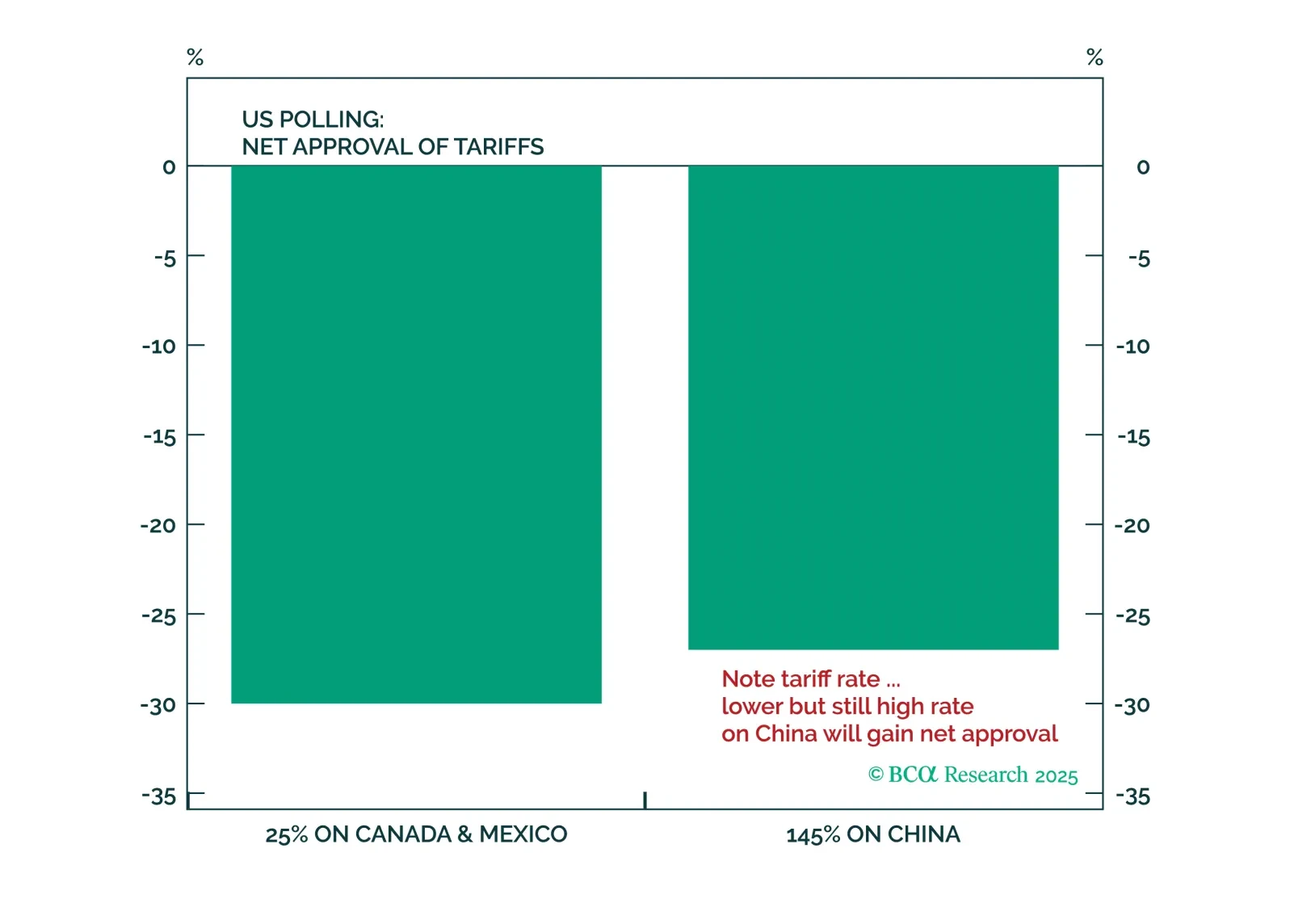

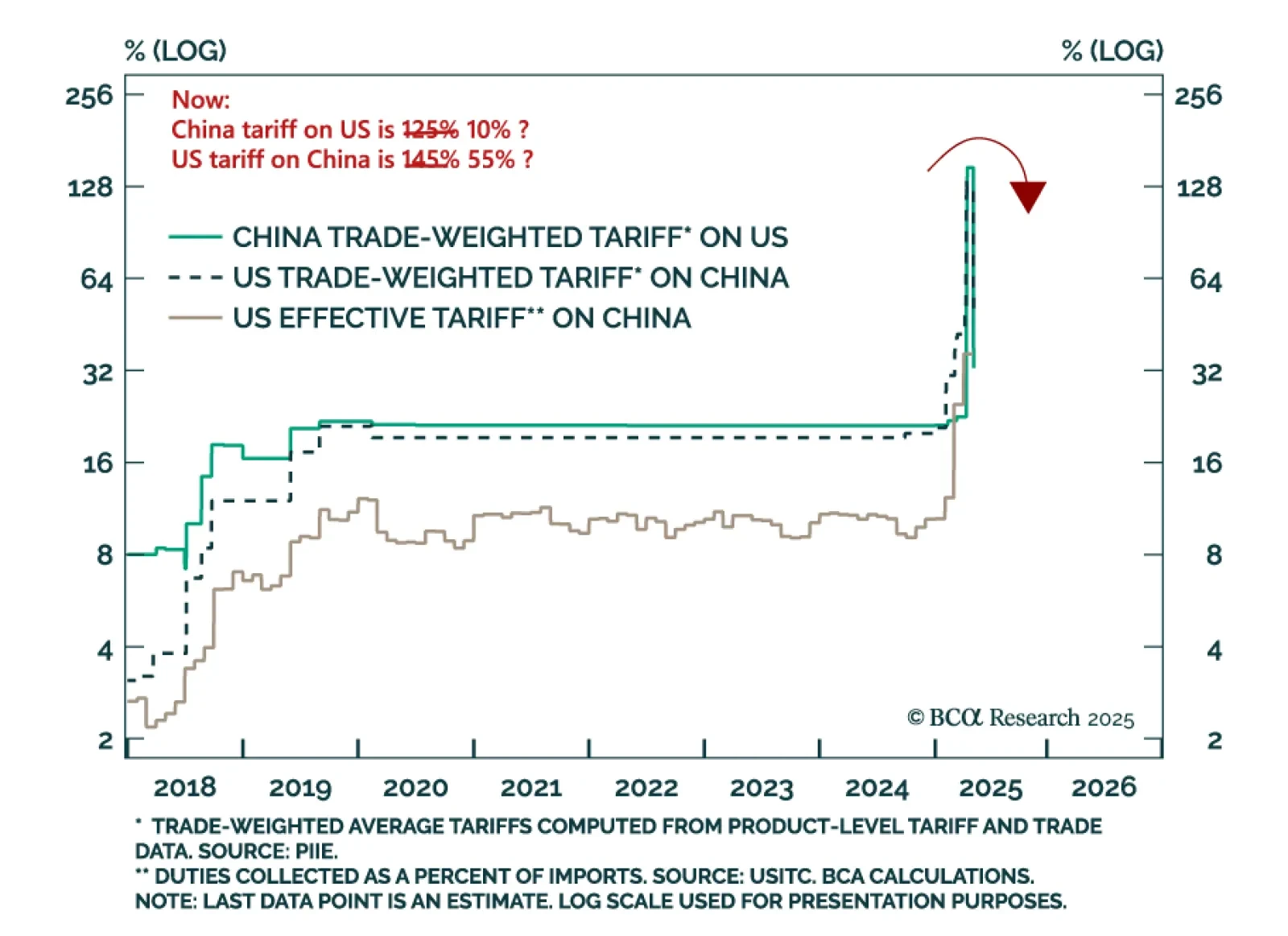

The US-China tariff deal confirms one thing: markets are still priced for perfection, with little upside even if a recession is dodged. The London negotiations yielded a partial agreement: The US will reduce tariffs, and China will…

