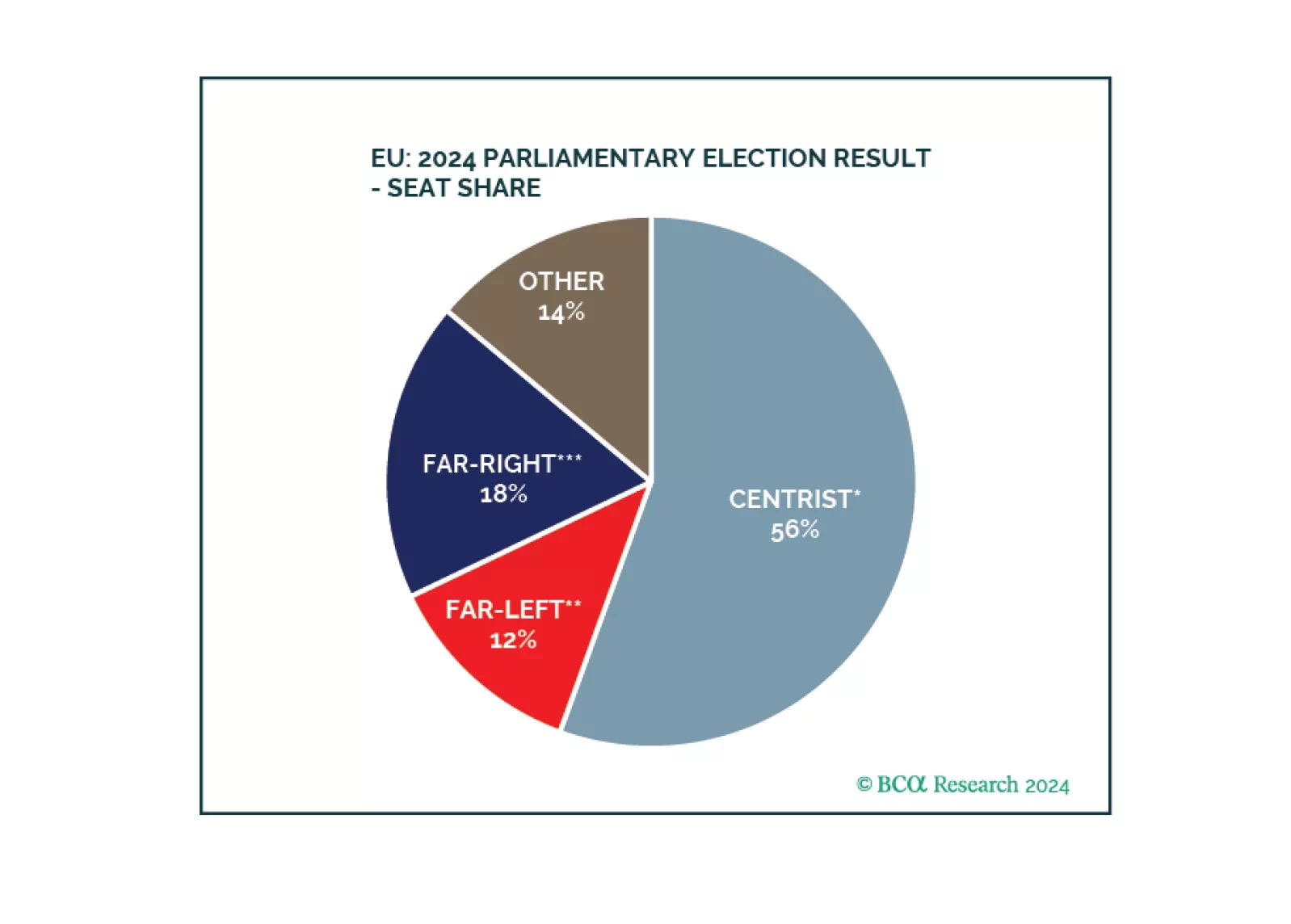

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…

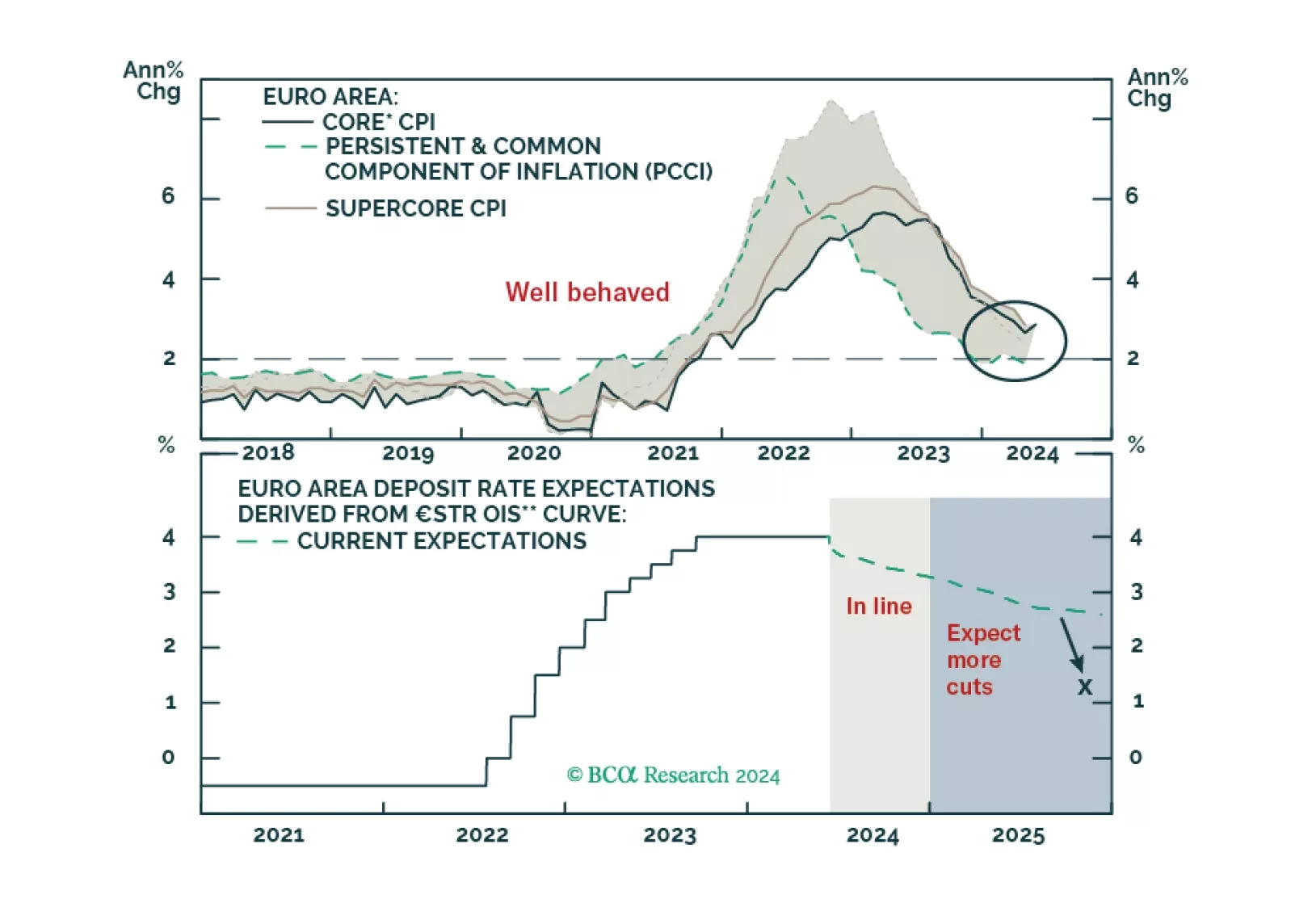

