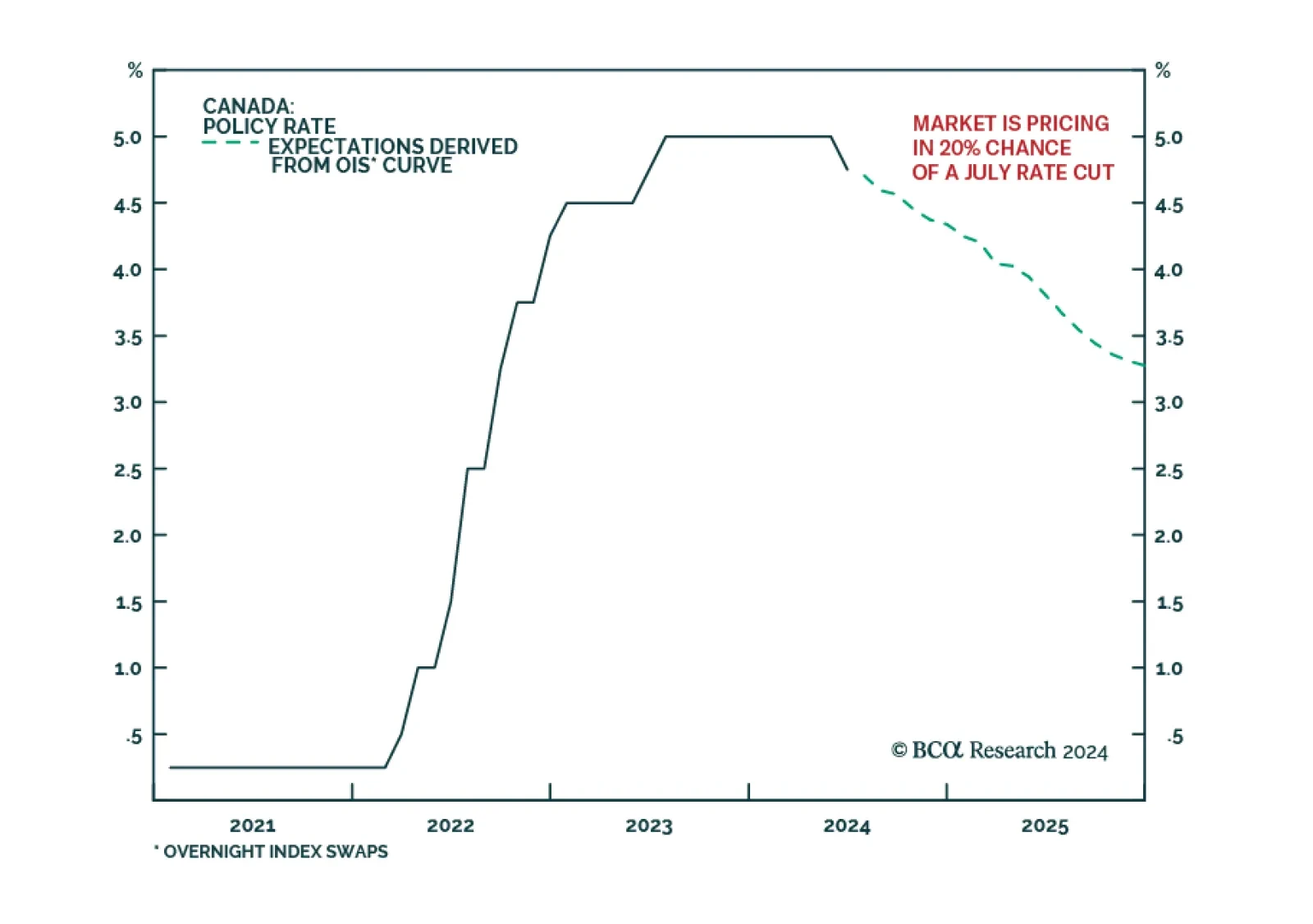

The Bank of Canada reduced its policy rate by 25 basis points from 5% to 4.75% on Wednesday, in line with the market consensus. Headline inflation and the BoC’s preferred measures of core inflation are within the BoC’…

