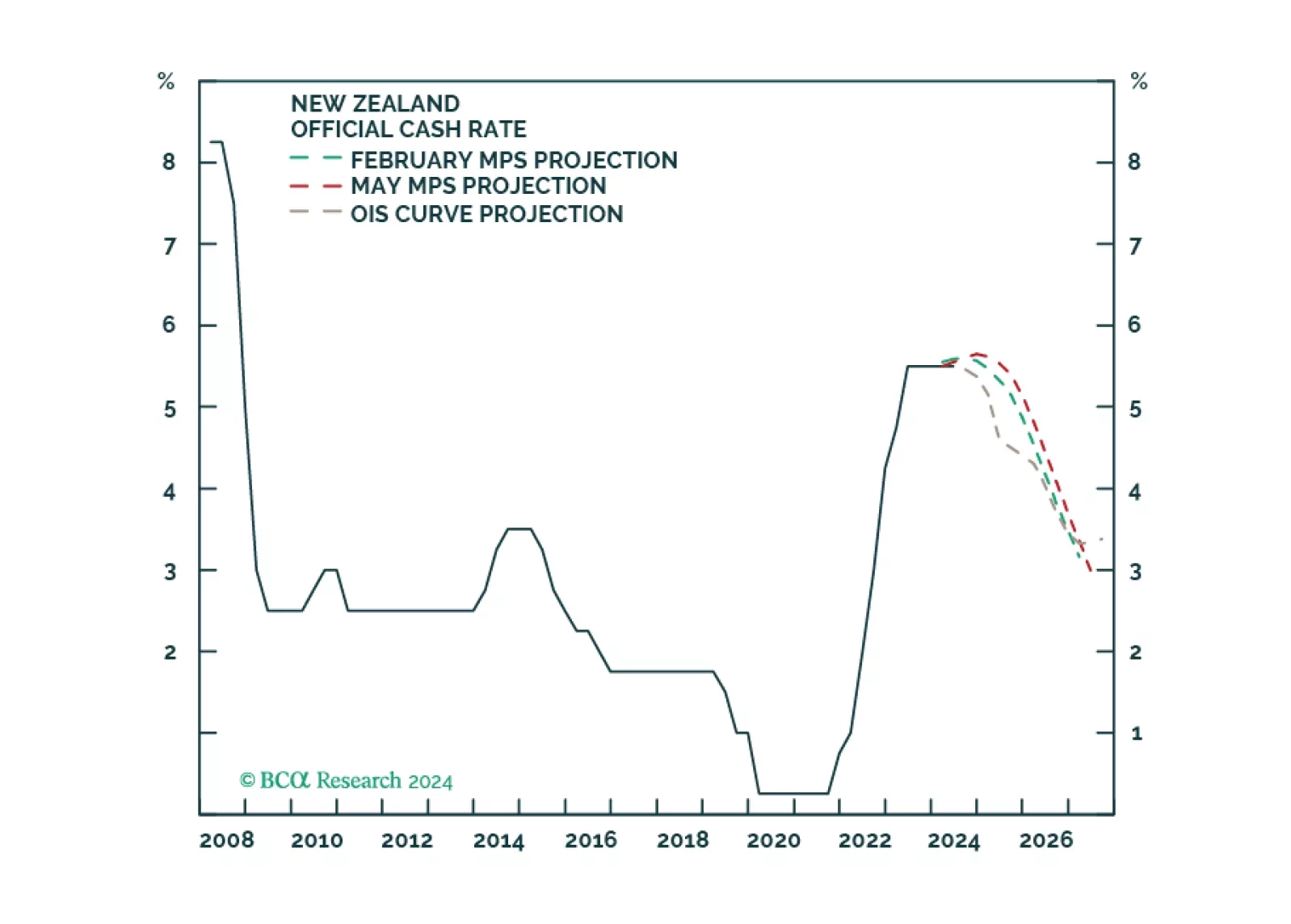

The Reserve Bank of New Zealand (RBNZ) kept interest rates on hold at this week’s monetary policy meeting, in line with expectations. However, there were three new notes from its monetary policy statement that will likely…