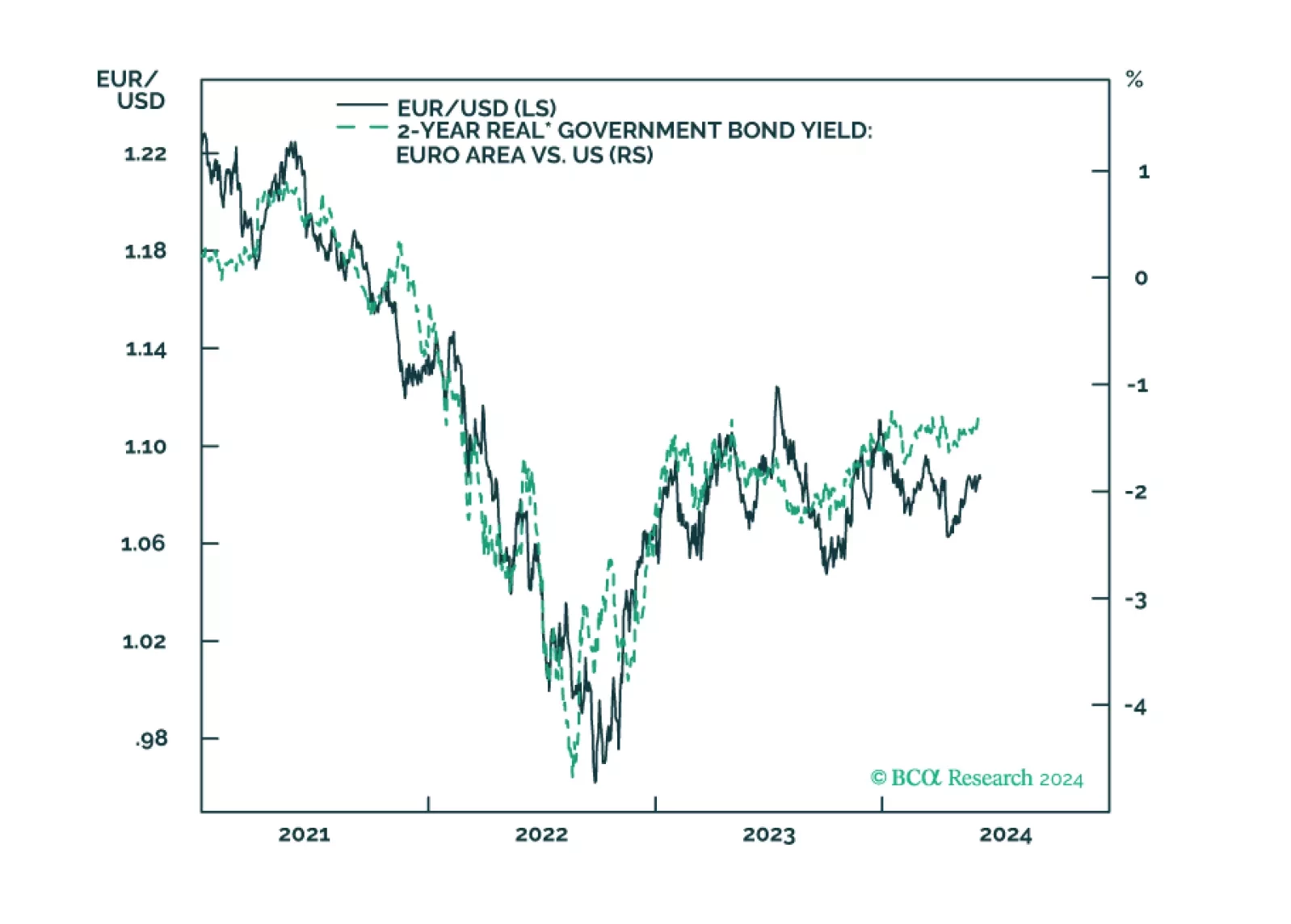

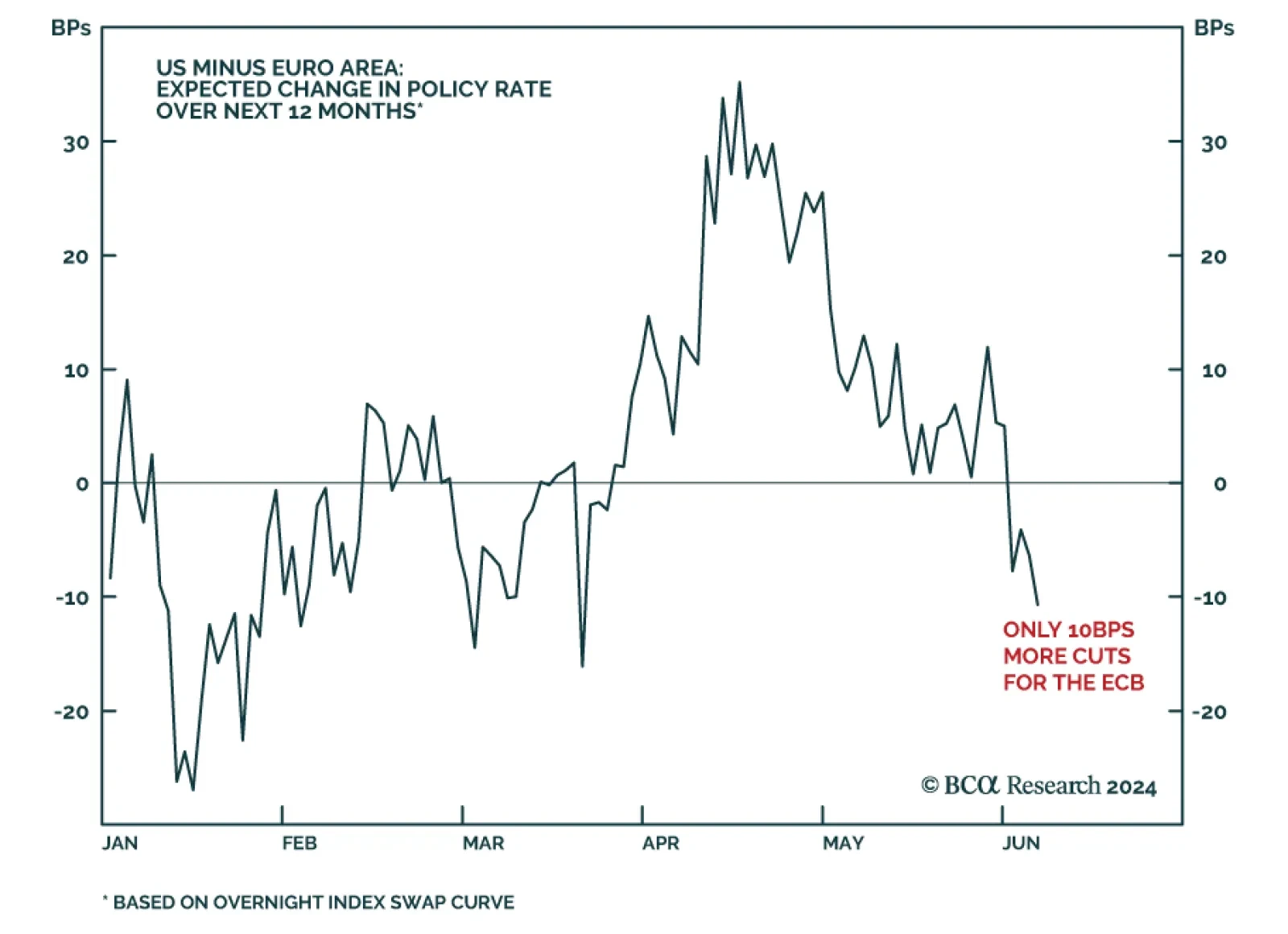

The ECB is now firmly in easing mode, even if it refuses to pre-commit to a specific rate path. What does this data dependency mean for the euro and European yields?

