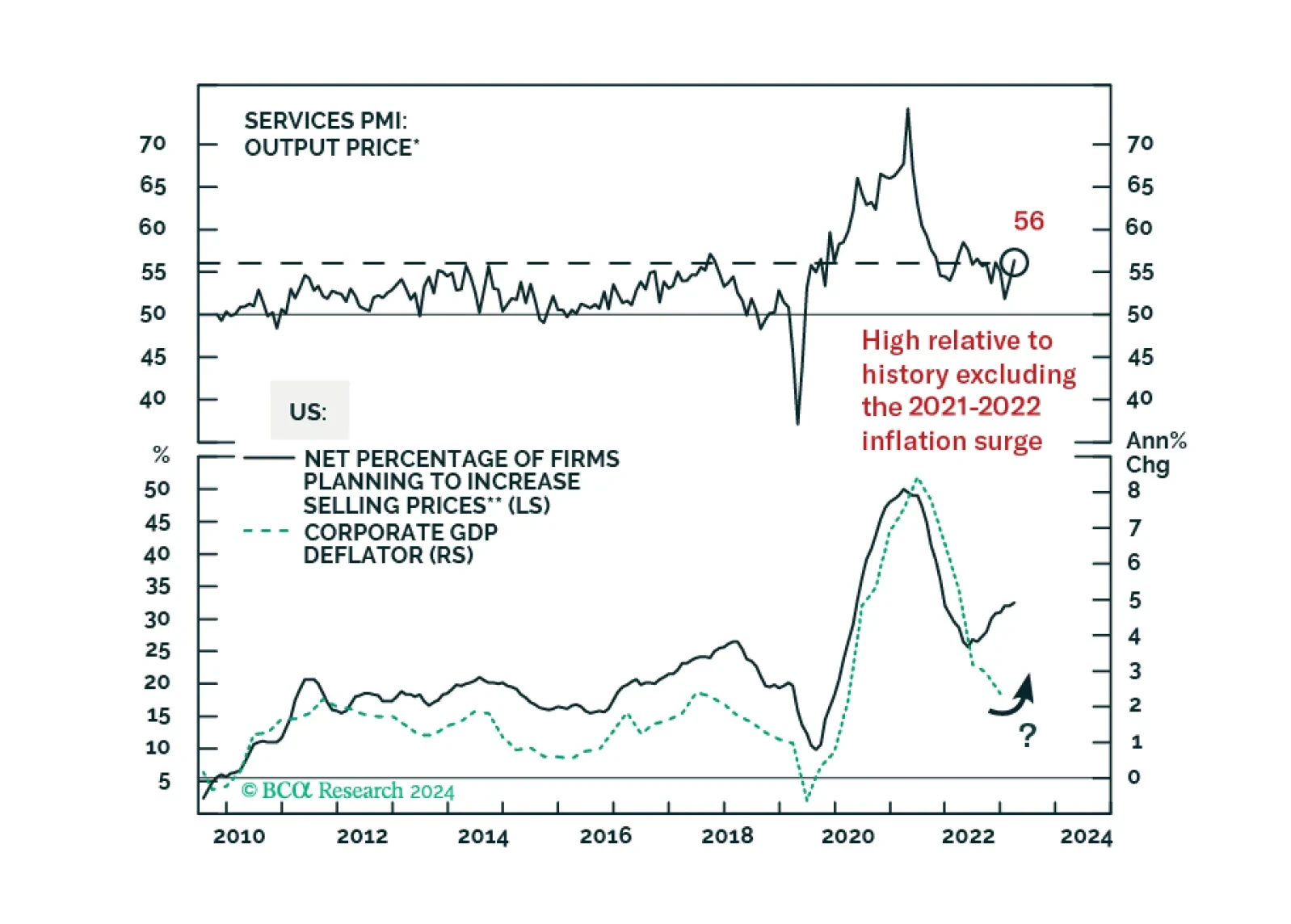

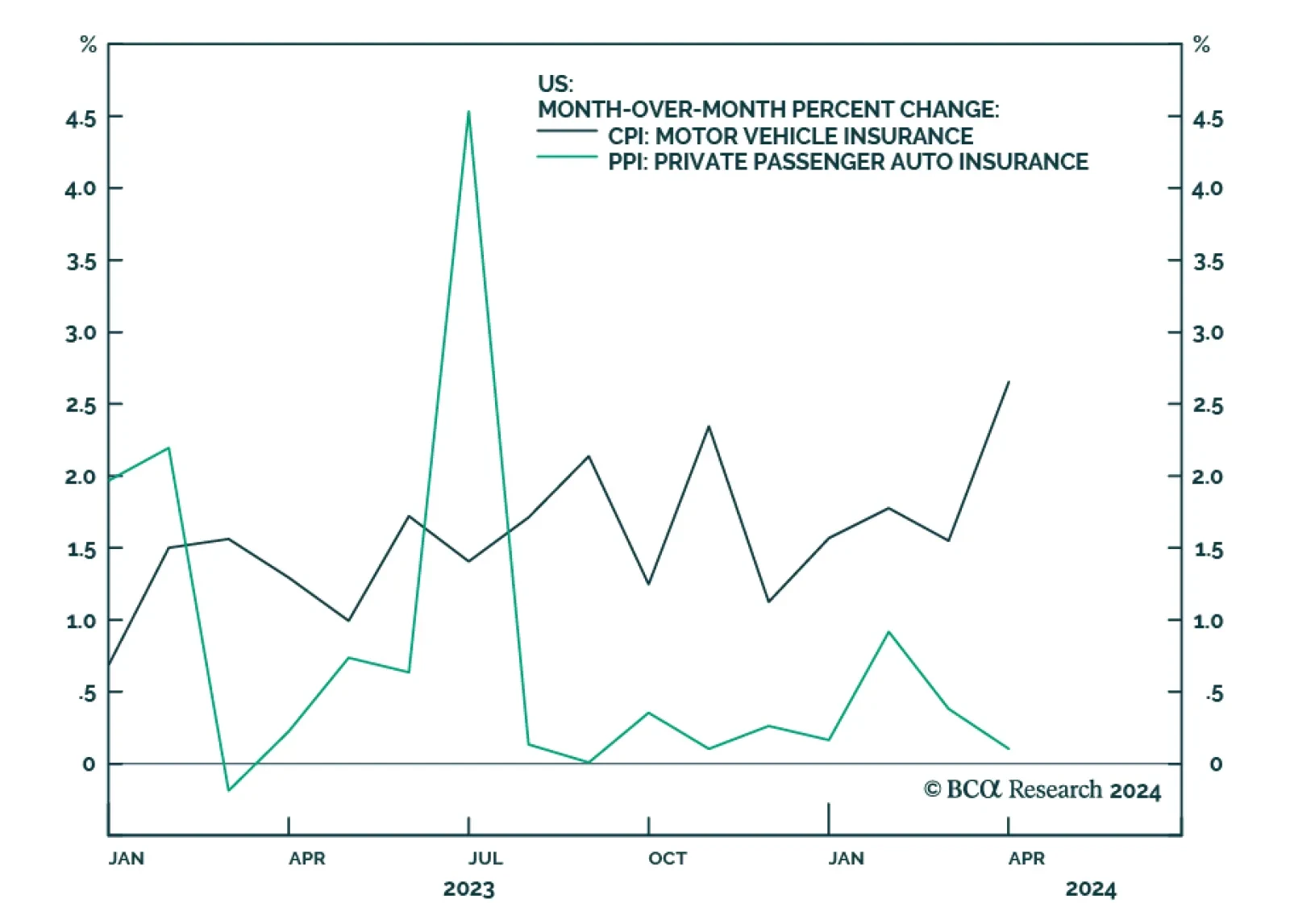

Thursday’s US Produce Price Index report for March shows headline PPI came in below expectations