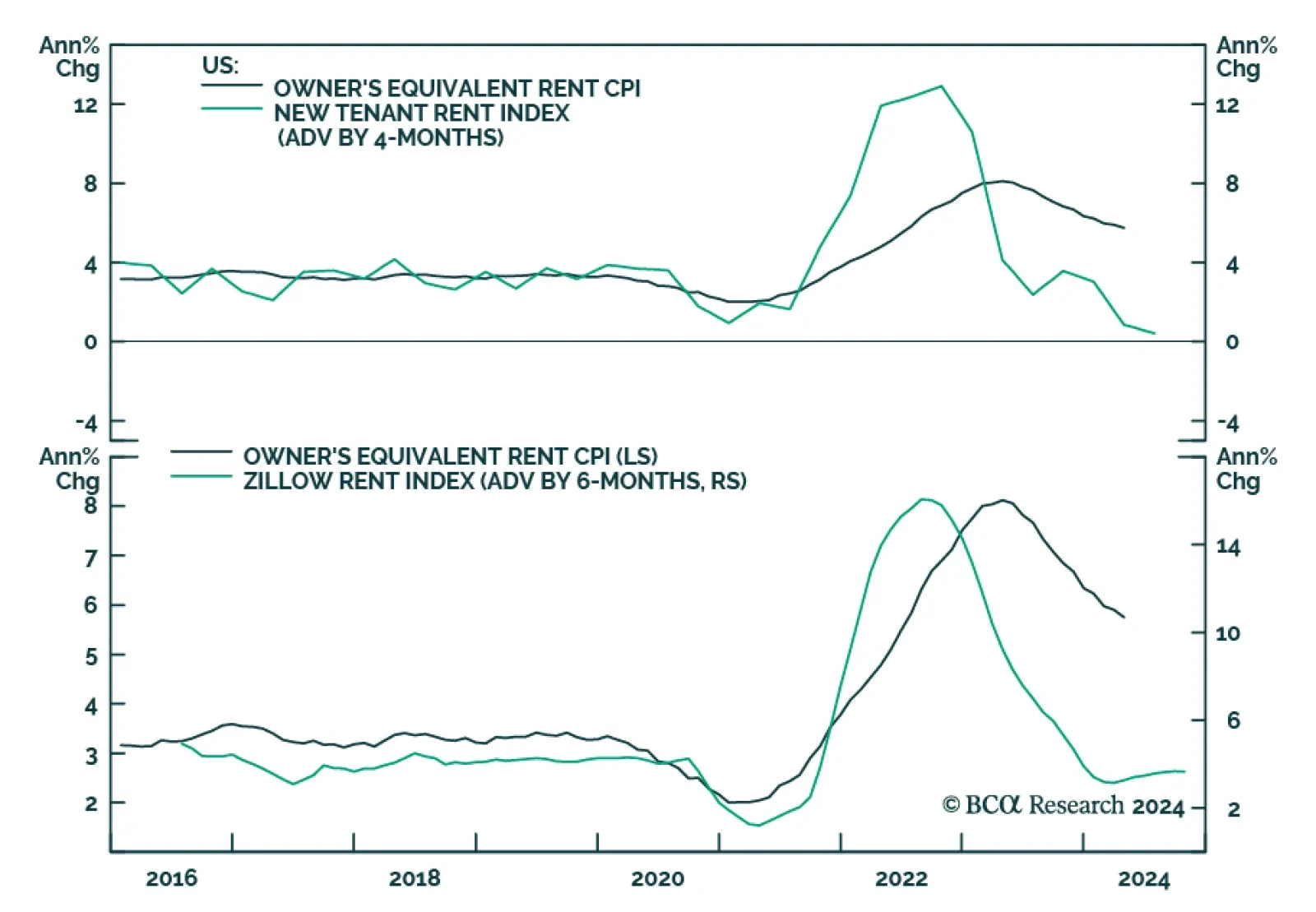

Minutes from the April 30 - May 1 FOMC meeting struck a hawkish tone on the latest discussions among Fed officials. Notably, the reference to “Various participants mention[ing] a willingness to tighten policy further should…