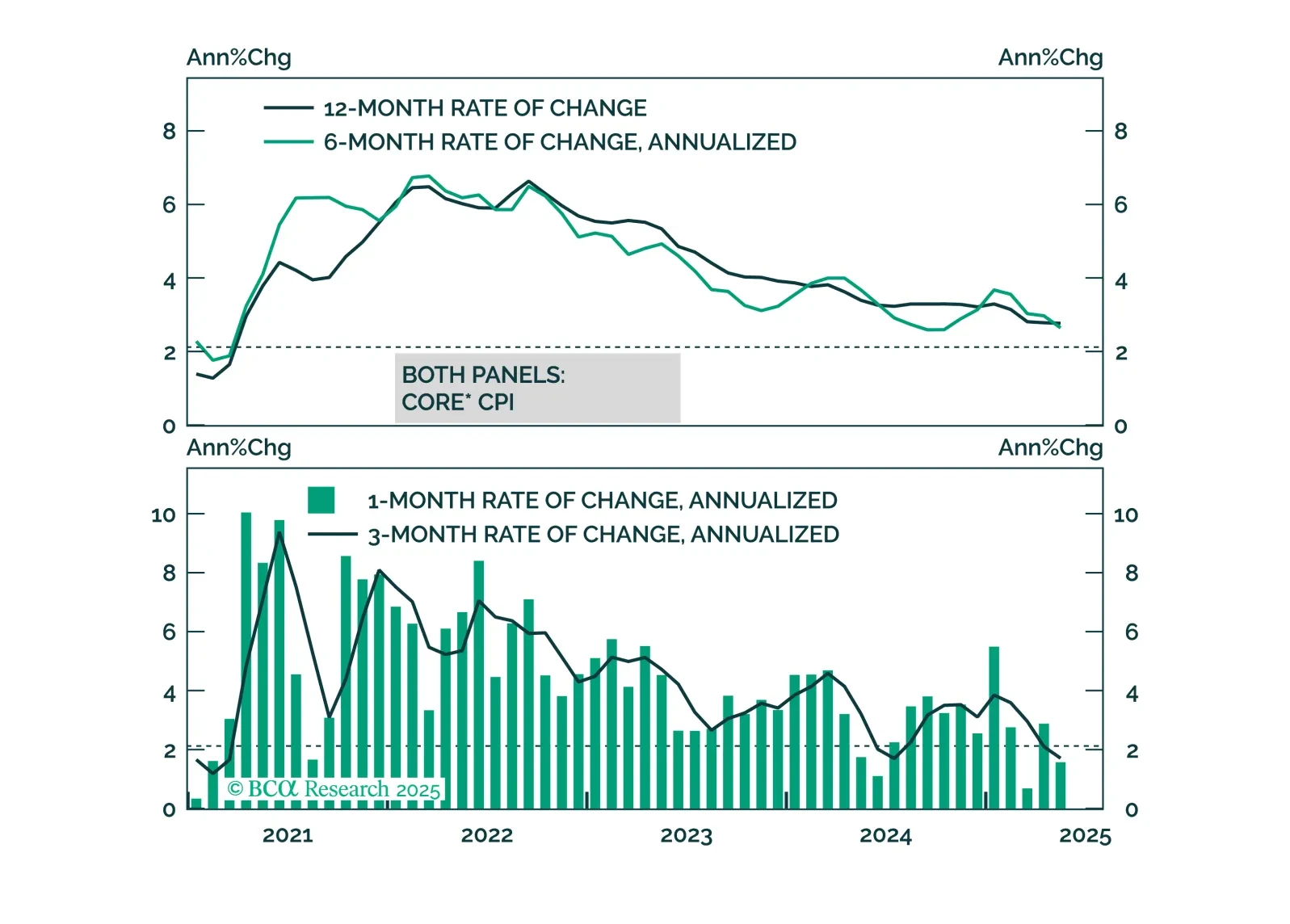

While we anticipate higher inflation in June, it looks increasingly likely that the price impact from tariffs will be less aggressive and long-lasting than many feared.