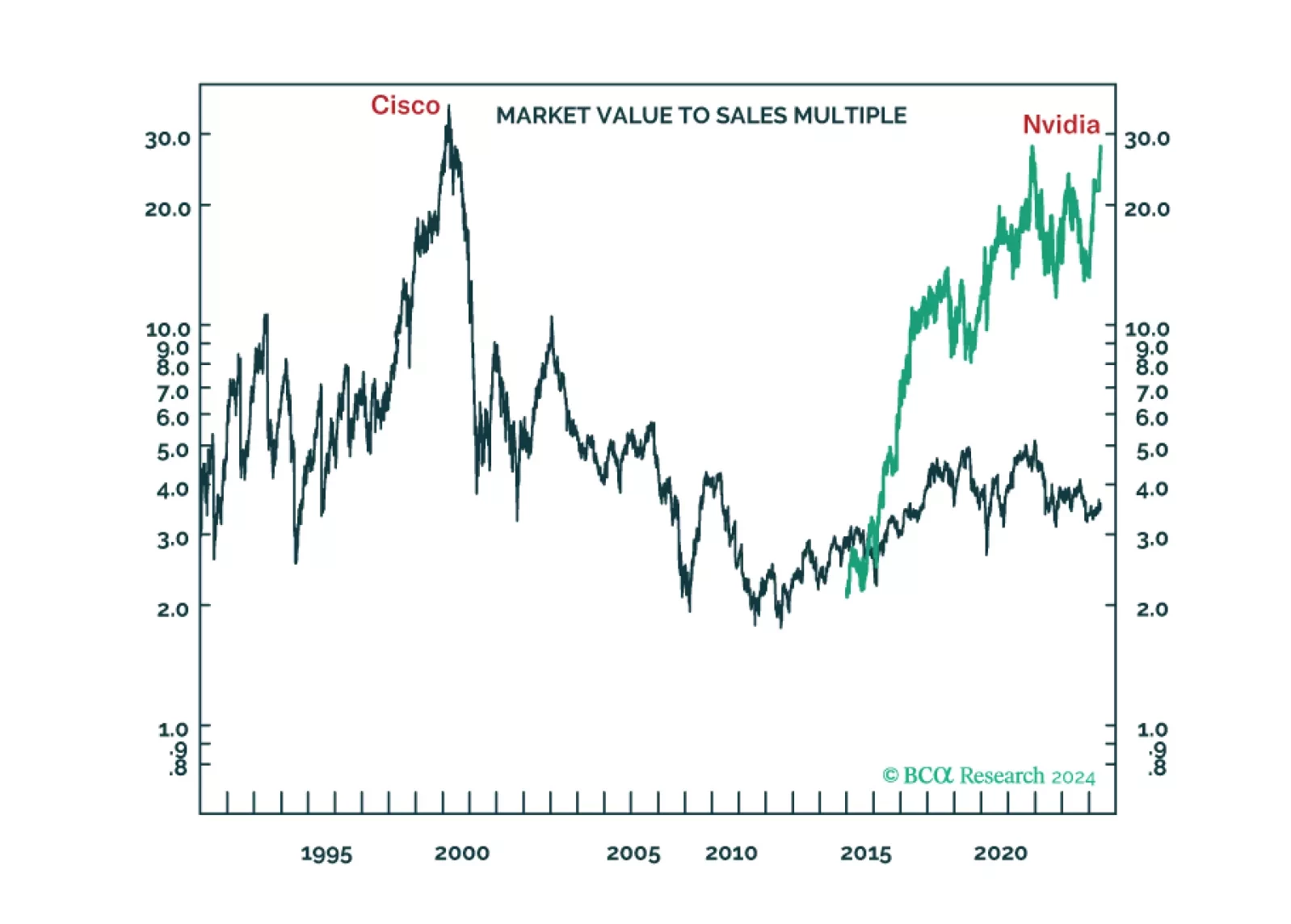

The long-term winners from the generative-AI gold rush are unlikely to be the ‘picks and shovels’ stock Nvidia or the overvalued US superstars of Web 2.0. We discuss the structural investment implications. Plus: time to go tactically…