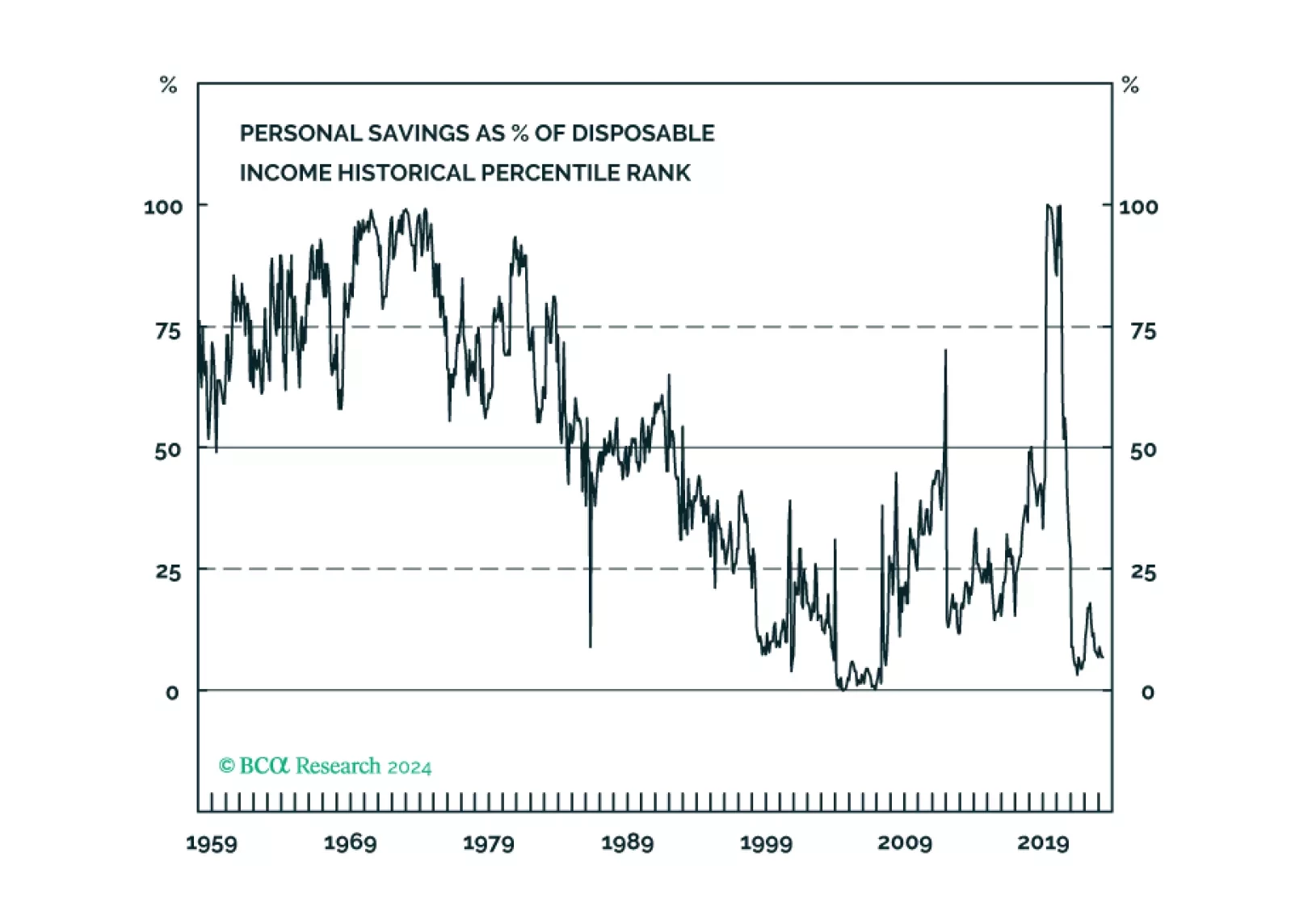

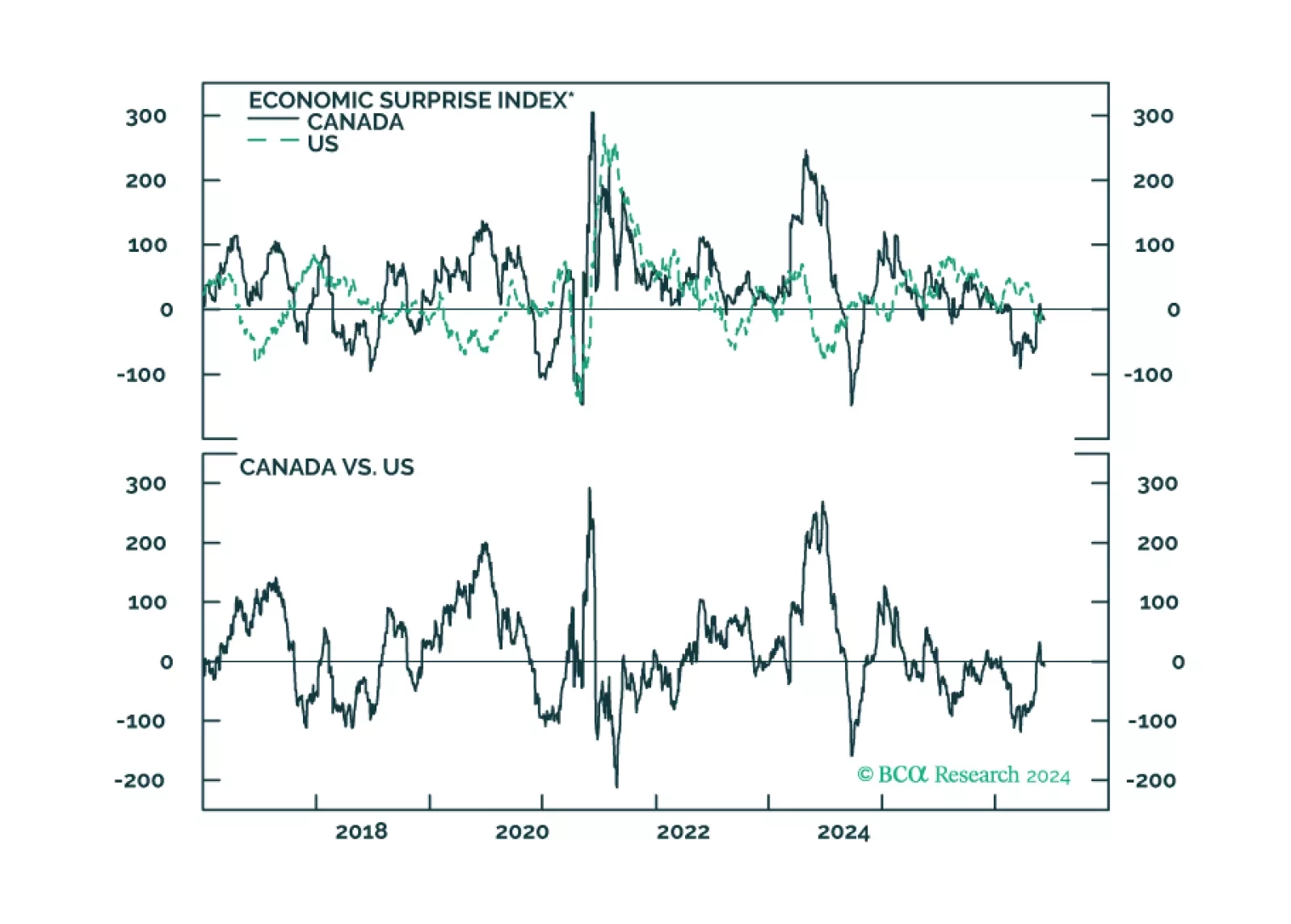

Although the comprehensive economic surprise indexes continued weakening in May, the metrics in our equity downgrade checklist haven’t softened enough to check more boxes now. While we continue to expect the US economy will enter a…