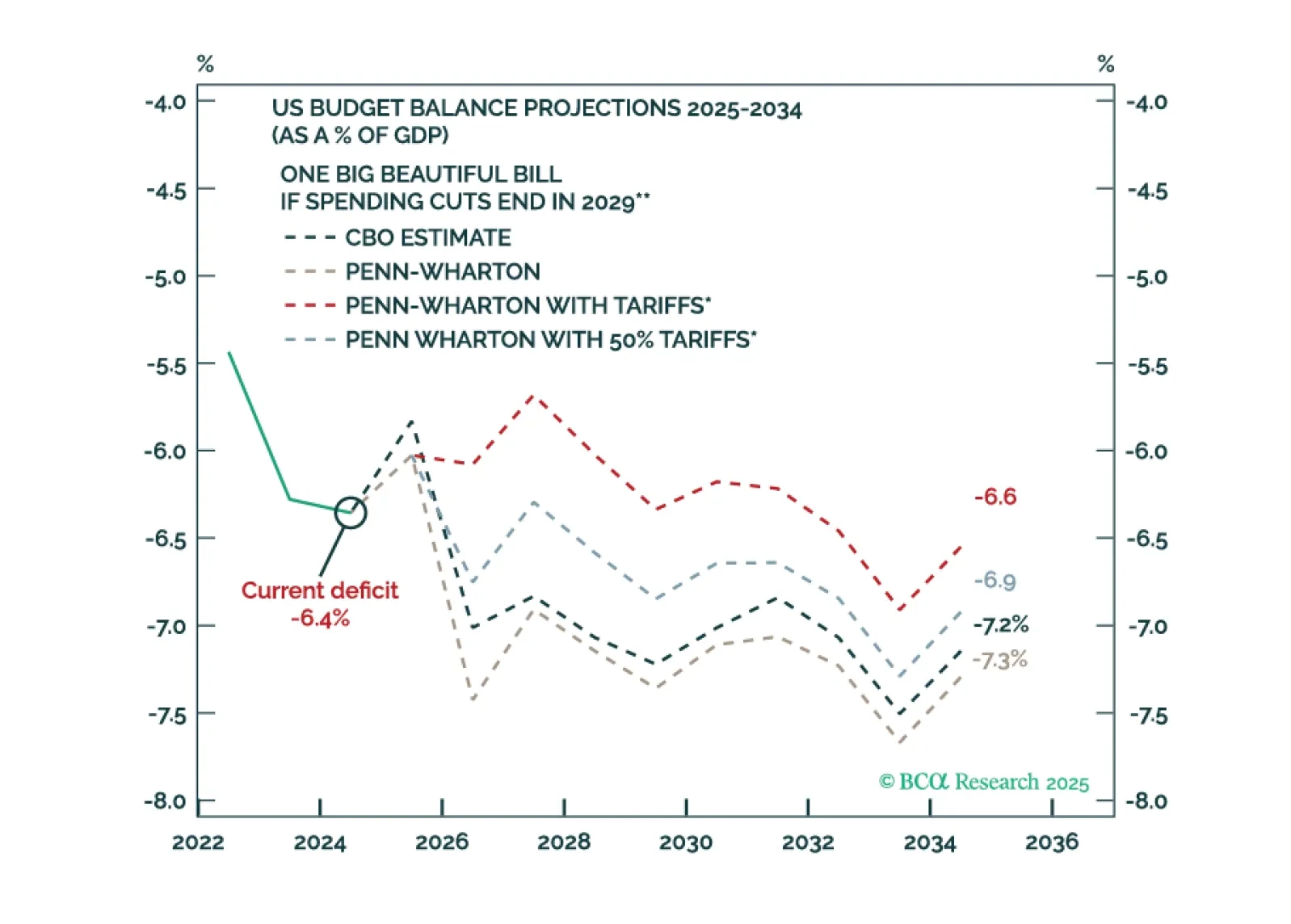

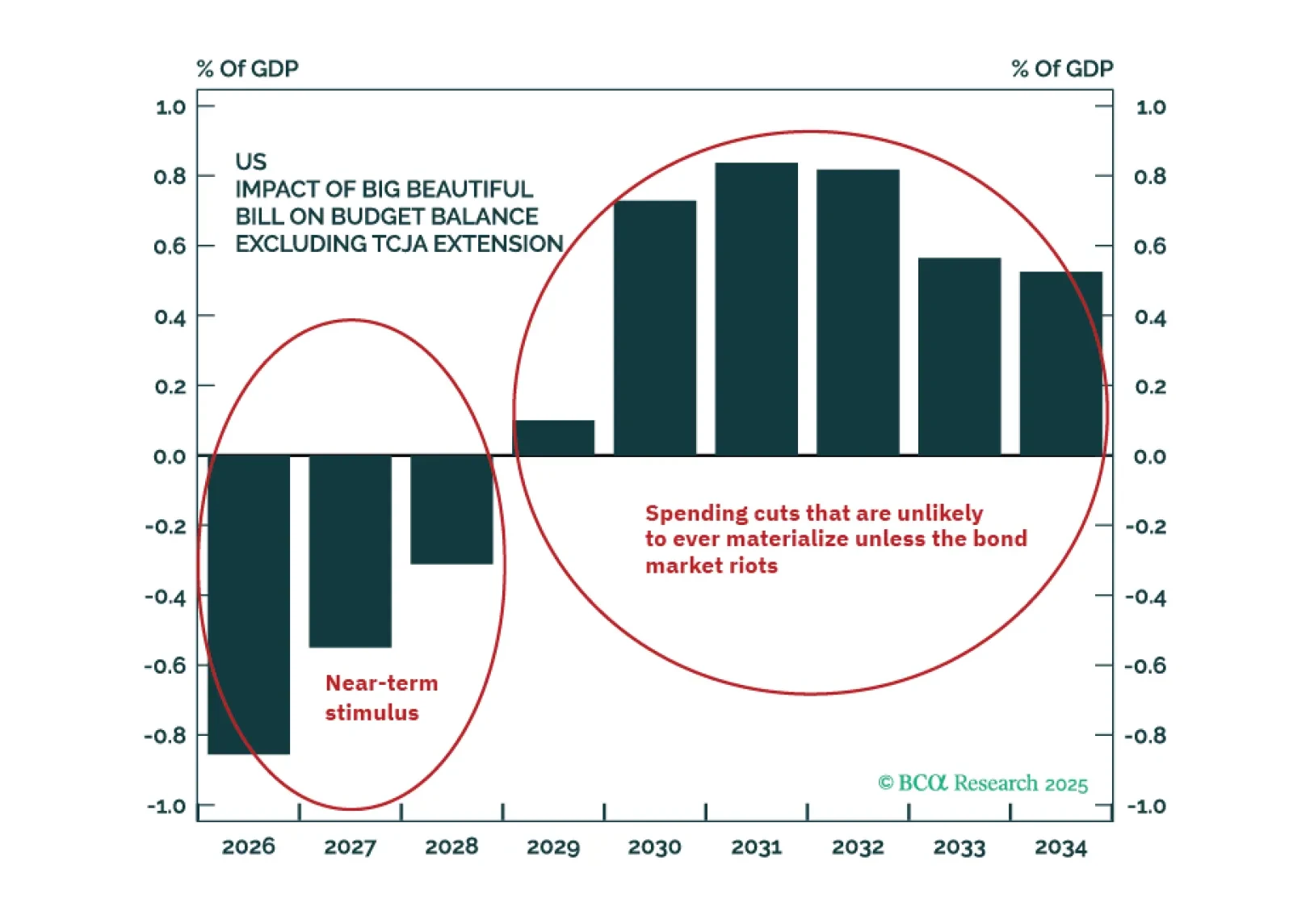

Bond market volatility will spike again in the near term. The Fed is committed to an easing cycle yet the Trump administration’s signature fiscal policy action will stimulate the economy. Tariffs are supposed to keep the budget…