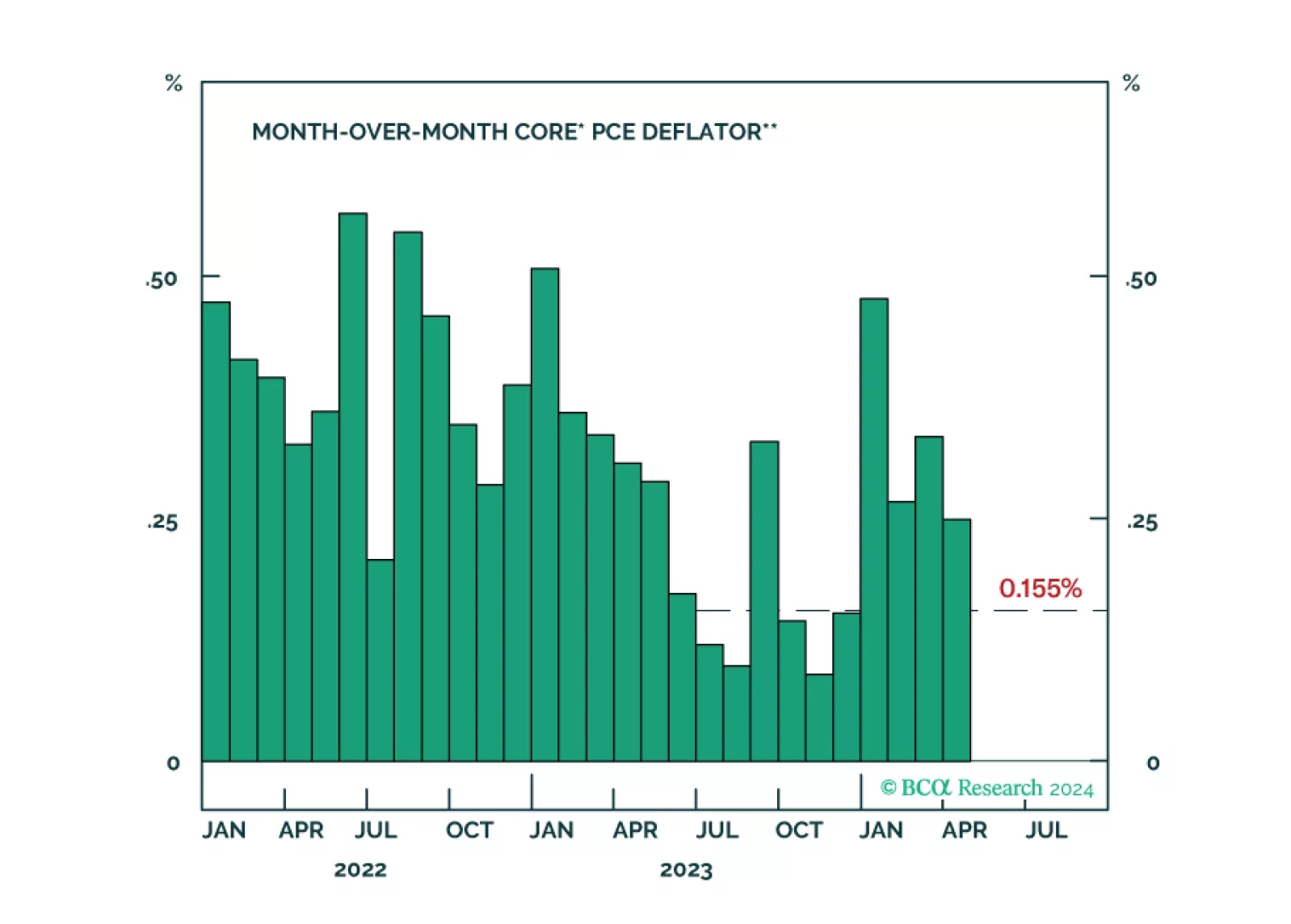

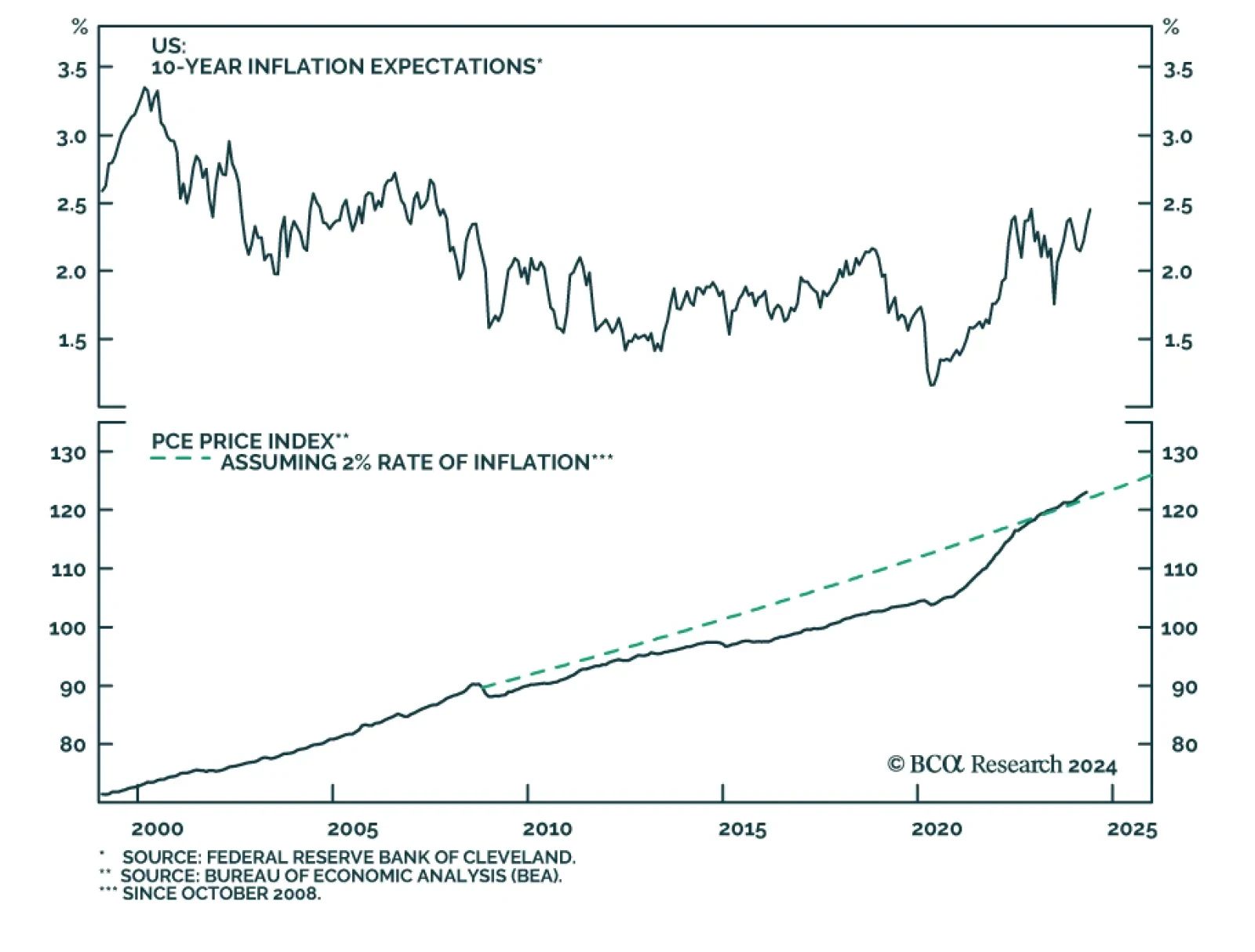

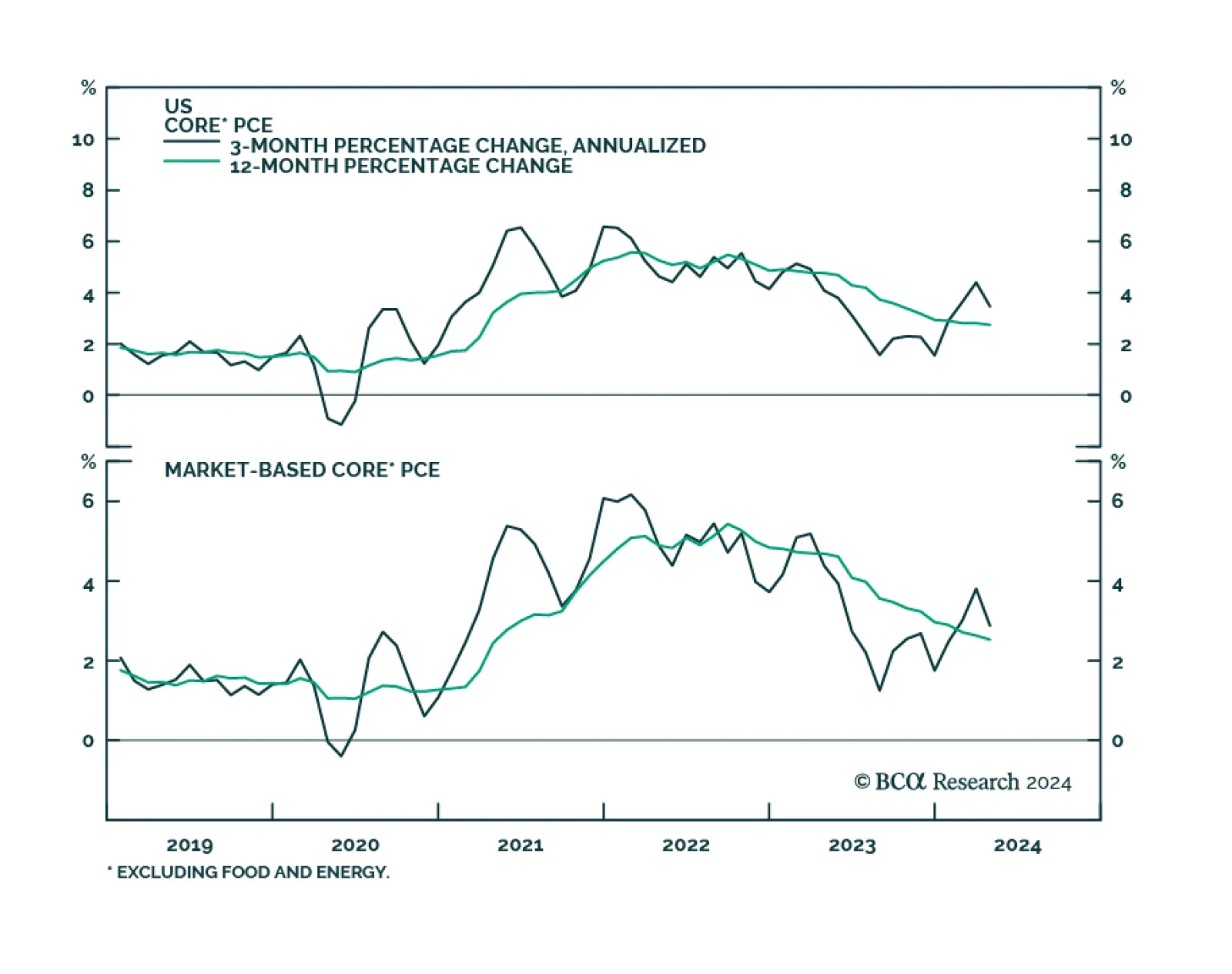

The moderation in core PCE in April was a step in the right direction towards a Fed easing. Our Global Investment Strategists also highlighted that outside of a few pandemic-related “catch-up” categories such as…