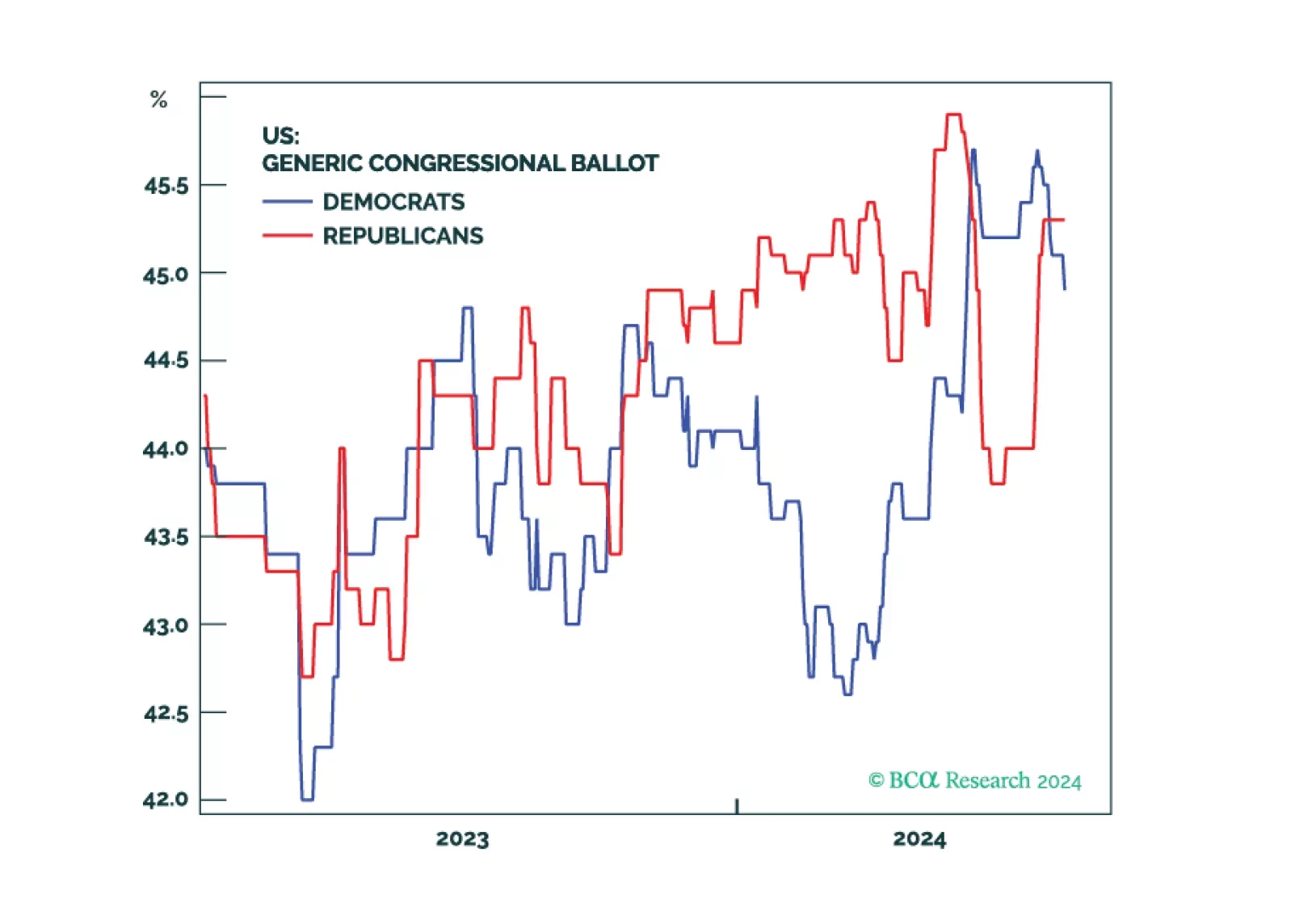

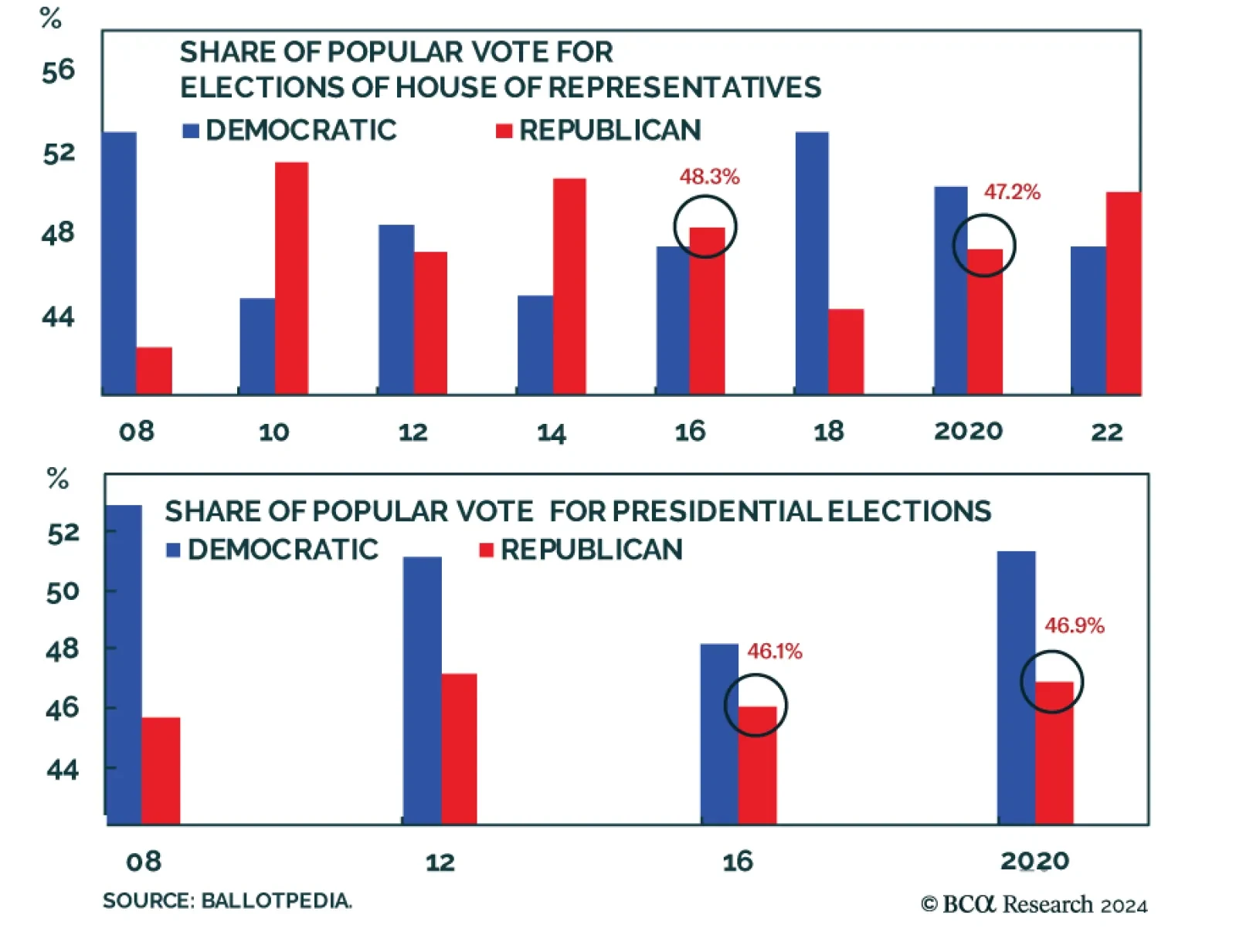

According to BCA Research’s US Political Strategy service, Republicans are more likely to win the Senate than the White House – and more likely to win either of