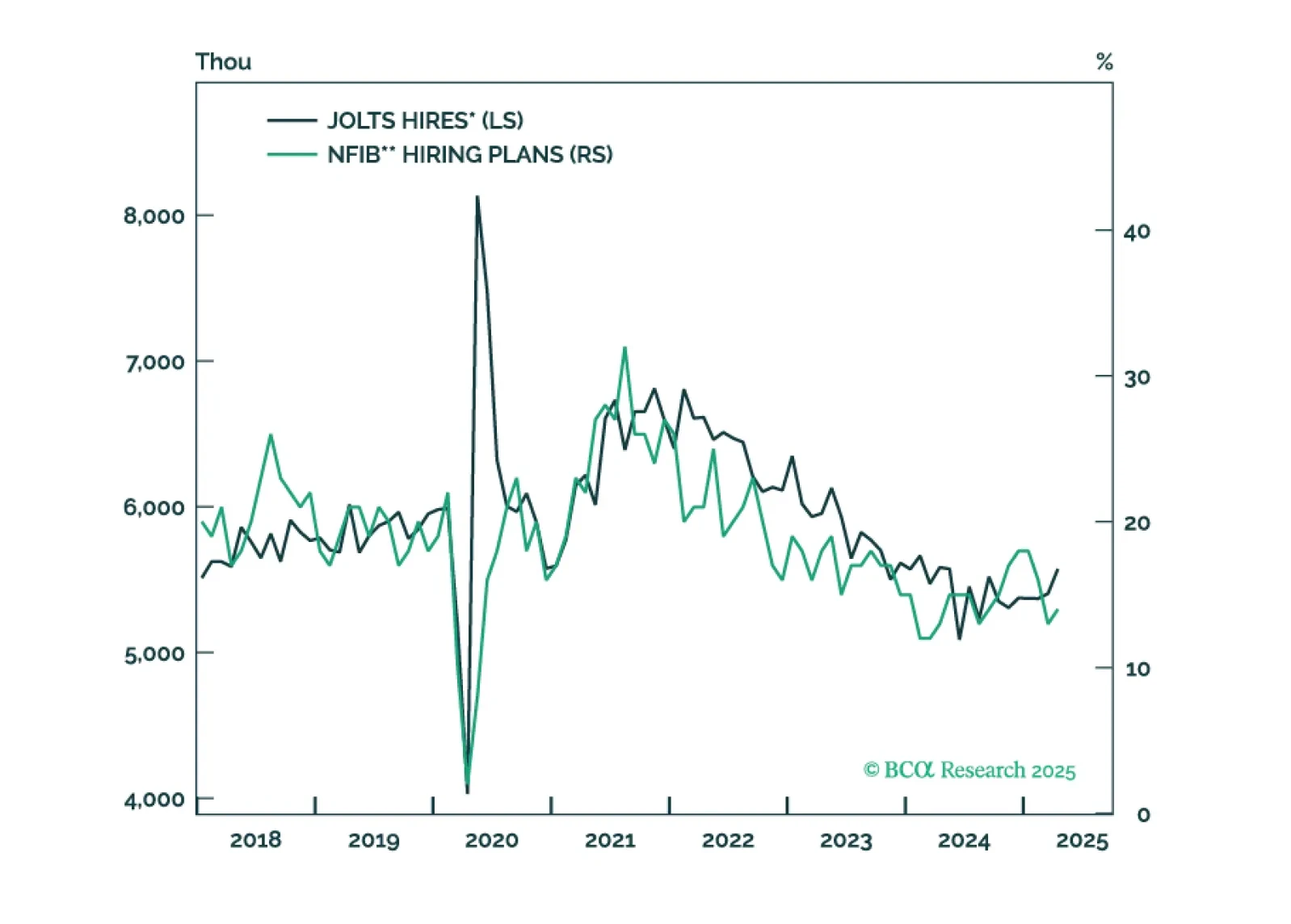

The US economy has held up better so far this year than we had expected. For the time being, investors should remain modestly underweight equities. A more aggressive underweight would be justified only once the “whites of the…