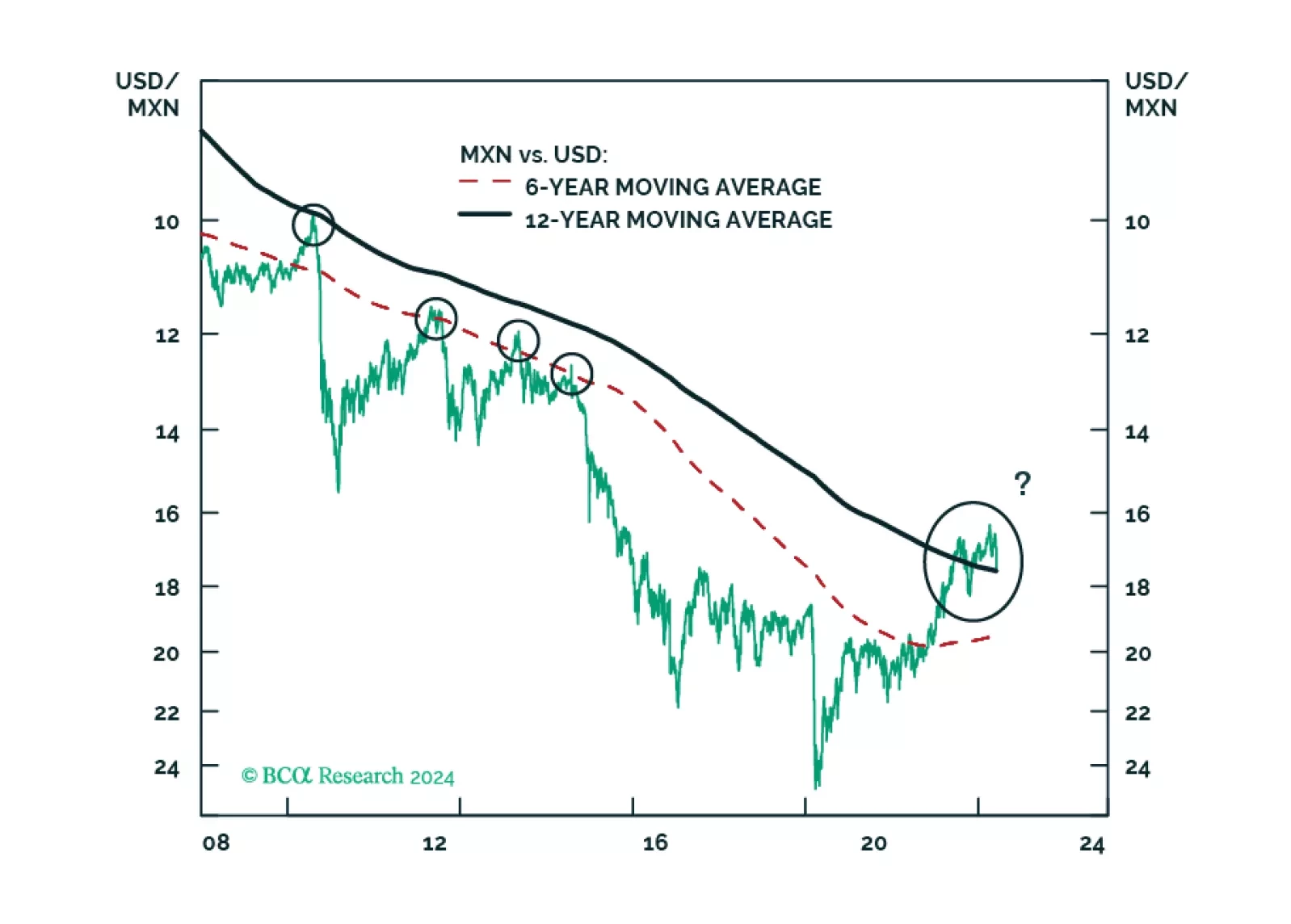

MORENA has once again swept the Mexican election: Claudia Sheinbaum will be president, with little to no constraint in Congress. All in all, Mexican politics will remain stable and overall supportive of markets. In the medium term,…

Our Portfolio Allocation Summary for June 2024.