on both a month-over-month (0.2%) and annual (2.1%) basis. Meanwhile, PPI ex food and energy came in at 0.2% m/m (in line with…

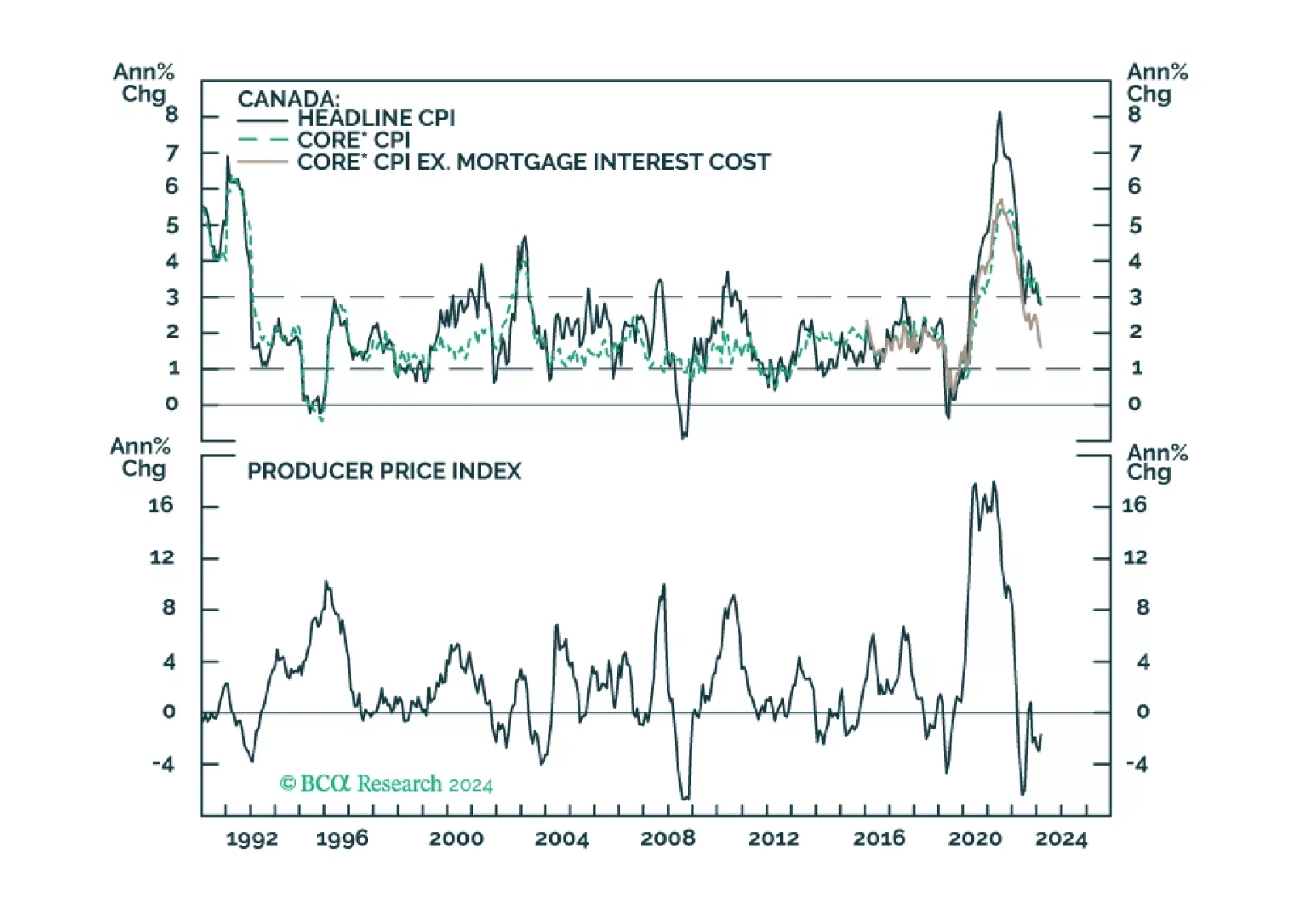