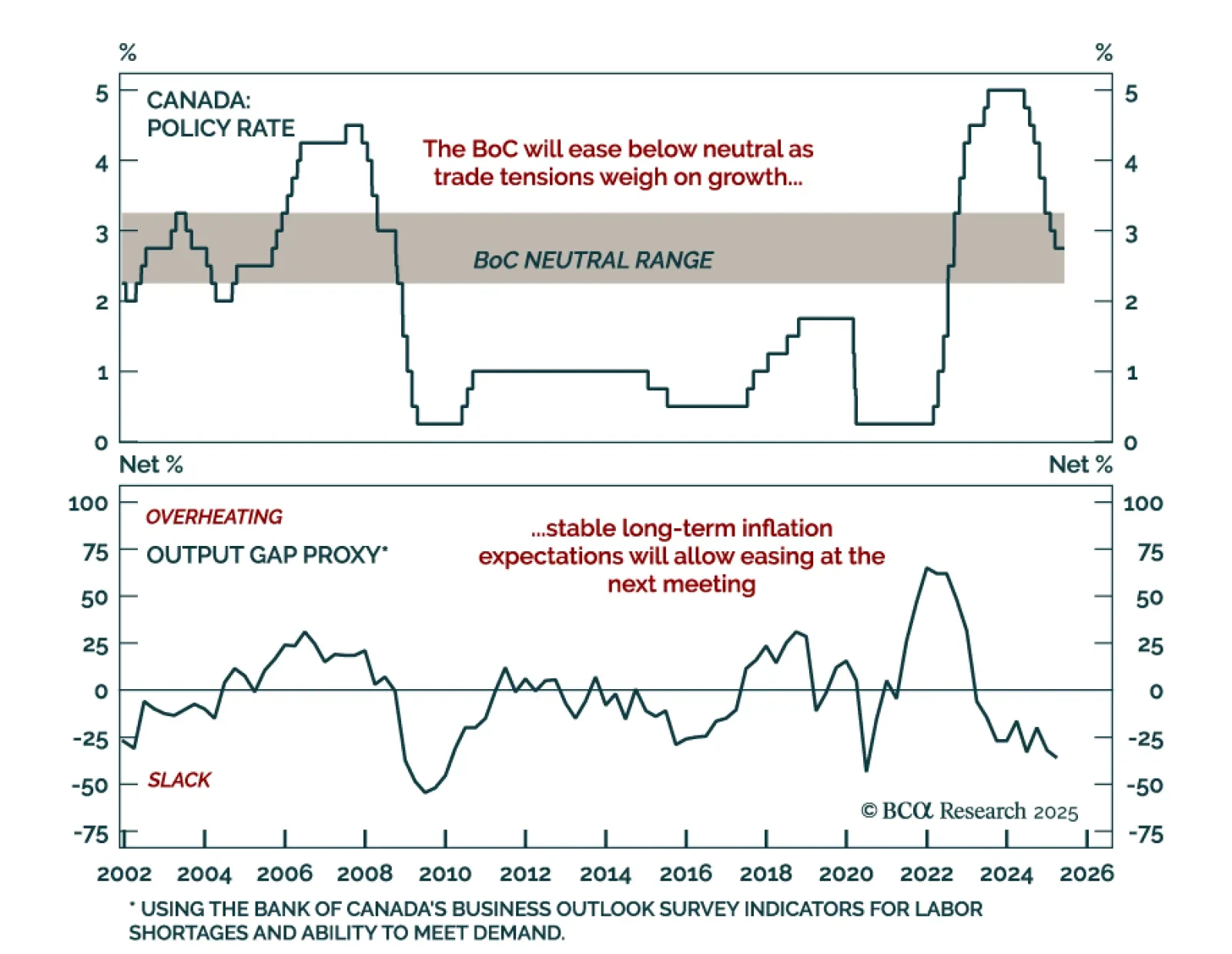

The Bank of Canada held rates at 2.75% but signaled a dovish shift, pushing us to overweight Canadian government bonds and go long CORRA futures. The policy rate remains within the BoC’s neutral range, allowing the Bank to wait for…