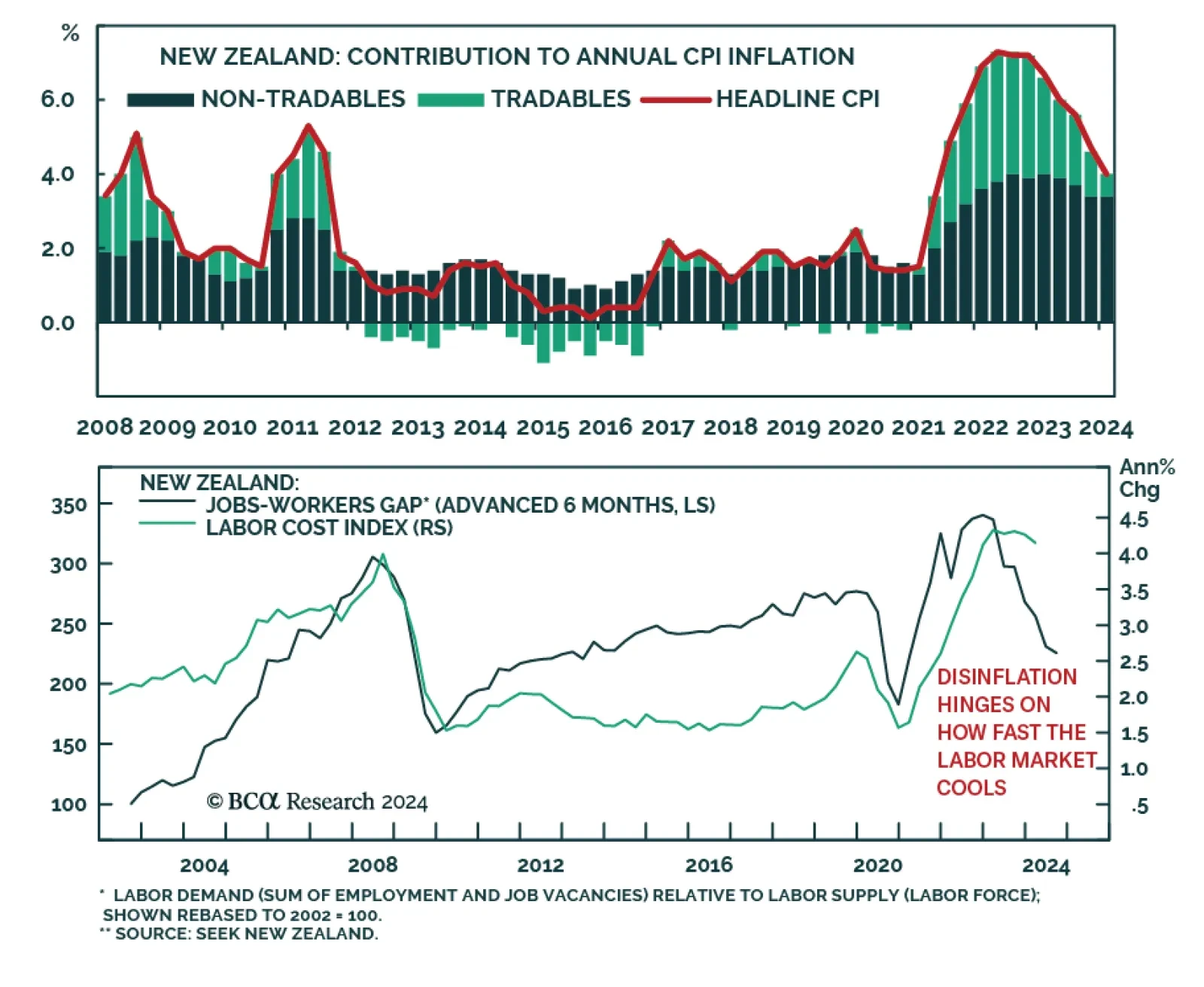

In this Insight, we revisit our "higher for longer" theme for the Reserve Bank of New Zealand, in light of the latest central bank meeting. In conclusion, we are inching towards a more dovish RBNZ ahead. Ergo, we recommend some fixed…