these than the House. But Republicans are favored in…

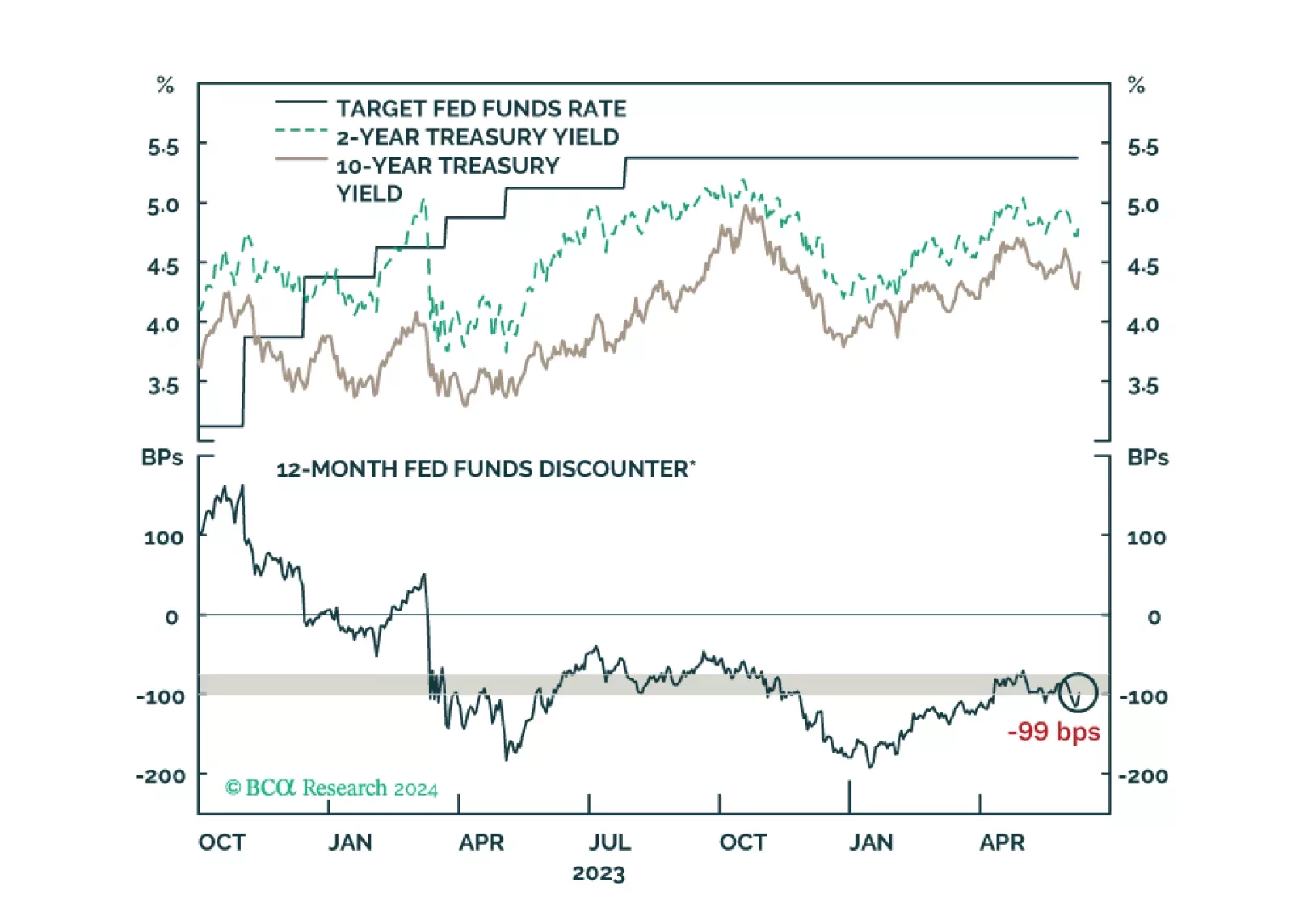

US Treasury yields bounced after this morning’s employment report. We offer our updated views about how long the recent trading range will hold.