Our Portfolio Allocation Summary for June 2025.

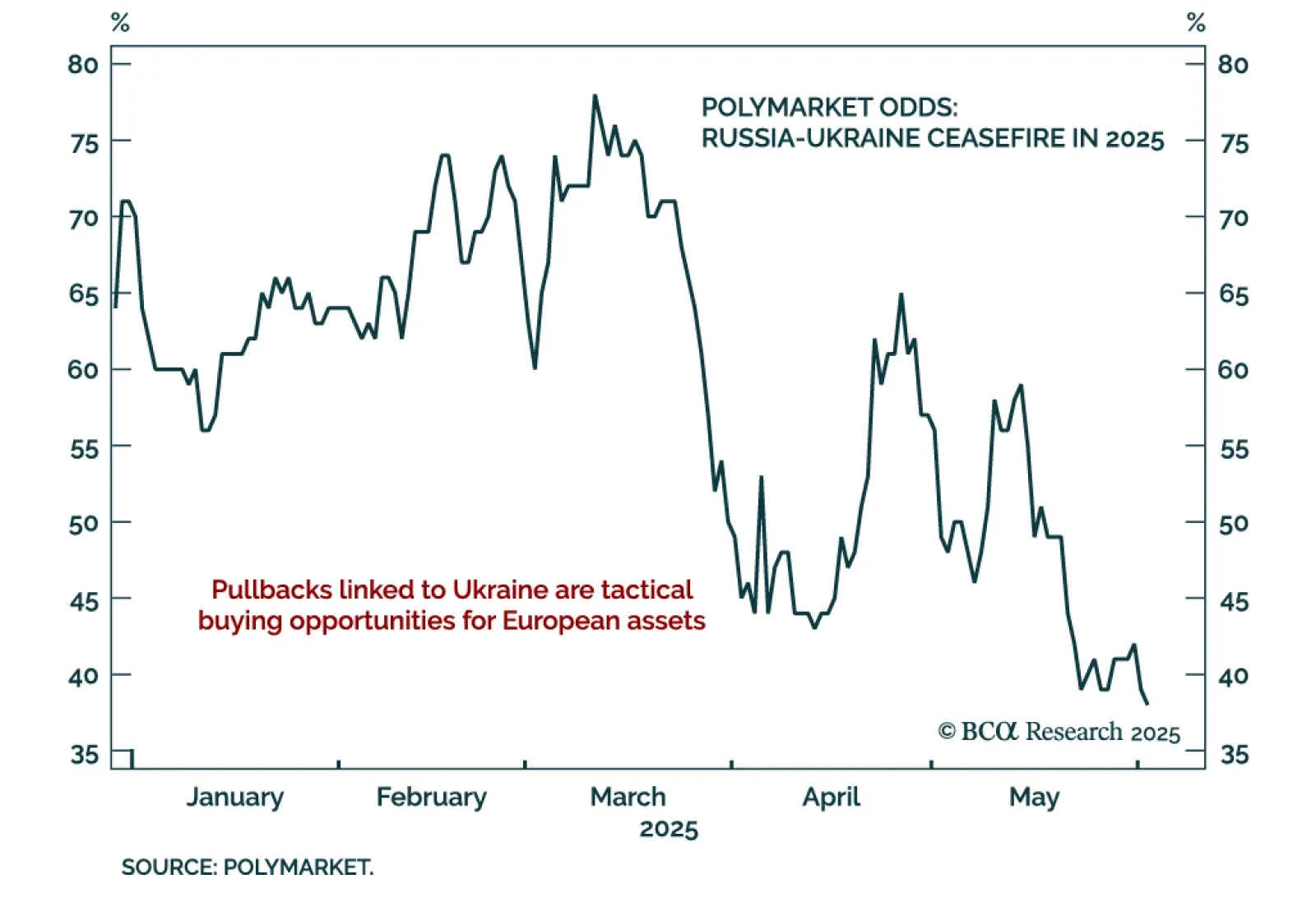

Ongoing military tensions between Ukraine and Rusia and renewed US-EU trade friction reinforce tactical opportunities to add European exposure on dips. Ukraine’s drone strike on Russian air assets and the limited outcome of the…