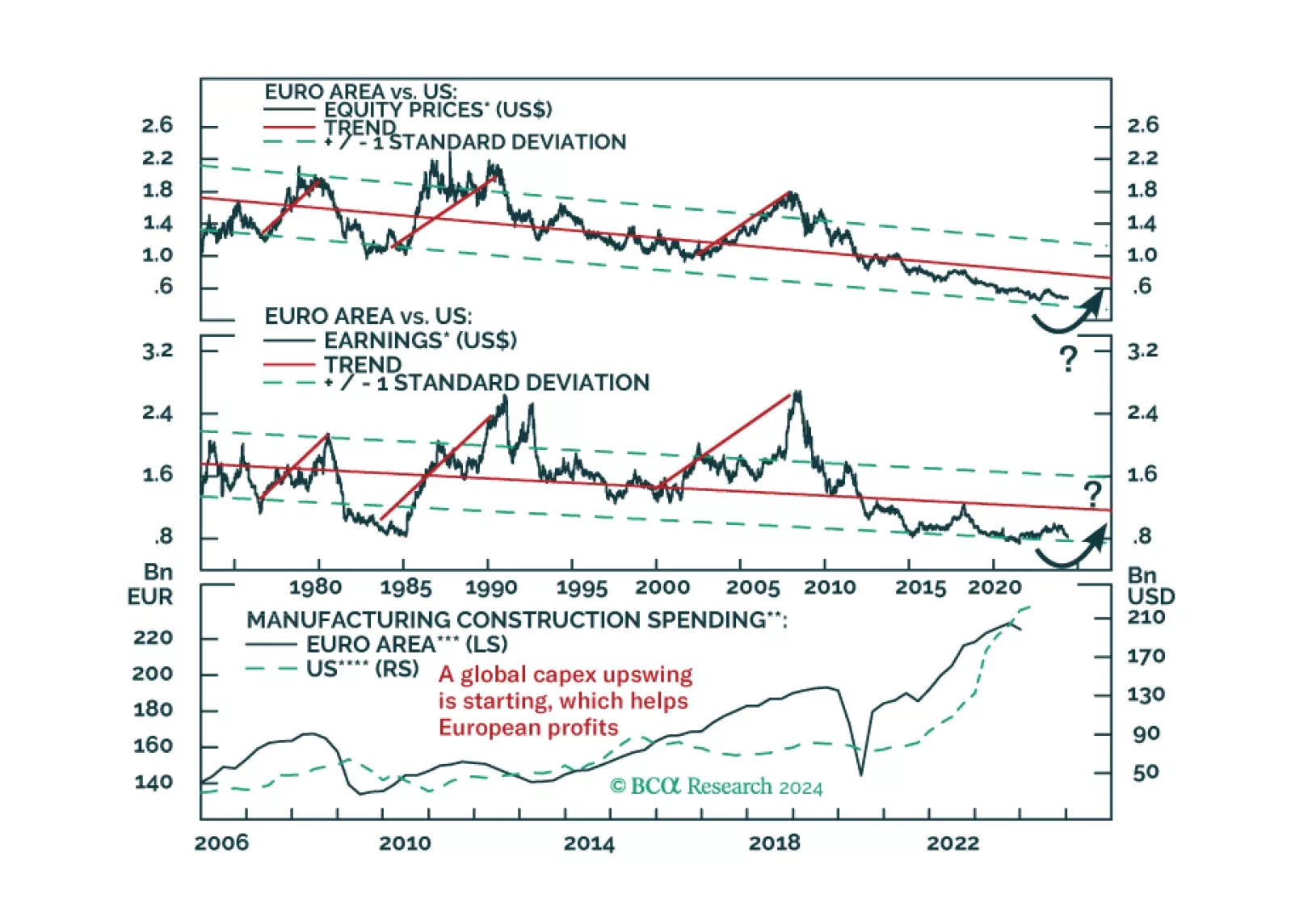

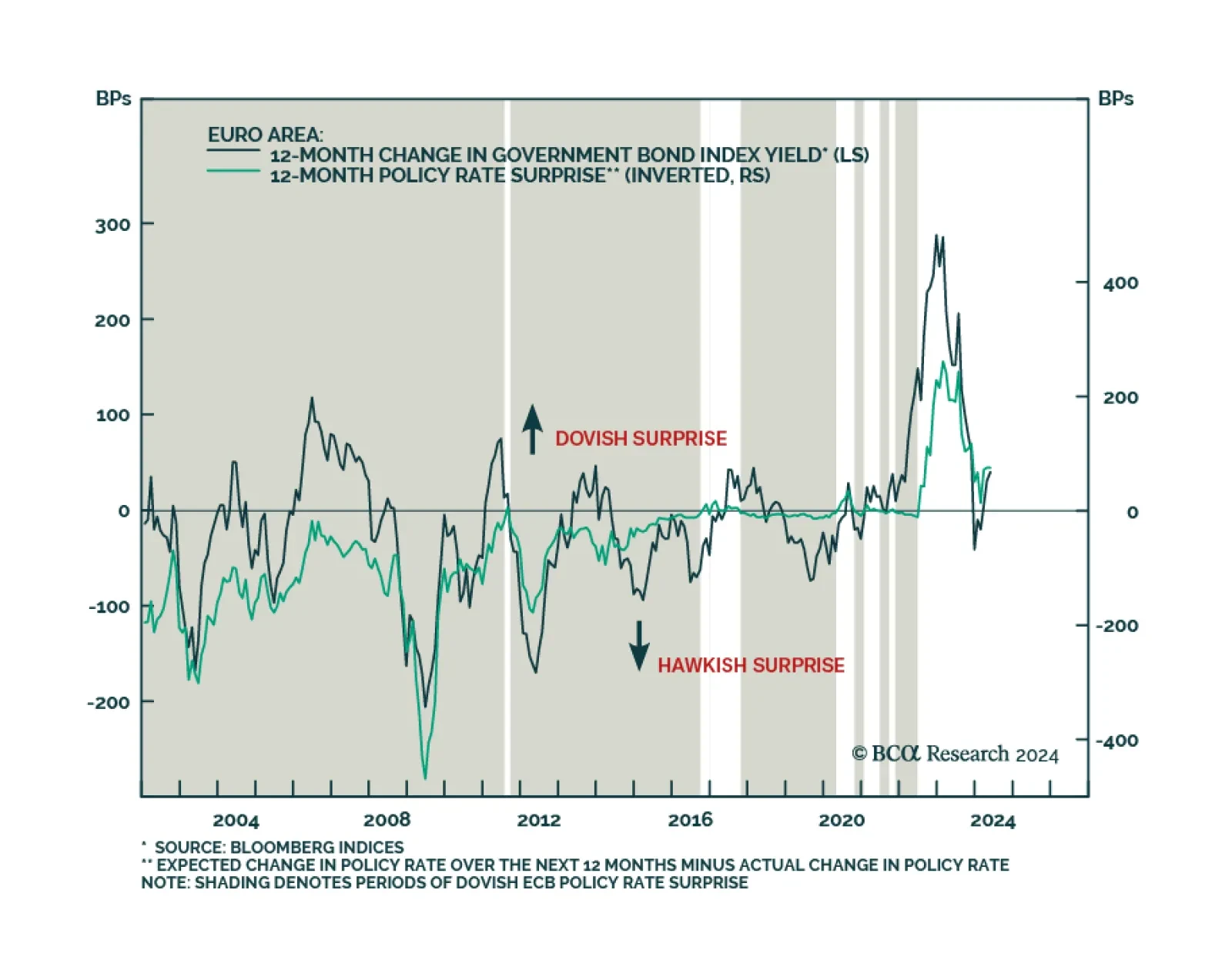

Euro Area CPI accelerated for the first time this year from 2.4% y/y to a faster-than-expected 2.6% y/y in May. Preliminary estimates also suggest that core CPI accelerated from 2.7% y/y to 2.9% y/y, against expectations of a…

US nominal personal income growth decelerated from 0.5% m/m to 0.3% m/m in April, in line with expectations. However, nominal personal spending surprised to the downside, and contracted 0.1% m/m in real terms. Core PCE –…