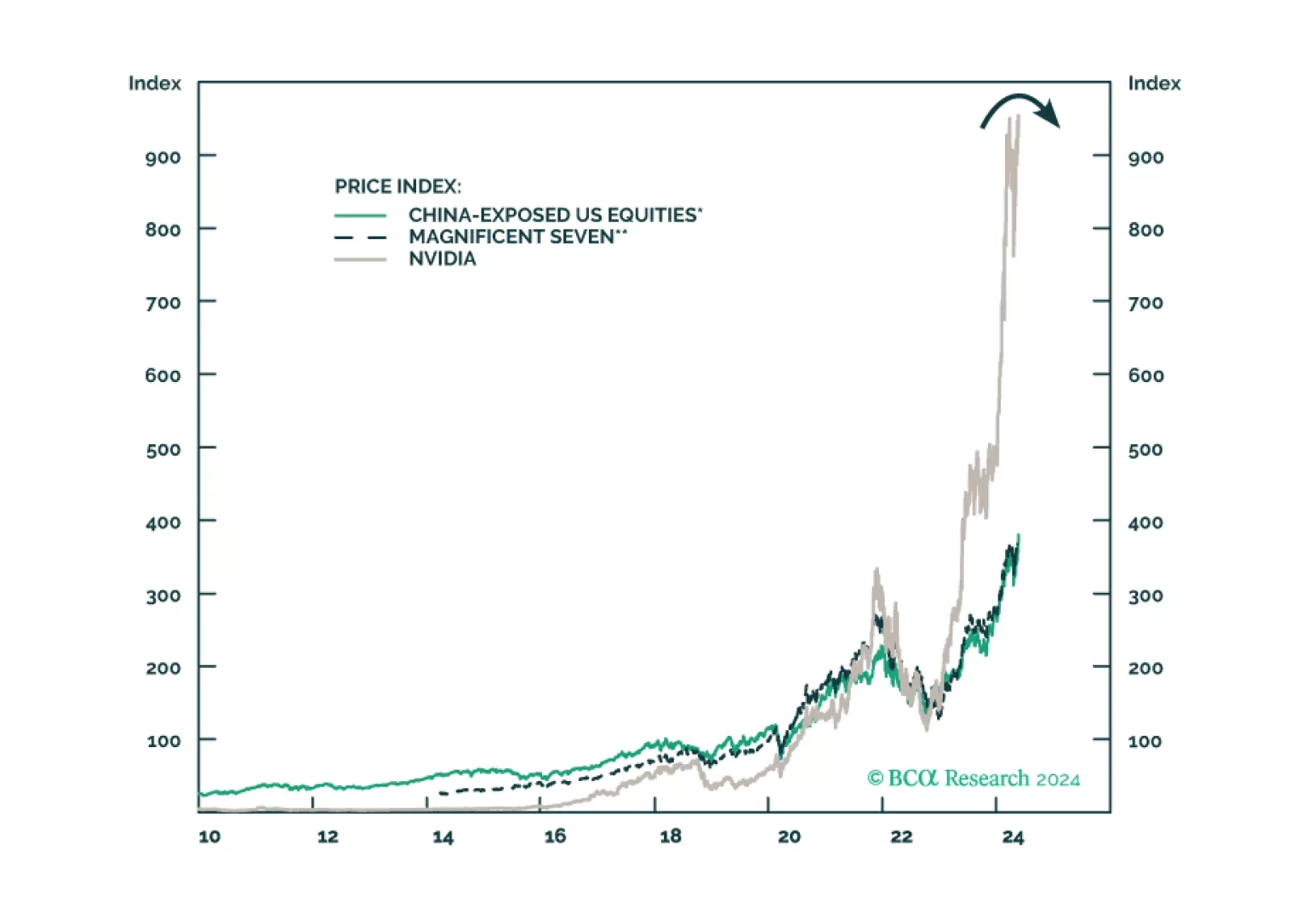

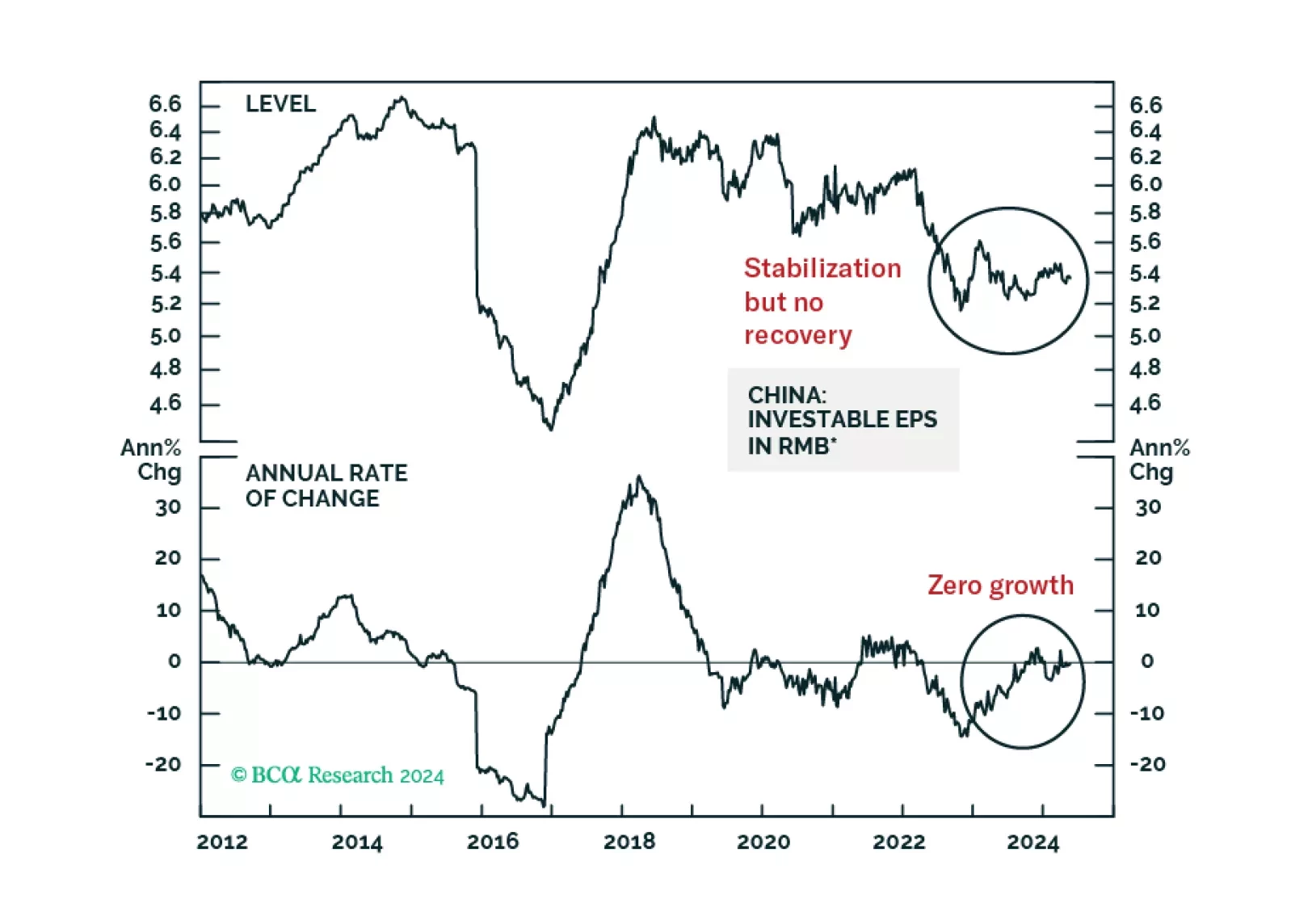

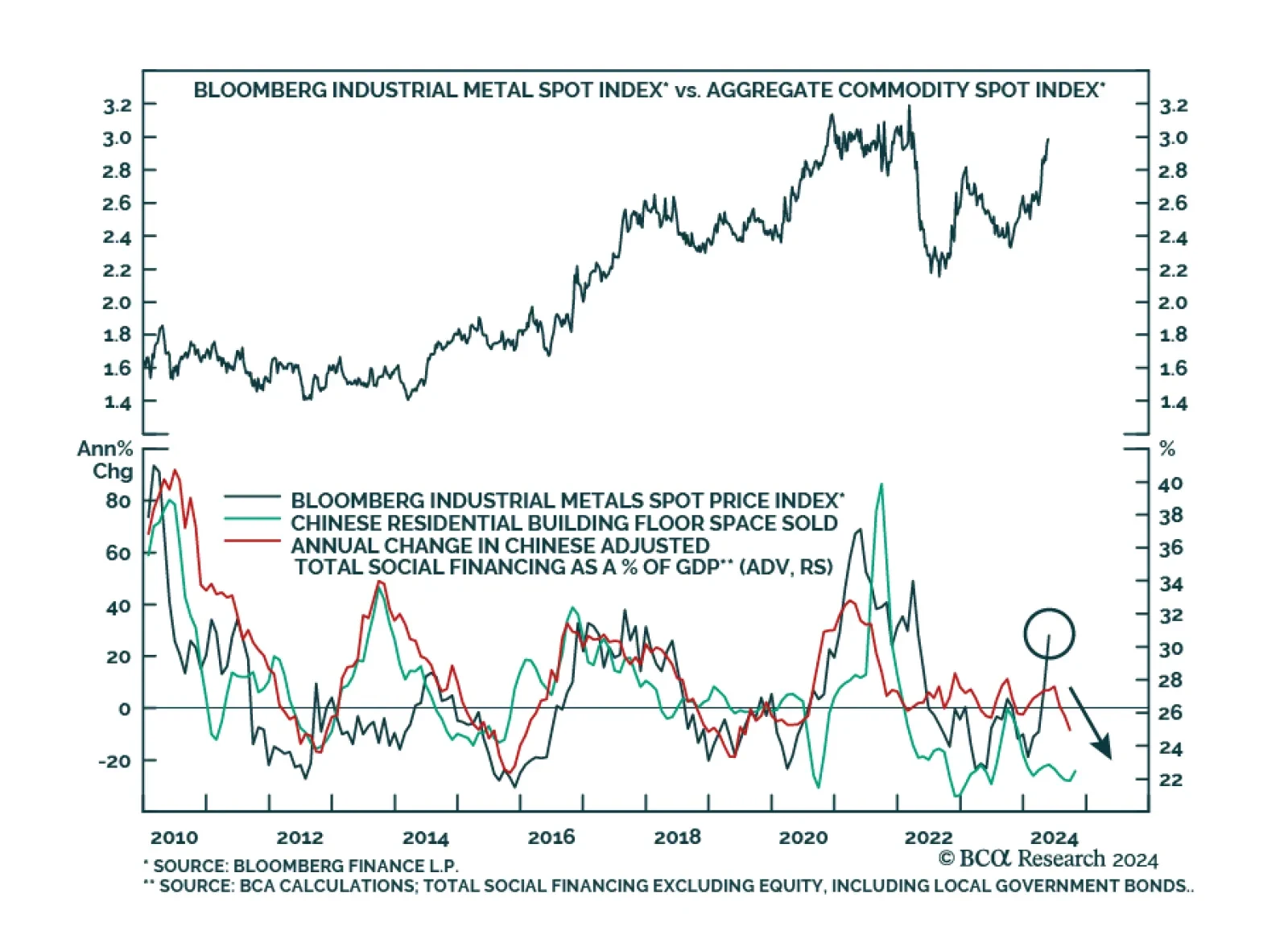

The RMB 500 billion program is small, as it is equivalent to only 4% of property developers' total funding from the past 12 months. This will preclude a recovery in property construction this year. Corporate profits will determine…

Industrial metals have outperformed the broad commodity complex this year and raced above the broad commodity complex even more meaningfully since the beginning of April. Our Commodity and Energy strategists have highlighted…