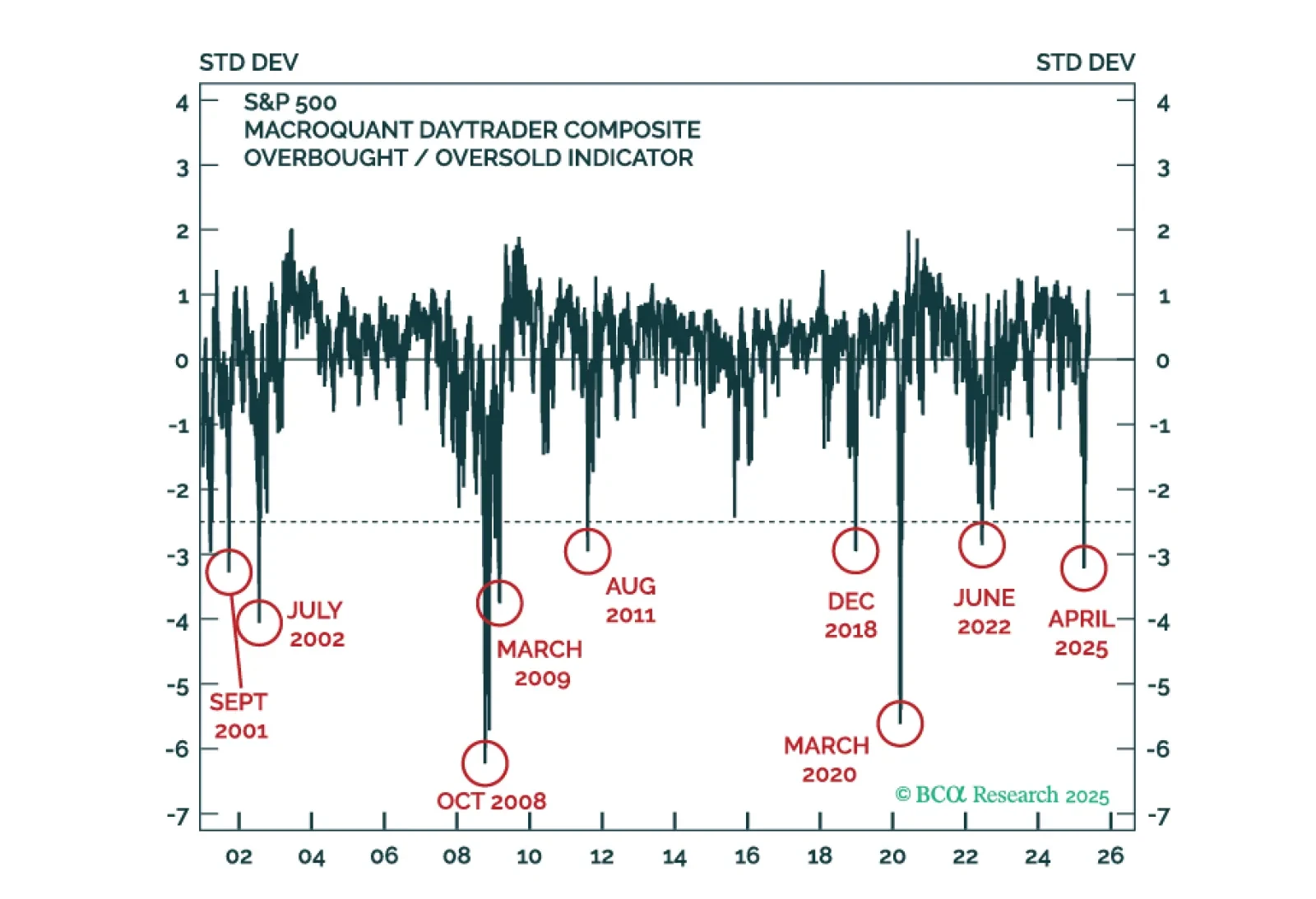

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

President Trump faces new restrictions on his trade powers coming from the US judicial branch, but they will not prevent him from continuing to restrict trade and investment with China. Rather, they will establish some curbs against…