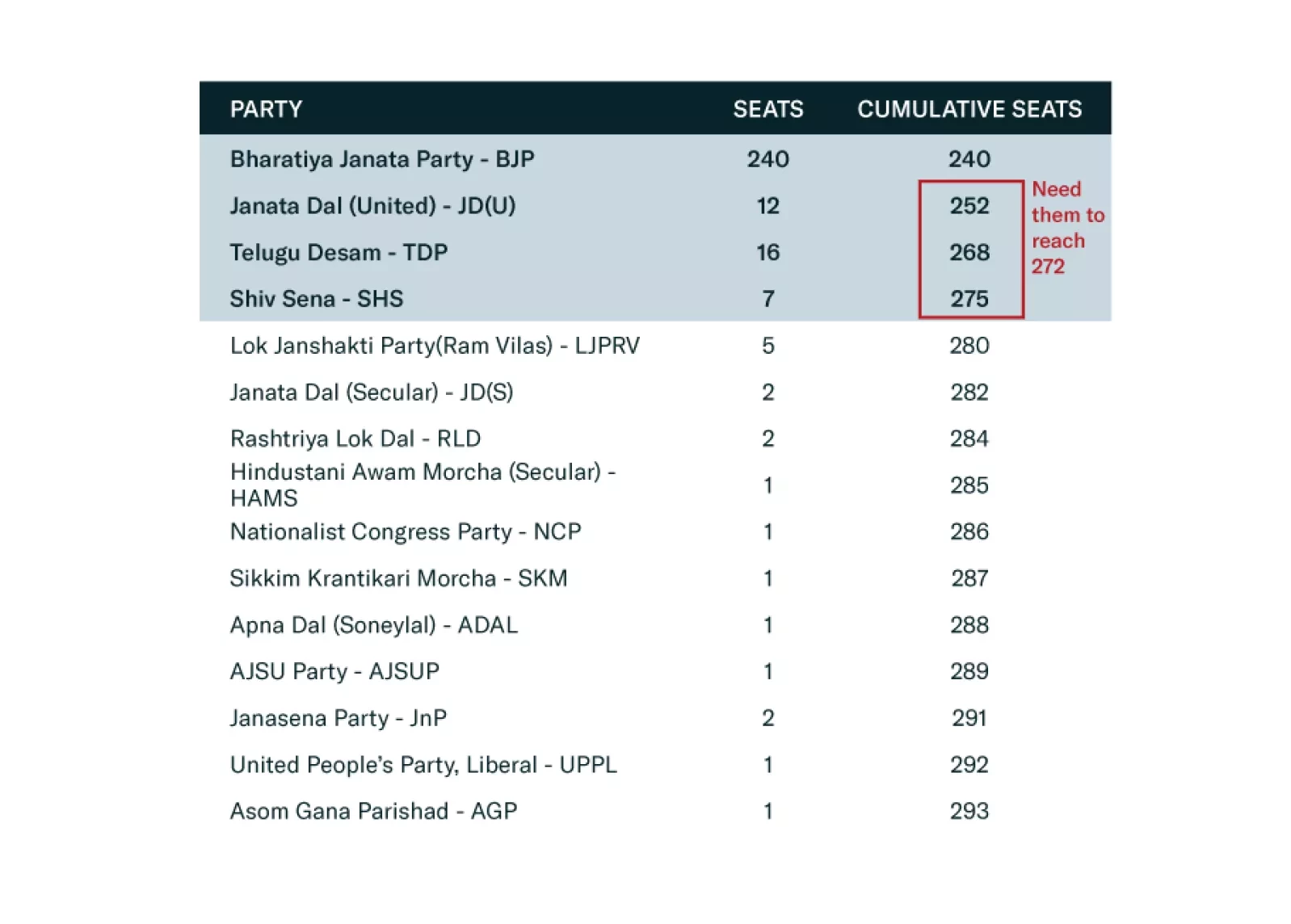

Prime Minister Narendra Modi won a third term and will become the third longest-serving prime minister of India. While investors responded negatively to the BJP’s loss of an outright majority, Modi and the NDA will continue to…

A short insight on the ECB and near-term implications for European asset markets.

Republicans are favored in the House and Senate even if they do not win the White House. A Democratic sweep is a 20% risk. The policy implication would be inflationary, but not so much as under a Republican sweep. Election…

After holding rates steady over the past nine months, the ECB delivered on its widely expected rate cut on Thursday. The Governing Council lowered all three key ECB interest rates by 25 bps, bringing the refinancing, marginal…

In this insight, we provide an update on the Canadian economy, given yesterday’s rate cut, and implications for Canadian assets.