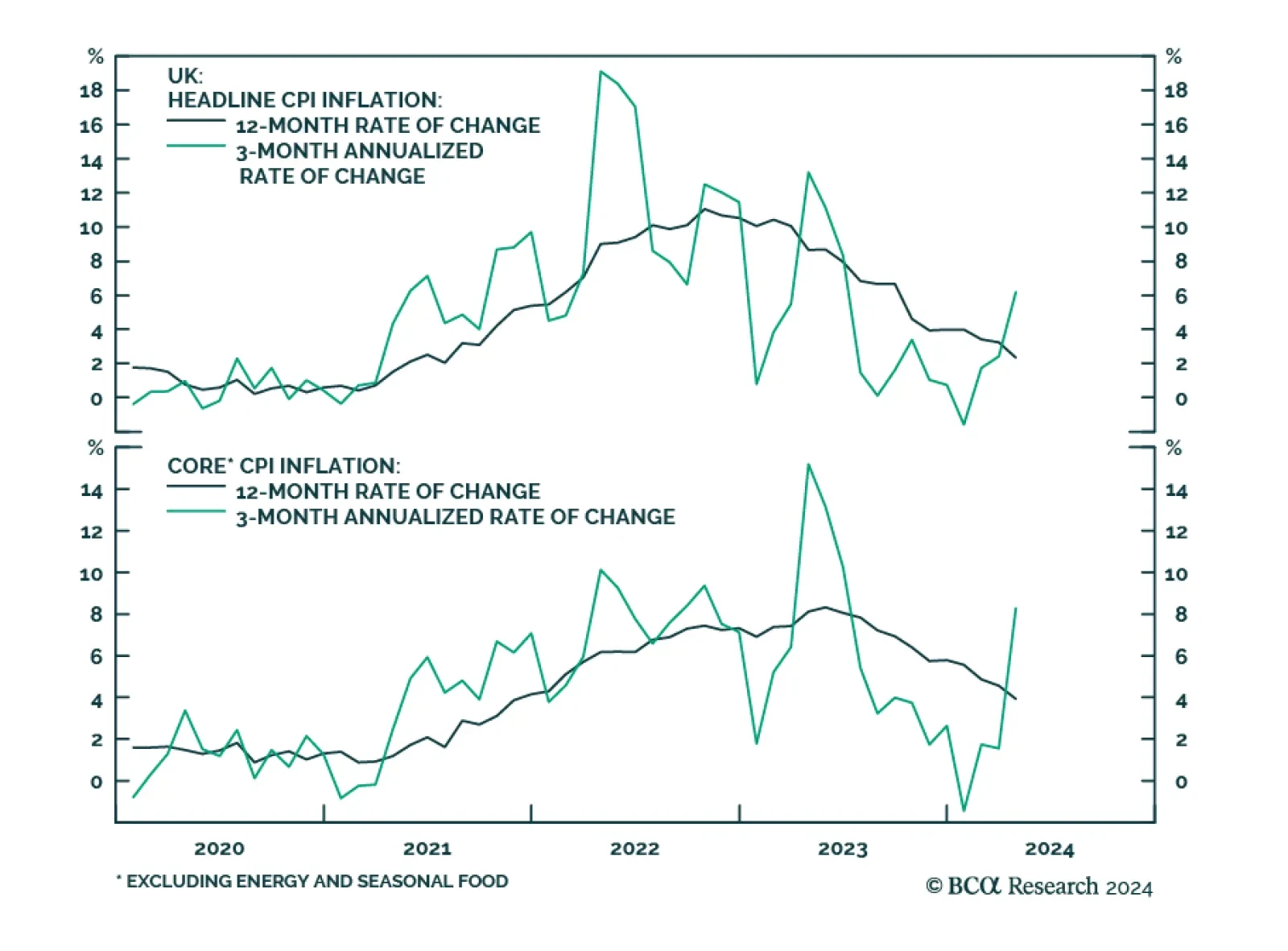

The UK CPI release surprised markets to the upside across the board on Wednesday. Headline CPI increased 2.3% year-on-year, above expectations of 2.1%. Core surprised to the upside as well, moderating from 4.2% to 3.9%y/y, less…