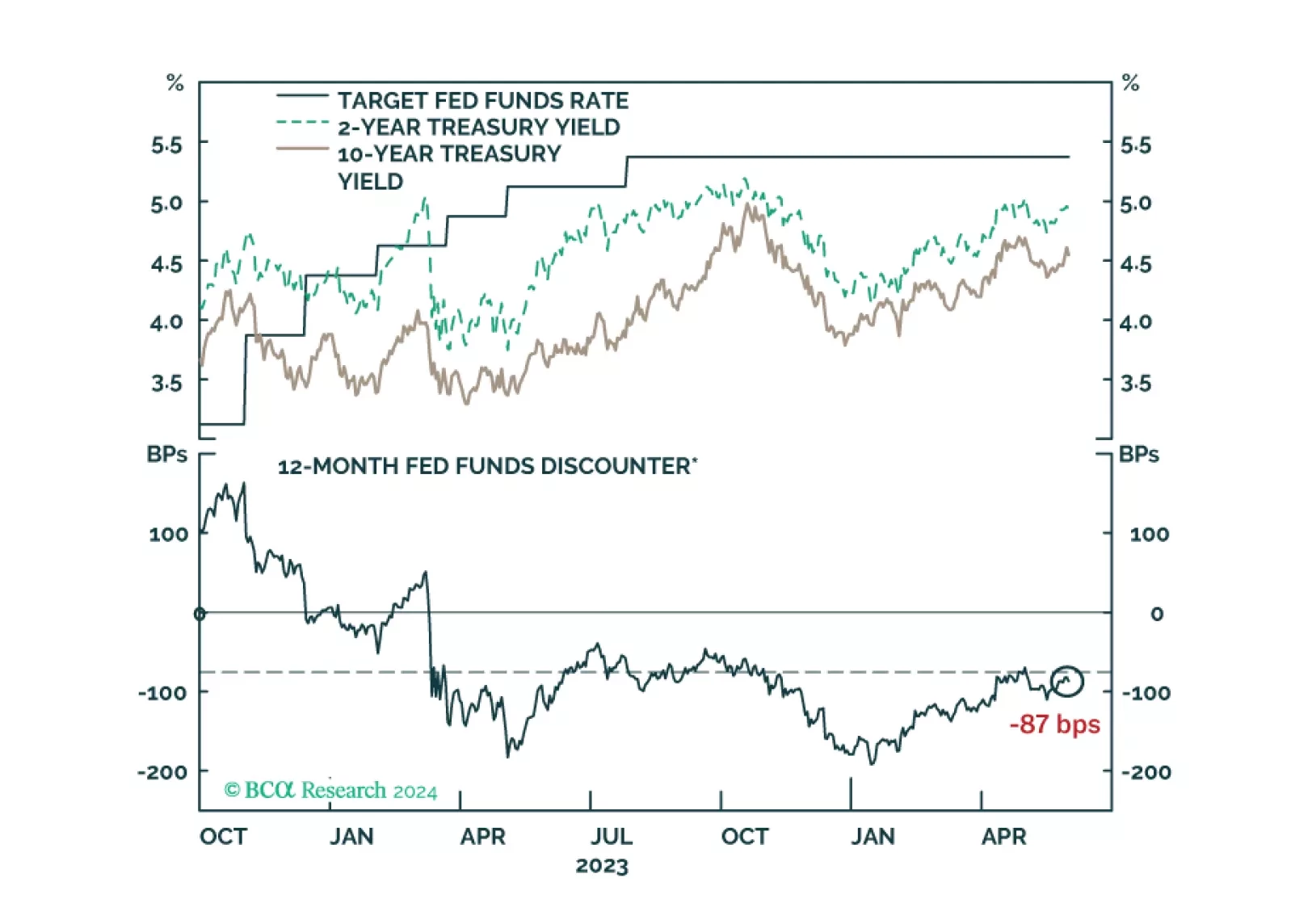

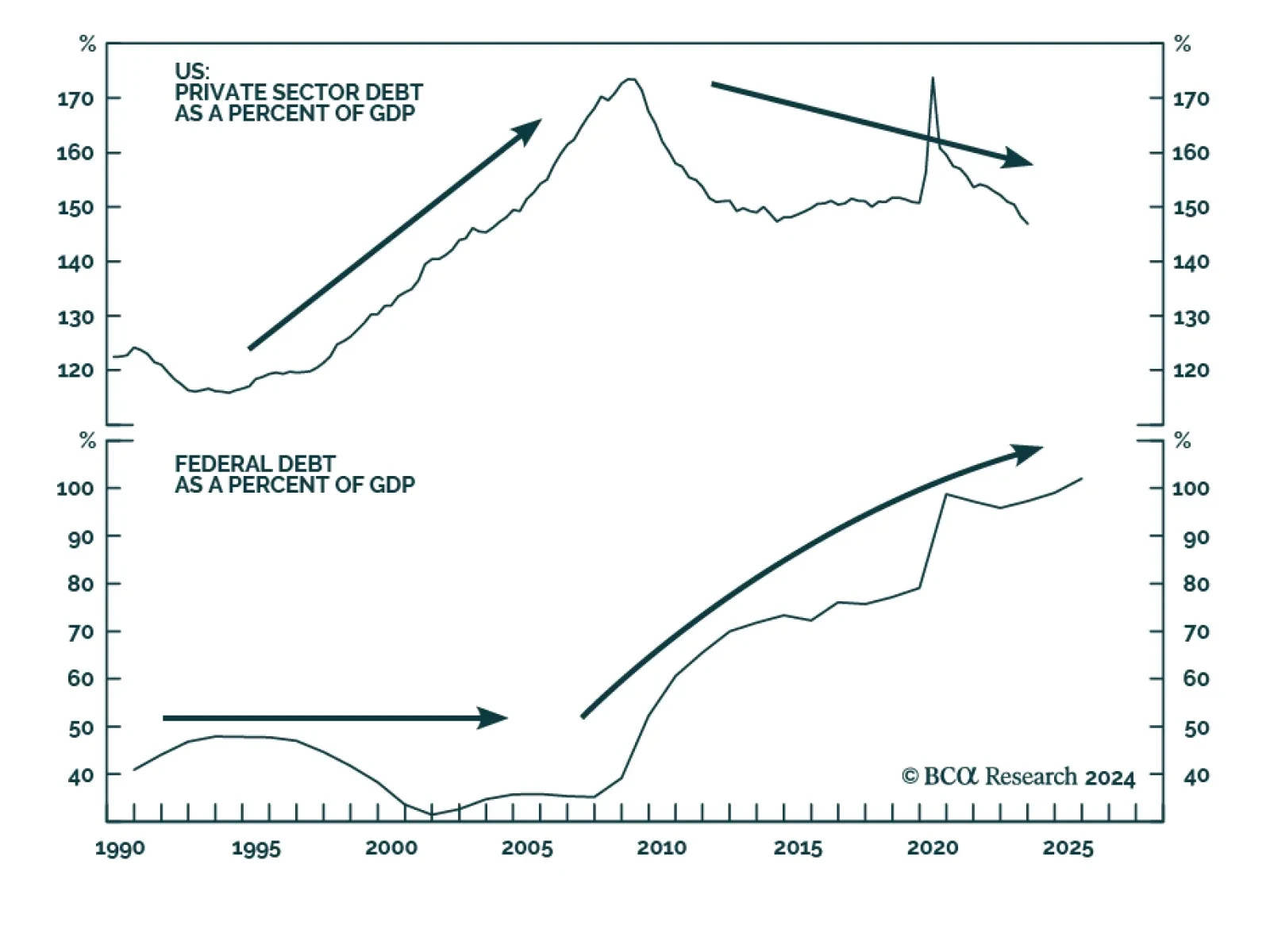

We comment on whether Treasury market valuation is sufficiently attractive to get long bonds and consider some of the common arguments for why yields may yet make new highs.

BCA developed the Debt Supercycle thesis in the 1970s to characterize the postwar surge in private sector indebtedness. Because rising debt burdens increased economic vulnerability, policymakers were forced to pursue increasingly…