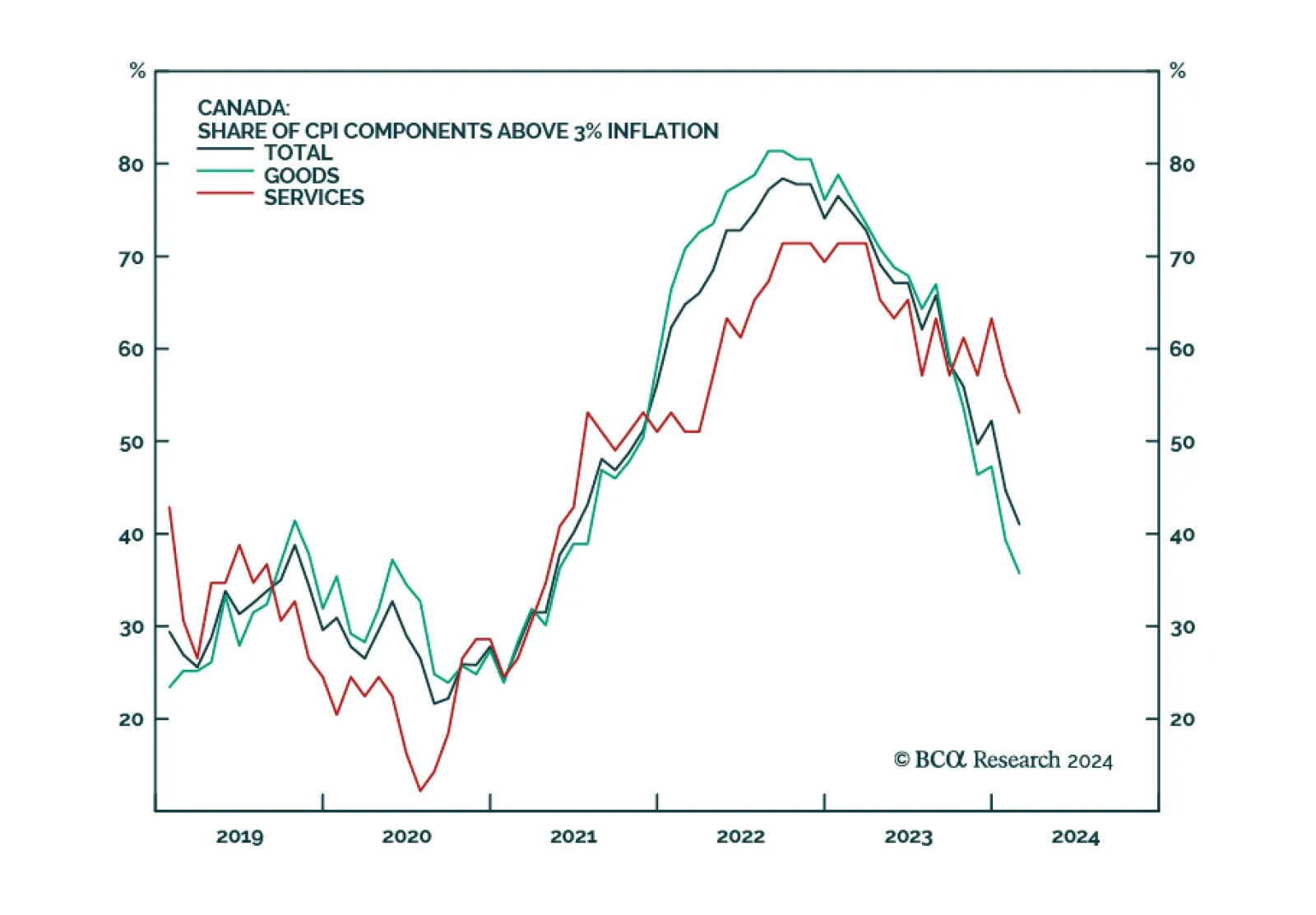

In this insight, we calibrate our investment views based on the latest Bank of Canada decision.

The Bank of Canada held its policy rate steady at 5% on Wednesday, in line with expectations. In his opening remarks following the announcement, Governor Tiff Macklem was cautiously dovish: “We don't want to leave…