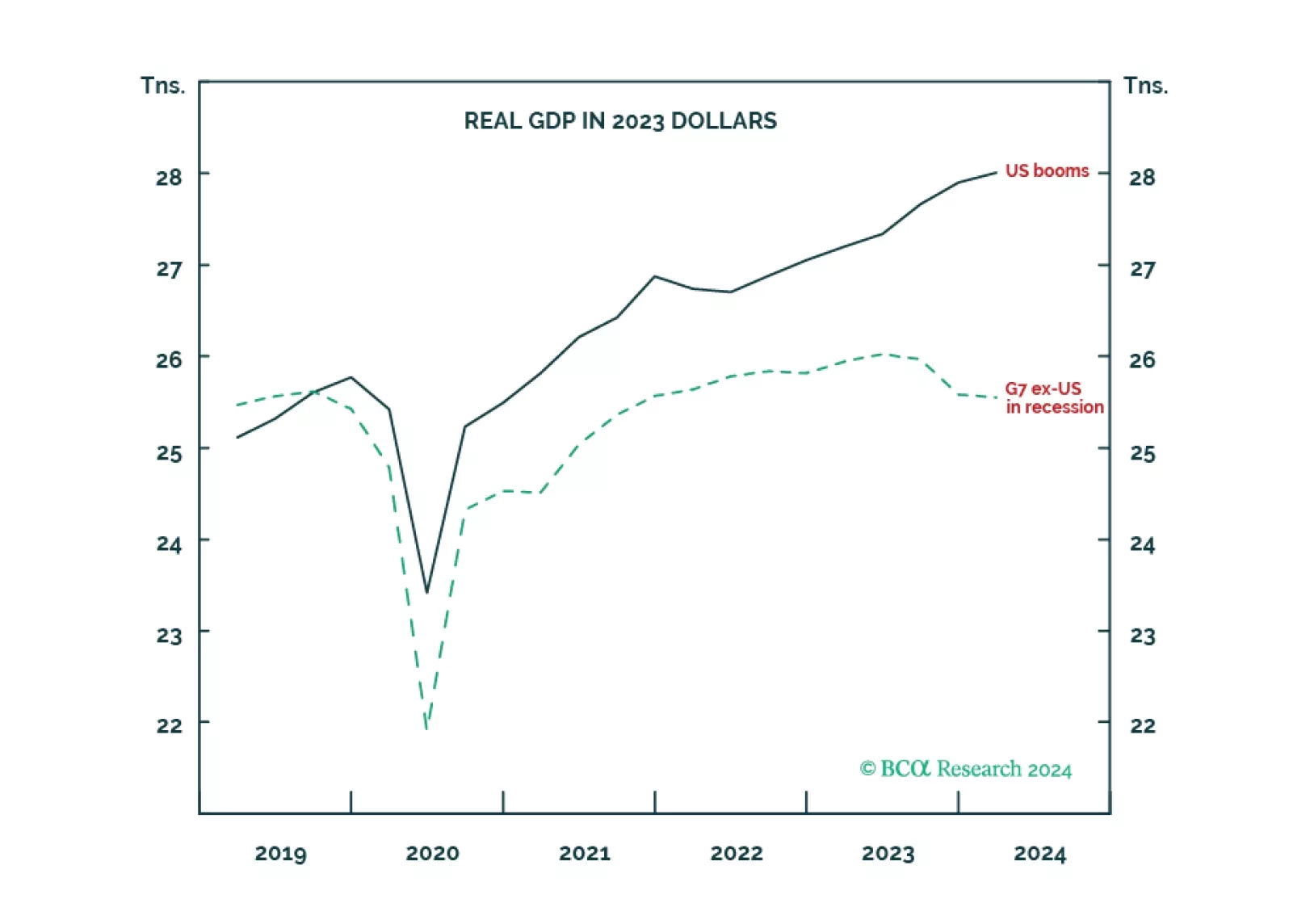

The economic schism in the world economy, between the non-US developed economy in recession and the US in strong growth, is unprecedented during our lifetimes. Now the schism will continue in reverse, as the non-US developed economy…

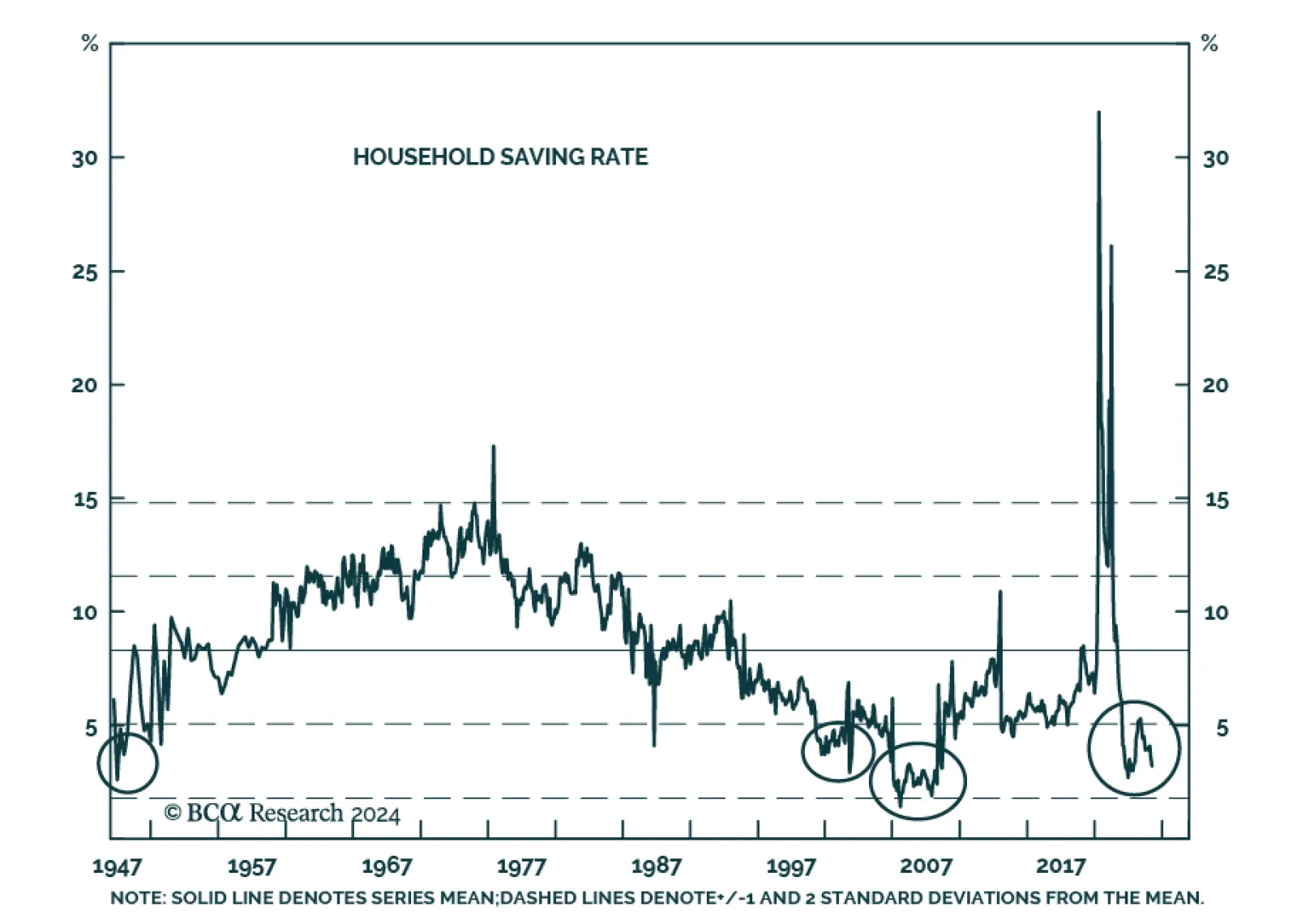

Our US Investment strategists have used the savings rate as a proxy for households’ willingness to spend. Its persistent decline suggests that consumers have been spending their pandemic-era excess savings and our…

Canada’s headline CPI inflation decelerated in April from 2.9% y/y to 2.7% y/y. Notably, core median CPI eased from 2.9% y/y to a softer-than-anticipated 2.6% y/y and core trimmed-mean CPI ticked lower from 3.2% to 2.9…